Abstract

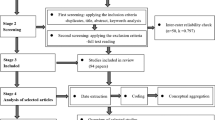

Crowdfunding is on the rise: its volume grew 1000% in only three years and is about to outpace worldwide venture capital spending. A quickly growing body of research is exploring the emerging crowdfunding phenomenon. While the literature offers a detailed and comprehensive picture of decision-making for traditional startup financing or bank loans, it does not provide a holistic understanding of decisions to invest in crowdfunded ventures. Many individual studies investigate isolated factors that influence investor decision-making in crowdfunding campaigns without integrating the findings regarding those influences. A comprehensive view of the relevant decision-making factors is necessary to build future research on and for practitioners to gain a better understanding of how investors choose. We conduct an interdisciplinary literature review to examine which factors influence the investment decisions in crowdfunding. From an analysis of 68 articles, we construct a comprehensive framework of relevant influence factors. Even though prior research covers many factors, others have received scant attention. Especially investors’ cognitive features and the context in which the investment decision is made seem to strongly influence decisions but are scarcely researched. In addition, most reviewed studies focus more on individual factors and campaign success than underlying decision processes. To highlight novel factors of crowdfunding investment decisions, we compare decision-making in traditional investments, such as venture capital and bank loans, to crowdfunding. Our findings offer new avenues for research toward understanding how the shift induced by crowdfunding changes our choices and actions. The analysis should support the endeavor to build better theories and provide a basis for further social and technological development.

Similar content being viewed by others

Notes

Venture capitalists and business angels both provide capital to young startups in exchange for shares of the venture. They are a major foundation of venture financing taking high risks and, in turn, demanding a larger share of the profit in case of success (Mason and Stark 2004). Business angels are usually wealthy and knowledgeable individuals, often founders themselves that provide money in early seed stages and also bring their experience, contacts, and close involvement to the table (Brettel 2003; Mason and Stark 2004). VCs are often organized more institutionalized, e.g., in funds, invest in larger scale, and usually enter in a later and less risky (growth-)stage, providing more capital but less personal involvement than BAs (Mason and Harrison 2002).

For simplicity, we refer to founding entrepreneurs, borrowers, fundraisers and everyone else requesting funding in a crowdfunding campaign as “founders” (for similar use see Beaulieu et al. 2015). We title everyone giving money to the founder “investors.”

We use the terms “campaign success” to address different dependent variables (DV). Due to the heterogeneity of the analyzed research, different measures are used throughout the literature. The most frequently used DVs are funding success (dummy variable indicating if a campaign reached the desired funding goal), number of investors, total funds raised, investment decision of individual investors (dummy coded), or height of an individual’s contribution. For lending-based campaigns a lower interest rate is also used as indicator for campaign success. All these DVs are also indicators for each funder’s “funding decision”, as referred to in later sections. It is common practice in IS literature reviews to cover a diverse set of dependent variables for a specific topic (Bélanger and Crossler 2011; Smith et al. 2011). See Appendix for an overview of the DVs in the reviewed articles.

As some studies cover several types of crowdfunding or different decision-making factors, the figures in the overview tables do not always add up to the 68 analyzed studies.

“Other Management & Economics” includes any management discipline besides entrepreneurship and information systems (e.g., organization, marketing, or finance).

References

Agrawal, A., Catalini, C., & Goldfarb, A. (2015). Crowdfunding: Geography, social networks, and the timing of investment decisions. Journal of Economics and Management Strategy, 24(2), 253–274.

Agrawal, A., Catalini, C., & Goldfarb, A. (2016). Are syndicates the killer app of equity Crowdfunding? California Management Review, 58(2), 111–124.

Agrawal, A. K., Catalini, C., & Goldfarb, A. (2011). The geography of crowdfunding. National Bureau of Economic Research, Working Paper No. 16820, retrieved from http://www.nber.org/papers/w16820.

Ahlers, G. K. C., Cumming, D., Günther, C., & Schweizer, D. (2015). Signaling in equity crowdfunding. Entrepreneurship Theory and Practice, 39(4), 955–980.

Akerlof, G. A. (1970). The market for ‘lemons’: quality uncertainty and the market mechanism. The Quarterly Journal of Economics, 84(3), 488–500.

Aksulu, A., & Wade, M. (2010). A comprehensive review and synthesis of open source research. Journal of the Association for Information Systems, 11(11), 576.

Allison, T. H., Davis, B. C., Short, J. C., & Webb, J. W. (2015). Crowdfunding in a Prosocial microlending environment: examining the role of intrinsic versus extrinsic cues. Entrepreneurship: Theory and Practice, 39(1), 53–73.

Altman, E. I. (1980). Commercial bank lending: process, credit scoring, and costs of errors in lending. Journal of Financial and Quantitative Analysis, 15(4), 813–832.

Altman, E. I., & Saunders, A. (1997). Credit risk measurement: developments over the last 20 years. Journal of Banking & Finance, 21(11–12), 1721–1742.

Andreoni, J. (1990). Impure altruism and donations to public goods: a theory of warm-glow giving. The Economic Journal, 100(401), 464–477.

Antonenko, P. D., Lee, B. R., & Kleinheksel, A. J. (2014). Trends in the crowdfunding of educational technology startups. TechTrends, 58(6), 36–41.

Arthurs, J. D., & Busenitz, L. W. (2003). The boundaries and limitations of agency theory and stewardship theory in the venture capitalist/entrepreneur relationship*. Entrepreneurship Theory and Practice, 28(2), 145–162.

Bachmann, A., Becker, A., Buerckner, D., Hilker, M., Kock, F., Lehmann, M., et al. (2011). Online peer-to-peer lending -- a literature review. Journal of Internet Banking & Commerce, 16(2), 1–18.

Barasinska, N., & Schäfer, D. (2014). Is crowdfunding different? Evidence on the relation between gender and funding success from a German peer-to-peer lending platform. German Economic Review, 15(4), 436–452.

Beaulieu, P. R. (1996). A note on the role of memory in commercial loan officers’ use of accounting and character information. Accounting, Organizations and Society, 21(6), 515–528.

Beaulieu, T., Sarker, S., & Sarker, S. (2015). A conceptual framework for understanding crowdfunding. Communications of the Association for Information Systems, 37(1), 1–31.

Beier, M., & Wagner, K. (2015). Crowdfunding success: a perspective from social media and E-commerce. In ICIS 2015 Proceedings, Track E-Business and E-Governance, Paper 11, Fort Worth, Texas, USA.

Bélanger, F., & Crossler, R. E. (2011). Privacy in the digital age: a review of information privacy research in information systems. MIS Quarterly, 35(4), 1017–1041.

Belleflamme, P., Lambert, T., & Schwienbacher, A. (2013). Individual crowdfunding practices. Venture Capital, 15(4), 313–333.

Belleflamme, P., Lambert, T., & Schwienbacher, A. (2014). Crowdfunding: tapping the right crowd. Journal of Business Venturing, 29(5), 585–609.

Bellman, S., Lohse, G. L., & Johnson, E. J. (1999). Predictors of online buying behavior. Communications of the ACM, 42(12), 32–38.

Bennett, R. (2009). Impulsive donation decisions during online browsing of charity websites. Journal of Consumer Behaviour, 8(2/3), 116–134.

Boeuf, B., Darveau, J., & Legoux, R. (2014). Financing creativity: crowdfunding as a new approach for theatre projects. International Journal of Arts Management, 16(3), 33–48.

Borello, G., De Crescenzo, V., & Pichler, F. (2015). The funding gap and the role of financial return crowdfunding: some evidence from European platforms. Journal of Internet Banking & Commerce, 20(1), 1–20.

Bretschneider, U., & Leimeister, J. M. (2017). Not just an ego-trip: exploring backers’ motivation for funding in incentive-based crowdfunding. The Journal of Strategic Information Systems. https://doi.org/10.1016/j.jsis.2017.02.002.

Brettel, M. (2003). Business angels in Germany: a research note. Venture Capital, 5(3), 251–268.

Bruce, I. W. (1994). Meeting need: Successful charity marketing. London: Institute of Chartered Secretaries and Administrators.

Bruns, V., Holland, D. V., Shepherd, D. A., & Wiklund, J. (2008). The role of human capital in loan officers’ decision policies. Entrepreneurship Theory and Practice, 32(3), 485–506.

Bruton, G., Khavul, S., Siegel, D., & Wright, M. (2015). New financial alternatives in seeding entrepreneurship: microfinance, crowdfunding, and peer-to-peer innovations. Entrepreneurship Theory and Practice, 39(1), 9–26.

Burtch, G., Ghose, A., & Wattal, S. (2013a). An empirical examination of users’ information hiding in a crowdfunding context. In ICIS 2013 Proceedings, Track 6: Economics and Value of IS, Paper 6, Milan, Italy.

Burtch, G., Ghose, A., & Wattal, S. (2013b). An empirical examination of the antecedents and consequences of contribution patterns in crowd-funded markets. Information Systems Research, 24(3), 499–519.

Burtch, G., Ghose, A., & Wattal, S. (2014a). An empirical examination of peer referrals in online crowdfunding. In ICIS 2014 Proceedings, Track 5: E-Business , Paper 52 , Auckland, New Zealand.

Burtch, G., Ghose, A., & Wattal, S. (2014b). An experiment in crowdfunding: assessing the role and impact of transaction-level information controls. In ICIS 2014 Proceedings, Track 6: Economics and Value of I S, Paper 4, Auckland, New Zealand.

Burtch, G., Ghose, A., & Wattal, S. (2014c). Cultural differences and geography as determinants of online Prosocial lending. MIS Quarterly, 38(3), 773–794.

Burtch, G., Ghose, A., & Wattal, S. (2015). The hidden cost of accommodating Crowdfunder privacy preferences: a randomized field experiment. Management Science, 61(5), 949–962.

Cacioppo, J. T., & Petty, R. E. (1982). The need for cognition. Journal of Personality and Social Psychology, 42(1), 116.

Chan, C. S. R., & Park, H. D. (2015). How images and color in business plans influence venture investment screening decisions. Journal of Business Venturing, 30(5), 732–748.

Chemin, M., & De Laat, J. (2013). Can warm glow alleviate credit market failures? Evidence from online peer-to-peer lenders. Economic Development and Cultural Change, 61(4), 825–858.

Chen, D., & Han, C. (2012). A comparative study of online P2P lending in the USA and China. Journal of Internet Banking & Commerce, 17(2), 1–15.

Cheung, C. M., Chan, G. W., & Limayem, M. (2005). A critical review of online consumer behavior: empirical research. Journal of Electronic Commerce in Organizations, 3(4), 1.

Cheung, C.-K., & Chan, C.-M. (2000). Social-cognitive factors of donating money to charity, with special attention to an international relief organization. Evaluation and Program Planning, 23(2), 241–253.

Childers, T. L., Carr, C. L., Peck, J., & Carson, S. (2002). Hedonic and utilitarian motivations for online retail shopping behavior. Journal of Retailing, 77(4), 511–535.

Cholakova, M., & Clarysse, B. (2015). Does the possibility to make equity Investments in crowdfunding projects crowd out reward-based investments? Entrepreneurship: Theory & Practice, 39(1), 145–172.

Choy, K., & Schlagwein, D. (2016). Crowdsourcing for a better world. Information Technology & People, 29(1), 221–247.

Christensen, C. M. (2013). The innovator’s dilemma: When new technologies cause great firms to fail. Boston: Harvard Business School Press.

Colombo, M. G., Franzoni, C., & Rossi-Lamastra, C. (2015). Internal social capital and the attraction of early contributions in crowdfunding. Entrepreneurship: Theory & Practice, 39(1), 75–100.

Companisto.com (2016). Crowdfunding for Mornin’ Glory. Retrieved from https://www.companisto.com/en/investment/morninglory. Accessed 5 May 2016.

Cordova, A., Dolci, J., & Gianfrate, G. (2015). The determinants of crowdfunding success: evidence from technology projects. Procedia - Social and Behavioral Sciences, 181, 115–124.

Cumming, D., & Johan, S. (2013). Demand-driven securities regulation: evidence from crowdfunding. Venture Capital, 15(4), 361–379.

Danos, P., Holt, D. L., & Imhoff, E. A. (1989). The use of accounting information in bank lending decisions. Accounting, Organizations and Society, 14(3), 235–246.

Darley, W. K., Blankson, C., & Luethge, D. J. (2010). Toward an integrated framework for online consumer behavior and decision making process: A review. Psychology and Marketing, 27(2), 94–116.

Das, S., Echambadi, R., McCardle, M., & Luckett, M. (2003). The effect of interpersonal trust, need for cognition, and social loneliness on shopping, information seeking and surfing on the web. Marketing Letters, 14(3), 185–202.

De Buysere, K., Gajda, O., Kleverlaan, R., Marom, D., & Klaes, M. (2012). A framework for European crowdfunding. European Crowdfunding Network (ECN), available at www.europecrowdfunding.org/european_crowdfunding_framework (61).

Dickert, S., Sagara, N., & Slovic, P. (2011). Affective motivations to help others: a two-stage model of donation decisions. Journal of Behavioral Decision Making, 24(4), 361–376.

Dixon-Woods, M., Cavers, D., Agarwal, S., Annandale, E., Arthur, A., Harvey, J., et al. (2006). Conducting a critical interpretive synthesis of the literature on access to healthcare by vulnerable groups. BMC Medical Research Methodology, 6(35), 1–13.

Dorfleitner, G., Priberny, C., Schuster, S., Stoiber, J., Weber, M., de Castro, I., et al. (2016). Description-text related soft information in peer-to-peer lending – Evidence from two leading European platforms. Journal of Banking & Finance, 64, 169–187.

Duarte, J., Siegel, S., & Young, L. (2012). Trust and credit: the role of appearance in peer-to-peer lending. Review of Financial Studies, 25(8), 2455–2484.

Dubé, L., & Paré, G. (2003). Rigor in information systems positivist case research: current practices, trends, and recommendations. MIS Quarterly, 27(4), 597–636.

Dushnitsky, G., Guerini, M., Piva, E., & Rossi-Lamastra, C. (2016). Crowdfunding in Europe: determinants of platform creation across countries. California Management Review, 58(2), 44–71.

EIOPA (2015). Financial stability report. EIOPA-FSC-15-088/2015. European insurance and occupational pensions authority. Available at https://eiopa.europa.eu/Publications/Reports/Financial_Stability_Report_December_2015.pdf.

Engel, J. F., Blackwell, R. D., & Miniard, P. W. (1995). Consumer behavior, 8th. New York: Dryder.

Evans, D. S., & Jovanovic, B. (1989). An estimated model of entrepreneurial choice under liquidity constraints. Journal of Political Economy, 97(4), 808–827.

Frydrych, D., Bock, A. J., Kinder, T., & Koeck, B. (2014). Exploring entrepreneurial legitimacy in reward-based crowdfunding. Venture Capital, 16(3), 247–269.

Galak, J., Small, D., & Stephen, A. T. (2011). Microfinance decision making: a field study of prosocial lending. Journal of Marketing Research (JMR), 48, S130–S137.

Galuszka, P., & Bystrov, V. (2014). Crowdfunding: a case study of a new model of financing music production. Journal of Internet Commerce, 13(3/4), 233–252.

Gefen, D. (2002). Customer loyalty in e-commerce. Journal of the Association for Information Systems, 3(1), 2.

Genevsky, A., & Knutson, B. (2015). Neural affective mechanisms predict market-level microlending. Psychological Science (Sage Publications Inc.), 26(9), 1411–1422.

Gerber, E. M., & Hui, J. (2013). Crowdfunding: motivations and deterrents for participation. ACM Transactions on Computer-Human Interaction, 20(6), 34 1–34:32.

Gerber, E. M., Hui, J. S., & Kuo, P.-Y. (2012). Crowdfunding: Why people are motivated to post and fund projects on crowdfunding platforms. In Proceedings of the International Workshop on Design, Influence, and Social Technologies: Techniques, Impacts and Ethics (vol. 2, p. 11).

Gigerenzer, G., & Goldstein, D. G. (1996). Reasoning the fast and frugal way: Models of bounded rationality. Psychological Review, 103(4), 650–669.

Glaser, B., & Strauss, A. (1967). The discovery of grounded theory: strategies for qualitative research. London: Weidenfeld and Nicholson.

Gleasure, R. (2015). Resistance to crowdfunding among entrepreneurs: An impression management perspective. The Journal of Strategic Information Systems, 24(4), 219–233.

Gonzalez, L., & Loureiro, Y. K. (2014). When can a photo increase credit? The impact of lender and borrower profiles on online peer-to-peer loans. Journal of Behavioral and Experimental Finance, 2, 44–58.

Greiner, M. E., & Wang, H. (2010). Building consumer-to-consumer trust in E-finance marketplaces: an empirical analysis. International Journal of Electronic Commerce, 15(2), 105–136.

Haas, P., Blohm, I., & Leimeister, J. M. (2014). An empirical taxonomy of crowdfunding intermediaries. In ICIS 2014 Proceedings, Track 19: Social Media and Digital Collaborations, Paper 13, Auckland, New Zealand.

Hall, J., & Hofer, C. W. (1993). Venture capitalists’ decision criteria in new venture evaluation. Journal of Business Venturing, 8(1), 25.

Hansen, T. (2008). Consumer values, the theory of planned behaviour and online grocery shopping. International Journal of Consumer Studies, 32(2), 128–137.

Harrison, R. (2013). Crowdfunding and the revitalisation of the early stage risk capital market: catalyst or chimera? Venture Capital, 15(4), 283–287.

Hennig-Thurau, T., Gwinner, K. P., Walsh, G., & Gremler, D. D. (2004). Electronic word-of-mouth via consumer-opinion platforms: what motivates consumers to articulate themselves on the internet? Journal of Interactive Marketing, 18(1), 38–52.

Herzenstein, M., Dholakia, U. M., & Andrews, R. L. (2011a). Strategic herding behavior in peer-to-peer loan auctions. Journal of Interactive Marketing, 25(1), 27–36.

Herzenstein, M., Sonenshein, S., & Dholakia, U. M. (2011b). Tell me a good story and I may lend you money: the role of narratives in peer-to-peer lending decisions. Journal of Marketing Research (JMR), 48, S138–S149.

Hibbert, S., & Horne, S. (1996). Giving to charity: questioning the donor decision process. The Journal of Consumer Marketing, 13(2), 4–13.

Hisrich, R. D., & Jankowicz, A. D. (1990). Intuition in venture capital decisions: an exploratory study using a new technique. Journal of Business Venturing, 5(1), 49.

Hobbs, J., Grigore, G., & Molesworth, M. (2016). Success in the management of crowdfunding projects in the creative industries. Internet Research, 26(1), 146–166.

Hong, Y., Hu, Y., & Burtch, G. (2015). How does social media affect contribution to public versus private goods in crowdfunding campaigns? In ICIS 2015 Proceedings, Track Social Media, Paper 22, Fort Worth: Texas, USA.

Hörisch, J. (2015). Crowdfunding for environmental ventures: an empirical analysis of the influence of environmental orientation on the success of crowdfunding initiatives. Journal of Cleaner Production, 107, 636–645.

Hulme, M. K., & Wright, C. (2006). Internet based social lending: past, present and future. Social Futures Observatory, 11, 1–115.

Iyer, R., Khwaja, A. I., Luttmer, E. F. P., & Shue, K. (2009). Screening in new credit markets: can individual lenders infer borrower creditworthiness in peer-to-peer lending? Harvard University, John F. Kennedy School of Government, Working Paper Series. https://doi.org/10.2139/ssrn.1570115.

Iyer, R., Khwaja, A. I., Luttmer, E. F., & Shue, K. (2015). Screening peers softly: Inferring the quality of small borrowers. Management Science, 62(6), 1554–1577.

Jenq, C., Pan, J., & Theseira, W. (2015). Beauty, weight, and skin color in charitable giving. Journal of Economic Behavior & Organization, 119, 234–253.

Jian, L., & Shin, J. (2015). Motivations behind donors’ contributions to Crowdfunded journalism. Mass Communication & Society, 18(2), 165.

Kahneman, D. (2011). Thinking, fast and slow. London: Macmillan.

Katawetawaraks, C., & Cheng, L. W. (2011). Online shopper behavior: Influences of online shopping decision. Asian Journal of Business Research, 1(2). Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2345198.

Khavul, S. (2010). Microfinance: creating opportunities for the poor? The Academy of Management Perspectives, 24(3), 58–72.

Khavul, S., Chavez, H., & Bruton, G. D. (2013). When institutional change outruns the change agent: the contested terrain of entrepreneurial microfinance for those in poverty. Journal of Business Venturing, 28(1), 30–50.

Kiva.org (2016). Kiva - about us. Retrieved from https://www.kiva.org/about. Accessed 29 April 2016.

Krahnen, J. P., & Weber, M. (2001). Generally accepted rating principles: a primer. Journal of Banking & Finance, 25(1), 3–23.

Lee, E., & Lee, B. (2012). Herding behavior in online P2P lending: an empirical investigation. Electronic Commerce Research and Applications, 11(5), 495–503.

Levin, R. B., Nowakowski, J., & O’brien, A. A. (2013). The JOBS act--implications for raising capital and for financial intermediaries. Journal of Taxation & Regulation of Financial Institutions, 26(5), 21–29.

Ley, A., & Weaven, S. (2011). Exploring agency dynamics of crowdfunding in start-up capital financing. Academy of Entrepreneurship Journal, 17(1), 85–110.

Lin, M., Prabhala, N. R., & Viswanathan, S. (2013). Judging borrowers by the company they keep: friendship networks and information asymmetry in online peer-to-peer lending. Management Science, 59(1), 17–35.

Lin, M., & Viswanathan, S. (2015). Home bias in online investments: an empirical study of an online crowdfunding market. Management Science, 62(5), 1393–1414.

Liu, D., Brass, D. J., Lu, Y., & Chen, D. (2015). Friendships in online peer-to-peer lending: pipes, prisms, and relational herding. MIS Quarterly, 39(3), 729–742.

Loureiro, Y. K., & Gonzalez, L. (2015). Competition against common sense. The International Journal of Bank Marketing, 33(5), 605–623.

Luo, B., & Lin, Z. (2013). A decision tree model for herd behavior and empirical evidence from the online P2P lending market. Information Systems & e-Business Management, 11(1), 141–160.

MacMillan, I., Siegel, R., & Narasimha, P. N. S. (1985). Criteria used by venture capitalists to evaluate new venture proposals. Journal of Business Venturing, 1(1), 119.

Malhotra, D. K. K., & Malhotra, R. (2003). Evaluating consumer loans using neural networks. Omega, 31(2), 83–96.

Mason, C. M., & Harrison, R. T. (2002). Is it worth it? The rates of return from informal venture capital investments. Journal of Business Venturing, 17(3), 211–236.

Mason, C., & Stark, M. (2004). What do Investors look for in a business plan?: A comparison of the investment criteria of bankers, venture capitalists and business angels. International Small Business Journal, 22(3), 227–248.

Massolution (2015). The crowdfunding industry report, 2015CF, available at http://reports.crowdsourcing.org/index.php?route=product/product&product_id=54.

Maxwell, A. L., Jeffrey, S. A., & Lévesque, M. (2011). Business angel early stage decision making. Journal of Business Venturing, 26(2), 212–225.

Meer, J. (2014). Effects of the price of charitable giving: Evidence from an online crowdfunding platform. Journal of Economic Behavior & Organization, 103, 113–124.

Mendes-Da-Silva, W., Rossoni, L., Conte, B. S., Gattaz, C. C., & Francisco, E. R. (2016). The impacts of fundraising periods and geographic distance on financing music production via crowdfunding in Brazil. Journal of Cultural Economics, 40(1), 75–99.

Michels, J. (2012). Do unverifiable disclosures matter? Evidence from peer-to-peer lending. Accounting Review, 87(4), 1385–1413.

Miles, M. B., & Huberman, A. M. (1984). Drawing valid meaning from qualitative data: toward a shared craft. Educational Researcher, 13(5), 20.

Mill, J. S. (1844). On the definition of political economy, and on the method of investigation proper to it. Essays on some unsettled questions of political economy. London: Longmans, Green, Reader, and Dyer.

Mollick, E. (2014). The dynamics of crowdfunding: An exploratory study. Journal of Business Venturing, 29(1), 1–16.

Mollick, E. R., & Nanda, R. (2015). Wisdom or madness? Comparing crowds with expert evaluation in funding the arts. Management Science, 62(6), 1533–1553.

Mollick, E., & Robb, A. (2016). Democratizing innovation and capital access: the role of crowdfunding. California Management Review, 58(2), 72–87.

Moritz, A., & Block, J. H. (2016). Crowdfunding: a literature review and research directions. In D. Brüntje, O. Gajda (Eds.), Crowdfunding in Europe. FGF studies in small business and entrepreneurship. Cham: Springer.

Moritz, A., Block, J., & Lutz, E. (2015). Investor communication in equity-based crowdfunding: A qualitative-empirical study. Qualitative Research in Financial Markets, 7(3), 309–342.

Moss, T. W., Neubaum, D. O., & Meyskens, M. (2015). The effect of virtuous and entrepreneurial orientations on microfinance lending and repayment: a signaling theory perspective. Entrepreneurship: Theory & Practice, 39(1), 27–52.

Noblit, G., & Hare, R. (1988). Meta-ethnography. Thousand Oaks: SAGE Publications.

Norton, E. (1995). Venture capital as an alternative means to allocate capital: an agency-theoretic view. Entrepreneurship: Theory and Practice, 20(2), 19–30.

Okoli, C., & Schabram, K. (2010). A guide to conducting a systematic literature review of Information Systems Research. Sprouts: Working Papers on Information Systems, 10(26), http://sprouts.aisnet.org/10-26.

Olson, J. C. (1976). Price as an informational cue: Effects on product evaluations. College of Business Administration, Pennsylvania State University: University Park.

Ordanini, A., Miceli, L., Pizzetti, M., & Parasuraman, A. (2011). Crowd-funding: transforming customers into investors through innovative service platforms. Journal of Service Management 22(4), R. P. Fisk (Ed.), (pp. 443–470).

Ortiz de Guinea, A., & Paré, G. (2017). What literature review type should I conduct? In R. Galliers & M. Sten (Eds.), The Routledge companion to management information systems. Oxford: Routledge, Taylor & Francis Group.

Paré, G., Tate, M., Johnstone, D., & Kitsiou, S. (2016). Contextualizing the twin concepts of Systematicity and transparency in information systems literature reviews. European Journal of Information Systems, 25(6), 493–508.

Patton, M. Q. (1980). Qualitative evaluation methods. Beverly Hills: Sage.

Piccoli, G., & Ives, B. (2005). It-dependent strategic initiatives and sustained competitive advantage: a review and synthesis of the literature. MIS Quarterly, 29(4), 747–776.

Pitschner, S., & Pitschner-Finn, S. (2014). Non-profit differentials in crowd-based financing: evidence from 50,000 campaigns. Economics Letters, 123(3), 391–394.

Pope, D. G., & Sydnor, J. R. (2011). What’s in a picture? Journal of Human Resources, 46(1), 53–92.

Preston, J. (2014). How Marillion pioneered crowdfunding in music. In Virgin.com Retrieved from https://www.virgin.com/music/how-marillion-pioneered-crowdfunding-in-music. Accessed 5 May 2016.

Prystav, F. (2016). Personal information in peer-to-peer loan applications: Is less more? Journal of Behavioral and Experimental Finance, 9, 6–19.

Ryu, S., & Kim, Y.-G. (2016). A typology of crowdfunding sponsors: birds of a feather flock together? Electronic Commerce Research and Applications, 16, 43–54.

Sahlman, W. A. (1990). The structure and governance of venture-capital organizations. Journal of Financial Economics, 27(2), 473–521.

Saxton, G. D., & Wang, L. (2014). The social network effect: the determinants of giving through social media. Nonprofit and Voluntary Sector Quarterly, 43(5), 850.

Schwarz, A., Mehta, M., Johnson, N., & Chin, W. W. (2007). Understanding frameworks and reviews: a commentary to assist us in moving our field forward by analyzing our past. SIGMIS Database, 38(3), 29–50.

Smith, H. J., Dinev, T., & Xu, H. (2011). Information privacy research: an interdisciplinary review. MIS Quarterly, 35(4), 989–1016.

Smith, P. F. (1964). Measuring risk on consumer Instalment credit. Management Science, 11(2), 327–340.

Sonenshein, S., Herzenstein, M., & Dholakia, U. M. (2011). How accounts shape lending decisions through fostering perceived trustworthiness. Organizational Behavior and Human Decision Processes, 115(1), 69–84.

Steinberg, D. (2012). The Kickstarter Handbook: Real-Life Success Stories of Artists, Inventors, and Entrepreneurs, Original edition. Philadelphia: Quirk Books.

Strauss, A. L., & Corbin, J. M. (1998). Basics of qualitative research: Techniques and procedures for developing grounded theory. Thousand Oaks: Sage Publications.

Strong, D. M., & Volkoff, O. (2010). Understanding organization - Enterprise system fit: a path to theorizing the information technology artifact. MIS Quarterly, 34(4), 731–756.

Sullivan, M. (2006). Crowdfunding. In fundavlog.com . Retrieved from http://web.archive.org/web/20070224191008/http://fundavlog.com/community/index.php?op=ViewArticle&articleId=9&blogId=1. Accessed 28 Apr 2016.

Thaler, R. (1980). Toward a positive theory of consumer choice. Journal of Economic Behavior & Organization, 1(1), 39–60.

Thaler, R. H. (2000). From Homo Economicus to Homo Sapiens. The Journal of Economic Perspectives, 14(1), 133–141.

Thaler, R. H., & Sunstein, C. R. (2008). Nudge: Improving decisions about health, wealth and happiness. New Haven: Yale University Press.

Thies, F., Wessel, M., & Benlian, A. (2014). Understanding the dynamic interplay of social buzz and contribution behavior within and between online platforms – Evidence from crowdfunding. In ICIS 2014 Proceedings, Track 19: Social Media and Digital Collaborations, Paper 7, Auckland, New Zealand.

Tsiotsou, R. (2006). The role of perceived product quality and overall satisfaction on purchase intentions. International Journal of Consumer Studies, 30(2), 207–217.

Tversky, A., & Kahneman, D. (1974). Judgment under uncertainty: heuristics and biases. Science, 185(4157), 1124–1131.

Vulkan, N., Åstebro, T., & Sierra, M. F. (2016). Equity crowdfunding: a new phenomena. Journal of Business Venturing Insights, 5, 37–49.

Weber, O., Scholz, R. W., & Michalik, G. (2010). Incorporating sustainability criteria into credit risk management. Business Strategy and the Environment, 19(1), 39–50.

Webster, J., & Watson, R. T. (2002). Analyzing the Past to Prepare for the Future: Writing a Literature Review. MIS Quarterly, 26(2), xiii–xxiii.

West, D. (2000). Neural network credit scoring models. Computers & Operations Research, 27(11), 1131–1152.

Whitty, M. T., & Joinson, A. (2008). Truth, lies and trust on the internet. Abingdon: Routledge.

Wolfswinkel, J. F., Furtmueller, E., & Wilderom, C. P. (2013). Using grounded theory as a method for rigorously reviewing literature. European Journal of Information Systems, 22(1), 45–55.

Xiao, X., Califf, C. B., Sarker, S., & Sarker, S. (2013). ICT innovation in emerging economies: a review of the existing literature and a framework for future research. Journal of Information Technology, 28(4), 264–278.

Xu, B., Zheng, H., Xu, Y., & Wang, T. (2016). Configurational paths to sponsor satisfaction in crowdfunding. Journal of Business Research, 69(2), 915–927.

Yum, H., Lee, B., & Chae, M. (2012). From the wisdom of crowds to my own judgment in microfinance through online peer-to-peer lending platforms. Electronic Commerce Research and Applications, 11(5), 469–483.

Zacharakis, A. L., & Meyer, G. D. (1998). A lack of insight: do venture capitalists really understand their own decision process? Journal of Business Venturing, 13(1), 57.

Zhang, J., & Liu, P. (2012). Rational herding in microloan markets. Management Science, 58(5), 892–912.

Zheng, H., Hung, J.-L., Qi, Z., & Xu, B. (2016). The role of trust management in reward-based crowdfunding. Online Information Review, 40(1), 97–118.

Zheng, H., Li, D., Wu, J., & Xu, Y. (2014). The role of multidimensional social capital in crowdfunding: a comparative study in China and US. Information Management, 51(4), 488–496.

Zvilichovsky, D., Inbar, Y., & Barzilay, O. (2013). Playing both sides of the market: success and reciprocity on crowdfunding platforms. In ICIS 2013 Proceedings, Track 6: Economics and the Value of IS, Paper 13, Milan, Italy.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editors: Roman Beck and Rainer Alt

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Hoegen, A., Steininger, D.M. & Veit, D. How do investors decide? An interdisciplinary review of decision-making in crowdfunding. Electron Markets 28, 339–365 (2018). https://doi.org/10.1007/s12525-017-0269-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12525-017-0269-y