Abstract

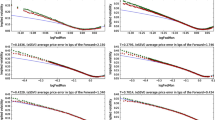

Imposing a symmetry condition on returns, Carr and Lee (Math Financ 19(4):523–560, 2009) show that (double) barrier derivatives can be replicated by a portfolio of European options and can thus be priced using fast Fourier techniques (FFT). We show that prices of barrier derivatives in stochastic volatility models can alternatively be represented by rapidly converging series, putting forward an idea by Hieber and Scherer (Stat Probab Lett 82(1):165–172, 2012). This representation turns out to be faster and more accurate than FFT. Numerical examples and a toolbox of a large variety of stochastic volatility models illustrate the practical relevance of the results.

Similar content being viewed by others

Notes

A comment on generalizations to stochastic interest rates is given in Remark 2.

Using that \(\sin \big (\frac{n\pi (x-b)}{a-b}\big ) = (-1)^{n}\,\sin \big (\frac{n\pi (x-a)}{a-b}\big )\), one obtains the results in Hieber and Scherer (2012), Theorem 2 (\(\mu = -1/2\), \(\sigma =1\), a generalization to \(\mu \in \mathbb {R}\) and \(\sigma >0\) is straightforward).

References

Bakshi, G., & Madan, D. (2000). Spanning and derivative security valuation. Journal of Financial Economics, 55(2), 205–238.

Ball, C. A., & Roma, A. (1994). Stochastic volatility option pricing. Journal of Financial and Quantitative Analysis, 29, 589–607.

Barndorff-Nielsen, O., & Shephard, N. (2001). Non-Gaussian Ornstein–Uhlenbeck based models and some of their uses in financial economics. Journal of the Royal Statistical Society: Series B, 63(2), 167–241.

Bates, D. (1996). Jumps and stochastic volatility: Exchange rate processes implicit in Deutsche Mark options. Review of Financial Studies, 9(1), 69–107.

Billingsley, P. (2008). Probability and measure. Wiley series in probability.

Bingham, N., & Kiesel, R. (2004). Risk-neutral valuation. Berlin: Springer.

Black, F., & Cox, J. C. (1976). Valuing corporate securities: Some effects of bond indenture provisions. Journal of Finance, 31(2), 351–367.

Brockwell, P., Chadraa, E., & Lindner, A. (2006). Continuous-time GARCH processes. The Annals of Applied Probability, 16(2), 790–826.

Carr, P., & Crosby, J. (2010). A class of Lévy process models with almost exact calibration to both barrier and vanilla FX options. Journal of Quantitative Finance, 10(10), 1115–1136.

Carr, P., & Lee, R. (2009). Put-call symmetry: Extensions and applications. Mathematical Finance, 19(4), 523–560.

Carr, P., & Madan, D. B. (1999). Option valuation using the fast Fourier transform. Journal of Computational Finance, 2, 61–73.

Carr, P., Ellis, K., & Gupta, V. (1998). Static heding of exotic derivatives. Journal of Finance, 53(3), 1165–1190.

Carr, P., Geman, H., Madan, D., & Yor, M. (2003). Stochastic volatility for Lévy processes. Mathematical Finance, 13(3), 345–382.

Carr, P., Zhang, H., & Hadjiliadis, O. (2011). Maximum drawdown insurance. International Journal of Theoretical and Applied Finance, 14(8), 1195–1230.

Christoffersen, P., Heston, S., & Jacobs, K. (2009). The shape and term structure of the index option smirk: Why multifactor stochastic volatility models work so well. Management Science, 55, 1914–1932.

Cox, D., & Isham, V. (1980). Monographs on applied probability and statistics: Point processes. London: Chapman & Hall.

Cox, D., & Miller, H. (1965). Theory of stochastic processes. London: Chapman & Hall.

Cox, J., Ingersoll, J., & Ross, S. (1985). A theory of the term structure of interest rates. Econometrica, 53, 187–201.

da Fonseca, J., Grasselli, M., & Tebaldi, C. (2007). Option pricing when correlations are stochastic: An analytical framework. Review of Derivatives Research, 10, 151–180.

Darling, D., & Siegert, A. (1953). The first passage problem for a continuous Markov process. The Annals of Mathematical Statistics, 24(4), 624–639.

Dassios, A., & Jang, J. W. (2003). Pricing of catastrophe reinsurance and derivatives using the Cox process with shot noise intensity. Finance and Stochastics, 7, 73–95.

Derman, E., Ergener, D., & Kani, I. (1994). Forever hedged. Risk, 7, 139–145.

Dufresne, D. (2001). The integrated square-root process. Working paper. University of Montreal.

Dupont, D. (2002). Hedging barrier options: Current methods and alternatives. Working paper.

Eraker, B., Johannes, M., & Polson, N. (2003). The impact of jumps in volatility and returns. Journal of Finance, 58(3), 1269–1300.

Escobar, M., Friederich, T., Seco, L., & Zagst, R. (2011). A general structural approach for credit modeling under stochastic volatility. Journal of Financial Transformation, 32, 123–132.

Feller, W. (1951). Two singular diffusion problems. The Annals of Mathematics, 54(1), 173–182.

Geman, H., & Yor, M. (1996). Pricing and hedging double-barrier options: A probabilistic approach. Mathematical Finance, 6(4), 365–378.

Götz, B. (2011). Valuation of multi-dimensional derivatives in a stochastic covariance framework. Ph.D. Thesis, TU Munich.

He, H., Keirstead, W., & Rebholz, J. (1998). Double lookbacks. Mathematical Finance, 8(3), 201–228.

Heston, S. (1993). A closed-form solution for options with stochastic volatility with applications to bond and currency options. Journal of Finance, 42, 327–343.

Hieber, P., & Scherer, M. (2012). A note on first-passage times of continuously time-changed Brownian motion. Statistics & Probability Letters, 82(1), 165–172.

Hull, J., & White, A. (1987). The pricing of options on assets with stochastic volatility. Journal of Finance, 42(2), 281–300.

Hurd, T. (2009). Credit risk modeling using time-changed Brownian motion. International Journal of Theoretical and Applied Finance, 12(8), 1213–1230.

Kammer, S. (2007). A general first-passage-time model for multivariate credit spreads and a note on barrier option pricing. Ph.D. Thesis, Justus-Liebig Universität Gießen.

Kiesel, R., & Lutz, M. (2011). Efficient pricing of constant maturity swap spread options in a stochastic volatility LIBOR market model. Journal of Computational Finance, 14(4), 37–72.

Kilin, F. (2011). Accelerating the calibration of stochastic volatility models. Journal of Derivatives, 18(3), 7–16.

Klüppelberg, C., Lindner, A., & Ross, M. (2004). A continuous-time GARCH process driven by a Lévy process: Stationarity and second-order behaviour. Journal of Applied Probability, 41(3), 601–622.

Lin, X. S. (1999). Laplace transform and barrier hitting time distribution. Actuarial Research Clearing House, 1, 165–178.

Lipton, A. (2001). Mathematical methods for foreign exchange. Singapore: World Scientific.

Naik, V. (1993). Option valuation and hedging strategies with jumps in the volatility of asset returns. Journal of Finance, 48(5), 1969–1984.

Pelsser, A. (2000). Pricing double barrier options using Laplace transforms. Finance and Stochastics, 4, 95–104.

Pigorsch, C., & Stelzer, R. (2009). A multivariate Ornstein–Uhlenbeck type stochastic volatility model. Working paper.

Raible, S. (2000). Lévy processes in finance: Theory, numerics, and empirical facts. Ph.D. Thesis, Freiburg University.

Reiner, E., & Rubinstein, M. (1991). Breaking down the barriers. Risk 4, 8, 28–35.

Rollin, S., Ferreiro-Castilla, A., & Utzet, F. (2011). A new look at the Heston characteristic function. Working paper.

Schöbel, R., & Zhu, J. (1999). Stochastic volatility with an Ornstein–Uhlenbeck process: An extension. Review of Finance, 3(1), 23–46.

Sepp, A. (2006). Extended CreditGrades model with stochastic volatility and jumps. Wilmott Magazine, 50–62.

Stein, E., & Stein, J. (1991). Stock price distributions with stochastic volatility: An analytical approach. Review of Financial Studies, 4, 727–752.

Author information

Authors and Affiliations

Corresponding author

Additional information

Peter Hieber acknowledges funding by the German Academic Exchange Service (DAAD).

Appendices

Appendix 1: Parameters of the Stein–Stein model

The functions \(L(u)\), \(M(u)\), and \(N(u)\) in the characteristic function are defined as

Appendix 2: Single barrier limit

In our series representation the limit \({a:=\ln (P)\rightarrow \infty }\) cannot be exchanged with the infinite summation over \(n\) as the series representation for \(X_{D,\infty }^{g(S_T)}(S_0)\) is not absolutely convergent. To derive the limiting expression, one has to change the series representation. Then, the limiting option price \(X_{D,\infty }^{g(S_T)}(S_0)\) is given by Theorem 1. For \(a:=\ln (P)\), \(b:=\ln (D)\), and \(x:=\ln (S_0)\), we obtain

If we change the parameterization [see He et al. 1998, Equations (2.3) and (2.4)], we get

This series is absolutely convergent, thus we can change limit and summation. In the limit \(a\rightarrow \infty \) only the “\(n=0\)” term remains, i.e.

Rights and permissions

About this article

Cite this article

Escobar, M., Hieber, P. & Scherer, M. Efficiently pricing double barrier derivatives in stochastic volatility models. Rev Deriv Res 17, 191–216 (2014). https://doi.org/10.1007/s11147-013-9094-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11147-013-9094-4