Abstract

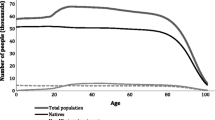

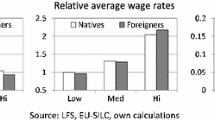

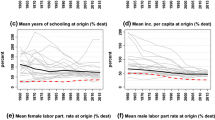

In this paper, we employ generational accounting to analyse the inter-temporal stance of Austrian public finance in 1998 as well as the inter-temporal fiscal impact of immigration to Austria. Immigrants affect inter-temporal fiscal balance in essentially two ways. Firstly, they have a demographic effect in enlarging the population (and thus the tax base) and in altering its age- (and gender-) composition. Secondly, they change the fiscal characteristics of age cohorts due to a representative immigrant exhibiting higher or lower tax and transfer payments than a representative native of the same age and gender. The overall fiscal effect of immigration is found positive, under the assumption that the age and fiscal characteristics of future immigrants resemble those of the current immigrant population in Austria. This is due to a favourable age composition and lower per capita net transfer receipts during retirement age, which compensate for lower per capita net tax payments during working age. However, immigration is not likely to achieve inter-temporal fiscal balance, even if immigration increases or migrants are screened by skill or age.

Similar content being viewed by others

References

A. Akbari (1989) ArticleTitle‘Benefits of Immigrants to Canada: Evidence on Tax and Public Services’ Canadian Public Policy 15 424–435

A.J. Auerbach (1997) ArticleTitle‘Generational Accounting in New Zealand: Is there Generational Balance?’ International Tax and Public Finance 4 IssueID2 201–28

Auerbach A.J., Oreopoulos P. (1999) ‘Generational Accounting and Immigration in the United States’, NBER Working Paper, 7041.

A.J. Auerbach J. Gokhale L. Kotlikoff (1991) ‘Generational Accounts: A Meaningful Alternative to Deficit Accounting’ D. Bradford (Eds) Tax Policy and the Economy Vol.5 Cambridge MA

Auerbach A.J., Gokhale J., Kotlikoff L. (1992) ‘Social Security and Medicare Policy from the Perspective of Generational Accounting’, Federal Reserve Bank of Cleveland Working Paper, 9206.

A.J. Auerbach J. Gokhale L. Kotlikoff (1994) ArticleTitle‘Generational Accounts: A Meaningful Way to Evaluate Fiscal Policy’ Journal of Economic Perspectives 8 73–94

Bonin H., Raffelhüschen B., and Walliser J. (2000) ‘Can Immigration Alleviate the Demographic Burden?’, Finanzarchiv, 57.

H. Bonin (2001) Generational Accounting - Theory and Application Springer Verlag Berlin, Heidelberg, New York

Bundesministerium für soziale Sicherheit und Generationen (BMSG) (various issues), Berichtüber die soziale Lage.

M. Clune (1997) The Fiscal Impacts of Immigrants: A California Case Study Department of Demography, University of California Berkeley

European Commission (1999) ‘Generational Accounting in Europe’, European Economy 6.

Eurostat (1999), European Community Household Panel (ECHP), Wave 5, 6 (Austrian Wave 4, 5).

D. Garvey T. Espenshade (1996) Fiscal Impacts of New Jersey’s Immigrant and Native Households on State and Local Governments: A New Approach and New Estimates Princeton University Office of Population Research

J. Gokhale B. Raffelhüschen J. Walliser (1995) ArticleTitle‘The Burden of German Unification: A Generational Accounting Approach’ Finanzarchiv 52 IssueID2 141–165

T. Gustaffson B.Osterberg (2001) ArticleTitle‘Immigrants and the Public Sector Budget: Accounting Exercises for Sweden’ Journal of Population Economics 14 689–708

Hauptverband der ö sterreichischen Sozialversicherungsträger (various issues), Statistisches Handbuch der ö sterreichischen Sozialversicherung.

Keuschnigg C., Keuschnigg M., Koman R., Lüth E., Raffelhüschen B. (1999) ‘Austria: Restoring Generational Balance’, in European Commission (1999), Generational accounting in Europe. European Economy 6.

C. Keuschnigg M. Keuschnigg R. Koman E. Lüth B. Raffelhüschen (2000) ArticleTitle‘Public Debt and Generational Balance in Austria’ Empirica 27 225–252

L.J. Kotlikoff (1992) Generational Accounting Macmillan USA

L. Kotlikoff (1993) ArticleTitle‘From Deficit Delusion to the Fiscal Balance Rule – Looking for a Sensible Way to Measure Fiscal Policy’ Journal of Economics 7 IssueID(suppl. 17–41

L. Kotlikoff B. Raffelhüschen (1999) ArticleTitle‘Generational Accounting Around the Globe’ American Economic Review 89 IssueID2 161–66

Kotlikoff L. and Leibfritz W. (1998) ‘An International Comparison of Generational Accounts’, NBER Working Paper, 6447.

Kotlikoff L.J. (2001) ‘Generational Policy’, NBER Working Paper, 8163.

Lehner G. (1999) ‘Bund schöpft 1998 Defizitquote nicht aus’, Wifo Monatsberichte 5.

Mayr K. (2004) ‘The Fiscal Impact of Immigrants in Austria – A Generational Accounting Analysis’, Working Paper, 0409, Department of Economics, University of Linz.

OECD (1994) ‘Trends in International Migration’, Sopemi Annual Report 1994.

OECD (1997) ‘Trends in International Migration’, Sopemi Annual Report 1996.

OECD (1999) ‘OECD Economic Surveys–Austria’.

Oreopoulos P. (1996) ‘A Generational Accounting Perspective on Canadian Public Policy’, Discussion Paper, 96/12, University of British Columbia, Department of Economics.

Österreichische Nationalbank (2003a) Table ‘Fiscal Indicators (Maastricht Definition) Updates’, http://www.oenb.at/isaweb/report.do?&lang=EN&report=7.24.2.

Österreichische Nationalbank (2003b) Table ‘Nominal GDP Growth - Expenditure Side’, http://www.oenb.at/isaweb/report.do?report=7.6.

Österreichische Nationalbank (2003c) ‘Staatsquoten - Struktur der Einnahmen’, Statistisches Monatsheft, Table 5.4.0, http://www2.oenb.at/stat-monatsheft/tabellen/540p.htm 2003.

Österreichische Nationalbank (1999) ‘Staatsschuldenausschuss (2000)’, Bericht über die Finanzschuld des Bundes, Wien.

H. Poschner (1996) Die Effekte der Migration auf die soziale Sicherung Universität Regensburg (Dissertation) Weiden

B. Raffelhüschen (1999a) ArticleTitle‘Generational Accounting in Europe’ American Economic Review 89 IssueID2 167–70

Raffelhüschen B. (1999b) ‘Generational Accounting: Method, Data and Limitations’, in European Commission (1999), Generational accounting in Europe. European Economy 6.

A. Razin E. Sadka (1995) ArticleTitle‘Resisting Migration: Wage Rigidity and Income Redistribution’ American Economic Review Papers and Proceedings 85 312–316

M. Riedel M.M. Hofmarcher (2001) Effects of Ageing on Health Expenditure Institute for Advanced Studies Vienna

J. Simon (1984) ArticleTitle‘Immigrants, Taxes and Welfare in the United States’ Population and Development Review 10 55–69

J. Simon (1989) The Economic Consequences of Immigration Basil Blackwell Oxford

J.P. Smith B. Edmonston (Eds) (1997) The New Americans – Economic, Demographic and Fiscal Effects of Immigration. National Academy Press Washington, DC.

Statistik Austria (1999) Krippen Kindergärten und Horte (Kindertagesheime) - Berichtsjahr 1998/99, Vol. 1308.

Statistik Austria (2000) Mikrozensus Jahresergebnisse 1998, Vol. 1328 (Tabelle 106).

Statistik Austria (2000) Österreichische Hochschulstatistik – Studienjahr 1998/99, Vol. 1355.

Statistik Austria (2001a) Statistische Nachrichten, 11/2001.

Statistik Austria (2001b) Statistische Nachrichten, 12/2001.

Statistik Austria (2002) MWST-Vorgaben 2000 für die VGR Jahresrechnung Privater Konsum, provided by Mr Bernhard Mazegger on request.

Statistik Austria (2002) Bildungsausgaben des Staates 1995 bis 1999, http://www.statistik.at, as of August 16, 2002.

Statistik Austria (2003a) Bevölkerung Österreichs im 21. Jahrhundert, ftp://www.statistik.at/pub/neuerscheinungen/bev21jhdt\,web.pdf as of 17 October, 2003.

Statistik Austria (2003b) Demographisches Jahrbuch 2001/2002.

Statistik Austria (2003c) Statistische Übersichten, http://www.statistik.at/statistische uebersichten/deutsch/pdf/indikato.pdf, as of January 5, 2004.

Storesletten K. (2000) ‘Sustaining fiscal policy through immigration’, Journal of Political Economy, 108(2).

Ulrich R. (1992), ‘Der Einfluss der Zuwanderung auf die staatlichen Einnahmen und Ausgaben in Deutschland’, in G. Buttler H.J. Hoffmann-Nowotny G. Schmitt-Rink (eds.), Acta Demographica, Heidelberg, pp. 189–208

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Mayr, K. The Fiscal Impact of Immigrants in Austria – A Generational Accounting Analysis. Empirica 32, 181–216 (2005). https://doi.org/10.1007/s10663-005-1758-3

Received:

Issue Date:

DOI: https://doi.org/10.1007/s10663-005-1758-3