Abstract

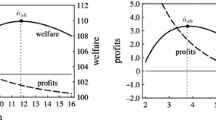

The question of how interventions from the Competition Authority (CA) affect investment is not a straightforward one: a tougher competition policy might, by reducing the ability to exert market power, either stimulate firms to invest more to counter the restrictions on their actions, or make firms invest less because of the reduced ability to have a return on investment. This tension is illustrated using two models. In one model investment is own-cost-reducing whereas in the other investment is anti-competitive. Anti-competitive investments are defined as investments that increase competitors’ costs. In both models the optimal level of investment is reduced with a tougher competition policy. Furthermore, while in the case of an anti-competitive investment a tougher authority necessarily leads to lower prices, in the case of a cost-reducing investment the opposite may happen when the impact of the investment on cost is sufficiently high. Results for total welfare are ambiguous in the cost-reducing investment model, whereas in the anti-competitive investment model welfare unambiguously increases due to a tougher competition policy.

Similar content being viewed by others

Notes

Motta (2004) refers as market failures examples natural monopoly features of markets, sunk cost industries, lock-in effects and switching costs, and network effects. As possibly harmful practices he refers collusion, exclusionary and predatory behavior, and competition-lessening mergers.

Motta (2004) talks about the issue of whether to use just consumer surplus as the measure of welfare to the competition authority or to include also the profits of firms in the equation under the justification that consumers are the ultimate owners of firms.

In this sense, no sophisticated considerations on the tradeoff between Schumpeterian appropriability vs. increases in competition are made here.

A survey on the relationship between market structure and innovation is conducted by Kamien and Schwartz (1975).

Chang (1995) addresses the theme of optimal antitrust policy in a cumulative innovating industry, but the issue is somehow subsidiary to optimal patent and contractual arrangements between firms on how to divide the benefits of innovation.

Along the course of the research process, a model with the same basic structure as the margin-based with cost-reducing investment was built up, with the sole difference that the probability of intervention and the severity of the fine were indexed to the revenue of each firm. Overall, the results were indicating welfare worsening with interventions by the CA, and the numerical examples, notwithstanding being quite irregular, also showed a high level of inefficiency relative to our base model. These results were omitted because the fact that the fine function was not indexed to a valid measure of the abuse of market power of firms (as the contribution margin) might have biased seriously the results against any intervention at all. Due to this lack of specification, we avoided this model because it would give us a disproportionately detrimental stand towards intervention by the CA.

This type of structure is present in many literature on R&D: D’Aspremont and Jacquemin (1988); Kamien et al. (1992); Barros and Nilsson (1999); Grünfeld (2003), for example, all present the same kind of model with linear demand, cost reducing investment and concave investment cost function, and use it in very diverse applications.

All proofs reported in the Annexes.

In this problem, the second-order condition that must be fulfilled in the investment optimization problem of each firm is \( \frac{{{k_i}}}{{\alpha_i^2}} > \frac{{2{n^2}}}{{{{\left( {n + 1} \right)}^2}}} \).

In fact, as the number of firms n tends to infinity, the length of the interval \( \left[ {\frac{{2{n^2}}}{{{{\left( {n + 1} \right)}^2}}};\frac{{2n}}{{n + 1}}} \right] \)will tend to zero, as both the lower bound and the upper bound will converge to 2. Thus, as the number of firms converges to infinity, the range of situations in which prices increase/quantities decrease due to a tougher competition policy becomes smaller.

Check the annex (Proof 1b)) for the expression.

In the monopoly case, an interesting insight related to the proceeds-maximizing rb is that it is equal to the monopoly profit maximizing quantity to the problem \( {\max _p}\pi = \left( {P - c} \right)\left( {A - P} \right),\,\,\,A - P * = Q * = \frac{{A - c}}{2} \). This corresponds to the monopolist problem with zero investment. In a sense, this means that if the CA decides to take upon a policy to maximize proceeds, then the firm is obliged to invest in order to reap any positive profit from the market. Hence, positive profits accrue to the firm only because of investment, making it essential for the firm’s existence.

In the same way, the CA’s costs being only fixed costs can be assumed and the qualitative nature of the results will remain unaltered.

The annexes at the end of the paper report the proofs.

Assuming a cost structure with only fixed costs for the CA would render the same qualitative results.

Again, the proceeds correspond exactly to a part of the total profit from the firms and do not produce economic value per se.

This choice of parameter values is not based on specific parameter ranges of the model, nor on the comparability of the parameters of both models (γ i is not comparable to α i ), but is only due to blunt laziness of the authors in finding new values to fit the second order conditions.

Check the annexes for proof and discussion.

Moreover, in both models, if the obtained n * is an integer, because \( A - c - {n^* }rb = 0 \) we will have zero investment by every firm in the market.

An interesting exercise would be to infer about the socially optimal number of firms n s in the economy, the effects of intervention in that socially optimal number and how the n * obtained above compares with n s. In reality, we tried to do that but due to the humongous expressions for total welfare, their optimization with respect to the number of firms was not possible, even with recourse to computers with Maple©, because the resulting derivatives were intractable.

Whether the entry impediments for firms are good or detrimental for welfare depends on a lot of issues. See Mankiw and Whinston (1986) for more on this.

In the real world, the generally less interventionist stance by the CAs in markets with free entry relative to markets in which entry is more difficult is justified on the grounds of this reasoning.

Mankiw and Whinston (1986) discuss these issues in detail.

For reasonable ranges of n, in both models the increase in the number of firms in the industry will decrease a firm’s individual investment level, which, per se, from a productive efficiency standpoint, can be interpreted as prejudicial in the cost-reducing model and beneficial in the anti-competitive investment one. Numerical examples were run for the derivatives of the total quantities and investment in the market and, in both models, in the context of such examples, total quantities seem to increase and total investment seems to decrease with the number of firms in the market. For further discussion on these topics refer to the authors.

Especially relevant if the set-up costs are of significant magnitude (Mankiw and Whinston (1986)).

However, we are led to believe, from the insights of Mankiw and Whinston (1986), that if product diversification was added to the mixture, the value consumers place on variety would be an extra force favoring more firms in the market. The argument towards a laissez-faire approach would be further strengthened.

See the annexes for proof and brief discussion.

For more on this, go to the proof of Proposition 4 in the annexes.

Go to the annexes for proof and discussion.

Again, no operational costs of the CA are assumed and we abstract from free entry considerations.

Situations in which the second order conditions are not verified represent added complexity in terms of equilibrium values. Moreover, the possible corner solutions arising will not make it easy to depict the effects of marginal changes in the toughness of the competition policy. Therefore, such considerations were not included for the sake of the simplicity and cogency of the argument.

Check the annexes for proof.

Namely for the own-cost-reducing model with n = 1 and \( \frac{{{k_i}}}{{{\alpha_i}^2}} < \left( {1 + 2n - {n^2}} \right)\frac{{2n}}{{{{\left( {n + 1} \right)}^2}}} = 1 \). In monopoly, this portrays the situation in which price increases/quantity decreases with regulation. This might be somehow puzzling since, by intuition, regulation is expected to be more worthwhile in a monopoly situation (to counter the excessive market power of the monopolist). Nevertheless, justification might be found in the fact that, for those situations in which the parameter values are conducive to a rise in prices with increases in regulation, that marginal rise in prices is especially high in the monopoly case. In these situations, the increase in the proceeds to the CA is not sufficient to cover for both the losses in consumer surplus and profit of the monopolist.

For instance, Martin (2001), by building a dynamic monopolistic model, reaches conclusions that show that a tougher CA is conducive to increases in investment and in the speed of innovation.

For this second stage problem, stability conditions of the equilibrium are verified according to Dixit’s prescriptions (1986).

The results here comply with the stability conditions prescribed by Dixit (1986).

This is larger than \( {I^* } = \frac{{A - c}}{{2\frac{k}{\alpha } - \alpha }} \), which, in the monopolistic free market functioning setting, is the optimal amount from the point of view of the firm.

This approach is the same as the one adopted by Barros and Nilsson (1999) and will be used for both models.

Operating costs of the CA are not included in the calculations and the second order conditions of the individual firm’s problem are assumed to hold.

References

Aghion P, Bloom N, Blundell R, Griffith R, Howitt P (2005) Competition and innovation: an inverted U relationship. Q J Econ 701–728

Andreoni J (1991) Reasonable doubt and the optimal magnitude of fines: should the penalty fir the crime? Rand J Econ 22(3):385–395

Barros P, Nilsson T (1999) Industrial policy and firm heterogeneity. Scand J Econ 101(4):597–616

Becker GS (1968) Crime and punishment: an economic approach. J Polit Econ 76(2):169–217

Bose P (1995) Regulatory errors, optimal fines and the level of compliance. J Public Econ 56:475–484

Chang HF (1995) Patent scope, antitrust policy and cumulative innovation. Rand J Econ 26(1):34–57

D’Aspremont C, Jacquemin A (1988) Cooperative and noncooperative R & D in Duopoly with spillovers. Am Econ Rev 78(5):1133–1137

Dixit AK (1986) Comparative statics for oligopoly. International Economic Review 27(1):107–122

Dixit AK (1988) A general model of R&D competition and policy. Rand J Econ 19(3):317–326

Etro F (2008) Endogenous market structures and anti-trust policy, http://dipeco.economia.unimib.it/endogenous/pdf/Etro.pdf, manuscript

Gaffard J-L, Quéré M (2006) What’s the aim for competition policy: optimizing market structure or encouraging innovative behaviors? J Evol Econ 16:175–187

Gans JS, Stern S (2000) Incumbency and R&D incentives: licensing the gale of creative destruction. J Econ Manage Strategy 9(4):485–511

Gilbert RJ, Newbery DMG (1982) Preemptive patenting and the persistence of monopoly. Am Econ Rev 72(3):514–526

Grünfeld L (2003) Meet me halfway but don’t rush: absorptive capacity and strategic R&D investment revisited. Int J Ind Organ 21:1091–1109

Harrington JE Jr (2008) Optimal corporate leniency programs. J Ind Econ 56(2):215–246

Jorde TM, Teece DJ (1990) Innovation and cooperation: implications for competition and antitrust. J Econ Perspect 4(3):75–96

Kamien MI, Schwartz N (1975) Market structure and innovation: a survey. J Econ Lit 13(1):1–37

Kamien MI, Muller E, Zang I (1992) Research joint ventures and R&D cartels. Am Econ Rev 82(5):1293–1306

Katsolacos Y, Ulph D (2009) On optimal legal standards for competition policy: a general welfare-based analysis. J Ind Econ 57(3):410–437

Leahy D, Neary JP (1997) Public policy towards R&D in oligopolistic industries. Am Econ Rev 87(4):642–662

Lyons B, Medvedev A (2007) Bargaining over remedies in merger regulation. CCP Working Paper 07-3

Mankiw NG, Whinston M (1986) Free entry and social inefficiency. Rand J Econ 17(1):48–58

Martin S (2001) Competition policy for high technology industries. Journal of Industry, Competition and Trade 1(4):441–465

Miceli TJ (2004) The economic approach to law. Stanford University Press, Stanford

Motta M (2004) Competition policy—theory and practice. Cambridge University Press, Cambridge

Shapiro C (2002) Competition policy and innovation. OECD Science, Technology and Industry Working Papers, 2002/11, OECD Publishing

Sorgard L (2009) Optimal merger policy: enforcement vs. deterrence. J Ind Econ 57(3):438–456

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Planas Raposo de Almeida Costa, A., Barros, P.P. Does a Tougher Competition Policy Reduce or Promote Investment?. J Ind Compet Trade 12, 119–141 (2012). https://doi.org/10.1007/s10842-010-0076-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-010-0076-z