Abstract

Commercial real estate (CRE) loan losses are a recurring contributor to bank failures and financial instability, yet they are not well understood. We examine a unique and proprietary data set of CRE loan defaults at banks that failed and were resolved by the FDIC after the 2008 financial crisis. We build upon an existing literature relating stochastic collateral values to loss given default (LGD). Consistent with model predictions, we show that CRE loans defaulting sooner after origination are more sensitive to declining economic conditions and exhibit LGDs that are more severe. These results are robust to a number of factors, including the declining balance of the loan over time. Our findings point to an inherent fragility associated with high CRE loan growth, even without necessarily a deterioration in lending standards, due to the changing composition of CRE loan seasoning in the industry. This reflects an unexplored risk in the literature concerning rapid and cyclical expansions in CRE credit.

Similar content being viewed by others

Notes

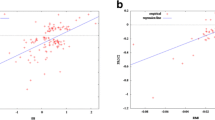

Source: FDIC calculations.

See Brueggeman and Fisher (2016), p.408, for discussion.

In Jokivuolle and Peura (2003), a loan’s probability of default E[I(AT ≤ D)] can also affect expected recoveries via the denominator of the third term in Eq.4. However, we already observe the default outcome in our sample of loans. We therefore do not assume inherent differences in default probabilities across the cross section of loan observations.

Requirements include: a) acquirers must manage the covered assets in the same way that they manage their own assets; b) acquirers must provide regular standardized reporting, adequate workpapers and evidence that the loans are being worked effectively; and c) the FDIC performs regular reviews of loss claims and on-site compliance reviews at least once a year. If the FDIC identifies a problem, the agency may demand program improvements, reverse loss claims or, in the case of a serious contract breach, abrogate the loss share coverage altogether. Acquirers have the right to contest any FDIC actions.

Only a small handful of loans in our data experienced zero losses due to properties that were foreclosed but exceeded the value of the outstanding debt plus expenses. Rather, the overwhelming majority of loans with zero losses appear to be cures in which the borrower was able to become current on the loan again after default. We therefore interpret our results in terms of the probability of curing the loan after default.

Source: CoStar.

References

Ambrose, B.W., Capone, C.A., & Deng, Y. (2001). Optimal put exercise: an empirical examination of conditions for mortgage foreclosure. Journal of Real Estate Finance and Economics, 23(2), 213–234.

Araten, M., Jacobs, M., & Varshney, P. (2004). Measuring LGD on commercial loans: an 18-year internal study. The RMA Journal May 28–35.

Asarnow, E., & Edwards, D. (1995). Measuring loss on defaulted bank loans: a 24-year study. Journal of Commercial Lending March 80–86.

Asea, P.K., & Blomberg, S.B. (1998). Lending cycles. Journal of Econometrics, 83(1), 89–128.

Bellotti, T., & Crook, J. (2012). Loss given default models incorporating macroeconomic variables for credit cards. International Journal of Forecasting, 28(1), 171–182.

Belotti, F., Deb, P., Manning, W.G., & Norton, E.C. (2015). twopm: Two-part models. The Stata Journal, 15(1), 3–20.

Berger, A.N., & Udell, G.F. (2004). The institutional memory hypothesis and the procyclicality of bank lending behavior. Journal of Financial Intermediation, 13(4), 458–495.

Broecker, T. (1990). Credit-worthiness tests and interbank competition. Econometrica, 58(2), 429–452.

Brueggeman, W.B., & Fisher, J.D. (2016). Real estate finance and investments, 15th edn. New York: McGraw-Hill.

Buschbom, S.L., Kau, J.B., Keenan, D.C., & Lyubimov, C. (2018). Delinquencies, default and borrowers’ strategic behavior toward the modification of commercial mortgages. Real Estate Economics 1–32.

Calem, P.S., & LaCour-Little, M. (2004). Risk-based capital requirements for mortgage loans. Journal of Banking and Finance, 28, 647–672.

Ciochetti, B.A. (1997). Loss characteristics of commercial mortgage foreclosures. Real Estate Finance, Spring 53–69.

Dell’Ariccia, G., & Marquez, R. (2006). Lending booms and lending standards. The Journal of Finance, 61(5), 2511–2546.

Dell’Ariccia, G., Igan, D., & Laeven, L.U. (2012). Credit booms and lending standards: Evidence from the subprime mortgage market. Journal of Money Credit and Banking, 44(2-3), 367–384.

Do, H.X., Rösch, D., & Scheule, H. (2018). Predicting loss severities for residential mortgage loans: a three-step selection approach. European Journal of Operational Research, 270(1), 246–259.

Do, H.X., Rösch D., & Scheule H. (2019). Liquidity constraints, home equity and residential mortgage losses. Journal of Real Estate Finance and Economics https://doi.org/10.1007/s11146-019-09709-9.

Downs, D.H., & Xu, P.T. (2015). Commercial real estate, distress and financial resolution: Portfolio lending versus securitization. Journal of Real Estate Finance and Economics, 51(2), 254–287.

Esaki, H., L’Heureux, S., & Snyderman, M. (1999). Commercial mortgage defaults: An update. Real Estate Finance, Spring 80–86.

Frye, J. (2000). Collateral damage. Risk, 13(4), 91–94.

Gorton, G., & He, P. (2008). Bank credit cycles. The Review of Economic Studies, 75(4), 1181–1214.

Gupton, G.M., Gates, D., & Carty, L.V. (2000). Bank-loan loss given default. Moody’s investors service, global credit research, November 69–92.

Hartmann-Wendels, T., Miller, P., & Töews, E. (2014). Loss given default for leasing: Parametric and nonparametric estimations. Journal of Banking and Finance, 40, 364–375.

Hwang, R.C., Chung, H., & Chu, C. (2016). A two-stage probit model for predicting recovery rates. Journal of Financial Services Research, 50, 311–339.

Jokivuolle, E., & Peura, S. (2003). Incorporating collateral value uncertainty in loss given default estimates and loan-to-value ratios. European Financial Management, 9(3), 299–314.

Kau, J.B., Keenan, D.C., & Kim, T. (1994). Default probabilities for mortgages. Journal of Urban Economics, 35, 278–296.

Lekkas, V., Quigley, J., & Van Order, R. (1993). Loan loss severity and optimal mortgage default. Journal of the American Real Estate and Urban Economics Association, 21(1), 353–371.

Leow, M., & Mues, C. (2012). Predicting loss given default (LGD) for residential mortgage loans: a two-stage model and empirical evidence for UK bank data. International Journal of Forecasting, 28(1), 183–195.

Leow, M., Mues, C., & Thomas, L. (2014). The economy and loss given default: Evidence from two UK retail lending data sets. The Journal of the Operational Research Society, Special Issue: Credit Risk Modelling, 65(3), 363–375.

Leung, S.F., & Yu, S. (1996). On the choice between sample selection and two-part models. Journal of Econometrics, 72, 197–229.

Loterman, G., Brown, I., Martens, D., Mues, C., & Baesens, B. (2012). Benchmarking regression algorithms for loss given default modeling. International Journal of Forecasting, 28, 161–170.

Matuszyk, A., Mues, C., & Thomas, L.C. (2010). Modelling LGD for unsecured personal loans: Decision tree approach. The Journal of the Operational Research Society, 61(3), 393–398.

Papke, L.E., & Wooldridge, J.M. (1996). Econometric methods for fractional response variables with an application to 401(k) plan participation rates. Journal of Applied Econometrics, 11, 619–632.

Pennington-Cross, A. (2006). The value of foreclosed property. Journal of Real Estate Research, 28(2), 193–214.

Qi, M., & Yang, X. (2009). Loss given default of high loan-to-value residential mortgages. Journal of Banking and Finance, 33(5), 788–799.

Qi, M., & Zhao, X. (2011). Comparison of modeling methods for loss given default. Journal of Banking and Finance, 35(11), 2842–2855.

Rajan, R.G. (1994). Why bank credit policies fluctuate: a theory and some evidence. The Quarterly Journal of Economics, 109(2), 399–441.

Rodano, G., Serrano-Velarde, N.A.B., & Tarantino, E. (2018). Lending standards over the credit cycle. The Review of Financial Studies, 31 (8), 2943–2982.

Ruckes, M. (2004). Bank competition and credit standards. The Review of Financial Studies, 17(4), 1073–1102.

Schuermann, T. (2004). What do we know about loss given default?. In Shimko, D (Ed.) Credit risk: models and management, risk books, chap, (Vol. 9 pp. 249–274).

Tanoue, Y., Kawada, A., & Yamashita, S. (2017). Forecasting loss given default of bank loans with multi-stage model. International Journal of Forecasting, 33, 513–522.

Wooldridge, J.M. (2010). Econometric analysis of cross section and panel data, 2nd edn. Cambridge: The MIT Press.

Zhang, J., & Thomas, L.C. (2012). Comparisons of linear regression and survival analysis using single and mixture distributions approaches in modelling LGD. International Journal of Forecasting, 28(1), 204–215.

Acknowledgements

A.J. Micheli provided valuable research assistance. We thank Rosalind Bennett, Christine Blair, Claire Brennecke, Jiakai Chen, Chintal Desai, Kristoph Kleiner, Troy Kravitz, Oscar Mitnik, Joseph Nichols, Phil Ostromogolsky, Manju Puri, Lan Shi, Justin Vitanza, as well as seminar participants at the FDIC Center for Financial Research, 2016 Eastern Finance Association Annual Meetings, 82nd International Atlantic Economic Conference, 2018 Interagency Risk Quantification Forum, and 2019 AEA Annual Meetings. We are also grateful to C.F. Sirmans and an anonymous referee for valuable comments. All errors are entirely our own.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interests

The authors declare that they have no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ross, E.J., Shibut, L. Loss Given Default, Loan Seasoning and Financial Fragility: Evidence from Commercial Real Estate Loans at Failed Banks. J Real Estate Finan Econ 63, 630–661 (2021). https://doi.org/10.1007/s11146-020-09783-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-020-09783-4