Abstract

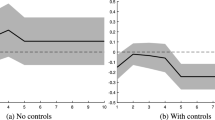

The paper investigates the link between domestic demand pressure and exports by considering an error correction dynamic panel model for eleven euro area countries over the last two decades. The results suggest that there is a statistically significant substitution effect between domestic and foreign sales. Furthermore, this relationship appears to be asymmetric, as the link is much stronger when domestic demand falls than when it increases. Weakness in the domestic market translates into increased efforts to serve markets abroad, but, conversely, during times of boom, exports are not negatively affected by increasing domestic sales. This reorientation towards foreign markets was particularly important during the crisis period, and thus could represent a new adjustment channel to strong negative domestic shocks. The results have important policy implications, as this substitution effect between domestic and external markets might allow the euro area countries under stress to improve their trade outcomes with a relatively small downward pressure on domestic prices.

Similar content being viewed by others

Notes

All the estimation results presented have been obtained using the usual fixed effects estimator. One should mention that the presence of the lagged endogenous variable might suggest the use of the well-known Arellano and Bond (1991) procedure. Firstly, the several estimation exercises conducted, using the Arellano and Bond procedure, to assess the sensitivity of the results to the estimation procedure pointed to qualitatively similar findings. Secondly, one should stress that the latter method has been developed for panels with a short time dimension and a very large number of cross-section observations. When the number of periods is large and the cross section is small, the use of this alternative estimator may lead to a loss of efficiency. On the other hand, the fixed effects estimator becomes consistent as the number of periods gets large [see Nickell (1981) and Alvarez and Arellano (2003)].

The long-run elasticities of price competitiveness (given by the ratio between the coefficient of the real effective exchange rate and the speed of adjustment) are 0.82, 1.00 and 0.73 for the models using the indicators based on the GDP deflator, the CPI and the ULCT, respectively.

Before its exclusion from the regressions presented above, the coefficient associated with positive changes of domestic demand presented a value close to zero with a very low t-ratio.

References

Allard, C. (2009). Competitiveness in Central-Europe: What has happened since EU accession? (IMF Working Paper 121). Washington, DC: International Monetary Fund.

Altomonte, C., Sono, T., & Vandenbussche, H. (2013). Firm-level productivity and exporting: Diagnosing the role of financial constraints. In European Commission (Ed.), Product market review 2013: Financing the real economy. European Union: Brussels (chapter 2).

Alvarez, J., & Arellano, M. (2003). The time series and cross-section asymptotics of dynamic panel data estimators. Econometrica, 71(4), 1121–1159.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58(2), 277–297.

Ball, R. J., Eaton, J. R., & Steuer, M. D. (1966). The relationship between United Kingdom export performance in manufactures and the internal pressure of demand. The Economic Journal, 76(303), 501–518.

Belke, A., Dobnik, F., & Dreger, C. (2011). Energy consumption and economic growth: New insights into the cointegration relationship. Energy Economics, 33(5), 782–789.

Belke, A., & Dreger, C. (2013). Current account imbalances in the euro area: Does catching up explain the development? Review of International Economics, 21(1), 6–17.

Belke, A., Oeking, A., & Setzer R. (2014). Exports and capacity constraints—A smooth transition regression model for six euro area countries (ECB Working Paper 1740). Frankfurt: European Central Bank.

Bernard, A., & Wagner, J. (2001). Export entry and exit by German firms. Weltwirtschaftliches Archiv/Review of World Economics, 137(1), 105–123.

Breitung, J. (2000). The local power of some unit root tests for panel data. In B. Baltagi (Ed.), Nonstationary panels, panel cointegration, and dynamic panels, advances in econometrics (Vol. 15, pp. 161–178). Amsterdam: JAI Press.

Ca’Zorzi, M., & Schnatz, B. (2007). Explaining and forecasting euro area exports: Which competitiveness indicator performs best? (ECB Working Paper 833). Frankfurt: European Central Bank.

Christodoulopoulou, S., & Tkačevs, O. (2014). Measuring the effectiveness of cost and price competitiveness in external rebalancing of euro area countries. What do alternative HCIS tell us? (ECB Working Paper 1736). Frankfurt: European Central Bank.

di Mauro, F., & Forster, K. (2008). Globalisation and the competitiveness of the euro area (ECB occasional paper 97). Frankfurt: European Central Bank.

ECB (European Central Bank). (2013). Country adjustment in the euro area: Where do we stand? Monthly Bulletin, May, pp. 85–102

Esteves, P. S., & Rua, A. (2013). Is there a role for domestic demand pressure on export performance? (ECB Working Paper 1594). Frankfurt: European Central Bank.

Esteves, P. S., & Rua, A. (2015). Is there a role for domestic demand pressure on export performance?. Empirical Economics. doi:10.1007/s00181-014-0908-5..

Fagan, G., Henry, J., & Mestre, R. (2001). An area-wide model for the euro area (ECB Working Paper 42). Frankfurt: European Central Bank.

Fagan, G., Henry, J., & Mestre, R. (2005). An area-wide model for the euro area. Economic Modelling, 22(1), 39–59.

Gros, D., Cinzia, A., Belke, A. H., Coutinho, L., & Giovannini, A. (2014). Implementation of the macroeconomic adjustment programmes in the euro area: State-of-play. Brussels: Centre for European Policy Studies.

Hall, P. A. (2012). The economics and politics of the euro crisis. German Politics, 21(4), 355–371.

Hubrich, K., & Karlsson, T. (2010). Trade consistency in the context of the eurosystem projection exercises: An overview (ECB Occasional Paper 108). Frankfurt: European Central Bank.

Im, K. S., Pesaran, M. H., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. Journal of Econometrics, 115(1), 53–74.

Impullitti, G., Irarrazabal, A., & Opromolla, L. D. (2013). A theory of entry into and exit from export markets. Journal of International Economics, 90(1), 75–90.

IMF (International Monetary Fund). (2013). External rebalancing in the euro area. IMF World Economic Outlook. October, (pp. 45–48).

Kao, C. (1999). Spurious regression and residual-based tests for cointegration in panel data. Journal of Econometrics, 90(1), 1–44.

Levin, A., Lin, C. F., & Chu, C. S. (2002). Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics, 108(1), 1–24.

Maddala, G. S., & Wu, S. (1999). A comparative study of unit root tests with panel data and a new simple test. Oxford Bulletin of Economics and Statistics, 61(S1), 631–652.

Melitz, M. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695–1725.

Nickell, S. J. (1981). Biases in dynamic models with fixed effects. Econometrica, 49(6), 1417–1426.

Pedroni, P. (2004). Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometric Theory, 20, 597–625.

Pisani-Ferry, J., Sapir, A., & Wolff, G. (2013). EU-IMF assistance to euro-area countries: An early assessment, Bruegel Blueprint, 779.

Vannoorenberghe, G. (2012). Firm-level volatility and exports. Journal of International Economics, 86(1), 57–67.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Unit root and cointegration tests

Appendix 2: Models estimated since 1999

Appendix 3: Models estimated without the long-run relationship

About this article

Cite this article

Bobeica, E., Esteves, P.S., Rua, A. et al. Exports and domestic demand pressure: a dynamic panel data model for the euro area countries. Rev World Econ 152, 107–125 (2016). https://doi.org/10.1007/s10290-015-0234-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-015-0234-9