Abstract

Employing a numerical general equilibrium model with multiple fuels, end-use sectors, heterogeneous households, and transport externalities, this paper examines three motives for differentiated carbon pricing in the context of Swiss climate policy: fiscal interactions with the existing tax code, non-\(\hbox {CO}_2\) related transport externalities, and social equity concerns. Interaction effects with mineral oil taxes reduce carbon taxes on motor fuels and transport externalities increase them. We show that the cost-effective overall carbon tax on motor fuels should be lower than the one on thermal fuels. This is found in spite of the fact that pre-existing taxes on motor fuels are well below our estimate of the transport externality per unit of transport fuel consumption. Differentiating taxes in favor of motor fuels yields only slightly more equitable incidence effects among households, suggesting that equity considerations play a minor role when designing differentiated carbon pricing policies.

Similar content being viewed by others

Notes

Other recent assessments of Swiss climate policy include Bretschger et al. (2011), Sceia et al. (2009), Sceia et al. (2012), which do not explicitly consider differentiated carbon prices. Sceia et al. (2009) and Sceia et al. (2012) analyze transportation-specific emission reduction targets and find them to be an inefficient deviation from economy-wide uniform carbon pricing.

Bovenberg and Goulder (1996) analyze optimal taxation of a polluting activity in presence of distortionary labor taxes. Their argument applies to our setting if one views the problem of taxing motor fuels more or less than thermal fuels as correcting the pre-existing motor fuel taxes to optimally manage the transport externality in presence of a distortionary \(\hbox {CO}_{2}\) tax. From a Swiss perspective, the \(\hbox {CO}_{2}\) tax is distortionary because, presumably, it makes emitters internalize global effects of climatic change of which Switzerland internalizes only a very small fraction.

Boeters (2014) finds that the most important drivers for carbon price differentiation are market power in export markets and taxes on consumption, intermediate inputs, and domestic outputs. At the same time, he warns that his model views taxes as distortive inefficiencies and shows that his case for carbon price differentiation weakens if his model channels tax revenues on motor fuels to road construction and maintenance and assumes that these have to be provided in proportion to motor fuel consumption.

The remaining difference between income and expenditure of households was attributed to direct transfers to or from the government. In our model, we index government transfers to the consumer price index thereby effectively assuming that households’ transfer income (in real terms) is unaffected by carbon taxation.

This is obviously a simplifying assumption. For example, people who have been in traffic accidents are likely to change their consumption of health services and people who experience changes in traffic noise in their neighborhood are likely to change their investment behavior in sound insulation. As this paper is not focused on analyzing transport externalities per se, we leave for future research to investigate the implications of relaxing this assumption—which, if addressed in a general equilibrium context, would call for an in-depth analysis going beyond the scope of this paper (see, for example, Carbone and Smith 2008). Moreover, welfare does not include the benefits from averted climate change due to reducing \(\hbox {CO}_2\) emissions in Switzerland which would be negligible due Switzerland’s tiny share in global emissions.

Consistently with Parry and Small (2005), \(\beta \) can be interpreted as the ratio between the elasticity of V with respect to the consumer fuel price (\(\eta _{{\textit{MF}}}\)) and the own-price elasticity of demand for fuel (\(\eta _{{\textit{FF}}}\)), i.e. \(\beta =\eta _{{\textit{MF}}}/\eta _{{\textit{FF}}}\). If fuel efficiency were fixed, then vehicle kilometers traveled would change in proportion to fuel use, so that \(\eta _{{\textit{MF}}}=\eta _{{\textit{FF}}}\).

We assume that the marginal and the average welfare loss from the transport externality per transport activity are the same. This appears appropriate as fuel taxes will reduce traffic in remote as well as in congested areas, in noisy as well as in silent places, and in accident prone locations as well as on straight, fenced roads.

A study of the Swiss Federal Office for Spatial Development (ARE 2014) has estimated the external cost from private transportation (including traffic congestion, air pollution, climate-related costs, and others) to be CHF 6.6 billion in 2010 of which 81.2% were not related to climate. According to this study, the total external costs per person kilometer are CHF 0.060 and the non-climate part of this is CHF 0.049 per person kilometer. In 2010, new private vehicles in Switzerland on average carried 1.6 persons and used 6.4 liters of gasoline per 100 kilometers (BFS 2013b). Thus, private transportation delivers at least 25 person kilometers per liter of gasoline. The costs of non-\(\hbox {CO}_2\) related transport externalities can thus be estimated to be about CHF 1.225 per liter of gasoline.

It is hard to quantify the range of uncertainty about estimates for the transport externalities. Based on findings from previous literature, Parry and Small (2005) suggest confidence intervals of size up to around (\(0.2\cdot \mu \), \(2.5\cdot \mu \)) for single components of non-climate related transport externalities, where \(\mu \) is the best guess estimate for the given component. Given that the Swiss estimate for transport externalities is rather high compared to the range of estimates cited by Parry and Small (2005), we choose the upper bound to the confidence interval of only 1.8 times the central estimate: (\(0.266\cdot \mu \), \(1.8\cdot \mu \)).

This type of forward calibration procedure has been used, for example, in Böhringer and Rutherford (2002).

See \(\hbox {``CO}_2\) Verordnung” (Anhang 8 zu Art. 45 Abs. 1) which regulates the Swiss ETS until 2020. We assume the same rate of change after 2020.

The cost-effective ETS cap is determined endogenously to minimize the welfare cost in Switzerland for achieving the given emissions reduction target.

The target is formulated in terms of all greenhouse gas (GHG) emissions and requires a reduction of at least 50% by 2030 relative to 1990 of which at least 30% should come from domestic reductions. Reducing all GHGs domestically by 30% corresponds to 40% domestic reduction of \(\hbox {CO}_2\) (Federal Council 2015a).

Focusing on the case of Switzerland as a small open economy, we exclude by construction any arguments for tax differentiation stemming from market power on international markets.

While the magnitude of MWC difference between the transportation and non-transportation sectors depends of course on the specific technology assumptions for modelling the transportation sector, the finding that marginal abatement costs in the transportation sector tend to be higher in the transportation sector is in line with previous studies (see, for example, Paltsev et al. 2005a; Abrell 2010; Karplus et al. 2013).

As of 2015, the mineral oil tax on motor fuels is CHF 0.7422 per liter while the tax on thermal fuels is only CHF 0.003 per liter.

Moreover, the numerical model failed to produce a solution for reaching reduction targets of 40% and higher in scenarios Transport or Thermal. While this does not rule out that a solution exists, it illustrates the difficulty of reaching the targets by taxing one fuel type only.

To prove this point, we run the model \(\beta = 1\), thus assuming that any change in motor fuel demand is directly proportional to changes in vehicle distance traveled. For a 30% overall reduction target, the cost-effective \(\hbox {CO}_{2}\) taxes would then be CHF 279.6/t\(\hbox {CO}_{2}\) on motor fuel, and CHF 195.7/t\(\hbox {CO}_{2}\) for thermal fuels. The difference of CHF 83.9/t\(\hbox {CO}_{2}\) corresponds to CHF 0.22 per liter of motor fuel and in combination with the mineral oil tax, motor fuels are taxed CHF 0.96 more per liter than they would be if they were used as thermal fuels. This is lower than the CHF 1.23 per liter that would be the efficient extra tax on motor fuels in absence of tax interaction effects. As the stringency of climate policy and thus the \(\hbox {CO}_{2}\) taxes increase, the tax interaction effect becomes stronger: For a 50% overall \(\hbox {CO}_{2}\) reduction target, cost effective \(\hbox {CO}_{2}\) taxes on motor and thermal fuels are the same (at CHF 766.5/t\(\hbox {CO}_{2}\)). Thus, motor fuels are only taxed CHF 0.74 more per liter than they would be if they were used as thermal fuels.

Note that following the definition of social welfare in (1), we assume that the impacts of transport externalities a distributed on a per-capita basis.

In this case, we assume that government spending is increased by an equal amount.

Even when revenues are recycled back to households in a lump-sum fashion, i.e. without distorting relative prices, lump-sum transfers have direct redistributive effects. Intuitively, giving the same amount of money under a per-capita recycling scheme to a poor and a rich household creates a relatively larger gain in utility for the poor household.

We have carried out additional sensitivity analysis which independently varies \(t_{{\text {avg}}}\) and \(\beta \) to analyze the relative contributions of the uncertainty of the two parameters. We find that the uncertainty associated with each parameter has a similar effect on the overall uncertainty.

A characteristic of many economic models is that they can be cast as a complementary problem. Mathiesen (1985) and Rutherford (1995) have shown that a complementary-based approach is convenient, robust, and efficient. The complementarity format embodies weak inequalities and complementary slackness, relevant features for models that are not integrable. contain bounds on specific variables, for example, activity levels which cannot a priori be assumed to operate at positive intensity. Such features are not easily handled with alternative solution methods.

While the carbon price for the non-ETS sectors is exogenously defined, the carbon price for the ETS industries results from the cap \(e_{max}^{{ ETS}}\) of the emission trading system.

For ease of notation we suppress the fact that taxes and carbon coefficients are differentiated by agent.

References

Abrell J (2010) Regulating \(\text{ CO }_2\) emissions of transportation in Europe: a CGE analysis using market-based instruments. Transp Res Part D 15:235–239

ARE, Bundesamt für Raumentwicklung (2014) Externe Kosten und Nutzen des Verkehrs in der Schweiz. Strassen-, Schienen-, Luft- und Schiffsverkehr 2010 und Entwickungen seit 2005

Armington P (1969) A theory of demand for products distinguished by place of production. Int Monet Fund Staff Pap 16:159–76

Babiker M, Bautista M, Jacoby H, Reilly J (2000) Effects of differentiating climate policy by sector: a U.S. example. In: Bernstein L, Pan J (eds) Sectoral economic costs and benefits of GHG mitigation. Proceedings of an IPCC Expert Meeting, 1415 Feb 2000, Technical Support Unit, IPCC Working Group III

Baumol WJ, Oates WE (1988) The theory of environmental policy, 2nd edn. Cambridge University Press, Cambridge

Bundesamt für Statistik (BFS) (2011) Swiss input–output table 2008 (su-e-04.02-IOT-2008)

Bundesamt für Statistik (BFS) (2012a) Haushaltsbudgeterhebung 2009. BFS Aktuell

Bundesamt für Statistik (BFS) (2012b) Haushaltsbudgeterhebung 2010

Bundesamt für Statistik (BFS) (2013a) Haushaltsbudgeterhebung 2011

Bundesamt für Statistik (BFS) (2013b) Mobilität und Verkehr 2013. Statistik der Schweiz, Bundesamt für Statistik (BFS), Neuchâtel

Bundesamt für Statistik (BFS) (2014) Steckbrief Haushaltserhebung. Neues Gewichtungsmodell, Resultate 2000–2003 und Studie zur Altersvorsorge. BFS Aktuell. http://www.bfs.admin.ch/bfs/portal/de/index/infothek/erhebungen__quellen/blank/blank/habe/01.html. Visited on 04.02.2015

Boeters S (2014) Optimally differentiated carbon prices for unilateral climate policy. Energy Econ 45:304–312

Böhringer C, Lange A, Rutherford TF (2014) Optimal emission pricing in the presence of international spillovers: decomposing leakage and terms-of-trade motives. J Public Econ 110:101–111. doi:10.1016/j.jpubeco.2013.11.011

Böhringer C, Rutherford TF (1997) Carbon taxes with exemptions in an open economy—a general equilibrium analysis of the german tax initiative. J Environ Econ Manag 32:189–203

Böhringer C, Rutherford TF (2002) Carbon abatement and international spillovers: a decomposition of general equilibrium effects. Environ Resource Econ 22(3):391–417

Bovenberg AL, Goulder LH (1996) Optimal environmental taxation in the presence of other taxes: general equilibrium analyses. Am Econ Rev 86:985–1000

Bretschger L, Ramer R, Schwark F (2011) Growth effects of carbon policies: applying a fully dynamic CGE model with heterogeneous capital. Resource Energy Econ 33(4):963–980

Calthrop E, Proost S (1998) Road transport externalities: interaction between theory and empirical research. Environ Resource Econ 11(3–4):335–348

Carbone JC, Smith VK (2008) Evaluating policy interventions with general equilibrium externalities. J Public Econ 92:1254–1274

Dales JH (1968) Pollution, property and prices: an essay in policy-making and economics. University of Toronto Press, Toronto

Dirkse SP, Ferris MC (1995) The PATH solver: a non-monontone stabilization scheme for mixed complementarity problems. Optim Methods Softw 5:123–156

Federal Council (Bundesrat) (2015a) Erläuternder Bericht zum Vorentwurf. Vernehmlassung für ein Klima- und Energielenkungssystem. http://www.news.admin.ch/NSBSubscriber/message/attachments/38702

Federal Council (Bundesrat) (2015b) Vernehmlassung für ein Klima- und Energielenkungssystem. https://www.news.admin.ch/message/index.html?lang=de&msg-id=56553

Fullerton D, Heutel G, Metcalf GE (2012) Does the indexing of government transfers make carbon pricing progressive? Am J Agric Econ 94(2):347–353

Hoel M (1996) Should a carbon tax be differentiated across sectors? South Econ J 59:17–32

Imhof J (2012) Fuel Exemptions, revenue recycling, equity and efficiency: evaluating post-kyoto policies for switzerland. Swiss J Econ Stat 148(2):197–227

Kallbekken S (2005) The cost of sectoral differentiation in the EU emissions trading scheme. Clim Policy 5:47–60

Karplus VJ, Paltsev S, Babiker M, Reilly JM (2013) Applying engineering and fleet detail to represent passenger vehicle transport in a computable general equilibrium model. Econ Model 30:295–305

Krutilla K (1991) Environmental regulation in an open economy. J Environ Econ Manag 20:127–142

Lipsey RG, Lancaster K (1956) The general theory of the second best. Rev Econ Stud 24:11–32

Markusen J (1975) International externalities and optimal tax structures. J Int Econ 5:15–29

Mathiesen L (1985) Computation of economic equilibria by a sequence of linear complementarity problems. Math Program Study 23:144–162

Metcalf GE (1999) A distributional analysis of green tax reforms. Natl Tax J 52(4):655–682

Metcalf GE (2009) Market-based policy options to control U.S. Greenhouse gas emissions. J Econ Perspect 23:5–27

Montgomery DW (1972) Markets in licenses and efficient pollution control programs. J Econ Theory 5(3):395–418

Nathani C, Sutter D, van Nieuwkoop R, Kraner S, Peter M, Zandonella R (2013) Energiebezogene differenzierung der schweizerischen input-output-tabele 2008. Schlussbericht an das Bundesamt für Energie, Rüschlikon/Zürich/Thun

Paltsev S, Jacoby L, Reilly JM, Viguier L, Babiker M (2005a) Transport and climate policy modeling the transport sector: the role of existing fuel taxes in climate policy. Springer, Berlin

Paltsev S, Jacoby H, Babiker M, Viguier L, Reilly J (2005b) Modeling the transport sector: the role of existing fuel taxes. In: Loulou R, Waaub J, Zaccour J (eds) Climate policy. Energy and environment: 25th anniversary of the group for research in decision analysis, vol 3. Springer, New York

Parry IWH, Small KA (2005) Does Britain or the United States have the right gasoline tax? Am Econ Rev 95(4):1276–1289

Parry IWH, Walls M, Harrington W (2006) Automobile externalities and policies. Resources for the future discussion paper June 2006, Revised January 2007, RFF DP 06-26. http://www.rff.org/files/sharepoint/WorkImages/Download/RFF-DP-06-26-REV

Rauscher M (1994) On ecological dumping. Oxford Econ Pap 46:822–840

Rausch S, Metcalf GE, Reilly JM (2011) Distributional impacts of carbon pricing: a general equilibrium approach with micro-data for households. Energy Econ 33(1):S20–S33

Rutherford TF (1995) Extension of GAMS for complementarity problems arising in applied economics. J Econ Dyn Control 19(8):1299–1324

Rutherford TF (1999) Applied general equilibrium modeling with MPSGE as a GAMS subsystem: an overview of the modeling framework and syntax. Comput Econ 14:1–46

Sceia A, Altamirano-Cabrerac J-C, Vielled M, Weidmanne N (2012) Assessment of acceptable Swiss post-2012 climate policiesa. Swiss J Econ Stat 148(2):2

Sceia A, Thalmann P, Vielle M (2009) Assessment of the economic impacts of the revision of the Swiss CO2 law with a hybrid model. REME-Report-2009-002, Lausanne

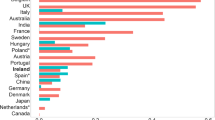

Sterner T (2012) Distributional effects of taxing transport fuel. Energy Policy 41:75–83

Acknowledgements

We gratefully acknowledge financial support by the Swiss Competence Center for Energy Research, Competence Center for Research in Energy, Society and Transition (SCCER-CREST) and the Commission for Technology and Innovation (CTI). We further gratefully acknowledge financial support by the SNF under grant number 407140_153710. We thank Renger van Nieuwkoop for his support with data preparation. We would like to thank Jan Abrell, Pierre-Alain Bruchez, André Müller, and two anonymous referees, for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: MCP Equilibrium Conditions for Numerical General Equilibrium Model

We formulate the model as a system of nonlinear inequalities and characterize the economic equilibrium as a mixed complementary problem (MCP) (Mathiesen 1985; Rutherford 1995)Footnote 25 consisting of two classes of conditions: zero profit and market clearance. Zero-profit conditions exhibit complementarity with respect to activity variables (quantities) and market clearance conditions exhibit complementarity with respect to price variables. We use the \(\perp \) operate to indicate complementarity between equilibrium conditions and variables. Model variables and parameters are defined in Tables 4, 5, and 6. We formulate the problem in GAMS and use the mathematical programming system MPSGE (Rutherford 1999) and the PATH solver (Dirkse and Ferris 1995) to solve for non-negative prices and quantities.

Zero-profit conditions for the model are given by:

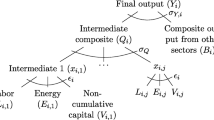

where \(Y_i\), \(A_i\), \(C_{hh}\), G, I denote domestic and Armington production, household and government consumption, and investment, respectively. \(to_i\) is the output tax imposed on sector i and \({ PC}_{hh}\), \({ PG}\), \({ PI}\) are the private and public consumption as well as investment price index. c denotes a cost function, r a revenue function. According to the nesting structures shown in Fig. 7a, the unit cost functions for production activities are given as:

where

\(\theta \) refers to share parameters, \(\sigma \) denotes elasticities of substitution. \(tl_i\), \(tk_i\), \({ PK}\) and \({ PL}\) are labour and capital taxes and prices, respectively. Prices denoted with an upper bar generally refer to tax-inclusive baseline prices observed in the benchmark equilibrium.

\({\textit{PAS}}_{i}\) denotes the tax and carbon price inclusive Armington prices, where \(ti_{i}\) is the intermediate input tax and \({ PA}_i\) the Aarmington composite price of commodity i. Carbon prices differ between ETS \(ets \in i\) and non-ETS \({ nets} \in i\) sectors. \(p_{CO_2}^{{ NETS}}\) and \(P_{CO_2}^{{ ETS}}\) denote the carbon prices for ETS and non-ETS industries,Footnote 26 respectively, and \(\phi _{i}\) the carbon coefficient. The price of non-ETS industries additionally includes the mineral oil tax \(pmo_i\). Hence, Armington prices for ETS and non-ETS sectors are defined asFootnote 27:

On the output side, producers differentiate between supply to the domestic and supply to export market using a constant elasticity of transformation function. Denoting the domestic product price by \({\textit{PD}}_i\) and the exchange rate by \({ PFX}\) the unit revenue function is defined as:

Trade is modelled via the Armington approach using a CES function between domestically produced an imported commodities. Denoting \(tm_i\) as import tax, the cost function of the Armington aggregation becomes:

According to the nesting structures shown in Fig. 7b, the unit cost functions for production activities are given as:

where

For government and investment consumption fixed shares are assumed:

Denoting each households initial endowments of labor and capital as \(\overline{ls}_{hh}\) and \(\overline{ks}_{hh}\), respectively, \({ INC}^C_{hh}\) and \({ INC}^G\) as consumer and government income and using Shephard’s lemma, market clearing equations become:

Carbon emissions of non-ETS industries are given by:

Private income is given as factor income net of investment expenditure and a lumpsum or direct tax payment to the local government. Public income is given as the sum of all tax revenues:

\(\overline{{ htax}}\) is a lumpsum tax on the representative household, i.e. a lumpsum payment from the household to the government. The multiplier \({ LSM}\) is used to implement revenue recycling in a lumpsum manner and determine by:

If revenues are not recycled but change government purchases, the multiplier is fixed and the preceding is dropped.

Appendix 2: Additional Tables and Figures

Rights and permissions

About this article

Cite this article

Landis, F., Rausch, S. & Kosch, M. Differentiated Carbon Prices and the Economic Cost of Decarbonization. Environ Resource Econ 70, 483–516 (2018). https://doi.org/10.1007/s10640-017-0130-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-017-0130-y