Abstract

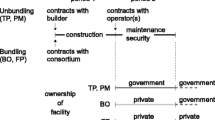

This paper addresses the benefits of bundling two sequential activities in the context of public–private partnerships (PPPs). The paper introduces a source of asymmetric information in the form of an externality parameter that links the building stage with subsequent operational activity. Within this framework, bundling allows the government to extract private information about the magnitude of the externality parameter. The framework also implies a higher degree of asymmetric information related to the operational stage than unbundling does when the contract is written. Our results indicate that the use of bundled contracts allows PPPs to be commitment devices that force governments to define ex-ante more coherent and informed plans, thereby improving investments and reducing unexpected cost overruns. However, because of the presence of asymmetric information, bundling makes any cost-reducing effort suboptimal during the operational phase.

Similar content being viewed by others

Notes

Martimort and Pouyet (2008) expand their basic model to allow for general schemes in which the builder’s payment depends on the operator’s cost, more complete contracts, and the introduction of an adverse-selection issue concerning operating costs. The authors conclude that, with a benevolent decision-maker and a privately informed operator, bundling is still the optimal organizational form when the externality is positive.

Since the shadow cost of public funds is higher in developing countries than it is in developed countries, optimal choices between regulation, on one hand, and outsourcing or privatization strategies, on the other, are expected to differ between those countries (Auriol and Picard 2009b).

For instance, an automated metro system may reduce the need for drivers (positive externality). However, while innovative designs and materials for the construction of sustainable public buildings can increase the social surplus, they can also increase maintenance costs (negative externality).

This cost function follows the structure proposed by Laffont and Tirole (1986). In the context of PPPs, the setting of our model is related to Hoppe and Schmitz (2013), where the agent in charge of the building task can come up with an innovation, while the agent in charge of the operation task can implement adaptations to improve the service provision whose cost depends on the first stage innovation.

This hypothesis is believable in real world cases where is the operator that is informed about the magnitude of his own maintenance and management costs for a given quality of the infrastructure. The information setting of the model is particularly suitable for some sectors, such as the transport sector, where the operator is entitled of most of the relevant information and, in practice, has to manage all relevant risks (Roumboutsos 2015).

Starting from this case, there is always the possibility of decentralizing through a menu of linear contracts \(T=a-bC\) (Laffont and Tirole 1993).

This IC condition gives the agent no incentive to deviate and ensures truth-telling. This necessary condition is also sufficient if the marginal cost decreases as the positive externality increases. For a detailed proof, see the online appendix (Lemma 1).

For a detailed proof, see the online appendix (Lemma 2).

This IC condition gives the agent no incentive to deviate and ensures truth-telling. This necessary condition is also sufficient if the marginal cost increases as the negative externality increases. For a detailed proof, see the online appendix (Lemma 3).

For a detailed proof, see the online appendix (Lemma 4).

The introduction of the parameters p and h allows for more general results. For the purpose of this analysis, it is assumed that \(p>0\), \(h>0\) and \(hp<1\).

In the presence of a positive externality, the function \(\sigma _{\theta }^{w}\) is concave and reaches a maximum for a value of \(\lambda \) between 0 and 1 unless the value of \(\theta \) is very high.

In standard projects, information on management costs is generally common knowledge for both parties, while in R&D investments, future information on costs or project outcomes is uncertain for both the public and the private sectors.

All projects that involve new applications of existing innovations are suitable examples.

References

Auriol E, Picard PM (2009a) Government outsourcing: public contracting with private monopoly. Econ J 119(540):1464–1493

Auriol E, Picard PM (2009b) Infrastructure and public utilities privatization in developing countries. World Bank Econ Rev 23(1):77–100

Auriol E, Picard PM (2013) A theory of bot concession contracts. J Econ Behav Organ 89(C):187–209

Baron DP, Myerson RB (1982) Regulating a monopolist with unknown costs. Econometrica 50(4):911–930

Bentz A, Grout P, Halonen ML (2002) Public–private partnerships: What should the state buy? In: CMPO working paper 01/40. University of Bristol, Bristol

Brumby J, Verhoeven M (2010) Public expenditure after the global financial crisis. In: The day after tomorrow: a handbook on the future of economic policy in the developing world. No. 2196. World Bank, Washington, pp 193–206

Coviello D, Moretti L, Spagnolo G, Valbonesi P (2017) Court efficiency and procurement performance. Scand J Econ 120:826–858

Dewatripont M, Legros P (2005) Public–private partnerships: contract design and risk transfer. EIB Pap 10(1):120–145

ECB (2016) Public investment in Europe. ECB Econ Bull (Issue no. 2/2016) 2:75–88

Engel E, Fischer R, Galetovic A (2013) The basic public finance of public private partnerships. J Eur Econ Assoc 11(1):83–111

EPEC (2011) The non financial benefit of PPPs. In: Technical report on EIB—European PPP expertise centre

EPEC (2012) Guidance on energy efficiency in public buildings. In: Technical report on EIB—European PPP expertise centre

Girth AM (2014) A closer look at contract accountability: exploring the determinants of sanctions for unsatisfactory contract performance. J Pub Adm Res Theor 24(2):317. https://doi.org/10.1093/jopart/mus033

Hart O (2003) Incomplete contracts and public ownership: remarks and an application to public–private partnerships. Econ J 113:C69–C76

Hodge GA, Greve C (2007) Public–private partnerships: an international performance review. Pub Adm Rev 67(3):545–558

Hoppe E, Schmitz PW (2013) Public–private partnerships versus traditional procurement: innovation incentives and information gathering. RAND J Econ 44(1):56–74

Iossa E, Martimort D (2015) The simple micro-economics of public private partnerships. J Pub Econ Theor 17(1):4–48

Iossa E, Russo FA (2008) Potenzialità e criticità del partenariato pubblico privato in italia. Rivista di Politica Econ 98(3):125–158

Koontz TM, Thomas CW (2012) Measuring the performance of public–private partnerships. Pub Perform Manag Rev 35(4):769–786

Laffont JJ, Tirole J (1986) Using cost observation to regulate firms. J Political Econ 94(3):614–641

Laffont JJ, Tirole J (1993) A theory of incentives in procurement and regulation. MIT Press, Cambridge

Li S, Sun H, Yan J, Yu J (2015) Bundling decisions in procurement auctions with sequential tasks. J Pub Econ 128:96–106

Martimort D, Pouyet J (2008) To build or not to build: normative and positive theories of private–public partnerships. Int J Ind Organ 26(2):392–411

OECD (2013) From lessons to principles for the use of public–private partnerships. In: Policy briefs, OECD: 32nd Annual meeting of working party of senior budget officials

OECD (2014) Recommendation of the council on effective public investment across levels of government. In: Technical report

Raisbeck P, Duffield C, Xu M (2010) Comparative performance of ppps and traditional procurement in australia. Constr Manag Econ 28(4):345–359

Roumboutsos A (2015) Public private partnerships in transport: trends and theory. In: Cost-European cooperation in science and technology

Saussier S, Phuong Tra T (2012) L’efficacité des contrats de partenariat en france : une premiére évaluation quantitative. Revue d’Économie Industrielle 2012. 4(140):81–110

Spagnolo G (2012) Reputation, competition, and entry in procurement. Int J Ind Organ 30(3):291–296

Acknowledgements

I am grateful to Emmanuelle Auriol, Federico Boffa, Sara Calligaris, Eshien Chong, Stefano Galavotti, Luciano Greco, Antonio Nicoló, Elena Podkolzina, Paola Valbonesi and the participants at the SIEPI workshop (Napoli 2014), the workshop How do Governance Complexity and Financial Constraints affect Public–Private Contracts? Theory and Empirical Evidence (Padova 2014), the EACES workshop (Moscow 2013) and the 54 RSA SIE conference (Bologna 2013) for their valuable comments and suggestions on different versions of this paper. A special thank to Eva Hoppe for her revision and very useful advice. I would also like to thank participants of the Baraza seminar (Toulouse TSE) and Chaire EPPP members for their useful feedback. Any remaining errors are the author’s responsibility. I gratefully acknowledge the financial support of the the University of Padova (Grant No. CPDA121089). I thank two anonymous referees as well as the Managing Editor, Giacomo Corneo, for their helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix

Appendix

This Appendix contains the proofs and the the comparative statistical analysis.

1.1 Proof of Proposition 1

The expected function that is used to perform the welfare analysis is the following:

1.1.1 Positive externality (\(a=1\))

Using the new investment and effort functions, the first-order conditions in the bundling case become:

\(I^{B}=\frac{p}{1-hp}\frac{s+(1+\lambda )\theta }{1+\lambda }-\frac{p}{1-hp}\frac{\lambda }{1+\lambda }\frac{1-F(\theta )}{f(\theta )}\),

\(e^{B}=h I^B-\frac{\lambda }{1+\lambda }\frac{1-F(\theta )}{f(\theta )}\).

Substituting in the government’s objective formula, we obtain the value function under bundling:

The new efforts functions applied to the unbundling case yield, respectively:

\(I^{U}=p\frac{s+(1+\lambda ){\overline{\theta }}}{(1+\lambda )(1-hp)}\),

\(e^{U}=h I^U\).

Substituting in the government’s objective formula, we obtain the value function under unbundling:

The net welfare gain/loss of governments when using bundling is equal to:

where \(e^B=\frac{hp}{1-hp}\frac{s+(1+\lambda )\theta }{1+\lambda }-\frac{hp}{1-hp}\frac{\lambda }{1+\lambda }\frac{1-F(\theta )}{f(\theta )}-\frac{\lambda }{1+\lambda }\frac{1-F(\theta )}{f(\theta )}\).

As a result, bundling dominates unbundling if and only if:

1.1.2 Proof of Corollary 2—positive externality

To study the sign of the derivative of \(\sigma _{\theta }^{w}\) varies with \(\lambda \), it is sufficient to study the derivative of the integrand in the previous inequality with respect to \(\lambda \) that is equal to:

As a conclusion, the value of \(\sigma _{\theta }^{2}\) can increase or decrease with \(\lambda \). Precisely, the derivative is positive if \(\lambda =0\), while it may become negative as \(\lambda \) increases. The second derivative is equal to:

1.1.3 Negative externality (\(a=-1\))

Using the new investment and effort functions, the first-order conditions in the bundling case become:

\(I^{B}=\frac{p}{1-hp}\frac{s-(1+\lambda )\theta }{1+\lambda }-\frac{p}{1-hp}\frac{\lambda }{1+\lambda }\frac{F(\theta )}{f(\theta )}\),

\(e^{B}=h I^B-\frac{\lambda }{1+\lambda }\frac{F(\theta )}{f(\theta )}\).

Substituting in the government’s objective formula, we obtain the value function under bundling:

The new efforts functions applied to the unbundling case yield, respectively:

\(I^{U}=p\frac{s-(1+\lambda ){\overline{\theta }}}{(1+\lambda )(1-hp)}\),

\(e^{U}=h I^U\).

Substituting in the government’s objective formula, we obtain the value function under unbundling:

The net welfare gain/loss of governments when using bundling is equal to:

where \(e^B=\frac{hp}{1-hp}\frac{s-(1+\lambda )\theta }{1+\lambda }-\frac{hp}{1-hp}\frac{\lambda }{1+\lambda }\frac{F(\theta )}{f(\theta )}-\frac{\lambda }{1+\lambda }\frac{F(\theta )}{f(\theta )}\).

As a result, bundling dominates unbundling if and only if:

1.1.4 Proof of Corollary 2—negative externality

To study the sign of the derivative of \(\sigma _{\theta }^{w}\) varies with \(\lambda \), it is sufficient to study the derivative of the integrand in the previous inequality with respect to \(\lambda \) that is equal to:

As a conclusion, the value of \(\sigma _{\theta }^{2}\) can increase or decrease with \(\lambda \). Precisely, the derivative is positive if \(\lambda =0\), while it is negative if \(\lambda =1\). The second derivative is equal to:

Rights and permissions

About this article

Cite this article

Buso, M. Bundling versus unbundling: asymmetric information on information externalities. J Econ 128, 1–25 (2019). https://doi.org/10.1007/s00712-018-0642-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-018-0642-0