Abstract

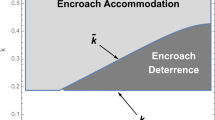

We show that the incentives of a vertically integrated supplier to “sabotage” the activities of downstream rivals can vary with both the type of sabotage and the nature of downstream competition. Cost-increasing sabotage is typically profitable under both Cournot and Bertrand competition. In contrast, demand-reducing sabotage is often profitable under Cournot competition, but unprofitable under Bertrand competition. Incentives for sabotage can vary non-monotonically with the degree of product differentiation.

Similar content being viewed by others

References

Beard T.R., Kaserman D., Mayo J. (2001). Regulation, vertical integration, and sabotage. Journal of Industrial Economics 49, 319–333

Bernheim B.D., & Willig R. (1996). The scope of competition in telecommunications. Monograph prepared for the AEI Studies in Telecommunications Deregulation.

Bulow J., Geanakoplos J., Klemperer P. (1985). Multimarket oligopoly: Strategic substitutes and complements. Journal of Political Economy 93, 488–511

Crémer J., Rey P., Tirole J. (2000). Connectivity in the commercial internet. Journal of Industrial Economics 48, 433–472

Crew M., Kleindorfer P., Sumpter J. (2005). Bringing competition to telecommunications by divesting the RBOCs. In: Crew M., Spiegel M. (Eds) Obtaining the best from regulation and competition. Norwell, MA, Kluwer Academic Publishers

Dixit A. (1986). Comparative statics for oligopoly. International Economic Review 27, 107–122

Economides N. (1998). The incentive for non-price discrimination by an input monopolist. International Journal of Industrial Organization 16, 271–284

Faulhaber G. (1987). Telecommunications in turmoil: Technology and public policy. Cambridge MA, Ballinger Publishing Company

Foros O., Kind H., Sogard L. (2002). Access pricing, quality degradation, and foreclosure in the internet. Journal of Regulatory Economics 22, 59–84

Kondaurova I., Weisman D. (2003). Incentives for non-price discrimination. Information Economics and Policy 15, 147–171

Lee S., Hamilton J. (1999). Using market structure to regulate a vertically integrated monopolist. Journal of Regulatory Economics 15, 223–248

Mandy D. (2000). Killing the goose that may have laid the golden egg: Only the data know whether sabotage pays. Journal of Regulatory Economics 17, 157–172

Mandy D., & Sappington D. (2003). Incentives for sabotage in vertically-related industries. Working Paper. Columbia, MO: University of Missouri.

Milgrom P., Roberts J. (1990). Rationalizability, learning, and equilibrium in games with strategic complementarities. Econometrica 58, 1255–1277

Reiffen D. (1998). A regulated firm’s incentive to discriminate: A reevaluation and extension of Weisman’s result. Journal of Regulatory Economics 14, 79–86

Salop S., Scheffman D. (1987). Cost-raising strategies. Journal of Industrial Economics 36, 19–34

Sappington D. (2006). On the merits of vertical divestiture. Review of Industrial Organization 29, 171–191

Sappington D., Weisman D. (2005). Self-sabotage. Journal of Regulatory Economics 27, 155–175

Sibley D., Weisman D. (1998a). The competitive incentives of vertically integrated local exchange carriers: An economic and policy analysis. Journal of Policy Analysis and Management 17, 74–93

Sibley D., Weisman D. (1998b). Raising rivals’ costs: The entry of an upstream monopolist into downstream markets. Information Economics and Policy 10, 451–470

Topkis D. (1995). Comparative statics of the firm. Journal of Economic Theory 67, 370–401

Vickers J. (1995) Competition and regulation in vertically related markets. Review of Economic Studies 62, 1–17

Vives X. (1984). Duopoly information equilibrium: Cournot and Bertrand. Journal of Economic Theory 34, 71–94

Vives X. (1999). Oligopoly pricing: Old ideas and new tools. Cambridge, MA, The MIT Press

Weisman D. (1995). Regulation and the vertically integrated firm: The case of RBOC entry into InterLATA long distance. Journal of Regulatory Economics 8, 249–266

Weisman D., Kang J. (2001). Incentives for discrimination when upstream monopolists participate in downstream markets. Journal of Regulatory Economics 20, 125–140

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Mandy, D.M., Sappington, D.E.M. Incentives for sabotage in vertically related industries. J Regul Econ 31, 235–260 (2007). https://doi.org/10.1007/s11149-006-9015-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-006-9015-7