Abstract

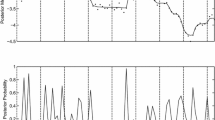

The aim of this paper is to provide a critical and comprehensive reexamination of empirical evidence on the ability of the dividend yield to predict Japanese stock returns. Our empirical results suggest that in general, the predictability is weak. However, (1) if the bubble economy period (1986–1998), during which dividend yields were persistently lower than the historical average, is excluded from the sample, and (2) if positive autocorrelation in monthly aggregate returns is taken into account, there is some evidence that the log dividend yield is indeed useful in forecasting future stock returns. More specifically, the log dividend yield contributes to predicting monthly stock returns in the sample after 1990 and when lagged stock returns are included simultaneously.

Similar content being viewed by others

References

Ang A., Bekaert G. (2007) Stock return predictability: Is it there?. Review of Financial Studies 20: 651–707

Aono, K., & Iwaisako, T. (2008). The consumption-wealth ratio, real estate wealth, and the Japanese Stock Market. Institute of Economic Research Discussion Paper, #A.504, Hitotsubashi University.

Aono K., & Iwaisako, T. (2009). Aggregate return predictability and the cross-section of Japanese stock returns. The paper presented at NFA association annual meeting, May 2009.

Bai J., Perron P. (1998) Estimating and testing linear models with multiple structual changes. Econometrica 66: 47–78

Bai J., Perron P. (2003) Computation and analysis of multiple structual change models. Journal of Applied Econometrics 18: 1–22

Campbell J. Y., Lo A. W., MacKinlay A. C. (1997) The econometrics of financial markets. Princeton University Press, Princeton, NJ

Campbell J. Y., Yogo M. (2006) Efficient tests of stock return predictability. Journal of Financial Economics 81: 27–60

Cochrane J. H. (2008) The dog that did not bark: A defense of return predictability. Review of Financial Studies 21: 1533–1575

Fama E. F., French K. R. (1988) Dividend yields and expected stock returns. Journal of Financial Economics 22: 3–25

Kejriwal, M., & Perron, P. (2008). A sequential procedure to determine the number of breaks in trend with an integrated or stationary noise component. Working paper, Boston University, February 2008, http://people.bu.edu/perron/papers/.

Lewellen J. (2004) Predicting returns with financial ratios. Journal of Financial Economics 74: 209–235

Lo A. W., MacKinlay A. C. (1990a) When are contrarian profits due to stock market overreaction?. Review of Financial Studies 3: 175–208

Lo A. W., MacKinlay A. C. (1990b) An econometric analysis of nonsynchronous trading. Journal of Econometrics 45: 181–211

Mankiw N. G., Shapiro M. D. (1986) Do we reject too often? Small sample properties of tests of rational expectations models. Economics Letters 20: 139–145

Newey W., West K. D. (1987) A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica 55: 703–708

Perron P., Yabu T. (2009) Estimating deterministic trends with an integrated or stationary noise component. Journal of Econometrics 151: 56–69

Stambaugh R.F. (1986) Bias in regressions with lagged stochastic regressors. Working paper, University of Chicago, Chicago

Stambaugh R.F. (1999) Predictive regressions. Journal of Financial Economics 54: 375–421

Torous W., Valkanov R., Yan S. (2004) On predicting stock returns with nearly integrated explanatory variables. Journal of Business 77: 937–966

White H. A. (1980) Heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica 48: 817–838

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Aono, K., Iwaisako, T. On the Predictability of Japanese Stock Returns Using Dividend Yield. Asia-Pac Financ Markets 17, 141–149 (2010). https://doi.org/10.1007/s10690-009-9105-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-009-9105-5