Abstract

This paper examines the effect of exchange rate movements on export volume, export revenues and propensity to export taking into account the extent of foreign value added content of exports (“backward integration”) in global value chains (GVCs). Using both product-level and firm-level panel data, our results suggest that Swiss exports (intensive margin) and the export probability (extensive margin) are negatively affected by a currency appreciation. However, this adverse effect is mitigated in sectors and firms that are more integrated in GVCs, which could be explained by the “natural hedging” of exchange rate movements. Our findings are robust to the use of different measures of natural hedging and GVC integration and also hold across various specifications and estimation methods that control for sample selection, firm heterogeneity, heteroskedastic errors and persistence in export behavior. The dynamic specifications also reveal that export hysteresis driven by a currency appreciation is a concern particularly for firms that are not established in export markets.

Similar content being viewed by others

Notes

Implicitly, we assume full-pass through into imported input prices, \(\frac{\partial mc_{ij}}{\partial e_{j}}=1\) and \(\frac{\partial mc_{ij}}{\partial wi}=1\). When demand is CES, constant mark-up pricing implies \(\Gamma _{ij}=0\). Constant returns to scale (CRS) technology of production translates into \(mc_{q}=0\), while decreasing return to scale (DRS) leads to \(mc_{q}>0\).

This result also holds when mark-ups decrease with the relative price, \(\Gamma _{ij}>0\) and in the case of decreasing return to scale, \(\Phi >0.\)

We acknowledge that this hysteresis result may turn out to be weaker if exporters anticipate that a future exchange rate shock will be of temporary nature. However, such an expectation would contradict that an exchange rate process is best approximated by a random walk, which implies that exchange rate changes should be regarded ex-ante as permanent and not predictable by fundamentals (Engel and West 2005). It is also clear, however, that agents may form (irrational) exchange rate expectations not in line with a random walk, as shown in Frankel and Froot (1987).

The classification of inputs (or intermediates) used in this paper is available at: http://wits.worldbank.org/wits/data_details.html.

The sector classification used to calculate the indices corresponds to those used in Swiss I–O tables. Each I–O table sector consists of one up to five 2-digit ISIC product groups.

\(R_{so}^{si}\) is based on the 2001 I–O table for Switzerland taken from OECD (2012). From the OECD, an I–O table for 2005 is also available. Comparisons of Swiss I–O tables between 2001 and 2005 show that the sectoral import shares in total imports in an output sector in fact remain relatively stable over time and are likely to be driven by sector-specific technological factors.

We do not differentiate between input and output-sector in the following sections and use the k subscript for a specific sector.

As large firms that are overrepresented in our sample tend to import more (see e.g., Bernard et al. 2007), this assumption may be plausible.

Following Helpman et al. (2008), we do not use the normality assumption to recover \(\eta _{jpt}\) and \(z_{jpt}\) from the selection equation and instead work directly with the predicted probabilities, \(\hat{\rho }_{jpt}\).

The estimates from LPM usually constitute reasonable approximations of average partial effects according to Wooldridge (2002).

However, at the suggestion of an anonymous referee, we also clustered the standard errors at the destination level to account for potential aggregation bias and found qualitatively similar results that are reported in Tables 12 and 13. In fact, the significance of results with product-level data is found to be robust to a variety of clustering in Appendix 3 strategies such as at the \(HS2\times destination\) level, at the \(HS6\times destination\) level (panel unit) and at the destination-year level.

Including a variable \(Exp_{t-3}\), which equals one if a product has been exported in \(t-3\), only has a negligible effect on the estimates (results are available upon request). This robustness check confirms that past exporting experience depreciates quickly over time.

In further sensitivity analyses, we find our results to be robust to the exclusion of the chemicals and pharmaceutical sectors. These results are available upon request.

See “Appendix 1” for a detailed description of the data.

Specifically, this includes firms in ISIC Rev. 3.1 codes 1 and 14–36. Excluding the agricultural and the mining and quarrying sectors, left our results qualitatively unchanged.

Implicit deflators are calculated by dividing an aggregate measured in current prices by the same aggregate measured in constant prices.

Proposition 1 cannot be tested due to the lack of data on export quantities. Note that Proposition 3 would require a test of the joint impact of \(\alpha _{it}\) and an import-weighted real effective exchange rate in industry f, \(\text {II REER}_{f(t)}\). Because the inclusion of both variables may lead to identification issues, we assume that the export-weighted \(\text {REER}_{t}\) equals the \(\text {II REER}_{f(t)}\). Furthermore, we tested the sensitivity of results to a lag choice at \(t-1\).

In addition, we checked the sensitivity of the regression results to the inclusion of other firm-level variables which did not improve the explanatory power of our model (e.g., foreign ownership status, unit labor costs, skill shares).

This also accounts for the fact that exports are generated by a limited dependent variable process including a large fraction of zeros. Alternatively, the benchmark equation could be modeled by way of a Poisson model of the following form with parameter vectors defined as row vectors: \(E(R_{it}|e_{t},\alpha _{it},x_{it})=exp(\beta _{0}+\beta _{1}e_{t}+\beta _{1}\alpha _{it}+\beta _{3}e_{t}\times \alpha _{it}+\beta _{4}gdp_{t}+\gamma z_{it})\).

Entry and exit patterns illustrated in Table 9 in “Appendix 1” may indicate lagged effects or a lack of an effect of the exchange rate on export participation at first glance. Yet, the data at hand do not allow us to estimate a dynamic model including the export status in the previous period. The inclusion of \(\text {Export}_{i,t-1}\) reduces the number of observations by more than one half as firms drop out and may re-enter over time. As a consequence, we are no longer able to obtain sufficiently precise estimates. Additionally, a Chamberlain approach for the selection model Wooldridge (1995), or bias corrected estimators Fernández-Val and Vella (2011) proved infeasible.

Note that this cannot take a potential correlation of non-response with the business cycle into account.

Standard errors have to be adjusted accordingly. The weights have been adjusted for the response probability of the firm such that \(p_{\ell _{i}}=p_{\ell _{i}^{0}}/E(\hat{r}_{i})\), where \(E(\hat{r}_{i})\) was obtained from a binary response model for the response probability on firm characteristics (language and geographic region, industry and size class); see Ley (2013).

Note that we employ the nonparametric bootstrap in these results taking the panel structure into account. While bootstrapping may not be a panacea, as we use FGLS (a random effects probit estimator precisely), this seems to be a better choice than using (cluster) robust estimation.

It would be preferable to pursue the previous empirical analysis by industry, however, this would restrict the sample size such that we are no longer able to obtain sufficiently precise results. Note that they are given for the year 2009 (cross section) by the OECD and calculated over time for the firm sample, however, the intermediate input shares prove to be stable over time.

Finally, at the suggestion of an anonymous referee, we also reproduced the results reported in Tables 5, 6 and 8 using a more aggregate clustering strategy. These results, reported in Tables 14, 15 and 16 in Appendix 3, respectively, were found to be robust to clustering the standard errors at the level of input-output industries. Note that the number of observations drops in the upper panel A of Table 14 as well as Tables 15 and 16 (as compared to Tables 5, 6 and 8) because there are missing observations on the cluster variable, the IO sector variable. Moreover, the number of observations in Table 14 panel B (as well as Table 8) is reduced due to dropping singleton observations when running the weighted regressions. In the presence of many singleton observations and with fixed effects nested within clusters (we utilize firm-level fixed effects, and each firm is assigned one IO sector), one tends to overstate the standard errors when not dropping the former. We thus needed to drop singleton observations in panel B of Tables 14 and 16, in contrast to what we did in Tables 5 and 8, where we kept them. In the end, we find the results reported in Tables 5, 6 and 8 preferable because with the firm-level dataset, it is likely that none of the assumptions for consistency of the cluster robust variance estimation are satisfied (for instance see MacKinnon and Webb 2017).

Source: Betriebszählung 2008.

References

Ahmed, S., Appendino, M., & Ruta, M. (2017). Global value chains and the exchange rate elasticity of exports. The BE Journal of Macroeconomics,. https://doi.org/10.1515/bejm-2015-0130.

Amiti, M., Itskhoki, O., & Konings, J. (2012). Importers, exporters, and exchange rate disconnect. NBER Working Paper No. 18615.

Auboin, M. & Ruta, M. (2013). The relationship between exchange rates and international trade: A review of economic literature. World Trade Review, 12(3), 577–605. https://doi.org/10.1017/S1474745613000025

Auer, R., & Saure, P. (2011). Chf strength and swiss export performance-evidence and outlook from a disaggregate analysis. Applied Economics Letters, 19(6), 521–531.

Baier, S. L., & Bergstrand, J. H. (2009). Bonus vetus ols: A simple method for approximating international trade-cost effects using the gravity equation. Journal of International Economics, 77(1), 77–85.

Baldwin, R., & Krugman, P. (1989). Persistent trade effects of large exchange rate shocks. Quarterly Journal of Economics, 104(4), 635–654.

Bems, R. & Johnson, R. C. (2015). Demand for value added and value-added exchange rates. National Bureau of Economic Research Working Paper Series.

Berman, N., Martin, P., & Mayer, T. (2012). How do different exporters react to exchange rate changes? Quarterly Journal of Economics, 127(1), 437–492.

Bernard, A., & Jensen, B. (2004). Why some firms export. Review of Economics and Statistics, 86(2), 561–569.

Bernard, A. B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2007). Firms in international trade. Journal of Economic Perspectives, 21(3), 105–130.

Bernard, A. B., & Wagner, J. (2001). Export entry and exit by German firms. Weltwirtschaftliches Archiv, 137(1), 105–123.

Burstein, A. & Gopinath, G. (2013). International prices and exchange rates. NBER Working paper No 18829.

Cameron, A. C., Gelbach, J., & Miller, D. L. (2011). Robust inference with multiway clustering. Journal of Business & Economic Statistics, 29(2), 238–249.

Campa, J. (2004). Exchange rates and trade: How important is hysteresis in trade? European Economic Review, 48(3), 527–548.

Das, S., Roberts, M., & Tybout, J. (2007). Market entry costs, producer heterogeneity, and export dynamics. Econometrica, 75(3), 837–873.

Engel, C., & West, K. D. (2005). Exchange rates and fundamentals. Journal of political Economy, 113(3), 485–517.

Fauceglia, D., Shingal, A., & Wermelinger, W. (2014). Natural hedging of exchange rate risk: The role of imported input prices. Swiss Journal of Economics and Statistics (SJES), 150(4), 261–296.

Fernández-Val, I., & Vella, F. (2011). Bias corrections for two-step fixed effects panel data estimators. Journal of Econometrics, 163(2), 144–162.

Frankel, J. A. & Froot, K. A. (1987). Using survey data to test standard propositions regarding exchange rate expectations. The American Economic Review, 77(1), 133–153.

Greenaway, D., Kneller, R., & Zhang, X. (2010). The effect of exchange rates on firm exports: The role of imported intermediate inputs. World Economy, 33(8), 961–986.

Head, K. & Mayer, T. (2013). Gravity equations: Workhorse, toolkit, and cookbook. CEPR Discussion Papers.

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica, 47(1), 153–161.

Helpman, E., Melitz, M., & Rubinstein, Y. (2008). Estimating trade flows: Trading partners and trading volumes. Quarterly Journal of Economics, 123(2), 441–487.

Lassmann, A. (2013). Exchange rate transmission and export activity at the firm level. KOF Working Papers No. 331.

Ley, M. (2013). Weighting principles in Surveys of the KOF Enterprise Panel.

MacKinnon, J., & Webb, M. (2017). Wild bootstrap inference for wildly different cluster sizes. Journal of Applied Econometrics, 32(2), 233–254.

Mundlak, Y. (1978). On the pooling of time series and cross section data. Econometrica, 46, 69–85.

Norton, E. C., Wang, H., & Ai, C. (2004). Computing interaction effects and standard errors in logit and probit models. Stata Journal, 4(2), 154–167.

OECD. (2012). STAN nput–output database total, domestic and imports (database), stats.oecd.org. Paris: OECD.

OECD. (2013). Interconnected economies: Benefiting from global value chains. Paris: OECD Publishing.

Roberts, M., & Tybout, J. (1997). The decision to export in colombia: an empirical model of entry with sunk costs. American Economic Review, 87(4), 545–564.

Silva, J., & Tenreyro, S. (2006). The log of gravity. Review of Economics and Statistics, 88(4), 641–658.

Wooldridge, J. M. (1995). Selection corrections for panel data models under conditional mean independence assumptions. Journal of Econometrics, 68(1), 115–132.

Wooldridge, J. M. (2002). Econometric analysis of cross section and panel data. Cambridge, MA: The MIT press.

Xiong, B., & Chen, S. (2014). Estimating gravity equation models in the presence of sample selection and heteroscedasticity. Applied Economics, 46(24), 2993–3003.

Zabel, J. E. (1992). Estimating fixed and random effects models with selectivity. Economics Letters, 40(3), 269–272.

Acknowledgements

We would like to thank the editor on this manuscript, Prof. Görg, two anonymous referees, Christian Busch, Michal Fabinger, Michael Siegenthaler, and participants at SECO seminars, the Australasian Trade Workshop 2015, and the annual EEA and ETSG conferences 2015 for their useful comments and suggestions. Funding provided by the Swiss State Secretariat for Economic Affairs (SECO) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Firm-level data description

The firm-level data stem from the KOF innovation survey in the years 1996, 1999, 2002, 2005, 2008, 2011, and 2013. It consists of a nonrandom sample of about 6500 firms, where multi-stage sampling is applied based on 34 industries such that the sample size is nonrandom. Within industries, the population is further stratified disproportionately based on 3 industry-specific size classes in such a way that large firms with at least 5 employees are oversampled. The sampling method is variable probability sampling, with the probability differing by size class and equalling 1 for the largest size class. According to the Federal Statistical Office, the average number of employees per firm was about 11.2 in 2008 (a total of 3,494,071 employees and 312,861 firms was reported), compared to the average of 285 for all firms in the same year in the sample.Footnote 27 Note that we observe firms with \(<5\) employees in the sample. This is solely due to firms that reduced employment in later periods.

All variables indicated in shares exhibit mass points at integer values resulting from the tendency of firms to round such figures up or down. However, histograms show that the variables are roughly continuously distributed such that they are not interval coded. This response bias concerns wages, intermediate inputs, and export volumes as well. We calculated these variables by multiplying the respective share by turnover.

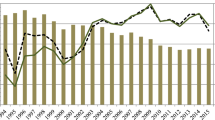

Table 9 in Appendix 1 indicates the export entry and exit behavior of firms as well as the total number of firms and the number of exporters according to year, shedding light on firm-level dynamics. The number of firms by year ranges from 714 (in 1999) to 989 (in 2002) compared to the overall number of distinct firms that amounts to 2611 over the entire period, hence the panel exhibits substantial dynamics. A substantial fraction of those firms export, as figures reported by year show. Second, the number of firms that change their export status (switchers) varies across time. Furthermore, there is variation in entry and exit dynamics. The distinction between firms that enter and exit illustrates that the pattern of firms that enter into exporting corresponds to the business cycle, increasing between 1999 and 2005, and decreasing over the following two periods, before increasing again in the last period of observation. Firms that exit follow by and large the pattern of the business cycle too (.i.e. the number of exiting firms tends to increase during economic downturns or crises), with the exception of a drop in exiting firms in 2011.

TFP is obtained as the residual from a regression of the log value added on log wage (the unit labor costs times the number of full-time equivalent employees) and log material costs, with standard errors clustered at the firm level. We use material costs because information on investment is sparse and information about capital is not available. Note that TFP is measured with error.

Appendix 2

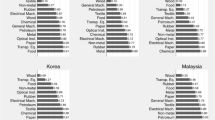

See Tables 10, 11 and Figs. 4 and 5.

Appendix 3

About this article

Cite this article

Fauceglia, D., Lassmann, A., Shingal, A. et al. Backward participation in global value chains and exchange rate driven adjustments of Swiss exports. Rev World Econ 154, 537–584 (2018). https://doi.org/10.1007/s10290-018-0310-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-018-0310-z