Abstract

This study examined the influence of parental interactions, years of work experience, financial knowledge, credit card attitudes, and personal characteristics on college students’ credit card behaviors (i.e., number of cards and amount of debt). Based on data collected across seven universities (N = 413), we found that students who had parents who argued about finances, were juniors/seniors, and were comfortable making minimum payments were the most likely to have $500 or more in credit card debt and two or more credit cards. In addition, number of credit cards held was the only dependent variable influenced by gender and fear of credit cards. These results highlight the importance of early interventions in the life of college students including involving parents as positive role models.

Similar content being viewed by others

References

Adams, T., & Moore, M. (2007). High-risk health and credit behavior among 18- to 25-year-old college students. Journal of American College Health, 56(2), 101–108. doi:10.3200/JACH.56.2.101-108.

Allen, M. W., Edwards, R., Hayhoe, C. R., & Leach, L. (2007). Imagined interactions, family money management patterns and coalitions, and attitudes toward money and credit. Journal of Family and Economic Issues, 28, 3–22. doi:10.1007/s10834-006-9048-1.

Avard, S., Manton, E., English, D., & Walker, J. (2005). The financial knowledge of college freshmen. College Student Journal, 39(2), 321–338. Retrieved from http://search.ebscohost.com.

Bandura, A. (1977). Social learning theory. Englewood Cliffs: Prentice-Hall.

Berg, C., Sanem, J., Lust, K., Ahluwalia, J., Kirch, M., & An, L. (2010). Health-related characteristics and incurring credit card debt as problem behaviors among college students. The Internet Journal of Mental Health, 6, 2. doi:10.5580/96d.

Borden, L. M., Lee, S., Serido, J., & Collins, D. (2008). Changing college students’ financial knowledge, attitudes, and behavior through seminar participation. Journal of Family and Economic Issues, 29, 23–40. doi:10.1007/s10834-007-9087-2.

Braunsberger, K., Lucas, L. A., & Roach, D. (2005). Evaluating the efficacy of credit card regulation. The International Journal of Bank Marketing, 23(3), 237–255. doi:10.1108/02652320510591702.

Chen, H., & Volpe, R.P. (1998). An analysis of personal financial literacy among college students. Financial Services Review, 7(2), 107–128. Retrieved from http://www.sciencedirect.com/science/article/B6W4D-46K97V4-5/2/278e39db6cdc76a61245cd56ef13090b.

Council for Economic Education (CEE). (2011). Survey of the states: Economics, personal finance and entrepreneurship education in our nation’s schools in 2011. New York: Author. Retrieved from http://www.councilforeconed.org/wp/wp-content/uploads/2011/11/2011-Survey-of-the-States.pdf.

Crocker, L., & Algina, J. (1986). Introduction to classical and modern test theory. Orlando: Harcourt Brace.

Dale, L.R., & Bevill, S. (2007). An analysis of the current status of student debt: Implications for helping vulnerable students manage debt. Academy of Educational Leadership Journal, 11(2), 121–128. Retrieved from http://news-business.vlex.com/vid/status-implications-vulnerable-manage-63976955.

Deacon, R. E., & Firebaugh, F. M. (1981). Family resource management principles and applications. Boston: Allyn and Bacon.

Draut, T., & Silva, J. (2004). Generation broke: Growth of debt among young Americans. New York: Demos. Retrieved from http://www.demos-usa.org/pubs/Generation_Broke.pdf.

Fox, J., & Bartholomae, S. (1999). Student learning style and educational outcomes: Evidence from a family financial management course. Financial Services Review, 8, 235–251. Retrieved from http://www2.stetson.edu/fsr/abstracts/vol_8_num4_p235.pdf.

Gallo, E. (2006). Credit, college, and competency. Journal of Financial Planning, 19(4), 50–52. Retrieved from http://search.ebscohost.com.

Grable, J., & Joo, S. (2006). Student racial differences in credit card debt and financial behaviors stress. College Student Journal, 40, 400–408. Retrieved from http://www.eric.ed.gov/ERICWebPortal/detail?accno=EJ765337.

Gudmunson, C. G., & Beutler, I. F. (2012). Relation of parental caring to conspicuous consumption attitudes in adolescents. Journal of Family and Economic Issues, 33. doi:10.1007/s10834-012-9282-7.

Gudmunson, C. G., & Danes, S. M. (2011). Family financial socialization: Theory and critical review. Journal of Family and Economic Issues, 32, 644–667. doi:10.1007/s10834-011-9275-y.

Gutter, M., & Copur, Z. (2011). Financial behaviors and financial well-being of college students: Evidence from a national survey. Journal of Family and Economic Issues, 32, 699–714. doi:10.1007/s10834-011-9255-2.

Hayhoe, C.R., Leach, L., Allen, M.W., & Edwards, R. (2005). Credit cards held by college students. Financial Counseling and Planning, 16(1), 1–10. Retrieved from http://www.afcpe.org/assets/pdf/vol1611.pdf.

Hayhoe, C. R., Leach, L., & Turner, P. R. (1999). Discriminating the number of credit cards owned by college students’ credit and money attitudes. Journal of Economic Psychology, 20, 643–656. doi:10.1016/S0167-4870(99)00028-8.

Horn, L. (2006). Placing college graduation rates in context: How 4-year college graduation rates vary with selectivity and the size of low-income enrollment (NCES 2007-161). U.S. Department of Education. Washington, DC: National Center for Education Statistics. Retrieved from http://nces.ed.gov/pubs2007/2007161.pdf.

Joo, S., & Grable, J. E. (2004). An exploratory framework of the determinants of financial satisfaction. Journal of Family and Economic Issues, 25, 25–50. doi:10.1023/B:JEEI.0000016722.37994.9f.

Joo, S., Grable, J.E., and Bagwell, D.C. (2003). Credit card attitudes and behaviors of college students. College Student Journal, 37(3), 405–419. Retrieved from http://www.eric.ed.gov/ERICWebPortal/detail?accno=EJ697043.

Jorgensen, B. L., & Savla, J. (2010). Financial literacy of young adults: The importance of parental socialization. Family Relations, 59(4), 465–478. doi:10.1111/j.1741-3729.2010.00616.x.

Kidwell, B., Brinberg, D., & Turrisi, R. (2003). Determinants of money management behavior. Journal of Applied Social Psychology, 33(6), 1244–1260. doi:10.1111/j.1559-1816.2003.tb01948.x.

Kim, J., LaTaillade, J., & Kim, H. (2011). Family processes and adolescents’ financial behaviors. Journal of Family and Economic Issues, 32, 668–679. doi:10.1007/s10834-011-9270-3.

Lyons, A. C. (2004). A profile of financially at-risk college students. Journal of Consumer Affairs, 38, 56–80. doi:10.1111/j.1745-6606.2004.tb00465.x.

Mandell, L., & Klein, L. (2007). Motivation and financial literacy. Financial Services Review, 16, 105–116. Retrieved from http://www2.stetson.edu/fsr/abstracts/vol_16_num2_p105.PDF.

Maurer, T. W., & Lee, S. A. (2011). Financial education with college students: Comparing peer-led and traditional classroom instruction. Journal of Family and Economic Issues, 32, 680–689. doi:10.1007/s10834-011-9266-z.

Nellie Mae. (2005). Undergraduate students and credit cards an analysis of usage rates and trends. Retrieved from http://www.nelliemae.com/pdf/ccstudy_2005.pdf.

Nelson, M., Lust, K., Story, M., & Ehlinger, E. (2008). Credit card debts, stress and key health risk behaviors among college students. American Journal of Health Promotion, 22(6), 400–412. doi:10.4278/ajhp.22.6.400.

Norvilitis, J. M., & MacLean, M. G. (2010). The role of parents in college students’ financial behaviors and attitudes. Journal of Economic Psychology, 31, 55–63. doi:10.1016/j.joep.2009.10.003.

Norvilitis, J. M., Merwin, M. M., Osberg, T. M., Roehling, P. V., Young, P., & Kamas, M. M. (2006). Personality factors, money attitudes, financial knowledge, and credit-card debt in college students. Journal of Applied Social Psychology, 36(6), 1395–1413. doi:10.1111/j.0021-9029.2006.00065.x.

Norvilitis, J.M., & Phillip, S.M. (2002). Credit card debt on college campuses: Causes, consequences, and solutions. College Student Journal, 36(3), 356–363. Retrieved from http://search.ebscohost.com.

Orozco, V., & Cauthen, N. (2009) Work less, study more and succeed: How financial supports can improve postsecondary success. Demos Postsecondary Success Series. Retrieved from http://www.demos.org/pubs/studymore_update_print-1.pdf.

Pallant, J. (2007). SPSS survival manual. New York: McGraw-Hill Education.

Palmer, T., Pinto, M., & Parente, D. (2001). College students’ credit card debt and the role of parental involvement: Implications for public policy. Journal of Public Policy and Marketing, 20(1), 105–113. Retrieved from http://www.jstor.org/stable/30000649.

Pedhazur, E. J., & Schmelkin, L. P. (1991). Measurement, design, and analysis: An integrated approach. Hillsdale: Lawrence Erlbaum Associates.

Peng, T. M., Bartholomew, S., Fox, J. J., & Cravener, G. (2007). The impact of personal financial education delivered in high school and college courses. Journal of Family and Economic Issues, 28, 265–284. doi:10.1007/s10834-007-9058-7.

Pinto, M., Parente, D., & Palmer, T. (2001). College student performance and credit card usage. Journal of College Student Development, 42(1), 49–58. Retrieved from http://www.eric.ed.gov/ERICWebPortal/detail?accno=EJ624498.

Robb, C. (2011). Financial knowledge and credit card behavior of college students. Journal of Family and Economic Issues, 32, 690–698. doi:10.1007/s10834-011-9259-y.

Robb, C., & Sharpe, D. (2009). Effect of personal financial knowledge on college students’ credit card behavior. Journal of Financial Counseling and Planning, 20(1), 25–43. Retrieved from http://www.eric.ed.gov/PDFS/EJ859561.pdf.

Roberts, R., Golding, J., Towell, T., & Weinreb, I. (1999). The effects of economic circumstances on British students’ mental and physical health. Journal of American College Health, 48(3), 103–109. doi:10.1080/07448489909595681.

Sallie Mae. (2009). How undergraduate students use credit cards: Sallie Mae’s national study of usage rates and trends 2009. Wilkes-Barre: Author. Retrieved from http://static.mgnetwork.com/rtd/pdfs/20090830_iris.pdf.

Schuchardt, J., Hanna, S.D., Hira, T.K., Lyons, A.C., Palmer, L., & Xiao, JJ. (2009). Financial literacy and education research priorities. Journal of Financial Counseling and Planning, 20(1), 84–95. Retrieved from http://www.eric.ed.gov/PDFS/EJ859569.pdf.

Shim, S., Barber, B., Card, N., Xiao, J., & Serido, J. (2010). Financial socialization of first-year college students: The roles of parents, work, and education. Journal of Youth and Adolescence, 39(12), 1457–1470. doi:10.1007/s10964-009-9432-x.

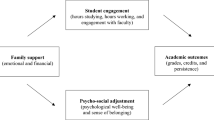

Shim, S., Xiao, J. J., Barber, B. L., & Lyons, A. C. (2009). Pathways to life success: A conceptual model of financial well-being for young adults. Journal of Applied Developmental Psychology, 30(6), 708–723. doi:10.1016/j.appdev.2009.02.003.

Walstad, W. B., Rebeck, K., & MacDonald, R. A. (2010). The effects of financial education on the financial knowledge of high school students. The Journal of Consumer Affairs, 44(2), 336–357. doi:10.1111/j.1745-6606.2010.01172.x.

Xiao, J. J., Tang, C., Serido, J., & Shim, S. (2011). Antecedents and consequences of risky behavior among college students: Application and extension of the theory of planned behavior. Journal of Public Policy and Marketing, 30(2), 239–245. doi:10.1509/jppm.30.2.239.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hancock, A.M., Jorgensen, B.L. & Swanson, M.S. College Students and Credit Card Use: The Role of Parents, Work Experience, Financial Knowledge, and Credit Card Attitudes. J Fam Econ Iss 34, 369–381 (2013). https://doi.org/10.1007/s10834-012-9338-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-012-9338-8