Abstract

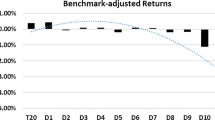

This paper examines whether the mispricing of accruals documented in equity markets extends to bond markets. The paper finds that corporate bonds of firms with high operating accruals underperform corporate bonds of firms with low operating accruals. In the first year after portfolio formation, the underperformance is 115 basis points using an accrual measure that includes capital investments and 93 basis points using an accrual measure that is based only on working capital investments. The Sharpe ratios of the zero-investment bond accrual portfolios are comparable to those of the corresponding zero-investment stock accrual portfolios. The results are also robust to risk adjustments based on both a factor model consisting of the Fama and French (J. Financial Econ 33 (1993) 3) stock and bond market factors and a characteristics model based on bond ratings and duration. Cross-sectional Fama–MacBeth regressions that use individual bond data and control for stock and bond issuances in addition to ratings and duration also confirm the time-series portfolio findings. Overall, our results reveal an accrual anomaly among bonds similar to that observed among stocks.

Similar content being viewed by others

Notes

Depending on how the earnings and cash flows are defined the operating accruals measure might include only working capital accruals (WCA) or both WCAs and capital investments. We discuss this in detail in Sect. 2.

The earnings quality explanation is usually accompanied by an earnings management hypothesis where it is suggested that the differences in earnings quality are the result of managers who use their discretion to manage earnings. However, one does not need to assume earnings management to explain the source of mispricing. Mispricing that is the result of investor unsophistication can coexist with more benign explanations for the observed differences in earnings quality.

See Copeland et al. (2000).

Richardson et al. (2005), formally derive a comprehensive measure of accruals by defining it as the difference between accrual earnings and cash earnings. The basic argument is that in the absence of accrual accounting the only asset or liability on the balance sheet would be cash. Thus, everything else on the balance sheet is accruals. This measure of accruals differs from the traditional definition in that it includes non-current assets and non-current liabilities.

Fairfield et al. (2003) define a similar measure except they scale the change in IC or net operating assets by total assets.

For a more detailed description of the database see Hong and Warga (2000).

In Sect. 4.3, we examine the robustness of our findings in a sub-sample that eliminates all bonds not in any Lehman bond index.

Elton et al. (2001) note that eliminating bonds not included in the indices eliminates all bonds with maturity less than a year. We exclude all bonds with less than 3 years to maturity from our analysis.

We have also examined the robustness of our findings by using different filters: >100% and <−50%, >90% and <−40% and the results do not appreciably change.

As discussed later, analysis using the most recently issued bond yielded similar results.

In calculating each quarter’s numbers, we adjust for the cumulative reporting of quarterly data by Compustat.

The Sharpe ratio is the ratio of the average excess return divided by the standard deviation of excess return.

All of the portfolio analysis is done using equal-weighted returns. However, we tested the robustness of our results using value-weighted portfolios. The results (untabulated) though slightly weaker continue to be economically and statistically significant. This is consistent with our sample consisting mainly of large firms.

Gebhardt et al. (2005) find that default and term betas estimated from factor models explain the cross-section of corporate bond returns better than characteristics such as ratings and duration.

We have also estimated regressions in which we use the excess stock return of the P1, P3, or P5 portfolios as the sixth factor in regressions involving the bond returns of the corresponding portfolios, and the results are similar.

Partitioning the firms into 25 portfolios yielded similar results.

We obtain data on equity and debt offerings from the Securities Data Corporation (SDC).

References

Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81(3), 637–659.

Chan, K., Chan, L., Jegadeesh, N., & Lakonishok, J. (2006). Earnings quality and stock returns. Journal of Business, 79(3), 1041–1082.

Collins, D., Gong, G., & Hribar, P. (2003). Investor sophistication and the mispricing of accruals. The Review of Accounting Studies, 8(2–3), 251–276.

Cohen, D., & Lys, T. (2006). Weighing the evidence on the relation between external corporate financing activities, a acruals and stock returns. Journal of Accounting and Economics, 42(1–2), 87–105.

Copeland, T., Koller, T., & Murrin, J. (2000). Valuation: Measuring and managing the value of companies (3rd ed.). John Wiley & Sons.

Dechow, P., Sloan, R., & Richardson, S. (2007). The persistence and pricing of the cash component of earnings. Working paper, University of Michigan and Barclays Global Investors.

Duffee, G. (1999). Estimating the price of default risk. Review of Financial Studies, 12(1), 197–226.

Elton, E., Gruber, M., Agrawal, D., & Mann, C. (2001). Explaining the rate spread on corporate bonds. Journal of Finance, 56, 247–277.

Fairfield, P. M., Whisenant, J. S., & Yohn, T. L. (2003). Accrued earnings and growth: Implications for future profitability and market mispricing. The Accounting Review, 78(1), 353.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns of stocks and bonds. Journal of Financial Economics, 33, 3–56.

Fama, E. F. (1998). Market efficiency, long-term returns, and behavioral finance. Journal of Financial Economics, 49, 283–306.

Gebhardt, W., Hvidjkaer, S., & Swaminathan, B. (2005). The cross-section of corporate bond returns: betas or characteristics? Journal of Financial Economics, 75(1), 85–114.

Hansen, L. P., & Hodrick, R. J. (1980). Forward exchange-rates as optimal predictors of future spot rates—An econometric-analysis. Journal of Political Economy, 88(5), 829–853.

Hirshleifer, D., Hou, K., Teoh, S. H., & Zhang, Y. (2004). Do investors overvalue firms with bloated balance sheets? Journal of Accounting and Economics, 38(1–3), 297–331.

Hite, G., & Warga, A. (1997). The effect of bond-rating changes on bond price performance. Financial Analyst Journal, 53, 35–51.

Hong, G., & Warga, A. (2000). An empirical study of bond market transactions. Financial Analysts Journal, 56, 32–46.

Loughran, T., & Ritter, J. (1995). The new issues puzzle. Journal of Finance, 50(1), 23–51.

Loughran, T., & Ritter, J. (2000). Uniformly least powerful test of market efficiency. Journal of Financial Economics, 55, 361–390.

Merton, R. (1974). On the pricing of corporate debt: The risk structure of interest rates. Journal of Finance, (May), 449–470.

Newey, W. K., & West, K. D. (1987). A simple, positive semidefinite, heteroskedasticity and autocorrelation consistent covariance-matrix. Econometrica, 55(3), 703–708.

Richardson, S., Sloan, R. G., Soliman, M., & Tuna, I. (2005). Accrual reliability, earnings persistence and stock prices. Journal of Accounting and Economics, 39(3), 437–485.

Sloan, R. G. (1996). Do stock prices fully reflect information in accruals and cash flows about future earnings? The Accounting Review (July), 289–315.

Spiess, D. K., & Affleck-Graves, J. (1999). The long-run performance of stock returns following debt offerings. Journal of Financial Economics, 54(1), 45–73.

Thomas, J. K., & Zhang, H. (2002). Inventory changes and future returns. Review of Accounting Studies, 7(2–3), 163–187.

Xie, H. (2001). The mispricing of abnormal accruals. Accounting Review, 76(3), 357–373.

Acknowledgements

We thank David Brown, Joel Demski, Paul Hribar, Charles Lee, Scott Richardson, Jay Ritter, Richard Sloan and workshop participants at Cornell University, University of Florida, University of Illinois, University of Michigan, Prudential Equity Group’s 18th Annual Quantitative Research Conference, QRG Quantitative Equity Conference for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bhojraj, S., Swaminathan, B. How does the corporate bond market value capital investments and accruals?. Rev Account Stud 14, 31–62 (2009). https://doi.org/10.1007/s11142-007-9056-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-007-9056-x