Abstract

Economic projections by the Federal Open Market Committee (FOMC) were very inaccurate in the years during and after the Great Recession. Relying on a model of collective prediction that weighs the “wisdom of crowds” against shared biases, we examine GDP forecast errors in a panel dataset of FOMC projections from 1992 through 2016. Consistent with the model, we find that diversity of projections reduces collective error, while shared bias magnifies collective error. Collective error is associated strongly with errors by the Federal Reserve Board staff. The benefits of diversity often are statistically significant, especially for projections with terms longer than 1 year.

Sources: a Based on FOMC \(SEP\), b adapted from FRB Greenbook (p. I-20), actual rates from FRED

Sources: a based on FOMC \(SEP\), b adapted from FRB Greenbook (p. I-27), actual rates from FRED

Similar content being viewed by others

Notes

Krause (1996) identifies different voting patterns between the FRB Governors and the regional Federal Reserve bank presidents. Eichler and Lähner (2014) find that FOMC members with experience at regional banks focus more on inflation stabilization, while those from the FRB favor output stabilization.

Landemore (2012, p. 1) notes that the idea of collective wisdom dates back to the time of Aristotle. Surowiecki (2004) proposes several types of crowd-sourced wisdom and identifies elements that lead to the success or failure of collective wisdom. Page (2007) provides a mathematical formalization, while Page (2014) discusses the sources and benefits of predictive diversity. Hong and Page (2004, p. 16385) find that “[g]roups of diverse problem solvers can outperform groups of high-ability problem solvers.” Budescu and Chen (2014) argue that the wisdom of crowds can be used to improve central bank forecasting.

See the FRB staff Greenbook (September 2008, p. I-26).

See the FRB staff Greenbook (December 2008, p. I-25).

For now, we discuss the case of predicting a single value X. For our empirical analysis in Sect. 5, predictions are made for values of \(X_t\) at some future time t.

Quadratic loss functions are commonly assumed in the evaluation of monetary policy.

Despite its widespread popularity, however, the authors argue that The Calculus has had limited impact on academic research outside the field of public choice or on the US political process.

Available online at https://www.federalreserve.gov/monetarypolicy/mpr_default.htm.

Romer (2010) provides a similar dataset back to 1978 but acknowledges (p. 952) that data prior to 1992 are incomplete and sometimes reveal discrepancies between the data available from the FRB and those published in the MPRs. Marquez and Kalfa (2021) update and extend Romer’s analysis using a dataset of MPRs and SEPs similar to the one used in this paper.

Available online at https://www.federalreserve.gov/monetarypolicy/fomc_historical_year.htm.

Available online at https://www.federalreserve.gov/monetarypolicy/fomc_historical_year.htm.

Available online at https://fred.stlouisfed.org.

Like Romer and Romer (2004), we find that results from regressions estimated by ordinary least squares (OLS) with robust standard errors are similar to those of our base-case WLS regressions.

For example, the forecast for the current year is the lag for the forecast 1 year ahead. The forecast 1 year ahead is the lag for the forecast 2 years ahead, and the forecast 2 years ahead is the lag for the forecast 3 years ahead. Forecasts for the current year are dropped since no lags are available.

For potential output, we rely on the percentage change in real potential GDP from the prior year available from FRED. The results relying on SEP data are similar using a constant rate of potential output such as the long-run average from 1960–2018 of \(y^*=3.1\%\) or the average over our sample period of \(y^*=2.6\%\). Future studies might explore other deviations from trend such as difference from the non-accelerating inflation rate of unemployment (NAIRU).

References

Abrams, B. A. (2006). How Richard Nixon pressured Arthur Burns: Evidence from the Nixon tapes. Journal of Economic Perspectives, 20(4), 177–188.

Alesina, A., & Sachs, J. (1984). Political parties and the business cycle in the United States, 1948–1984. Journal of Money, Credit and Banking, 2, 63–82.

Amacher, R. C., & Boyes, W. J. (1978). Cycles in senatorial voting behavior: Implications for the optimal frequency of elections. Public Choice, 33, 5–13.

Arai, N. (2016). Evaluating the efficiency of the FOMC’s new economic projections. Journal of Money, Credit, and Banking, 48(5), 1019–1049.

Bennani, H., Kranz, T., & Neuenkirch, M. (2018). Disagreement between FOMC members and the Fed’s staff: New insights based on a counterfactual interest rate. Journal of Macroeconomics, 58, 139–153.

Bernanke, B. S. (2016). Federal Reserve economic projections: What are they good for? Brookings blog. Brookings Institution, November 28, 2016.

Binder, C. C. (2021). Central bank communications and disagreement about the natural rate hypothesis. International Journal of Central Banking, 17(2), 81–123.

Binder, C. C., & Wetzel, S. (2018). The FOMC versus the staff revisited: When do policymakers add value? Economic Letters, 171(2018), 72–75.

Blinder, A. S. (2007). Monetary policy by committee: Why and how? European Journal of Political Economy, 23, 106–123.

Boettke, P. J., Salter, A. W., & Smith, D. J. (2021). Money and the rule of law: Generality and predictability in monetary institutions. Cambridge University Press.

Buchanan, J. M., & Tullock, G. (2004 [1962]). The calculus of consent: The logical foundations of constitutional democracy. Liberty Fund Inc.

Budescu, D. V., & Chen, E. (2014) Identifying expertise to extract the wisdom of crowds, Management Science, 61(2), 4–6, 249–486.

Cachanosky, N., Cutsinger, B. P., Hogan, T. L., Luther, W. J., & Salter, A. W. (2021). The Federal Reserve’s response to the COVID-19 contraction: An initial appraisal. Southern Economic Journal, 87(4), 1152–1174.

Chang, A. C., & Hanson, T. J. (2016). The accuracy of forecasts prepared for the Federal Open Market Committee. Journal of Economics and Business, 83(2016), 23–43.

Chappell, H. W., Jr., Havrilesky, T. M., & McGregor, R. R. (1993). Partisan monetary policies: Presidential influence through the power of appointment. The Quarterly Journal of Economics, 108(1), 185–218.

Clark, J. R., & Lee, D. R. (2012). The impact of The calculus of consent. In Lee, D. R. (Ed.), Public choice, past and present: The legacy of James M. Buchanan and Gordon Tullock (pp 1–15). Springer.

Culbertson, D. S., & Sinclair, T. M. (2014). The failure of forecasts in the Great Recession. Challenge, 57(6), 34–45.

Eichler, S., & Lähner, T. (2014). Forecast dispersion, dissenting votes, and monetary policy preferences of FOMC members: The role of individual career characteristics and political aspects. Public Choice, 160, 429–453.

El-Shagi, M., Giesen, S. & Jung, A. (2014). Does the Federal Reserve staff still beat private forecasters? ECB Working Paper No. 1635. February, 2014.

Ellis, M. A., & Liu, D. (2013). Do FOMC forecasts add value to staff forecasts? European Journal of Political Economy, 32, 332–340.

Ellison, M., & Sargent, T. J. (2012). A defense of the FOMC. International Economic Review, 53(4), 1047–1065.

Faust, J., & Wright, J. H. (2008). Efficient forecast tests for conditional policy forecasts. Journal of Econometrics, 146, 293–303.

Froyen, R. T., Havrilesky, T., & Waud, R. N. (1997). The asymmetric effects of political pressures on US monetary policy. Journal of Macroeconomics, 19(3), 471–493.

Havrilesky, T., & Gildea, J. (1992). Reliable and unreliable partisan appointees to the Board of Governors. Public Choice, 73, 397–417.

Havrilesky, T., & Gildea, J. (1995). The biases of Federal Reserve bank presidents. Economic Inquiry, 33(2), 274–284.

Hirosato, Y. (2009). A conceptual model for “indigenizing” educational reforms and capacity development in developing countries, Ch.2, pp. 23–40. In Hirosato, Y., & Kitamura, Y. (Eds.), The political economy of educational reforms and capacity development in Southeast Asia. Springer.

Hogan, T. L. (2021). Fed Forecasting since the Great Recession, American Institute for Economic Research Sound Money Project Working Paper 2021-07.

Hong, L., & Page, S. E. (2004). Groups of diverse problem solvers can outperform groups of high-ability problem solvers. Proceedings of the National Academy of Sciences, 101(46), 16385–16389.

Hong, L., & Page, S. E. (2012). Some microfoundations of collective wisdom. In H. Landemore & J. Elster (Eds.), Collective wisdom: Principles and mechanisms (pp. 56–71). Cambridge University Press.

Jordan, J. L., & Luther, W. J. (2020). Central bank independence and the Federal Reserve’s new operating regime. Quarterly Review of Economics and Finance.

Krause, G. A. (1996). Agent heterogeneity and consensual decision making on the Federal Open Market Committee. Public Choice, 88, 83–101.

Landemore, H. (2012). Collective wisdom: Old and new. In H. Landemore & J. Elster (Eds.), Collective wisdom: Principles and mechanisms (pp. 1–20). Cambridge University Press.

MacRae, C. D. (1977). A political model of the business cycle. Journal of Political Economy, 85(April), 239–263.

Marquez, J., & Kalfa, S. Y. (2021). The forecasts of individual FOMC members: New evidence after ten years. In Working paper 2021-003 , George Washington University Department of Economics, H. O. Stekler Research Program on Forecasting.

Meltzer, A. H. (2011). Politics and the Fed. Journal of Monetary Economics, 58(1), 39–48.

Nordhaus, W. D. (1975). The political business cycle. Review of Economic Studies, 4(April), 169–190.

Orphanides, A., & Wieland, V. (2008). Economic projections and rules of thumb for monetary policy, Federal Reserve Bank of St. Louis. Review, 90(4), 307–24.

Page, S. E. (2007). The difference: How the power of diversity creates better groups, firms, schools, and societies. Princeton, NJ: Princeton University Press.

Page, S. E. (2014). Where diversity comes from and why it matters? European Journal of Social Psychology, 44(4), 267–279.

Patton, A. J., & Timmermann, A. (2012). Forecast rationality tests based on multi-horizon bounds. Journal of Business and Economic Statistics, 30(1), 1–17.

Romer, C. D., & Romer, D. H. (2000). Federal Reserve information and the behavior of interest rates. American Economic Review, 90(3), 429–457.

Romer, C. D., & Romer, D. H. (2008). The FOMC versus the staff: Where can monetary policymakers add value? American Economic Review: Papers and Proceedings, 98(2), 230–235.

Romer, D. H. (2010). A new data set on monetary policy: The economic forecasts of individual members of the FOMC. Journal of Money, Credit and Banking, 42(5), 951–957.

Romer, T. (1988). On James Buchanan’s contributions to public economics. Journal of Economic Perspectives, 2(4), 165–179.

Selgin, G. (2020). The menace of fiscal QE Washington. DC: Cato Institute.

Smales, L. A., & Apergis, N. (2016). The influence of FOMC member characteristics on the monetary policy decision-making process. Journal of Banking and Finance, 64, 216–231.

Sheng, X. S. (2015). Evaluating the economic forecasts of FOMC members. International Journal of Forecasting, 31(2015), 166–175.

Surowiecki, J. (2004). The wisdom of crowds New York. NY: Anchor Books.

Svensson, L. E. O. (1999). Inflation targeting as a monetary policy rule. Journal of Monetary Economics, 43(3), 607–654.

Tillman, P. (2011). Strategic forecasting on the FOMC. European Journal of Political Economy, 27(2011), 547–553.

Tridimas, G. (2017). Constitutional choice in ancient Athens: The evolution of the frequency of decision making. Constitutional Political Economy, 28(3), 209–230.

Wheelock, D. C. (2018) “FOMC dissents: Why some members break from consensus. On the economy blog. Federal Reserve Bank of St. Louis. January 09, 2018.

Acknowledgements

For helpful comments and suggestions, the author thanks Carola Binder, Maxwell Hampton, Amelia Janaskie, Leo Krasnozhon, Alexander Schaefer, David Schatz, seminar participants at Texas Tech University, the Public Choice Society annual conference, and the AIER Sound Money Program annual conference.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Disclosure

The author has no related interests to disclose and received no grants or funding for this project. All data used in this study are publicly available from the Federal Reserve Board of Governors and the Federal Reserve Banks of Philadelphia and St. Louis.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

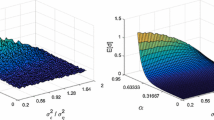

Appendix A. Applying the diversity prediction theorem to FOMC projections

Appendix A. Applying the diversity prediction theorem to FOMC projections

Assume agents want to predict the true value of some variable \(X\). Let \(x_{im}\) be independent predictions of \(X\) by individual \(i\) at meeting \(m\). Let \(s_m\) be the mean prediction of \(i\) individuals at meeting \(m\).

Let \(c\) be the mean of \(s_m\) over \(m\) meetings.

Let collective error be the squared difference between the collective error and the target value \((c-X)^2\). We use the diversity prediction theorem (DPT) to solve for collective error in terms of meeting diversity, the squared difference between individual and collective predictions at each FOMC meeting \((s_m-c)^2\), and meeting error, the squared difference between the mean meeting prediction and the actual value \((s_M-X)^2\). We begin by expanding the polynomial of collective error, inserting an additional square of collective error \((c^2-c^2)\), and then rearranging the terms.

Since \(c\) is the mean of \(s_m\) as shown in equation 17, we can replace two of the \(c\) variables with the mean of \(s_m\). We then insert a square of the mean of \(s_m\) minus itself. We then rearrange the terms into groups of \(X\) and \(c\).

Since \(X\) and \(c\) are constant in \(m\), these terms can be moved inside a single summation.

Factoring the polynomials gives us the DPT used in Eq. 1.

Since \(s_m\) is the mean of individual predictions per meeting, we can follow the same process of the DPT to expand into components of meeting diversity, the squared difference between individual predictions and the mean meeting prediction \((x_{im}-s_m)^2\), and the individual error, the squared difference between individual predictions and actual values \((x_{im}-X)^2\).

Inserting Eqs. 33 into 25 gives us Eq. 34. Collective error \((c-X)^2\) equals the mean of individual errors \((x_{im}-X)^2\) less group diversity \((s_m-c)^2\) and mean meeting diversity \((x_{im}-s_m)^2\).

Rights and permissions

About this article

Cite this article

Hogan, T.L. The calculus of dissent: Bias and diversity in FOMC projections. Public Choice 191, 105–135 (2022). https://doi.org/10.1007/s11127-021-00952-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11127-021-00952-4