Abstract

Consumer search is not only costly but also tiring. We characterize the intertemporal effects that search fatigue has on monopoly and oligopoly prices, the product lines offered by firms, and the provision of consumer assistance (i.e., advice). These effects vary based on the type of search that occurs among stores and within them. In contrast to standard search models, accounting for fatigue leads to product proliferation and time-varying prices, cyclical price dispersion, and consumer assistance. We analyze the welfare implications of search fatigue and discuss the conditions under which product proliferation and cyclical price dispersion are most pronounced.

Similar content being viewed by others

Notes

See, for example, Lippman and McCall (1976), Reinganum (1979), Stiglitz (1979), Weitzman (1979), Braverman (1980), MacMinn (1980), Salop and Stiglitz (1982), Burdett and Judd (1983), Carlson and McAfee (1983), and Rob (1985). Baye et al. (2006) provide a comprehensive review of the vast literature on consumer search.

Grubb (2015) surveys the literature in industrial organization and emphasizes the role of artificial product differentiation to exploit behavioral consumers. As will become clear, our findings can generalize to any channel through which the firms may engage in obfuscation. Focusing on excessive product proliferation yields concrete empirical predictions. However, our analysis also applies to other related phenomena, such as a lack of clear disclosure, price complexity, or any other mechanism through which firms may preserve rents in the face of competition.

Policy-makers are also increasingly aware of the problems that are caused by product proliferation as a way to exploit consumer search fatigue. In 2011, the UK energy regulator Ofgem found that there were “too many confusing tariffs, making it harder for consumers to shop around for the best deal” and proposed to restrict each energy provider to offer only one tariff per payment method.

In reality, such products might be inferior and have some positive, though lower value. We choose to make them worthless to make our analysis particularly tractable.

If we set \(\kappa =0\), the firms will be indifferent between producing any number of goods greater or equal to the equilibrium quantities we derive. The necessary upper bound on \(\kappa\) is different, based on the specifications in each version of our model and the particular search technology.

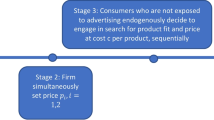

Although a consumer incurs no search cost once she is a shopper at time t, she incurs the cost \(c(x_{t-1})\) to become a shopper. We call this the search cost or the cost of search fatigue.

Note that the additional products that are produced by each firm are meant only to slow and fatigue a searching consumer. If we did not allow firms to provide assistance, then fatigued consumers might buy such decoy products in equilibrium. Thus, our model does not allow firms to manipulate uninformed or fatigued consumers which might be more prone to manipulation, and it restricts assistance to be well-meaning.

We assume that firms set prices after the consumer chooses whether to search to capture that firms often offer discounts after the consumer arrives at their store. In an alternative model in which firms post prices before the consumer searches, but then can offer discounts, a rational consumer will take into account each firm’s ex post behavior when deciding whether to use her search technology.

There also exists an equilibrium in which the consumer searches every other period because \(c(0)=0\). But, it is still the case that \(\ell ^*=1\), \(p^{1,*}=\bar{q}\) for all t, and no assistance is given, \(a_t^*=0\). Consumer and producer surplus are the same.

Traditional welfare losses of monopoly that arise from the reduction of quantity sold to consumers are absent in our model. Here, the monopolist is able to extract all the surplus from the consumers and thus does not exclude any consumer who has a valuation above the marginal cost of production of the good. Also, in the monopoly case, there is no incentive to over-produce or differentiate, as there typically is in models in which the threat of competition induces excess product proliferation (e.g., Schmalensee 1978).

The consumer has no reason to deviate from the equilibrium in Proposition 2. If she did so, she might rest in two subsequent periods. However, she has no incentive to do so because she has a search cost of zero. Resting twice, she would forego a current payoff of \(\bar{q}\) and would face the identical decision next period.

When a firm adds another product to its product line, that additional product increases consumers’ costs of search fatigue and lightens the load for other firms to engage in wasteful product proliferation to fatigue the consumer. Because product proliferation is privately costly, but beneficial for other firms, this positive externality could lead to free-riding and no product proliferation in equilibrium. However, we assume that \(\kappa\) is sufficiently small such that even avoiding to pay \(L^*\kappa\) in product-line costs is not a profitable deviation for a firm.

For this reason, any non-negative price for the redundant products may be a part of an equilibrium. Searchers and non-searchers alike are almost surely better off with a special product.

We are unable to prove in all generality that \(\varDelta (\delta =1,\mu _t)\) is strictly positive and concave in \(\mu _t\) for all \(0<\mu _t<\frac{1}{2}\) and hence \(\varDelta (\delta =1,\mu _t)<0\) and convex for all \(\frac{1}{2}<\mu _t<1\). This would establish that for \(\delta > \bar{\delta }(\mu _t)\) all consumers who search with the minority of consumers would switch to searching with the majority of consumers. In that case, for \(\mu _t < \frac{1}{2}\) all consumers will search in even periods and rest in uneven periods while the opposite would hold if \(\mu _t > \frac{1}{2}\) and the price distribution used by the firms would vary according to Proposition 2.

We have not uncovered an example in which the first type of steady state equilibrium arises, but it remains a theoretical possibility.

References

Baye, M., Morgan, J., & Scholten, P. (2006). Information, search, and price dispersion. In T. Hendershott (Ed.), Handbook on economics and information systems (pp. 323–371). Amsterdam: Elsevier Science.

Braverman, A. (1980). Consumer search and alternative market equilibria. Review of Economic Studies, 47, 487–502.

Burdett, K., & Judd, K. (1983). Equilibrium price dispersion. Econometrica, 51, 955–970.

Campbell, A., Mayzlin, D., & Shin, J. (2017). Buzz management. RAND Journal of Economics, 48(1), 203–229.

Carlin, B. (2009). Strategic price complexity in retail financial markets. Journal of Financial Economics, 91, 278–287.

Carlson, J., & McAfee, P. (1983). Discrete equilibrium price dispersion. Journal of Political Economy, 91, 480–493.

Dasgupta, P., & Maskin, E. (1986). The existence of equilibrium in discontinuous economic games, I: Theory. Review of Economic Studies, 53, 1–26.

Diamond, P. (1971). A model of price adjustment. Journal of Economic Theory, 3, 156–168.

Ellison, G., & Wolitzky, A. (2012). A search cost model of obfuscation. RAND Journal of Economics, 43(3), 417–441.

Ericson, K. M. (2014). Consumer inertia and firm pricing in the Medicare Part D prescription drug insurance exchange. American Economic Journal: Economic Policy, 6(1), 38–64.

Fasolo, B., Hertwig, R., Huber, M., & Ludwig, M. (2009). Size, entropy, and density: What is the difference that makes the difference between small and large real-world assortments? Psychology and Marketing, 26, 254–279.

Gabaix, X., & Laibson, D. (2006). Shrouded attributes, consumer myopia, and information suppression in competitive markets. Quarterly Journal of Economics, 121, 505–540.

Grubb, M. (2015). Behavioral consumers in industrial organization: An overview. Review of Industrial Organization, 47(3), 247–258.

Gu, Z., & Liu, Y. (2013). Consumer fit search, retailer shelf layout, and channel interaction. Marketing Science, 32, 652–668.

Hämäläinen, S. (2017). Obfuscation by Substitutes, Drowning by Numbers. Working Paper, University of Helsinki.

Hortaçsu, A., Madanizadeh, S. A., & Puller, S. (2017). Power to choose: An analysis of consumer behavior in the Texas retail electricity market. American Economic Journal: Economic Policy, 9(4), 192–226.

Hurban, B. (2012). Don’t fall victim to daily deal fatigue. Fox Business. https://www.foxbusiness.com/features/dont-fall-victim-to-daily-deal-fatigue. Accessed 27 Aug 2018.

Lippman, S., & McCall, J. (1976). The economics of job search. Economic Inquiry, 14, 155–189.

MacMinn, R. (1980). Search and market equilibrium. Journal of Political Economy, 88, 308–327.

Mitchell, V. W., & Papavassiliou, V. (1999). Marketing causes and implications of consumer confusion. Journal of Product and Brand Management, 8, 319–339.

Petrikaite, V. (2018). Consumer obfuscation by a multiproduct firm. RAND Journal of Economics, 49, 206–223.

Reinganum, J. (1979). A simple model of equilibrium price dispersion. Journal of Political Economy, 87, 851–858.

Rob, R. (1985). Equilibrium Price Distributions. Review of Economic Studies, 52, 487–504.

Rosenthal, R. (1980). A model in which an increase in the number of sellers leads to a higher price. Econometrica, 48, 1575–1579.

Salop, S., & Stiglitz, J. (1977). Bargains and ripoffs: A model of monopolistically competitive price dispersion. Review of Economic Studies, 44, 493–510.

Salop, S., & Stiglitz, J. (1982). The theory of sales: A simple model of equilibrium price dispersion with identical agents. American Economic Review, 72(5), 1121–1130.

Schmalensee, R. (1978). Entry deterrence in the ready-to-eat breakfast cereal industry. The Bell Journal of Economics, 9, 305–327.

Spears, D. (2011). Economic decision-making in poverty depletes behavioral control. B.E. Journal of Economic Analysis & Policy, 11(1), 1–44.

Spiegler, R. (2006). Competition over agents with boundedly rational expectations. Theoretical Economics, 1, 207–231.

Stahl, D. (1989). Oligopolistic pricing with sequential consumer search. American Economic Review, 79, 700–712.

Sterling, G. (2007). Report: 7 out of 10 Americans Experience ‘Search Engine Fatigue’. Search Engine Land, October 23 and Kelton Research: Autobytel. http://www.searchengineland.com/report-7-out-of-10-americans-experience-search-engine-fatigue-12509. Accessed 27 Aug 2018.

Stiglitz, J. (1979). Equilibrium in product markets with imperfect information. American Economic Review, 69, 339–345.

Thompson, D., Hamilton, R., & Rust, R. (2005). Feature fatigue: When product capabilities become too much of a good thing. Journal of Marketing Research, 42, 431–442.

Varian, H. (1980). A model of sales. American Economic Review, 70, 651–659.

Weitzman, M. (1979). Optimal search for the best alternative. Econometrica, 47, 641–654.

Wilson, C. M. (2010). Ordered search and equilibrium obfuscation. International Journal of Industrial Organization, 28, 496–506.

Acknowledgements

We wish to thank Larry White (the editor) and two anonymous referees for comments and suggestions that greatly improved the paper. We are also grateful to Ricardo Alonso, Antonio Bernardo, Simon Board, Vince Crawford, Phil Leslie, Steven Lippman, Konstantin Milbradt, Barry Nalebuff, Martin Oehmke, Heikki Rantakari, Richard Saouma, Joel Sobel, Kosuke Uetake, Miguel Villas-Boas, Ivo Welch, Kevin Williams, and Jidong Zhou for helpful discussions and suggestions, as well as to seminar participants at Michigan, UCLA, Yale, the Southwest Economic Theory conference, the Econometric Society North American Summer Meetings, and the USC-UCLA Finance Day.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A

Proof of Proposition 1

The proof proceeds by backward induction within each period and by checking whether the firm or the consumer has a profitable deviation.

Suppose that \(\ell =1\). Then, the firm has no incentive to provide assistance. Therefore, \(a=0\) is consistent with an equilibrium. At \(\tau =2\), the firm chooses \(p=\bar{q}\) since: if \(p>\bar{q}\), the consumer does not purchase; and if \(p<{q}\), the firm earns strictly less. At \(\tau =1\), the consumer does not search, since \(\ell =1\). Searching after periods of rest is not a profitable deviation even though \(c(0)=0\).

Now, we can check if choosing \(\ell =1\) at \(t=0\) is optimal for the firm. Since the firm’s profit function is

choosing any \(\ell >1\) is not a profitable deviation. \(\square\)

Proof of Proposition 2

The proof proceeds by backward induction within each period. There are L products offered in the market, of which n are special products.

Suppose that the consumer becomes a shopper in period t and selects the product with the highest utility. Bertrand competition between the firms that offer identical products leads to \(p_{j}^{m}=0\) for all j and m. To show this, suppose that \(p_{j}^{m}=0\) for all j and m, and that firm j deviates by setting \(p_{j}^{m}>0\) for any m. For \(m\ge 2\), the payoff to the consumer from purchasing such a product from firm j would be negative which would lead to no sale. For \(m=1\), if \(p_{j}^{1}>0\), the consumer would purchase the special product from another firm. Therefore, increasing prices is not a profitable deviation. In this case, the consumer selects one of the special products from one of the n firms and earns a surplus of \(\bar{q}-c(x_{t-1})\). All firms earn zero profits.

Suppose that the consumer does not become a shopper in period t. The consumer is willing to buy the product to which she was allocated as long as it offers non-negative utility. If the consumer is randomly allocated to firm j and \(\ell _j>1\), the firm optimally chooses \(a_{j}=1\). For any \(\ell _{j}\), each firm j optimally sets prices \(p^{1}=\bar{q}\) and \(p^{j}>0\) for \(j \ne 1\), and its profits are \(\bar{q}\). All other firms earn zero profits. Each firm’s expected per period profit is equal to \(\frac{\bar{q}}{n}\). The consumer earns zero surplus.

Hence, the consumer becomes a shopper in period t if and only if \(\bar{q}>c(x_{t-1})\). If the consumer did not become a shopper in period \(t-1\) (i.e., \(x_{t-1}=0\)), she becomes a shopper in period t because \(\bar{q}>0\). Let \(\bar{L}\) be the smallest integer such that \(\bar{q} \le c(\bar{L})\). If \(L < \bar{L}\), the consumer becomes a shopper in every period, and each firm earns zero discounted expected profits. If \(L \ge \bar{L}\), the consumer becomes a shopper in all odd-numbered periods (\(t=1, t=3,\dots\)) and does not search in all even-numbered periods (\(t=2, t=4,\dots\)). In this case, each firm j earns discounted expected profits equal to

and the consumer’s expected discounted surplus is

Consider that search is all-or-nothing. We now show that \(L^*=\bar{L}\) is unique in equilibrium and that \(a_j=0\) in odd-numbered periods. Suppose that all firms except j choose to produce a total of \(x<\bar{L}\) products. It is straightforward to show that firm j prefers to produce \(\bar{L}-x\) products to deter search in all even-numbered periods. Now, suppose that the total number of products that are offered in the market is equal to \(\bar{L}\). If a particular firm j produces \(\ell _j^*+1\) instead of \(\ell _j^*\) products, it incurs an extra cost \(\kappa\) and thus reduces its expected discounted profits. If it instead produces only the special product, it avoids paying \((\ell _j^*-1)\kappa\) in product-line costs; but its (expected) per-period profit drops to zero. Because \(\kappa\) is small, this is never a profitable deviation. Finally, when the consumer searches in odd-numbered periods, firm j has a strict incentive to set \(a_j=0\) since \(c(\bar{L}-1)<\bar{q}\).

Now consider that search is sequential. Since the consumer will visit only one firm when rested, each firm has a strict incentive to produce \(\bar{L}\) products. If \(\ell _j < \bar{L}\) and the consumer visits firm j, she will become a shopper in the next period, and firm j will lose \(\frac{\delta \bar{q}}{n}\). Because \(\kappa (\bar{L})<\frac{\delta \bar{q}}{n}\), the firm has no incentive to deviate from producing \(\bar{L}\). Likewise, if firm j produces \(\bar{L}+1\) instead of \(\bar{L}\) products, it incurs an extra cost \(\kappa\) and reduces its expected discounted profits. This is not a profitable deviation. \(\square\)

Proof of Corollary 1

The logic of Proposition 2 for sequential search across firms holds here as well, except that each firm has an incentive to produce more than \(\bar{L}\) products. To see this, suppose each firm produces exactly \(\ell _j^*=\bar{L}\) and the consumer sorts products one-by-one. Assume that the consumer randomly chooses a product each time she decides to examine a subsequent one. Define \(P(\ell )\) as the probability that the consumer chooses the special product after at least \(\bar{L}\) draws. By construction, \(P(\ell )\) is increasing in \(\ell\) for \(\ell \ge \bar{L}\). With probability \(1-P(\ell )\), the consumer becomes a shopper again at \(t+1\), and each firm loses an expected surplus of \(\frac{\delta \bar{q}}{n}\). Because \(\kappa < [P(\bar{L}+1)-P(\bar{L})] \frac{\delta \bar{q}}{n}\), each firm has a strict incentive to produce more than \(\bar{L}\) products. \(\square\)

Proof of Proposition 3

Suppose the consumer searches sequentially with variable cost \(c(0)=0\) and selects the product with the highest utility. Bertrand competition between the firms that offer identical products leads to \(p_{j}^{m}=0\) for all j and m. The logic follows the same way as in the proof of Proposition 2 above. In this case, the consumer selects one of the special products from one of the n firms and earns a surplus of \(\bar{q}-c(x_{t-1})\). All firms earn zero profits.

Suppose the consumer has a variable search cost of \(c(x_{t-1})>0\). Then, following Diamond (1971), it is an equilibrium for each firm j with \(\ell _{j}\) to set prices \(p^{1}=\bar{q}\) and \(p^{j}>0\) for \(j \ne 1\). In such case, each firm has an incentive to provide advice \(a_j=1\) if the consumer is randomly paired with one of its non-special products. Taking this into account, there is no profitable deviation for the consumer to pay a positive search cost. In this case, the firm that attracts the consumer in this period earns \(\bar{q}\), and all other firms earn zero profits. Each firm’s expected per period profit is equal to \(\frac{\bar{q}}{n}\). The consumer earns zero surplus.

Hence, the consumer searches when \(c(0)=0\) and does not search otherwise. Therefore, it is optimal for each firm j to produce two products. If firm j deviates and produces only the special product, and the consumer visits this store, firm j loses an expected surplus of \(\frac{\delta \bar{q}}{n}\) next period. Since \(\kappa <\frac{\delta \bar{q}}{n}\), the firm has no incentive to deviate from producing two products. Likewise, if firm j produces three products instead, it incurs an extra cost \(\kappa\) and reduces its expected discounted profits. This is not a profitable deviation.

Given this, the consumer searches in all odd-numbered periods (\(t=1, t=3,\dots\)) and does not search in all even-numbered periods (\(t=2, t=4,\dots\)). Each firm j earns discounted expected profits equal to

and the consumer’s expected discounted surplus is

\(\square\)

Proof of Proposition 4

Outline of proof The proof proceeds by backward induction within each period. In each period, we first consider consumer buying behavior and the consumer assistance that is offered by each firm conditional on identifying which consumers are searching. Following that, we consider the firms’ pricing strategies. Working backward, we then consider the search decision by consumers. Finally, we show the existence of an equilibrium \((\ell ^*, F^*_t(p),a_t^*)\).

Step One: Buying behavior and consumer assistance

At any time t, \(\mu _t\)-type consumers identify all products and prices in the market and choose the one that gives the highest payoff. By construction, \(x_t=L\), so that their next period search cost is c(L). When a firm identifies a searching consumer, it chooses \(a_j=0\) as there is a cost to reducing future search costs and no benefit to giving assistance. At time t, \((1-\mu _t)\)-type consumers are randomly paired with a firm. In this case, the firm will offer \(a_j=1\) and direct the consumer to the product that is most profitable for the firm. As we will show shortly, in equilibrium this is the special product.

Step Two: Pricing

First, let us consider the price of the special product and assume that the firm always directs \((1-\mu _t)\)-types to this product. Eventually, we will show that this is indeed always optimal in equilibrium. Define \(J^{*}\) as the set of firms that quote the lowest price for the special product and \(n_{j^{*}}\) as the number of firms in \(J^{*}\). Then, the payoff function for each firm \(j \in N\) is

where the expected demand \(Q_j\) is calculated as

Given this, the payoff to each firm is continuous, except when its price is the lowest and equal to at least one of its competitors.

We prove existence of a symmetric mixed-strategy equilibrium by appealing to Theorem 5 in Dasgupta and Maskin (1986). Using their notation, let \(A_j=[0,\bar{q}]\) be the action space for firm j and let \(a_j \in A_j\) be a price in that space. As such, \(A_j\) is non-empty, compact, and convex for all j. Define \(A= \times _{j \in N} A_j\) and \(a= (a_1, \ldots ,a_n)\). Let \(U_j:A \rightarrow \mathbb {R}\) be defined as the profit function in (A5). Define the set \(A^{*}(j)\) by

and the set \(A^{**}(j) \subseteq A^{*}(j)\) by

Therefore, the payoff function \(U_j\) is bounded and continuous, except over points \(\bar{a} \in A^{**}(j)\). The sum \(\sum _{j \in N} U_j(a)\) is continuous since discontinuous shifts in demand from informed consumers between firms at points in \(A^{**}= \times _{j \in N} A^{**}(j)\) occur as transfers between firms that have the same low price in the industry. Finally, it is straightforward to show that \(U_j(a_j,a_{-j})\) is weakly lower semi-continuous. Since any time \(p_i=p_j=p_{min}\), firm i and j share the demand, there exists a \(\lambda \in [0,1]\) large enough such that

for \(\epsilon\) arbitrarily small. Rearranging and letting \(\epsilon \rightarrow 0\) yields

which is true for all \(\lambda \ge \frac{1}{2}\). Therefore by Theorem 5 in Dasgupta and Maskin (1986), there exists a symmetric mixed-strategy equilibrium for this subgame, conditional on the firms always directing non-searching consumers to the special product.

We can now prove properties about \(F^*(p)\), again conditional on the firm always directing consumers to the special product:

-

1.

Continuity Suppose that there did exist a countable number of mass points in the distribution of \(F^*(p)\). Then, for any \(p>0\), we can find a mass point \(p'\) and an \(\epsilon >0\) such that \(f^*(p')=a>0\) and \(f^*(p' -\epsilon )=0\). Now consider a deviation by firm j to choose \(\hat{F}(p)\) such that \(\hat{f}(p')=0\) and \(\hat{f}(p'-\epsilon )=a\). Since \(E[\pi _j(p)]\) using \(F^*(p)\) is strictly less than using \(\hat{F}(p)\), this would be a profitable deviation. Last, there can never be a mass point at \(p=0\) because it is a dominated strategy to choose \(p=0\). Therefore, in equilibrium, no mass points can exist.

-

2.

Strict monotonicity (Increasing) Suppose that there exists an interval \([p_a,p_b]\) within \([0,\bar{q}]\) such that \(F(p_b)-F(p_a)=0\) and that \(F(p_a)>0\). Then, for any \(\hat{p}\) such that \(p_a<\hat{p}<p_b\), \([1-F(\hat{p})]^{n-1}= [1-F(p_a)]^{n-1}\). Since \(\hat{p}[1-F(\hat{p})]^{n-1}> p_a [1-F(p_a)]^{n-1}\) and \(\hat{p}[1-(1-F(\hat{p}))^{n-1}]> p_a [1-(1-F(p_a))^{n-1}]\), then there exists a profitable deviation. Thus, \(F(p_b)-F(p_a)\ne 0\) for any interval \([p_a,p_b]\) within \([0,\bar{q}]\).

Given continuity and strict monotonicity, we can write the symmetric F(p) explicitly. For any price p that a firm may choose,

Since each firm needs to be indifferent between setting an price over a support \([p^*,\bar{q}]\), we can write

Rearranging yields the expression in (1). We can then solve

for \(p^*\) which yields (2). Finally, inspecting (2), it is clear that \(p^*>0\) for any \(\mu _t <1\). Therefore, the firms will always direct non-searching consumers to the special product because they do not make positive profits by selling alternative products.

The comparative statics in Proposition 4 regarding \(\mu _t\) and n are derived by straightforward differentiation. Taking the limit of \(1-F_t(p)\) yields

which implies that as \(n \rightarrow \infty\), \(F_t(p) \rightarrow 0\) for all p.

Step Three: Consumer Search Decision

For the consumers with \(x_{t-1} >0\), they will search if and only if

For now, let us suppose that the firms choose their product lines so that (A11) does not hold. Indeed, we will show this to be the case in step four below.

Given this, any consumer with \(x_{t-1}=0\) has the option to search since \(c(0)=0\) or to rest again and search in the next period with those currently with \(x_{t-1} >0\). Let us consider this choice when the proportion of currently rested consumers is \(\mu _t=r\). When the consumer decides to follow the equilibrium strategy to search this period, her expected discounted payoff is

where \(E[\min \{p\} \vert r]\) denotes the expected minimum price when a proportion r of consumer searches. If she deviates and rests again, her payoff is

Note that the cost of search does not enter her payoffs because \(c(0)=0\). Thus, from Eqs. (A12) and (A13) the consumer has an incentive to deviate if and only if

By definition, we have \(E[p \vert r] > E[\min \{p\} \vert r]\) and \(E[p \vert 1-r] - E[\min \{p\} \vert 1-r]\). Thus, for sufficiently small \(\delta\) this inequality is not satisfied, and the consumer does not find it profitable to deviate from the equilibrium strategy. Therefore, there exists a \(\bar{\delta }\) such that if \(\delta < \bar{\delta }\), \(\mu _t=r\) for all odd periods \(t \in \{1,3,\ldots \}\) and is equal to \(1-r\) otherwise.

Step Four: Firms’ Choice of Product Lines

Given that \(c(\cdot )\) is strictly increasing in its argument, there exists an \(\bar{L}\) such that \(\bar{q}- E[p_{min}|F(p)]< c(\bar{L})\), so the consumer does not search. With the condition that \(\kappa\) is small, proving that any \(\ell ^*\) that induces \(L=\bar{L}\) follows the same logic as in Proposition 2. \(\square\)

Proof of Proposition 5

The proof follows the exact same logic as the proof of Proposition 4. The only difference is the computation of \(F_t(p)\).

In any period t, for any price p that a firm may choose,

Since each firm needs to be indifferent between setting an price over a support \([p^*,\bar{q}]\), we can write

Rearranging yields the expression in (4). We can then solve

for \(p^*\) which yields (5).

The comparative statics with regard to \(\lambda\) in Proposition 5 are derived by straightforward differentiation. \(\square\)

Appendix B

Let us reconsider the all-or-nothing search model that was posed in Sect. 2 with the following differences: To make the analysis easier, suppose that in each period, every firm chooses prices from \([0,\infty )\) for each of its products. More interestingly, let us relax the assumption with regard to random allocation of the consumer to products in the market when she does not search. Let us suppose that for any \(t \ge 2\), if the consumer does not search, she does not incur a cost and remains with the firm with whom she previously transacted. We call this the consumer’s incumbent firm.

Proposition B1

(Inertia) Suppose that n firms compete in a dynamic all-or-nothing search setting with inertia. Then, there exists an equilibrium with\(L^*=\bar{L}\)and

-

1.

In all odd-numbered periods (\(t=1, t=3,\ldots\)), the consumer searches,\(a^*_j=0\)for all j, and \(p_j^{m,*}=0\)for all \(j\in N,m \in \ell _j\).

-

2.

In all even-numbered periods (\(t=2, t=4,\ldots\)), no consumer search occurs, \(a_j=1\)for all j,\(p_j^{1,*}=\bar{q}\)for all j, and \(p_j^{m,*}>0\)for all \(j \in N, m \in \ell _j\)such that\(m > 1\).

Each firm earns discounted expected profits equal to

and the consumer’s expected discounted surplus is

Proof of Proposition B1

Suppose that there are \(L>n\) products that are offered in the market and that the consumer does not search in period \(t=1\). The consumer is willing to buy the product to which she was allocated as long as it offers non-negative utility. If the consumer is randomly allocated to firm j and \(\ell _j>1\), the firm optimally chooses \(a_{j}=1\). For any \(\ell _{j}\), each firm j optimally sets prices \(p^{1}=\bar{q}\) and \(p^{j}>0\) for \(j \ne 1\), and its profits are \(\bar{q}\). All other firms earn zero profits during that period, and the consumer earns zero surplus.

Suppose that the consumer does not search in period \(t \ge 2\) and remains with her incumbent firm. Again, the consumer is willing to buy a product as long as it offers non-negative utility. If \(\ell _j>1\), the firm optimally chooses \(a_{j}=1\). For any \(\ell _{j}\), each firm j optimally sets prices \(p^{1}=\bar{q}\) and \(p^{j}>0\) for \(j \ne 1\), and its profits are \(\bar{q}\). All other firms earn zero profits in that period, and the consumer earns zero surplus.

Now, consider that the consumer searches in period t and selects the product with the highest utility. Bertrand competition between the firms that offer identical products leads to \(p_{j}^{1}= 0\) for all j. To see this, assume that \(p_{j}^{1}=0\) for all j, and that firm k deviates by setting \(p_{k}^{1}>0\). Since \(p_{k}^{1}>0\), the consumer would purchase the special product from another firm. Therefore, increasing prices is not a profitable deviation.

Hence, the consumer searches in period t, if and only if \(\bar{q}>c(x_{t-1})\). If the consumer did not search in period \(t-1\) (i.e., \(x_{t-1}=0\)), she searches in period t because \(c(0)<\bar{q}\). Recall that \(\bar{L}\) is the smallest integer such that \(\bar{q} \le c(\bar{L})\). If \(L < \bar{L}\), the consumer searches in every period, and each firm earns zero discounted expected profits. If \(L \ge \bar{L}\), the consumer searches in all odd-numbered periods (\(t=1, t=3,\ldots\)) and does not search in all even-numbered periods (\(t=2, t=4,\ldots\)). In this case, each firm j earns discounted expected profits equal to

and the consumer’s expected discounted surplus is

Suppose that in equilibrium all other \(n-1\) firms choose to produce a total of \(x<\bar{L}\) products. We now show that firm j prefers to produce \(\bar{L}-x\) products to deter search in all even-numbered periods. The assumption that \(\kappa\) is small assures this to be the case. Further, when the consumer searches in odd-numbered periods, firm j has a strict incentive to set \(a_j=0\) since \(c(\bar{L}-1)<\bar{q}\).

Suppose that the total number of products offered in the market is equal to \(\bar{L}\). If a particular firm j produces \(\ell _j^*+1\) instead of \(\ell _j^*\) products, it incurs an extra cost \(\kappa\) and thus reduces its expected discounted profits. Now, suppose that the firm only produces the special product. It avoids paying \((\ell _j^*-1)\kappa\) in product line costs, but its (expected) per-period profit drops to zero. Because \(\kappa\) is small, this is never a profitable deviation.

Hence, there is a unique equilibrium number of products \(L=\bar{L}\). \(\square\)

Rights and permissions

About this article

Cite this article

Carlin, B.I., Ederer, F. Search Fatigue. Rev Ind Organ 54, 485–508 (2019). https://doi.org/10.1007/s11151-018-9657-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-018-9657-5