Abstract

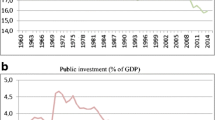

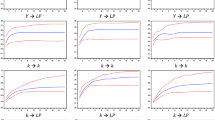

The issue of whether public capital is productive has received a great deal of recent attention. Yet, empirical analyses of public capital productivity have been limited to a small sample of countries for which official capital stock estimates are available. Building on a new database that provides internationally comparable capital stock estimates, this paper estimates the dynamic effects of public capital using the vector autoregressive (VAR) methodology for a large set of OECD countries. The empirical results suggest that there is evidence for positive output effects of public capital in OECD countries, but hardly any evidence for positive employment effects.

Similar content being viewed by others

References

Akaike, H. (1974). “A New Look at the Statistical Model Identification,” IEEE Transactions on Automatic Control 19, 716–723.

Aschauer, D. A. (1989). “Is Public Expenditure Productive?” Journal of Monetary Economics 23, 177–200.

Batina, R. G. (1998). “On the Long Run Effects of Public Capital and Disaggregated Public Capital on Aggregate Output,” International Tax and Public Finance 5: 263–281.

Baxter, M. and R. G. King. (1993). “Fiscal Policy in General Equilibrium,” American Economic Review 83, 315–333.

Cheung, Y.-W. and K. S. Lai. (1993). “Finite-Sample Sizes of Johansen’s Likelihood Ratio Tests for Cointegration,” Oxford Bulletin of Economics and Statistics 55, 313–328.

Crowder, W. J. and D. Himarios. (1997). “Balanced Growth and Public Capital: An Empirical Analysis,” Applied Economics 29, 1045–1053.

Cullison, W. E. (1993). “Public Investment and Economic Growth,” Federal Reserve Bank of Richmond Economic Quarterly 79, 19–33.

De Haan, J., J.-E. Sturm and B. J. Sikken. (1996). “Government Capital Formation: Explaining the Decline,” Weltwirtschaftliches Archiv 132, 55–74.

Doornik, J. A. (1996). Testing Vector Error Autocorrelation and Heteroscedasticity, Nuffield College, Oxford. http://www.doornik.com/research/vectest.pdf

Dufour, J.-M. and E. Renault. (1998). “Short Run and Long Run Causality in Time Series: Theory,” Econometrica 66, 1099–1125.

Engle, R. F. and C. W. J. Granger. (1987). “Co-Integration and Error Correction: Representation, Estimation, and Testing,” Econometrica 55, 251–276.

Everaert, G. (2003). “Balanced Growth and Public Capital: An Empirical Analysis with I(2) Trends in Capital Stock Data,” Economic Modelling 20, 741–763.

Flores de Frutos, R., M. Gracia-Diez and T. Perez-Amaral. (1998). “Public Capital Stock and Economic Growth: An Analysis of the Spanish Economy,” Applied Economics 30, 985–994.

Granger, C. W. J. (1969). “Investigating Causal Relations by Econometric Models and Cross-Spectral Methods,” Econometrica 37, 424–438.

Hamilton, J. D. (1994). Time Series Analysis. Princeton, NJ: Princeton University Press.

Hannan, E. J. and B. G. Quinn. (1979). “Determination of the Order of an Autoregression,” Journal of the Royal Statistical Society, Series B, 41, 190–195.

Hansen, H. and K. Juselius. (1995). CATS in RATS: Cointegration Analysis of Time Series. Evanston, IL: Estima.

Johansen, S. (1988). “Statistical Analysis of Cointegration Vectors,” Journal of Economic Dynamics and Control 12, 231–254.

Johansen, S. (1991). “Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models,” Econometrica 59, 1551–1580.

Johansen, S. (1995). Likelihood-Based Inference in Cointegrated Vector Autoregressive Models. Oxford: Oxford University Press.

Kamps, C. (2005). “New Estimates of Government Net Capital Stocks for 22 OECD Countries 1960–2001,” IMF Staff Papers (forthcoming). An earlier version is available as IMF Working Paper 04/67. International Monetary Fund, Washington, DC.

King, R. G. and S. T. Rebelo. (1999). “Resuscitating Real Business Cycles,” In J.B. Taylor, and M. Woodford (eds.), Handbook of Macroeconomics. Volume 1B. Amsterdam: Elsevier.

King, R. G., C. I. Plosser, J. H. Stock and M. W. Watson. (1991). “Stochastic Trends and Economic Fluctuations,” American Economic Review 81, 819–840.

Ligthart, J. E. (2002). “Public Capital and Output Growth in Portugal: An Empirical Analysis,” European Review of Economics and Finance 1, 3–30.

Lütkepohl, H. (1991). Introduction to Multiple Time Series Analysis. Berlin: Springer.

Lütkepohl, H. (2001). “Vector Autoregressions.” In B.H. Baltagi (ed.), A Companion to Theoretical Econometrics. Oxford: Blackwell.

MacKinnon, J. G., A. A. Haug, and L. Michelis. (1999). “Numerical Distribution Functions of Likelihood Ratio Tests for Cointegration,” Journal of Applied Econometrics 14, 563–577.

Mamatzakis, E. C. (1999). “Testing for Long Run Relationship Between Infrastructure and Private Capital Productivity: A Time Series Analysis for the Greek Industry,” Applied Economics Letters 6, 243–246.

McMillin, W. D. and D. J. Smyth. (1994). “A Multivariate Time Series Analysis of the United States Aggregate Production Function,” Empirical Economics 19, 659–673.

Mittnik, S. and T. Neumann. (2001). “Dynamic Effects of Public Investment: Vector Autoregressive Evidence from Six Industrialized Countries,” Empirical Economics 26, 429–446.

Otto, G. D. and G. M. Voss. (1996). “Public Capital and Private Production in Australia,” Southern Economic Journal 62, 723–738.

Pereira, A. M. (2000). “Is All Public Capital Created Equal?” Review of Economics and Statistics 82, 513–518.

Pereira, A. M. (2001a). “On the Effects of Public Investment on Private Investment: What Crowds in What?” Public Finance Review 29, 3–25.

Pereira, A. M. (2001b). “Public Investment and Private Sector Performance—International Evidence,” Public Finance & Management 1, 261–277.

Pereira, A. M. and J. M. Andraz. (2003). “On the Impact of Public Investment on the Performance of U.S. Industries,” Public Finance Review 31, 66–90.

Pereira, A. M. and R. Flores de Frutos. (1999). “Public Capital Accumulation and Private Sector Performance,” Journal of Urban Economics 46, 300–322.

Pereira, A. M. and O. Roca Sagales. (1999). “Public Capital Formation and Regional Development in Spain,” Review of Development Economics 3, 281–294.

Pereira, A. M. and O. Roca Sagales. (2001). “Infrastructures and Private Sector Performance in Spain,” Journal of Policy Modeling 23, 371–384.

Pereira, A. M. and O. Roca Sagales. (2003). “Spillover Effects of Public Capital Formation: Evidence from the Spanish Regions,” Journal of Urban Economics 53, 238–256.

Pesaran, M. H. and R. P. Smith. (1998). “Structural Analysis of Cointegrating VARs,” Journal of Economic Surveys 12, 471–505.

Phillips, P. C. B. (1998). “Impulse Response and Forecast Error Variance Asymptotics in Nonstationary VARs,” Journal of Econometrics 83, 21–56.

Schwarz, G. (1978). “Estimating the Dimension of a Model,” Annals of Statistics 6, 461–464.

Sims, C. A. (1980). “Macroeconomics and Reality,” Econometrica 48, 1–48.

Sims, C. A. (1987). “Comment on ‘D.E. Runkle, Vector Autoregressions and Reality,” Journal of Business and Economic Statistics 5, 443–449.

Sims, C. A. and T. Zha. (1999). “Error Bands for Impulse Responses,” Econometrica 67, 1113–1155.

Sims, C. A., J. H. Stock and M. W. Watson. (1990). “Inference in Linear Time Series Models with some Unit Roots,” Econometrica 58, 113–144.

Stock, J. H. and M. W. Watson. (1999). “Business Cycle Fluctuations in US Macroeconomic Time Series.” In J. B. Taylor, and M. Woodford (eds.), Handbook of Macroeconomics. Vol. 1A. Amsterdam: Elsevier.

Sturm, J.-E. and J. De Haan. (1995). “Is Public Expenditure Really Productive? New Evidence for the USA and the Netherlands,” Economic Modelling 12, 60–72.

Sturm, J.-E., J. Jacobs and P. Groote. (1999). “Output Effects of Infrastructure Investment in the Netherlands 1853–1913,” Journal of Macroeconomics 21, 355–380.

Sturm, J.-E., G. H. Kuper and J. De Haan. (1998). “Modelling Government Investment and Economic Growth on a Macro Level: A Review,” In S. Brakman, H. van Ees, and S.K. Kuipers (eds.), Market Behaviour and Macroeconomic Modelling. London: Macmillan Press.

Turnovsky, S. J. (1997). “Fiscal Policy in a Growing Economy with Public Capital,” Macroeconomic Dynamics 1, 615–639.

Voss, G. M. (2002). “Public and Private Investment in the United States and Canada,” Economic Modelling 19, 641–664.

White, H. (1980). “A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity,” Econometrica 48, 817–838.

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Code: C32, E62, H54

Rights and permissions

About this article

Cite this article

Kamps, C. The Dynamic Effects of Public Capital: VAR Evidence for 22 OECD Countries. Int Tax Public Finan 12, 533–558 (2005). https://doi.org/10.1007/s10797-005-1780-1

Issue Date:

DOI: https://doi.org/10.1007/s10797-005-1780-1