Abstract

Central bank credit has expanded dramatically in some of the Euro Area member countries since the beginning of the financial crisis. This paper makes two contributions to understand this stylized fact. First, we discuss a simple model of monetary policy that includes (i) a credit channel and (ii) a common pool problem in a monetary union. We illustrate that the interaction of the two elements leads to an inflation bias that is independent of the standard time-inconsistency bias. Secondly, we present an institutional analysis that is consistent with the view of fragmented monetary policy and empirical evidence that illustrates the heterogeneity of central bank credit expansion.

Similar content being viewed by others

Notes

See von Hagen and Süppel (1994) for an analysis of a common pool problem in the central bank decision making.

More broadly, the cost could also include potential losses of extending credit to illiquid banks. These would be shared by the capital key in the Eurosystem. In our model, we abstract from this possibility.

See also Neumann (2012).

For the purpose of the subsequent analysis we can view central banks and national regulators as one entity. In the policy conclusions we highlight the need for both, a common regulation and a uniform catalogue of eligible collateral.

See Tornell and Westermann (2012a).

“Die zyprische Notenbank ist dafür verantwortlich, die Solvenz ihrer Banken zu beurteilen”, ECB spokeswoman, June 26th, 2013, Süddeutsche Zeitung.

See e.g. European Parliament (2013), Question P-004750/2013. See also ECB website: “Prior to the publication […] in the list of eligible marketable assets, national central banks (NCBs) proactively assess the eligibility of the marketable assets. The NCB of the country where the asset is admitted to trading on a regulated market or traded on a non-regulated market is responsible for the assessment of the eligibility of the marketable asset” (https://www.ecb.int/paym/coll/standards/marketable/html/index.en.html).

Frankfurter Allgemeine Zeitung, October 24, 2012.

Also in the case of losses, if counterparties become insolvent, it only shares the average of these costs.

The credit channel effect is assumed to be the same for all countries. The results of Jiménez et al. (2012), however, suggest that the credit channel of monetary policy may be particularly strong in environments with weak bank balance sheets such as in some of the euro area member countries in crisis.

Refinancing credits in the European System of Central Banks usually make up the largest part of the monetary base, e.g. in the end of 2012 central bank credit accounted for 69.2 % of the total monetary base.

This assumption can also be motivated by the law of one price. Money printed in one country can be used to purchase goods in any other member country, thus in an arbitrage-free world the price level will be the same for all countries. It is, however, sufficient to assume that domestic inflation costs do not rise proportionally to domestic credit for the inflation bias to occur.

See also Tornell and Westermann (2012a) for an overview of some of these patterns.

See Sachs, Tornell and Velasco (1996) for the analysis of a similar pattern in Mexico 1994/5.

See also Alessandrini et al. (2013) who discuss how TARGET2-balances have contributed to macroeconomic imbalances in the Euro Area. The authors argue that limits on TARGET2-balances would be hard to implement, as they would increase the risk of a speculative attack within the Euro Area.

Also in other countries inflation is still moderate at this point. When we discuss the inflation bias and the “costs in terms of inflation”, we also mean the risks of future inflation that NCBs are willing to accept. The banks present holdings of excess deposits have prevented a larger inflation for the euro area as a whole so far, but certainly bear the risk that this inflation will come at a later stage, once excess deposits are withdrawn from the central banks.

A condition called a “key feature of a unified currency” by Friedmann (1992).

References

Aizenman J (1992) Competitive externalities and the optimal seigniorage. J Money, Credit, Bank 24(1):61–71

Alesina A, Drazen A (1991) Why are stabilizations delayed? Am Econ Rev 82:1170–1188

Alesina A, Perotti R (1999) Budget deficits and budget institutions. In: Fiscal Institutions and Fiscal Performance, Poterba JM, von Hagen J (eds), University of Chicago Press

Alessandrini P, Fratianni M, Hallett AH, Presbitero AF (2013) External imbalances and fiscal fragility in the euro area. Open Economies Review

Barro RJ, Gordon DB (1983) Rules, discretion and reputation in a model of monetary policy. J Monet Econ 12:101–121

Basley T, Coate S (2003) Centralized vs. decentralized provision of local public goods: A political economy analysis. J Public Econ 87:2611–2637

Buiter W (2012) Is the Eurozone at risk of turning into the rouble zone? Citi Economics, Global Economics View, London

Casella A (1992) Participation in a currency union. Am Econ Rev 82(4):847–863

Chari VV, Kehoe PJ (2008) Time inconsistency and free-riding in a monetary union. J Money, Credit, Bank 40:1329–1356

Davig T, Leeper E, Walker T (2012) Inflation and the fiscal limit. Eur Econ Rev 55(1):31–47

Eichengreen B, Grilli V, Fischer S (1993) A payments mechanism for the former soviet union: Is the EPU a relevant precedent? Econ Policy 8(17):309–353

Feldstein M, Vaillant M (1998) Can state taxes redistribute income? J Public Econ 68(3):369–396

Friedmann M (1992) Money mischief: Episodes in monetary history. Harcourt Brace Jovanovich, New York

Galí J, Perotti R (2003) Fiscal policy and monetary integration in Europe. Econ Policy 18(37):533–572

Garber PM (1999) The target mechanism: Will it propagate or stifle a stage III crisis? Carn-Roch Conf Ser Public Policy 51(1):1999

Hallerberg M, von Hagen J (1999) Electoral institutions, cabinet negotiations, and budget deficits within the european union. In: Fiscal institutions and fiscal performance, Poterba J, von Hagen J (eds.) University of Chicago Press, 209–232.

Hausmann R, Purfield CM (2004) The challenge of fiscal adjustment in a democracy: The Case of India. IMF Working Paper 04/168

Jiménez G, Ongena S, Peydró J-L, Saurina J (2012) Credit supply and monetary policy: Identifying the bank balance-sheet channel with loan applications. Am Econ Rev 102(5):2301–2326

Kashyap AK, Stein JC, Wilcox DW (1993) Monetary policy and credit conditions: Evidence from the composition of external finance. Am Econ Rev 83:78–98

Kletzer KM, Singh N (1997) The political economy of Indian fiscal federalism. In: Fiscal Policies in India, Mundle S (ed.), Oxford University Press.

Knight B (2003) Common tax pool problems in federal systems. In: Democratic Constitutional design and policy, Congelton RD, Swedenborg B (eds.) MIT Press, 229–247

Krogstrup S, Wyplosz C (2010) A common pool theory of supranational deficit ceilings. Eur Econ Rev 54(2):269–278

Lipton D, Sachs JD (1992) Prospects for Russia’s economic reforms. Brook Pap Econ Act 1992(2):213–283

Neumann MJM (2012) The refinancing of banks drives target debt. CESifo Forum, 29–32

Sachs J, Tornell A, Velasco A (1996) The collapse of the Mexican Peso: What have we learned? Econ Policy 11(22):13–63

Sinn H-W (2003) Risktaking, limited liability, and the competition of bank regulators. FinanzArchiv/Public Finance Analysis 59(3):305–329

Sinn H-W, Wollmershäuser T (2012) Target loans, current account balances and capital flows. The ECB’s rescue facility. Int Tax Public Financ 19(4):468–508

Steinkamp S, Westermann F (2012) On creditor seniority and sovereign bond prices in europe. CESifo Woking Paper No. 3944.

Tornell A (2012) The dynamic tragedy-of-the-commons in the Eurozone, the ECB and Target2 imbalances. UCLA mimeo

Tornell A, Westermann F (2005) Boom-bust cycles and financial liberalization, MIT Press.

Tornell A, Westermann F (2012a) The tragedy-of-the-commons at the European Central bank and the next rescue operation. VOXeu.org

Tornell A, Westermann F (2012b) Europe needs a federal reserve, The New York Times.

Von Hagen J, Eichengreen B (1996) Federalism, Fiscal Restraints and European Monetary Union. Am Econ Rev 82(2):134–138

Von Hagen J, Süppel R (1994) Central bank constitutions for federal monetary unions. Eur Econ Rev 38(3–4):774–782

Walsh CE (2010) Monetary theory and policy. 3. ed., MIT Press.

Weingast B, Shepsle K, Johnson C (1981) The political economy of benefits and costs: A neoclassical approach to distributive politics. J Polit Econ 96:132–163

Williamson SD (2013) The balance sheet and the future of fed policy. Open Economies Review.

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank Aaron Tornell and Jürgen von Hagen for useful comments on earlier versions of this paper. We are also grateful to the discussants and participants of the 44. Konstanz Seminar on Monetary Theory and Policy, the CESifo Area Conference on Macro, Money & International Finance, and the research seminar at the Central Bank of Turkey for useful comments and suggestions.

Appendices

Appendix A: The Interaction with a Barro-Gordon Time Inconsistency Problem

In this appendix we analyze the interaction between the two new elements–a credit channel and a common pool problem–with the standard time inconsistency problem that derives from the Phillips curve trade-off in a Barro-Gordon setting. We show that the results presented above are independent from this other classical inflation bias in the literature.

1.1 A Single Country

We keep the notation as above, and add the expectation about future inflation denoted by π e. The utility function and output in a single country are as follows:

with \( \frac{\partial \pi }{\partial \Delta d}>0 \) and Δm = Δd. Furthermore, we assume that agents are characterized by rational expectations.

Lemma 2

In a single country with a Barro-Gordon time inconsistency problem and a credit channel of monetary policy, the inflation bias is: \( \lambda \left(\alpha +\frac{\partial y}{\partial \Delta m}\right) \).

Proof

\( \mathrm{ARG}\ {\mathrm{MAX}}_{\Delta m}U=\lambda \left(\alpha \left(\Delta m-{\pi}^e\right)\right)+{y}_c\left(\Delta m\right)-\frac{1}{2}{\left(\Delta m\right)}^2;\frac{\partial U}{\partial \Delta m}=\lambda \left(\alpha +\frac{\partial y}{\partial \Delta m}\right)-\Delta m=0;\Delta {m}^{*}=\lambda \left(\alpha +\frac{\partial y}{\partial \Delta m}\right). \)

The optimal inflation \( \Delta {m}^{*}=\lambda \left(\alpha +\frac{\partial y}{\partial \Delta m}\right) \) is larger than zero, and larger than the standard Barro-Gordon result, which is Δm* = λα in the simple setting. The existence of a credit channel adds a further motive to conduct expansionary monetary policy.

1.2 Currency Union

Now consider, again, the same setup for a currency union. Utility and output functions are given as follows:

with \( \frac{\partial {y}_i}{\partial \Delta {d}_i}>0 \). We make the same assumptions as above, namely, π i = π, and \( \pi =\frac{1}{n}{\displaystyle {\sum}_{i=1}^n\Delta {m}_i} \), as well as Δm i = Δd i .

Proposition 2

In a currency union with a Barro-Gordon time inconsistency problem and a credit channel of monetary policy, the inflation bias is larger than in a single country.

Proof

\( \mathrm{ARG}\ {\mathrm{MAX}}_{\Delta {m}_i}{U}_i=\lambda \left(\alpha \left(\frac{1}{n}{\displaystyle {\sum}_{i=1}^n\Delta {m}_i-{\pi}^e}\right)+{y}_c\left(\Delta {m}_i\right)\right)-\frac{1}{2}{\left(\frac{1}{n}{\displaystyle {\sum}_{i=1}^n\Delta {m}_i}\right)}^2;\frac{\partial {U}_i}{\partial \Delta {m}_i}=\frac{1}{n^2}\left({\displaystyle {\sum}_{\begin{array}{c}\hfill j=1\hfill \\ {}\hfill j\ne i\hfill \end{array}}^n\Delta {m}_j-{n}^2\frac{\partial {y}_i}{\partial \Delta {m}_i}\lambda - n\alpha \lambda +\Delta {m}_i}\right)=0;\Delta {m}_i^{\ast }= n\lambda \left(\alpha +n\frac{\partial {y}_i}{\partial \Delta {m}_i}\right)-{\displaystyle {\sum}_{\begin{array}{c}\hfill j=1\hfill \\ {}\hfill j\ne i\hfill \end{array}}^n\Delta {m}_j}; In\ symmetric\ equilibrium:\Delta {m}^{\ast }=\lambda \left(\alpha +n\frac{\partial y}{\partial \Delta m}\right);\lambda \left(\alpha +n\frac{\partial y}{\partial \Delta m}\right)-\lambda \left(\alpha +\frac{\partial y}{\partial \Delta m}\right)=\frac{\partial y}{\partial \Delta m}\lambda \left(n-1\right)>0. \)

The inflation in equilibrium will be \( \Delta {m}^{\ast }=\lambda \left(\alpha +n\frac{\partial y}{\partial \Delta m}\right) \). Note that the original Barro-Gordon inflation bias is unaffected by our extensions. When comparing the optimal inflation rate in the currency union of the main paper (without Barro-Gordon) and the appendix, we get exactly the standard inflation bias explaining the difference:

Corollary

The tragedy of the commons does not affect the Barro-Gordon time inconsistency bias.

Proof

In a currency union without time inconsistency problem: \( \Delta {m}_i^{\ast }= n\lambda \frac{\partial {y}_i}{\partial \Delta {m}_i}; \) in a currency union with time inconsistency problem: \( \Delta {m}^{\ast }=\lambda \left(\alpha +n\frac{\partial y}{\partial \Delta m}\right); n\lambda \frac{\partial {y}_i}{\partial \Delta {m}_i}-\lambda \left(\alpha +n\frac{\partial y}{\partial \Delta m}\right)=\lambda \alpha . \)

The intuition for this corollary can be illustrated by analyzing the effect of a currency union on the marginal cost and benefit from inflation. As the benefits from inflation in the Barro-Gordon model derive from the impact of inflation on wages, the currency union will not affect the trade-off between the output and inflation. Printing more money will be associated with the average cost in terms of inflation, as above. But it will also lead only to the average benefit. As both are aligned, there is no additional incentive for printing money to make use of the Phillips-curve trade off.

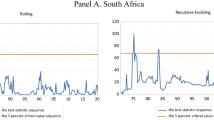

Appendix B: Country-level Figures

Appendix C: Monetary Policy of Major Central Banks

Appendix D: Data Sources

Rights and permissions

About this article

Cite this article

Dinger, V., Steinkamp, S. & Westermann, F. The Tragedy of the Commons and Inflation Bias in the Euro Area. Open Econ Rev 25, 71–91 (2014). https://doi.org/10.1007/s11079-013-9300-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-013-9300-x