Abstract

An outside innovator invents a new product the viability of which is uncertain. The production technology is licensed to a number (strategic choice) of risk-averse potential Cournot producers by means of: an up-front fee, a per-unit royalty, an ad valorem royalty, or a two-part tariff. The incentive to innovate is maximized with a pure up-front fee if potential producers are (or are close to) risk neutral. Otherwise, it is maximized with a combination of up-front fee and ad valorem royalty. Any scheme that contains a royalty component (per-unit or ad valorem) maximizes the innovation diffusion. Irrespective of the magnitude of licensees’ risk aversion, the innovator and consumers are better off, but licensees are worse off with schemes that have an ad valorem royalty component than with a per-unit royalty component. Consumers are best off with pure up-front fee that avoids double marginalization, even though the innovator optimally sells only one license and creates a monopoly. The results remain similar for a risk-averse innovator, but change considerably with a producing innovator.

Similar content being viewed by others

Notes

For instance, in a sample of 278 licensing contracts, 78\(\%\) include a royalty, among which 96\(\%\) use ad valorem schemes (see Bousquet et al. 1998). The IFA Educational Foundation and Frandata (2000) reported that 1006 out of a sample of 1226 franchisors charged their franchisees ad valorem royalty, mostly with some level of up-front fee.

For the 160 examples of failed product innovation (including products of Facebook, Amazon, Microsoft, Google, Nike, and others), see https://www.cbinsights.com/research/corporate-innovation-product-fails/.

The assertion that innovation’s diffusion is at maximum for a two-part tariff with ad valorem royalty is established numerically. All other results of the paper are proven analytically (including the proof of maximum diffusion with a pure ad valorem royalty).

However, franchising is different from licensing of innovations in several aspects. First, licensing (franchising) is not the only source of revenue for the franchisor but it is for the innovator. Often franchisors force franchisees to buy raw material from suppliers who in return give franchisors some kickback. Another major difference is in the amount of control the franchisors have with respect to franchisees. Franchisors protect their trademarks and logos and control the business concept.

References

Blair, R., & Lafontaine, F. (2005). The economics of franchising. Cambridge: Cambridge University Press.

Bousquet, A., Cremer, H., Ivaldi, M., & Wolkowicz, M. (1998). Risk sharing in licensing. International Journal of Industrial Organization, 16, 535–554.

Colombo, S., & Filippini, L. (2015). Patent licensing with Bertrand competitors. The Manchester School, 83(1), 1–16.

Fan, C., Jun, B., & Wolfstetter, E. (2018). Per unit versus ad valorem royalty licensing. Economics Letters, 170, 71–75.

Hernandez, M. R., & Llobet, G. (2006). Patent licensing revisited: Heterogeneous firms and product differentiation. International Journal of Industrial Organization, 24(1), 149–175.

Hesse, R. (2015). Business review letter from the acting assistant attorney general of the Antitrust Division, US Department of Justice, to Michael A. Lindsay. Institute of Electrical and Electronics Engineers, Piscataway, February 2.

Heywood, J., Li, J., & Ye, G. (2014). Per unit versus ad valorem royalties under asymmetric information. International Journal of Industrial Organization, 37(C), 38–46.

IFA Educational Foundation and Frandata Corp. (2000). The profile of franchising. Washington, DC: IFA.

Llobet, G., & Padilla, J. (2016). The optimal scope of the royalty base in patent licensing. The Journal of Law and Economics, 59(1), 45–73.

San Martin, M., & Saracho, A. I. (2015). Optimal two-part tariff licensing mechanisms. The Manchester School, 83, 288–306.

Sen, D., & Tauman, Y. (2007). General licensing schemes for a cost-reducing innovation. Games and Economic Behavior, 59, 163–186.

Teece, D. J. (2015). Are the IEEE proposed changes to IPR policy innovation friendly? Working paper Series No. 2. Berkeley: University of California, Tusher Center for the Management of Intellectual Capital.

Acknowledgements

We thank anonymous referees for very valuable comments. Special thanks to Prof. Lawrence White for his efforts to provide very detailed suggestions that improved the paper considerably. This paper was initiated when the first author was a postdoc in IDC, Herzliya and later in School of Mathematical Sciences, Tel Aviv University.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Proposition 1

Suppose the innovator sells k licenses. Let \(q_i\) be the output of licensee i who maximizes his expected utility \(\rho \big [(p-c) q_i\big ]^{\frac{1}{\eta }}\). The total Cournot output is \(Q(k)= \frac{k\,(a-c)}{(k+1)b}\) and each licensee makes a profit equal to \(\frac{(a-c )^2}{(k+1)^2 b}\). A licensee is willing to pay up front X s.t. \(U(X)=\rho \bigg (\frac{(a-c )^2}{(k+1)^2 b}\bigg )^{\frac{1}{\eta }}\). Thus \(X=\rho ^{\eta }\frac{(a-c )^2}{(k+1)^2 b}\). The total revenue of the innovator is \(\rho ^{\eta } \frac{k(a-c )^2}{(k+1)^2 b}\), which is maximized at \(k^*=1\). The innovator obtains upfront \(\rho ^{\eta } \frac{(a-c)^2}{4b}\) and the licensee obtains \((1-\rho ^{\eta }) \frac{(a-c)^2}{4b}\) with probability \(\rho\) and \(-\rho ^{\eta } \frac{(a-c)^2}{4b}\) with probability \(1-\rho\). The closer to risk neutrality is the licensee, the higher is the innovator’s payoff. The licensee is left with zero profit if he is risk neutral (\(\eta =1\)). □

Proof of Proposition 2

Given the strategy (k, r) of the innovator, licensee i maximizes \(\bigg (p(Q)\,-c-r\bigg )\,q_i\) over \(q_i\). The Cournot quantity is

The innovator maximizes his expected revenue \(E \Pi ^I_r(k,r) =\rho \, r Q_r(k,r)\) over k and r. The optimal royalty is \(r^*=\frac{a-c}{2}\) (independent of k) and the optimal number of licensees is \(k^*=N\). □

Proof of Proposition 3 i

Suppose k licensees compete simultaneously in quantities. Each licensee maximizes \(q_i\, (p\,(1-v)-c)\) over \(q_i\). The Cournot quantity and price are

The innovator’s set of relevant strategies is \(S= \bigg \{ (k,v)| 0\le v \le 1-\frac{c}{a},\, 0< k \le N\bigg \}\). By (12),

We first show that \(k^*=N\). Treating k as a continuous variable we have

Since \(v < 1-\frac{c}{a}\), by (14)

Case 1.1 \(1-\frac{2\,c}{a}\le v \le 1-\frac{c}{a}\). By (14), \(\,\,\frac{\partial E \Pi ^{I}_{v}}{\partial k}(k,v) > 0\), implying \(k_{v}^*=N\).

Case 1.2 \(0\le v<1-\frac{2\,c}{a}\). In this case, \(\,\,\frac{\partial E \Pi ^{I}_{v}}{\partial k}(k,v) > 0\) iff \(k < \frac{a(1-v)}{a(1-v)-2c}\), implying \(k_{v}^*= \min \bigg (\frac{a(1-v^*)}{a(1-v^*)-2c} , N \bigg )\).

Suppose \(k_{v}^*=\frac{a(1-v^*)}{a(1-v^*)-2c}\le N\), equivalently, \(v^*\le 1-\frac{2c\,N}{a(N-1)}\) and \(1-\frac{2c\,N}{a(N-1)}< 1-\frac{2\,c}{a}\).

Let \(g(v) \equiv E \Pi ^{I}_{v}(\frac{a(1-v)}{a(1-v)-2c},v)\). By (13),

g(v) is increasing in v and \(v^*\le 1-\frac{2c\,N}{a(N-1)}\), hence \(g(v^*) \le G(1-\frac{N\,2c}{a(N-1)})\). Since \((\frac{a(1-v^*)}{a(1-v^*)-2c},v^*)\) maximizes the revenue of the innovator, \(g(v^*) = g(1-\frac{2c\,N}{a(N-1)})\) and \(E\Pi ^{I}_{v}(\frac{a(1-v^*)}{a(1-v^*)-2c},v^*) = E\Pi ^{I}_{v}(N,1-\frac{2c\,N}{a(N-1)})\). Thus \(v^*=1-\frac{2c\,N}{a(N-1)}\) and \(k^*_{v}=N\) must hold. □

Lemma 1

\(E\Pi ^{I}_{v}(N,v)\) is single peaked in \(v \in \left[ 0, 1-\frac{c}{a}\right]\). The maximizer \(v^*\) is an interior point.

Proof

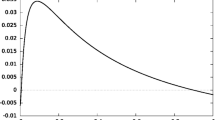

and it is continuous in v. It is easy to verify that \(\frac{\partial E\Pi ^{I}_{v} }{\partial v} (N,0)>0\) and \(\frac{\partial E\Pi ^{I}_{v} }{\partial v} (N,1-\frac{c}{a})<0\). Hence \(\frac{\partial E\Pi ^{I}_{v} }{\partial v} (N,v)=0\) has a solution in \((0, 1-\frac{c}{a})\). Next

For \(v \in [0, 1-\frac{c}{a}]\), in the former case, \(\frac{\partial E\Pi ^{I}_{v} }{\partial v} (N,v)\) starts positive, monotonically decreasing in v and ends negative. In the latter case, \(\frac{\partial E\Pi ^{I}_{v} }{\partial v} (N,v)\) starts positive, first increasing then decreasing in v, and ends negative. Hence the solution to \(\frac{\partial E\Pi ^{I}_{v} }{\partial v} (N,v)=0\) is unique and \(E\Pi ^{I}_{v}(N,v)\) is single peaked. Its maximizer turns out to be

where \(B=3c \left( { \sqrt{3}\sqrt{\left[ (a+c)N-a\right] ^3\,c+27\,a^2{N}^2c^2}}-9\, N c\,a \right)\). □

Corollary 2

\(\frac{\partial E\Pi _{v}^{I}}{\partial v }(N,v) >0\) implies \(v<v^*\), and \(\frac{\partial E\Pi _{v}^{I}}{\partial v }(N,v) <0\) implies \(v>v^*\).

Given the complicated formula of \(E\Pi _{v}^{I}(N,v)\), it is impossible for us to compare its value under different v. However, \(\frac{\partial E\Pi _{v}^{I}}{\partial v }(N,v)\) is relatively neat, enabling us to do the comparison.

Proof of Proposition 3 ii

Next we compute the limit of \(v^*\) as N grows indefinitely. By (13), for every \(v \in [0, 1-\frac{a}{c}]\), \(E\Pi ^{I}_{v}(v,N) = \dfrac{\rho \,Nv\,[a\,(1-v)-c] [a (1-v)+c\,N]}{(N+1)^2b\,(1-v)^2 }\),

Hence \(\lim \nolimits _{N \rightarrow \infty } E\Pi ^{I}_{v}(v,N) =\frac{cf[a(1-v)-c]}{b\,(1-v)^2} \equiv E\Pi ^{I}_{v}(v,\infty )\). Since \(v^* \equiv v^*(N)\) is the maximizer of \(E\Pi ^{I}_{v}(v,N)\) over v and \(E\Pi ^I_{v}\) is continuous in \([0, 1-\frac{a}{c}]\),

The sequence \(v^*(N)\) is bounded and therefore has a cluster point. Namely, there exists a subsequence \((N_m)_{m=1}^{\infty }\) and \({\hat{v}}\) s.t. \(v^*(N_m ) \rightarrow {\hat{v}}\) as \(m \rightarrow \infty\). By (19),

By continuity of \(E\Pi _{v}^I\) in v, taking the limit as \(m \rightarrow \infty\), we have for all \(v \in [0, 1-\frac{c}{a}]\),

proving that \({\hat{v}}\) is a maximizer of \(E\Pi ^I_{v}(v,\infty )\) over v. Since \(E\Pi ^I_{v}(v,\infty ) =\frac{cf[a(1-v)-c]}{b\,(1-v)^2}\) has a unique maximizer \(\frac{a-c}{a+c}\), \(\lim \nolimits _{N \rightarrow \infty } v^*(N)\) exists and it is \({\hat{v}} =\frac{a-c}{a+c}\). □

Proof of Proposition 3 iii

Follows from standard Cournot computation. □

Proof of Proposition 4 i

Follows directly from Propositions 1, 2 and 3.□

Proof of Proposition 4 ii

By Proposition 3, the optimal ad valorem price is \(p^*_{v}= \dfrac{a(1-v^*)+Nc}{(N+1)(1-v^*)}\). Hence \(p^*_{v}>\frac{a+c}{2}=p^*_f\) is equivalent to \(v^*>1-\frac{2Nc}{(a+c)(N+1)-2a}\). Since

by Corollary 1, \(v^*>1-\frac{2Nc}{(a+c)(N+1)-2a}\) and \(p^*_{v}>p^*_f\).

Comparing (9) and (7), \(p^*_{v}<p^*_r\) iff \(v^* < \frac{a-c}{a+c}\equiv {\hat{v}}\). By Corollary 1, since \(\dfrac{\partial E \Pi ^{I}_{v} }{\partial v}|_{v={\hat{v}}}=-\dfrac{\rho a(a-c)^2N}{ 4bc \left( N+1 \right) ^{2} } <0\), we have

and \(p^*_f<p^*_{v}<p^*_r\). By (3), (9) and (7), \(p^*_f=\lim \nolimits _{N \rightarrow \infty }p^*_{v}=\lim \nolimits _{N \rightarrow \infty }p^*_r\). □

Proof of Proposition 4 iii

Since \(1-\frac{c}{a}-{\hat{v}}= \frac{c(a -c)}{a (a +c)} >0\), by (13)

It is easy to verify that \(a>c\) implies \(E\Pi ^{I}_{v}(N,{\hat{v}})>E\Pi ^{I^*}_r\), hence \(E\Pi ^{I^*}_{v}> E\Pi ^{I^*}_{r}\).

By (ii), \(p^*_{v}> p^*_f= p_M\), where \(p_M\) is the monopoly price. Hence \(E\Pi ^{I^*}_{v}+N\cdot E\Pi ^{L^*}_{v}=(p^*_{v}-c) Q^*_{v} < \Pi _M= \frac{\rho (a -c)^2}{4\,b}\), where \(\Pi _M\) is the expected monopoly profit. By Proposition 3, \(E\Pi ^{L}_{v}>0\), hence \(E\Pi ^{I^*}_{v}< \frac{\rho (a -c)^2}{4\,b}\).

By (1) and (5), \(\Pi ^{I^*}_f < E\Pi ^{I^*}_{r}\) iff \(\rho ^{\eta -1} < \frac{N}{N+1}\), or equivalently, \(\eta >1 + \ln \frac{ N}{N+1}/\ln \rho \equiv \eta _2\).

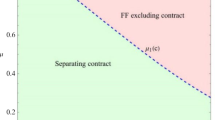

By (1) and (11), \(\Pi ^{I^*}_f > E\Pi ^{I^*}_{v}\) iff \(\rho ^{\eta -1} > \frac{N\,4b}{(N+1)^2 (a-c)^2}\frac{v^*\,[a\,(1-v^*)-c] [a (1-v^*)+c\,N]}{b\,(1-v^*)^2 }\), equivalently, \(1 \le \eta < 1+ \ln \bigg (\frac{ N\,4b}{(N+1)^2 (a-c)^2}\frac{v^*\,[a\,(1-v^*)-c] [a (1-v^*)+c\,N]}{b\,(1-v^*)^2 }\bigg ) /\ln \rho \equiv \eta _1\). As N grows indefinitely, \(\Pi ^{I^*}_f \le \Pi ^{I^*}_f+E\Pi ^{L^*}_f=\lim \nolimits _{N \rightarrow \infty }E\Pi ^{I^*}_{v}=\lim \nolimits _{N \rightarrow \infty }E\Pi ^{I^*}_{r}=\dfrac{\rho (a -c)^2}{4\,b}\). □

Proof of Proposition 4 iv

By (6) and (10), \(E\Pi ^{L^*}_r>E\Pi ^{L^*}_{v}\) iff \(\frac{(a -c)^2}{4}>\frac{[a(1-v^*)-c]^2}{1-v^*}\). Equivalently,

Let \(v_3=\frac{(a-c)(7a+c-\sqrt{a^2+c^2+14ac})}{8a^2}\). It is easy to verify that

Since J(v) is continuous and concave in v, \(v_3<v^*<{\hat{v}}\) is a sufficient condition for \(J(v^*)>0\). By (20), \(v^*<{\hat{v}}\) and we have

where

Notice that \(A_4>0\) iff \((a+c)^2 (a^2+c^2+14ac)>4c^2(3a+c)^2\). Equivalently, \((a-c)^4+ 4c[(a-c)^3+4a(a^2-c^2) ]>0.\) This holds for \(a>c\).

On the other hand, \(A_5>0\) iff \(\bigg [(a-c)^4+16ac^2(a+c)\bigg ]\sqrt{a^2+c^2+14ac}>128a^2c^3\). Equivalently, \(16ac^2(a+c)\sqrt{a^2+c^2+14ac}>128a^2c^3,\) which holds for all \(a>0, c>0\).

Thus \(h(N)>0\) and \(\dfrac{\partial E \Pi ^{I}_{v} }{\partial v}|_{v=v_3}>0\). By Corollary 1, \(v^*>v_3\). This proves that \(E \Pi ^{L^*}_{v}<E \Pi ^{L^*}_{r}\).

By (2) and (6) \(E \Pi ^{L^*}_{f}>E \Pi ^{L^*}_{r}\) iff \(\eta >1+ \ln \bigg [1-\frac{1}{(N+1)^2} \bigg ]/\ln \rho \equiv \eta _4\). By (2) and (10), \(E \Pi ^{L^*}_{f}<E \Pi ^{L^*}_{v}\) iff \(1 \le \eta <1+ \ln \bigg \{ 1-\frac{4[a(1-v^*)-c]^2}{(a-c)^2 (N+1)^2 (1-v^*)}\bigg \} /\ln \rho \equiv \eta _3\). \(\bigg (\eta _3 <\eta _4\) iff \(E\Pi ^{L^*}_r>E\Pi ^{L^*}_{v} \bigg )\). Finally, by (6) and (10), \(\lim \nolimits _{N \rightarrow \infty } E\Pi ^{L^*}_{v}(N)= \lim \nolimits _{N \rightarrow \infty }E\Pi ^{L^*}_{r}(N)=0\). □

Proof of Proposition 5

Note that \(\frac{\partial CS_{v}}{\partial v}(N,v) <0\). By (20), \(v^* <\frac{a-c}{a+c}\equiv {\hat{v}}\) for all \(N \ge 1\). Comparing (8) and (21),

Comparing (4) and (21), \(CS_f>CS_{v} \, {\text {iff}}\,\,\,v^* >1-\dfrac{2Nc}{(N-1)a+(N+1)c}\). Since

by Corollary 1, \(v^* >1-\dfrac{2Nc}{(N-1)a+(N+1)c}\) impling \(CS_f>CS_{v}\). Also,

By Proposition 4, since \(p^*_{v}> p^*_f=p_M\), \(E\Pi ^{I}_{v}(N,v)+N\cdot E\Pi ^{L}_{v}< \Pi _M=\Pi ^{I^*}_f+\Pi ^{L^*}_f\). We have

Let

then

t(v) is quadratic and convex in v, and \(t(v)=0\) has two solutions \(v_1=\dfrac{(N-2)(a-c)}{(N-2)(a-c)+2Nc}\) and \(v_2=\dfrac{a-c }{a+c}={\hat{v}}\). By (17),

Let \(\alpha (N)= (2c^2+5ac+a^2)N^2-4(a+c)(a-2c)N+4(a-c)(a-2c)\), which is increasing in N for \(N\ge 2\) and \(\alpha (2)=16c(a+2c)>0\). Also \(\alpha (1)=a^2-3ac+18c^2>0\) for all a and c. Hence \(\alpha (N) >0\) and \(\frac{\partial E\Pi _{v}^I}{\partial v} |_{v=v_1}>0\) for all \(N\ge 1\). By Corollary 1, \(v_1<v^*\) and by (20), \(v^*<v_2\). Since \(v_1<v^*<v_2\), \(\,\,t(v^*)<0\) and \(E\Pi ^{I^*}_{r}+N\cdot E\Pi ^{L^*}_{r}< E\Pi ^{I}_{v}(v^*)+N\cdot E\Pi ^{L}_{v}(v^*)\). □

Proof of Proposition 6

Given (k, r), the total Cournot output is \(Q(k,r)= \frac{k}{(k+1)b}(a-c-r)\), for \(r<a-c\) if demand is positive. The total royalty payment collected by the innovator is \(r\cdot Q(k,r)=\frac{kr(a-c-r)}{(k+1)b}\), which is maximized at \(r_{fr}^*= \frac{a-c}{2}\). The net profit of each licensee is \(\frac{(a-c)^2}{4b(k+1)^2}\), and his willingness to pay up front is F s.t. \(U(F)=\rho \cdot U(\frac{(a-c)^2}{4b(k+1)^2})\). Equivalently, \(F= \frac{\rho ^{\eta }(a-c)^2}{4b(k+1)^2}\). The total expected revenue of the innovator is therefore,

It is easily verified that

implying \(k_{fr}^*=N\) and

Comparing this with the pure up-front fee scheme (see (1)), we have \(\Pi ^{I^*}_{fr}> \Pi ^{I^*}_{f}\,{\text {iff}}\, \eta \ge \frac{\ln \big ( \frac{N^2+N}{N^2+N+1}\big )}{\ln \rho }\). □

Proof of Proposition 7

Given (k, v), each licensee obtains \([(1-v) p(k,v)-c]\, q(k,v)\) and is willing to pay up front F, s.t. \(U(F)=\rho U([(1-v) p(k,v)-c] q(k,v))\). Equivalently, \(F=\rho ^{\eta } [(1-v) p(k,v)-c]\, q(k,v)\).

The innovator’s expected revenue is

If \(\eta \ge \frac{\ln \big ( \frac{N^2+N}{N^2+N+1}\big )}{\ln \rho }\), by (22), \(E\Pi ^{I}_{fv}(N,{\hat{v}})-E\Pi ^{I^*}_{fr}=\dfrac{N(a-c)^3(\rho -\rho ^{\eta })}{4(a+c) b (N+1)^2}>0\). Hence \(E\Pi ^{I}_{fv}(N,{\hat{v}}) >E\Pi ^{I^*}_{fr}\) and \(E\Pi ^{I^*}_{fv}\ge E\Pi ^{I}_{fv}(N,{\hat{v}}) >E\Pi ^{I^*}_{fr}\). If \(\eta =1\), \(E\Pi ^{I}_{fv}(k,v)\) is maximized at \(v=0\) and \(v^*= \frac{\rho ^\eta (a-c)^2}{4b}\). The optimal licensing scheme boils down to pure up-front fee described in Proposition 1. Therefore, there exists \({\tilde{\eta }} \in \bigg (1, \frac{\ln \big ( \frac{N^2+N}{N^2+N+1}\big )}{\ln \rho }\bigg )\) s.t. the optimal scheme consists of positive up-front fee and positive ad valorem royalty if \(\eta \ge {\tilde{\eta }}\), and the optimal scheme is pure up-front fee if \(1 \le \eta < {\tilde{\eta }}\).

Part (iii) follows from \(p_{fv}=p_{v}\). □

Proof of Claim 1

and it is continuous in v. It is easy to verify that \(\frac{\partial E\Pi ^{I}_{v} }{\partial v} (k,0)>0\) and \(\frac{\partial E\Pi ^{I}_{v} }{\partial v} (k,1-\frac{c}{a})<0\). Also,

For \(v \in [0, 1-\frac{c}{a}]\), \(\frac{\partial E\Pi ^{I}_{fv} }{\partial v} (k,v)\) starts positive, monotonically decreases in v and ends with a negative value. The solution to \(\frac{\partial E\Pi ^{I}_{fv} }{\partial v} (k,v)=0\) is unique and it maximizes \(E\Pi ^{I}_{fv}(k,v)\). □

Proof of Proposition 8

As explained in the paragraph exceeding Proposition 8, if the innovator sells licenses, he charges up-front fee only. Suppose the innovator sells \(k-1\), \(k\ge 2\), licenses, we have

Hence the innovator’s payoff is decreasing in k for \(k \ge 3\). The optimal k is thus either 2 or 3. Since

we have

Let \(\Delta _1(\rho )= \bigg (\frac{1+\rho ^\eta }{9} \bigg )^{ 1/\eta } -\bigg (\frac{1+2\rho ^\eta }{16} \bigg )^{ 1/\eta }- (1-\rho )\bigg [ \left( \frac{1}{8}\right) ^{1/\eta }-\left( \frac{1}{9} \right) ^{1/\eta } \bigg ]\). Then

Since \(\frac{1}{9}\bigg (\frac{1+\rho ^\eta }{9} \bigg )^{ \frac{1}{\eta }-1}- \frac{1}{8}\bigg (\frac{1+2\rho ^\eta }{16} \bigg )^{\frac{1}{\eta }-1} >0\) is equivalent to \(2(\frac{1}{8} )^{\frac{1}{\mu -1}}-\left( \frac{1}{9}\right) ^{\frac{1}{\mu -1}}>-2\rho ^\mu \bigg [(\frac{1}{8} )^{\frac{1}{\mu -1}}-\left( \frac{1}{9}\right) ^{\frac{1}{\mu -1}} \bigg ]\), which always holds, we have \(\Delta _1(\rho )\ge \Delta _1(0)=2\left( \frac{2}{9}\right) ^{1/\eta }-\left( \frac{1}{16}\right) ^{1/\eta }-\left( \frac{1}{8}\right) ^{1/\eta }>0\). Therefore \(EU(\Pi ^I + F)>EU(\Pi ^I +2 F)\).

Finally, \(EU(\Pi ^I + F) > EU(\Pi ^M)\) iff \(h(\rho )\equiv \rho \bigg (\frac{1+\rho ^\eta }{9} \bigg )^{ 1/\eta } + (1-\rho ) \bigg (\frac{\rho ^\eta }{9} \bigg )^{ 1/\eta }-\rho \cdot \bigg (\frac{1}{4} \bigg )^{1/\eta }>0\). It is easy to verify that \(h'(\rho )<0, h(0)>0\) iff \(\eta >\frac{\ln 9/4}{\ln 2}\) and \(h(1)<0\). Hence there exists a unique \(\rho _0\) s.t. \(h(\rho _0)=0\) and \(EU(\Pi ^I + F) > EU(\Pi ^M)\) iff \(\rho <\rho _0\). □

Rights and permissions

About this article

Cite this article

Ma, S., Tauman, Y. Licensing of a New Product Innovation with Risk Averse Agents. Rev Ind Organ 59, 79–102 (2021). https://doi.org/10.1007/s11151-020-09797-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-020-09797-5