Abstract

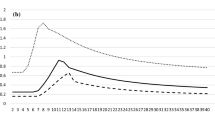

This paper investigates the impact of an increase in life expectancy on the level and the distribution of income in the presence of skill heterogeneity and automation. It shows analytically that an increase in life expectancy induces the replacement of low-skilled workers by automation capital and high-skilled workers. Moreover, it raises the skill premium and has an ambiguous effect on total income. A simulation exercise, based on US data, shows that an increase in life expectancy raises the level as well as the inequality of income. We consider redistributive policies that can mitigate some of the adverse effects of an increase in life expectancy for low-skilled workers.

Similar content being viewed by others

Notes

Our calculations based on data in International Federation of Robotics (2019a).

See Prettner and Bloom (2020), pp. xi and xii.

The advanced economies are not the only ones facing rapid population aging. Some emerging economies follow closely a similar transformation. For example, in China, the share of the population aged 65 years or over has continuously increased in recent years and reached 11.9% in 2019.

For a presentation of the arguments see Chapter 6 in Prettner and Bloom (2020).

The economic use of AI can be divided into five categories: Deep Learning, Robotization, Dematerialization, Gig economy, and Autonomous Driving (see Wisskirchen et al. 2017)

The first industrial robot was installed in a General Motors automobile factory in New Jersey (Brynjolfsson and McAfee 2016).

Other important applications of AI in health include deep learning to diagnose diseases, medical robots and AI-powered radiology assistant, to name but a few.

Indeed, Gehringer and Prettner (2019) using data from the OECD find a remarkably robust positive relation between decreasing mortality and technological progress.

Recent empirical studies that examine the relation between demographics and automation include Abeliansky and Prettner (2017) and Acemoglu and Restrepo (2018). The first study finds that an increase in population growth is associated with a reduction in the growth rate of automation density. The second study documents that countries that undergo faster aging—measured by an increase in the ratio of older to middle-aged workers—invest more in robots.

To simplify our analysis, we do not consider taxation and unemployment benefits.

The logarithmic utility function that we use results in great analytical tractability; however, it yields a constant saving rate, βρ/(1 + βρ) (the income and substitution effect of an increase in the interest rate offset each other). Thus, one cannot distinguish the effect of an increase in patience, as captured by an increase in β, from the effect of an increase in longevity, as captured by an increase in ρ, on saving. On the contrary, the two parameters have an opposite effect on future consumption \(c_{o,t+1}^{i}.\) Whereas an increase in β raises \( c_{o,t+1}^{i},\) because the future matters more, an increase in ρ lowers it, because the opportunity cost of future consumption (= ρ/(1 + rt+ 1) increases.

The working paper version of the article (Zhang et al. 2021) presents the proof of the proposition.

Nevertheless, our results are robust to lower values of ϕ.

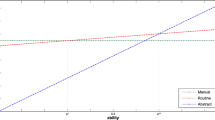

Our results are also qualitatively robust to changes in σ (see Subsection A.3 in the Appendix of Zhang et al. 2021). For high values of σ the adjustment in the quantities and prices of labor are relatively small. In fact, when σ = 1, the two types of labor become perfect substitutes. In this case, the ratios of their marginal products (wages) remain constant (= λ/1 − λ) and their levels of employment cease to respond to changes in longevity.

In Subsection A.4 of Zhang et al. (2021), we also present all the results in a tabular form both in levels and in percentage changes.

As shown in Subsection A.5.1 of Zhang et al. (2021), our results are robust with respect to changes in τ.

In Subsection A.6 of Zhang et al. (2021), we consider the case where a vacancy-maintenance subsidy at a constant rate is financed by a constant robot tax and additional lump-sum taxation. The results are qualitatively the same.

As mentioned by Gasteiger and Prettner (2020), in an open-economy world, the success of a robot tax requires its coordinated implementation in many countries to avoid the reallocation of capital to jurisdictions that do not impose such a tax.

This is not the first time that we observe a decrease in the life expectancy of certain groups. For example, the average life expectancy among American women without a high school diploma declined from 78.5 years in 1990 to 73.5 years in 2008 (Olshansky et al. 2012).

In addition, automation capital and traditional physical capital increase as either ρh or ρl goes up (see Subsection A.2 in the Appendix of Zhang et al. 2021).

Note that the income of the old high-skilled is the highest among the four groups, followed by the income of the young high-skilled, then by the income of the old low-skilled and finally by the income of the young low-skilled.

As explained in detail in Prettner and Strulik (2020), these numbers are based on the empirical approximation of the ability distribution with the IQ distribution.

As shown in Subsection A.5.2 of Zhang et al. (2021), our results are robust with respect to changes in τ.

In Subsection A.6 of Zhang et al. (2021), we consider the case where an education subsidy at a constant rate is financed by a constant robot tax and additional lump-sum taxation. The results are qualitatively the same.

References

Abeliansky A, Prettner K (2017) Automation and demographic change. Hohenheim Discussion Papers in Business, Economics and Social Sciences. Discussion Paper 05–2017

Acemoglu D, Manera A, Restrepo P (2020) Does the us tax code favor automation? NBER working paper 27052

Acemoglu D, Restrepo P (2018) Demographics and automation. NBER working paper 24421

Acemoglu D, Restrepo P (2020) Robots and jobs: evidence from US labor markets. J Polit Econ 128:2188–244

Baldanzi A, Prettner K, Tscheuschner P (2019) Longevity-induced vertical innovation and the tradeoff between life and growth. J Popul Econ 32:1293–313

Blackburn K, Cipriani P (2002) A model of longevity, fertility and growth. J Econ Dyn Control 26:187–204

Bloom D, Canning D, Graham B (2003) Longevity and life-cycle savings. Scand J Econ 105:319–338

Brynjolfsson E, McAfee A (2016) The second machine age: work, progress, and prosperity in a time of brilliant technologies. W. W. Norton & Company

Chassamboulli A, Palivos T (2014) A search-equilibrium approach to the effects of immigration on labor market outcomes. Int Econ Rev 55:111–129

Chakraborty S (2004) Endogenous lifetime and economic growth. J Econ Theory 116:119–137

Cipriani P (2014) Population aging and PAYG pensions in the OLG model. J Popul Econ 27:251–56

Cords D, Prettner K (2019) Technological unemployment revisited: automation in a search and matching framework. GLO Discussion Paper Series 308, Global Labor Organization

de la Croix D, Pierrard O, Sneessens H (2013) Aging and pensions in general equilibrium: labor market imperfections matter. J Econ Dyn Control 37:104–24

Dynarski M (2003) Does aid matter? Measuring the effect of student aid on college attendance and completion. Am Econ Rev 93:279–288

Friese M (2016) The labor market effect of demographic change: alleviation for financing social security. VfS Annual Conference (Augsburg) working paper, German Economic Association

Gasteiger E, Prettner K (2020) Automation, stagnation, and the implications of a robot tax. Macroecon Dyn. forthcoming

Gehringer A, Prettner K (2019) Longevity and technological change. Macroecon Dyn 23:1471–1503

Guerreiro J, Rebelo S, Teles P (2021) Should robots be taxed? Rev Econ Stud. forthcoming

Guimarães L, Gil P (2019) Explaining the labor share: automation vs labor market institutions. MPRA paper no. 92062

International Federation of Robotics (2019a) World robotics industrial robots 2019

International Federation of Robotics (2019b) World robotics service robots 2019

Kinugasa T, Mason A (2007) Why countries become wealthy: the effects of adult longevity on saving. World Dev 35:1–23

Lankisch C, Prettner K, Prskawetz A (2019) How can robots affect wage inequality? Econ Model 81:161–169

Li H, Zhang J, Zhang J (2007) Effects of longevity and dependency rates on saving and growth: evidence from a panel of cross countries. J Dev Econ 84:138–154

Lucas R (1990) Liquidity and interest rates. J Econ Theory 50:237–264

Olshansky J, Antonucci T, Berkman L, Binstock R, Boersch-Supan A, Cacioppo J, Carnes B, Carstensen L, Fried L, Goldman D, Jackson J, Kohli M, Rother J, Zheng Y, Rowe J (2012) Differences in life expectancy due to race and educational differences are widening, and many may not catch up. Health Aff 31:1803–1813

Ottaviano I, Peri G (2012) Rethinking the effect of immigration on wages. J Eur Econ Assoc 10:152–97

Palivos T, Varvarigos D (2017) Pollution abatement as a source of stabilization and long-run growth. Macroecon Dyn 21:644–676

Prettner K (2019) A note on the implications of automation for economic growth and the labor share. Macroecon Dyn 23:1294–301

Prettner K, Bloom D (2020) Automation and its macroeconomic consequences: theory, evidence, and social impacts. Academic Press, Cambridge

Prettner K, Strulik H (2020) Innovation, automation, and inequality: policy challenges in the race against the machine. J Monet Econ. forthcoming

Sasson I, Hayward M (2019) Association between educational attainment and causes of death among white and black US adults, 2010-2017. J Amer Med Assoc 322:756–763

Stähler N (2021) The impact of aging and automation on the macroeconomy and inequality. J Macroecon 67:103278

United Nations (2019) World Population Prospects 2019: Highlights

Wisskirchen G, Biacabe B, Bormann U, Muntz A, Niehaus G, Soler G, Brauchitsch B (2017) Artificial intelligence and robotics and their impact on the workplace. IBA Global Employment Institute 11:49–67

Zhang J, Zhang J, Lee R (2001) Mortality decline and long-run economic growth. J Public Econ 80:485–507

Zhang J, Zhang J (2005) The effect of life expectancy on fertility, saving, schooling and economic growth: theory and evidence. Scand J Econ 107:45–66

Zhang X, Palivos T, Liu X (2021) Aging and automation in economies with search frictions. MPRA paper 107950

Zhavoronkov A, Bischof E, Lee K (2021) Artificial intelligence in longevity medicine. Nat Aging 1:5–7

Acknowledgements

We are indebted to Editor Oded Galor and two anonymous referees of this journal whose comments and suggestions have helped us improve the paper substantially.

Funding

Xiangbo Liu (corresponding author) acknowledges the research support by the Fundamental Research Funds for the Central Universities and the Research Funds of Renmin University of China (Grant No. 19XNI002).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible editor: Oded Galor

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhang, X., Palivos, T. & Liu, X. Aging and automation in economies with search frictions. J Popul Econ 35, 621–642 (2022). https://doi.org/10.1007/s00148-021-00860-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-021-00860-3