Abstract

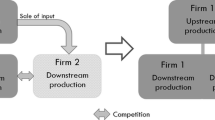

This article explains the inherent loss of an indirect competitor and reduction in competition when a vertical merger raises input foreclosure concerns. We then calculate a measure of the effective increase in the HHI measure of concentration for the downstream market, and we refer to this “proxy” measure as the “dHHI.” We derive the dHHI measure by comparing the pricing incentives and associated upward pricing pressure (“UPP”) that are involved in two alternative types of acquisitions: (1) vertical mergers that raise unilateral input foreclosure concerns (and the associated vertical GUPPI measures); and (2) horizontal acquisitions of partial ownership interests among competitors that raise unilateral effects concerns (and the associated modified GUPPI and modified HHI measures). This dHHI measure can be a useful tool for vertical merger analysis.

Similar content being viewed by others

Notes

United States v. AT&T, Inc., 916 F.3d 1029, 1032 (D.C. Cir. 2019).

United States v. Sabre Corp., No. 19-1548-LPS, 2020 U.S. Dist. LEXIS 64637 (D. Del. Apr. 7, 2020).

The draft VMGs which were released for public comment on January 10, 2020, suggested a safe harbor that was based on a 20% market share threshold, under which vertical mergers would have been considered unlikely to be anticompetitive. The agencies received more than 70 comments on the January draft, and the final version included significant improvements—including the elimination of the 20% market share “safe harbor.” (VMGs 2020).

The model assumes for simplicity that there initially are no vertically integrated firms. Each downstream firm sets the price of its product unilaterally: in the sense that the firm takes the prices that are charged by all of the other firms as given. Similarly, each upstream firm sets the prices of its input to the downstream firms unilaterally—it takes the prices charged by the other upstream firms as given—but takes into account that raising the price of its input to a given downstream firm will induce that downstream firm to increase its downstream price in response (Inderst and Valletti 2011). Other models assume that each upstream firm negotiates bilaterally with each downstream firm over the price of the input (Moresi 2020; Rey and Vergé 2020).

The input foreclosure also could lead to accommodating responses either by the upstream rivals of the merged firm—they also would increase their input prices to the targeted downstream rivals—or by the non-targeted downstream rivals: they also would increase their output prices to consumers. These accommodating responses would exacerbate the anticompetitive effects of input foreclosure (Krattenmaker and Salop 1986; Ordover et al., 2019).

We assume unilateral conduct pre-merger. Intuitively, if pre-merger the upstream merging firm were to raise its input prices to downstream firms, the other upstream firms would not match the price increase because they would anticipate that the upstream merging firm likely would then “cheat” and reduce price. So, upstream coordination does not occur pre-merger. Post-merger, however, upstream coordination that is targeted at the rivals of the downstream merging firm is more likely to occur than is true pre-merger: The upstream merging firm would have a weaker incentive to “cheat” since reducing its input prices to downstream rivals would reduce the downstream profit that would be earned by the downstream merging firm (Nocke and White 2007; Normann 2009).

Downstream coordination increases the profit of the downstream merging firm, but reduces the profit that the upstream merging firm earns from sales to downstream rivals. It is possible that the overall effect of downstream coordination would be to increase the total profits of the merged firm (Biancini and Ettinger 2017; Mendi 2009).

It is the case that customer foreclosure can lead to input foreclosure. For example, suppose that customer foreclosure leads a targeted upstream rival or rivals to lose substantial sales and this raises their marginal costs or leads to exit. As a result, the upstream merging firm (and its remaining competitors) may gain the power to increase input prices to the rivals of the downstream firm, either unilaterally or through coordinated action. This input foreclosure then could raise the costs of the downstream rivals and harm consumers. However, our analysis and the dHHI are not directly geared towards this possibility either.

For a summary and citations to the original articles, see Shapiro (2010). The delta HHI often is considered a screen for the increase in coordination concerns, based on work by Stigler. Willig showed that the delta HHI also is related to the GUPPI under the assumption that diversion ratios are proportional to market shares and market demand is perfectly inelastic. The delta HHI also is related to the increase in the average price–cost margin in the Cournot model, though the use of pre-merger market shares implies that it overstates the increase—since absent efficiencies the market shares of the merging firms will be smaller post-merger than pre-merger.

Even here, the incentives to raise input prices to these downstream firms would be limited by a number of factors, including: (1) the pass-through of the input price increases into the output prices of these downstream firms; (2) downstream competition from firms that do not purchase inputs from the upstream merging firm; and (3) the elasticity of demand in the downstream market.

The upstream merging firm does not exert direct control over the production and pricing decisions of the firms that it supplies (as it would if it owned those firms), but instead it controls them indirectly through changes in the input prices that it charges to them.

As was indicated previously, we do not take into account any merger-specific EDM or other cognizable efficiencies at this stage of the analysis. As with horizontal mergers, any cognizable efficiencies would be analyzed if the merger is investigated further.

The vGUPPIu is related to the vGUPPIr but is not our focus for the derivation of the proxy dHHI of the downstream market.

As we discussed above, we assume no input substitution. If input substitution is possible, the vGUPPIr is smaller and requires additional information. The assumption of no input substitution is appropriate for our purpose of measuring a potential increase in effective concentration in the downstream market. We will discuss this issue in more detail in Sect. 4.2.

BRD = PTRU is obtained by setting (1) equal to (2) and solving for BRD.

A cost pass-through rate of 50% is consistent with linear demand. Shapiro (2010) suggested the use of a 50% pass-through rate as the default rate for horizontal GUPPIs.

Each foreclosed rival would have a vGUPPIr (Moresi and Salop 2013).

Our analysis uses hypothetical horizontal transactions, not actual horizontal transactions, to proxy for the pricing incentive effects of a vertical merger. For example, the fact that (say) three targeted rivals might behave “as if” each had a 50% ownership share in the downstream merging firm does not mean that real world ownership shares add up to 150%. Therefore, it does not imply that the increase in effective concentration is overstated.

In this simple example, there cannot be any EDM since the downstream merging firm is not a customer of the upstream merging firm. Because we are focusing solely on a measure of effective concentration, we do not take into account any merger-specific EDM or other efficiencies at this stage of the analysis.

Furthermore, this UPP effect—that the downstream division of the merged firm will have an incentive to compete less aggressively in the downstream market if a rival is also a customer of the upstream division—may induce the rival to continue to purchase the input from the upstream division, even if it could obtain the input at a lower price from a different supplier. This is because switching to a different supplier would intensify competition from the merged firm (Chen 2001).

The Chen effect corresponds to the vGUPPId1 measure in our vGUPPI article. The article discusses two other vGUPPId measures that do take account of any merger-specific EDM (Moresi and Salop 2013). These would be incorporated into a full competitive effects analysis—albeit not a safe harbor analysis before it is known whether the EDM is likely to occur or is merger-specific (VMGs 2020).

We are using equation (A14) of the technical appendix of our vGUPPI article, with the convention that one unit of output requires one unit of the input under consideration: Ak = 1. That is different from the convention that is used in Eq. (3) of our vGUPPI article, where the input share SUR does not appear explicitly in the formula: It is accounted for in the calculation of the input “price” or input cost per unit of output).

This incentive to increase the price of the downstream merging firm can be explained as follows: If the downstream merging firm increases its price, a fraction of its lost sales—DRDR—will be diverted to the downstream rival under consideration. However, that rival may use the upstream merging firm for a share (SUR) of its input purchases, in which case the upstream merging firm gains incremental sales (DRDR × SUR) and earns a dollar margin (MUR × WUR) on each incremental sale. Normalizing this effect as a percentage of the output price of the downstream merging firm (PD) yields Eq. (3).

Similarly, the previous analysis of the pricing incentives of the upstream merging firm did not take account of the impact of increasing the output price of the downstream merging firm.

Equation (5) is obtained by setting (3) equal to (4) and solving for BDR.

If instead there are two downstream customers but each one purchases only 50% of its input purchases from the upstream merging firm, then the increase in effective concentration is equal to 120 (that is, 2 × 0.5 × 0.3 × 20 × 20).

If there are no foreclosure concerns and the downstream firms are not symmetric, then the UPP may outweigh the EDM of the downstream merging firm when the pre-merger world satisfies some or all of the following properties: (a) the downstream merging firm buys fewer inputs from the upstream merging firm than do its rivals; (b) the upstream merging firm earns a lower dollar margin on input sales to the downstream merging firm than it earns on input sales to rival downstream firms; (c) the downstream market demand is sufficiently inelastic; and (d) the downstream merging firm has little ability to substitute inputs from rival suppliers with inputs from the upstream merging firm. However, if there are no foreclosure concerns, then the EDM outweighs the UPP of the downstream merging firm when the downstream firms are symmetric, as shown in Moresi and Salop (2013) and Chen (2001).

For example, in a beer merger, an “all beer” market definition would satisfy the hypothetical monopolist test, and so also might “light beer,” “domestic beer,” and “craft beer” market definitions.

EP denotes the elasticity of the price of the targeted rival (PR) with respect to an increase in the input price that the rival must pay to the upstream merging firm (WUR).

ESR denotes the elasticity of the upstream merging firm’s share of the rival’s input purchases (SUR) with respect to an increase in the input price that the rival must pay to the upstream merging firm (WUR).

Our vGUPPI article provides a method for “calibrating” the values of EP and ESR, but this requires the assumption of pre-merger symmetric downstream firms and requires estimates for the downstream cost pass-through rate (PTRR) and the aggregate price elasticity of downstream market demand (E) (Moresi and Salop 2013). In addition, the calibration of EP can be more complicated when there are multiple targeted rivals (Moresi and Salop 2013).

In addition, all of the potentially foreclosed firms should be included in the analysis.

Das Varma and De Stefano (2020) observe that, “[u]nder certain commonly used assumptions, a vertical merger may even create an incentive for the merged firm to lower its rivals’ cost.” Domnenko and Sibley (2019) also note that, “[i]n the simulations, the upstream price paid by the remaining downstream rival can either rise or fall.”.

The GUPPIs for horizontal mergers are always positive in the absence of efficiencies. Consider a horizontal merger of Firm-A and Firm-B, and suppose that the merger will generate cost savings for Firm-A only. Suppose that the net UPP for the product of Firm-A is negative, so that on balance there is downward pricing pressure (DPP) on the price that is charged by Firm-A. That does not affect the GUPPI of Firm-B—which remains positive. However, a merger simulation model might predict that the prices of both Firm-A and Firm-B will fall. For example, this can occur if demand is linear, the diversion ratio from Firm-A to Firm-B is relatively high, and the diversion ratio from Firm-B to Firm-A is relatively low.

They also would be reinforced by the accommodating price responses of non-merging firms.

This earlier unpublished article used a linear demand model and was a building block for the two papers.

Similarly, when vGUPPIu \(\ge \) 0 in Eq. (11), the simultaneity leads to |SvGUPPId2| >|vGUPPId2|. This is because vGUPPIu is first-round and thus implicitly assumes vGUPPId2 = 0. But if vGUPPId2 < 0, we see from Eq. (10) that SvGUPPIu < 0 (when vGUPPIu \(\ge \) 0), and hence it follows from Eq. (9) that |SvGUPPId2| >|vGUPPId2| (when vGUPPIu \(\ge \) 0).

The two studies compare simulation results with the simple vGUPPIs–not with the simultaneous vGUPPIs. We are not suggesting that the simultaneous vGUPPIs always would have been much closer to the simulation results than the simple vGUPPIs. But they are an easy step in the right direction.

For example, with secret contracting and non-linear input prices, there is no EDM because pre-merger suppliers set marginal prices equal to marginal costs (Rey and Vergé 2020).

As a result of upstream competition, the upstream merging firm earns a smaller margin and sells fewer inputs to rivals of the downstream merging firm, which implies that the upstream loss from foreclosure is smaller and hence the incentive to foreclose is stronger than it would be absent upstream competition. (Moresi, 2020).

References

Asoni, A., & Sarafidis, Y. (2017). Economic tools for gauging the competitive effects of partial acquisitions in the energy sector. Newsletter of the Transportation and Energy Industries Committee, Section of Antitrust Law, American Bar Association, Summer 2017, 15–22. Retrieved from http://www.crai.com/sites/default/files/publications/Economic-Tools-for-Gauging-the-Competitive-Effects-of-Partial-Acquisitions-in-the-energy-sector.pdf.

Atalay, E., Hortaçsu, A., & Syverson, C. (2014). Vertical integration and input flows. American Economic Review, 104, 1120–1148.

Baker, J. B., Rose, N. L., Salop, S. C., & Morton, F. S. (2020). Recommendations and comments on the draft vertical merger guidelines. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3543736.

Biancini, B., & Ettinger, D. (2017). Vertical integration and downstream collusion. International Journal of Industrial Organization, 53(c), 99–113.

Chen, Y. (2001). On vertical mergers and their competitive effects. The RAND Journal of Economics, 32(4), 667–685.

Das Varma, G., & De Stefano, M. (2020). Equilibrium analysis of vertical mergers. Antitrust Bulletin, 65(3), 445–458. https://doi.org/10.1177/0003603X20929138

Domnenko, G., & Sibley, D. S. (2019). Simulating vertical mergers and the vertical GUPPI approach. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3447687.

Hausman, J., Moresi, S., & Rainey, M. (2011). Unilateral effects of mergers with general linear demand. Economic Letters, 111(2), 119–121.

Hoffman, B. D. (2018). Vertical merger enforcement at the FTC. Remarks of the Acting Director, Bureau of Competition, U.S. Federal Trade Commission. Retrieved from https://www.ftc.gov/system/files/documents/public_statements/1304213/hoffman_vertical_merger_speech_final.pdf.

Inderst, R., & Valletti, T. (2011). Incentives for Input foreclosure. European Economic Review, 55(6), 820–831.

Krattenmaker, T. G., & Salop, S. C. (1986). Anticompetitive exclusion: Raising rivals’ costs to achieve power over price. Yale Law Journal, 96(2), 209–293.

Kwoka, J., & Slade, M. (2020). Second thoughts on double marginalization. Antitrust, 34, 51–56.

Lu, S., Moresi, S., & Salop, S. C. (2007). A note on vertical mergers with an upstream monopolist: Foreclosure and consumer welfare effects. Retrieved from https://www.crai.com/sites/default/files/publications/Merging-with-an-upstream-monopolist.pdf.

Mendi, P. (2009). Backward integration and collusion in a duopoly model with asymmetric costs. Journal of Economics, 96(2), 95–112.

Moresi, S. (2020). Vertical mergers and bargaining models: Simultaneous versus sequential pricing. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3541099.

Moresi, S., & Salop, S. C. (2013). vGUPPI: Scoring unilateral pricing incentives in vertical mergers. Antitrust Law Journal, 79(1), 185–214.

Nocke, V., & White, L. (2007). Do vertical mergers facilitate upstream collusion? American Economic Review, 97(4), 1321–1339.

Normann, H. (2009). Vertical integration, raising rivals’ costs and upstream collusion. European Economic Review, 53(4), 461–480.

O’Brien, D. P., & Salop, S. C. (2000). Competitive effects of partial ownership: Financial interest and corporate control. Antitrust Law Journal, 67, 559–614.

Ordover, J. A., Saloner, G., & Salop, S. C. (2019). Equilibrium vertical foreclosure. American Economic Review, 80(1), 127–142.

Rey, P., & Vergé, T. (2020). Multilateral vertical contracting. Retrieved from https://www.tse-fr.eu/sites/default/files/TSE/documents/doc/by/rey/744_version2020.pdf.

Shapiro, C. (2010). The 2010 horizontal merger guidelines: From Hedgehog to Fox in 40 years. Antitrust Law Journal, 77, 701–759.

U.S. Department of Justice & Federal Trade Commission (2010). Horizontal merger guidelines. [“HMGs”]. Retrieved from https://www.ftc.gov/sites/default/files/attachments/merger-review/100819hmg.pdf.

U.S. Department of Justice & Federal Trade Commission. (2020). Vertical merger guidelines. [“VMGs”]. Retrieved from https://www.ftc.gov/system/files/documents/reports/us-department-justice-federal-trade-commission-vertical-merger-guidelines/vertical_merger_guidelines_6-30-20.pdf.

United States v. AT&T, Inc., 916 F.3d 1029, 1032 (D.C. Cir. 2019).

United States v. Sabre Corp., No. 19-1548-LPS, 2020 U.S. Dist. LEXIS 64637 (D. Del. Apr. 7, 2020).

Werden, G. J. (1996). A robust test for consumer welfare enhancing mergers among sellers of differentiated products. Journal of Industrial Economics, 44(4), 409–413.

Wong-Ervin, K. (2020) U.S. Vertical merger guidelines: Recommendations and thoughts on EDM and merger specificity. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3523652.

Acknowledgements

The authors are Vice President and Director of Economic Modeling at Charles River Associates (Moresi); Professor of Economics and Law, Georgetown University Law Center, and Senior Consultant at Charles River Associates (Salop). The analysis and opinions expressed here are our own and do not necessarily represent the views of our colleagues or consulting clients. We would like to thank Herb Hovenkamp for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Moresi, S., Salop, S.C. When Vertical is Horizontal: How Vertical Mergers Lead to Increases in “Effective Concentration”. Rev Ind Organ 59, 177–204 (2021). https://doi.org/10.1007/s11151-021-09827-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-021-09827-w