Abstract

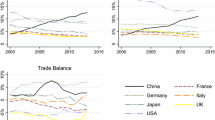

The introduction of the Euro has been accompanied by the hope that international competition between EMU member states would increase due to higher price transparency. This paper contributes to the literature by analyzing price elasticities in international trade flows between Germany and France and between Germany and the United Kingdom before and after the introduction of the Euro. Using disaggregated Eurostat trade statistics, we adopt a heterogeneous dynamic panel framework for the estimation of price elasticities. We suggest a Kalman-filter approach to control for unobservable quality changes which otherwise would bias estimates of price elasticities. We divide the complete sample, which ranges from 1995 to 2008, into two sub-samples and show that price elasticities in trade between EMU members did not change substantially after the introduction of the Euro. Hence, we do not find evidence for an increase in international price competition resulting from EMU.

Similar content being viewed by others

Notes

This does only hold if there is at least a small degree of exchange rate pass-through such that prices actually change in case of exchange rate movements.

Frankel and Rose (1998), for example, have argued that the introduction of a single currency leads to a higher degree of international integration, meaning that the net benefit of a currency union compared to a flexible exchange rate regime is increased ex post after its introduction.

Instead, the common currency did rather promote investments due to lower real interest rates and lower capital costs (Boltho and Eichengreen 2008). For the larger member states, the savings in transaction costs were already a priori expected to amount only to a maximum of 0.2% of GDP (Commission of the European Communities 1990)

The Euro’s effect on price convergence has additionally been analyzed by Engel and Rogers (2004), Allington et al. (2005) and Rogers (2007). In this context, the fact that international trade especially between high-income countries is largely intra-industry in nature, i.e., consists of the exchange of differentiated goods, might be relevant. In a world of product differentiation, the hopes that higher price transparency in case of a common currency will lead to more arbitrage transactions and will thereby increase trade flows and price convergence are probably overstated, since due to brand loyalties and goods or services designed to specific customer needs, competition is not solely limited to prices (Posen 1999).

For an overview see Anderson and van Wincoop (2004), for example.

See, for example, Lütkepohl (2005).

See also Erkel-Rousse and Mizra (2002) for a discussion of unit values in the context of import price elasticity estimation.

These assumptions are necessary for identification because the pure structural VAR is just-identified leaving no degrees of freedom. Therefore additional parameters—like an additional shock variance – cannot be estimated.

Of course, nominal import shares and relative prices would also change in the same magnitude if quantity demanded would not react to changes in relative prices, i.e., if price elasticity of demand equals zero. Since in the Kalman filter estimation, such common changes in relative prices and import shares would not enter into price elasticity estimates, but into the unobservable quality variable, price elasticities could be over-estimated.

Price elasticities of demand in different product categories should depend on whether products are rather substitutes or compliments. The more products in a certain HS-group are substitutes, the higher price elasticities of demand should be.

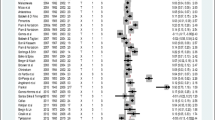

To be more precise, we do not report the usual mean estimate but trimmed means. We have excluded the 2.5% highest estimates and the 2.5% lowest estimates of the HS6 categories because there are some extreme outliers. (We do not trim within each HS2 section.)

Elasticities higher than one are reported especially for more homogeneous sections like mineral fuels (section 27) or iron and steel (section 72), for example. Elasticities smaller than one are reported for more heterogeneous sections like pharmaceuticals (section 30) or machinery and mechanical appliances (section 84), see Electronic supplementary materials.

According to the SVAR estimations reported in the separate Electronic supplementary materials, price elasticities in German imports from France are above average in HS product groups 4 (Dairy produce, birds’ eggs, natural honey, edible products of animal origin) and 22 (Beverages, spirits and vinegar). These HS categories are only considered in German imports from France. In the other trade relations, their share is below 1%.

Estimation results with January 1999 as cutting point can be obtained on request.

References

Allington N, Kattuman P, Waldmann F (2005) One market, one money, one price?. Int J Central Bank 1(3):73–116

Alvarez L, Dhyne E, Hoeberichts M, Kwapil C, LeBihan H, Luennemann P, Martins F, Sabbatini R, Stahl H, Vermeulen P, Vilmunen J (2005) Sticky prices in the euro area—a summary of new micro evidence. ECB Discussion Paper 563

Anderson J, van Wincoop E (2004) Trade costs. J Econ Lit 42(3):691–751

Bayami T, Harmsen R, Turunen J (2011) Euro area export performance and competitiveness. IMF Working Paper 11/140

Baye M, Gatti R, Kattuman P, Morgan J (2006) Did the Euro foster online price competition? Evidence from an international price comparison site. Econ Inq 44(2):265–279

Blanchard O, Giavazzi F (2003) Macroeconomic effects of regulation and deregulation in goods and labor markets. Q J Econ 118(3):879–907

Boltho A, Eichengreen B (2008) The economic impact of european integration. CEPR Discussion Paper 6820

Calvo G (1983) Staggered prices in an utility-maximizing framework. J Moentary Econ 12(3):383–398

Canova F (2007) Methods for applied macroeconomic research. Princeton University Press, Princeton

Chari V, Kehoe P, McGrattan E (2002) Can sticky price models generate volatile and persistent real exchange rates?. Rev Econ Stud 29(3):533–563

Chen N, Imbs J, Scott A (2009) The dynamics of trade and competition. J Int Econ 77:50–62

Commission of the European Communities (1990) One market, one money. An evaluation of the potential benefits and costs of forming an economic and monetary union. Eur Econ 44

Corsetti G, Dedola L, Leduc S (2008) International risk sharing and the transmission of productivity shocks. Rev Econ Stud 75:443–473

Corsetti G, Pesenti P (2005) International dimensions of optimal monetary policy. J Monet Econ 52(2):281–305

Deutsche Bundesbank (2009) Price convergence in the euro area. Monthly Bulletin March, pp 33–47

Engel C, Rogers J (2004) European product market integration after the euro. Econ Policy 19(39):347–384

Erkel-Rousse H, Mizra D (2002) Import price elasticities: reconsidering the evidence. Can J Econ 55(2):282–306

Evenett S, Keller W (2002) On theories explaining the success of the gravity equation. J Political Econ 110(2):281–316

Fabiani S, Druant M, Hernando I, Kwapil C, Landau B, Loupias C, Martins F, Mathae T, Sabbatini R, Stokman A (2005) The pricing behaviour of firms in the euro area: new survey evidence. ECB Working Paper 535

Fellettigh A, Federico S (2010) Measuring the price elasticity of import demand in the destination markets of italian exports. Bank of Italy, Working Paper 776

Frankel J (1997) Regional trading blocs in the world economic system. Institute for International Economics, Washington

Frankel J, Rose A (1998) The endogeneity of optimum currency area criteria. Econ J 108:1009–1025

Gil-Pareja S, Sosvilla-Rivero S (2008) Price convergence in the European car market. Appl Econ 40(2):241–250

Goldberg P, Knetter M (1999) Measuring the intensity of competition in export markets. J Int Econ 47:27–60

Goldberg P, Verboven F (2005) Market integration and convergence to the law of one price: evidence from the European car market. J Int Econ 65:49–73

Hoffmann M, Holtemöller O (2010) Transmission of nominal exchange rate changes to export prices and trade flows and implications for exchange rate policy. Scand J Econ 112(1):127–161

Imbs J, Mejean I (2010) Trade elasticities: a final report for the european commission. European Economy—Economic Papers 432

Katics M, Petersen B (1994) The effect of rising import competition on market power: a panel data study of US manufacturing. J Ind Econ 42(3):277–286

Krugman P (1979) Increasing returns, monopolistic competition, and international trade. J Int Econ 9:469–479

Lane P (2006) The real effects of the Euro. J Econ Perspect 20(4):47–66

Linnemann H (1966) An econometric study of international trade flows. North Holland, Amsterdam

Lütkepohl H (2005) New introduction to multiple times series analysis. Springer, Berlin

Lutz M Price convergence under EMU? First estimates. In: Deardorff A (eds) The past, present and future of the European Union. pp 48–73 Palgrave McMillan, Basingstoke, (2004)

Melitz M, Ottaviano G (2008) Market size, trade, and productivity. Rev Econ Stud 75:295–316

Posen A (1999) Why EMU is irrelevant for the german economy. Working paper 99-5, Institute for International Economics, Washington

Rogers J (2007) Monetary union, price level convergence, and inflation: How close is Europe to the USA?. J Monet Econ 54:785–796

Sutton J (2007) Quality, trade and the moving window: the globalization process. Econ J 117:469–498

Taylor J (1980) Aggregate dynamics and staggered contracts. J Political Econ 88(1):1–23

Acknowledgments

We thank Annika Klatt for excellent research assistance and Herbert Buscher, Toralf Pusch, and two anonymous referees for helpful comments on an earlier version of this paper.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Holtemöller, O., Zeddies, G. Has the Euro increased international price elasticities?. Empirica 40, 197–214 (2013). https://doi.org/10.1007/s10663-011-9182-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-011-9182-3

Keywords

- European integration

- Introduction of the Euro

- Import price elasticity

- Panel data

- Kalman-filter

- Structural vector autoregression