Abstract

Carbon taxes evoke a variety of public responses, often with negative implications for policy support, implementation, and stringency. Here we use topic modeling to analyze associations of Spanish citizens with a policy proposal to introduce a carbon tax. This involves asking two key questions, to elicit (1) citizens’ associations with a carbon tax and (2) their judgment of the fairness of such a policy for distinct uses of tax revenues. We identify 11 topics for the first question and 18 topics for the second. We perform regression analysis to assess how respondents’ associations relate to their carbon tax acceptability, knowledge, and sociodemographic characteristics. The results show that, compared to people accepting the carbon tax, those rejecting it show less trust in politicians, think that the rich should pay more than the poor, consider the tax to be less fair, and stress more a lack of renewable energy or low-carbon transport. Respondents accepting a carbon tax emphasize more the need to solve environmental problems and care about a just society. These insights can help policymakers to improve the design and communication of climate policy with the aim to increase its public acceptability.

Similar content being viewed by others

Notes

In fact, providing respondents with multiple questions about use of carbon tax revenues can help to elicit a variety of associations related to fairness, such as fairness related to a particular revenue use, what would be a fair policy in general, or what the notion of fairness means to them exactly.

Because of many missing values present in responses for income and political views (approx. 25% and 15% respectively), we do not use these as covariates.

As we demonstrate in Fig. 8 in the Appendix, we do not have any strong correlation between any pair of covariates included in each of the two topic models. Since perceived fairness of carbon tax and its acceptability are strongly positively correlated, we decided to not include them in the same model. We further estimate the variance inflation factor (VIF) which measures how much the variance of a regression coefficient is inflated due to multicollinearity in the model. In all estimations, we observe a VIF value between 1.04 and 1.14, which is far below the conservative benchmark of 5, suggesting absence of multicollinearity.

We limit the maximum number of topics to 20 in view of the relatively small data sample we are working with. Note that Tvinnereim et al. (2017b), who used a larger survey sample, considered a range between 3 and 12 topics only.

This reflects the earlier finding by Chang et al. (2009) that topic models with higher held-out log-likelihood are sometimes harder to interpret.

The statements come from the ten responses with the highest topic prevalence.

Henceforth, we refer to topic # as T#.

The correlation between car use and number of inhabitants is − 0.21 indicating that frequent car users often come from rural areas.

Henceforth, we will use X* as a part of topic label to indicate the close relationship.

References

Andor MA, Frondel M, Sommer S (2018) Equity and the willingness to pay for green electricity in Germany. Nat Energy 3:876–881. https://doi.org/10.1038/s41560-018-0233-x

Arora S, Ge R, Halpern Y, Mimno D, Moitra A, Sontag D, Wu Y, Zhu M (2013) A practical algorithm for topic modeling with provable guarantees. In: Dasgupta S, Mc Allester D (eds) Proceedings of the 30th International Conference on Machine Learning, Volume 28 of Proceedings of Machine Learning Research, PMLR, Atlanta, Georgia, USA, 280–288

Beiser-McGrath LF, Bernauer T (2019) Could revenue recycling make effective carbon taxation politically feasible? Sci Adv 5:eaax3323. https://doi.org/10.1126/sciadv.aax3323

Blei DM, Lafferty JD (2007) A correlated topic model of science. The Annals of Applied Statistics 1(1):m 17-35

Bristow AL, Wardman M, Zanni AM, Chintakayala PK (2010) Public acceptability of personal carbon trading and carbon tax. Ecol Econ 69:1824–1837. https://doi.org/10.1016/j.ecolecon.2010.04.021

Carattini S, Baranzini A, Thalmann P, Varone F, Vöhringer F (2017) Green taxes in a post-Paris world: are millions of nays inevitable? Environ Resour Econ. https://doi.org/10.1007/s10640-017-0133-8

Carattini S, Carvalho M, Fankhauser S (2018) Overcoming public resistance to carbon taxes. Wiley Interdisciplinary Reviews: Climate Change:e531. https://doi.org/10.1002/wcc.531

Centro de Investigaciones Sociológicas (CIS), Barómetro de Septiembre 2019

Chang J, Boyd-Graber J, Gerrish S, Wang C, Blei DM (2009) Reading tea leaves: how humans interpret topic models. In: Advances in neural information processing systems NIPS, pp 288–296

Craig BM, Hays RD, Pickard AS, Cella D, Revicki DA, Reeve BB (2013) Comparison of US panel vendors for online surveys. J Med Internet Res 15(11):e260

Douenne T, Fabre A (2020) French attitudes on climate change, carbon taxation and other climate policies. Ecol Econ 169:106496

Drews S, van den Bergh JCJM (2016) What explains public support for climate policies? A review of empirical and experimental studies. Clim Pol 16:855–876. https://doi.org/10.1080/14693062.2015.1058240

Fernández-Reyes R, Iménez Gómez I (2019) Media coverage of climate change mitigation in the Spanish press. In: La comunicación de la mitigación ante la emergencia climática ISBN 9788418167034, pp 207–246

Haites E (2018) Carbon taxes and greenhouse gas emissions trading systems: what have we learned? Clim Pol 18(8):955–966

Huang A, Lehavy R, Zang AY, Zheng R (2017) Analyst information discovery and interpretation roles: a topic modeling approach. Manag Sci 64(6):2833–2855

Jagers SC, Martinsson J, Matti S (2018) The impact of compensatory measures on public support for carbon taxation: an experimental study in Sweden. Clim Pol:1–14. https://doi.org/10.1080/14693062.2018.1470963

Klenert D, Mattauch L, Combet E, Edenhofer O, Hepburn C, Rafaty R, Stern N (2018) Making carbon pricing work for citizens. Nat Clim Chang 8:669–677. https://doi.org/10.1038/s41558-018-0201-2

Kotchen MJ, Turk ZM, Leiserowitz AA (2017) Public willingness to pay for a US carbon tax and preferences for spending the revenue. Environ Res Lett 12:094012. https://doi.org/10.1088/1748-9326/aa822a

Lachapelle E (2017) Communicating about Carbon Taxes and Emissions Trading Programs. Oxford Research Encyclopedia of Climate Science. https://doi.org/10.1093/acrefore/9780190228620.013.431

Leiserowitz A (2006) Climate change risk perception and policy preferences: the role of affect, imagery, and values. Clim Chang 77(1–2):45–72. https://doi.org/10.1007/s10584-006-9059-9

Lesnikowski A, Belfer E, Rodman E, Smith J, Biesbroek R, Wilkerson JD, Ford JD, Berrang-Ford L (2019) Frontiers in data analytics for adaptation research: topic modeling. Wiley Interdiscip Rev Clim Chang 10:e576. https://doi.org/10.1002/wcc.576

Lodge M, Taber CS (2013) The rationalizing voter. Cambridge University Press

Lorenzoni I, Leiserowitz A, De Franca Doria M, Poortinga W, Pidgeon NF (2006) Cross-National Comparisons of image associations with “global warming” and “climate change” among laypeople in the United States of America and Great Britain. J Risk Res 9(3):265–281. https://doi.org/10.1080/13669870600613658

Maestre-Andrés S, Drews S, van den Bergh J (2019a) Perceived fairness and public acceptability of carbon pricing: a review of the literature. Clim Pol 19:1186–1204. https://doi.org/10.1080/14693062.2019.1639490

Maestre-Andrés S, Drews S, Savin I, van den Bergh J (2019b) Carbon tax acceptability with information provision and mixed revenue uses. Working paper, ICTA-UAB

Mildenberger M, Tingley D (2017) Beliefs about climate beliefs: the importance of second-order opinions for climate politics. Br J Polit Sci:1–29. https://doi.org/10.1017/S0007123417000321

Moloney G, Leviston Z, Lynam T, Price J, Stone-Jovicich S, Blair D (2014) Using social representations theory to make sense of climate change: what scientists and nonscientists in Australia think. Ecol Soc 19(3). https://doi.org/10.5751/ES-06592-190319

OECD (n.d.) It does not specify the year. Effective carbon rates. Pricing CO2 through taxes and emission trading systems. Available at https://www.oecd.org/tax/tax-policy/environmental-tax-profile-spain.pdf

Pettigrew S (2020) Spanish carbon pricing the lowest in the EU. https://www.climatescorecard.org/2020/03/spanish-carbon-pricing-the-lowest-in-the-eu/

Roberts ME, Stewart BM, Tingley D, Lucas C, Leder-Luis J, Gadarian SK, Albertson B, Rand DG (2014) Structural topic models for open-ended survey responses. Am J Polit Sci 58:1064–1082. https://doi.org/10.1111/ajps.12103

Roberts ME, Stewart BM, Tingley D (2019) stm: an R package for structural topic models. J Stat Softw 91(2). https://doi.org/10.18637/jss.v091.i02

Savin I, Drews S, van den Bergh JCJM (2020) Free associations of citizens and scientists with economic and green growth: A computational linguistics analysis, EVOCLIM working paper, ICTA-UAB.

Torcal M (2014) The decline of political trust in Spain and Portugal: economic performance or political responsiveness? Am Behav Sci 58:1542–1567. https://doi.org/10.1177/0002764214534662

Tvinnereim E, Fløttum K (2015) Explaining topic prevalence in answers to open-ended survey questions about climate change. Nat Clim Chang 5:744–747. https://doi.org/10.1038/nclimate2663

Tvinnereim E, Liu X, Jamelske EM (2017a) Public perceptions of air pollution and climate change: different manifestations, similar causes, and concerns. Clim Chang 140:399–412. https://doi.org/10.1007/s10584-016-1871-2

Tvinnereim E, Fløttum K, Gjerstad Ø, Johannesson MP, Nordø ÅD (2017b) Citizens’ preferences for tackling climate change. Quantitative and qualitative analyses of their freely formulated solutions. Glob Environ Chang 46:34–41. https://doi.org/10.1016/j.gloenvcha.2017.06.005

World Bank (2019) “State and trends of carbon pricing – 2019.” Washington, DC

Funding

This work was funded by a Recercaixa 2016 project titled “Understanding Societal Views on Carbon Pricing” and an ERC Advanced Grant from the European Research Council (ERC) under the European Union’s Horizon 2020 Research and Innovation Programme (grant agreement no. 741087). I.S. acknowledges financial support from the Russian Science Foundation (RSF grant number 19-18-00262).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Context of carbon taxes in Spain

Spain has historically not had an explicit carbon tax on all products but has high levels of taxes on energy use. In 2014, Spain implicitly priced over 30% of the country’s total carbon emissions above €30/CO2-ton, with the highest taxes generally being placed on the transportation sector (OECD, it does not specify the year). In 2019, Spain again priced a similar percentage of around 30% of emissions at an average of €15/CO2-ton, covering a mere 3% of its total emissions output (Pettigrew 2020). Moreover, as a member of the European Union, Spain is covered by the EU ETS. According to the World Bank (2019), Spain has a carbon tax since 2014 ($17 per ton of CO2); however, this is a tax aimed at reducing fluorinated greenhouse gases (F-gases) (see the entry for Spain in the Carbon Pricing Dashboard of the World Bank: https://carbonpricingdashboard.worldbank.org/map_data). This can be interpreted as implicit carbon price, but to call them an explicit carbon tax would be inaccurate. Moreover, there is hardly any discussion about carbon pricing in Spanish media or society. For example, an analysis of coverage of climate change mitigation in Spanish newspapers shows that although “economic incentives” receive some attention when discussing solutions, carbon taxation overall does not stand out as an important issue (Fernández-Reyes and Iménez Gómez 2019). Finally, note that literature reviews of carbon taxation tend not to mention Spain (e.g., Haites 2018).

Survey questions used in this study

Under the Paris Agreement from 2015, each country, including Spain, must implement policies to reduce their CO2 emissions, which contribute to climate change. One major proposal to achieve emissions reduction is by implementing a carbon tax on fossil fuels whose combustion is the main cause of CO2 emissions.

-

1.

Do you know how a carbon tax works? (Response options: not at all, a little, somewhat, a lot, very much)

-

2.

Here are several sentences about carbon taxation. Can you tell us whether you think they are true or false? (Response options: “true”, “false”, “do not know”)

-

A carbon tax is levied on the carbon content of fossil fuels, such as coal and oil.

-

A carbon tax mandates all producers and consumers which low-carbon technology they should adopt.

-

A carbon tax makes renewable energy sources, such as solar electricity, more expensive than fossil fuels.

-

A carbon tax imposes a legally binding limit on the amount of CO2 emissions that firms and consumers are allowed to emit.

-

-

A carbon tax allows reducing other, existing taxes such as VAT or labour taxes.

-

A carbon tax will raise the price of coal and reduce the price of gasoline.

The following information is provided to half of the sample (group 1) about how a carbon tax works:

“A carbon tax is a charge on fossil fuels in proportion to the amount of carbon they contain as this determines how many CO2 emissions result from their combustion. This will, for instance, raise the price of coal more than that of gasoline and the latter more than that of natural gas. Producers and consumers are then stimulated to switch to renewable energy, save energy on heating, alter fuel-based transport, etc. Because fuel prices alter, the prices of other products and services throughout the economy will change as well: the ones that generate considerable CO2 in production will become more expensive, while prices are likely to alter little or remain the same for products and services that cause little or no CO2 during production. A significant carbon tax thus encourages all firms and household to shift to goods and services that use fewer high-carbon energy sources during their production.”

-

3.

How effective do you think a carbon tax is for reducing CO2 emissions? (Response options: Very ineffective, ineffective, neither ineffective nor effective, effective, very effective).

-

4.

How fair or unfair do you consider a carbon tax? (Response options: very unfair, somewhat unfair, neither unfair nor fair, somewhat fair, very fair).

-

5.

Who do you think should carry most of the burden of the carbon tax? (Response options: businesses, consumers, both, none).

-

6.

How do you think a carbon tax will affect you personally? (Response options: I would be much worse off, I would be somewhat worse off, I would be neither worse off nor better off, I would be somewhat better off, I would be much better off).

-

7.

How do you think a carbon tax will affect low-income households? (Response options: they would be much worse off, they would be somewhat worse off, they would be neither worse off nor better off, they would be somewhat better off, they would be much better off).

-

8.

How trustworthy do you think politicians are in implementing the carbon tax properly? (Response options: very untrustworthy, untrustworthy, neither untrustworthy not trustworthy, trustworthy, very trustworthy).

-

9.

How acceptable do you find a carbon tax? (Response options: completely unacceptable, somewhat unacceptable, neither unacceptable nor acceptable, somewhat acceptable, completely acceptable).

-

10.

Which of these two objectives do you think is the main purpose of a carbon tax? (Response options: to generate revenues, to change behaviour of producers and consumers, do not know).

Carbon taxes generate revenues which can be used for different purposes. As an illustrative example, for instance, according to one estimate, a (low) carbon tax of €5/ton CO2 would already generate approximately €1.3 billion of additional government revenues. To put this number in perspective: Spain’s expenditures for education were €2.6 billion in 2018.

Here we present five options to use the revenues:

-

Return all the revenues to compensate low-income households.

-

Support the development of climate projects (e.g. investing in public transport, planting trees, subsidies for renewable energy).

-

Use half of the revenues to support the development of climate projects and the other half to compensate low-income households.

-

Return the revenues in equal amount to all households as compensation.

-

Use half of the revenues to support development of climate projects and the other half to compensate all households in equal amount.

-

11.

How effective do you think the carbon tax is for reducing CO2 emissions if its revenues are used to [the question is repeated for each of the five revenue uses mentioned above]? (Response options: Very ineffective, ineffective, neither ineffective nor effective, effective, very effective).

-

12.

How fair or unfair do you consider a carbon tax if its revenues are used to [the question is repeated for each of the five revenue uses mentioned above]? (Response options: very unfair, somewhat unfair, neither unfair nor fair, somewhat fair, very fair).

-

13.

How do you think a carbon tax affects you personally if its revenues are used to [the question is repeated for each of the five revenue uses mentioned above]? (Response options: I would be much worse off, I would be somewhat worse off, I would be neither worse off nor better off, I would be somewhat better off, I would be much better off).

-

14.

How you think a carbon tax affects low-income households if its revenues are used to [the question is repeated for each of the five revenue uses mentioned above]? (Response options: they would be much worse off, they would be somewhat worse off, they would be neither worse off nor better off, they would be somewhat better off, they would be much better off).

-

15.

How acceptable do you find the carbon tax if its revenues are used to [the question is repeated for each of the five revenue uses mentioned above]? (Response options: completely unacceptable, somewhat unacceptable, neither unacceptable nor acceptable, somewhat acceptable, completely acceptable).

16. What percentage of the total carbon tax revenues (100%) would you prefer to allocate for each of the 3 proposed options? Please make sure that the total amount is equal to 100%. | % of revenue allocated |

Support the development of climate projects | |

Return the revenues to compensate low-income households | |

Return the revenues in equal amount to all households as compensation |

-

17.

Which factor– effectiveness or fairness – played a stronger role in your decision on how to allocate the revenue generated by the carbon tax? (Response options: only effectiveness, more effectiveness than fairness, equally effectiveness and fairness, more fairness than effectiveness, only fairness, neither effectiveness nor fairness).

-

18.

How many people are in your household?

-

19.

Could you tell us in which of the following ranges your net monthly income of your household falls? (Responses options: No income, €1000 or less, between €1001-€2000, between €2001-€3000, between €3001-€4000, more than €4001, I prefer not to answer).

-

20.

What is the highest level of studies you have completed? (Response options: less than 5 years of school, primary, secondary, bachelor/medium professional formation, superior professional formation, university).

-

21.

How concerned are you about climate change? (Response options: not at all, a little, somewhat, much, very much).

-

22.

Where would you situate yourself ideologically? Use a scale ranging from 1 to 10, where 1 is ‘left-wing’ and 10 is ‘right-wing’?

-

23.

Which political party did you vote in the last general elections of the 28th April 2019?

-

24.

How often do you use a car? (Response options: never, less than once a month, few times a month, once a week, few times a week, everyday).

-

25.

How many minutes do you travel by car on an average working day? (Response options: none, less than 30 minutes, between 30 and 60 minutes, between 61 (1 hour) and 90 minutes (1:30 hours), Between 91 minutes (1:30hours) and 120 minutes (2 hours), more than 120 minutes (2hours or more).

Descriptive statistics

Further results

To test our results for robustness, we replicated the procedure on the first open question after excluding people who completed the survey very quickly (“speeders”), as they may have not thought as well about their responses. In particular, we discarded 218 (approx. 11%) respondents who required less than 8 min on the whole survey. For the first open question, this reduced the sample to 843 unique terms and 16,707 tokens. Testing the resulting dataset on the optimal number of topics, we find that 12 topics fit the data better than 11 as by adding just one more topic produces better results on all three selection criteria (Fig. 12).

After forming the model with 12 topics using the same six covariates we used before (age, gender, education, car use, perceived level of knowledge about carbon tax, and acceptability of carbon tax), we report the most discriminating terms of the resulting topics and their proportions in Table 8. Recognizing that many of these topics look very similar to those reported in Table 1 based on the full data sample, we tried to match the closest equivalents by assigning to a topic X from Table 1 a topic X* in Table 8.Footnote 10

For 7 out of 11 topics, we could find a unique equivalent. One should stress at this point that an equivalent does not imply a perfect one-to-one relationship, but that a considerable fraction of discriminating terms between the topics is overlapping, while open textual responses with high topic prevalence convey the views consistent with the topic label. For topics 2 and 7 from Table 1, we could find not one but two equivalents in Table 8 (i.e., these have been seemingly split in two distinct clusters each), while two other topics, 9 and 11, have been merged into a single cluster. Thus, we clearly see how views expressed in topics from Table 1 can be observed also in Table 8, while also topic proportions of equivalent topics are similar.

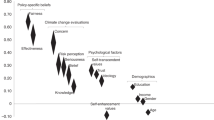

To further ensure that the new topics reflect similar findings concerning how expressed views differ among the population depending their age, gender, and other covariates we used to form the topics, we produce Fig. 13 reporting results of the regression analysis, where we establish associations between topic proportions and their covariates. As one can see, Fig. 13 produces a result similar to the one in Fig. 3. For example, the view that there are already too many taxes (Topics 3 and 3* in the older and newer topic models) are expressed comparatively more by older people, with less education, lower level of knowledge about the carbon tax, and lower acceptability of this policy initiative. Furthermore, examining significance of other regression coefficients reported in Table 7, we find only car use for topic 10* (“It will only work if all countries participate”) to be weakly significant (at 10% and not at 1% as it was for topic 10 in Fig. 3).

Based on this evidence, we conclude that our results reported in the main papers are robust to exclusion of respondents who completed the survey questionnaire very quickly.

Effect of covariates on topic prevalence for associations with carbon tax implementation after deleting the speeders. Note: Values generated by a regression where the outcome variable is the proportion of each public response dedicated to each topic, given the selected STM model. The panel shows point estimates and confidence intervals of the effects of selected covariates on topic prevalence, holding all other covariates constant. The plot for gender shows mean difference in topic proportions between male and female (a positive value on the X-axis indicates a larger prevalence for men). Only a subset of topics corresponding to those depicted in Fig. 3 in the main text is displayed. Confidence intervals plotted as dashed lines indicate the 95% uncertainty range and include both regression and measurement uncertainties associated with the STM model

Rights and permissions

About this article

Cite this article

Savin, I., Drews, S., Maestre-Andrés, S. et al. Public views on carbon taxation and its fairness: a computational-linguistics analysis. Climatic Change 162, 2107–2138 (2020). https://doi.org/10.1007/s10584-020-02842-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10584-020-02842-y