Abstract

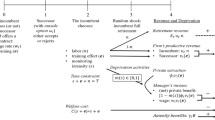

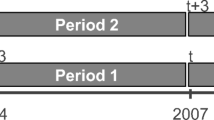

The article analyses the relationship between succession and firm performance. Applying a non-parametric matching approach on a panel of roughly 4,000 Austrian family firms we evaluate the impact of actual (past) succession as well as planned (future) successions on employment growth. Analysing succession plans, we do not find a significant difference in employment growth between firms that plan to transfer the firm in the next 10 years and those who do not. In contrast, past succession exerts a significant and positive employment growth effect, which becomes stronger over time.

Similar content being viewed by others

Notes

Gersick et al. (1997) report that family firms account for 65–80% of all worldwide business, and for about 40% of the Fortune 500 companies. Although many family firms are small, in aggregate they represent about half of the US gross domestic product (Aronoff et al. 1997) and employ more than 80% of the work force (Neuberg and Lank 1998).

For a description of the institutional aspects in Austria, see Mandl and Voithofer (2005).

Succession is so central that Ward (1987) chooses to define family firms in terms of the potential for succession: ‘we define a family business as one that will be passed on for the family’s next generation to manage and control’ (p. 252).

For a more recent literature review on family firms, see also Chrisman et al. (2005).

The authors allude to Griliches and Regev (1995) who analyse firm exits and find firms that will exit in the future to have significantly lower growth rates in the years before exit compared to surviving firms. This phenomenon is called the ‘shadow of death’. Recent empirical evidence on this issue is provided by Almus (2004).

A large number of empirical studies, particularly for the farm sector, suggest a significant impact of farm characteristics as well as of characteristics of the farm operator’s family on the probability of (planned and actual) succession (Kimhi 1994; Stiglbauer and Weiss 2000; and Glauben et al. 2004; Bennedsen et al. 2007).

The institute annually collects economic performance data on a random sample of roughly 4,500 small- and medium-sized manufacturing firms in 19 industries.

To shed some additional light on the specific circumstances of the succession events a follow-up telephone survey was conducted by the Austrian Institute for SME Research in February 2007. From the 136 firms in the sample that experienced succession in the past, 94 were successfully contacted. Half of them (47 firms) refused to participate in the follow-up survey, 17 indicated that they are unable to recall details of the succession event (which took place about 10 years ago), and the remaining 30 firms provided additional information. Although this number is too small to carry out a detailed statistical analysis, the results nevertheless are helpful to make some first inferences. From these 30 firms, six companies (20%) experienced a transfer of management only (with ownership unchanged), another six companies (20%) experienced a transfer of ownership only (with management unchanged) and the remaining 18 companies (60%) reported both, a change in ownership and management. With respect to the differentiation between ‚family succession’ and ‚non-family succession’ the follow-up survey reveals that the transfer took place within the family in 24 succession cases (80%). Non-family members were involved in six cases (20%) only. This gives some justification to the assumptions made above.

A detailed discussion of the matching approach as well as a survey on its applications in labour-market evaluation studies is available in Heckman et al. (1999). An interesting empirical application of the matching-technique, which is closely related to the present issue, is reported in Almus (2004). The author investigates the growth rates of firms in the years before market drop-out and compares this to the performance of surviving firms.

The different propensity score matching schemes used in the empirical literature are discussed in more detail in Heckman et al. (1997), Smith and Todd (2005) as well as Becker and Ichino (2002). Since there is no consensus on the best matching estimator to adopt, we compare our results from 5-nearest neighbour matching with those obtained from one-to-one nearest neighbour matching, kernel matching and radius matching (the latter two applying kernel weights).

We use the unbounded \( x{'}_{i} \hat{\beta } \) rather than the bounded propensity score \( \Phi {\left( {x{'}_{i} \hat{\beta }} \right)} \) because of its preferable distribution properties (Hujer et al. 1997).

Authors from different fields of economics (and, in particular, from economic psychology and marketing) have challenged the usefulness of intention measures (such as succession plans) as a predictor for actual behaviour. Foxall (1983), for example, argues that a high intention-behaviour correspondence should be expected only under strictly limited (and unrealistic) conditions. Empirical support for the intention-behaviour discrepancy in succession plans is provided by Väre et al. (2005).

References

Almus, M. (2004). The shadow of death—an empirical analysis of the pre-exit performance of New German firms. Small Business Economics, 23, 189–201.

Anderson, R. C., & Reeb, D. M. (2003). Founding-family ownership and firm performance: Evidence from the S&P 500. The Journal of Finance, 58(3), 1301–1328.

Aronoff, C. E., Astrachan, J. H., & Ward, J. L. (1997). Family Business Sourcebook II. Marietta, GA: Business Owner Resources.

Becker, S. O., & Ichino, A. (2002). Estimation of average treatment effects based on propensity scores. The Stata Journal, 2(4), 358–377.

Bennedsen, M., Nielsen, K., Pérez-González, F., & Wolfenzon, D., (2007). Inside the family firm: The role of families in succession decisions and performance’, forthcoming in The Quarterly Journal of Economics.

Bertrand, M., & Schoar, A. (2006). The role of family in family firms. Journal of Economic Perspectives, 20(2), 73–96.

Chrisman, J. J., Chua, J. H., & Sharma, P. (2003). Current trends and future directions in family business management studies: Toward a theory of the family firm. Coleman Foundation White Paper Series.

Chrisman, J. J., Chua, J. H., & Sharma, P. (2005). Trends and directions in the development of a strategic management theory of the family firm. Entrepreneurship Theory and Practice, 29, 555–575.

Cucculelli, M., & Micucci, G. (2006). Entrepreneurship, inherited control and firm performance in Italian SMEs. Working Paper No. 258, Department of Economics, Universita’ Politecnica delle Marche.

Foxall, G. R. (1983). Consumer choice. New York: St. Martins Press.

Gersick, K., Davis, J., McCollom H., & Lansberg, I. (1997). Generation to generation: Life cycles of the family business. Boston: Harvard Business School Press.

Glauben, T., Tietje, H., & Weiss, C. R. (2004). Intergenerational succession on farm households: Evidence from Upper-Austria. Review of Economics of the Household, 2(4), 441–460.

Griliches, Z., & Regev, H. (1995). Firm productivity in Israeli industry 1979–1988. Journal of Econometrics, 65, 175–203.

Handler, W. C. (1994). Succession in family business: A review of the research. Family Business Review, 7(2), 133–157.

Heckman, J. J., Ichimura, H., & Todd, P. (1997). Matching as an econometric evaluation estimator: Evidence from evaluating a job training programme. The Review of Economic Studies, 64, 605–654.

Heckman, J. J., LaLonde, R. J., & Smith, J. A. (1999). The economics and econometrics of active labor market programs. In O. Ashenfelter & D. Card (Eds.), Handbook of labor economics 3a (pp. 1865–2097). Amsterdam.

Hujer, R., Maurer, K. O., & Wellner, M. (1997). The impact of training on unemployment duration in West Germany. Discussion Paper 74, Department of Economics, Johann Wolfgang Goethe-University, Frankfurt.

Kimhi, A. (1994). Optimal timing of farm transferal from parent to child. American Journal of Agricultural Economics, 76, 228–236.

Kimhi, A., Kislev, Y., & Arbel, S. (1995). Intergenerational succession on Israeli family farms, preliminary evidence from panel data, 1971–1988. Working Paper, Department of Agricultural Economics and Management, Hebrew University.

Mandl, I. (2004). Business transfers and successions in Austria. Paper presented at the EISB conference, Turku, 10th September.

Mandl, I., & Voithofer, P. (2005). Situation und Trends der Unternehmensnachfolge in Österreich. Wirtschaftspolitische Blätter, 2, 316–327.

McConaughy, D. L., Walker, M. C., Henderson, G. V., & Mishra, C. S. (1998). Founding family controlled firms: Efficiency and value. Review of Financial Economics, 7, 1–19.

Morck, R. K., Strangeland, D. A., & Yeung, B. (2000). Inherited wealth, corporate control and economic growth: The Canadian disease? In Morck (Ed.), Concentrated corporate ownership. Chicago.

Neuberg, F., & Lank, A. G. (1998). The family business: Its governance for sustainability. London: Macmillan.

Pérez-González, F. (2006). Inherited control and firm performance. American Economic Review, 96(5), 1559–1588.

Rosenbaum, P. R., & Rubin, D. B. (1983). The central role of the propensity score in observational studies for causal effects. Biometrika, 70, 41–55.

Rubin, D. B. (1977). Assignment to treatment group on the basis of a covariate. Journal of Educational Statistics, 2, 1–26.

Smith, B. F., & Amoako-Adu, B. (1999). Management succession and financial performance of family controlled firms. Journal of Corporate Finance, 5, 341–368.

Smith, J. A., & Todd, P. E. (2005). Does matching overcome lalonde’s critique of nonexperimental estimators? Journal of Econometrics, 125, 305–353.

Sraer, D., & Thesmar, D. (2007). Performance and behaviour of family firms: Evidence from the French Stock Market. Journal of the European & Economic Association, 5(4), 709–751.

Steier, L. (2001). Next-generation entrepreneurs and succession: An explanatory study of modes and means of managing social capital. Family Business Review, 14(3), 259–276.

Stiglbauer, A., & Weiss, C. R. (2000). Family and non−family succession in the Upper−Austrian farm sector. Cahiers d’économie et sociologie rurales, 54, 5–26.

Väre, M., Weiss, C. R., & Pietola, K. (2005). On the intention-behaviour discrepancy: Empirical evidence from successions on farms in Finland. SFB Discussion Paper no. 3, Vienna University of Economics and Business Administration.

Villalonga, B., & Amit, R. (2006). How do family ownership, control and management affect firm value? Journal of Financial Economics, 80, 385–417.

Ward, J. L. (1987). Keeping the family business healthy. San Francisco: Jossey-Bass.

Wasserman, N. (2003). Founder-CEO succession and the paradox of entrepreneurial success. Organization Science, 14(2), 149–172.

Weiss, C. R. (1999). Farm growth and survival: Econometric evidence for individual farms in Upper Austria. American Journal of Agricultural Economics, 81(1), 103–116.

Acknowledgements

The authors acknowledge helpful comments on an earlier version of this paper from the editor and a journal referee as well as from the participants of the 2006 Congress of the European Economic Association (Vienna), the 2006 Conference of the European Association for Research in Industrial Economics (Amsterdam) and seminars in Jönköping (Sweden) and Nice (France). Financial support from the Austrian Science Fund (SFB F 020) is also gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Diwisch, D.S., Voithofer, P. & Weiss, C.R. Succession and firm growth: results from a non-parametric matching approach. Small Bus Econ 32, 45–56 (2009). https://doi.org/10.1007/s11187-007-9072-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-007-9072-z