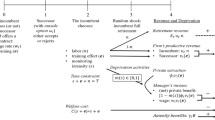

Abstract

We examine the influence of succession in small and medium-sized family businesses by focusing on investment decisions, credit financing, and business performance. Using data on German SMEs, we find that the succession event affects investment behavior negatively before but positively after the transfer takes place when compared to firms without any succession intentions. With respect to performance, we show that firms’ growth rates increase after succession has taken place. Although hypothesized, we find no empirical evidence to suggest that banks tend to reject successors more often than they reject other business owners when deciding to extend credit to firms for investment purposes.

Similar content being viewed by others

Notes

The sample size for those firms with a recorded succession event between 2002 and 2006 in the pre-succession phase was n = 14 (Table 3) and n = 12 (Table 4). The sample size in the post succession phase for these firms was n = 60 and n = 45 (Table 3, model ts + 1 and ts + 2) as well as n = 54 and n = 41 (Table 4, model ts + 1 and ts + 2).

References

Ahrens, J.-P., Calabrò, A., Huybrechts, J., & Woywode, M. (2019). The enigma of the family successor–firm performance relationship: A methodological reflection and reconciliation attempt. Entrepreneurship Theory and Practice, 43(3), 437–474. https://doi.org/10.1177/1042258718816290.

Ajzen, I. (1985). From intention to action: A theory of planned behavior. Action control. Berlin Heidelberg: Springer.

Akerlof, G. A. (1970). The market for “lemons”: Quality uncertainty and the market mechanism. The Quarterly Journal of Economics, 84(3), 488–500.

Backes-Gellner, U., & Werner, A. (2007). Entrepreneurial signaling via education: A success factor in innovative start-ups. Small Business Economics, 29(1), 173–190.

Barach, J. A., & Ganitsky, J. B. (1995). Successful succession in family business. Family Business Review, 8, 131–155. https://doi.org/10.1111/j.1741-6248.1995.00131.x .

Barach, J. A., Ganitsky, J. B., Carson, J. A., & Doochin, B. A. (1988). Entry of the next generation: Strategic challenges for family business. Journal of Small Business Management, 26(2), 49–72.

Basco, R., & Calabrò, A. (2017). “Whom do I want to be the next CEO?” desirable successor attributes in family firms. Journal of Business Economics, 87(4), 487–509.

Bennedsen, M., Nielsen, K. M., Perez-Gonzalez, F., & Wolfenzon, D. (2007). Inside the family firm: The role of families in succession decisions and performance. The Quarterly Journal of Economics, 122(6), 647–691.

Binks, M. R., & Ennew, C. T. (1996). Growing firms and the credit constraint. Small Business Economics, 8, 17–25. https://doi.org/10.1007/BF00391972 .

Bjuggren, P.-O., & Sund, L.-G. (2005). Organization of transfers of small and medium-sized enterprises within the family: Tax law considerations. Family Business Review, 18, 305–319. https://doi.org/10.1111/j.1741-6248.2005.00050.x .

Block, J. H., Jaskiewicz, P., & Miller, D. (2011). Ownership versus management effects on performance in family and founder companies: A Bayesian reconciliation. Journal of Family Business Strategy, 2, 232–245. https://doi.org/10.1016/j.jfbs.2011.10.001 .

Bocatto, E., Gispert, C., & Rialp, J. (2010). Family-owned business succession: The influence of pre-performance in the nomination of family and nonfamily members: Evidence from Spanish firms. Journal of Small Business Management, 48, 497–523. https://doi.org/10.1201/b10321-2 .

Cabrera-Suarez, K., Saa-Perez, P., & Garcia-Almeida, D. (2001). The succession process from a resource- and knowledge-based view of the family firm. Family Business Review, 14, 37–48. https://doi.org/10.1111/j.1741-6248.2001.00037.x .

Cadieux, L. (2007). Succession in small and medium-sized family businesses: Toward a typology of predecessor roles during and after instatement of the successor. Family Business Review, 20, 95–109. https://doi.org/10.1111/j.1741-6248.2007.00089.x .

Carr, J. C., Chrisman, J. J., Chua, J. H., & Steier, L. P. (2016). Family firm challenges in intergenerational wealth transfer. Entrepreneurship Theory and Practice, 40, 1197–1208. https://doi.org/10.1111/etap.12240 .

Chrisman, J. J., & Patel, P. C. (2012). Variation in R&D investments of family and nonfamily firms: Behavioral agency and myopic loss perspectives. Academy of Management Journal, 55(4), 976–997.

Cressy, R. (1996). Commitment lending under asymmetric information: Theory and tests on U.K. startup data. Small Business Economics, 8, 397–408. https://doi.org/10.1007/BF00389557 .

Daspit, J. J., Holt, D. T., Chrisman, J. J., & Long, R. G. (2016). Examining family firm succession from a social exchange perspective: A multiphase, multistakeholder review. Family Business Review, 29, 44–64. https://doi.org/10.1177/0894486515599688 .

Davis, P. S., & Harveston, P. D. (1999). In the founder's shadow: Conflict in the family firm. Family Business Review, 7(4), 311–323.

Dehlen, T., Zellweger, T., Kammerlander, N., & Halter, F. (2014). The role of information asymmetry in the choice of entrepreneurial exit routes. Journal of Business Venturing, 29, 193–209. https://doi.org/10.1016/j.jbusvent.2012.10.001 .

De Massis, A., Chua, J. H., & Chrisman, J. J. (2008). Factors preventing intra-family succession. Family Business Review, 21, 183–199. https://doi.org/10.1111/j.1741-6248.2008.00118.x .

De Massis, A., Sieger, P., Chua, J., & Vismara, S. (2016). Incumbents’ attitude toward intrafamily succession: An investigation of its antecedents. Family Business Review, 29(3), 278–300.

DeTienne, D. R. (2010). Entrepreneurial exit as a critical component of the entrepreneurial process: Theoretical development. Journal of Business Venturing, 25, 203–215. https://doi.org/10.1016/j.jbusvent.2008.05.004 .

DeTienne, D. R., & Chirico, F. (2013). Exit strategies in family firms: How socioemotional wealth drives the threshold of performance. Entrepreneurship Theory and Practice, 37, 1297–1318. https://doi.org/10.1111/etap.12067 .

Diwisch, D. S., Volthofer, P., & Weiss, C. R. (2009). Succession and firm growth: Results from a non-parametric matching approach. Small Business Economics, 32, 45–56.

Dyer, W. G. (2006). Examining the “family effect” on firm performance, Family business review, 19(4), 253–273.

Felden, B., & Pfannenschwarz, A. (2008). Unternehmennachfolge. München: Oldenbourg Verlag.

Giambatista, R. C., Rowe, W. G., & Riaz, S. (2005). Nothing succeeds like succession: A critical review of leader succession literature since 1994. The Leadership Quarterly, 16, 963–991. https://doi.org/10.1016/j.leaqua.2005.09.005 .

Gilding, M., Gregory, S., & Cosson, B. (2015). Motives and outcomes in family business succession planning. Entrepreneurship Theory and Practice, 39, 299–312. https://doi.org/10.1111/etap.12040 .

Habbershon, T. G., & Williams, M. L. (1999). A resource-based framework for assessing the strategic advantages of family firms. Family Business Review, 12, 1–25. https://doi.org/10.1111/j.1741-6248.1999.00001.x .

Handler, W. C. (1994). Succession in family business: A review of the research. Family Business Review, 7, 133–157. https://doi.org/10.1111/j.1741-6248.1994.00133.x .

Handler, W. C., & Kram, K. E. (1988). Succession in family firms: The problem of resistance. Family Business Review, 1, 361–381. https://doi.org/10.1111/j.1741-6248.1988.00361.x .

Harvey, M., & Evans, R. (1995). Life after succession in the family business: Is it really the end of problems? Family Business Review, 8(1), 3–16.

Hauck, J., & Prügl, R. (2015). Innovation activities during intra-family leadership succession in family firms: An empirical study from a socioemotional wealth perspective. Journal of Family Business Strategy, 6, 104–118. https://doi.org/10.1016/j.jfbs.2014.11.002 .

Hillier, D., Martínez, B., Patel, P. C., Pindado, J., & Requejo, I. (2018). Pound of flesh? Debt contract strictness and family firms. Entrepreneurship Theory and Practice, 42(2), 259–282.

Jaskiewicz, P., Heinrichs, K., Rau, S. B., & Reay, T. (2016). To be or rot to be: How family firms manage family and commercial logics in succession. Entrepreneurship Theory and Practice, 40, 781–813. https://doi.org/10.1111/etap.12146 .

Jaskiewicz, P., Uhlenbruck, K., Balkin, D. B., & Reay, T. (2013). Is nepotism good or Bbad?: Types of nepotism and implications for knowledge management. Family Business Review, 26, 121–139. https://doi.org/10.1177/0894486512470841 .

Kammerlander, N. (2016). "I want this firm to be in good hands": Emotional pricing of the resigning entrepreneurs. International Small Business Journal, 34(2), 189–214.

Kaye, K., & Hamilton, S. (2004). Roles of trust in consulting to financial families. Family Business Review, 17, 151–163. https://doi.org/10.1111/j.1741-6248.2004.00010.x .

Kimhi, A. (1997). Intergenerational succession in small family businesses: Borrowing constraints and optimal timing of succession. Small Business Economics, 9, 309–318. https://doi.org/10.1023/A:1007987731337 .

Koropp, C., Grichnik, D., & Gygax, A. F. (2013). Succession financing in family firms. Small Business Economics, 41, 315–334. https://doi.org/10.1007/s11187-012-9442-z .

Kotlar, J., & De Massis, A. (2013). Goal setting in family firms: Goal diversity, social interactions, and collective commitment to family-centered goals. Entrepreneurship Theory and Practice, 37, 1263–1288. https://doi.org/10.1111/etap.12065 .

Lambrecht, J. (2005). Multigenerational transition in family businesses: A new explanatory model. Family Business Review, 18, 267–282. https://doi.org/10.1111/j.1741-6248.2005.00048.x .

Le Breton-Miller, I., & Miller, D. (2013). Socioemotional wealth across the family firm life cycle: A commentary on “family business survival and the role of boards”. Entrepreneurship Theory and Practice, 37, 1391–1397. https://doi.org/10.1111/etap.12072 .

Le Breton-Miller, I., Miller, D., & Steier, L. (2004). Toward an integrative model of effective FOB succession. Entrepreneurship Theory and Practice, 28(4), 305–328.

Lee, K. S., Lim, G. H., & Lim, W. S. (2003). Family business succession: Appropriation risk and choice of successor. Academy of Management Review, 28(4), 657–666.

Lubatkin, M. H., Schulze, W. S., Ling, Y., & Dino, R. N. (2005). The effects of parental altruism on the governance of family-managed firms. Journal of Organizational Behavior: The International Journal of Industrial, Occupational and Organizational Psychology and Behavior, 26(3), 313–330.

Madison, K., Holt, D. T., Kellermanns, F. W., & Ranft, A. L. (2016). Viewing family firm behavior and governance through the lens of agency and stewardship theories. Family Business Review, 29, 65–93. https://doi.org/10.1177/0894486515594292 .

McMullen, J. S., & Warnick, B. J. (2015). To nurture or groom?: The parent-founder succession dilemma. Entrepreneurship Theory and Practice, 39, 1379–1412. https://doi.org/10.1111/etap.12178 .

Miller, D., Le Breton-Miller, I., Lester, R. H., & Cannella, A. A. (2007). Are family firms really superior performers? Journal of Corporate Finance, 13, 829–858. https://doi.org/10.1016/j.jcorpfin.2007.03.004 .

Miller, D., Steier, L., & Le Breton-Miller, I. (2003). Lost in time: Intergenerational succession, change, and failure in family business. Journal of Business Venturing, 18, 513–531. https://doi.org/10.1016/S0883-9026(03)00058-2 .

Molly, V., Laveren, E., & Deloof, M. (2010). Family business succession and its impact on financial structure and performance. Family Business Review, 23, 131–147. https://doi.org/10.1177/0894486510365062 .

Nordqvist, M., Wennberg, K., Bau’, M., & Hellerstedt, K. (2013). An entrepreneurial process perspective on succession in family firms. Small Business Economics, 40, 1087–1122. https://doi.org/10.1007/s11187-012-9466-4 .

Olbrich, M. (2005). Unternehmensnachfolge durch Unternehmungsverkauf. Wiesbaden: Springer Fachmedien.

Parker, S. C. (2016). Family firms and the “willing successor” problem. Entrepreneurship Theory and Practice, 40, 1241–1259. https://doi.org/10.1111/etap.12242 .

Pyromalis, V. D., & Vozikis, G. S. (2009). Mapping the successful succession process in family firms: Evidence from Greece. International Entrepreneurship and Management Journal, 5(4), 439.

Schell, S., Hiepler, M., & Moog, P. (2018). It’s all about who you know: The role of social networks in intra-family succession in small and medium-sized firms. Journal of Family Business Strategy, 9(4), 311–325.

Schulze, W. S., Lubatkin, M. H., & Dino, R. N. (2003). Exploring the agency consequences of ownership dispersion among the directors of private family firms. Academy of Management Journal, 46(2), 179–194.

Sharma, P., Chrisman, J. J., & Chua, J. H. (2003). Succession planning as planned behavior: Some empirical results. Family Business Review, 16, 1–15. https://doi.org/10.1111/j.1741-6248.2003.00001.x .

Sharma, P., & Irving, P. G. (2005). Four bases of family business successor commitment: Antecedents and consequences. Entrepreneurship Theory and Practice, 29(1), 13–33.

Shepherd, D. A., & Zacharakis, A. (2000). Structuring family business succession: An analysis of the future leader’s decision making. Entrepreneurship Theory and Practice, 24(4), 25–39.

Sonfield, M. C., & Lussier, R. N. (2004). First-, second-, and third-generation family firms: A comparison. Family Business Review, 17(3), 189–202.

Steier, L. (2001). Next-generation entrepreneurs and succession: An exploratory study of modes and means of managing social capital. Family Business Review, 14, 259–276. https://doi.org/10.1111/j.1741-6248.2001.00259.x .

Stewart, A., & Hitt, M. A. (2012). Why can’t a family business be more like a nonfamily business? Family Business Review, 25, 58–86. https://doi.org/10.1177/0894486511421665 .

Stiglitz, J. E., & Weiss, A. (1981). Credit rationing in markets with imperfect information. American Economic Association, 71(3), 393–410.

Ward, J. L. (1988). The special role of strategic planning for family businesses. Family Business Review, 1(2), 105–117.

Ward, J. L. (2011). Keeping the family business healthy: How to plan for continuing growth, profitability and family leadership. New York: Palgrave Macmillan.

Wennberg, K., Wiklund, J., Hellerstedt, K., & Nordqvist, M. (2011). Implications of intra-family and external ownership transfer of family firms: Short-term and long-term performance differences. Strategic Entrepreneurship Journal, 5, 352–372. https://doi.org/10.1002/sej.118 .

Williams Jr., R. I., Pieper, T. M., Kellermanns, F. W., & Astrachan, J. H. (2018). Family firm goals and their effects on strategy, family and organization behavior: A review and research agenda. International Journal of Management Reviews, 20, S63–S82.

Wooldridge, J. M. (2002). Introductory econometrics: A modern approach, 2003: South-Western College Publishing, New York.

Xi, J. M., Kraus, S., Filser, M., & Kellermanns, F. W. (2015). Mapping the field of family business research: Past trends and future directions. International Entrepreneurship and Management Journal, 11(1), 113–132.

Yu, A., Lumpkin, G. T., Sorenson, R. L., & Brigham, K. H. (2012). The landscape of family business outcomes: A summary and numerical taxonomy of dependent variables. Family Business Review, 25(1), 33–57.

Zellweger, T., & Kammerlander, N. (2015). Family, wealth, and governance: An agency account. Entrepreneurship Theory and Practice, 39(6), 1281–1303.

Zellweger, T., Sieger, P., & Halter, F. (2011). Should I stay or should I go?: Career choice intentions of students with family business background. Journal of Business Venturing, 26, 521–536. https://doi.org/10.1016/j.jbusvent.2010.04.001 .

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Ljuba Haunschild died while working on this paper.

Rights and permissions

About this article

Cite this article

Werner, A., Schell, S. & Haunschild, L. How does a succession influence investment decisions, credit financing and business performance in small and medium-sized family firms?. Int Entrep Manag J 17, 423–446 (2021). https://doi.org/10.1007/s11365-019-00613-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-019-00613-5