Abstract

We propose two alternative models to estimate fundamental prices on real estate markets. The first model is based on a no-arbitrage condition between renting and buying. The second model interprets the period costs as the result of market equilibrium between housing demand and supply. We estimate both models for the USA, the UK, Japan, Switzerland, and the Netherlands. We find that observed prices deviate substantially and for long periods from their estimated fundamental values. However, we find some evidence that, in the long-run, actual prices tend to return to their fundamental values progressively. This result is due to both impulse–response functions and forecast analyses. In particular, we find that using the fundamental price significantly increases the accuracy of out-of-sample long-term forecasts of the price.

Similar content being viewed by others

Notes

This relationship is also emphasized by Herring and Wachter (1999).

Ayuso and Restoy (2006) construct an intertemporal asset pricing model for the price of houses. However, they do not explicitly model the user costs of housing and do not calculate a fundamental value of rents.

According to Poterba (1984) or Flavin and Yamashita (2002), the tax deductibility of mortgage payments has two effects on the user costs: it reduces the relevant mortgage rate and (because nominal mortgage payments are deductible) inflation rates become relevant. However, the introduction of the tax deductibility has mainly a level effect on fundamental house prices overall. If we assume that marginal tax rates are constant over time, the level effect would be completely offset by a change of the parameters of our estimation. However, if there is a change in the fiscal regime, then there can be a bigger effect on the development of the house price . In the Netherlands, for example, the tax deductibility has been limited to reduce house-price inflation in recent years. When we look at the development of house prices in the Netherlands, this attempt was successful. But from a theoretical point of view, a limitation of the tax deductability would have the same effect as a sudden increase of the mortgage rate on a new level: house prices should fall. Therefore, taking the tax deductibility of mortgage payments into account does not help to explain the current level of house prices in the Netherlands.

Poterba (1984, p. 738) also mentions these difficulties.

This formula basically reflects the returns on holding residential real estate in Cho (1996).

Here, we assume that \(\underset{i\rightarrow \infty }{\lim }\left[ \delta ^{i}H_{t+i}\right] /\left[ \prod_{j=0}^{i}R_{t+j}\right] =0\). Therefore, we rule out the possibility of a rational bubble in the housing market.

Therefore, we neglect demographic effects in our study. The demographic structure of a society can have an effect on saving rates, preferences for housing, and risk premiums. In our model, we allow for differences of these parameters between countries but not for changes over time. However, according to Meen (2006), coefficients of house price models are showing only little change over time.

Cf. also “Data.”

The literature offers a range of fundamentals to determine the demand for housing: Case and Shiller (2003), for example, consider personal income per capita, population, employment and the unemployment rate. Among other factors, Holly and Jones (1997) also consider real income and a demographic factor. Both papers conclude that income is the most important factor. Collyns and Sendhadji (2002) points out real GDP as an important fundamental because it is a measure for the aggregated level of income per capita and population. Therefore, our model is in line with this literature.

Generally, one could also consider a positive relationship between construction and property prices. In that case, construction would develop endogenous. Since data on construction is available directly, we will treat construction as an exogenous variable.

The imputed rent is not stationary because in the rent and the S/D model, it is defined as a linear function of non-stationary variables, i.e the rents or the GDP respectively.

Cf. Campbell et al. (1997, p. 261) for the details on the first-order Taylor approximation.

We have that \(\rho =1/\left( 1+\exp \left( -\ln \delta -\bar{x} -\Delta \bar{h}\right) \right) \) and \(\kappa _{1}=-\ln \rho -\left( 1-\rho \right) \ln \left( 1/\rho -1\right) \), where \(\bar{x}=E\left( x_{t}\right)\) and \(\Delta \bar{h}=E\left( \Delta h_{t}\right) \).

In the remainder of this paper, we use small letters to indicate the logarithm of a variable.

Cf. Campbell et al. (1997, p. 261) for the details on the first-order Taylor approximation.

We have that \(\theta\! =\!1/\left(1\!+\!\exp \left( \bar{b}\!-\!\ln \delta\! -\!\bar{s}\right) \right) \) and \(\kappa _{2}\!=\!-\ln \theta \!-\!\left( 1\!-\!\theta \right) \ln \left( 1/\theta \!-\!1\right)\) where \(\bar{b}\!=\!E\left( b_{t}\right)\) and \(\bar{s}=E\left( s_{t}\right) .\)

We have that \(\varphi =\frac{1-\rho +\rho \theta -\rho \theta ^{2}}{1-\rho \theta }\), \(\lambda =\frac{\left( 1-\theta \right) \left( 1-\rho \right) }{ 1-\rho \theta },\) and \(c^{\ast }=c-\frac{\theta \left( 1-\rho \right) \rho \kappa _{2}}{\left( 1-\rho \theta \right) \left( 1-\rho \right) }+\ln \alpha .\) The term ln α in the constant comes from the definition of \(x_{t}^{^{\prime }}\).

Note that all coefficients are known and can be computed as explained in Appendix 2.

Note that s t is not directly observable and \(\tilde{x}_{t}\) is therefore not observable. However, we can get s t as explained in Appendix 2 and then infer the log price-to-imputed-rent ratio \(\tilde{x}_{t}\) from it.

Note that all coefficients are known and can be computed as explained in Appendix 2.

Cf. Hilbers et al. (2001).

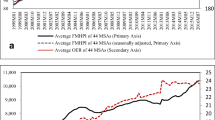

The only exception is the USA, where the S/D and the rent model deviate substantially from each other.

With the exception of the S/D model for the USA, which is more volatile than the actual price.

For example Krugman (1998).

Cf. Hamilton (1994).

There are two exceptions to this conclusion: the rent models for Switzerland and for Japan. In these two cases, the fundamental dynamic model beats the benchmark and the other models for long forecast horizons.

The series of b t is observable and κ 2 is known if θ and δ are known. We assume that δ is equal to 1% per year, which corresponds to the value usually used by banks.

Cf. footnote no. 22.

References

Ayuso, J., & Restoy, F. (2006). House prices and rents: An equilibrium asset pricing approach. Journal of Empirical Finance, 13, 371–388.

Case, K. E., & Shiller, R. J. (2003). Is there a bubble in the housing market? Brookings Papers an Economic Activity, 2, 299–362.

Campbell, J. Y., Lo, A. W., & MacKinlay, A. C. (1997). The econometrics of financial markets. Princeton: Princeton University Press.

Campbell, J. Y., & Shiller, R. J. (1988). The dividend–price ratio and expectations of future dividends and discount factors. Review of Financial Studies, 3, 195–228.

Cho, M. (1996). House price dynamics: A survey of theoretical and empirical issues. Journal of Housing Research, 7, 145–172.

Collyns, C., & Senhadji, A. (2002). Lending booms, real estate bubbles and the asian crisis. IMF Working Paper, WP/02/20.

Dickey, D. A., & Fuller, W. A. (1979). Estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74, 427–431.

Dougherty, A., & Van Order, R. (1982). Inflation, housing costs, and the consumer price index. American Economic Review, 72, 154–164.

Engle, R. F., & Granger, C. W. J. (1987). Co-integration and error correction: Representation, estimation and testing. Econometrica, 55, 251–276.

Flavin, M., & Yamashita, T. (2002). Owner-occupied housing and the composition of the household portfolio. American Economic Review, 92, 345–362.

Flood, R. P., & Hodrick, R. J. (1990). On testing speculative bubbles. Journal of Economic Perspectives, 4, 85–101.

Girouard, N., Kennedy, M., van den Noord, P., & André, C. (2006). Recent house price developments: The role of fundamentals. OECD, Economics Department Working Papers No. 475.

Hamilton, J. D. (1994). Time series analysis. Princeton: Princeton University Press.

Herring, R., & Wachter, S. (1999). Real estate booms and banking busts: An international perspective. Wharton FIC WP 99–27.

Hilbers, P., Lei, Q., & Zacho, L. (2001). Real estate market developments and financial sector soundness. IMF Working Paper WP/01/129.

Himmelberg, C., Mayer, C., & Sinai, T. (2005). Assessing high house prices: Bubbles, fundamentals, and misperceptions. Journal of Economic Perspectives, 19, 67–92.

Holly, S., & Jones, N. (1997). House prices since the 1940s: Cointigration, demography and asymmetrics. Economic Modelling, 14, 549–565.

Krugman, P. (1998). What happened to Asia? www.mit.edu/krugman.

Kwiatkowski, D., Phillips, P. C. B., Schmidt, P., & Shin, Y. (1992). Testing the null hpypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? Journal of Econometrics, 54, 159–178.

McCarthy, J., & Peach, R. W. (2004). Are home prices the next “bubble”? FRBNY Economic Policy Review, December.

Meen, G. (2006). Ten new propositions in UK housing macroeconomics: An overview of the first years of the century. Working Paper, University of Reading.

Van den Noord, P. (2006). Are house prices nearing a peak? A probit analysis for 17 OECD countries. OECD, Economics Department Working Papers No. 488.

Pain, N., & Westaway, P. (1997). Modelling structural change in the UK housing market: A comparison of alternative house price models. Economic Modelling, 14, 587–610.

Phillips, P. C. B., & Perron, P. (1988). Testing for unit root in time series regression. Biometrika, 75, 335–346.

Poterba, J. M. (1984). Tax subsidies to owner-occupied housing: An asset-market approach. Quarterly Journal of Economics, 99, 729–752.

Poterba, J. M. (1992). Taxation and housing: Old quastions, new answers. American Economic Review, 82, 237–242.

Schwab, R. M. (1982). Inflation expectations and the demand for housing. American Economic Review, 72, 143–153.

Sinai, T., & Souleles, N. S. (2005). Owner-occupied housing as a hedge against rent Risk. The Quarterly Journal of Economics, 102, 763–789.

Weeken, O. (2004). Asset pricing and the housing market. Bank of England Quarterly Review, Spring 2004.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper has benefited from the comments and suggestions of Shaun Bond, Peter Westerheide, an anonymous referee and the participants of the Maastricht-Cambridge-MIT Real Estate Finance and Investment Symposium 2006. Scientific support by the National Center of Competence in Research “Financial Valuation and Risk Management” (NCCR Finrisk) is gratefully acknowledged. The opinions expressed herein are those of the authors and do not necessarily reflect the views of the Swiss National Bank.

Appendices

Appendix 1: Data

Appendix 2: Econometric Methodology

To recapitulate the results of “The Fundamental Price Equation,” the computation of the fundamental prices given by the rent model requires: (1) the linearization parameter ρ, (2) the VAR coefficients in A and (3) the constant c. In addition, the S/D model needs (4) the supply series s t , 5) the linearization parameter θ and (6) and the constant c ∗ . The VAR coefficients can be easily estimated with traditional methods. The next sections describe how to get the other elements.

Linearization Parameter \(\protect\rho \)

Recall from footnote no. 19 that the parameter ρ is defined as

where \(\bar{x}=\bar{p}-\bar{h}\). If both the price and the imputed rent are observable, it is straightforward to compute ρ. Unfortunately, in our case, the imputed rents and the prices are not expressed in the same units. Thus, we have that \(\bar{x}=\bar{p}-\bar{h}-\ln \omega \), where ω is the conversion factor of the imputed rent units in terms of price units. This conversion factor is unobservable. To cope with this problem, we estimate ρ with an OLS regression of Eq. 12. For example, with the Rent model, we estimate the equation:

The parameter a gives us an estimation of κ 1 + ln δ − ln ω − φ and the parameter b is our estimation of ρ.

Constants c and c ∗

To estimate c and c ∗ , we assume that, on average over time , the observed log price-to-imputed-rent ratio \(\hat{x}_{t}\) is equal to the fundamental price \(x_{t}^{\bullet }\) for the rent model (\(E\left( \hat{x} _{t}\right) =E\left( x_{t}^{\bullet }\right) \)) and that \(\tilde{x}_{t}\) is equal to \(x_{t}^{\ast }\) for the S/D model (\(E\left( \tilde{x}_{t}\right) =E\left( x_{t}^{\ast }\right) \)).

Taking the unconditional expectation of Eq. 24 and using the vector z t of fundamentals corresponding to each model implies that:

and

respectively.

Supply and Linearization Parameter \(\protect\theta \)

As mentioned in footnote no. 26, the computation of the supply-demand model requires to first estimate the housing supply s t , which is not directly observable. Note that the entire series of s t can be recovered if the initial s 0 is known. To see how, first note that Eq. 19 states that s t is a functionFootnote 34 f 1 of s 0 and θ

Furthermore, we knowFootnote 35 that θ is a function of the average \(\bar{ b}-\bar{s}\)

By substitution of s t , we have that

This equation can be numerically solved for θ once the initial supply is known. Consequently, the only unknown in this problem is the initial housing supply. Once s 0 is known, θ and the entire series of s t can be recovered with Eq. 17.

We can determine s 0 by imposing one additional condition: we impose that the average one-period imputed rent growth rate must be equal to the average renting price growth rate. This is equivalent to saying that, in the long term, the cost of living in a house must grow at the same rate as the cost of living in a rented flat. If this condition is violated one, of these two alternatives will be infinitely more costly than the other. This condition, together with Eq. 15, yields \(\overline{\Delta s_{t}}=\overline{\Delta y_{t}}-\overline{\Delta q_{t}}\) where \(\overline{ \Delta q_{t}}\) is the average renting price growth rate. As \(\overline{ \Delta s_{t}}\) is also a function of s 0, it is also possible to compute the s 0 which gives the adequate initial condition. Then, starting from s 0, the entire series housing supplies can be recovered and used to compute \(x_{t}^{\ast }\).

Rights and permissions

About this article

Cite this article

Hott, C., Monnin, P. Fundamental Real Estate Prices: An Empirical Estimation with International Data. J Real Estate Finan Econ 36, 427–450 (2008). https://doi.org/10.1007/s11146-007-9097-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-007-9097-8