Abstract

We examine entry decisions in first-price and English clock auctions with participation costs. Potential bidders observe their value and report maximum willingness to pay (WTP) to participate. Entry occurs if revealed WTP (weakly) exceeds the randomly drawn participation cost. We find no difference in WTP between auction formats, although males have a higher WTP for first-price auctions. WTP is decreasing in the number of potential bidders, but this reduction is less than predicted and small in magnitude.

Similar content being viewed by others

Notes

Aycinena and Rentschler (2017) uses within-subject variation on auction formats to evaluate revenue equivalence predictions between first-price and English clock auctions with endogenous entry and a fixed number of potential bidders, both when the bidders are informed regarding the number of entrants when choosing their bids, and when they are not. Our design differs from theirs in that we are able to more precisely measure entry behavior, and that we study the effect of varying the number of potential bidders.

In a related approach, Li and Zheng (2009) studies procurement auctions in which potential bidders only learn their private cost of supplying the good upon entering. This paper then tests the model using data from highway mowing auctions in Texas.

A similar approach has examined entry with private information other than value before entry decision. Such private information includes participation costs independently drawn from a common distribution (Moreno and Wooders 2011) or signals which provide information about the other valuations (Ye 2004).

Much attention in this environment has been on second-price auctions, as potential bidders who enter have a weakly dominant strategy to bid their valuation (e.g., Campbell 1998; Miralles 2008; Tan and Yilankaya 2006; Cao and Tian 2008). Green and Laffont (1984) and Cao and Tian (2009) allow both valuations and participation costs to be private information at the time of entry.

Ertaç et al. (2011) measures willingness to pay to enter either a first or second price auction, and varies the number of opposing bidders and whether that is known before entry, after entry or not at all. Participating bidders face simulated opponents who bid according to the risk-neutral equilibrium. They find significant over-entry in both auction formats, and across information structures.

This may arise when multiple online auction sites sell identical products, but differ in the auction mechanism they employ.

This implies that their results on entry are not comparable to our results. In their setting, over-entry in an auction format necessarily implies under-entry in another auction format. Our setting allows for over or under entry in either, both, or none of the auction formats.

Aycinena and Rentschler (2017) tests revenue equivalence predictions between these two auction formats for a fixed set of potential bidders in an environment where potential bidders make binary entry decisions. Additionally, it evaluates whether or not informing bidders of the number of entrants prior to bidding affects revenue.

That is, the Becker DeGroot Marschak (BDM) procedure (Becker et al. 1964) is used to elicit WTP, so that each participant has an incentive to report her true WTP.

Alternatively, we could have elicited the minimum value they required to participate given the cost of entry. We choose to elicit WTP because such assessments are more likely to coincide with decisions faced by participants outside the lab.

Specifically, the confirmation screen displayed what would happen if the participation cost were weakly less than their stated WTP as well as what would happen if it was strictly greater, and asked them to confirm (or modify) their decision.

For a detailed analysis comparing behavior between this two entry mechanisms, refer to Aycinena et al. (2017).

This is a relatively high level of feedback for auction environments. Neugebauer and Selten (2006) shows that providing losing bids as feedback may reduce overbidding in first-price auctions. Also, providing all observed bids as feedback in both auction formats could reduce the extent to which potential bidders prefer one format over the other. If potential bidders were to prefer English clock auctions due to an expectation of greater feedback, then providing all observed bids in first-price auctions may reduce their relative WTP for English clock auctions. Varying the level of feedback, as well as varying the relative level of feedback across auction formats, would be interesting questions for future research.

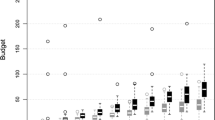

When there are five potential bidders, median WTP in region one drops to one for first-price auctions and two for English clock auctions in the second half of the experiment.

Recall that group size is either \(n=5\) or \(n=3\) for the first ten periods and then switches back and forth in ten period blocks.

We also estimated models controlling for lagged entry, lagged win and lagged number of entrants. Lagged entry is not statistically significant. Lagged win is positive and statistically significant only during the second half. Lagged number of entrants is negative and statistically significant. The coefficients on the variables of interest are robust to including any or all of these controls. In the interest of brevity, we do not report these regressions here, although there are available on request.

The second coefficient captures the difference in the effect of first price auctions for five potential bidders.

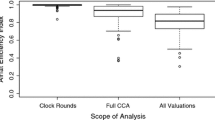

When there are three potential bidders there is no significant difference in WTP across auction formats when all regions are considered (robust rank order test, \(\acute{U}=1.448\), \(p>0.10\)), as well as when attention is restricted to region two (robust rank order test, \(\acute{U}=0.669\), \(p>10.10\)). Similarly, when there are five potential bidders there is no significant difference in WTP across auction formats in all regions (robust rank order test, \(\acute{U}=0.922\), \(p>0.10\)), and when attention is restricted to region two (robust rank order test, \(\acute{U}=0.669\), \(p>0.10\)). We rely on the p-values for the robust rank order test reported in Feltovich (2003).

Ivanova-Stenzel and Salmon (2008b) and Ivanova-Stenzel and Salmon (2011) both find that bidders will often choose English clock auctions over first-price auctions when bidders do not know their valuation prior to entry. Since all else is equal between the two formats in their design, it is not possible to determine if this choice represents a higher WTP.

This is on average across all regions, pooling the two auction formats. The average observed reduction in WTP is \(5.66\%\) for first price auctions and \(4.01\%\) for English clock auctions. Using non-parametric tests with session-level data across all regions and pooling across auction formats, we find that the difference in observed WTP across group size is marginally significant: sign test, \(w=8\), \(p=0.055\).

The specifications reported separate the effect of group size by auction format. Although, in the interest of brevity, we do not report them here, we also consider specifications which pool the group size effect (by excluding the \(FP_i \cdot G_{it}^5\) interaction). The pooled effect is significant in all specifications.

As above, models controlling for lagged entry, win and number of entrants were also estimated. The results of these robustness checks mirror those corresponding to Table 6. Again, these regressions are not reported in the manuscript, although they are available on request.

The p values for tests of coefficients are reported below the relevant specification.

This increase in responsiveness to theoretical predictions and the lower level of over-entry during the second half are statistically significant, although we do not report the relevant regressions in the interest of brevity.

Recall that potential bidders have previous experience in a similar experiment, and are thus likely to have an easier time forming accurate beliefs about relative payoffs than inexperienced participants. This point is particularly important since Engelbrecht-Wiggans and Katok (2005) argues that experimental participants have a difficult time determining expected payoffs in a given auction format.

The theoretical predictions of the model assume that entry threshold strategies are determined exclusively by expected payoffs. This does not seem to be the case for the results of under-sensitivity to group size and male preference for first-price auctions. A working paper version of this manuscript discusses and evaluates whether a male preference for first-price auctions is driven by differences in preferences for competition (Gneezy et al. 2003; Niederle and Vesterlund 2007), differences in risk attitudes across gender (Eckel and Grossman 2008), or more speculatively, differences in attitudes towards strategic uncertainty.

This need not be true. Strictly speaking, all that need hold is for the bids that determine prices to be, on average, lower than Nash predictions.

Recall that the cutoff value is given by \(v_c=100 \cdot (c_i/100)^{1/n}\), so that the intercept is increasing in the realized participation cost. This is because a higher participation cost implies a higher entry threshold value, which means that in equilibrium any bidder must have a higher value.

In English clock auctions we only observe the bid of non-winning bidders. Thus, our analysis of English clock auctions will restrict attention to non-winning bids.

We restrict attention to auctions with more than one bidder because in first-price auctions with only one bidder they can win the auction with a bid of zero, and in English clock auctions with one bidder the auction ends automatically at a price of zero.

The p values for tests of coefficients are reported below the relevant specification.

Cooper and Fang (2008) find evidence for spiteful bidding in second price auctions.

We reject the null that the sum of the coefficients on \(\nu _{it}\) and \(\nu _{it} \cdot G_{it}^5\) are equal to one. p-values for these tests are reported below the relevant specifications.

References

Aycinena D, Rentschler L (2017) Auctions with endogenous participation and an uncertain number of bidders: experimental evidence. Working paper

Aycinena D, Bejarano H, Rentschler L (2017) Informed entry in auctions. Working paper

Becker G, DeGroot M, Marschak J (1964) Measuring utility by a single-response sequential method. Behav Sci 9(3):226–232

Camerer C, Lovallo D (1999) Overconfidence and excess entry: an experimental approach. Am Econ Rev 89(1):306–318

Campbell C (1998) Coordination in auctions with entry. J Econ Theory 82(2):425–450

Cao X, Tian G (2008) Second-price auctions with differentiated participation costs. Working paper

Cao X, Tian G (2009) Second-price auctions with two-dimensional private information on values and participation costs. Working paper

Cao X, Tian G (2010) Equilibria in first-price auctions with participation costs. Games Econ Behav 69(2):258–273

Cooper DJ, Fang H (2008) Understanding overbidding in second price auctions: an experimental study. Econ J 118(532):1572–1595

Cox J, Smith V, Walker J (1983) Tests of a heterogeneous bidders theory of first-price auctions. Econ Lett 12(3):207–212

Cox J, Smith V, Walker J (1988) Theory and individual behavior of first-price auctions. J Risk Uncert 1(1):61–99

Cox JC, Smith VL, Walker JM (1992) Theory and misbehavior of first-price auctions: comment. Am Econ Rev 1392–1412

Crawford V, Iriberri N (2007) Level-k auctions: can a nonequilibrium model of strategic thinking explain the winner’s curse and overbidding in private-value auctions? Econometrica 75(6):1721–1770

Eckel C, Grossman P (2008) Men, women and risk aversion: experimental evidence. Handb Exp Econ Res 1:1061–1073

Engelbrecht-Wiggans R (1993) Optimal auctions revisited. Games Econ Behav 5(2):227–239

Engelbrecht-Wiggans R (2001) The effect of entry and information costs on oral versus sealed-bid auctions. Econ Lett 70(2):195–202

Engelbrecht-Wiggans R, Katok E (2005) Experiments on auction valuation and endogenous entry. Adv Appl Microecon Res Annu 13:169–193

Engelbrecht-Wiggans R, Katok E (2007) Regret in auctions: theory and evidence. Econ Theory 33(1):81–101

Engelbrecht-Wiggans R, Katok E (2009) A direct test of risk aversion and regret in first price sealed-bid auctions. Decis Anal 6(2):75–86

Ertaç S, Hortaçsu A, Roberts J (2011) Entry into auctions: an experimental analysis. Int J Ind Organ 29(2):168–178

Feltovich N (2003) Nonparametric tests of differences in medians: comparison of the wilcoxon–Mann–Whitney and robust rank-order tests. Exp Econ 6(3):273–297

Filiz-Ozbay E, Ozbay EY (2007) Auctions with anticipated regret: theory and experiment. Am Econ Rev 1407–1418

Fischbacher U (2007) z-tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10(2):171–178

Fischbacher U, Thoni C (2008) Excess entry in an experimental winner-take-all market. J Econ Behav Organ 67(1):150–163

Gneezy Uri, Niederle Muriel, Rustichini Aldo (2003) Performance in competitive environments: gender differences. Q J Econ 118(3):1049–1074

Goeree J, Holt C, Palfrey T (2002) Quantal response equilibrium and overbidding in private-value auctions. J Econ Theory 104(1):247–272

Green J, Laffont J (1984) Participation constraints in the vickrey auction. Econ Lett 16(1):31–36

Harstad R (1990) Alternative common-value auction procedures: revenue comparisons with free entry. J Polit Econ 421–429

Holt C, Sherman R (1994) The loser’s curse. Am Econ Rev 84(3):642–652

Isaac M, Walker J (1985) Information and conspiracy in sealed bid auctions. J Econ Behav Organ 6(2):139–159

Ivanova-Stenzel R, Salmon T (2004) Bidder preferences among auction institutions. Econ Inquiry 42(2):223–236

Ivanova-Stenzel R, Salmon T (2008a) Revenue equivalence revisited. Games Econ Behav 64(1):171–192

Ivanova-Stenzel R, Salmon T (2008b) Robustness of bidder preferences among auction institutions. Econ Inquiry 46(3):355–368

Ivanova-Stenzel R, Salmon T (2011) The high/low divide: self-selection by values in auction choice. Games Econ Behav 73(1)

Kagel J, Levin D (1993) Independent private value auctions: bidder behaviour in first-, second- and third-price auctions with varying numbers of bidders. Econ J 103(419):868–879

Klemperer P (2002) What really matters in auction design. J Econ Perspect 16(1):169–189

Levin D, Smith J (1994) Equilibrium in auctions with entry. Am Econ Rev 84(3):585–599

Li T, Zheng X (2009) Entry and competition effects in first-price auctions: theory and evidence from procurement auctions. Rev Econ Stud 76(4):1397–1429

Lu J (2009) Auction design with opportunity cost. Econ Theory 38(1):73–103

McAfee R, McMillan J (1987) Auctions with entry. Econ Lett 23(4):343–347

Menezes F, Monteiro P (2000) Auctions with endogenous participation. Rev Econ Des 5(1):71–89

Miralles A (2008) Intuitive and noncompetitive equilibria in weakly efficient auctions with entry costs. Math Soc Sci 56(3):448–455

Moreno D, Wooders J (2011) Auctions with heterogeneous entry costs. RAND J Econ 42(2):313–336

Neugebauer T, Selten R (2006) Individual behavior of first-price auctions: the importance of information feedback in computerized experimental markets. Games Econ Behav 54(1):183–204

Niederle Muriel, Vesterlund Lise (2007) Do women shy away from competition? Do men compete too much? Q J Econ 122(3):1067–1101

Palfrey T, Pevnitskaya S (2008) Endogenous entry and self-selection in private value auctions: an experimental study. J Econ Behav Organ 66(3):731–747

Pevnitskaya S (2004) Endogenous entry in first-price private value auctions: the self-selection effect. Working paper

Reiley D (2005) Experimental evidence on the endogenous entry of bidders in internet auctions. Exp Bus Res 103–121

Smith J, Levin D (1996) Ranking auctions with risk averse bidders. J Econ Theory 68(2):549–561

Smith J, Levin D (2002) Entry coordination in auctions and social welfare: an experimental investigation. Int J Game Theory 30(3):321–350

Tan G, Yilankaya O (2006) Equilibria in second-price auctions with participation costs. J Econ Theory 130(1):205–219

Ye L (2004) Optimal auctions with endogenous entry. BE J Theor Econ 4(1):8

Author information

Authors and Affiliations

Corresponding author

Additional information

Financial support from the International Foundation for Research in Experimental Economics (IFREE) is gratefully acknowledged. Thanks also to Jorge Chang Urrea, Pedro Monzón Alvarado, Diego Fernandez and Maximilian Pfeifer for outstanding research assistance. We have benefited from comments and suggestions from participants in seminars at Universidad Francisco Marroquín, Florida State University, the Economic Science Institute at Chapman University, CeDEx at the University of Nottingham, the University of California at Santa Barbara, the Antigua Experimental Economics Conference, and the North-American ESA conference.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix A: Bidding behavior

Appendix A: Bidding behavior

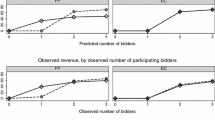

Potential bidders enter more often than predicted. If bidders were reporting a WTP in keeping with their beliefs regarding their expected earnings, the observed over-entry would imply that they believe that bids are, on average, below the Nash prediction, thus increasing expected payoffs of entering the auction.Footnote 27 Since in English clock auctions bidders have a weakly dominant strategy to bid their value, potential bidding holding such beliefs seems unlikely. In first-price auctions equilibrium bids depend on both the observed number of bidders, as well as beliefs about the entry threshold employed by bidders. In particular, the Nash bidding function in first-price auctions is linear in the bidder’s value. The slope of this function, \((m-1)/m\), is increasing in the number of bidders. The intercept, \(v_c/m\) is decreasing in the number of bidders and increasing in the cutoff entry value.Footnote 28 The entry cost has already been incurred at the bidding stage. In an English clock auction, it is a sunk cost that does not affect the weakly dominant bidding strategy. In a first price auction, it is still a sunk cost, but in equilibrium, it provides information on the minimum value of entrants. As such, it affects the minimum bid independent of value.

Bidding behavior relative to Nash predictions is illustrated in Fig. 4. Summary statistics are contained in Table 9. Notice that bidding in first-price auctions is bimodal, one of which represents overbidding, the other of which represents underbidding. For English clock auctions we see a substantial amount of bidding in accordance with theory, as well as some underbidding. Significantly, note that in all treatments except FP5, bidding is, on average, below Nash predictions. This result is puzzling, since there is a large literature which finds that bidders in English clock auctions learn quickly to bid their value (Harstad 1990) and that bidders in first-price auctions tend to overbid (Kagel and Levin 1993). Many possible explanations for overbidding in first-price auctions. Explanations related to the preferences of bidders include risk averse bidders (Cox et al. 1983, 1988), a joy of winning (Cox et al. 1992; Holt and Sherman 1994), and regret averse bidders (Engelbrecht-Wiggans and Katok 2007; Filiz-Ozbay and Ozbay 2007; Engelbrecht-Wiggans and Katok 2009). Explanations which relax the assumptions of Nash equilibrium include quantal response equilibrium (Goeree et al. 2002) and level-k models of bidders (Crawford and Iriberri 2007).

The purpose of this paper is not to determine which, if any, of these models best explains our data. However, it is worth noting that risk aversion, a joy of winning, or regret aversion are not able to explain both the over-entry and under-entry we observe.

Our results on bidding are surprising, and suggest a need for further research. While we are not able to conclusively offer an explanation for this behavior, We conjecture that a portion of bidders are not treating the cost of entry as a sunk cost when formulating their bids. Bidding relative to a naive model of bidding, in which a bidders behaves as though his value were \(v_{it}-c_{it}\) is illustrated in Fig. 5 which contains kernel densities of bids relative to this model by group size and auction format. Notice that the densities are bimodal, and that in English clock auctions, one of these modes corresponds with this naive model of bidding. Note that such a model is not able to fully explain the underbidding we observe in first-price auctions.

Another factor that may contribute to the observed underbidding in first-price auctions is the relatively high level of feedback utilized in our design. In particular, subjects are informed of all observed bids at the end of each period. Neugebauer and Selten (2006) and Isaac and Walker (1985) both find that providing feedback which includes the losing bids tends to reduce bids. Further research is needed to determine the extent to which feedback drives bidding behavior in our experiment.

To further analyze bidding behavior, we estimate bidding functions for each auction format via GLS and include random effects to control for individual subject variation, and cluster standard errors at the session level. The dependent variable is the observed bid.Footnote 29 To determine the effect of value on bids, we include \(v_{it}\). We also include the observed number of bidders (\(m_{it}\) and the realized entry cost (\(c_{it}\)) of bidder i in period t. Additionally, we include \(G_{it}^5\), and interact this dummy with \(v_{it}\) \(m_{it}\) and \(c_{it}\). In some specifications we also include additional controls. In particular we control for \(Male_i\), \(Age_i\), \(ln(t+1)\)), and \(GroupOrder_i\).

Table 10 reports results for English clock and first-auctions in which there in more than one bidder.Footnote 30 Notice that in English clock auctions, the coefficient on \(v_{it}\) is predicted to be one, and all other coefficients are predicted to be zero. However, while the coefficient on \(v_{it}\) is positive and highly significant it is statistically lower than one in all specifications.Footnote 31 Thus, bidders in English clock auctions respond positively to value, but despite it being a weakly dominated bidding strategy, they bid less than their value. Note that bidders do seem to be learning, as evidenced by an increase of the coefficient for \(v_{it}\) during the second half of the experiment. However, the coefficient is still less than one. Note that he conjecture that bidders are falling victim to the sunk cost fallacy is consistent with the negative and statistically significant coefficient on \(c_{it}\). This coefficient decreases during the second half, but it is still negative and marginally significant.

Also counter to theory, we find that under some specifications bids are increasing in \(m_{it}\) when group size is three, but that this effect is negative for a group size of five. The magnitude of these effects are small and may reflect (anti) social preferences.Footnote 32

For first price auctions, we find a positive and statistically significant effect of value, and a negative and statistically significant effect of participation cost. Both are relevant variables for Nash bidding. However, the predicated coefficients depend on the number of bidders. To facilitate the comparison on bidding behavior with Nash predictions we report additional specifications which include \(\nu _{it}=v_{i}\cdot (m-1)/m\) (i.e. the slope of the Nash bidding function) in place of \(v_{it}\), and \(\kappa _{it}= (c_{i} / 100)^{1/n}\cdot 100/m\) (i.e. the intercept of the Nash bidding function) in place of \(c_{it}\).

Table 11 contain the results of these specifications. We find that the coefficient on \(\nu _{it}\) is not only positive and significant, but we are unable to reject that it is equal to one in any specification. In the first half of the experiment, the interaction of \(\nu _{it}\) and groups size is negative and significant, indicating that responsiveness is less than predicted by theory when group size is five.Footnote 33 However, if we restrict attention to the second half of the experiment, the coefficient on \(\nu _{it} \cdot G_{it}^5\) is not longer significant: we cannot reject that bids respond to changes in value as predicted by theory, regardless of group size. Thus, the slope of our estimated bid functions are in line with theoretical predictions.

The coefficient on \(\kappa _{it}\) is positive and statistically significant when we consider all periods, but we reject the null that it is equal to one. Furthermore, when we restrict attention to the second half of the experiment, the coefficient is no longer significant. That is, the intercept of the bid function seems to be lower than what theory predicts. As such, we conclude that deviations of bidding from theory are largely driven by bidders not accounting for the information that the entry cost conveys regarding the interval of bids from which the values of other bidders are drawn.

Rights and permissions

About this article

Cite this article

Aycinena, D., Bejarano, H. & Rentschler, L. Informed entry in auctions. Int J Game Theory 47, 175–205 (2018). https://doi.org/10.1007/s00182-017-0583-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00182-017-0583-9