Abstract

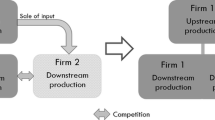

The raising rivals’ costs theory predicts that a vertical merger will create an incentive for the vertically integrated firm to increase input prices to downstream rivals. A simple formula exists to estimate the magnitude of this input price increase. This formula has played a central role in the regulatory evaluation of a number of important recent vertical mergers and is likely to continue to play an important role in the regulatory evaluation of future vertical mergers. The formula requires an estimate of the upstream pass-through rate. Calculation of the upstream pass-through rate is complicated by the fact that prices in many upstream markets are determined by bilateral negotiations, where bargaining power is split between both sides of the market. Thus the manner in which the division of bargaining power affects the upstream pass-through rate must be taken into account. This paper shows that the existing formula for estimating the upstream pass-through rate has some deficiencies and suggests two new formulas for estimating it—depending on the timing of the upstream and downstream pricing decisions.

Similar content being viewed by others

Notes

For readers who are unfamiliar with the literature on vertical contracting, an important caveat to be aware of is that the RRC theory depends critically on the assumption that input prices are linear—that contractual arrangements between upstream and downstream firms simply specify a unit price at which the downstream firm can purchase units of the input without any lump-sum fees or restrictions on the quantity that is purchased. It is this assumption that creates a link between rent extraction at the upstream level and downstream prices. An alternate literature exists that explores the effects of vertical mergers with non-linear input prices. The seminal papers in this literature are Hart and Tirole (1990), O’Brien and Shaffer (1992) and McAfee and Schwartz (1994). See Rey and Verge (2019) for a recent contribution and further references. The subject of comparing the usefulness and applicability of these two very different classes of models is a subject beyond the scope of this paper. To date, the literature that is based on the assumption that input prices are linear has played a much more influential role in antitrust enforcement and policy analysis than this alternate literature.

The Nash bargaining model (Nash 1950) is generally used in the economics literature to model the outcome of bilateral bargaining. Horn and Wolinksky (1988) is the seminal paper that employed the Nash bargaining model to model equilibrium in markets where bargaining power is split between buyers and sellers. Other papers in this literature include Binmore et al. (1986), Chipty and Synder (1999), Collard-Wexler et al. (2019), Crawford et al. (2018), Crawford and Yurukoglu (2012), Cuesta et al. (2019), Dafny et al. (2019), Das Varma and De Stefano (2020), Dragenska et al. (2010), Gaudin (2018), Gowrisankaran et al. (2015), Ho and Lee (2017), Iozzi and Valleti (2014), Nevo (2014), Rogerson (2020) and Sheu and Taragin (2017).

For an early attempt to inject bargaining theory into the evaluation of vertical mergers, see Rogerson’s (2003a,b) submissions to the Federal Communications Commission (FCC) when it considered the News Corp./DirecTV merger. As will be discussed further below, the generalized RRC theory was the central theory of harm that was adopted by the FCC when it considered the Comcast/NBCU merger in 2010 and by the U. S. Department of Justice (DOJ) when it attempted to block the AT&T/Time Warner merger in 2020. Cases outside the United States where the generalized RRC theory was the central theory of harm that was adopted by the government agency that reviewed the merger include: the Bell Canada/Astral merger, which was reviewed by Canadian antitrust authorities in 2012 (Competition Bureau Canada 2012); the Liberty Global/Corelio/W&W/De Vijver Media merger, which was reviewed by the European Commission in 2015 (European Commission DG 2015); and the MEO/GMC merger, which was reviewed by the Portuguese antitrust authorities in 2017 (Codinha et al. 2018; OECD 2019; Rodrigues 2019).

The RRC model actually identifies an additional incentive effect that a vertical merger has on prices—besides the RRC effect that was discussed above. This additional incentive effect is usually referred to as the “elimination of double marginization” (EDM) effect. A short appendix to this paper provides a brief discussion of the EDM effect. It also describes the role that the simple formula for estimating the magnitude of the RRC effect plays in the evaluation of the net welfare impact of a vertical merger—taking account of both effects.

Note that the upstream pass-through rate is distinct from the downstream pass-through rate, which is the share of a cost increase experienced by a downstream firm that is passed through to the price that the downstream firm charges to consumers. An increase in input prices that are charged to rival downstream firms ultimately harms downstream consumers by causing downstream prices to rise, and the downstream pass-through rate is thus relevant for calculating the ultimate impact of an increase in input prices on downstream prices. However, the relevant pass-through rate for calculating the impact of a vertical merger on the input prices that are charged to downstream rivals is the upstream pass-through rate.

See Rogerson (2020) for further discussion of this assumption.

In this paper the assumption that upstream prices are determined before downstream prices and that firms that negotiate upstream prices take account of the effect that changes in negotiated upstream prices will have on downstream prices will be referred to as the assumption that “prices are set sequentially.” The assumption that upstream prices and downstream prices are determined simultaneously (which is equivalent to the assumption that upstream prices are determined before downstream prices, but that firms negotiating upstream prices ignore the effect that changes in negotiated upstream prices will have on downstream prices), will be referred to as the assumption that “prices are set simultaneously”.

Also see Moresi and Salop (2021) for a more recent discussion of this theory.

This is the correct upstream pass-through rate for the case when upstream and downstream prices are determined simultaneously and the upstream firm has all of the bargining power. In this case the upstream firm offers a price that extracts all of the downstream firm’s profit taking the downstream price as fixed, and this price does not depend on the upstream firm’s cost, so the upstream pass-through rate is equal to zero. See Sect. 5 for details.

The NBS will be described in more detail in the next section of the paper. The NBS posits that there is an exogenously determined parameter θ ∈ [0,1] that can be interpreted as the bargaining power of the upstream firm. The negotiated input price is determined by the underlying incremental profit functions of the firms and the value of θ. For θ = 0, the NBS predicts that the negotiated price will be the price that the downstream firm would offer if it was able to make a TIOLI offer to the upstream firm. For θ = 1, the NBS predicts that the negotiated price will be the price that the upstream firm would offer if it was able to make a TIOLOI offer to the downstream firm. The predicted price moves monotonically between these two values for intermediate values of θ. For empirical purposes the value of θ for a pair of firms that are involved in a particular negotiation can be estimated by examining how profits were split on previous similar negotiations.

This means that a contract between U and D only specifies a fixed price per unit of the input, w, and D is allowed to purchase any quantity that it wishes at the specified input price. In particular, there are no fixed fees or lump sum payments of any sort, no minimum purchase requirement and no limit on the maximum quantity of the input that can be purchased. Furthermore, the contract between U and D places no restrictions of any sort on the downstream price that D charges for its product. The results of the RRC model depend critically on the assumption that input prices are linear. See footnote 2 for additional discussion.

Horn and Wolinksky (1988) is the seminal paper that employed the Nash bargaining model to model equilibrium in markets where bargaining power is split between buyers and sellers. Other papers employ this assumption include Chipty and Snyder (1999), Crawford et al. (2018), Crawford and Yurukoglu (2012), Cuesta et al. (2019), Dafny et al. (2019) Das Varma and De Stefano (2020), Draganska et al. (2010), Gaudin (2018), Gowrisankaran et al. (2015), Ho and Lee (2017), Iozzi and Valleti (2014), Nevo (2014), Rogerson (2020), and Sheu and Taragin (2017).

See the Appendix for a discussion of the role that a simple formula for estimating the magnitude of the RRC effect can play at different stages of the evaluation of a vertical merger.

As mentioned above, the pass-through rate for all linear demand curves is equal to ½. If the downstream demand curve is linear, this implies that the derived demand curve will also be linear. Therefore ρDD will be equal to ½ if the downstream demand curve is linear.

An earlier analysis of the upstream pass-through rate when prices are set sequentially is contained in Gaudin (2016). Guadin (2016) derives an expression characterizing the upstream pass-through rate for the case of a general downstream demand curve. The expression depends on both the curvature of the downstream demand curve and the derivative of the curvature of the downstream demand curve with respect to price. Although Gaudin (2016) does not explicitly note this fact, the results of Gaudin (2016) can be used to fairly directly show that formula (4.2) is correct for a broader class of demand curves than linear demand curves. In particular, the results of Gaudin (2016) can be used to fairly directly show that formula (4.2) is correct for any downstream demand curve that exhibits constant curvature. (Gaudin’s formula characterizing the upstream pass-through rate collapses to formula (4.2) when the derivative of the curvature function is set equal to 0 in this formula.) The curvature of a linear demand curve is equal to 0 and, in particular is therefore constant. However, demand curves with other constant curvature values also exist. See Gaudin (2016) for details. I would like to thank Germain Gaudin for pointing this out to me.

See Rogerson (2020) for further discussion of this assumption.

Note that ρD is the pass-through rate of the downstream demand curve and is thus a different variable than ρDD, which is the pass-through rate of the derived demand curve and is defined by wmaxʹ(c). These two pass-through rates are equal for the case of a linear downstream demand curve. (When downstream demand is linear, the derived demand curve is also linear. Therefore ρD and ρDD are both equal to ½.) However, in general, they are different.

Recall that in the case of linear demand, formula (4.2) provides the correct formula for calculating the upstream pass-through rate for all values of θ when prices are set sequentially.

Results in Gaudin (2016) together with the above result in Eq. (6.4) can be used to show that the result that the fully correct upstream pass-through rate when prices are set sequentially is greater than the full-equilibrium upstream pass-through rate when prices are set simultaneously, extends beyond the case when downstream demand is linear to the more general case where downstream demand exhibits a constant curvature. As discussed in footnote 22, results in Gaudin (2016) can be used to show that formula (4.2) is the perfectly correct formula for calculating the upstream pass-through rate so long as downstream demand exhibits a constant curvature. Gaudin (2016) also shows that ρD is equal to ρDD when downstream demand exhibits constant curvature. Thus condition (6.4) holds when downstream demand exhibits constant curvature.

See Shapiro (2021) for a very interesting discussion of the somewhat different roles that economics necessarily plays in the internal analysis of a vertical merger by an antitrust agency versus the presentation of the case during litigation.

References

Baker, J. B. (2011). Comcast/NBCU: The FCC provides a roadmap for vertical merger analysis. Antitrust, 25(2), 36–42.

Binmore, K., Rubinstein, A., & Wolinksy, A. (1986). The Nash Bargaining solution in economic modelling. RAND Journal of Economics, 17(2), 176–188.

Chipty, T., & Snyder, C. (1999). The role of firm size in bilateral bargaining: A study of the cable television industry. Review of Economics and Statistics, 81(2), 326–340.

Codinha, A., Costa, M., Ribeiro, M., & Marques, P. (2018). Vertical mergers: the MEO/GMC case, CPI Antitrust Chronicle, October, 34–38.

Collard-Wexler, A., Gowrisankaran, G., & Lee, R. S. (2019). ‘Nash-in-Nash’ bargaining: A microfoundation for applied work. Journal of Political Economy, 127(1), 163–195.

Competition Bureau Canada. (2012). Competition Bureau Review of the proposed acquisition of Astral by Bell, available at https://www.competitionbureau.gc.ca/eic/site/cb-bc.nsf/eng/03544.html

Crawford, G. S., Lee, R. S., Whinston, M. D., & Yurukoglu, A. (2018). The welfare effects of vertical integration in multichannel television markets. Econometrica, 86(3), 891–954.

Crawford, G. S., & Yurukoglu, A. (2012). The Welfare effects of bundling in multichannel television markets. American Economic Review, 102(2), 643–685.

Cuesta, J. I., Noton, C., & Vatter, B. (2019). Vertical integration between hospitals and insurers, working paper, available at http://www.dii.uchile.cl/~cnoton/VI_CNV_2019.pdf

Dafny, L., Ho, K., & Lee, R. (2019). Price effects of cross-market hospital mergers. RAND Journal of Economics, 50(2), 286–325.

Das Varma, G., & De Stefano, M. (2020). Equilibrium analysis of vertical mergers. The Antitrust Bulletin, 65(3), 1–14.

Department of Justice. (2017). Complaint, U. S. v. AT&T Inc. et. al., Case 17-2511, November 20, available at https://www.justice.gov/atr/case/us-v-att-inc-directv-group-holdings-llc-and-time-warner-inc

Domnenko, G., & Sibley, D. S. (2019). Simulating vertical mergers and the vertical GUPPI approach (Preliminary Draft), working paper, January 1, available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3447687&dgcid=ejournal_htmlemail_io:firm:structure,:purpose,:organization:contracting:ejournal_abstractlink

Draganska, M., Klapper, D., & Villas-Boas, S. B. (2010). A larger slice or a larger pie? An empirical investigation of bargaining power in the distribution channel. Marketing Science, 29(1), 57–74.

European Commission DG Competition. (2015). Case M.7194-Liberty Global/Corellio/W&W/Dd Vijver Media, available at https://ec.europa.eu/competition/mergers/cases/decisions/m7194_20150224_20600_4264271_EN.pdf

Federal Communications Commission. (2011). Memorandum opinion and order, in the matter of applications of comcast corporation, general electric company and NBC Universal, Inc. For Consent to Assign Licenses and Transfer Control of Licensees, MB Docket No. 10-56, January 20

Gaudin, G. (2016). Pass-through, vertical contracts, and bargains. Economics Letters, 139, 1–4.

Gaudin, G. (2018). Vertical bargaining and retail competition: What drives countervailing power? Economic Journal, 128, 2380–2413.

Gowrisankaran, G., Nevo, A., & Town, R. (2015). Mergers when prices are negotiated: Evidence from the hospital industry. American Economic Review, 105(1), 172–203.

Hart, O., & Tirole, J. (1990). Vertical integration and market foreclosure. Brookings Papers on Economic Activity: Microeconomics, 66, 205–286.

Ho, K., & Lee, R. S. (2017). Insurer competition in health care markets. Econometrica, 85(2), 379–417.

Horn, H., & Wolinksky, A. (1988). Bilateral monopoly and incentives for merger. RAND Journal of Economics, 19(3), 408–419.

Iozzi, A., & Valleti, T. (2014). Vertical bargaining and countervailing power. American Economic Journal: Microeconomics, 6(3), 106–135.

Krattenmaker, T. G., & Salop, S. C. (1986). Anticompetitive exclusion: Raising rivals’ costs to achieve market power over price. Yale Law Journal, 96(2), 209–293.

Kwoka, J., & Slade, M. (2020). Second thoughts on double marginalization. Antitrust Magazine, 34(2), 51–56.

Lu, S., Moresi, S., & Salop, S. (2007). A note on vertical mergers with an upstream monopolist: Foreclosure and consumer welfare effects, working paper, available at https://www.crai.com/sites/default/files/publications/Merging-with-an-upstream-monopolist.pdf

McAfee, R. P., & Schwartz, M. (1994). Opportunism in multilateral vertical contracting: Nondiscrimination, exclusivity and uniformity. American Economic Review, 84(1), 210–230.

Moresi, S., & Salop, S. C. (2013). vGUPPI: Scoring unilateral pricing incentives in vertical mergers. Antitrust Law Journal, 79(1), 185–214.

Moresi, S., & Salop, S. C. (2021). When vertical is horizontal: How vertical mergers lead to increases in “effective concentration”. Review of Industrial Organization. https://doi.org/10.1007/s11151-021-09827-w.

Murphy, K. M. (2010a). Economic analysis of the impact of the proposed Comcast/NBCU transaction on the cost to MVPDs of obtaining access to NBCU programming. Submitted as attachment to Comments of DirecTV, Inc., In the Matter of Applications of Comcast Corporation, General Electric Company and NBC Universal, Inc. For Consent to Assign Licenses and Transfer Control of Licensees, MB Docket No. 10-56, June 21.

Murphy, K. M. (2010b). Response of Professor Kevin M. Murphy to reply report of Mark Israel and Michael L. Katz. Submitted as attachment to Reply Comments of DirecTV, Inc., In the Matter of Applications of Comcast Corporation, General Electric Company and NBC Universal, Inc. For Consent to Assign Licenses and Transfer Control of Licensees, MB Docket No. 10-56, August 19.

Nash, J. (1950). The bargaining problem. Econometrica, 18, 155–162.

Nevo, A. (2014). Mergers that increase bargaining leverage, available at https://www.justice.gov/atr/file/517781/download

O’Brien, D., & Shaffer, G. (1992). Vertical control with bilateral contracts. Rand Journal of Economics, 23(3), 299–308.

OECD Directorate for Financial and Enterprise Affairs Competition Committee. (2019). Vertical mergers in the technology, media and telecom sector—Note by Portugal, DAF/COMPWE(2019)19, available at https://one.oecd.org/document/DAF/COMP/WD(2019)19/en/pdf

Rey, P., & Verge, T. (2019). Secret contracting in multilateral relations, working paper, available at https://www.tse-fr.eu/sites/default/files/TSE/documents/doc/by/rey/secret.pdf

Rodrigues, A. S. (2019). Vertical mergers: An anatomy of two cases in Portugal, CPI Antitrust Chronicle, October, 1–6.

Rogerson, W. P. (2003a). An economic analysis of the competitive effects of the takeover of DirecTV by News Corp. Submitted as an attachment to Comments of Advance Newhouse, Cable One, Cox and Insight, In the Matter of General Motors Corporation, Transferors and the News Corporation Limited, Transferee, For Authority to Transfer Control, MB Docket 03-124, June 16.

Rogerson, W. P. (2003b). A further economic analysis of the takeover of DirecTV by News Corp. Submitted as an attachment to Notice of Ex-Parte Comments by Advance Newhouse, Cable One, Cox and Insight, In the Matter of General Motors Corporation, Transferors and the News Corporation Limited, Transferee, For Authority to Transfer Control, MB Docket 03-124, August 4.

Rogerson, W. P. (2010a). Economic analysis of the competitive harms of the proposed Comcast-NCBU Transaction. Submitted as attachment to Comments of the American Cable Association, In the Matter of Applications of Comcast Corporation, General Electric Company and NBC Universal, Inc. For Consent to Assign Licenses and Transfer Control of Licensees, MB Docket No. 10-56, June 21.

Rogerson, W. P. (2010b). A further economic analysis of the proposed Comcast-NCBU Transaction. Submitted as attachment to Reply Comments of the American Cable Association, In the Matter of Applications of Comcast Corporation, General Electric Company and NBC Universal, Inc. For Consent to Assign Licenses and Transfer Control of Licensees, MB Docket No. 10-56, August 19.

Rogerson, W. P. (2010c). An estimate of the consumer harm that will result from the Comcast-NCBU Transaction. Submitted as attachment to American Cable Association Notice of Ex Parte Filing, In the Matter of Applications of Comcast Corporation, General Electric Company and NBC Universal, Inc. For Consent to Assign Licenses and Transfer Control of Licensees, MB Docket No. 10-56, November 8.

Rogerson, W. P. (2014). A vertical merger in the video programming and distribution industry. In J. E. Kowka & L. J. White (Eds.), The antitrust revolution (6th ed., pp. 534–575). Oxford: Oxford University Press.

Rogerson, W. P. (2020). Modeling and predicting the competitive effects of vertical mergers: The bargaining leverage over rivals effect. Canadian Journal of Economics, 53(2), 407–436.

Salop, S. C., & Scheffman, D. T. (1983). Raising rivals’ costs. American Economic Review, 73(2), 267–271.

Salop, S. C., & Scheffman, D. T. (1987). Cost-raising strategies. Journal of Industrial Economics, 36(1), 19–34.

Shapiro. C. (2018). Expert report of Carl Shapiro, U. S. v. AT&T Inc. et. al., Case 17-2511, February 2, available at https://www.justice.gov/atr/case/us-v-att-inc-directv-group-holdings-llc-and-time-warner-inc

Shapiro. C. (2021). Vertical mergers and input foreclosure: lessons from the AT&T/time warner case. Review of Industrial Organization (forthcoming).

Sheu, G. S., & Taragin, C. (2017). Simulating mergers in a vertical supply chain with bargaining, working paper, available at https://www.justice.gov/atr/page/file/1011676/download

Slade, M. E. (2020). Vertical mergers: Ex post evidence and ex ante evaluation methods, working paper, available at https://econ2017.sites.olt.ubc.ca/files/2020/02/pdf_paper_Slade-Margaret_Vertical_Mergers.pdf

Weyl, E. G., & Fabinger, M. (2013). Pass-through as an economic tool: Principles of incidence under imperfect competition. Journal of Political Economy, 121(3), 528–583.

Acknowledgements

I would like to thank Germain Gaudin, Kathleen Hagerty, Steve Salop, Carl Shapiro and the editor, Larry White, for helpful discussions and comments. Department of Economics, Northwestern University, 2211 Campus Drive 3rd Floor, Evanston, IL, 60208.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Taking the Elimination of Double Marginalizaion (EDM) Effect into Account

Appendix: Taking the Elimination of Double Marginalizaion (EDM) Effect into Account

There is a sense in which the RRC theory might be more appropriately referred to as the RRC/EDM theory—where “EDM” stands for “elimination of double marginalization”—because the theory actually identifies two different countervailing incentive effects created by a vertical merger. The first effect is the RRC effect: that an incentive is created for the vertically integrated firm to charge higher prices to rival downstream firms, or perhaps even foreclose them completely. This effect occurs because, after the merger, the vertically integrated firm now views the lost profit of its own downstream partner as an extra opportunity cost of providing the input to rival downstream firms, and a share of this cost increase is passed through to downstream rivals in the form of an increased input price.

The second effect is the EDM effect: that an incentive is created for the vertically merged firm to lower its own downstream price. This effect occurs because, after the merger, the downstream division will view the cost of the input as its true marginal cost to the vertically integrated firm, which is lower than the price that it was previously charged when the firms were separately owned and the input price was marked up above marginal cost.

The RRC effect creates upward pricing pressure on downstream prices and thus harms downstream consumers. The EDM effect creates downward pricing pressure on downstream prices and thus benefits downstream consumers. The new equilibrium prices after the merger reflect the combined impact of both of these incentive effects. Given that there are two countervailing incentive effects on prices, an important part of the RRC analysis involves determining the net effect of both incentives on downstream prices.

Given that the ultimate goal of the competitive analysis of a vertical merger is to determine the net impact of both incentive effects on downstream prices, one might question whether a formula that provides an estimate of only one of these two effects is useful. I believe that such a formula is still extremely useful and that its usefulness is enhanced by the fact that it is very simple and intuitive and also that it is based on variables whose values can be estimated based on data that are normally easily available when government agencies review a merger.

First, since the RRC effect is harmful to consumers and the EDM effect is beneficial to consumers, a simple and easy-to-apply formula to measure the magnitude of the RRC effect can be used as a screen by antitrust agencies to determine which vertical mergers require more detailed investigation. In particular, if the simple formula shows that the RRC effect is likely to be insignificant even before taking account of the countervailing EDM effect, this could provide a basis for approving the merger without detailed additional analysis.

Second, and more important, even though a full analysis of the welfare impact of a vertical merger requires an assessment of the manner in which the merger will affect downstream equilibrium prices taking both effects into account, such a calculation is necessarily complex since it involves determining how changes in multiple equilibrium conditions simultaneously interact with one another to determine equilibrium prices in two vertically related markets. A full equilibrium simulation will provide such an answer but will not necessarily provide much intuition or transparency into explaining the determinants of the equilibrium effects on downstream prices. An easy-to-understand calculation of the magnitude of the RRC effect can play a significant role in providing such transparency. This can be particularly important in a litigation context in front of a generalist judge.Footnote 29

Related to this issue, it is also relatively simple and straightforward to directly calculate the magnitude of the EDM effect by directly estimating the reduction in the vertically integrated firm’s marginal cost of supplying itself with the input due to the merger. Ideally, an intuitive justification and explanation of the magnitudes of predicted changes in downstream equilibrium prices should be based on presenting and explaining the simple calculations of both of these effects.

While the separate calculation of the effect of a vertical merger on rivals’ marginal costs and the vertically integrated firm’s marginal cost does not provide a final answer to the question of how these cost changes affect downstream prices, it provides a large degree transparency into the determinants of these price changes. Shapiro (2018) provided exactly such an explanation of the predicted equilibrium impacts on downstream prices in his testimony as an expert witness for the DOJ in the AT&T/TW merger.

Furthermore, the estimates of the changes in firms’ marginal costs due to the vertical merger can be fed into a downstream simulation to determine the net effect of the merger on downstream prices. This is the method that Shapiro (2018) used to calculate the net impact of both incentive effects on downstream prices. Thus, the simple formula for calculating the magnitude of the input price increase can be used as an input into to a second stage of the analysis that does determine the net impact of both incentive effects on downstream prices. This method is not fully equivalent to a simulation that simultaneously solves for equilibrium upstream and downstream prices that satisfy all of the new equilibrium conditions that are created by a vertical merger.Footnote 30 However, it has the advantage of being more transparent than a full simulation.

See Shapiro (2021) for a detailed description and discussion of Shapiro’s (2018) testimony. Also see Das Varma and De Stefano (2018), Domnenko and Sibley (2019), Kwoka and Slade (2020), Lu et al. (2007), Rogerson (2020), Sheu and Taragin (2017), and Slade (2020) for further discussion of the EDM effect and evaluating the net impact of both the RRC and EDM effects.

Rights and permissions

About this article

Cite this article

Rogerson, W.P. The Upstream Pass-Through Rate, Bargaining Power and the Magnitude of the Raising Rivals’ Costs (RRC) Effect. Rev Ind Organ 59, 205–227 (2021). https://doi.org/10.1007/s11151-021-09837-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-021-09837-8