Abstract

We develop a model of monetary policy implementation in which banks bid for liquidity provided by the central bank in fixed rate auctions, considering liquidity injections and extractions as well as the impact of a subsequent interbank market. We derive the equilibrium demands of banks. We also investigate the impact the central bank auction has on the subsequent interbank market and find that while lending in the interbank market is reduced, the interest rates are moving in the desired direction. In the context of the interbank network, the impact of monetary policy on banks depends on their network locations, which may give rise to the prospects of distributional effects of monetary policy.

Similar content being viewed by others

References

Abbink K, Brandts J, Pezanis-Christou P (2006) Auctions for government securities: a laboratory comparison of uniform, discriminatory and spanish designs. J Econ Behav Organ 61(2):284–303

Acemoglu D, Ozdaglar A, Tahbaz-Salehi A (2015) Systemic risk and stability in financial networks. Am Econ Rev 105(2):564–608

Allen F, Gale D (2000) Financial contagion. J Polit Econ 108(1):1–33

Andries N, Billon S (2016) Retail bank interest rate pass-through in the euro area: an empirical survey. Econ Syst 40(1):170–194

Anton JJ, Yao DA (1989) Split awards, procurement, and innovation. RAND J Econ, pp 538–552

Anton JJ, Yao DA (1992) Coordination in split award auctions. Q J Econ 107(2):681–707

Ausubel LM, Cramton P, Pycia M, Rostek M, Weretka M (2014) Demand reduction and inefficiency in multi-unit auctions. Rev Econ Stud 81(4):1366–1400

Ayuso J, Repullo R (2003) A model of the open market operations of the European central bank. Econ J 113(490):883–902

Back K, Zender JF (1993) Auctions of divisible goods: on the rationale for the treasury experiment. Rev Financ Stud 6(4):733–764

Back K, Zender JF (2001) Auctions of divisible goods with endogenous supply. Econ Lett 73(1):29–34

Battiston S, Gatti DD, Gallegati M, Greenwald B, Stiglitz JE (2012) Liaisons dangereuses: Increasing connectivity, risk sharing, and systemic risk. J Econ Dyn Control 36(8):1121–1141

Bernanke BS, Blinder AS (1992) The federal funds rate and the channels of monetary transmission. Am Econ Rev, pp 901–921

Bindseil U, Nyborg KG, Strebulaev IA (2009) Repo auctions and the market for liquidity. J Money Credit Bank 41(7):1391–1421

Binmore K, Swierzbinski J (2000) Treasury auctions: uniform or discriminatory? Rev Econ Design 5(4):387–410

Biondi Y, Zhou F (2019) Interbank credit and the money manufacturing process: a systemic perspective on financial stability. J Econ Interac Coord 14(3):437–468

Brunetti C, Di Filippo M, Harris JH (2010) Effects of central bank intervention on the interbank market during the subprime crisis. Rev Financ Stud 24(6):2053–2083

Carpenter S, Demiralp S, Eisenschmidt J (2014) The effectiveness of non-standard monetary policy in addressing liquidity risk during the financial crisis: the experiences of the federal reserve and the European central bank. J Econ Dyn Control 43:107–129

Cassola N, Hortaçsu A, Kastl J (2013) The 2007 subprime market crisis through the lens of European central bank auctions for short-term funds. Econometrica 81(4):1309–1345

Craig B, Von Peter G (2014) Interbank tiering and money center banks. J Financ Intermediat 23(3):322–347

Ehrmann M, Gambacorta L, Martínez-Pagés J, Sevestre P, Worms A (2001) Financial systems and the role of banks in monetary policy transmission in the euro area. European Central Bank Working Paper No. 105

European Central Bank (2011) The implementation of monetary policy in the euro area

Ewerhart C, Cassola N, Valla N (2010) Declining valuations and equilibrium bidding in central bank refinancing operations. Int J Ind Organ 28(1):30–43

Fabra N, Fehr N-H, Harbord D (2006) Designing electricity auctions. RAND J Econ 37(1):23–46

Federico G, Rahman D (2003) Bidding in an electricity pay-as-bid auction. J Regul Econ 24(2):175–211

Freixas X, Parigi BM, Rochet J-C (2000) Systemic risk, interbank relations, and liquidity provision by the central bank. J Money Credit Banking, pp 611–638

Fricke D, Lux T (2015) Core-periphery structure in the overnight money market: evidence from the e-mid trading platform. Comput Econ 45(3):359–395

Furfine C (2003) Interbank exposures: quantifying the risk of contagion. J Money Credit Bank 35(1):111–128

Gambacorta L, Marques-Ibanez D (2011) The bank lending channel: lessons from the crisis. Econ Policy 26(66):135–182

Georg C-P (2013) The effect of the interbank network structure on contagion and common shocks. J Bank Finance 37(7):2216–2228

Goldreich D (2007) Underpricing in discriminatory and uniform-price treasury auctions. J Financ Quantitative Anal 42(2):443–466

Harris M, Raviv A (1981) Allocation mechanisms and the design of auctions. Econometrica, pp 1477–1499

Holt CA Jr (1980) Competitive bidding for contracts under alternative auction procedures. J Polit Econ 88(3):433–445

Hortaçsu A, McAdams D (2010) Mechanism choice and strategic bidding in divisible good auctions: an empirical analysis of the Turkish treasury auction market. J Polit Econ 118(5):833–865

Horváth R, Podpiera A (2012) Heterogeneity in bank pricing policies: the Czech evidence. Econ Syst 36(1):87–108

Kang B-S, Puller SL (2008) The effect of auction format on efficiency and revenue in divisible goods auctions: a test using Korean treasury auctions. J Ind Econ 56(2):290–332

Kashyap AK, Stein JC (2000) What do a million observations on banks say about the transmission of monetary policy?. Am Econ Rev, pp 407–428

Klemperer PD, Meyer MA (1989) Supply function equilibria in oligopoly under uncertainty. Econometrica, pp 1243–1277

Krause A, Giansante S (2012) Interbank lending and the spread of bank failures: a network model of systemic risk. J Econ Behav Organ 83:583–608

Krause A, Giansante S (2018) Network-based computational techniques to determine the risk drivers of bank failures during a systemic banking crisis. IEEE Trans Emerg Top Comput Intell 2(3):174–184

Langfield S, Liu Z, Ota T (2014) Mapping the UK interbank system. J Bank Finance 45:288–303

Linzert T, Schmidt S (2011) What explains the spread between the euro overnight rate and the ecb’s policy rate? Int J Finance Econ 16(3):275–289

McAndrews J, Sarkar A, Wang Z (2017) The effect of the term auction facility on the London interbank offered rate. J Bank Finance 83:135–152

Nautz D, Oechssler J (2003) The repo auctions of the European central bank and the vanishing quota puzzle. Scand J Econ 105(2):207–220

Nyborg KG, Strebulaev IA (2003) Multiple unit auctions and short squeezes. Rev Financ Stud 17(2):545–580

Petrevski G, Bogoev J (2012) Interest rate pass-through in south east europe: an empirical analysis. Econ Syst 36(4):571–593

Rudebusch GD, Wu T (2008) A macro-finance model of the term structure, monetary policy and the economy. Econ J 118(530):906–926

Shimizu T (2017) Heterogeneity of expectations and financial crises: a stochastic dynamic approach. J Econ Interac Coord 12(3):539–560

Sims CA (1992) Interpreting the macroeconomic time series facts: the effects of monetary policy. Eur Econ Rev 36(5):975–1000

Taylor JB, Williams JC (2009) A black swan in the money market. Am Econ J Macroecon 1(1):58–83

Tenorio R (1997) On strategic quantity bidding in multiple unit auctions. J Ind Econ 45(2):207–217

Teply P, Klinger T (2019) Agent-based modeling of systemic risk in the European banking sector. J Econ Interac Coord 14(4):811–833

Vickrey W (1961) Counterspeculation, auctions, and competitive sealed tenders. J Finance 16(1):8–37

Wilson R (1979) Auctions of shares. Q J Econ, pp 675–689

Wu T (2008) On the effectiveness of the federal reserve’s new liquidity facilities. Federal Reserve Bank of Dallas Working Paper 0808

Xiao D, Krause A (2017) Balancing liquidity and profitability through interbank markets: endogenous interest rates and network structures. Working Paper, University of Bath

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This work was supported by Humanities and Social Sciences Foundation of the Ministry of Education of China No. 20YJCZH184.

Appendices

Appendix: Proofs

1.1 Proof of Lemma 1

Based on reservation prices in equations (4) and (5), we easily get \(\lim _{Q\rightarrow 0} r_i^a\left( Q_i\right) =r_i^a(0)=r^f+\frac{\theta _i}{1-\theta _i}\frac{\left( 1+r_i^E\right) {\mathbf {E}}_i\left( {\mathbf {D}}_i+{\mathbf {B}}_i-{\mathbf {R}}_i\right) }{{\mathbf {R}}_i\left( {\mathbf {D}}_i+{\mathbf {B}}_i\right) }\) and \(\lim _{Q\rightarrow 0} r_i^b\left( Q_i\right) =r_i^b(0)=r^f+\frac{\theta _i}{1-\theta _i}\frac{\left( 1+r_i^E\right) {\mathbf {E}}_i}{{\mathbf {R}}_i}\). From this, we easily obtain that \(r_i^b(0)-r_i^a(0)=\frac{\theta _i}{1-\theta _i}\frac{\left( 1+r^E_i\right) {\mathbf {E}}_i}{{\mathbf {R}}_i}\frac{{\mathbf {R}}_i}{\left( {\mathbf {D}}_i+{\mathbf {B}}_i\right) }>0.\)

1.2 Proof of Proposition 1

Let us first consider the case of liquidity injection, i. e. \(Q_i>0\). The optimization problem (6) has a unique solution as \(U_i\) is a concave function of \(Q_i\) whose second derivative is

where \(U_1=\frac{\partial U_i}{\partial \rho _i}>0\), \(U_{11}=\frac{\partial ^2 U_i}{\partial \rho _i^2}<0\), \(U_{12}=U_{21}=\frac{\partial ^2 U_i}{\partial \rho _i \partial {r^E_i}}>0\), \(U_{22}=\frac{\partial ^2 U_i}{\partial {r^E_i}^2}\,{<}\,0\).

Therefore, the solution to the problem in equation (6) is either at the boundary if one of the constraints is binding or at the local maximum of \(U_i\). Solving for \(\frac{\partial U_i}{\partial Q_i}=0\) gives the local maximum. The first constraint cannot be binding as insolvency gives zero utility. Also note the last constraint is binding when bank i’s valuation for borrowing is already lower than \(r^{CB}_f\) at \(Q_i=0\), that is \(r_i^a(0)<r^{CB}_f\). Therefore, we can write the solution to problem in equation (6) as,

where \(\varphi =\psi _i^2-\left( {\mathbf {D}}_i+{\mathbf {B}}_i\right) {\mathbf {R}}_i\frac{r^{CB}-r_i^a(0)}{r^{CB}-r^f}\).

Secondly, consider liquidity extraction, i. e. \(Q_i<0\). Similarly, this problem has a unique solution because \(U_i\) is a concave function of \(Q_i\) whose second derivative is

The second constraint is binding when bank i’s valuation for lending is already higher than \(r^{CB}_f\) at \(Q_i=0\), or \(r^{CB}_f>r_i^b(0)\). Solving for the local maximum by letting \(\frac{d U_i}{d Q_i}=0\) completes the solution.

Combining these two results gives us the result shown in the proposition.

Dropping the constraint that \(Q_i\le {\overline{Q}}_i\) as it does not affect the sign of the derivative of \(Q_i^f(r)\), we obtain that

in the case of liquidity injection and

in the case of liquidity extraction.

1.3 Proof of Lemma 2

The proof is trivial from inverting the equilibrium bid schedule in Proposition 1.

1.4 Proof of Lemma 3

We prove the individual parts in turn:

-

1.

By inserting \(Q_i^f=0\) into the inverse bid schedule given in Lemma 2 we instantly see that these are identical to the reservation prices defined in Lemma 1.

-

2.

By inserting \(Q_i^f=0\) into the inverse bid schedule given in Lemma 2 we instantly see that these are identical to the reservation prices defined in Lemma 1.

-

3.

\(r_i^a(0)-r_i^b(0)=\frac{\theta _i}{1-\theta _i}\frac{\left( 1+r_i^E\right) {\mathbf {E}}_i}{{\mathbf {D}}_i+{\mathbf {B}}_i}>0\) which in combination with claims 1 and 2 of this lemma completes this proof.

-

4.

Suppose there is a \(Q_i^f<0\) such that \(r^{CB}\left( Q_i^f\right) <r_i^b\left( Q_i^f\right) \). As the reservation prices are determined such that upon making a deposit of \(Q_i^f\), the utility level does not change from the situation of not making a deposit. Receiving an amount less than \(r_i^b\left( Q_i^f\right) \) will reduce the utility level of bank i, contradicting the requirement that \(r^{CB}\left( Q_i^f\right) \) maximizes the utility.

-

5.

Suppose there is a \(Q_i^f>0\) such that \(r^{CB}\left( Q_i^f\right) >r_i^a\left( Q_i^f\right) \). As the reservation prices are determined such that upon taking a loan from the central bank of \(Q_i^f\), the utility level does not change from the situation of not taking a loan. Paying an amount more than \(r_i^a\left( Q_i^f\right) \) will reduce the utility level of bank i, contradicting the requirement that \(r^{CB}\left( Q_i^f\right) \) maximizes the utility.

1.5 Proof of Lemma 4

The marginal prices here are bank i’s marginal valuation for liquidity. Thus, for \(Q_i>0\), \({\widetilde{r}}_i^{a}= \frac{\partial Q_ir_i^a}{\partial Q_i}\), while for \(Q_i<0\), \({\widetilde{r}}_i^{b}= \frac{\partial Q_ir_i^b}{\partial Q_i}\), where \(r_i^a\) and \(r_i^b\) are the reservation prices given determined in equations (4) and (5).

1.6 Proof of Proposition 3

We prove both claims in this proposition in turn, commencing with the case of liquidity injection. Let us consider an arbitrary bank i and denote the equilibrium demand schedule of any bank by \(Q_i^v(r)\). If all banks, apart from bank i submit their optimal demand schedules and the total supply of liquidity by the central bank is \(Q^{CB}\), the residual demand schedule this bank faces, considering the constraint on the amount it can bid for, is given by

where we require that \(r > r^f\). Assume now that \(Q_i^c\) is on the optimal demand curve for bank i at an interest rate \(r^c\). This rate \(r^c\) would be the lowest possible rate at which the bank can submit its bid and still obtain the requested amount. Due to discriminatory pricing in variable rate auctions, any bid higher than \(r^c\) would result in a utility loss as the bank pays more than it has to. Thus, for any rate \(r>r^c\) the submitted demand is zero. On the other hand, at a rate \(r<r^c\) a bid would not be successful as it is too low; hence, what price or amount is submitted becomes irrelevant. Hence, the only possible equilibrium would be for a bank to submit a bid at exactly \(r^c\) for the quantity it requires at that rate.

In the following, we show that in equilibrium a bank will submit a bid schedule as indicated in the proposition.

If \(r^a_i(0)\le {\widetilde{r}}\) the reservation price of not submitting a bid, or equivalently a bid of zero, is optimal as exceeding your reservation price will result in a loss of utility.

In all other cases, we now show that alternative points on the residual demand schedule give the bank a lower utility and can thus not be an equilibrium. Let us now consider another equilibrium \({\widehat{r}}\ne {\widetilde{r}}\). If we have that \(r^a_i(0)>{\widehat{r}}>{\widetilde{r}}\), we find that \(Q^c_i={\overline{Q}}_i\) as can be easily seen by inserting the expressions for \(Q_j^v\) into \(Q_i^c\) above.

In the case of \({\widehat{r}}\le {\widetilde{r}}\) we compare \({\widetilde{Q}}_i\left( {\widehat{r}}\right) \) and \(Q_i^c\left( {\widehat{r}}\right) \). By construction \({\widetilde{Q}}_i\left( {\widehat{r}}\right) \) gives the same utility level at \({\widehat{r}}\) as \(Q_i^f\left( {\widetilde{r}}\right) \) at \({\widetilde{r}}\), i.e. it lies on the same indifference curve as the optimal demand schedule. If \({\widetilde{Q}}_i\left( {\widehat{r}}\right) \ge Q_i^c\left( {\widehat{r}}\right) \) then \(Q_i^c\) would give the bank less cash than \({\widetilde{Q}}_i\) at the same price; given that banks prefer more cash, this would lead to a lower utility level and would thus not be optimal.

We now show that \({\widetilde{Q}}_i\left( {\widehat{r}}\right) \ge Q_i^c\left( {\widehat{r}}\right) \) as follows:

where the last step is obtained as \(Q_{i}^f\left( {\widetilde{r}}\right) \le {{\bar{Q}}}_i\) and \({{\bar{Q}}}_j-Q_{j}^f\left( {\widetilde{r}}\right) \) and \(Q_{k}^f\left( {\widetilde{r}}\right) -{\widetilde{Q}}_k({\widehat{r}})\) are always non-negative. If there exists one \(j \ne i\), such that \({{\bar{Q}}}_j-Q_{j}^f\left( {\widetilde{r}}\right) \ge \max _{k=1,\ldots ,N} \left( Q_{k}^f\left( {\widetilde{r}}\right) -{\widetilde{Q}}_k({\widehat{r}})\right) \), we have,

Otherwise we have

In the case of liquidity extraction the same steps are followed as above. The possible demand by bank i given the demand by all other banks is determined as

where we take into account that banks cannot deposit more than their cash reserves and require that \(r>r^f\). With the same arguments made before, for any \(r<r^c\), the optimal interest rate, the bank does not receive sufficient interest on their deposits with the central bank and thus will bid an amount of zero. Furthermore, if \(r_i^b(0)\ge {\widetilde{r}}\), the reservation price is too high for the bank to bid for depositing cash with the central bank, and thus will also bid an amount of zero.

For the case of \(r_i^b(0)< {\widehat{r}}<{\widetilde{r}}\), we can easily show that \(Q_i^c(r)=\max \left( -{\mathbf {R}}_i,Q^{CB}\right) \) by inserting for \(Q_j^v(r)\). In the case that \({\widehat{r}}\ge {\widetilde{r}}\) we follow the same arguments as in the case of liquidity injection and need to show that \({\overline{Q}}_i({\widehat{r}})\le Q_i^c({\widehat{r}})\). We obtain

The penultimate step arises as \(Q_{i}^f\left( {\widetilde{r}}\right) \ge -{\mathbf {R}}_i\) and \({\overline{Q}}_k({\widehat{r}})\ge Q_{k}^f\left( {\widetilde{r}}\right) \).

1.7 Proof of Lemma 5

This lemma follows from the definition of the inverse bid schedule, \(r_i^v(Q_i)=\inf \left\{ r>r^f| Q_i^v(r)\le Q_i\right\} \). It is also obvious that \(r_i^v(Q_i)\) is a non-increasing function of \(Q_i\). To show this, we only need to show that \(R^{-1}(Q_i)\) is a non-increasing function of \(Q_i\). This is true as when r increases, both \(\min \Big \{{{\bar{Q}}}_i,Q_{i}^f\left( {\widetilde{r}} \right) +\max _{j=1,\ldots ,N} \left( Q_{j}^f\left( {\widetilde{r}} \right) -{\widetilde{Q}}_j(r)\right) \Big \} \) and \( Q_{i}^f\left( \widetilde{{\widetilde{r}}} \right) -\max _{j=1,\ldots ,N} \left( \widetilde{{\widetilde{Q}}}_j(r)- Q_{j}^f\left( \widetilde{{\widetilde{r}}} \right) \right) \) are non-increasing as can easily be seen.

1.8 Proof of Proposition 4

We need to show the tuple \(\left( r^{CB}_f,Q_1^f,\ldots ,Q_N^f\right) \) also clears the market when bid schedules are as described in Proposition 3. First consider the case of \(Q_i^f\ge 0\), when the amount of operation is \(Q^{CB}=\sum _{i=1}^N Q_i^f=\sum _{i=1}^N \max \left( 0,Q_i^f\left( r^{CB}_f\right) \right) \), obviously \(r^{CB}_f \in \left\{ r\ge r^f|\sum _i^N \max \left( 0,Q_i^f(r)\right) = Q^{CB}\right\} \). Note that \(Q_i^f(r)\) is strictly decreasing before reaching limit \({{\bar{Q}}}_i\). Therefore, \(\sum _i^N \max \left( 0,Q_i^f(r)\right) \) is strictly decreasing as \(0<Q^{CB}<(N-1){{\bar{Q}}}_i\) and has thus a unique solution. Therefore, \({\widetilde{r}}\) defined in Proposition 3 equals \(r^{CB}_f\), since \(Q_{i}^v\left( r^*\right) =Q_{i}^f\left( r^*\right) \) (if \({\widetilde{r}}>r_i^a(0)\) this also holds as both are zero), what remains to be shown is \(r^{CB}_v={\widetilde{r}}\). This is obvious as \(\sum _{i=1}^N Q_{i}^v\left( {\widetilde{r}}\right) =Q^{CB}\) clears the market while any \(r<{\widetilde{r}}\) cannot.

The proof for \(Q_i^f\le 0\) follows exactly the same process.

1.9 Proof of Proposition 2

It is easy to verify that \(\left( {\widehat{r}}^{IB}, \lambda Q_1^I\left( {\widehat{r}}^{IB}\right) ,\ldots , \lambda Q_1^I\left( {\widehat{r}}^{IB}\right) \right) \) clears the market. We show here that a bank i cannot gain higher expected utility after the interbank market by deviating from the bid schedule proposed here. As shown in Proposition 3, it is optimal for any bank i to pay no more than the clearing rate of the primary market, so in the following we only consider bid schedules where a bank demands zero if the interest rate charged is larger than expected clearing rate in the interbank market. We show the case for liquidity injection here as for liquidity extraction the argument can be made in exactly the same way.

Let us consider bank i having any alternative bid schedule where it bids \(Q_i>0\) at a rate \(r_i^{CB}\) and \(Q_i=0\) at some rate \(r>r_i^{CB}\). Firstly, if \(r_i^{CB}<{\widehat{r}}^{IB}\), bank i does not participate in the primary market but only the interbank market. This does not change the clearing rate as the reduced allocation to bank i is compensated by increased allocation to other banks. Consequently, in the interbank market, bank i demands more funds, while other banks are expected to demand less due to their increased allocation by the central bank; hence, the aggregate amount is unchanged and so is the expected interbank rate. Here, bank i only shifts part of its demand from central bank funds to the interbank market and its expected overall utility increase is the same; hence, it is not better off.

Secondly, if \(r_i^{CB}={\widehat{r}}^{IB}\), but \(Q_i^f\left( {\widehat{r}}^{IB}\right) \ge Q_i\ne Q_i^I\left( {\widehat{r}}^{IB}\right) \), this results in bank i borrowing less from the central bank as the rate is less favourable and this has a similar effect as in the case where \(r_i^{CB}<{\widehat{r}}^{IB}\). If \(r_i^{CB}={\widehat{r}}^{IB}\), but \( Q_i^f\left( {\widehat{r}}^{IB}\right) <Q_i \ne Q_i^f\left( {\widehat{r}}^{IB}\right) \), bank i could be worse off. Its allocation could exceed \(Q_i^f\left( {\widehat{r}}^{IB}\right) \) which is the optimal amount that maximize i’s utility or by over-reporting its demand bank i also makes the demand for liquidity to be greater in subsequent interbank markets and thus raises the expected interbank rate for all banks, including itself.

Thirdly, if \(r_i^{CB}>{\widehat{r}}^{IB}\) and if \(Q_i\ge Q_i^I\left( {\widehat{r}}^{IB}\right) \) bank i would be strictly worse off because it pays more for liquidity from the central bank as well as the interbank market. The former is obvious, and the latter is because over-reporting bank i’s demand raises expected interbank rates as discussed above. On the other hand, if \(Q_i < Q_i^I\left( {\widehat{r}}^{IB}\right) \), bank i would still be worse off. Suppose in this case, bank i gets an allocation of \(Q_i^{CB}\) from the central bank and demands \(Q_i^{IB}\) in the interbank market. Obviously, for \(Q_i^{CB}\), bank i pays more than \({\widehat{r}}^{IB}\) which reduces its utility. For \(Q_i^{IB}\), there is a chance bank i pays less than \({\widehat{r}}^{IB}\), even so, this is not enough to compensate for i’s utility loss from central bank funds. Suppose the opposite is true, that bank i pays in the interbank market \(r_i^{IB}<{\widehat{r}}^{IB}\), keeping its utility the same as before. Consider all combinations of rate and quantity (r, Q) in the interbank market that gives the same utility as originally, i. e. \(\Big \{(r,Q)| U_i\left( \rho _i(Q),r_i^E(r, Q)\right) =U_i\left( \rho _i\left( Q_{i}^I\left( {\widehat{r}}^{IB}\right) \right) ,r_i^E\left( {\widehat{r}}^{IB},Q_{i}^I\left( {\widehat{r}}^{IB}\right) \right) \right) , {\widehat{r}}^{IB}>r >r^f\Big \}.\) If the collateral constraint is not binding for bank i, it has to demand \(Q_i^{IB}\) in order to maximize its utility, corresponding to the maximum of r, but \(r<{\widehat{r}}^{IB}\) implies \(Q_i^{IB}+Q_i^{CB}\ge Q_i^I \left( {\widehat{r}}^{IB}\right) \). If the collateral is binding, equality holds here.

Overall, this implies interbank markets cannot clear as banks’ aggregate demand must be more than the supply due to a drop in interbank market rate and the fact bank i is also demanding more than or equal as before. Therefore, bank i cannot reach the same level of utility as originally.

Appendix: Variable rate tenders

In variable rate tenders, the central bank exogenously fixes the total amount of liquidity extracted or injected at \(Q^{CB}\). The interest rate is set such that only those banks can participate that have submitted the highest (lowest) demand schedules for borrowing (depositing) until the total amount is reached. The interest rate is thus set such that \(\sum _{i=1}^N Q_i\le Q^{CB}\). Each bank pays the interest rate at which it has submitted its bids, i.e. pricing is discriminatory and banks will not pay the same price, but according to their bid schedule. Therefore, the reservation price of a bank will be the marginal value of any amount obtained. The following lemma determines these marginal prices:

Lemma 4

In variable rate tenders, the marginal prices are given by

for \(Q_i>0\) and

for \(Q_i<0\).

As before for fixed rate tenders, in order to maximize utility, banks will not submit their marginal prices, but act strategically. Proposition 3 shows the characterization of one such equilibrium, where we assume that banks know each other’s liquidity positions.

Proposition 3

Let \({\widetilde{r}} \in \left\{ r\ge r^f\right| \left. \sum _{i=1}^N \max \left( 0,Q_i^f(r)\right) = Q^{CB}\right\} \), \(\widetilde{{\widetilde{r}}} \in \left\{ r\ge r^f\right| \left. \sum _{i=1}^N \min \left( 0,Q_i^f(r)\right) = Q^{CB}\right\} \), \({\widetilde{Q}}_i(r)\in \left\{ Q_i\le Q_{i}^f\left( {\widetilde{r}} \right) \right| \left. U_i\left( \rho _i(Q_i),r_i^E(r, Q_i)\right) \right. \)\(\left. =U_i\left( \rho _i\left( Q_{i}^f\left( {\widetilde{r}}\right) \right) ,r_i^E\left( {\widetilde{r}},Q_{i}^f\left( {\widetilde{r}}\right) \right) \right) , r>r^f\right\} \), and \(\widetilde{{\widetilde{Q}}}_i(r)\in \left\{ Q_i\ge Q_{i}^f\left( {\widetilde{r}} \right) \right| \left. \right. \)\(\left. U_i\left( \rho _i(Q_i),r_i^E(r, Q_i)\right) =U_i\left( \rho _i\left( Q_{i}^f\left( {\widetilde{r}}\right) \right) ,r_i^E\left( {\widetilde{r}},Q_{i}^f\left( {\widetilde{r}}\right) \right) \right) , r>r^f\right\} \).

One Nash equilibrium bid schedule is then determined as follows:

-

If \(0<Q^{CB}<(N-1){\bar{Q}}_i\) the demand schedule is given by

$$\begin{aligned} Q_{i}^v(r)=\left\{ \begin{array}{lll} \min \left\{ {{\bar{Q}}}_i,Q_{i}^f\left( {\widetilde{r}} \right) +\max _{j=1,\ldots ,N} \left( Q_{j}^f\left( {\widetilde{r}} \right) -{\widetilde{Q}}_j(r)\right) \right\} &{}\quad { if} &{} r^f \le r < {\widetilde{r}}\\ Q_{i}^f\left( {\widetilde{r}} \right) &{}\quad { if} &{} r = {\widetilde{r}} \\ 0 &{}\quad { if} &{} r > {\widetilde{r}} \text {~or~} r_i^a(0)\le {\widetilde{r}} \\ \end{array} \right. . \end{aligned}$$ -

If \(-\min _j\left( \sum _{i\ne j}^N{\mathbf {R}}_i\right)<Q^{CB}<0\), the demand schedule is given by

$$\begin{aligned} Q_{i}^v(r)=\left\{ \begin{array}{lll} 0 &{}\quad { if} &{} r^f \le r < \widetilde{{\widetilde{r}}} \text {~or~} r_i^b(0)\ge \widetilde{{\widetilde{r}}}\\ Q_{i}^f\left( \widetilde{{\widetilde{r}}} \right) &{}\quad { if} &{} r= \widetilde{{\widetilde{r}}} \\ Q_{i}^f\left( \widetilde{{\widetilde{r}}} \right) -\max _{j=1,\ldots ,N} \left( \widetilde{{\widetilde{Q}}}_j(r)- Q_{j}^f\left( \widetilde{{\widetilde{r}}} \right) \right) &{}\quad { if} &{} r > \widetilde{{\widetilde{r}}} \\ \end{array} \right. \end{aligned}$$

The equilibrium is then trivially determined such that \(\sum _{i=1}^NQ_i^v\left( r\right) =Q^{CB}\). Due to the full information banks have of each other’s liquidity position, they can fully anticipate the respective demands and submit bids that ensure this equilibrium to be reached.

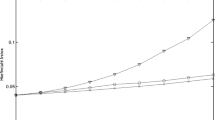

This demand schedule is not easily interpreted and comparable to the result obtained in the fixed rate tender. Hence, we illustrate the equilibrium in Fig. 3. We see that the bids submitted by the banks are entirely flat at \({\widetilde{r}}\) and \(\widetilde{{\widetilde{r}}}\), respectively, until the quantity bid reaches \(Q_i^f\). For larger quantities beyond this threshold the rate acceptable would be lower for liquidity injections and higher for liquidity extractions, the exact shape depending on the liquidity shocks and preferences of the banks. This area of the demand schedule has no unique solution for the same allocations and interest rates. Proposition 3 provides one such bid schedule explicitly.

This inverse bid schedule is given more formally in the following lemma.

Lemma 5

The inverse bid schedule in variable rate tenders is given by

where \(R^{-1}(Q_i)\) denotes the inverse function of \(Q_{i}^v(r)\) as defines in Proposition 3.

As in the case of fixed rate tenders we observe bid shading by banks, which can easily be verified by comparing the equilibrium in Proposition 4 with the marginal prices in Lemma 4.

Even though the bid schedules in the two considered tender mechanisms are very different, we can show that the allocation the central bank achieves can be identical in both cases, i.e. each bank obtains the same amount and the same interest rate.

Proposition 4

An equilibrium exists with \(Q_i^f=Q_i^v\) and \(r^{CB}_f=r^{CB}_v\).

From a central bank perspective, the two tender formats generate the same revenue. Similar results have been found in single unit auctions with risk neutral participants and a private value framework such as in Vickrey (1961), Holt Jr (1980), or Harris and Raviv (1981). For multi-unit auctions, as in our case, such a result is not generally valid. Which auction mechanism gives the higher revenue can be ambiguous and is also quite sensitive to assumptions about the auction as shown in Ausubel et al. (2014). In our model, using the assumption that information of other banks’ reservation prices is known leads to not only a tractable equilibrium but also the revenue equivalence of the two auction mechanisms.

Rights and permissions

About this article

Cite this article

Xiao, D., Krause, A. Bank demand for central bank liquidity and its impact on interbank markets. J Econ Interact Coord 17, 639–679 (2022). https://doi.org/10.1007/s11403-021-00336-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-021-00336-3

Keywords

- Central bank operation

- Bid shading

- Multi-unit auction

- Fixed rate auction

- Variable rate auction

- Interbank network

- Core–periphery network