Abstract

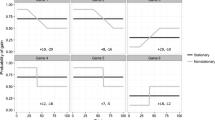

We investigate how people make choices when they are unsure about the value of the options they face and have to decide whether to choose now or wait and acquire more information first. In an experiment, we find that participants deviate from optimal information acquisition in a systematic manner. They acquire too much information (when they should only collect little) or not enough (when they should collect a lot). We show that this pattern can be explained as naturally emerging from Fechner cognitive errors. Over time participants tend to learn to approximate the optimal strategy when information is relatively costly.

Similar content being viewed by others

Notes

This is clearly the case when the DM can access new external information when waiting to make a choice. The framework we describe can also be used in situations where no new external information is available. In such situations, taking more time to engage in cognitive introspection can help reduce the uncertainty about the values of the different choices by matching previous memories with perceived features of the available choices (Ratcliff et al. 2016).

That is \(U(d_{t}=a;\pi _t) = \pi _{t} U_0 + (1- \pi _{t}) U_1\) if \(d_{t} = a\) and \(U(d_{t}=b;\pi _t) = \pi _{t} U_1 + (1- \pi _{t}) U_0\) if \(d_{t} = b\).

Among all the possible choices of urn compositions, we chose this one to have signals which are moderately informative. We can therefore study participants facing a flow of moderately informative signals and deciding when to stop.

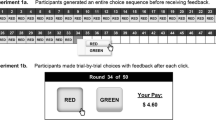

Ideally, one could prefer a constant optimal threshold, but it would require an infinite horizon. Since the participants have to pay to sample signals, we provide them with a budget to do so. This budget is finite and, as a consequence, the experiment has a finite horizon and an optimal threshold which is not constant. Our analyses rely on the identification assumption that participants are not influenced by the length of the horizon as such (e.g. via some heuristic using a proportion of the horizon to decide when to stop). Note that an alternative solution would have been to vary the budget of participants across treatments to provide the same horizon. But such design implies potential wealth effect issues as a major drawback.

This choice is identical to choosing an action \(d_t \in \{a,b\}\) mirroring the state of the world.

All amounts are in Australian dollars.

It is enough to reach the expected stopping time in each treatment. Time horizons were the following: \(T=100\) in the $0.10 condition, \(T=20\) in the $0.50 condition and \(T=10\) in the $1 condition.

In the loss frame we inform the participants that they are all given $20 at the start of the session, and that correctly guessing the nature of the urn will allow them to keep this money. On the other hand, in the gain frame we tell them that if they make the right guess, they will get $20.

According to the optimal sequential sampling model, framing the payoffs as gains or losses should not matter. However, there is extensive evidence that individual behaviour substantially changes depending on whether a prospect is framed as leading to possible gains or losses (Kahneman and Tversky 1979; Wakker 2010). A simple way to introduce the idea that “losses loom larger than gains”, is to consider that when the DM faces a potential loss, the payoff V is subjectively transformed in \(\mu V\), with \(\mu >1\). Mechanically, the higher stakes push the optimal frontier outwards and make the marginal incentive to sample greater. We did not find any effect of framing. We report these analyses in “Framing effects” section of Appendix in Electronic Supplementary Material.

The results of the CRT are provided in “CRT” section of Appendix in Electronic Supplementary Material.

This has been shown to be an efficient way to allocate payment in experiments with repeated choices, see Baltussen et al. (2012).

All the Wilcoxon signed-rank tests reported are performed on subject-wise moments and bootstrapped 10,000 times

The previous analyses only made comparison between average optimal strategy and average behaviour over all the rounds.

In the $0.1, $0.50, and $1 treatments, this is equivalent to increasing the size of the sampling set by 10%, 25% and 100% respectively.

All regressions are clustered at the individual level.

The slope of the regression line is neither statistically significant for the average stopping time (\(p=0.21\)) nor for the signal intensity (\(p=0.54\)).

We did not find any significant difference in individual characteristics such as gender or CRT score on their tendency to make mistakes.

We thank a reviewer for making this very useful suggestion.

References

Abdellaoui, M., Bleichrodt, H., & Paraschiv, C. (2007). Loss aversion under prospect theory: A parameter-free measurement. Management Science, 53, 1659–1674.

Baltussen, G., Post, G. T., van den Assem, M. J., & Wakker, P. P. (2012). Random incentive systems in a dynamic choice experiment. Experimental Economics, 15, 418–443.

Bearden, J. N., Rapoport, A., & Murphy, R. O. (2006). Sequential observation and selection with rank-dependent payoffs: An experimental study. Management Science, 52, 1437–1449.

Bleichrodt, H., & Wakker, P. P. (2015). Regret theory: A bold alternative to the alternatives. The Economic Journal, 125, 493–532.

Bogacz, R., Brown, E., Moehlis, J., Holmes, P., & Cohen, J. D. (2006). The physics of optimal decision making: A formal analysis of models of performance in two-alternative forced-choice tasks. Psychological Review, 113, 700.

Caplin, A., & Martin, D. (2016). The dual-process drift diffusion model: evidence from response times. Economic Inquiry, 54, 1274–1282.

Charness, G., & Dave, C. (2017). Confirmation bias with motivated beliefs. Games and Economic Behavior, 104, 1–23.

Conte, A., Hey, J. D., & Moffatt, P. G. (2011). Mixture models of choice under risk. Journal of Econometrics, 162, 79–88.

Della Seta, M., Gryglewicz, S., & Kort, P. M. (2014). Willingness to wait under risk and ambiguity. Berkeley: mimeo.

El-Gamal, M. A., & Grether, D. M. (1995). Are people Bayesian? Uncovering behavioral strategies. Journal of the American Statistical Association, 90, 1137–1145.

Fehr, E., & Rangel, A. (2011). Neuroeconomic foundations of economic choice-recent advances. The Journal of Economic Perspectives, 25, 3–30.

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10, 171–178.

Frederick, S. (2005). Cognitive reflection and decision making. The Journal of Economic Perspectives, 19, 25–42.

Friedman, D., & Rust, J. (1993). The double auction market: Institutions, theories, and evidence (Vol. 14). Boulder: Westview Press.

Fudenberg, D., Strack, P., & Strzalecki, T. (2015). Stochastic choice and optimal sequential sampling. Available at SSRN 2602927.

Fudenberg, D., Strack, P., & Strzalecki, T. (2018). Speed, accuracy, and the optimal timing of choices. American Economic Review, 108, 3651–84.

Gabaix, X., Laibson, D., Moloche, G., & Weinberg, S. (2006). Costly information acquisition: Experimental analysis of a boundedly rational model. The American Economic Review, 96, 1043–1068.

Gold, J. I., & Shadlen, M. N. (2002). Banburismus and the brain: Decoding the relationship between sensory stimuli, decisions, and reward. Neuron, 36, 299–308.

Gollier, C. (2004). The economics of risk and time. Cambridge: MIT Press.

Greiner, B. (2015). Subject pool recruitment procedures: Organizing experiments with ORSEE. Journal of the Economic Science Association, 1, 114–125.

Hey, J. D., & Orme, C. (1994). Investigating generalizations of expected utility theory using experimental data. Econometrica: Journal of the Econometric Society, 62, 1291–1326.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. American Economic Review, 92, 1644–1655.

Jones, M., & Sugden, R. (2001). Positive confirmation bias in the acquisition of information. Theory and Decision, 50, 59–99.

Kahneman, D. (2003). Maps of bounded rationality: Psychology for behavioral economics. The American Economic Review, 93, 1449–1475.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica: Journal of the Econometric Society, 47, 263–291.

Krajbich, I., Oud, B., & Fehr, E. (2014). Benefits of neuroeconomic modeling: New policy interventions and predictors of preference. The American Economic Review, 104, 501–506.

Kruse, T., & Strack, P. (2015). Optimal stopping with private information. Journal of Economic Theory, 159, 702–727.

Loomes, G., & Sugden, R. (1986). Disappointment and dynamic consistency in choice under uncertainty. The Review of Economic Studies, 53, 271–282.

Martin, V., Hurn, S., & Harris, D. (2012). Econometric modelling with time series: Specification, estimation and testing. Cambridge: Cambridge University Press.

McDonald, R., & Siegel, D. (1986). The value of waiting to invest. The Quarterly Journal of Economics, 101, 707–728.

Oprea, R., Friedman, D., & Anderson, S. T. (2009). Learning to wait: A laboratory investigation. The Review of Economic Studies, 76, 1103–1124.

Perlow, L. A., Okhuysen, G. A., & Repenning, N. P. (2002). The speed trap: Exploring the relationship between decision making and temporal context. Academy of Management Journal, 45, 931–955.

Rabin, M., & Schrag, J. L. (1999). First impressions matter: A model of confirmatory bias. Quarterly Journal of Economics, 114, 37–82.

Radner, R., & Stiglitz, J. (1984). A nonconcavity in the value of information. Bayesian Models in Economic Theory, 5, 33–52.

Ratcliff, R., Smith, P. L., Brown, S. D., & McKoon, G. (2016). Diffusion decision model: Current issues and history. Trends in Cognitive Sciences, 20, 260–281.

Sela, A., & Berger, J. (2012). Decision quicksand: How trivial choices suck us in. Journal of Consumer Research, 39, 360–370.

Tartakovsky, A., Nikiforov, I., & Basseville, M. (2014). Sequential analysis: Hypothesis testing and changepoint detection. Boca Raton: CRC Press.

Treich, N. (1997). Risk tolerance and value of information in the standard portfolio model. Economics Letters, 55, 361–363.

Viefers, P., Strack, P. (2014). Too proud to stop: Regret in dynamic decisions. Available at SSRN 2465840.

Wakker, P. P. (2010). Prospect theory: For risk and ambiguity. Cambridge: Cambridge University Press.

Wald, A. (1945). Sequential tests of statistical hypotheses. The Annals of Mathematical Statistics, 16, 117–186.

Wald, A., & Wolfowitz, J. (1948). Optimum character of the sequential probability ratio test. The Annals of Mathematical Statistics, 19, 326–339.

Webb, R. (2013). Dynamic constraints on the distribution of stochastic choice: Drift Diffusion implies Random Utility. Unpublished, New York University.

Weiß, C. H. (2008). Thinning operations for modeling time series of counts—A survey. AStA Advances in Statistical Analysis, 92, 319–341.

Wilson, A. (2014). Bounded memory and biases in information processing. Econometrica, 82, 2257–2294.

Woodford, M. (2014). Stochastic choice: An optimizing neuroeconomic model. The American Economic Review, 104, 495–500.

Yariv, L. (2002). I’ll see it when i believe it? A simple model of cognitive consistency.

Zwick, R., Rapoport, A., Lo, A. K. C., & Muthukrishnan, A. V. (2003). Consumer sequential search: Not enough or too much? Marketing Science, 22, 503–519.

Acknowledgements

For detailed and constructive comments we gratefully thank Martijn van den Assem, Aurélien Baillon, Sebastian Ebert, Drew Fudenberg, Changxia Ke, Martin Kocher, Morten Lau, Philipp Strack, Susan Thorp, Peter Wakker, Joel van der Weele and Leonard Wolk. We also benefited from comments by seminar and conference participants at the Economic Science Association World Meetings (Sydney), Erasmus School of Economics in Rotterdam, Monash University, University of Technology of Sydney, University of Sydney, University of Melbourne, VU Amsterdam, Griffith University, Australian Meeting of the Econometric Society (Sydney), Australian Conference of Economists (Adelaide), Econometric Society Summer School (Kyoto), Asian Meeting of the Econometric Society (Kyoto). The final version of the paper greatly benefited from insights and suggestions from two reviewers which led us to improve the main interpretation of the results. Harriet Smith provided excellent research assistance. For S. Massoni, the project has been conducted in the framework of the program FUTURE LEADER of Lorraine Université d’Excellence within the program Investissements Avenir (ANR-15-IDEX-04-LUE) operated by the French National Research Agency (ANR). The views expressed in this article are those of the authors alone.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

About this article

Cite this article

Descamps, A., Massoni, S. & Page, L. Learning to hesitate. Exp Econ 25, 359–383 (2022). https://doi.org/10.1007/s10683-021-09718-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-021-09718-7