Abstract

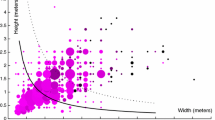

We analyze the evolution of the entry of painters and price of paintings in the XVII century Amsterdam art market. In line with evolutionary theory, demand-driven entry in the market was first associated with product innovations and a rapid increase in the number of painters. After reaching a peak, the number of painters started to decrease in parallel with a price decline and the introduction of process innovations. To test for the role of profitability in the art market as a determinant of endogenous entry of painters, we build a price index for the representative painting inventoried in Dutch houses. This is based on hedonic regressions controlling for characteristics of the paintings (size, genre, placement in the house), the owners (job, religion, value of the collection, size of the house) and the painters. After a peak at the beginning of the century, the real price of paintings decreased until the end of the century. We provide anecdotal evidence for which high initial prices attracted entry of innovators, and econometric evidence on the causal relation between price movements and entry.

Similar content being viewed by others

Notes

See Kemp (1990) on the history of technical innovations in art history.

Data on the number of painters in each Dutch city have been recently put together by the Ecartico project of the Amsterdam Centre for the Study of the Golden Age based at the University of Amsterdam.

For a challenging essay on the role of interests and ideas in changing pre-modern northwestern Europe, see McCloskey (2015).

Recent interdisciplinary research in economic history and cultural economics has been focused on the organization of historical markets for paintings, mainly during the XVII century for both primary markets (for instance see North 1999; Spear and Sohm 2010; Etro and Pagani 2012, 2013) and secondary markets (Montias 1991, 2002). For a parallel investigation on the economics of music composers in the XVIII and XIX centuries see Scherer (2004).

Hedonic price indexes for paintings were introduced by Chanel et al. (1994).

Inventories contain price evaluations rather than prices of effective transactions. However, as shown in Etro and Stepanova (2013), the analysis of prices from auctions leads to very similar results, suggesting that evaluations in inventories did reflect prices from the secondary market. We focus on inventories because the available data cover the entire century while auctions data are available only with gaps for the first four decades and the last two of the century.

The price regressions provide some interesting results in their own, showing, for instance, that smaller paintings, copies, anonymous paintings and paintings placed in private rooms or in the kitchen tend to have lower prices. The number of rooms in the house of the owner is a proxy for wealth and tends to be positively related to prices. Contrary to what emerges from descriptive statistics (Montias 1982, 2002), price differentials for alternative genres (figuratives, landscapes, genre paintings, still life paintings) disappear after controlling for the unobservable quality of paintings with the artists’ fixed effects. Finally, inventories drawn after the death of the owner or for a marriage have higher prices on average than those due to the insolvency of the owner or drawn to build a collateral for debt.

Early investigations were only based on nominal prices (Chong 1987; North 1999) and have pointed out an increase in average nominal prices from the beginning to the end of the century, with only price reductions for landscape paintings (Montias 1996) and genre paintings from the first to the second quarter of the century.

Similar theses have been advanced to link the high prices of paintings to other innovative periods, such as Mannerism and Rococo in Venice (Etro and Pagani 2013), the Neoclassical age in Paris (Etro and Stepanova 2015) and the Victorian age in London (Bayer and Page 2011; Etro and Stepanova 2017). However, as far as we know, this is the first attempt to provide causal evidence in support of this thesis.

On the Dutch society of the time see Schama (1987).

Some pupils paid up to 100 guilders a year (excluding board and lodging) to be trained by famous masters such as Rembrandt, Honthorst or Dou (North 1999, p. 65). To have an idea of the size of such an investment, Montias (1982) calculates that artists paid an average rent of 142 guilders a year, and bought houses of an average price of 1785 guilders.

Rembrandt asked double without success. However, he was later paid 1200 guilders for the Adoration of the Shepherds (1646, München, Alte Pinakothek) and the same for a Circumcision. Exports were rare, but we know that three paintings by Rembrandt were sent to Antonio Ruffo in Sicily for 500 guilders each. See Sluijter (2008). The same price was reached for a Susanna, while Lodewijk van Ludick paid 600 guilders for a Nativity and a Circumcision (Crenshaw 2006).

Montias (1982) provided also a regression of the logprice of the value of art collections on a time trend and on the logarithm of the total value of the inventories as a proxy of the wealth of the art collectors. There was no evidence of a significant time trend, while the wealth elasticity was estimated at 1.23, suggesting that wealthier collectors were significantly increasing their share of artworks in their holdings. Montias (1996) estimated the same elasticity at 1.42 for Amsterdam in the period 1600-1669.

In 1609, the United Provinces concluded the twelve-year truce with Spain, reaching the de facto recognition of independence. Remarkably, this opened the door to trade with Flanders and, in particular, to the arrival of Flemish paintings, which probably contributed to the drop in price during the second decade of the XVII century. See Sluijter (2008).

For an interesting descriptive analysis of these data, see Rasterhoff (2012).

We know that population was about 30,000 in 1575, 60,000 in 1600, 105,000 in 1622, 120,000 in 1635, 140,000 in 1650, about 200,000 in 1675 and 1690, and 205,000 at the end of the century and we interpolated other values. See http://www.populstat.info/. The plagues of 1635 and 1663 caused sudden drops in population.

Recently, macroeconomic models with imperfect competition and endogenous entry (as, for instance, Etro and Colciago 2010) have reproduced similar patterns at the sectoral level.

Since the price index is bi-annual, three periods correspond to six years.

For a distinction between demand-pull and technology-push theories of technical change, see Dosi (1982).

Landscape painters Esaias van de Velde and Jan Porcellis introduced the tonal style, the execution of which could be more rapid (this made Porcellis able to write a contract in 1615 that bound him to produce forty paintings in twenty weeks). The same style was also adopted in still life paintings, as by Willem Claesz. Heda. Its main diffusion, however, was in the field of landscapes, where it was taken to the extreme by Jan van Goyen, Salomon van Ruysdael and Pieter de Molijn: they were said to take only one day to paint their pictures and therefore were able to reduce substantially the unitary price of their works. See Slive (1995).

However, as noticed by a referee, these innovations were not always associated with cheaper production: some landscapes (by Ruysdael or van de Velde) used a reduced color scale, as one would see it at dusk, but they were not monochromatic, and some other works were small to accommodate domestic spaces, but they were also more detailed.

Prices are usually expressed as in the following example: f 2: 4: 6. This should be read as 2 guilders, 4 stuivers, 6 penningen. Notice that 20 stuivers (st.) correspond to a guilder (f.), and 16 penningen (pen.) amount to a stuiver.

To calculate the art value of the collections we took into account also the imported works and those of uncertain attribution.

This came from the inventory of the art dealer Johannes de Renialme (the most valuable in the dataset), who owned also other works by Rembrandt, Dou and Rubens at the top of the price distribution, evaluated respectively 600, 600 and 500 guilders.

Rembrandt went bankrupt in 1656, but we do not have evaluations from his inventory. Nevertheless, we know that the subsequent sale did not record high prices (Crenshaw 2006). As Schama (1999) notices, “the Negro Heads and The Descent from the Cross, a Jerome, an Ox, and a Bittern, a Danae and The Concord of the State, fifty or so paintings fetching altogether less than a thousand guilders”.

For instance, Chong (1987), focusing on a sample of high price paintings (excluding copies), has emphasized an average price of portraits increasing from 6 guilders in 1600-25, to 11 in 1626-50, 23 in 1651-75 and 37 in 1676-1700. The corresponding figures for genre paintings are 28, 22, 31 and 88 guilders, respectively, while still life paintings were priced 27, 30, 24 and 41 guilders in the four consecutive periods. Figurative paintings of religious subject moved from 33 guilders, to 43, 70 and 52. Finally, the price of landscapes moved from 30 guilders in 1600-25 to 22 in 1626-1650, 24 in 1651-1675 and 44 guilders in 1676-1700. Montias (1996) focused on landscapes drawn from two random samples of Amsterdam inventories, and showed a decline in the average nominal price of landscape paintings from 11.65 gulden in the period 1600-1619 (out of 64 observations) to 6.1 in the period 1650-1659 (out of 60 observations).

To public rooms we attribute the main reception rooms such as the great hall (saal), the great room (groote camer) and the best room (beste camer), and the office (comptoir). To private rooms we attribute back (achter-) rooms, upstairs (boven-) rooms, the ‘inner hearth’ (binnen camer), and the sleeping and children rooms. We exclude from the classification the front (voor-) rooms and side (zij-) rooms, because their purpose is not generally clear and can change across houses, and all the rooms without any indication of their placement within the house.

In Etro and Stepanova (2013) we run a multinomial Probit model for the placement in different rooms controlling for the main painting characteristics, such as whether it was a copy or whether it was attributed to an artist, whether it was large or small, and its genre, including some sub-genres. Larger paintings were 18 % more likely to be placed in the voorhuys while smaller paintings were more likely to be in private rooms or in the kitchen. Attributed paintings were 9 % more likely to be displayed in public rooms, especially when they represented figurative subjects, while private rooms and kitchens tended to display lower quality paintings as, respectively, portraits and still life paintings.

It is important to remark that we do not have precise data on the size of paintings, and we could only classify a third of them as small or large compared to the average size (when mentioned in the description of the painting). However the variability in size was lower in home collections compared to paintings destined to public commissions (which could be much larger).

Controlling for the average price of painting in the collections can be problematic if there is a limited heterogeneity between collections, which is not the case in this dataset. However, the other results are robust when we omit this control.

One should notice that portraits were penalized in the evaluation of the secondary market since the value for the commissioner was higher than the value for another collector.

As is well known, Rubens organized his workshop as a real enterprise, exploiting a large number of collaborators to produce an impressive amount of well paid works.

We tried to test for death effects, but the dataset is too limited to identify clear patterns.

According to Schama (1999, p. 330-331), this could be a matter of local taste: “ while we recognize the universal quality of Hals’ élan vital, in 1630 it probably seemed merely the best specimen of a parochial Haarlem-style... The Hals style certainly appealed to some Amsterdammers, since they would commission him to paint one of their militia companies. But it’s not hard to imagine the plutocrats who now disdained the bulk for the ”fine” trades considering Hals’s brassy ebullience as fit for the brewers and linen bleachers of Haarlem, but not for what they supposed to be their own more elegant fashion.”

This is the same inventory price index of Fig. 1.

As noticed by Hauser (1951, Vol. II), “not only Rembrandt and Hals, but also Vermeer, the third leading painter in Holland, had to fight against material worries. And the other two greatest painters of the country, Pieter de Hooch and Jacob van Ruisdael, were also not highly esteemed by their contemporaries and by no means among the artists leading a comfortable life. The epic of Dutch painting is not complete unless one adds that Hobbema had to give up painting in the best years of his life.”

See Etro and Colciago (2010) for a model of dynamic entry with imperfect competition between an endogenous number of differentiated producers.

In other words R, Granger causes E if:

$$\mathbb{E}\left\{ E_{t}\shortmid\left\{ E_{t-s}\right\}_{s=1}^{t},\left\{ R_{t-s}\right\}_{s=1}^{t}\right\} \neq\mathbb{E}\left\{ E_{t} \shortmid\left\{ E_{t-s}\right\}_{s=1}^{t}\right\} $$where \(\mathbb {E}\left [ \cdot \right ] \) is the expectation operator. The concept is operationalized by estimating a model of the form:

$$E_{t}=\alpha_{0}+\sum\limits_{s=1}^{L}\alpha_{s}E_{t-s}+\sum\limits_{s=1}^{L}\beta_{s}R_{t-s}+\varepsilon_{t} $$and testing the null hypothesis:

$$H_{0}= {\textstyle\bigcup\limits_{s=1}^{L}} \left( \beta_{s}=0\right) $$where L is the number of lags. See Granger (1969), Engle and Granger (1987) and Sims et al. (1992).

Similar results would emerge using the auction price index that covers a limited time period. However, this is based on more limited data and control variables. For this reason we focus on the inventory price index.

We run the same analysis using the percentage of painters in the population obtaining very similar results.

In our case, this was not possible because the only available macroeconomic variable, the real wage, is not directly related to the price of paintings, since the latter should reflect asset pricing principles (it depends on the expected consumption dividend of holding a painting and, possibly, the resale price). The return on different assets would be the ideal tool for this analysis.

See for instance Borowiecki (2015) on the origins of cultural supply in Italy.

References

Bayer T M, Page J R (2011) The development of the art market in England: money as muse, 1730-1900. Pickering & Chatto Publishers

Borowiecki K J (2015) Historical origins of cultural supply in Italy. Oxford Econ Papers 67(3):781–805

Box GEP, Jenkins GM (1970) Time series analysis: forecasting and control. Holden Day, San Francisco

Chanel O, Gérard-Varet L-A, Ginsburgh V (1994) Prices and returns on paintings: an exercise on how to price the priceless. Geneva Papers Risk Insur Theory 19(1):7–21

Chong A (1987) The market for landscape painting in seventeenth-century Holland. In: Sutton P (ed) Masters of the 17th-Century Dutch landscape painting. Exh. Cat., Boston, pp 104–20

Crenshaw P (2006) Rembrandt’s bankruptcy: the artist, his patrons, and the art world in seventeeth-century Netherlands. Cambridge University Press, Cambridge

De Marchi N, Van Miegroet H (1994) Art, value, and market practices in the Netherlands in the seventeenth century. Art Bull 76(3):451–64

De Marchi N, Van Miegroet H (eds) (2006) The history of art markets , Ch. 3. In Ginsburgh V, and Throsby D (eds) Handbook of the economics of art and culture, vol 1, Elsevier

De Vries J (1982) An Inquiry into the behavior of wages in the Dutch Republican and the Southern Netherlands from 1580 to 1800. In: Aymard M (ed) Dutch capitalism and World capitalism. Cambridge University Press, Cambridge

De Vries J, van der Woude A (1997) The first modern economy: success, failure, and perseverance of the Dutch economy, 1500-1815. Cambridge University Press

Dosi G (1982) Technological paradigms and technological trajectories: a suggested interpretation of the determinants and directions of technical change. Res Polic 11 (3):147–62

Engle RF, Granger CWJ (1987) Cointegration and error correction: representation, estimation and testing. Econometrica 55:251–76

Etro F., Colciago A. (2010) Endogenous market structures and the business cycle. Econ J 120:1201–34

Etro F., Marchesi S., Pagani L. (2015) The labor market in the art sector of Baroque Rome. Economic Inquiry 53(1):365–87

Etro F., Pagani L. (2012) The market for paintings in Italy during the seventeenth century. J Econ Hist 72(2):423–47

Etro F, Pagani L (2013) The market for paintings in the venetian republic from renaissance to Rococo. J Cultur Econ 37(4):391–415

Etro F, Stepanova E (2013) The market for paintings in the Netherlands during the Seventeenth Century, University of Venice, Ca’ Foscari, Dept. of Economics W.P. 16

Etro F, Stepanova E (2015) The market for paintings in Paris between Rococo and romanticism. Kyklos 68(1):28–50

Etro F, Stepanova E (2016) Art collections and taste in the Spanish Siglo de Oro. J Cultur Econ. in press

Etro F, Stepanova E (2017) Art auctions in London at the time of the industrial revolution, mimeo, Venice

Gort M, Klepper S (1982) Time paths in the diffusion of product innovations. Econ J 92:630–53

Granger CWJ (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37(3):424–38

Hauser A (1951) The social history of art. Routledge, London

Jovanovic B, Lach S (1989) Entry, exit, and diffusion with learning by doing. Amer Econ Rev 79(4):690–99

Kemp M (1990) The science of art: optical themes in western art from Brunelleschi to Seurat. Yale University Press, New Haven

Klepper S (1996) Entry, exit, growth, and innovation over the product life cycle. Amer Econ Rev:562–83

Klepper S (1997) Industry life cycles. Ind Corpor Change 6:145–82

Klepper S (2002) Firm survival and the evolution of oligopoly. RAND J Econ 33(1):37–61

Klepper S, Graddy E (1990) The evolution of new industries and the determinants of market structure. RAND J Econ 21(1):27–44

Loughman J, Montias J M (2001) Public and private spaces. Works of art in seventeenth-century Dutch houses. Antique Collectors Club Ltd

McCloskey D (2015) It was ideas and ideologies, not interests or institutions, which changed in Northwestern Europe, 1600–1848. J Evol Econ 25(1):57–68

vanMander K (1604) Het Leven der Doorluchtighe Nederlandtsche, en Hooghduytsche Schilders, Haarlem

Martens M, Peeters N (2006) Paintings in Antwerp Houses (1532-1567), Chapter 2 in De Marchi, N and H Van Miegroet Mapping markets for paintings in Europe 1450-1750. Brepols

Montias JM (1982) Artists and artisans in Delft: a socio-economic study of the seventeenth century. Princeton

Montias JM (1987) Cost and value in seventeenth-century art. Art Hist 10 (4):455–66

Montias JM, De Vries J (1991) Works of art in seventeenth-century Amsterdam: an analysis of sub-jects and attributions. In: Freedberg D (ed) Art in history/ history in art: studies in seventeenth-century Dutch culture, Santa Monica, pp 331–72

Montias JM (1996) Quantitative methods in the analysis of 17th century Dutch inventories. In: Ginsburgh V, Menger P (eds) Economics of arts - selected essays, Elsevier

Montias JM (2002) Art at auction in 17th century Amsterdam. Amsterdam University Press, Amsterdam

Nelson R, Winter SG (1982) An evolutionary theory of economic change. Harvard University Press

North M (1999) Art and commerce in the Dutch golden age. Yale University Press, New Haven

Ogilvie S (2004) Guilds, efficiency, and social capital: evidence from German Proto-industry. Econ Hist Rev 57(2):286–333

Prak MR (2008) Painters, guilds and the art market during the Dutch Golden Age. In: Prak M, Epstein SR (eds) Guilds, innovation and the European economy 1400-1800. Cambridge University Press, Cambridge

Rasterhoff C (2012) The fabric of creativity in the Dutch Republic. Painting and publishing as cultural industries, 1580-1800, PhD Dissertation, Utrecht

Schama S (1987) The embarrassment of riches: an interpretation of Dutch culture in the Golden Age. Alfred A. Knopf, New York

Schama S (1999) Rembrandt’s eyes. Alfred A. Knopf, New York

Scherer FM (2004) Quarter notes and bank notes: the economics of music composition in the 18th and 19th centuries. Princeton University Press, Princeton

Sims CA, Stock JH, Watson MW (1990) Inference in linear time series models with some unit roots. Econometrica 58:133–44

Slive S (1995) Dutch painting 1600-1800. Yale University Press, New Haven

Sluijter EJ (2008) Determining value on the art market in the Golden Age: an introduction. In: Tummers A (ed) Art market and connoisseurship: a closer look at paintings by Rembrandt, Rubens and their contemporaries, pp 7–28

Spear R, Sohm P (2010) Painting for profit. The economic lives of seventeenth-century Italian painters. Yale University Press, New Haven

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Economet 66(1–2):225–50

Winter SG (1984) Schumpeterian competition in alternative technological regimes. J Econ Behav Organiz 5(3):287–320

Acknowledgments

We are grateful to Karol Jan Borowiecki, Roberto Casarin, Giovanni Dosi, Kathryn Graddy, Neil De Marchi, Bruno Frey, Alessandro Nuvolari and Paul Richard Sharp for comments and especially to Mario Padula for initial participation to the project and many invaluable suggestions. The paper was presented at the University of Southern Denmark in Odense and the Ca’ Foscari University of Venice. Finally, Etro is thankful to Louisa Wood Ruby, Head of Photoarchive Research at the Frick Collection (New York).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Etro, F., Stepanova, E. Entry of painters in the Amsterdam market of the Golden Age. J Evol Econ 26, 317–348 (2016). https://doi.org/10.1007/s00191-016-0456-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-016-0456-6