Abstract

We develop a neoclassical growth model having a realistic demographic structure. We identify the critical channel of impact to be the intertemporal consumption allocation decision through the “generational turnover term”. Expressing the aggregate dynamics as a generalization of the conventional neoclassical growth model provides important insights, enabling us to view in a unified way how alternative demographic structures impinge on the macrodynamic equilibrium. Using an approximation to the generational turnover term, we are able to characterize both the steady state and the local transitional dynamics. Through numerical simulations, we analyze the steady state as well as the transitional effects of structural and demographic changes.

Similar content being viewed by others

Notes

This can be readily confirmed by consulting any one of the leading textbooks on modern growth theory (or macrodynamics) where some version of the Ramsey model or the Romer (1986) model—depending upon the underlying production structure—is the overwhelmingly dominant paradigm.

A key component of the BBW model to deal with uncertainty of life-span, the existence of an actuarially fair insurance market, was originally introduced by Yaari (1965).

Many variants of the model exist, including extensions to an initial third period, for education; see, e.g., Docquier and Michel (1999).

For this reason, Auerbach and Kotlikoff (1987), in their comprehensive study of fiscal policy, introduced 55 periods in order to accommodate multiple generations, while employing a time unit of the order of one year. With the advent of cheap and powerful computing, the Auerbach–Kotlikoff approach has been extended to allow for further complexity; see, for instance, Krueger and Ludwig (2007). However, a caveat concerning these models is that, because of their complexity, the underlying mechanisms driving particular results become less transparent.

Much of this growing literature analyzing continuous-time overlapping generations economies with finite horizons builds on the classic contributions of Cass and Yaari (1967) and Tobin (1967); see also Burke (1996), Demichelis and Polemarchakis (2007), and Edmond (2008) for related developments. This literature tends to focus on issues relating to existence and determinacy of equilibrium, as well as its characterization, in a more abstract form than is our intent here.

Boucekkine et al. (2002) adopt a generalization of the Blanchard mortality function, thereby embedding the latter as a special case. This formulation is also adopted by Heijdra and Mierau (2012). Heijdra and Romp (2008) use the Gompertz (1825) exponential mortality hazard function in a small open-economy overlapping generations model. Faruqee (2003) approximates the Gompertz function with an estimated hyperbolic function, which he introduces into the model of Blanchard (1985). Finally, Bruce and Turnovsky (2012) represent survival by a function of de Moivre (1725).

The generational turnover term is a central element of overlapping generations models. Accordingly, it also features in the analyses of, amongst others, Heijdra and Ligthart (2006) and d’Albis and Augeraud-Véron (2009), who use the Blanchard and rectangular mortality functions, respectively. In contrast, in the current paper, we provide a general characterization of this term.

Elsewhere, we have introduced a more realistic demographic structure into a one-sector endogenous growth model. As in the benchmark model of Romer (1986), the economy is always on its balanced growth path, so that there are no transitional dynamics, either in aggregates or in the distributional measures; see Mierau and Turnovsky (2013). That paper has a very different focus in that it emphasizes the impact of the demographic structure on the endogenously determined equilibrium growth rate, as well as its impact on the natural rate of wealth inequality.

Their analysis employs linear utility and a constant returns production that uses human capital as its only input.

We employ US mortality data, but Heijdra and Mierau (2012) successfully apply the BCL function to Dutch data. However, like other functions, such as the de Moivre function, the BCL function fails in the extreme old age tail of the mortality distribution; see Fig. 2. Recently, in their study on human life-span, Strulik and Vollmer (2013) show how this convex extreme old age tail can be successfully tracked by the three-parameter Gompertz function.

Throughout this paper, we take D to be finite, though the extension to an infinite D is straightforward.

From (1)–(3), we see that the discount increases with age if and only if SS″ < (S′)2, which is certainly met if the mortality function is concave.

This result follows from perfect competition between annuity firms. If competition between annuity firms is less than perfect, there is a load factor, 0 ≤ λ ≤ 1, on the annuity premium, and individuals receive only λμ (t − v) on their annuities. This is studied by Heijdra and Mierau (2012).

Although annuity firms cancel debts of individuals, they will not take up debts of individuals who die indebted for sure. That is, at some time, D−ε, annuity firms will refuse to issue life insurance and recall all debts. Letting ε → 0 gives the constraint implied by the annuity firms.

Note that a constant birth rate does not imply that all cohorts have the same fertility rate. It simply says that in the demographic steady state (see below), the birth rate of the entire population can be captured in a single quantity, just like we can express the average mortality in a single quantity (Lotka 1998).

Formally, the rate of change of consumption of t–v year old agents is \(\lim \limits _{h\to 0} \frac {C(v+h,t+h)-C(v,t)}{h}=C_{v} (v,t)+C_{t} (v,t)\).

A tilde indicates a steady-state value.

In a related study, Doepke (2005) shows that the original Barro–Becker model cannot account for the large decline in fertility rates observed in most developed countries over the past century. He then goes on to show that neither discrete nor sequential fertility choice can bring the model in line with the decline in fertility rates.

Since there is some ambiguity with respect to the precise naming of the various mean value theorems, we are using the following specific result. For any real valued function f (x) on the interval [a,b] and function g(x) that is integrable and does not change sign over the interval (a, b), there exists a value c ∈ (a, b) such that \(\int _{a}^{b} {f(x)g(x)\mathrm {d}x=f(c)}\int _{a}^{b} {g(x)\mathrm {d}x}\).

We should note that the intermediate value v 1 ∈ (t − D, t) will, in general, be a function of t, in which case μ (t−v 1) should be written as μ (t − v 1 (t)). We refrain from representing this explicitly, so as not to clutter notation.

Intuitively, since t enters the numerator and denominator of (34) in identical ways to the first order of approximation, their effects are offsetting.

In fact, if we evaluate r w (t) at steady state, \(\tilde {r}_{w} \), in which case d μ H (τ − t) is exactly zero.

Since 0 < s 1, s 2 < 78, the maximum |s 1 − s 2| = 78, in which case the coefficient is around 0.001 and is still negligible.

We should also note that \(\text {sgn}\left [ r_{w} \left (t+s_{1}\right )=r_{w}(t+s_{2})\right ]\) may be either negative or positive. In the former case, \(d\mu _{H}\) will dampen out over time. In the latter case, while it will eventually become nonnegligible, this will take thousands of periods to occur. For example, taking the coefficient of 0.0001, \(\mu _{H}\) will increase by just 1 % over the first 100 periods.

We should caution in situations where the demographic transition occurs at a rapid finite rate that this term might cease to be negligible. However, that is not so in the transition we consider.

These conditions have been relaxed in a subsequent work by Gan and Lau (2010), who show further that uniqueness is still obtained if \(\sigma = 1\).

Human Mortality Database. University of California, Berkeley (USA), and Max Planck Institute for Demographic Research, Rostock (Germany). Available at www.mortality.org or www.humanmortality.de.

With this in mind, it might be more appropriate to refer to D as the maximum attainable economic age. We should also note that the ability of the BCL data to track mortality data closely is not restricted to the USA. It does just as well for The Netherlands; for example, see Heijdra and Mierau (2012). The reason why it fits so well is because, as Bruce and Turnovsky (2013, p.18) point out, it is a very good first-order approximation to the Gompertz function, which is widely accepted and adopted by demographers as a realistic representation of mortality. The Gompertz function itself, however, being doubly exponential, turns out to be computationally intractable in a model of this complexity.

The most direct comparison is of course with Blanchard (1985); see footnote 6 for some of the other examples. Parameterizing mortality, as these studies do, also seems to us to be more convenient for investigating the effects of counterfactual changes in mortality.

UN Population Predictions 2010. Available at www.un.org/esa/population

The equilibrium values of \(\mu _{C}, \mu _{H}\), and \(\mu _{\Delta }\), approximated as constants during the transition, are obtained by substituting the steady-state aggregate quantities and consumption profile from Section 3.2, together with the hazard rate associated with the BCL mortality function, into (27b), (30a), and (30b).

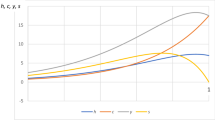

The stable eigenvalues are \(\lambda _{1}^{\text {RA}} =-0.065, \lambda _{1}^{\text {BBW}} =-0.066, \lambda _{1}^{\text {BCL}} =-0.077\).

Under BBW, we can show that the steady-state per capita capital stock satisfies \(\sigma \left (f^{\prime }(\tilde {k}_{\text {BBW}})-\delta -\rho \right )=\beta \tilde {k}_{\text {BBW}} \tilde {\Delta }^{-1}\tilde {c}^{-1}\), where \(\tilde {\Delta }\) is defined using the exponential mortality function, \(e^{\mu u}\) Subtracting (43a), \(f^{\prime }( \tilde {k}_{\text {BBW}})-f^{\prime } (\tilde {k}_{\text {RA}})=\left (\beta \tilde {k}_{\text {BBW}}/\sigma \tilde {\Delta }\tilde {c}\right )-n\). If the population growth rate \(n = 0\), as in Blanchard (1985), then \(f^{\prime }(\tilde {k}_{\text {BBW}})>f^{\prime } (\tilde {k}_{\text {RA}})\) and \(\tilde {k}_{\text {RA}} >\tilde {k}_{\text {BBW}} \). Otherwise, the comparison depends upon the right-hand side of this relation.

In an earlier version of this paper (available on request), we studied the impact of an increase in the population growth rate induced by either a change in the birth rate or a change in the mortality rate. There we showed that depending on the source of demographic change, an increase in the population growth rate can increase, decrease, or not affect the aggregate per capita capital stock.

As before, our birth rate is a little high because it also includes immigration. Technically, the birth rate arises from the demographic steady state (15) in which we take the population growth rate and mortality structure as given and solve for a consistent birth rate. The BCL function used to estimate the mortality parameters fits equally well for 1960 as for 2006, yielding the estimates and standard errors: \(\mu _{0} = 43.9817 (3.4183); \mu _{1} = 0.0535 (0.0012)\); adjusted \(R^{2} = 0.996\). Since the BCL function fits the two endpoints of the transition so closely, we can be confident that it also approximates the average transition rate between 1960 and 2006 closely, as well.

In an earlier version of this paper we also studied the consequences of the demographic changes for the life cycle distribution of consumption and assets (as in Fig. 3). There we find that the life cycle patterns obtained by Fair and Dominguez (1991) and Attfield and Cannon (2003) are confirmed by our numerical simulations. These results are available on request.

We may note that when studying the transitional dynamics of the demographic transition we do not consider the dynamics of the demographic system itself. In that sense, our results should be interpreted as though the economy where moving along a (continuous) sequence of demographic steady states in which the survival curve is gradually being shifted outward.

In our simulations we treat 1960 and 2006 as steady-state equilibria, with all demographic parameters being set to satisfy the demographic steady state. Setting \(\theta = 0.05\), implies that around 90 % of the transition from one steady state to the other is completed within the time horizon of 46 years. Since our approximation justifies treating the weighted average mortality rates \(\mu _{H}, \mu _{C}, \mu _{\Delta }\) as constant over the transition, it is compatible with the corresponding changes in the raw mortality rate \(\mu \) implied by the parameterized mortality function. We also ignore any feedback from the economic structure to the demographic structure.

We have also traced out the adjustment paths that would have prevailed in a representative agent (RA) model. These paths are very similar to the composite adjustment in Fig. 5iii.This indicates that while the RA model cannot account for the nonmonotonic adjustment induced by a birth rate driven change in the population growth alone, it does very well when composite changes in the population growth rate are considered.

It is also consistent with the related evidence from cross-country studies of fertility and growth. These have typically found the correlations between economic growth and population growth to be negative for less developed economies, having higher birth rates, and positive for developed economies, with their lower mortality rates (Kelley 1988).

Even if one takes \(\left | {s_{1} -s_{2}} \right |=78\), the maximum possible value, these two expressions total -0.02 rather than -0.011, and their contribution remains negligible.

References

Attfield CLF, Cannon E (2003) The impact of age distribution variables on the long run consumption function. Discussion paper no. 03/546. University of Bristol, Bristol

Auerbach AJ, Kotlikoff LJ (1987) The dynamics of fiscal policy. Cambridge University Press, Cambridge

Barro RJ, Becker GS (1989) Fertility choice in a model of economic growth. Econometrica 57:481–501

Becker GS (1981) A treatise on the family. Harvard University Press, Cambridge

Becker GS, Barro RJ (1988) A reformulation of the economic theory of fertility. Q J Econ 103:1–25

Blanchard OJ (1985) Debt, deficits and finite horizons. J Polit Econ 93:223–247

Blanchet D (1988) A stochastic version of the Malthusian trap model: consequences for the empirical relationship between economic growth and population growth in LDC’s. Math Popul Stud 1:79–99

Bloom DE, Canning D, Mansfield RK, Moore M (2007) Demographic change, social security systems, and savings. J Monetary Econ 54:92–114

Bommier A, Lee RD (2003) Overlapping generations models with realistic demography. J Popul Econ 16:135–160

Boucekkine R, de la Croix D, Licandro O (2002) Vintage human capital, demographic trends, and endogenous growth. J Econ Theory 104:340–375

Bruce N, Turnovsky SJ (2012). Demography and growth: a unified treatment of overlapping generations. Macroecon Dyn (in press). doi:10.1017/S1365100512000235

Bruce N, Turnovsky SJ (2013) Social security, growth, and welfare in overlapping generations economics with or without annuities. J Public Econ 101:12–24

Buiter WH (1988) Death, birth, productivity growth and debt neutrality. Econ J 98:279–93

Burke JL (1996) Equilibrium for overlapping generations in continuous time. J Econ Theory 70:364–390

Cass D, Yaari ME (1967) Individual saving, aggregate capital accumulation, and efficient growth. In: Shell K (ed) Essays on the theory of optimal economic growth. MIT, Cambridge, pp 233–268

Chu AC, Cozzi G, Liao CH (2013) Endogenous fertility and human capital in a Schumpeterian growth model. J of Popul Econ 26:181–202

Cigno A (1998) Fertility decisions when infant survival is endogenous. J Popul Econ 11:21–28

d’Albis H (2007) Demographic structure and capital accumulation. J Econ Theory 132:411–434

d’Albis H, Augeraud-Véron E (2009) Competitive growth in a life-cycle model: existence and dynamics. Int Econ Review 50:459–484

Demichelis S, Polemarchakis HM (2007) The determinacy of equilibrium in economies of overlapping generations. Econ Theory 32:461–475

de Moivre A (1725) Annuities upon lives. W. P., London [Repr. in The Doctrine of Chances, 3rd ed. (1756), 261–328.]

Diamond PA (1965) National debt in a neoclassical growth model. Am Econ Rev 55:1126–1150

Docquier F, Michel P (1999) Education subsidies, social security and growth: the implications of a demographic shock. Scand J Econ 101:425–440

Doepke M (2004) Accounting for fertility decline during the transition to growth. J Econ Growth 9:347–383

Doepke M (2005) Child mortality and fertility: does the Barro-Becker model fit the facts? J Popul Econ 18:337–366

Edmond C (2008) An integral equation representation for overlapping generations in continuous time. J Econ Theory 143:596–609

Erlandsen S, Nymoen R (2008) Consumption and population age structure. J Popul Econ 21:505–520

Fair RC, Dominguez KM (1991) Effects of the changing US age distribution on macroeconomic equations. Am Econ Rev 81:1276–1294

Faruqee H (2003) Debt, deficits, and age-specific mortality. Rev Econ Dyn 6:300–312

Gan Z, Lau SHP (2010) Demographic structure and overlapping generations: a simpler proof with more general conditions. J Math Econ 46:311–319

Gompertz B (1825) On the nature of the function expressive of the law of human mortality, and on a new mode of determining the value of life contingencies. Philos T R Soc 115:513–85

Guvenen F (2006) Reconciling conflicting evidence on the elasticity of intertemporal substitution: a macroeconomic perspective. J Monetary Econ 53:1451–1472

Heijdra BJ, Ligthart JE (2006) The macroeconomic dynamics of demographic shocks. Macroecon Dyn 10:349–370

Heijdra BJ, Romp WE (2008) A life-cycle overlapping-generations model of the small open economy. Oxford Econ Pap 60:88–121

Heijdra BJ, Mierau JO (2012) The individual life-cycle, annuity market imperfection and economic growth. J Econ Dyn Control 36:876–890

Kelley AC (1988) Economic consequences of population change in the third world. J Econ Lit 27:1685–1728

Kelley AC, Schmidt RM (1995) Aggregate population and economic growth correlations: the role of the components of demographic change. Demography 32:543–555

Krueger D, Ludwig A (2007) On the consequences of demographic change for rates of returns to capital, and the distribution of wealth and welfare. J Monetary Econ 54:49–87

Lau SHP (2009) Demographic structure and capital accumulation: a quantitative assessment. J Econ Dyn Control 33:554–567

Lotka AJ (1998) Analytical theory of biological populations. Plenum, New York

Manuelli RE, Seshadri A (2009) Explaining international fertility differences. Q J Econ 124:771–807

May J (1970) Period analysis and continuous analysis in Patinkin’s macroeconomic model. J Econ Theory 2:1–9

Mierau JO, Turnovsky SJ (2013) Demography, growth, and inequality. Econ Theory 2013:1–40

Modigliani F, Brumberg R (1954) Utility analysis and the consumption function: an interpretation of cross-section data. In: Kurihara K. (ed) Post-Keynesian economics. Rutgers University Press, New Brunswick, pp 388–436

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94:1002–37

Samuelson PA (1958) An exact consumption-loan model of interest with or without the social contrivance of money. J Polit Econ 66:467–482

Sinha T (1986) Capital accumulation and longevity. Econ Lett 22:385–389

Soares RR (2005) Mortality reductions, educational attainment, and fertility choices. Am Econ Rev 95:580–601

Strulik H, Vollmer S (2013) Long-run trends of human aging and longevity. J Popul Econ. doi:10.1007/s00148-012-0459-z

Tobin J (1967) Life cycle and balanced growth. In: Fellner W (ed) Ten economic studies in the tradition of Irving Fisher. Wiley, New York, pp 231–256

Turnovsky SJ (1977) Macroeconomic analysis and stabilization policy. Cambridge University Press, Cambridge

Varvarigos D, Zakaria IZ (2013) Endogenous fertility in a growth model with public and private health expenditures. J Popul Econ 26:67–85

Weil P (1989) Overlapping families of infinitely-lived agents. J Public Econ 38:183–198

Yaari ME (1965) Uncertain lifetime, life insurance, and the theory of the consumer. Rev Econ Stud 32:137–150

Acknowledgments

Research for this paper was begun while Mierau was visiting the University of Washington. Turnovsky’s research was supported in part by the Castor Endowment at the University of Washington. The paper has benefited from seminar presentations at Boaziçi University, the University of Louvain-la-Neuve, University of Leicester, Victoria University of Wellington, and ETH Zürich; as well as at the 2011 Conference of the Association of Public Economic Theory in Bloomington, IN, in the 10th Journées Louis-André Gérard-Varet Conference on Public Economics in Marseille, France, June 2011; and the 2012 Conference of the Society of the Advancement of Economic Theory in Brisbane, Australia. We gratefully acknowledge the constructive comments by Hippolyte d’Albis, Antoine Bommier, Raouf Boucekkine, Ben Heijdra, Paul Lau, Jenny Ligthart, and Ward Romp; two referees and the editor, Alessandro Cigno, on earlier drafts; as well as helpful discussions with Viola Angelini, Neil Bruce, and Wen-Jen Tsay.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Alessandro Cigno

Appendix: Generalization of approximation to transitional dynamics to includechanging mortality with calendar time

Appendix: Generalization of approximation to transitional dynamics to includechanging mortality with calendar time

Throughout the text, we have assumed that the survival and mortality functions are independent of calendar time. In this Appendix, we show it is straightforward to generalize the approximation employed in the local dynamics, to allow for these functions to depend upon both age and calendar time. Specifically, the survival function, Eq. 3a, is modified to \(S(s,t) = e^{-M(s,t)}\), where s denotes age, and t is calendar time. The corresponding mortality rate is thus \(\mu (s,t)=-S_{s}(s,t)/S(s,t)=M_{s}(s,t)\), implying that \(\mu _{t}(s,t)=M_{st}(s,t)\). With this notation, the average mortality rate defined by Eq. 34a may be written as follows:

Differentiating (46) with respect to calendar time, t, yields:

where:

specifies the proportionate rate of change in the survival rate over calendar time. Since our application focuses on an increase in the survival rate, \(S_{t}(s,t) > 0\), and (48) implies \(M_{t}(s,t) < 0\) Applying the mean value theorem to (47), precisely as we did to (34b), and regrouping terms, we can write (47) as follows:

where \(0 < s_{1}(t) < D, 0 < s_{2}(t) < D\). The first term on the right-hand side of (49) remains as in the text and reflects the impact of the evolution of the economic variables on the weighted average mortality rate, \(\mu _{H}\). The remaining terms reflect the effects of the changing mortality over calendar time on that same quantity. Taking the first-order approximation yields:

which, using the relationship \(\mu _{t}(s,t)=M_{st}\left (s,t\right )\), may be written as follows:

Thus, analogous to (36b), we obtain:

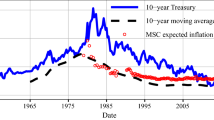

The first term, describing the impact of the changing economic structure on the weighted average, remains unchanged from (36b) and has been demonstrated to be small. The remaining terms describe the gradual impact of the change in mortality, and these too are small. For the USA, the average mortality rate during the second half of the twentieth century was about 0.01, declining at a rate of about 1 % per year, implying that \(\mu = 0.01\), \(\mu _{t}=-0.0001\). Taking \(| {s_{1} -s_{2} } |<10\), the second and third expressions in the parenthesis total around -0.011, and for \(\tilde {\mu }_{H} =0.003\), they are of the order of 0.00003, even smaller than the first component.Footnote 43 Thus, the change in \(\mu _{H}\) is negligible and can essentially be treated as constant and independent of t. Indeed, further support for treating \(\mu _{H}\) as constant in our specific application to the change in the mortality structure in the USA is provided by the fact that we find the overall decline in \(\mu _{H}\) over the period of 1960–2006 (treating both endpoints as steady states) to be from 0.0039 to 0.0029.

Analogous arguments apply to the other weighted mortality rates, \(\mu _{C}, \mu _{\Delta }\). Comparing their respective values at 1960 and 2006, we find that \(\mu _{C}\) increases by 0.0001 from 0.0187 to 0.0188, while \(\mu _{\Delta }\) declines by 0.0013 from 0.0053 to 0.0040. With the three weighted mortality rates and their respective changes all being small, their accumulated effects on the dynamics of the aggregate variables are surely negligible.

Rights and permissions

About this article

Cite this article

Mierau, J.O., Turnovsky, S.J. Capital accumulation and the sources of demographic change. J Popul Econ 27, 857–894 (2014). https://doi.org/10.1007/s00148-013-0479-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-013-0479-3