Abstract

This article considers a pure-endowment stationary stochastic overlapping generations economy, in which agents have maxmin expected utility preferences. Two main results are obtained. First, we show that multiple stationary monetary equilibria exist. Consequently, real and price indeterminacies arise under the assumption that aggregate shock exists. Second, we show that each of these stationary monetary equilibria is conditionally Pareto optimal, i.e., no other stationary allocations strictly Pareto dominate the equilibrium allocations.

Similar content being viewed by others

Notes

To be more precise, axiomatizations of the MEU preference by Schmeidler (1982, 1989), and Gilboa and Schmeidler (1989) were demonstrated in the framework of Anscombe and Aumann (1963), not in Savage’s. Furthermore, Schmeidler (1989) axiomatized the Choquet expected utility (CEU) preference and showed that the class of convex CEU preferences belongs to the class of MEU preferences. By relaxing Savage’s postulates, the MEU preference was axiomatized in Savage’s framework by Casadesus-Masanell et al. (2000) and Alon and Schmeidler (2014).

According to the terminologies proposed by Knight (1921), the situation where the agents’ beliefs are not summarized by a single probability measure is called Knightian uncertainty. Thus, ambiguity is a special case of Knightian uncertainty, and the MEU preference is a special case of ambiguity.

There are good literature surveys such as Epstein and Schneider (2010), Gilboa and Marinacci (2013), and Guidolin and Rinaldi (2013). Etner et al. (2012) surveyed an ever-growing literature regarding decision theory under ambiguity after the papers by Schmeidler (1989) and Gilboa and Schmeidler (1989), and they also considered applications of ambiguity to economics.

See also Billot et al. (2000).

Epstein and Wang (1994) use similar logic to no aggregate uncertainty in order to show indeterminacy of equilibria in an intertemporal general equilibrium model with an infinitely lived representative agent. Note, however, that they only demonstrated nominal indeterminacy in this setting, i.e., they demonstrated the indeterminacy of the equilibrium asset prices but not of the equilibrium allocation. In their model, the single representative agent consumes the sum of the initial endowment and the dividend at each date along the equilibrium price path, and hence, real indeterminacy does not occur by the definition of the equilibrium. Also note that Epstein and Wang (1994) assume an uncertainty-averse representative agent in Lucas (1978) model. Essentially, the former is different from the latter only in this respect although the former assumes that consumptions are continuous over the state space to avoid some mathematical difficulty which would arise when consumptions were only measurable. Epstein and Wang (1995) overcome this difficulty by using the concept of analyticity.

Here, an “idiosyncratic component of the asset returns” refers to asset payoffs’ difference across some states over which endowments remain identical. While “no trade” can occur over some price width when endowments are universally identical according to Dow and Werlang (1992), Epstein and Wang (1994) showed that it can still occur even with idiosyncratic shocks in this restricted sense. In their framework of a representative agent, the state of no trade is equivalent to an equilibrium, and hence, the presence of some price width with no trade implies indeterminacy of equilibria. Mukerji and Tallon (2001) incorporate Epstein and Wang’s (1994) idea into a truly general equilibrium setting and showed “no trade” result and indeterminacy. Mukerji and Tallon (2004b) use this idiosyncratic shocks in order to solve a “puzzle” that the public want to denominate contracts in currency units. They extend Magill and Quinzii’s (1997) general equilibrium model where both nominal and indexed bonds are available for trade by assuming ambiguity-averse agents and then derive conditions under which there is no trade in indexed bonds in any equilibrium. Further, Ozsoylev and Werner (2011) use a similar idiosyncratic shocks to show the emergence of illiquid rational expectations equilibria by demonstrating that there exists a range of values of the signal and random asset supply over which the arbitrageurs, the suppliers of money, cease the trade in an asset pricing model with information transmission and with ambiguity-averse agents.

See Rinaldi (2009) for additional information on results in Mukerji and Tallon (2001). Note, however, that since the MEU preference is a special case of the variational preference axiomatized by Maccheroni et al. (2006) and since any variational preference may be approximated arbitrarily well by another smooth variational preference, Rinaldi’s (2009) result is not a confirmation that Mukerji and Tallon’s (2001) result works for the whole class of variational preferences. In a similar fashion, the robust indeterminacy in this article is concerned with the robustness with respect to only the initial endowments and not the robustness with respect to both the initial endowments and the preferences, that is, the preferences are supposed to be fixed. The authors are grateful to an anonymous referee for making this point clear.

Interested readers may also see Ohtaki (2015).

Recently, Ohtaki and Ozaki (2013) extended the standard dominant root characterization of the optimal allocations to the economy under ambiguity.

Except for the preferences, the ingredients of our model are similar to those in Labadie’s work (2004). However, her objective was to examine the financial arrangements that could result in the optimal allocations, not to examine the in/determinacy of stationary monetary equilibrium.

This definition of the date-event tree is standard and can be seen in, for example, Chattopadhyay (2001).

That is, the formation of the belief is independent of the past history of realized states. Further, the set of priors may not be common to all agents who are distinguished by the states at which they are born.

Gilboa and Schmeidler (1989) axiomatized the MEU preferences over lottery acts, and Casadesus-Masanell et al. (2000) axiomatized the MEU preferences over Savage acts. Their axiomatization does not depend on whether the state space is finite or infinite, and hence, it may be applied to our situation with a finite state space.

Labadie (2004) considered a time-separable utility index function.

The \(\varepsilon \)-contamination was first axiomatized by Nishimura and Ozaki (2006).

In (1), we assume that the budget constraints hold with equalities. We can do this for the first budget constraint without loss of generality by the strict increase of u. For the other budget constraints, we simply assume it. Also note that we exclude corner solutions by assuming that \((c^y,(c^o_{s^{\prime }})_{s^{\prime }\in S}) \in \mathfrak {R}_{++}\,\times \,\mathfrak {R}_{++}^S\) and (2).

The MEU preferences in the Cobb–Douglas form as in this example have recently been axiomatized by Faro (2013).

To be more precise, the marginal rates of substitution for indifferent curves derived from \(\hat{U}^s\), denoted by \(\widehat{MRS}_{s}(x^o)\), are calculated using

$$\begin{aligned} \widehat{MRS}_{\alpha }\left( x^o\right) =-\frac{\hat{U}^{\alpha }_1\left( x^o\right) }{\hat{U}^{\alpha }_2\left( x^o\right) } =\left\{ \begin{array}{ll} \displaystyle \frac{\left[ \left( 1+\varepsilon \right) x^o_{\alpha } -\varepsilon \bar{\omega }_{\alpha }\right] x^o_{\beta }}{\left( 1-\varepsilon \right) \left( \bar{\omega }_{\alpha }-x^o_{\alpha }\right) x^o_{\alpha }} &{}\quad \hbox {if}\quad x^o_{\alpha }>x^o_{\beta },\\ \displaystyle \frac{\left[ \left( 1+\delta \right) x^o_{\alpha } -\delta \bar{\omega }_{\alpha }\right] x^o_{\beta }}{\left( 1-\delta \right) \left( \bar{\omega }_{\alpha }-x^o_{\alpha }\right) x^o_{\alpha }} &{}\quad \hbox {if}\quad x^o_{\alpha }<x^o_{\beta }, \end{array} \right. \end{aligned}$$and

$$\begin{aligned} \widehat{MRS}_{\beta }\left( x^o\right) =-\frac{\hat{U}^{\beta }_1\left( x^o\right) }{\hat{U}^{\beta }_2\left( x^o\right) } =\left\{ \begin{array}{ll} \displaystyle \frac{\varepsilon \left( \bar{\omega }_{\beta } -x^o_{\beta }\right) x^o_{\beta }}{\left[ \left( 2-\varepsilon \right) x^o_{\alpha } -\left( 1-\varepsilon \right) \bar{\omega }_{\beta }\right] x^o_{\alpha }} &{}\quad \hbox {if}\quad x^o_{\alpha }>x^o_{\beta },\\ \displaystyle \frac{\delta \left( \bar{\omega }_{\beta } -x^o_{\beta }\right) x^o_{\beta }}{\left[ \left( 2-\delta \right) x^o_{\alpha } -\left( 1-\delta \right) \bar{\omega }_{\beta }\right] x^o_{\alpha }} &{}\quad \hbox {if}\quad x^o_{\alpha }<x^o_{\beta }\\ \end{array} \right. \end{aligned}$$if \(x^o_{\alpha }\ne x^o_{\beta }\). However, it cannot be calculated at \(x^o\) with \(x^o_{\alpha }=x^o_{\beta }\), if \(\varepsilon <\delta \).

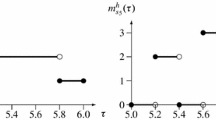

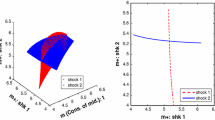

The detail of the box diagram presented here was provided in Ohtaki (2014).

To be more precise, Magill and Quinzii (2003, Proposition 2) show the indeterminacy of the candidates for “expectation functions,” each of which constructs a nonstationary rational expectations equilibrium with circulating money.

See also Theorem of Ohtaki (2015).

As shown by Gottardi (1996), a “zero-th order” stationary monetary equilibrium (where money prices only depend on the current states) is locally isolated. In contrast, Spear et al. (1990) showed that the “first-” and “second-order” stationary monetary equilibria (where money prices may depend on the past states) are indeterminate. In our article, the stationarity always refers to the “zero-th order.”

The basic idea is as follows. Let \(s_{1} := \arg \min _{s^{\prime }\in S}\omega ^o_{s^{\prime }}+q^*_{s^{\prime }}\), and let \({\mathcal {M}}_{1}\) be the set of probability measures in \({\mathcal {P}}_s\) that assign the largest probability to \(s_{1}\). Then, let \(s_{2} := \arg \min _{s^{\prime }\in S\backslash \{s_{1}\}}\omega ^o_{s^{\prime }}+q^*_{s^{\prime }}\), and let \({\mathcal {M}}_{2}\) be the set of probability measures in \({\mathcal {M}}_{1}\) that assign the largest probability to \(s_{2}\). Continuing this process can lead to a single probability measure in \({\mathcal {P}}_s\) that is the unique element of \({\mathcal {M}}_s(c^M_s(q))\). In general, however, the success of this procedure hinges upon the nature of \({\mathcal {P}}_s\). In this sense, the argument of this footnote stands only heuristically. For example, if \({\mathcal {P}}_s\) is characterized by \(\varepsilon \)-contamination, the above procedure will determine a single probability measure.

As stated in the previous footnote, the system of equations can possibly be a system of inclusions. Because we are concerned with a sufficient condition for multiple equilibria, we can neglect such a situation for our purpose.

Interested readers may refer to Cass et al. (1992), which also provided the existence and regularity results for the stationary monetary equilibrium in a more complicated stochastic OLG model.

Consider \(\overline{s}\) and \(\underline{s}\) such that \(\omega _{\overline{s}}=\max _{s \in S}\omega ^o_s\) and \(\omega _{\underline{s}}=\min _{s \in S}\omega ^o_s\). Because \(\pi \gg 0\) for each \(\pi \in {\mathcal {P}}_s\), \(\bar{c}^{\, *o}\) should satisfy that \(1<\min _{\pi \in {\mathcal {P}}_{\underline{s}}} \sum _{s^{\prime }\in S}(\bar{c}^{\, o*}-{\omega }^o_{s^{\prime }})\pi _{s^{\prime }} /(\bar{c}^{\, *o}-{\omega }^o_{\underline{s}}) \le u_1(\bar{\omega }-\bar{c}^{\, *o},\bar{c}^{\, *o}) /u_2(\bar{\omega }-\bar{c}^{\, *o},\bar{c}^{\, *o}) \le \max _{\pi \in {\mathcal {P}}_{\overline{s}}} \sum _{s^{\prime }\in S}(\bar{c}^{\, o*}-{\omega }^o_{s^{\prime }})\pi _{s^{\prime }} /(\bar{c}^{\, *o}-{\omega }^o_{\overline{s}})<1\). However, this is a contradiction.

This result can be extended to slightly more general preferences. See Ohtaki (2015).

In the framework of additively time-separable preferences, Manuelli (1990) also provides uniqueness results under an additional assumption that the states’ evolution follows an i.i.d. process. He considers a stochastic OLG model with a general state space, and hence, it includes a finite state space case as in our model as a special case. Note that even when the set of priors, \({\mathcal {P}}_s\), is independent of s, Corollary 2 still demonstrates the existence of a continuum of stationary monetary equilibria.

Note that the proof of Theorem 4 does not require continuous differentiability of u.

References

Aiyagari, S.R., Peled, D.: Dominant root characterization of Pareto optimality and the existence of optimal equilibria in stochastic overlapping generations models. J. Econ. Theory 54, 69–83 (1991)

Alon, S., Schmeidler, D.: Purely subjective maxmin expected utility. J. Econ. Theory 152, 382–412 (2014)

Anscombe, F.J., Aumann, R.J.: A definition of subjective probability. Ann. Math. Stat. 34, 199–205 (1963)

Aubin, J.P.: Mathematical Methods of Game and Economic Theory. North-Holland, Amsterdam (1979)

Billot, A., Chateauneuf, A., Gilboa, I., Tallon, J.-M.: Sharing beliefs: between agreeing and disagreeing. Econometrica 68, 685–694 (2000)

Casadesus-Masanell, R., Klibanoff, P., Ozdenoren, E.: Maxmin expected utility over Savage acts with a set of priors. J. Econ. Theory 92, 35–65 (2000)

Cass, D., Green, R.C., Spear, S.E.: Stationary equilibria with incomplete markets and overlapping generations. Int. Econ. Rev. 33, 495–512 (1992)

Chateauneuf, A., Dana, R.-A., Tallon, J.-M.: Risk sharing rules and equilibria with non-additive expected utilities. J. Math. Econ. 61(4), 953–957 (2000)

Chattopadhyay, S.: The unit root property and optimality: a simple proof. J. Math. Econ. 36, 151–159 (2001)

Chattopadhyay, S., Gottardi, P.: Stochastic OLG models, market structure, and optimality. J. Econ. Theory 89, 21–67 (1999)

Dana, R.-A.: Ambiguity, uncertainty aversion and equilibrium welfare. Econ. Theory 23, 569–587 (2004)

Demange, G., Laroque, G.: Social security and demographic shocks. Econometrica 67, 527–542 (1999)

Diamond, P.A.: National debt in a neoclassical growth model. Am. Econ. Rev. 55, 1126–1150 (1965)

Dow, J., Werlang, S.R.C.: Uncertainty aversion, risk aversion, and the optimal choice of portfolio. Econometrica 60(1), 197–204 (1992)

Ellsberg, D.: Risk, ambiguity, and the Savage axioms. Q. J. Econ. 75, 643–669 (1961)

Epstein, L.G., Schneider, M.: Ambiguity and asset markets. Annu. Rev. Financ. Econ. 2, 315–346 (2010)

Epstein, L.G., Wang, T.: Intertemporal asset pricing under Knightian uncertainty. Econometrica 62, 283–322 (1994)

Epstein, L.G., Wang, T.: Uncertainty, risk-neutral measures and security price booms and crashes. J. Econ. Theory 67, 40–82 (1995)

Etner, J., Jeleva, M., Tallon, J.-M.: Decision theory under ambiguity. J. Econ. Surv. 26, 234–270 (2012)

Faro, J.H.: Cobb-Douglas preferences under uncertainty. Econ. Theory 54, 273–285 (2013)

Fukuda, S.-I.: Knightian uncertainty and poverty trap in a model of economic growth. Rev. Econ. Dyn. 11, 652–663 (2008)

Gajdos, T., Hayashi, T., Tallon, J.-M., Vergnaud, J.-C.: Attitude toward imprecise information. J. Econ. Theory 140, 27–65 (2008)

Ghirardato, P., Marinacci, M.: Ambiguity made precise. J. Econ. Theory 102, 251–289 (2002)

Gilboa, I., Marinacci, M.: Ambiguity and the Bayesian Paradigm. In: Acemoglu, D., Arellano, M., Dekel, E. (eds.) Advances in economics and econometrics tenth world congress, pp. 179–242. Cambridge University, Cambridge (2013)

Gilboa, I., Schmeidler, D.: Maxmin expected utility with non-unique prior. J. Math. Econ. 18, 141–153 (1989)

Gottardi, P.: Stationary monetary equilibria in overlapping generations models with incomplete markets. J. Econ. Theory 71, 75–89 (1996)

Guidolin, M., Rinaldi, F.: Ambiguity in asset pricing and portfolio choice: a review of the literature. Theory Decis. 74, 183–217 (2013)

Kehoe, T.J., Levine, D.K.: Regularity in overlapping generations exchange economies. J. Math. Econ. 13, 69–93 (1984)

Klibanoff, P., Marinacci, M., Mukerji, S.: A smooth model of decision making under ambiguity. Econometrica 73, 1849–1892 (2005)

Knight, F.: Risk, uncertainty and profit. Houghton Mifflin, Boston (1921)

Labadie, P.: Aggregate risk sharing and equivalent financial mechanisms in an endowment economy of incomplete participation. Econ. Theory 27, 789–809 (2004)

Lucas Jr, R.E.: Asset prices in an exchange economy. Econometrica 46, 1429–1445 (1978)

Maccheroni, F., Marinacci, M., Rustihici, A.: Ambiguity aversion, robustness, and the variational representation of preferences. Econometrica 74, 1447–1498 (2006)

Magill, M., Quinzii, M.: Which improves welfare more: a nominal or an indexed bond? Econ. Theory 10, 1–37 (1997)

Magill, M., Quinzii, M.: Indeterminacy of equilibrium in stochastic OLG models. Econ. Theory 21, 435–454 (2003)

Mandler, M.: Endogenous indeterminacy and volatility of asset prices under ambiguity. Theor. Econ. 8, 729–750 (2013)

Manuelli, R.: Existence and optimality of currency equilibrium in stochastic overlapping generations models: the pure endowment case. J. Econ. Theory 51, 268–294 (1990)

Mukerji, S., Tallon, J.-M.: Ambiguity aversion and incompleteness of financial markets. Rev. Econ. Stud. 68(4), 883–904 (2001)

Mukerji, S., Tallon, J.-M.: An overview of economic applications of David Schmeidler’s models of decision making under uncertainty. In: Gilboa, I. (ed.) Uncertainty in Economic Theory. Routledge, New York (2004a)

Mukerji, S., Tallon, J.-M.: Ambiguity aversion and the absence of indexed debt. Econ. Theory 24, 665–685 (2004b)

Nishimura, K.G., Ozaki, H.: An axiomatic approach to \(\varepsilon \)-contamination. Econ. Theory 27, 333–340 (2006)

Ohtaki, E., Ozaki, H.: Optimality in a stochastic OLG model with ambiguity. Tokyo Center for Economic Research Paper No. E-69. Available at SSRN: http://ssrn.com/abstract=2377585 (2013)

Ohtaki, E.: A note on the existence of monetary equilibrium in a stochastic OLG model with a finite state space. Econ. Bull. 31, 485–492 (2011)

Ohtaki, E.: Golden rule optimality in stochastic OLG economies. Math. Soc. Sci. 65, 60–66 (2013)

Ohtaki, E.: Tractable graphical device for analyzing stationary stochastic OLG economies. J. Macroecon. 40, 16–26 (2014)

Ohtaki, E.: A note on the existence and uniqueness of stationary monetary equilibrium in a stochastic OLG model. Macroecon. Dyn. 19, 701–707 (2015)

Ozsoylev, H., Werner, J.: Liquidity and asset prices in rational expectations equilibrium with ambiguous information. Econ. Theory 48, 469–491 (2011)

Rigotti, L., Shannon, C.: Sharing risk and ambiguity. J. Econ. Theory 147, 2028–2039 (2012)

Rinaldi, F.: Endogenous incompleteness of financial markets: the role of ambiguity and ambiguity aversion. J. Math. Econ. 45, 880–901 (2009)

Sakai, Y.: Conditional Pareto optimality of stationary equilibrium in a stochastic overlapping generations Model. J. Econ. Theory 44, 209–213 (1988)

Savage, L.J.: The Foundations of Statistics. John Wiley, New York (1954). (2nd ed., 1972, Dover, New York)

Schmeidler, D.: Subjective probability without additivity. (Temporary Title), Working Paper, The Foerder Institute for Economic Research, Tel Aviv University (1982)

Schmeidler, D.: Subjective probability and expected utility without additivity. Econometrica 57, 571–587 (1989). (Its working paper is first published in 1982)

Spear, S.E., Srivastava, S., Woodford, M.: Indeterminacy of stationary equilibrium in stochastic overlapping generations models. J. Econ. Theory 50, 265–284 (1990)

Takayama, A.: Mathematical Economics. The Dryden Press, Hinsdale, IL (1974)

Tallon, J.-M.: Do sunspots matter when agents are choquet-expected-utility maximizers? J. Econ. Dyn. Control 22, 357–368 (1998)

Acknowledgments

The second author’s work was supported by JSPS KAKENHI Grant Number 23530226. This work was also supported by the grant-in-aid for the Global COE Program “Raising Market Quality-Integrated Design of Market Infrastructure” from MEXT. Both authors thank the two anonymous referees and participants at numerous seminars for their helpful comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ohtaki, E., Ozaki, H. Monetary equilibria and Knightian uncertainty. Econ Theory 59, 435–459 (2015). https://doi.org/10.1007/s00199-015-0887-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-015-0887-6

Keywords

- Money

- Maxmin expected utility

- Conditional Pareto optimality

- Indeterminacy

- Stochastic overlapping generations model