Abstract

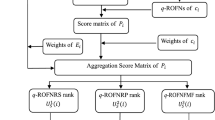

Sustainability has emerged as a dominating paradigm across global institutions as a critical component for their prospects. Organisations all across the globe must commit to strengthen the values as a participant in sustainable development. Financial institutions are no exception; they are also being pushed to undertake many sustainable initiatives, such as increasing socially meaningful, relevant, and sustainable projects. In addition, they may contribute to sustainable growth by enacting a green banking policy. To promote the green financing strategy, this study proposes a multi-criteria sustainable credit scoring model considering triple bottom line attributes (economic, environmental, and social) besides managerial attributes. The model is built on a novel hybrid approach that combines the fuzzy best–worst method (BWM) with the fuzzy technique for order preferences by similarity to an ideal solution (TOPSIS). The fuzzy BWM was used to weigh factors, while the fuzzy TOPSIS was utilised to evaluate borrowers. The integration of fuzzy set theory assisted in overcoming decision-making ambiguity. An empirical analysis was performed to demonstrate the utility of the proposed model. According to the study’s findings, the most important attribute for sustainable credit scoring is environmental and social sustainability and financial sustainability. On policy implications, regulators could also use the framework as a benchmark to counsel financial institutions on how to include different sustainable criteria into their credit lending process. Furthermore, financial institutions could use the proposed technique as a part of a sustainable lending policy to identify potential borrowers engaged in sustainable business.

Similar content being viewed by others

References

Abdul Razak, L., Ibrahim, M. H., & Ng, A. (2020). Which sustainability dimensions affect credit risk? Evidence from corporate and country-level measures. Journal of Risk and Financial Management, 13(12), 316. https://doi.org/10.3390/jrfm13120316

Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of FINANCE, XXIII(4), 589–609. https://doi.org/10.2307/2978933

Altman, E. I., Esentato, M., & Sabato, G. (2018). Assessing the credit worthiness of Italian SMEs and mini-bond issuers. Global Finance Journal, December 2017, 100450. https://doi.org/10.1016/j.gfj.2018.09.003

Altman, E. I., Sabato, G., & Wilson, N. (2010). The value of non-financial information in SME risk management. The Journal of Credit Risk, 6(2), 95–127. https://doi.org/10.21314/jcr.2010.110

Angilella, S., & Mazzù, S. (2015). The financing of innovative SMEs: A multicriteria credit rating model. European Journal of Operational Research, 244(2), 540–554. https://doi.org/10.1016/j.ejor.2015.01.033

Atanda, J. O., & Öztürk, A. (2020). Social criteria of sustainable development in relation to green building assessment tools. Environment, Development and Sustainability, 22(1), 61–87. https://doi.org/10.1007/s10668-018-0184-1

Bai, C., Shi, B., Liu, F., & Sarkis, J. (2019). Banking credit worthiness: Evaluating the complex relationships. Omega (united Kingdom), 83, 26–38. https://doi.org/10.1016/j.omega.2018.02.001

Belas, J., Smrcka, L., Gavurova, B., & Dvorsky, J. (2018). The impact of social and economic factors in the credit risk management of SME. The Impact of Social and Economic Change, 24(3), 1215–1230. https://doi.org/10.1002/j.1556-6978.1967.tb01896.x

Boffo, R., & Patalano, R. (2020). ESG investing: Practices, progress and challenges. http://www.oecd.org/finance/ESG-Investing-Practices-Progress-and-Challenges.pdf.

Boggia, A., Massei, G., Paolotti, L., Rocchi, L., & Schiavi, F. (2018). A model for measuring the environmental sustainability of events. Journal of Environmental Management, 206, 836–845. https://doi.org/10.1016/j.jenvman.2017.11.057

Chen, D., Faibil, D., & Agyemang, M. (2020). Evaluating critical barriers and pathways to implementation of e-waste formalization management systems in Ghana: A hybrid BWM and fuzzy TOPSIS approach. Environmental Science and Pollution Research, 27(35), 44561–44584. https://doi.org/10.1007/s11356-020-10360-8

Chi, G., & Zhang, Z. (2017). Multi criteria credit rating model for small enterprise using a nonparametric method. Sustainability (Switzerland), 9(10). https://doi.org/10.3390/su9101834

Dong, J., Wan, S., & Chen, S. M. (2021). Fuzzy best-worst method based on triangular fuzzy numbers for multi-criteria decision-making. Information Sciences, 547, 1080–1104. https://doi.org/10.1016/j.ins.2020.09.014

Doumpos, M., & Figueira, J. R. (2019). A multicriteria outranking approach for modeling corporate credit ratings: An application of the ELECTRE TRI-NC method. Omega (united Kingdom), 82, 166–180. https://doi.org/10.1016/j.omega.2018.01.003

Erdogan, A. I. (2018). Factors affecting SME access to bank financing: An interview study with Turkish bankers. Small Enterprise Research, 25(1), 23–35. https://doi.org/10.1080/13215906.2018.1428911

European Commission. (2019). Financing sustainable growth. SUSTAINABLE FINANCE.

G20 Green Finance Study Group. (2016). G20 Green Finance Synthesis Report 2016. G20 Green Finance Synthesis Report, August, 1–11.

García, F., Giménez, V., & Guijarro, F. (2013). Credit risk management: A multicriteria approach to assess creditworthiness. Mathematical and Computer Modelling, 57(7–8), 2009–2015. https://doi.org/10.1016/j.mcm.2012.03.005

Gastelum Chavira, D. A., Leyva Lopez, J. C., Solano Noriega, J. J., Ahumada Valenzuela, O., & Alvarez Carrillo, P. A. (2017). A credit ranking model for a parafinancial company based on the ELECTRE-III method and a multiobjective evolutionary algorithm. Applied Soft Computing Journal, 60, 190–201. https://doi.org/10.1016/j.asoc.2017.06.021

Georgios, K. (2019). Credit risk evaluation and rating for SMES using statistical approaches: The case of European SMES manufacturing sector. Journal of Applied Finance & Banking, 9(5), 59–83.

Ghosh, P., Westhoff, P., & Debnath, D. (2019). Biofuels, food security, and sustainability. In Biofuels, bioenergy and food security (pp. 211–229). Academic Press. https://doi.org/10.1016/C2015-0-00851-6

Guo, S., & Zhao, H. (2017). Fuzzy best-worst multi-criteria decision-making method and its applications. Knowledge-Based Systems, 121, 23–31. https://doi.org/10.1016/j.knosys.2017.01.010

Gutiérrez-Nieto, B., Serrano-Cinca, C., & Camón-Cala, J. (2016). A credit score system for socially responsible lending. Journal of Business Ethics, 133(4), 691–701. https://doi.org/10.1007/s10551-014-2448-5

Haeussler, C., & Sauermann, H. (2013). Credit where credit is due? The impact of project contributions and social factors on authorship and inventorship. Research Policy, 42(3), 688–703. https://doi.org/10.1016/j.respol.2012.09.009

Höck, A., Klein, C., Landau, A., & Zwergel, B. (2020). The effect of environmental sustainability on credit risk. Journal of Asset Management, 21(2), 85–93. https://doi.org/10.1057/s41260-020-00155-4

Hwang, C.-L., & Yoon, K. (1981). Multiple attribute decision making methods and applications a state-of-the-art survey. In Lecture Notes in Economics and Mathematical Systems (Vol. 186). Springer. https://doi.org/10.1007/978-3-642-48318-9

Ignatius, J., Hatami-Marbini, A., Rahman, A., Dhamotharan, L., & Khoshnevis, P. (2018). A fuzzy decision support system for credit scoring. Neural Computing and Applications, 29(10), 921–937. https://doi.org/10.1007/s00521-016-2592-1

Ishizaka, A., & Nemery, P. (2013). Multi-Criteria Decision Analysis, 1st ed. John Wiley & Sons, Ltd, Chichester, United Kingdom, 2013. https://doi.org/10.1002/9781118644898.

Kumar, K., & Prakash, A. (2020). Managing sustainability in banking: Extent of sustainable banking adaptations of banking sector in India. Environment, Development and Sustainability, 22(6), 5199–5217. https://doi.org/10.1007/s10668-019-00421-5

Lozano, R. (2018). Sustainable business models: Providing a more holistic perspective. Business Strategy and the Environment, 27(8), 1159–1166. https://doi.org/10.1002/bse.2059

Hirschey, M. (1979). Fundamentals of managerial economics S. H. Julian Gough (Ed.), 1st ed. The Macmillan Press Ltd, South-Western. https://doi.org/10.1007/978-1-349-16225-3

Martí-Ballester, C. P. (2020). Examining the financial performance of pension funds focused on sectors related to sustainable development goals. International Journal of Sustainable Development and World Ecology, 27(2), 179–191. https://doi.org/10.1080/13504509.2019.1678532

Martini, A. (2021). Socially responsible investing: From the ethical origins to the sustainable development framework of the European Union. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-021-01375-3

Merikas, A., Merika, A., Penikas, H. I., & Surkov, M. A. (2020). The Journal of Economic Asymmetries The Basel II internal ratings based ( IRB ) model and the transition impact on the listed Greek banks. The Journal of Economic Asymmetries, 22(November 2019), e00183. https://doi.org/10.1016/j.jeca.2020.e00183

Miah, M. D., Rahman, S. M., & Mamoon, M. (2020). Green banking: The case of commercial banking sector in Oman. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-020-00695-0

Mohd Nor, S., Abdul Rahim, R., & Che Senik, Z. (2016). The potentials of internalising social banking among the Malaysian Islamic banks. Environment, Development and Sustainability, 18(2), 347–372. https://doi.org/10.1007/s10668-015-9651-0

Morelli, J. (2011). Environmental sustainability: A definition for environmental professionals. Journal of Environmental Sustainability, 1(1), 1–10. https://doi.org/10.14448/jes.01.0002

Mou, Q., Xu, Z., & Liao, H. (2016). An intuitionistic fuzzy multiplicative best-worst method for multi-criteria group decision making. Information Sciences, 374, 224–239. https://doi.org/10.1016/j.ins.2016.08.074

Mousavi, M. M., & Lin, J. (2020). The application of PROMETHEE multi-criteria decision aid in financial decision making: Case of distress prediction models evaluation. Expert Systems with Applications. https://doi.org/10.1016/j.eswa.2020.113438

NǍdǍban, S., Dzitac, S., & Dzitac, I. (2016). Fuzzy TOPSIS: A general view. Procedia Computer Science, 91(Itqm), 823–831. https://doi.org/10.1016/j.procs.2016.07.088

Poveda, C. A., & Lipsett, M. (2011). A review of sustainability assessment and sustainability/environmental rating systems and credit weighting tools. Journal of Sustainable Development, 4(6), 36–55. https://doi.org/10.5539/jsd.v4n6p36

Ramadan, Z. (2018). The gamification of trust: The case of China’s “social credit.” Marketing Intelligence and Planning, 36(1), 93–107. https://doi.org/10.1108/MIP-06-2017-0100

Rehman, A., Ullah, I., Afridi, F. E. A., Ullah, Z., Zeeshan, M., Hussain, A., & Rahman, H. U. (2021). Adoption of green banking practices and environmental performance in Pakistan: a demonstration of structural equation modelling. Environment, Development and Sustainability, January, 1–23. https://doi.org/10.1007/s10668-020-01206-x

Rezaei, J. (2015). Best-worst multi-criteria decision-making method. Omega, 53, 49–57. https://doi.org/10.1016/j.omega.2014.11.009

Roy, P. K., & Shaw, K. (2021). A credit scoring model for SMEs using AHP and TOPSIS. International Journal of Finanance and Economics. https://doi.org/10.1002/ijfe.2425

Salih, M. M., Zaidan, B. B., Zaidan, A. A., & Ahmed, M. A. (2019). Survey on fuzzy TOPSIS state-of-the-art between 2007 and 2017. Computers and Operations Research, 104, 207–227. https://doi.org/10.1016/j.cor.2018.12.019

Şengül, Ü., Eren, M., Eslamian Shiraz, S., Gezder, V., & Sengül, A. B. (2015). Fuzzy TOPSIS method for ranking renewable energy supply systems in Turkey. Renewable Energy, 75, 617–625. https://doi.org/10.1016/j.renene.2014.10.045

Shi, B., Wang, J., Qi, J., & Cheng, Y. (2015). A novel imbalanced data classification approach based on logistic regression and fisher discriminant. Mathematical Problems in Engineering. https://doi.org/10.1155/2015/945359

Singh, M. P., Chakraborty, A., Roy, M., & Tripathi, A. (2021). Developing SME sustainability disclosure index for Bombay Stock Exchange (BSE) listed manufacturing SMEs in India. Environment, Development and Sustainability, 23(1), 399–422. https://doi.org/10.1007/s10668-019-00586-z

Sofuoğlu, M. A. (2020). Fuzzy applications of Best-Worst method in manufacturing environment. Soft Computing, 24(1), 647–659. https://doi.org/10.1007/s00500-019-04491-5

Staszkiewicz, P., & Staszkiewicz, L. (2015). Chapter 5—financial information. In L. S. Piotr Staszkiewicz (Ed.), Finance volume 1: A quantitative introduction (Vol. 1, pp. 72–100). https://doi.org/10.1016/B978-0-12-801584-1.00005-6

Sun, H., Mohsin, M., Alharthi, M., & Abbas, Q. (2020). Measuring environmental sustainability performance of South Asia. Journal of Cleaner Production, 251, 119519. https://doi.org/10.1016/j.jclepro.2019.119519

Uddin, M. S., Chi, G., Al Janabi, M. A. M., & Habib, T. (2020). Leveraging random forest in micro-enterprises credit risk modelling for accuracy and interpretability. International Journal of Finance and Economics, April, 1–17. https://doi.org/10.1002/ijfe.2346

Vallance, S., Perkins, H. C., & Dixon, J. E. (2011). What is social sustainability? A clarification of concepts. Geoforum, 42(3), 342–348. https://doi.org/10.1016/j.geoforum.2011.01.002

Visser, W., & Elkington, J. (2013). Cannibals with Forks. The Top 50 Sustainability Books, April, 108–112. https://doi.org/10.9774/gleaf.978-1-907643-44-6_24

Wang, M., & Ku, H. (2021). Utilizing historical data for corporate credit rating assessment. Expert Systems with Applications, 165(August 2020), 113925. https://doi.org/10.1016/j.eswa.2020.113925

WCED. (1987). Our common future. In World commission on environment and development (Vol. 4, Issue 1). https://doi.org/10.1080/07488008808408783

Weber, O. (2017). Corporate sustainability and financial performance of Chinese banks. Sustainability Accounting, Management and Policy Journal, 8(3), 358–385. https://doi.org/10.1108/SAMPJ-09-2016-0066

Weber, O., Hoque, A., & Ayub Islam, M. (2015). Incorporating environmental criteria into credit risk management in Bangladeshi banks. Journal of Sustainable Finance and Investment, 5(1–2), 1–15. https://doi.org/10.1080/20430795.2015.1008736

Woodcraft, S., Bacon, N., Caistor-Arendar, L., Hackett, T., & Hall, P. (2011). Design for social sustainability: A framework for creating thriving new communities. Social Life, 54.

World Commission on Environment and Development. (1987). Chapter 2: Towards sustainable development I. The concept of sustainable development. Our Common Future, 1–19.

Yurdakul, M., & Iç, Y. T. (2005). Development of a performance measurement model for manufacturing companies using the AHP and TOPSIS approaches. International Journal of Production Research, 43(21), 4609–4641. https://doi.org/10.1080/00207540500161746

Zeidan, R., Boechat, C., & Fleury, A. (2015). Developing a sustainability credit score system. Journal of Business Ethics, 127(2), 283–296. https://doi.org/10.1007/s10551-013-2034-2

Zhakanova Isiksal, A. (2020). The financial sector expansion effect on renewable electricity production: Case of the BRICS countries. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-020-01010-7

Zhang, W., He, H., & Zhang, S. (2019). A novel multi-stage hybrid model with enhanced multi-population niche genetic algorithm: An application in credit scoring. Expert Systems with Applications, 121, 221–232. https://doi.org/10.1016/j.eswa.2018.12.020

Zimmer, K., Fröhling, M., & Schultmann, F. (2016). Sustainable supplier management—a review of models supporting sustainable supplier selection, monitoring and development. International Journal of Production Research, 54(5), 1412–1442. https://doi.org/10.1080/00207543.2015.1079340

Ziout, A., Azab, A., Altarazi, S., & ElMaraghy, W. H. (2013). Multi-criteria decision support for sustainability assessment of manufacturing system reuse. CIRP Journal of Manufacturing Science and Technology, 6(1), 59–69. https://doi.org/10.1016/j.cirpj.2012.10.006

Acknowledgments

The author express his sincere thanks to Mrs. Kamalika Roy, Aishi Roy, and Ariya Roy for their continuous support and encouragements during the research.

Funding

NA.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No conflict of interest.

Availability of data, code and material

Available as supplementary documents, anonymized data available on requests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Roy, P.K., Shaw, K. Developing a multi-criteria sustainable credit score system using fuzzy BWM and fuzzy TOPSIS. Environ Dev Sustain 24, 5368–5399 (2022). https://doi.org/10.1007/s10668-021-01662-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-021-01662-z