Abstract

Auditors tend to be more conservative in their audits when they face greater litigation risk. However, it is unclear whether this conservatism is always desirable or whether it can be excessive. To evaluate the usefulness of greater auditor conservatism, we examine whether auditor conservatism improves audit quality and imposes real operating consequences for clients. We examine auditor behavior in a sample of auditors’ client banks, when one of the auditor’s other client banks fails (as deemed by the FDIC). We find that auditors that experience a bank failure within their portfolio become more conservative for surviving clients. However, we find that the larger loan loss provisions at surviving clients are no more timely, are less accurate, and reverse in subsequent periods. This finding suggests that auditors’ initial portfolio-wide response to a specific client failure may be overly conservative. We also document that surviving client banks face real consequences in terms of constraints on their lending because of the auditor’s excessive conservatism. Overall, we conclude that, in some situations, auditors may overreact, leading to excessive conservatism, which in turn has adverse consequences for clients.

Similar content being viewed by others

Notes

Kaplan and Williams (2013) argue that auditors have incentives to issue more going concern opinions than is appropriate, which is indicative of excessive auditor conservatism, in order to reduce their liability.

In the construction of the auditor’s portfolio of clients, we drop all clients outside of the commercial bank industry. Thus, the auditor’s portfolio is an industry specific portfolio of clients. Further, we require an auditor to have two commercial banks in their portfolio to be retained for our analyses.

However, focusing on a single industry offers one distinct advantage in that it allows us to focus on one accrual. Focusing on a single accrual—loan loss provisions—facilitates a sharper separation into its normal and abnormal components than typical accrual measures (Kanagaretnam et al. 2010).

The exclusion of banks from empirical analyses eliminates a substantial portion of firms within the economy, as the financial sector accounts for approximately one-fifth of the S&P 500 companies.

In October 2012, the Federal Deposit Insurance Corporation (FDIC), as the receiver for the failed Colonial Bank of Montgomery, Alabama, sued PricewaterhouseCoopers, the external auditor.

Following prior studies in the audit literature, we capture conservative audit behavior using the client banks’ accruals (DeFond and Subramanyam 1998). Specifically, we use loan loss provisions to measure accruals in banks because this is the most important accrual in the banking industry and because broad accruals-based metrics using models designed for non-financial firms, such as the Jones (1991) model, are inappropriate (Beatty et al. 2002). Larger loan loss provisions decrease earnings and imply more conservative audits, while smaller loan loss provisions result in higher earnings, which are consistent with more lenient audits.

For a more in-depth discussion of our client failure variable, please refer to Sect. 3.1.

We acknowledge that the loan loss provision is a joint product of the client bank and the auditor. However, we interpret systematic conservatism in loan loss provisions that is related to auditor portfolio events but not supported by client fundamentals as evidence that auditors exerted pressure on clients to report higher loan loss provisions.

In our setting the frequency of going concern opinions is low. We therefore acknowledge the limitation of performing this analysis in only a univariate setting (Desai et al. 2016).

For example, Kothari and Lester (2012, p. 350) state that “it is clear that the poor implementation of fair value accounting standards has been a factor in causing and prolonging the Great Recession.”.

Two recent studies utilizing audit fees examine whether auditors succeeded in detecting impending bank failures before the onset of the financial crisis and find mixed evidence. On one hand, Desai et al. (2016) find that average audit fees did not increase during the period before the financial crisis and conclude that auditors were unable to predict the impact of the crisis on the banks they audited. On the other hand, Doogar et al. (2015) focus their study specifically on auditors and find that in the year leading up to the financial crisis, audit fees increased for banks with higher levels of audit risk.

In our study, we note that we can only identify going concern reports for public client banks. Due to the low number of going concern opinions issued in the year prior to a public bank failure, and to our inability to obtain going concern reporting for the private bank failures, we lack a sufficient sample to separately evaluate the effect of a failure when the auditor anticipated it. As a result, we note that a measure regarding the prior receipt of a going concern opinion is noisy. Nevertheless, we examine whether the prior receipt of a going concern opinion for a public bank failure mitigates the predicted association. In untabulated analyses, we fail to find that the prior receipt of a going concern opinion mitigates the predicted association. However, we acknowledge that the inferences from this additional analysis are limited.

To the extent that conservatism results in timely loss recognition (Basu 1997), it could enhance the usefulness of accounting (e.g., Watts 2003; Ball et al. 2008). Yet, in an analytical study, Gigler et al. (2009) show that conservatism decreases the efficiency of debt contracts when it results in unwarranted covenant violations. This finding suggests that conservative accounting may not necessarily be unambiguously desirable.

In untabulated analyses, we examine and find that our results are robust to the exclusion of the financial crisis years. In addition, we further exclude 2010 and 2011 to ensure that we can generalize our results to a period with somewhat normal economic conditions. In untabulated analyses, we continue to find some evidence that the initial response by auditors experiencing a client failure was excessively conservative and did not necessarily improve audit quality at surviving banks. However, it does appear that the extent of excessive conservatism is dampened in a more normal period.

Auditor portfolios are formed using all available bank data.

We include all banks with available data in our primary sample. However, all of our results are robust to removing banks with less than $500 million in assets, which is the threshold under FDIC regulation 12 CFR part 363 for a bank to have a required external audit.

We acknowledge that a lawsuit naming the auditor as a defendant can take years to resolve and therefore this lagged research design is more appropriate in their context.

We separate the audit window into four quarters to identify when the first client failure in an auditor’s firm-wide and office-level portfolio occurs. We note that the first firm or office client failure for an auditor within the audit window for the year occurs at a rate of 45.1% in the first 3 months of the window, 38.4% in months 4 through 6, 15.1% in months 7 through 9, and 1.4% in months 10 through 12. This univariate analysis helps alleviate concerns that our time window is unrealistic. Furthermore, we create four indicator variables of Client Failure National (Office) to identify when the first client failure occurs within the firm-wide and office-level portfolio and run our primary regression with all four indicator variables included. We find that Client Failure National (Office) for the first three months and for months four through six is positive and significant. In addition, we note that Client Failure Office is positive and significant in months seven through nine, whereas Client Failure National is insignificant. Finally, we note that the indicator variables for months 10 through 12 are highly insignificant for both client failure variables. This suggests that an auditor’s conservative response to a bank failure within their portfolio is primarily driven by those auditors that experience a failure within the first half of the audit window. Overall, this analysis helps further alleviate the concern that our audit window is unrealistic and indicates that the auditor has adequate time to respond on remaining portfolio clients from the time of their first failure in the audit window.

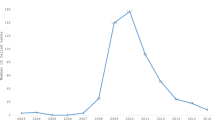

As a robustness check, we use an alternative audit window which aligns with the calendar year, January 1 through December 31. Relating to Fig. 2, our Client Failure National variable would be one for the auditors of bank failure #1 and bank failure #2 in 2010 and for the auditor of bank failure #3 in 2011. In untabulated analyses, we find our results are robust to using this alternative audit window.

The sample of public and private bank-year observations includes only bank-year observations that did not have a failure during the respective year. For example, Imperial Capital Bancorp failed on December 18, 2009. Thus, the 2008 bank-year observation for Imperial bank is included in the analysis, but the 2009 bank-year observation is excluded. Of the 160 bank holding companies that experience a failure, 16 either fail before they can issue their 2008 financial reports or miss the necessary data to estimate our main regression models. Thus, our sample includes 144 banks representing 215 bank-year observations where the bank subsequently failed.

While our primary measure of loan loss provisions is scaled by average loan balances, consistent with the prior literature, a potential concern in our study is a mechanical relationship between the dependent variables, Loan Loss Provision and ∆Loans, because of the scalar in Loan Loss Provision. In untabulated analyses, we find no correlation between average loan balances and ∆Loans, which suggests that the dependent variables are not mechanically related. Nevertheless, we examine and find that our main results are robust to alternative scalars for loan loss provisions, such as ending total assets and beginning loan balance.

Our main results are also robust to clustering standard errors by bank and calendar year.

Since we don’t have a strong prior on when loan loss provisions should reverse, we follow Dechow et al. (2012) and use 1 year.

The banking industry is skewed in terms of bank size—a few banks account for a significant proportion of the industry assets. Thus, while 24% of banks are audited by Big 4 auditors, the large banks in our sample are mainly clients of Big 4 auditors (93% of public banks with assets over $10 billion).

As in Table 1, we note that certain auditors experience more than one failure in a given year. Therefore, in our robustness analysis, we also include measures for the number of client banks that failed at the national (office) level during the year. In an untabulated analysis, we find that the number of additional bank failures at the national level does not incrementally influence an auditor’s conservative response. However, we find support for an incrementally conservative response at the office level for each additional bank failure.

The average loan loss provision is 1% of the total loan value and β1 = 0.002, indicating 20% of the total loan loss provision (0.002/0.010 = 20%). Average total loans for our sample is $8.17 billion; $8.17 billion × 1% × 20% = $16.3 million.

Note that the reversals test requires two years of client failure data, which restricts our sample period to 2009–2014 instead of the 2008–2014 period used in our main analysis. This restriction leads to a loss of 781 observations or approximately 14% of our sample (as expected).

However, if a powerful client is able to eliminate the excessive conservatism, then we would not expect them to switch auditors. In untabulated analyses, we find that client power does not have a mitigating effect on the conservative response by auditors to a bank failure in their portfolio.

If the cost of not detecting a potential bank failure is high enough to the economy as a whole, it may be optimal to allow a few banks to suffer the adverse consequences of an unwarranted going concern opinion. If not, then the auditors’ conservative response is not desirable.

Due to the lack of data availability for the various corporate governance measures for non-public banking clients, we are restricted to public banking clients in our sample.

Alternatively, we rerun our analyses including auditor fixed effects and find results consistent with our primary analyses.

References

Acito, A.A., C.E. Hogan, and R.D. Mergenthaler. (2018). The effects of PCAOB inspections on auditor–client relationships. The Accounting Review 93 (2): 1–35.

Altamuro, J., and A. Beatty. 2010. How does internal control regulation affect financial reporting? Journal of Accounting and Economics 49: 58–74.

Ball, R., A. Robin, and G. Sadka. 2008. Is financial reporting shaped by equity markets or by debt markets? An international study of timeliness and conservatism. Review of Accounting Studies 13: 168–205.

Barton, J. 2005. Who cares about auditor reputation? Contemporary Accounting Research 22 (3): 549–586.

Basu, S. 1997. The conservatism principle and the asymmetric timeliness of earnings. Journal of Accounting and Economics 24 (1): 3–37.

Beatty, A.L., B. Ke, and K.R. Petroni. 2002. Earnings management to avoid earnings declines across publicly and privately held banks. The Accounting Review 77 (3): 547–570.

Beatty, A., and S. Liao. 2011. Do delays in expected loss recognition affect banks’ willingness to lend? Journal of Accounting and Economics 52 (1): 1–20.

Beatty, A., and S. Liao. 2014. Financial accounting in the banking industry: A review of the empirical literature. Journal of Accounting and Economics 58: 339–383.

Bell, T.B., W.R. Landsman, and D.A. Shackelford. 2001. Auditors’ perceived business risk and audit fees: Analysis and evidence. Journal of Accounting Research 39 (1): 35–43.

Bills, K.L., D.C. Jeter, and S.E. Stein. 2015. Auditor industry specialization and evidence of cost efficiencies in homogenous industries. The Accounting Review 90 (5): 1721–1754.

Bills, K.L., and N.M. Stephens. 2016. Spatial competition at the intersection of the large and small audit firm markets. Auditing: A Journal of Practice and Theory 35 (1): 23–45.

Blouin, J., B.M. Grein, and B.R. Rountree. 2007. An analysis of forced auditor change: The case of former Arthur Anderson clients. The Accounting Review 82 (3): 621–650.

Cahan, S.F., and W. Zhang. 2006. After Enron: Auditor conservatism and ex-Andersen clients. The Accounting Review 81 (1): 49–82.

Carcello, J.V., and Z. Palmrose. 1994. Auditor litigation and modified reporting on bankrupt clients. Journal of Accounting Research 31 (Supplement): 1–30.

Carson, E., N.L. Fargher, M.A. Geiger, C.S. Lennox, K. Raghunandan, and M. Willekens. 2013. Audit reporting for going-concern uncertainty: A research synthesis. Auditing: A Journal of Practice and Theory 32 (Supplement): 353–384.

Chen, F., K. Lam, W. Smieliauskas, and M. Ye. 2016. Auditor conservatism and banks’ measurement uncertainty during the financial crisis. International Journal of Auditing 20: 52–65.

Chy, M., and O. Hope. 2021. Real effects of auditor conservatism. Review of Accounting Studies 26: 730–771.

Cohen, J., G. Krishnamoorthy, and A.M. Wright. 2002. Corporate governance and the audit process. Contemporary Accounting Research 19 (4): 573–594.

DeAngelo, L.E. 1981. Auditor size and audit quality. Journal of Accounting and Economics 3 (3): 183–199.

DeFond, M.L., and K.R. Subramanyam. 1998. Auditor changes and discretionary accruals. Journal of Accounting and Economics 25 (1): 35–67.

DeFond, M.L., and J. Zhang. 2014. A review of archival auditing research. Journal of Accounting and Economics 58: 275–326.

Dechow, P., A. Hutton, J. Kim, and R. Sloan. 2012. Detecting earnings management: A new approach. Journal of Accounting Research 50: 275–334.

Desai, H., S. Rajgopal, and J.J. Yu. 2016. Did information intermediaries see the banking crisis coming from leading indicators in banks’ financial statements? Contemporary Accounting Research 33 (2): 579–606.

Doogar, R., S. Rowe, and P. Sivadasan. 2015. Asleep at the wheel (again)? Bank audits during the lead-up to the financial crisis. Contemporary Accounting Research 32 (1): 358–391.

Dugan, J. (2009). Loan loss provisioning and pro-cyclicality. Remarks by John C. Dugan, Comptroller of the Currency, before the Institute of International Bankers.

Farber, D.B. 2005. Restoring trust after fraud: Does corporate governance matter? The Accounting Review 80 (2): 539–561.

Francis, J.R. 2004. What do we know about audit quality? British Accounting Review 36: 345–368.

Francis, J.R., and P.N. Michas. 2012. The contagion effect of low-quality audits. The Accounting Review 88 (2): 521–552.

Francis, J.R., D.J. Stokes, and D.J. Anderson. 1999. City markets as a unit of analysis in audit research and the re-examination of Big 6 market shares. Abacus 35: 185–206.

Francis, J.R., and M.D. Yu. 2009. Big 4 office size and audit quality. The Accounting Review 84 (5): 1521–1552.

Geiger, M.A., K. Raghunandan, and D.V. Rama. 2005. Recent changes in the association between bankruptcies and prior audit opinions. Auditing: A Journal of Practice and Theory 24 (1): 21–35.

Gigler, F., C. Kanodia, H. Sapra, and R. Venugopalan. 2009. Accounting conservatism and the efficiency of debt contracts. Journal of Accounting Research 47 (3): 767–797.

Gleason, C.A., and L.F. Mills. 2011. Do auditor-provided tax services improve the estimate of tax reserves? Contemporary Accounting Research 28 (5): 1484–1509.

Harsanyi, J.C. 1967. Games of incomplete information played by Bayesian players, Part I. Management Science 14: 159–182.

Heninger, W.G. 2001. The association between auditor litigation and abnormal accruals. The Accounting Review 76: 111–126.

Herrmann, D.R.S., and Pornupatham, and T. Vichitsarawong. . 2008. The impact of the asian financial crisis on auditors’ conservatism. Journal of International Accounting Research 7 (2): 43–63.

Jin, J.Y., K. Kanagaretnam, and G.J. Lobo. 2011. Ability of accounting and audit quality variables to predict bank failure during the financial crisis. Journal of Banking and Finance 35 (11): 2811–2819.

Johnstone, K.M., and J.C. Bedard. 2003. Risk management in client acceptance decisions. The Accounting Review 78 (4): 1003–1025.

Jones, J.J. 1991. Earnings management during import relief investigations. Journal of Accounting Research 29 (2): 193–228.

Kanagaretnam, K., C.Y. Lim, and G.J. Lobo. 2010. Auditor reputation and earnings management: International evidence from the banking industry. Journal of Banking and Finance 34: 2318–2327.

Kanodia, C., and A. Mukherji. 1994. Audit pricing, lowballing and audit turnovers: A dynamic analysis. The Accounting Review 69 (4): 593–615.

Kaplan, S.E., and D.D. Williams. 2013. Do going concern audit reports protect auditors from litigation? A simultaneous equations approach. The Accounting Review 88 (1): 199–232.

Kinney, W., Z.V. Palmrose, and S. Scholz. 2004. Auditor independence, non-audit services, and restatements: Was the US government right? Journal of Accounting Research 42: 561–588.

Klein, A. 2002. Audit committee, board of director characteristics, and earnings management. Journal of Accounting and Economics 33: 375–400.

Kothari, S.P., and R. Lester. 2012. The role of accounting in the financial crisis: Lessons for the future. Accounting Horizons 26 (2): 335–351.

Krishnan, J. 1994. Auditing switching and conservatism. The Accounting Review 69 (1): 200–215.

Lara, J.M.G., B.G. Osma, and F. Penalva. 2009. Accounting conservatism and corporate governance. Review of Accounting Studies 14: 161–201.

Lee, H.Y., and V. Mande. 2003. The effect of the Private Securities Litigation Reform Act of 1995 on accounting discretion of client managers of Big 6 and non-Big 6 auditors. Auditing a: Journal of Practice and Theory 22 (1): 93–108.

Lennox, C.S., and A. Kausar. 2017. Estimation risk and auditor conservatism. Review of Accounting Studies 22: 185–216.

Lennox, C., and B. Li. 2014. Accounting misstatements following lawsuits against auditors. Journal of Accounting and Economics 57: 58–75.

Louwers, T.J., F.M. Messina, and M.D. Richard. 1999. The auditor’s going-concern disclosure as a self-fulfilling prophecy: A discrete-time survival analysis. Decision Sciences 30 (3): 805–824.

Lu, T., and H. Sapra. 2009. Auditor conservatism and investment efficiency. The Accounting Review 84 (6): 1933–1958.

Lys, T., and R.L. Watts. 1994. Lawsuits against auditors. Journal of Accounting Research 32 (Supplement): 65–93.

Menon, K., and D.D. Williams. 2010. Investor reaction to going concern audit reports. The Accounting Review 85 (6): 2075–2105.

Murfin, J. 2012. The supply-side determinants of loan contract strictness. The Journal of Finance 67 (5): 1565–1601.

Mutchler, J.F. 1984. Auditors’ perceptions of the going-concern opinion decision. Auditing a: Journal of Practice and Theory 3 (2): 17–30.

Nichols, D.C., J.M. Wahlen, and M.M. Wieland. 2009. Publicly traded versus privately held: Implications for conditional conservatism in bank accounting. Review of Accounting Studies 14: 88–122.

Nicoletti, A. 2018. The effects of bank regulators and external auditors on loan loss provisions. Journal of Accounting and Economics 66 (1): 244–265.

O’Keefe, T.B., D.A. Simunic, and M.T. Stein. 1994. The production of audit services: Evidence from a major public accounting firm. Journal of Accounting Research 32 (2): 241–261.

Palmrose, Z.V. 1987. Litigation and independent auditors: The role of business failures and management fraud. Auditing: A Journal of Practice and Theory 6: 90–103.

Prawitt, D.F., N.Y. Sharp, and D.A. Wood. 2012. Internal audit outsourcing and the risk of misleading or fraudulent financial reporting: Did Sarbanes-Oxley get it wrong? Contemporary Accounting Research 29 (4): 1109–1136.

Simunic, D.A. 1984. Auditing, consulting, and auditor independence. Journal of Accounting Research 22 (2): 679–702.

Thoman, L. 1996. Legal damages and auditor efforts. Contemporary Accounting Research 13: 275–306.

Watts, R. 2003. Conservatism in accounting part I: Explanations and implications. Accounting Horizons 17 (3): 207–221.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank Stephen Penman (editor) and an anonymous reviewer for the valuable comments and suggestions provided throughout the review process. We are grateful for the helpful comments from Dane Christensen, Keith Czerney, Matt Ege, Bill Felix, Barb Grien, Phil Lamoreaux, Tom Omer, Shyam V. Sunder, workshop participants at Boston University and the University of Oklahoma, and conference participants at the 2014 American Accounting Association (AAA) annual meeting and the 2016 AAA Audit Midyear Meeting.

Appendix A: Variable definitions

Appendix A: Variable definitions

Dependent variables | |

Loan Loss Provision | Loan loss provision as a percentage of the average of beginning and ending total loans |

Loan Charge Off | Loan charge-offs scaled by beginning total assets |

ΔLoans | The change in the natural log of the total loan balance from the beginning to the end of the year, scaled by beginning of the year total assets |

Independent variables | |

Client Failure National | Indicator variable equal to one if at least one of the auditor firm’s client banks failed during the year and zero otherwise |

Client Failure Office | Indicator variable equal to one if at least one of the auditor office’s client banks failed during the year and zero otherwise |

Big 4 | Indicator variable equal to one if the auditor was a Big 4 auditor and zero otherwise |

Log(Auditor Portfolio Size) | Logarithm of total assets of all banks within the auditor's portfolio for the year |

Log(Assets) | Logarithm of total assets |

Δ Non Performing Loans | Change in nonperforming loans as a percentage of the average of beginning and ending total loans |

Loan Loss Reserve | Loan loss reserve as a percentage of total loans at the beginning of the year |

LoanR | Loans secured by real estate as a percentage of total loans |

LoanC | Commercial and industrial loans as a percentage of total loans |

LoanD | Loans to depository institutions as a percentage of total loans |

LoanA | Loans to finance agricultural production as a percentage of total loans |

LoanI | Loans to individuals as a percentage of total loans |

LoanF | Loans to foreign governments as a percentage of total loans |

Deposits | Lagged total deposits scaled by total loans |

Tier 1 Capital | Tier 1 capital deflated by total assets |

ΔUnemployment | change in the annual unemployment rate |

Public | Indicator variable equal to one if the bank is a public company and zero otherwise |

Rights and permissions

About this article

Cite this article

Hall, C., Judd, J.S. & Sunder, J. Auditor conservatism, audit quality, and real consequences for clients. Rev Account Stud 28, 689–725 (2023). https://doi.org/10.1007/s11142-021-09653-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-021-09653-1