Abstract

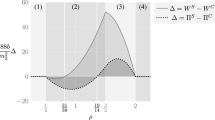

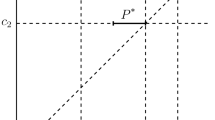

We analyze optimal penal codes in both Bertrand and Cournot supergames with product differentiation. We prove that the relationship between optimal punishments and the security level (individually rational discounted profit stream) depends critically on the degree of supermodularity in the stage game, using a linear duopoly supergame with product differentiation. The security level in the punishment phase is reached only under extreme supermodularity, i.e., when products are perfect substitutes and firms are price setters. Finally, we show that Abreu's rule cannot be implemented under Cournot behavior and strong demand complementarity between products.

Similar content being viewed by others

References

Abreu, D. J. (1986): “Extremal Equilibria of Oligopolistic Supergames.”Journal of Economic Theory 39: 191–225.

— (1988): “On the Theory of Infinitely Repeated Games with Discounting.”Econometrica 56: 383–396.

Bulow, J., Geanakoplos, J., and Klemperer, P. (1985): “Multimarket Oligopoly: Strategic Substitutes and Complements.”Journal of Political Economy 93: 488–511.

Chang, M. H. (1991): “The Effects of Product Differentiation on Collusive Pricing.”International Journal of Industrial Organization 9: 453–469.

— (1992): “Intertemporal Product Choice and Its Effects on Collusive Firm Behavior.”International Economic Review 33: 773–793.

Deneckere, R. (1983): “Duopoly Supergames with Product Differentiation.”Economics Letters 11: 37–42.

— (1984): “Corrigenda.”Economics Letters 15: 385–387.

Dixit, A. K. (1979): “A Model of Duopoly Suggesting a Theory of Entry Barriers.”Bell Journal of Economics 10: 20–32.

Friedman, J. W. (1971): “A Non-Cooperative Equlibrium for Supergames.”Review of Economic Studies 28: 1–12.

Friedman, J. W., and Thisse, J.-F. (1993): “Partial Collusion Fosters Minimum Product Differentiation.”Rand Journal of Economics 24: 631–645.

Fudenberg, D., and Tirole, J. (1991):Game Theory. Cambridge, Mass.: MIT Press.

Häckner, J. (1994): “Collusive Pricing in Markets for Vertically Differentiated Products.”International Journal of Industrial Organization 12: 155–177.

— (1995): “Endogenous Product Design in an Infinitely Repeated Game.”International Journal of Industrial Organization 13: 277–299.

— (1996): “Optimal Symmetric Punishments in a Bertrand Differentiated Products Duopoly.”International Journal of Industrial Organization 14: 611–630.

Lambertini, L. (1997): “Prisoners' Dilemma in Duopoly (Super)Games.”Journal of Economic Theory 77: 181–191.

Lambson, V. E. (1987): “Optimal Penal Codes in Price-Setting Supergames with Capacity Constraints.”Review of Economic Studies 54: 385–397.

— (1994): “Some Results on Optimal Penal Codes in Asymmetric Bertrand Supergames.”Journal of Economic Theory 62: 444–468.

— (1995): “Optimal Penal Codes in Nearly Symmetric Bertrand Supergames with Capacity Constraints.”Journal of Mathematical Economics 24: 1–22.

Ross, T. W. (1992): “Cartel Stability and Product Differentiation.”International Journal of Industrial Organization 10: 1–13.

Rothschild, R. (1992): “On the Sustainability of Collusion in Differentiated Duopolies.”Economics Letters 40: 33–37.

Singh, N., and Vives, X. (1984): “Price and Quantity Competition in a Differentiated Duopoly.”Rand Journal of Economics 15: 546–554.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Lambertini, L., Sasaki, D. Optimal punishments in linear duopoly supergames with product differentiation. Zeitschr. f. National#x00F6;konomie 69, 173–188 (1999). https://doi.org/10.1007/BF01232420

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01232420