Abstract

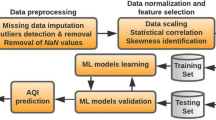

This study examines how the determinants of the political risk factor affect the forecasting performance of the United Arab Emirates’ stock market during the COVID-19 pandemic. The empirical investigations of this goal are conducted through using new machine learning models including a linear regression, an artificial neural network, a random forest, an extreme gradient boosting (XGBoost), and a light gradient boosting (LightGBM). We also use a game theory-based model the SHapley Additive explanation (SHAP) interpretation framework to evaluate the most important features for predicting the UAE’s stock market prices. The experimental results show that the LightGBM and XGBoost outperform the traditional machine learning models such as the linear regression and produce a holistic probability distribution over the entire outcome space, which helps quantify the uncertainties related to the effect of the COVID-19 pandemic on predicting the UAE’s stock market. The novel SHAP algorithm also provides insights in interpreting the complex “black box” architecture of the machine learning models to help predict this country’s stock prices. The results provide important implications for the political risk management in periods akin to the COVID-19 pandemic.

Similar content being viewed by others

References

Abegaz, F., & Wit, E. (2013). Sparse time series chain graphical models for reconstructing genetic networks. Biostatistics, 14(3), 586–599. https://doi.org/10.1093/biostatistics/kxt005

Adadi, A., & Berrada, M. (2018). Peeking inside the black-box: A survey on explainable artificial intelligence (XAI). IEEE Access, 6, 52138–52160. https://doi.org/10.1109/ACCESS.2018.2870052

Alqahtani, A., Hammoudeh, S., & Selmi, R. (2022). Relationship between different sources of geopolitical risks and stock markets in the GCC region: A dynamic correlation analysis. Review of Behavioral Finance, 14(2), 296–316. https://doi.org/10.1108/RBF-07-2019-0099

Asteriou, D., & Siriopoulos, C. (2000). The role of political instability in stock market development and economic growth: The case of Greece. Economic Notes, 29(3), 355–374. https://doi.org/10.1111/1468-0300.00037

Babar, B., Luppino, L. T., Boström, T., & Anfinsen, S. N. (2020). Random forest regression for improved mapping of solar irradiance at high latitudes. Solar Energy, 198, 81–92. https://doi.org/10.1016/j.solener.2020.01.034

Bailey, W., & Chung, Y. P. (1995). Exchange rate fluctuations, political risk, and stock returns: Some evidence from an emerging market linked references are available on JSTOR for this article. The Journal of Financial and Quantitative Analysis, 30(4), 541–561.

Baker, S. R., & Bloom, N. (2013). Does uncertainty reduce growth? Using disasters as natural experiments. NBER working papers, 1–31.

Banerjee, P., & Dutta, S. (2022). The effect of political risk on investment decisions. Economics Letters, 110301.

Baruník, J., & Křehlík, T. (2018). Measuring the frequency dynamics of financial connectedness and systemic risk. Journal of Financial Econometrics, 16(2), 271–296. https://doi.org/10.1093/jjfinec/nby001

Bekaert, G., Harvey, C. R., Lundblad, C. T., & Siegel, S. (2014). Political risk spreads. Journal of International Business Studies, 45(4), 471–493. https://doi.org/10.1057/jibs.2014.4

Ben Jabeur, S. (2020). The relationship between renewable energy consumption and economic growth in France: A necessary condition analysis. Environmental Modeling and Assessment, 25(3), 397–409. https://doi.org/10.1007/s10666-019-09678-6

Ben Jabeur, S., Khalfaoui, R., & Ben Arfi, W. (2021). The effect of green energy, global environmental indexes, and stock markets in predicting oil price crashes: Evidence from explainable machine learning. Journal of Environmental Management, 298, 113511. https://doi.org/10.1016/j.jenvman.2021.113511

Berkman, H., Jacobsen, B., & Lee, J. B. (2011). Time-varying rare disaster risk and stock returns. Journal of Financial Economics, 101(2), 313–332.

Boutchkova, M., Doshi, H., Durnev, A., & Molchanov, A. (2012). Precarious politics and return volatility. The Review of Financial Studies, 25(4), 1111–1154. https://doi.org/10.1093/rfs/hhr100

Brogaard, J., & Detzel, A. (2015). The asset-pricing implications of government economic policy uncertainty. Management Science, 61(1), 3–18. https://doi.org/10.1287/mnsc.2014.2044

Bustos, O., & Pomares-Quimbaya, A. (2020). Stock market movement forecast: A systematic review. Expert Systems with Applications. https://doi.org/10.1016/j.eswa.2020.113464

Caldara, D., & Iacoviello, M. (2022). Measuring geopolitical risk. American Economic Review, 112(4), 1194–1225.

Carta, S., Ferreira, A., Podda, A. S., Reforgiato Recupero, D., & Sanna, A. (2021). Multi-DQN: An ensemble of Deep Q-learning agents for stock market forecasting. Expert Systems with Applications, 164(July 2020), 113820. https://doi.org/10.1016/j.eswa.2020.113820

Chakraborty, D., Elhegazy, H., Elzarka, H., & Gutierrez, L. (2020). A novel construction cost prediction model using hybrid natural and light gradient boosting. Advanced Engineering Informatics, 46, 101201. https://doi.org/10.1016/j.aei.2020.101201

Chatzis, S. P., Siakoulis, V., Petropoulos, A., Stavroulakis, E., & Vlachogiannakis, N. (2018). Forecasting stock market crisis events using deep and statistical machine learning techniques. Expert Systems with Applications, 112, 353–371. https://doi.org/10.1016/j.eswa.2018.06.032

Chen, T., & Guestrin, C. (2016). XGBoost: A scalable tree boosting system. In Proceedings of the 22nd ACM SIGKDD International Conference on Knowledge Discovery and Data Mining, KDD ’16 (pp. 785–794). New York, NY, USA: Association for Computing Machinery. https://doi.org/10.1145/2939672.2939785

Cheng, H., & Shi, Y. (2020). Forecasting China’s stock market variance. Pacific Basin Finance Journal, 64(August), 101421. https://doi.org/10.1016/j.pacfin.2020.101421

Cho, J. S., Kim, T., & Shin, Y. (2015). Quantile cointegration in the autoregressive distributed-lag modeling framework. Journal of Econometrics, 188(1), 281–300.

Choi, W., Chung, C. Y., & Wang, K. (2021). Firm-level political risk and corporate investment. Finance Research Letters, 102307.

Chowdhury, R., Mahdy, M. R. C., Alam, T. N., Al Quaderi, G. D., & Arifur Rahman, M. (2020). Predicting the stock price of frontier markets using machine learning and modified Black-Scholes Option pricing model. Physica a: Statistical Mechanics and Its Applications, 555, 124444. https://doi.org/10.1016/j.physa.2020.124444

Costantini, G., Epskamp, S., Borsboom, D., Perugini, M., Mõttus, R., Waldorp, L. J., & Cramer, A. O. J. (2015). State of the aRt personality research: A tutorial on network analysis of personality data in R. Journal of Research in Personality, 54, 13–29. https://doi.org/10.1016/j.jrp.2014.07.003

Dai, P. F., Xiong, X., Liu, Z., Huynh, T. L. D., & Sun, J. (2021). Preventing crash in stock market: The role of economic policy uncertainty during COVID-19. Financial Innovation. https://doi.org/10.1186/s40854-021-00248-y

Dai, Z., Dong, X., Kang, J., & Hong, L. (2020). Forecasting stock market returns: New technical indicators and two-step economic constraint method. North American Journal of Economics and Finance, 53(May), 101216. https://doi.org/10.1016/j.najef.2020.101216

Desai, S., & Ouarda, T. B. M. J. (2021). Regional hydrological frequency analysis at ungauged sites with random forest regression. Journal of Hydrology, 594, 125861. https://doi.org/10.1016/j.jhydrol.2020.125861

Diamonte, R. L., Liew, J. M., & Stevens, R. L. (1996). Political risk in emerging and developed markets. Financial Analysts Journal, 52(3), 71. https://doi.org/10.2469/faj.v52.n3.1998

Diebold, F. X., & Yilmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28(1), 57–66.

Diebold, F. X., & Yılmaz, K. (2014). On the network topology of variance decompositions: Measuring the connectedness of financial firms. Journal of Econometrics, 182(1), 119–134.

Dimic, N., Orlov, V., & Piljak, V. (2015). The political risk factor in emerging, frontier, and developed stock markets. Finance Research Letters, 15, 239–245. https://doi.org/10.1016/j.frl.2015.10.007

Ding, Q., Huang, J., Gao, W., & Zhang, H. (2022). Does political risk matter for gold market fluctuations? A structural VAR analysis. Research in International Business and Finance, 60, 101618. https://doi.org/10.1016/j.ribaf.2022.101618

dos Santos, M. B. C., Klotzle, M. C., & Pinto, A. C. F. (2021). The impact of political risk on the currencies of emerging markets. Research in International Business and Finance, 56, 101375.

Epskamp, S., Borsboom, D., & Fried, E. I. (2018). Estimating psychological networks and their accuracy: A tutorial paper. Behavior Research Methods, 50(1), 195–212. https://doi.org/10.3758/s13428-017-0862-1

Fan, J., Ma, X., Wu, L., Zhang, F., Yu, X., & Zeng, W. (2019). Light Gradient Boosting Machine: An efficient soft computing model for estimating daily reference evapotranspiration with local and external meteorological data. Agricultural Water Management, 225, 105758. https://doi.org/10.1016/j.agwat.2019.105758

Fischer, T., & Krauss, C. (2018). Deep learning with long short-term memory networks for financial market predictions. European Journal of Operational Research, 270(2), 654–669. https://doi.org/10.1016/j.ejor.2017.11.054

Freeman, L. C. (1979). Centrality in social networks. Social Networks, 1(3), 215–239. https://doi.org/10.1016/0378-8733(78)90021-7

Friedman, J. H. (2001). Greedy function approximation: A gradient boosting machine. The Annals of Statistics, 29, 1189–1232. https://www.jstor.org/stable/2699986

Ghosh, I., Jana, R. K., & Sanyal, M. K. (2019). Analysis of temporal pattern, causal interaction and predictive modeling of financial markets using nonlinear dynamics, econometric models and machine learning algorithms. Applied Soft Computing, 82, 105553. https://doi.org/10.1016/j.asoc.2019.105553

Ghosh, I., Sanyal, M. K., & Jana, R. K. (2018). Fractal inspection and machine learning-based predictive modelling framework for financial markets. Arabian Journal for Science and Engineering, 43(8), 4273–4287. https://doi.org/10.1007/s13369-017-2922-3

Giudici, P., & Raffinetti, E. (2021). Shapley-Lorenz eXplainable artificial intelligence. Expert Systems with Applications, 167, 114104. https://doi.org/10.1016/j.eswa.2020.114104

Glick, R., & Taylor, A. M. (2010). Collateral damage: Trade disruption and the economic impact of war. The Review of Economics and Statistics, 92(1), 102–127.

Gonchar, K., & Greve, M. (2022). The impact of political risk on FDI exit decisions. Economic Systems, 100975.

Gu, S., Kelly, B., & Xiu, D. (2020). Empirical asset pricing via machine learning. The Review of Financial Studies, 33(5), 2223–2273. https://doi.org/10.1093/rfs/hhaa009

Günay, S. (2016). Is political risk still an issue for Turkish stock market? Borsa Istanbul Review, 16(1), 21–31. https://doi.org/10.1016/j.bir.2016.01.003

Guo, Y., Li, J., Li, Y., & You, W. (2021). The roles of political risk and crude oil in stock market based on quantile cointegration approach: A comparative study in China and US. Energy Economics, 97, 105198. https://doi.org/10.1016/j.eneco.2021.105198

Hadavandi, E., Shavandi, H., & Ghanbari, A. (2010). Integration of genetic fuzzy systems and artificial neural networks for stock price forecasting. Knowledge-Based Systems, 23(8), 800–808.

Haq, A. U., Zeb, A., Lei, Z., & Zhang, D. (2021). Forecasting daily stock trend using multi-filter feature selection and deep learning. Expert Systems with Applications, 168(May 2020), 114444. https://doi.org/10.1016/j.eswa.2020.114444

Hashmi, S. M., Chang, B. H., & Bhutto, N. A. (2021). Asymmetric effect of oil prices on stock market prices: New evidence from oil-exporting and oil-importing countries. Resources Policy, 70, 101946. https://doi.org/10.1016/j.resourpol.2020.101946

Hassan, K. M., Al-Sultan, W. S., & Al-Saleem, J. A. (2003). Stock market efficiency in the gulf cooperation council countries (GCC): The case of Kuwait stock exchange. Development, 1(1), 1–21.

Howell, L. (2000). The handbook of country and political risk analysis. PRS Group. Inc.

Jabeur, S. B., Ballouk, H., Arfi, W. B., & Khalfaoui, R. (2021). Machine learning-based modeling of the environmental degradation, institutional quality, and economic growth. Environmental Modeling and Assessment. https://doi.org/10.1007/s10666-021-09807-0

Jabeur, S. B., Sadaaoui, A., Sghaier, A., & Aloui, R. (2020). Machine learning models and cost-sensitive decision trees for bond rating prediction. Journal of the Operational Research Society, 71(8), 1161–1179. https://doi.org/10.1080/01605682.2019.1581405

Jayawardena, N. I., Todorova, N., Li, B., & Su, J. J. (2020). Volatility forecasting using related markets’ information for the Tokyo stock exchange. Economic Modelling, 90(May), 143–158. https://doi.org/10.1016/j.econmod.2020.05.008

Jiang, W., Martek, I., Hosseini, M. R., & Chen, C. (2021). Political risk management of foreign direct investment in infrastructure projects: Bibliometric-qualitative analyses of research in developing countries. Engineering, Construction and Architectural Management, 28(1), 125–153. https://doi.org/10.1108/ECAM-05-2019-0270

Jing, T., Huang, J., Zhang, H., & Luo, Y. (2021). Time-varying impact of political risk on copper prices. Transactions of Nonferrous Metals Society of China, 31(8), 2532–2544.

Kabir Hassan, M., Maroney, N. C., Monir El-Sady, H., & Telfah, A. (2003). Country risk and stock market volatility, predictability, and diversification in the Middle East and Africa. Economic Systems, 27(1), 63–82. https://doi.org/10.1016/S0939-3625(03)00017-7

Kamara, A. F., Chen, E., & Pan, Z. (2022). An ensemble of a boosted hybrid of deep learning models and technical analysis for forecasting stock prices. Information Sciences, 594, 1–19.

Ke, G., Meng, Q., Finley, T., Wang, T., Chen, W., Ma, W., et al. (2017). LightGBM: A highly efficient gradient boosting decision tree. Advances in Neural Information Processing Systems, 2017-Decem(Nips), 3147–3155.

Khalfaoui, R., Boutahar, M., & Boubaker, H. (2015). Analyzing volatility spillovers and hedging between oil and stock markets: Evidence from wavelet analysis. Energy Economics, 49, 540–549. https://doi.org/10.1016/j.eneco.2015.03.023

Khalfaoui, R., Solarin, S. A., Al-Qadasi, A., & Ben Jabeur, S. (2022). Dynamic causality interplay from COVID-19 pandemic to oil price, stock market, and economic policy uncertainty: Evidence from oil-importing and oil-exporting countries. Annals of Operations Research. https://doi.org/10.1007/s10479-021-04446-w

Khalfaoui, R., Tiwari, A. K., Kablan, S., & Hammoudeh, S. (2021). Interdependence and lead-lag relationships between the oil price and metal markets: Fresh insights from the wavelet and quantile coherency approaches. Energy Economics, 101, 105421. https://doi.org/10.1016/j.eneco.2021.105421

Kiangala, S. K., & Wang, Z. (2021). An effective adaptive customization framework for small manufacturing plants using extreme gradient boosting-XGBoost and random forest ensemble learning algorithms in an Industry 4.0 environment. Machine Learning with Applications, 4, 100024. https://doi.org/10.1016/j.mlwa.2021.100024

Kim, H. Y., & Mei, J. P. (2001). What makes the stock market jump? An analysis of political risk on Hong Kong stock returns. Journal of International Money and Finance, 20(7), 1003–1016. https://doi.org/10.1016/S0261-5606(01)00035-3

Kim, M. K., Kim, Y.-S., & Srebric, J. (2020). Predictions of electricity consumption in a campus building using occupant rates and weather elements with sensitivity analysis: Artificial neural network vs. linear regression. Sustainable Cities and Society, 62, 102385. https://doi.org/10.1016/j.scs.2020.102385

Kirikkaleli, D. (2020). The effect of domestic and foreign risks on an emerging stock market: A time series analysis. North American Journal of Economics and Finance, 51(June 2018), 100876. https://doi.org/10.1016/j.najef.2018.11.005

Lauritzen, S. L. (1996). Graphical models. Oxford: Clarendon Press.

Lehkonen, H., & Heimonen, K. (2015). Democracy, political risks and stock market performance. Journal of International Money and Finance, 59, 77–99. https://doi.org/10.1016/j.jimonfin.2015.06.002

Leippold, M., Wang, Q., & Zhou, W. (2021). Machine learning in the Chinese stock market. Journal of Financial Economics. https://doi.org/10.1016/j.jfineco.2021.08.017

Liu, J., Ma, F., & Zhang, Y. (2019). Forecasting the Chinese stock volatility across global stock markets. Physica a: Statistical Mechanics and Its Applications, 525, 466–477. https://doi.org/10.1016/j.physa.2019.03.097

Lobo, B. J. (1999). Jump risk in the U.S. stock market: Evidence using political information. International Review of Economics and Finance, 8(1), 149–163. https://doi.org/10.1016/s1058-3300(00)00011-2

Lundberg, S. M., & Lee, S. I. (2017). A unified approach to interpreting model predictions. Advances in neural information processing systems, 30.

Ma, X., Sha, J., Wang, D., Yu, Y., Yang, Q., & Niu, X. (2018). Study on a prediction of P2P network loan default based on the machine learning LightGBM and XGboost algorithms according to different high dimensional data cleaning. Electronic Commerce Research and Applications, 31, 24–39. https://doi.org/10.1016/j.elerap.2018.08.002

Masih, R., Peters, S., & De Mello, L. (2011). Oil price volatility and stock price fluctuations in an emerging market: Evidence from South Korea. Energy Economics, 33(5), 975–986. https://doi.org/10.1016/j.eneco.2011.03.015

Mazur, M., Dang, M., & Vega, M. (2021). COVID-19 and the March 2020 stock market crash. Evidence from S&P1500. Finance Research Letters, 38(3), 101690. https://doi.org/10.1016/j.frl.2020.101690

Mensi, W., Lee, Y.-J., Vinh Vo, X., & Yoon, S.-M. (2021). Does oil price variability affect the long memory and weak form efficiency of stock markets in top oil producers and oil Consumers? Evidence from an asymmetric MF-DFA approach. The North American Journal of Economics and Finance, 57, 101446. https://doi.org/10.1016/j.najef.2021.101446

Miller, T. (2019). Explanation in artificial intelligence: Insights from the social sciences. Artificial Intelligence, 267, 1–38. https://doi.org/10.1016/j.artint.2018.07.007

Moretti, E., Steinwender, C., & Van Reenen, J. (2014). The intellectual spoils of war? Defense R&D, productivity and spillovers. In American economic association annual meeting.

Nevasalmi, L. (2020). Forecasting multinomial stock returns using machine learning methods. Journal of Finance and Data Science, 6, 86–106. https://doi.org/10.1016/j.jfds.2020.09.001

Opsahl, T., Agneessens, F., & Skvoretz, J. (2010). Node centrality in weighted networks: Generalizing degree and shortest paths. Social Networks, 32(3), 245–251. https://doi.org/10.1016/j.socnet.2010.03.006

Pai, P.-F., & Lin, C.-S. (2005). A hybrid ARIMA and support vector machines model in stock price forecasting. Omega, 33(6), 497–505.

Pástor, Ľ, & Veronesi, P. (2012). Uncertainty about government policy and stock prices. Journal of Finance, 67(4), 1219–1264. https://doi.org/10.1111/j.1540-6261.2012.01746.x

Pástor, Ľ, & Veronesi, P. (2013). Political uncertainty and risk premia. Journal of Financial Economics, 110(3), 520–545.

Perotti, E. C., & Van Oijen, P. (2001). Privatization, political risk and stock market development in emerging economies. Journal of International Money and Finance, 20(1), 43–69. https://doi.org/10.1016/S0261-5606(00)00032-2

Pham, A. V., Adrian, C., Garg, M., Phang, S.-Y., & Truong, C. (2021). State-level COVID-19 outbreak and stock returns. Finance Research Letters, 102002. https://doi.org/10.1016/j.frl.2021.102002

Pirgaip, B. (2021). Pan(dem)ic reactions in Turkish stock market: evidence from share repurchases. Eurasian Economic Review, (0123456789). https://doi.org/10.1007/s40822-021-00173-6

Rouwenhorst, K. G. (1999). Local return factors and turnover in emerging stock markets. The Journal of Finance, 54(4), 1439–1464. https://doi.org/10.1111/0022-1082.00151

Saadaoui, F. (2012). A probabilistic clustering method for US interest rate analysis. Quantitative Finance, 12(1), 135–148.

Saâdaoui, F., & Messaoud, O. B. (2020). Multiscaled neural autoregressive distributed lag: A new empirical mode decomposition model for nonlinear time series forecasting. International Journal of Neural Systems, 30(08), 2050039.

Saâdaoui, F., & Mrad, M. (2017). Stochastic modelling of the price-volume relationship in electricity markets: Evidence from the Nordic energy exchange. International Transactions on Electrical Energy Systems, 27(9), e2362.

Shan, C., Tang, D. Y., Wang, S. Q., & Zhang, C. (2022). The diversification benefits and policy risks of accessing China’s stock market. Journal of Empirical Finance, 66, 155–175. https://doi.org/10.1016/j.jempfin.2022.01.001

Sharif, A., Aloui, C., & Yarovaya, L. (2020). COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. International Review of Financial Analysis, 70, 101496. https://doi.org/10.1016/j.irfa.2020.101496

Siavash, N. K., Ghobadian, B., Najafi, G., Rohani, A., Tavakoli, T., Mahmoodi, E., et al. (2020). Prediction of power generation and rotor angular speed of a small wind turbine equipped to a controllable duct using artificial neural network and multiple linear regression. Environmental Research, 10, 110434. https://doi.org/10.1016/j.envres.2020.110434

Singhal, S., & Ghosh, S. (2016). Returns and volatility linkages between international crude oil price, metal and other stock indices in India: Evidence from VAR-DCC-GARCH models. Resources Policy, 50, 276–288. https://doi.org/10.1016/j.resourpol.2016.10.001

Snowberg, E., Wolfers, J., & Zitzewitz, E. (2007). Partisan impacts on the economy: Evidence from prediction markets and close elections. Quarterly Journal of Economics, 122(2), 807–829. https://doi.org/10.1162/qjec.122.2.807

Sonenshine, R., & Kumari, S. (2022). The differential impact of political risk factors on emerging market bond spreads and credit rating outlooks. Journal of Economics and Business. https://doi.org/10.1016/j.jeconbus.2022.106066

Su, Z.-W., Umar, M., Kirikkaleli, D., & Adebayo, T. S. (2021). Role of political risk to achieve carbon neutrality: Evidence from Brazil. Journal of Environmental Management, 298, 113463.

Sun, X., Liu, M., & Sima, Z. (2020). A novel cryptocurrency price trend forecasting model based on LightGBM. Finance Research Letters, 32, 101084. https://doi.org/10.1016/j.frl.2018.12.032

Tibshirani, R. (1996). Regression Shrinkage and Selection Via the Lasso. Journal of the Royal Statistical Society: Series B (methodological), 58(1), 267–288. https://doi.org/10.1111/j.2517-6161.1996.tb02080.x

Tsai, J., & Wachter, J. A. (2015). Disaster risk and its implications for asset pricing. Annual Review of Financial Economics, 7, 219–252.

Vortelinos, D. I., & Saha, S. (2016). The impact of political risk on return, volatility and discontinuity : Evidence from the international stock and foreign exchange markets. Finance Research Letters, 17, 222–226. https://doi.org/10.1016/j.frl.2016.03.017

Wang, J., Lu, X., He, F., & Ma, F. (2020). Which popular predictor is more useful to forecast international stock markets during the coronavirus pandemic: VIX vs EPU? International Review of Financial Analysis, 72(May), 101596. https://doi.org/10.1016/j.irfa.2020.101596

Wang, Y., Sun, S., Chen, X., Zeng, X., Kong, Y., Chen, J., et al. (2021). Short-term load forecasting of industrial customers based on SVMD and XGBoost. International Journal of Electrical Power & Energy Systems, 129, 106830. https://doi.org/10.1016/j.ijepes.2021.106830

Woodside, A. G. (2013). Moving beyond multiple regression analysis to algorithms: Calling for adoption of a paradigm shift from symmetric to asymmetric thinking in data analysis and crafting theory. Journal of Business Research, 66(4), 463–472. https://doi.org/10.1016/j.jbusres.2012.12.021

Yu, J., & Mai, D. (2020). Political turnover and stock crash risk: Evidence from China. Pacific Basin Finance Journal, 61(19), 101324. https://doi.org/10.1016/j.pacfin.2020.101324

Zaremba, A., Cakici, N., Demir, E., & Long, H. (2022). When bad news is good news: Geopolitical risk and the cross-section of emerging market stock returns. Journal of Financial Stability, 58, 100964. https://doi.org/10.1016/j.jfs.2021.100964

Zhang, C., & Chen, X. (2011). The impact of global oil price shocks on China’s stock returns: Evidence from the ARJI(-ht)-EGARCH model. Energy, 36(11), 6627–6633. https://doi.org/10.1016/j.energy.2011.08.052

Zhou, M.-J., Huang, J.-B., & Chen, J.-Y. (2022). Time and frequency spillovers between political risk and the stock returns of China’s rare earths. Resources Policy, 75, 102464. https://doi.org/10.1016/j.resourpol.2021.102464

Zoungrana, T. D., tan Toé, D. L., & Toé, M. (2021). Covid-19 outbreak and stocks return on the West African Economic and Monetary Union’s stock market: An empirical analysis of the relationship through the event study approach. International Journal of Finance and Economics. https://doi.org/10.1002/ijfe.2484

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Khalfaoui, R., Ben Jabeur, S., Hammoudeh, S. et al. The role of political risk, uncertainty, and crude oil in predicting stock markets: evidence from the UAE economy. Ann Oper Res (2022). https://doi.org/10.1007/s10479-022-04824-y

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-022-04824-y