Abstract

This paper describes the mechanism that drives the peak of conventional oil in a region, and shows that identifying this peak is assisted by access to oil industry backdated proved-plus-probable oil discovery data. The paper then uses estimates of the ultimately recoverable resource (URR) of conventional oil to show that the plateau in the global production of this oil since 2005 has been resource-limited, at least for oil prices well in excess of $100/bbl. Since this date the world’s marginal barrels have been of non-conventional oils and ‘other liquids’. The economic and political consequences of this plateau are then examined. These include the steep rise in oil price after 2004 (in significant part reflecting the increased production cost of the marginal barrels); this contributing to the 2008/9 global recession; the lower EROI ratios and higher CO2 emissions of the marginal barrels; and the growth of US tight oil. The post-2004 oil price rise is set in the context of oil price changes since 1923. This shows that the price of oil over this period has been set primarily by increases in the marginal production cost of oil, overlain by relatively short-term price excursions due to supply/demand imbalances. Finally we note that the global economy as currently configured requires increasing supply of inexpensive oil if the economic expectations of the world’s rapidly growing population are to be met. But supply of low-cost oil is in decline, and the world must use less oil to meet climate change goals. Resolving this conundrum looks to be difficult. Annex 1 sets out definitions and data. Annex 2 summarises the current wide range of views and forecasts of global ‘all-liquids’ supply.

Source: IHS Energy ‘Liquids’ data; from Fig. 7 of Miller and Sorrell (2014) for cumulative discovery from 1900 to 2007, and from the corresponding Fig. 3 for cumulative production over the same period. Included in this plot are the data for end-2011 as given in the text of the Miller and Sorrell paper. Data are 2P, except for the US and Canada non-frontier areas, which are proved (‘1P’) data. The 2P data are backdated, in that they reflect information available to the IHS Energy as of 2007 (for the discovery curve), and to 2011 (for the final discovery data point). Reserves are calculated here (as done also by IHS Energy) by subtracting cumulative production from cumulative discovery. IHS Energy data are for oil in fields for conventional oil, and as announced in projects for non-conventional oils

Source: From a presentation by P.R. Bauquis and D. Babusiaux: ‘L’offshore pétrolier et gazier situation actuelle et perspectives, given at an ASPO-France meeting, 6 February 2019. The slide itself says: “Source: IHS (Edin) for conventional discoveries volumes (@01/01/2018), BP (Statistical Review of World Energy) for production figures, & Rystad for unconventional figures.”

Source: Chart by M. Mushalik. Data are from the US EIA for crude-plus-condensate, NGPLs, other liquids, and refinery gain; Canada tar sands data from the Canadian Association of Petroleum Producers; Orinoco oil data are from PDVSA. From time to time updates of this chart may be available at https://crudeoilpeak.info/latest-graphs

Source: IEA, ‘Resources to Reserves’ report, 2013

Source: Chart produced by Matt Mushalik, data from EIA

Source: Matt Mushalik

Source: Martin Pelletier, Financial Post Feb. 29, 2016, article titled: ‘Is the oil price plunge a recession trigger? History says otherwise’. Pelletier writes: ‘History has proven that every time there was a major global recession it was immediately preceded by a large spike in oil prices followed by a large drop during the recession’

Similar content being viewed by others

Data Repository

To access papers published in ‘The Oil Age’, go to www.theoilage.org and select: ‘View Articles’.

Notes

In the context of tight oil we note that George P. Mitchell, the pioneer of shale gas (which in turn led to tight oil), was “in the 1970s a sponsor of the work of Dennis Meadows, whose Club of Rome study ‘The Limits to Growth’ was a global wake-up call on the pressing need for sustainable energy technologies and food sources worldwide. … The Mitchells also underwrote the National Academies' ‘Our Common Journey: A Transition Toward Sustainability.” [Wikipedia, accessed 8 Nov. 2019.]

A key meeting held in 1997 at the IEA reflected two opposite views: ‘a near-term peak in oil’, and ‘no oil constraints in sight’ (see recollections by some of those present in Campbell 2011). J-M Bourdaire chaired this meeting, and endorsed the ‘peak is close’ view in the 1998 IEA World Energy Outlook. In its base case this used the then-USGS mean global URR for conventional oil of 2300 Gb, and predicted that the global peak of all-oil, except for ‘unidentified unconventional’ oil, would occur in 2014. Bourdaire later made it clear that ‘unidentified unconventional’ was intended to signal the expectation of an all-oil peak. In the event US tight oil became this ‘unidentified unconventional’. In 1998 there had been considerable push-back against the IEA making any mention of peak oil, and a similar situation occurred with the IEA 2008 WEO under Birol, see Chapter 29 of Auzanneau (2018).

One of us (Bentley) has had a number of communications with Dale, his predecessor as Chief Economist at BP, Peter Davies, with Aguilera and also Lynch. None of these communications seems to have altered the views of any of those involved, including Bentley.

References

Aguilera RF (2014) Production costs of global conventional and unconventional petroleum. Energy Policy 64:134–140

Aguilera RF, Radetzki M (2016) The price of oil. Cambridge University Press, Cambridge

Aguilera RF (2019) Presentation: The exceptional price performance of oil: explanations & prospects, SPE talk CSpring 2019

Andrews S, Udall R (2015) Oil prophets: looking at world oil studies over time. Oil Age 1(3):41–61

Auzanneau M (2018) Oil, power and war: a dark history. Chelsea Green Publishing, New York

Ayres RU, Warr B (2009) The economic growth engine: how energy and work drive material prosperity. Edward Elgar Publishing Ltd., Cheltenham

Baumeister C, Kilian L (2016) Forty years of oil price fluctuations: why the price of oil may still surprise us. J Econ Perspect 30(1):139–160

Benes J, Chauvet M, Kamenik O, Kumhof M, Laxton D, Mursula S, Selody J (2012) The future of oil: geology versus technology. IMF Working Paper WP/12/109, International Monetary Fund

Bentley RW (2015a) A Review of some estimates for the Global Ultimately Recoverable Resource (‘URR’) of conventional oil, as an explanation for the differences between oil forecasts (part 1). Oil Age 1(3):63–90

Bentley RW (2015b) A Review of some estimates for the Global Ultimately Recoverable Resource (‘URR’) of conventional oil, as an explanation for the differences between oil forecasts (part 2). Oil Age 1(4):55–77

Bentley RW (2015c) Forecasting oil production using data in the BP statistical review of world energy. Oil Age 1(1):59–73

Bentley RW (2016a) Introduction to peak oil - Lecture notes in energy. Springer, New York

Bentley RW (2016b) Book review: the Oracle of oil: a Maverick geologist’s quest for a sustainable future. Oil Age 2(2):55–75

Bentley RW (2016c) A Review of some estimates for the Global Ultimately Recoverable Resource (‘URR’) of conventional oil, as an explanation for the differences between oil forecasts (part 3). Oil Age 2(1):57–81

Bentley RW (2018) The need for strong caveats on proved oil reserves, and on R/P ratios. Paper available from www.theoilage.org, then select ‘Oil Data and Analysis’, and ‘DOWNLOAD PDF’

Bentley RW, Bentley Y (2015a) Explaining the price of oil, 1861 to 1970: the need to use reliable data on oil discovery and to account for ‘mid-point’ peak. Oil Age 1(2):57–83

Bentley RW, Bentley Y (2015b) Explaining the price of oil, 1971 to 2014: the need to use reliable data on oil discovery and to account for ‘mid-point’ peak. Energy Policy 86:880–890

Bentley RW, Mannan SA, Wheeler SJ (2007) Assessing the date of the global oil peak: the need to use 2P reserves. Energy Policy 35:6364–6382

Campbell CJ (ed) (2011) Peak oil personalities. Inspire Books, Skibbereen

Campbell CJ (2013) Campbell’s Atlas of oil and gas depletion, 2nd edn. Springer, New York

Campbell CJ (2015) Modelling oil and gas depletion. Oil Age 1(1):9–33

Campbell CJ, Laherrère JH (1995) The world’s supply of oil, 1930–2050. Petroconsultants S.A., Geneva, Oct 1995, 650pp; and on CD-ROM

Campbell CJ, Laherrère JH (1998) The end of cheap oil. Scientific American, March, pp 78–83

Carbajales-Dale M (2019) When is EROI not EROI? Biophys Econ Resour Qual 4:16

Dale S (2015) The new economics of oil. Presentation at the society of business economists annual conference, London, 13 Oct

Dale S (2017) Presentation at Imperial College, London, Dec 2017

Dale S, Fattouh B (2018) Peak oil demand and long-run oil prices. Oxford Institute of Energy Studies, Energy Insight 25, Jan. 2018.

Dittmar M (2016) Regional oil extraction and consumption: a simple production model for the next 35 years. Part I. Biophy Econ Resour Qual 1:7

Dittmar M (2017) A regional oil extraction and consumption model. Part II: Predicting the declines in regional oil consumption. Biophys Econ Resour Qual 2:16

Fattouh B (2007) The drivers of oil prices: the usefulness and limitations of non-structural model, the demand-supply framework and informal approaches. Discussion Paper 71, School of Oriental and African Studies, University of London, UK

Financial Times (2020) Mike Pompeo says US ready to meet all Belarus’s oil needs. Article by James Shotter, Central Europe Correspondent, 1 Feb 2020

Globalshift Ltd (2018) Data are from the company website (www.globalshift.co.uk), and as also kindly supplied by the company

Hamilton JD (2009a) Causes and consequences of the oil shock of 2007–08. Brook Pap Econ Act Spring 2009:215–283

Hamilton JD (2009) Understanding crude oil prices. Energy J IAEE 30(2):179–206

Hamilton JD (2011) Historical oil shocks. Department of Economics, University of California, San Diego

Hewett DF (1929) Cycles in metal production. Technical Publication No. 183. American Institute of Mining and Metallurgical Engineers, New York

Hubbert MK (1949) Energy from fossil fuels. Science, vol. 109, 14 Feb, pp 103–109

Hubbert MK (1956) Nuclear energy and the fossil fuels. Shell Oil Company/American Petroleum Institute. Presented before the Spring Meeting of the Southern District, American Petroleum Institute, Plaza Hotel, San Antonio, Texas, 7–9 Mar 1956

Hubbert MK (1982) Techniques of prediction as applied to the production of oil and gas. Oil and gas supply modeling: proceedings of a symposium at the department of commerce, Washington DC, June 18–20 1980; pp 16–141

Hughes D (2019) Shale reality check 2019: drilling into the U.S. government’s optimistic forecasts for shale gas and tight oil production through 2050. https://www.postcarbon.org/publications/shale-reality-check-2019/

Institute of International Finance (IIF) (2020) Global debt monitor report: sustainability matters, 13 Jan, 2020

Jackson PM, Smith LK (2014) Exploring the undulating plateau: the future of global oil supply. Phil Trans R Soc A 372:20120491

Jefferson M (2019) Why do so many economists underplay the psychological and biophysical aspects of life on earth? Biophys Econ Resour Qual 4:15

Kaufmann RK, Connelly C (2020) Oil price regimes and their role in price diversions from market fundamentals. Nat Energy 5:141–149

Keen S, Ayres RU, Standish R (2019) A note on the role of energy in production. Ecol Econ 157:40–46

King LC, van den Bergh JCJM (2018) Implications of net energy-return-on-investment for a low-carbon energy transition. Nat Energy. https://doi.org/10.1038/s41560-018-0116-1

Laherrère JH (2015) A global oil forecasting model based on multiple ‘Hubbert’ curves and adjusted oil-industry ‘2P’ discovery data: background, description & results. The Oil Age 1(2):13–37

Laherrère JH, Perrodon A, Demaison G (1994) Undiscovered petroleum potential. Petroconsultants S.A., Geneva, 383 pp

Laherrère JH, Perrodon A, Campbell CJ (1996) The world's gas potential. Petroconsultants SA, Geneva July/August 1996, 200 pp; and on CD-ROM

Laherrère JH, Miller R, Campbell CJ, Wang J, Bentley RW (2016, 2017). Oil forecasting: data sources and data problems. Part 1, Oil Age 2(3):23–124; Part 2, Oil Age 2(4):1–88; Part 3, Oil Age 3(1):1–135

Lynch M (2019) The peak oil denier takes a victory lap. Forbes website, 4 Nov 2019. https://www.forbes.com/sites/michaellynch/#6571d90d21a1

Masnadi MS et al (2018) Global carbon intensity of crude oil production. Science 361(6405):851–853

McGlade C, Ekins P (2015) The geographical distribution of fossil fuels unused when limiting global warming to 2 °C. Nature 517:187–190

Michaux S (2019) Oil from a critical raw material perspective. Geological Survey of Finland (GTK); 22.12.2019, GTK Open File Work Report 70/2019

Miller RG (2015) A bottom-up model of future global oil supply. Oil Age 1(2):39–55

Miller RG, Sorrell SR (2014) The future of oil supply. Phil Trans R Soc A 372:20130179

Murphy DJ (2014) The implications of the declining energy return on investment of oil production. Phil Trans R Soc A 372:20130126

Nduagu EI, Gates ID (2015) Unconventional heavy oil growth and global greenhouse gas emissions. Environ Sci Technol 49(14):8824–8832

Perrodon A, Laherrère JH, Campbell CJ (1998) The world's non-conventional oil and gas. The Petroleum Economist Ltd, London

Rystad Energy (2018) Data from Rystad Energy press release, 15 Jun 2018

Rystad Energy (2019) Rystad Energy Upstream Webinar, 19 Feb 2019

Rystad Energy (2020) Data shown on page 3 of Petroleum Review, Institute of Energy, UK, Feb 2020

Smith MR (2015) Forecasting oil and gas supply activity. Oil Age 1(1):35–58

Solé J, García-Olivares A, Turiel A, Ballabrera-Poy J (2018) Renewable transitions and the net energy from oil liquids: a scenarios study. Renew Energy 116:258–271

Sorrell S, Speirs J, Bentley R, Brandt A, Miller R (2009) Global oil depletion: an assessment of the evidence for a near-term peak in global oil production. Technology and Policy Assessment report: UK Energy Research Centre, August 2009. ISBN 1-903144-0-35. (Go to: www.ukerc.ac.uk & search ‘TPA reports’.)

Wachtmeister H, Henke P, Höök M (2018) Oil projections in retrospect: revisions, accuracy and current uncertainty. Appl Energy 220:138–153

Wang JL et al (2019) How long can the U.S. tight oil boom last? Presented at the 11th international conference on applied energy (ICAE2019) on August 12–15, 2019 in Västerås, Sweden

Wold E (2015) Bottom-up modelling of future global oil supply and associated spend. Oil Age 1(4):19–39

World Bank (2015) The great plunge in oil prices: causes, consequences, and policy responses. In: Baffes J, Ayhan Kose M, Ohnsorge F, Stocker M (eds) World Bank Group Policy Research Note PRN/15/01, March

World Bank (2019) Commodity markets outlook, October. World Bank Group, Washington, DC

World Oil (2019) Shale oil explorers say outlook for growth contradicts grim reality. Online article dated 11/27/2019 by Rachel Adams-Heard and Kevin Crowley at: https://www.worldoil.com/news/2019/11/27/shale-oil-explorers-say-outlook-for-growth-contradicts-grim-reality

Yergin D (1990) The prize: the epic quest for oil, money, and power. Simon & Schuster, New York

Yergin D (2011) There will be oil. Wall Street J. 17 Sept 2011

Acknowledgements

Earlier versions of this paper have been reviewed in part or whole by Michael Smith, Richard Miller, Colin Campbell and Jean Laherrère. We also thank the anonymous reviewers who have considerably helped improve the paper. Thanks are due also to the Longueville Library, Sydney, which provided excellent facilities for part of the writing. Errors that remain are ours. Should readers have comments we would much like to receive these.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors contributed to this study, and have read and approved the final manuscript. On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Annex 1: Data—Definitions, Reliability, Sources and Calculation Methods

Categories of Oil

There is no agreed classification of types of oil, but the following is used fairly generally, albeit often with significant modification:

-

Conventional oil: Light or medium density oil occurring in discrete oil fields, usually having an oil–water contact, produced by primary (own pressure, or pumping) or secondary (natural gas or water injection) recovery techniques. Currently this class of oil supplies about 70% of global ‘all-liquids’, and has constituted the vast majority of oil produced to-date.

-

Enhanced oil recovery (EOR): Covers a wide range of techniques to enhance oil production from a reservoir, sometimes classed as tertiary recovery, and includes thermal stimulation, CO2 or nitrogen injection, and injection of a range of other chemicals to improve recovery. EOR may increasingly include the use in conventional oil fields of techniques developed for recovery of tight oil.

-

Non-conventional oil: Typically refers to oils from extensive accumulations, and includes: light-tight (‘shale’) oil produced by horizontal drilling combined with hydraulic fracturing and use of proppants; heavy oils produced by thermal means; and oil from tar sands and the Orinoco basin. We distinguish these oils from conventional oil as their production is typically more complex (and hence usually more costly) than for conventional oil because either the oil itself, or the material in which it is located, needs physical alteration for the oil to be produced.

-

Natural gas liquids (NGLs): Liquids produced from gas reservoirs, either on production, or after treatment of the gas by a processing plant (where the latter are classed as natural gas plant liquids, NGPLs).

-

‘Other liquids’, which include:

-

Oil produced from kerogen (‘oil shale’ oil), coal (coal-to-liquids, CTLs) or gas (gas-to-liquids, GTLs).

-

Oil produced from biomass, either directly or via chemical conversion.

-

Synthetic oil, produced chemically from non-oil feedstocks.

-

As with the non-conventional oils these ‘other liquids’ are usually more expensive to produce than conventional oil, and moreover often have investment/production profiles more akin to mining than conventional oil production.

-

-

Refinery gain: The increase in volume (but not energy) resulting from the processing of oil to produce lighter fractions.

Because the available oil data often do not break down into this level of detail, in this paper by ‘conventional oil’ we generally mean conventional oil as defined above plus EOR, and also most heavy oils except tar sands and Orinoco oil; and excluding NGPLs.

A specific category of conventional oil is used by Campbell, that of ‘Regular Conventional’ oil; where this is conventional oil as defined above, but less Arctic oil, heavy and extra-heavy oils (defined by Campbell as oils with densities < 17.5º API), and deepwater oil from water depths greater than 500 m. This category of oil also excludes NGPLs.

And Laherrère has recently stated (private correspondence) that the term ‘conventional oil’ as used in the landmark Campbell and Laherrère (1998) paper: ‘The End of Cheap Oil’ referred to his recall to any crude oil produced except extra-heavy oil, oil from kerogen, other extensive oil such as tars sands and Orinoco oil, and oil in traps with no water contact.

Data Sources and Reliability

-

For data on annual oil production and annual average real-terms oil price this paper uses BP’s Statistical Review of World Energy; often abbreviated ‘BP Stats. Rev.’ For oil production, the BP Stats. Rev. says these data comprise: “crude oil, shale oil, oil sands and condensate (both lease condensate and gas plant condensate). Excludes liquid fuels from other sources such as natural gas liquids, biomass and derivatives of coal and natural gas.”

-

Proved reserves: Public-domain data on proved (1P) oil reserves, such as those from the EIA, OPEC, BP Stats. Rev., World Oil and Oil and Gas Journal should not be used for understanding past or future oil production, except as set out in Bentley (2015c). Incidentally, Campbell (2013, p6) suggests based on oil industry 2P data that for some Middle East OPEC countries the 1P oil reserves reported may be the country’s original 2P reserves, i.e. 2P reserves before production started. This approach might be seen as defensible, as it is the basis on which oil and gas fields which cross national boundaries are allocated, and would help explain why the reserves estimates for these countries do not change.

-

Proved-plus-probable (2P) reserves: These reserves data should be used instead of 1P data, and are available from a wide variety of sources, and in aggregate form from oil industry consultancies such as IHS Energy, Wood Mackenzie and Rystad Energy. In addition, Globalshift Ltd. now provides 2P data for free of oil yet-to-produce to 2100.

-

Definition of URR: For conventional oil the URR is the sum of the region’s cumulative production, plus the oil that has been discovered but not yet produced (the oil reserves), plus the oil expected to be found in future (the ‘yet-to-find’). When the URR includes non-conventional oil its estimation is somewhat more problematic, as often the various non-conventional oil resources (such as tar sands oil, or oil from kerogen) were discovered and quantified long in the past, but only become included in a region’s reserves when specific projects to extract these oils get either proposed or approved. In this case, the URR estimate generated may be especially sensitive to assumptions on future technological change and oil price. In both cases URR estimates sometimes include an estimate of the additional oil that will be produced over time due to reasonably-anticipated advances in technology, and increases in oil price.

-

Estimating URR: There are a number of different ways to estimate URR, for example see Campbell and Laherrère (1998), or Annexes 4 and 5 of Bentley (2016a). These vary from ‘Hubbert linearisation’, which requires only past production data, to summarising future production to a distant future date based on a by-field (aggregated where individual field data are unavailable) and by-project model, combined with assumptions on future discovery and technical gain, as is done by Globalshift in the data presented in Table 2. Also, once the peak of oil discovery in a region is past, extrapolation of the backdated discovery trend, combined with knowledge of the petroleum geology in the region and views on future technical gain, can give robust estimates. For a detailed discussion of URR estimates and how they have influenced recent oil forecasts, see Bentley (2015a, b; 2016c). For the key mid-1990s Petroconsultants reports giving URR estimates for global oil and gas (including the non-conventionals) see Laherrère et al. (1994); Campbell and Laherrère (1995); Laherrère et al. (1996); and Perrodon et al. (1998).

-

URR growth: A question arises as to how reliable are URR estimates, with for example BP Stats. Rev. in 2019 stating in its download on reserves definitions:

-

“Ultimately recoverable resource (URR) … is an estimate of the total amount of oil that will ever be recovered and produced. It is a subjective estimate in the face of only partial information. Whilst some consider URR to be fixed by geology and the laws of physics, in practice estimates of URR continue to be increased as knowledge grows, technology advances and economics change. Economists often deny the validity of the concept of ultimately recoverable reserves as they consider that the recoverability of resources depends upon changing and unpredictable economics and evolving technologies.”

-

o

URR estimates can certainly change over time. But for conventional oil once the peak in discovery is past URR estimates can remain remarkably static. For example, the higher of the two URRs assumed for conventional oil in the US Lower-48 by Hubbert (1956) of 200 Gb still looks about right, as US conventional oil production peaked at close to half this; and where Campbell (2013) gives 200 Gb for US ‘Regular Conventional’ oil. Likewise, the UK government’s estimate in 1974 of 4500 Mt for UK North Sea oil is still valid today. Likewise also, as discussed above, the global URR estimate range from the 1970s to early ‘80 s of 1800 Gb–2500 Gb, if perhaps on the conservative side, is still not unrealistic today.

-

o

Please see also:

-

For a detailed analysis of oil data, and data providers, see Laherrère et al. (2016, 2017).

-

Note that most major international oil companies are themselves past their resource-limited peak in oil production, certainly for conventional oil; see: https://crudeoilpeak.info

Volumes of Conventional Oil, Non-Conventional Oils, and Other Liquids

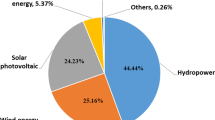

The world contains very large quantities of potentially recoverable oils and other liquids. The volumes of these, and their production cost ranges (in 2012 dollars), are shown in Fig. 4.

In Fig. 4 ‘conventional’ oil can be viewed in various ways. It can be just the first three blocks on the left of the chart, giving a URR of ~ 3600 Gb; it usually includes also Arctic and ultra-deepwater oil, for a total URR of ~ 3800; or can include also EOR oil, for a total URR of ~ 4200 Gb.

For shale (‘light-tight’) oil, estimates of its global URR are still in flux:

-

In 2016 the United States Geological Survey (USGS) estimated the global recoverable resource of shale oil to be around 750 Gb; considerably larger than the IEA 2013 estimate of ~ 250 Gb shown in Fig. 4.

-

More recently, IHS Energy estimated ~ 840 Gb of light-tight technically recoverable oil in 25 ‘super-basins’ around the world.

-

The US EIA currently gives an estimate for the global unproved technically recoverable resource (UTRR) of tight oil at https://www.eia.gov/analysis/studies/worldshalegas. This gives data for 46 countries, mostly from 2013, though some data are from 2014 and 2015, for a total UTRR of 418 Gb. To this the global cumulative production and proved reserves of tight oil of ~ 35 Gb need to be added, to give a URR of ~ 455 Gb.

-

Rystad’s global ‘2PCX’ estimate for light-tight oil is ~ 275 Gb, defined as the: “Most likely estimate [of remaining oil reserves] for existing fields, plus contingent resources in discoveries, plus risked prospective resources in yet undiscovered fields.” (Rystad 2018). Hence adding global cumulative production of ~ 15 Gb yields a URR of ~ 290 Gb.

Put together, these estimates suggest that the world has perhaps some 400 Gb–800 Gb of potential technically recoverable resources of tight oil. But having resources is one thing, having access rights, government approval and public support to bring these on-stream is another, and where for much of the tight oil outside the US these factors are far from clear. (Moreover, much of US tight oil production has been from companies experiencing negative free cash flows from operations, and hence need increases in the price of oil to turn these cash flows positive.)

Overall, the main conclusion from Fig. 4 is that the world has still available very large quantities of potentially technically recoverable oil and other liquids, of the order of ~ 7000 Gb. This is about five times the quantity of ‘all-liquids’ already consumed (shown by the leftmost rectangle of Fig. 4) of ~ 1200 Gb by 2012, hence ~ 1400 Gb by 2018.

Finally we note that, except for tight oil, the quantities of technically recoverable oil by category shown in Fig. 4 have been known with reasonable accuracy for many years.

Three Sets of Global Oil Production Peak Data and URR Estimates

This section gives the data underlying approximate global URR oil estimates from Campbell, Globalshift Ltd., and Rystad Energy. Note that the categories of oil covered by these estimates differ.

Annex 2: Forecasts and Views on Future ‘All-liquids’ Supply

Given that global production of conventional oil will decline soon unless the price of oil goes very high, this annex summarises the current main forecasts and views on the future of ‘all-liquids’. These range from seeing constraints to ‘all-liquids’ supply as already binding, to those that see such constraints as some distance away, to those that in essence dismiss such constraints altogether.

We recognise that the authors of these forecasts and views may see the summaries we give below as over-simple, but our purpose is not great precision in describing these but to capture their range, and hence indicate the work needed to achieve closer agreement on this important subject. We list the forecasts and views in sequence from the more concerned to the less concerned, but note that all pre-date the sharp fall in oil demand in early 2020.

Oil-Supply Constraints are Already Binding, and Will Become More so Unless Oil Demand Falls Rapidly

This forecast reflects the modelling of Campbell and Laherrère (Campbell and Laherrère, 1998; Campbell 2015; Laherrère 2015), where their models incorporate their findings that oil discovery data held in at least some of the oil industry datasets need to be reduced significantly if they are to correctly reflect proved-plus-probable (2P) oil discovery. The authors suggest this is the case for some Middle East countries, and also for FSU countries, where for the latter the oil reserves reported are ABC1, and in the view of these authors are typically 30% higher than 2P estimates.

Peak Global Conventional Oil Production is Expected Fairly Soon, and Will Likely not be Compensated by Production of All-Oil, or All-Liquids, Unless the Price of Oil is Very High

Forecasts holding this view come from a range of ‘independents’ (individuals and some key consultancies) including IHS CERA (Jackson and Smith 2014), Miller (2015), Rystad Energy (Wold 2015), and Globalshift Ltd. (Smith 2015). These forecasts are based on detailed bottom-up models by field and project, and use a combination of published oil news and data and oil industry commercial 2P datasets covering oil discovery, production and reserves.

This view is in part supported by the UKERC Global Oil Depletion study which concluded: “On the basis of the current evidence we suggest that a peak of conventional oil production before 2030 appears likely and there is a significant risk of a peak before 2020.” (Sorrell et al. 2009). It also seems to be the view of a recent study published by the Geological Survey of Finland, based on current literature rather than on detailed modelling (Michaux 2019), and also that of two papers in this journal which forecast future regional and global oil production based on regional and country production decline curves (Dittmar 2016, 2017).

Conventional Oil Production Will Stay Roughly On-Plateau At Least Out to 2040, and There Are Plenty of Non-conventional Oils and Other Liquids That Can Come On-Stream to Meet the Expected Increase in Demand, Although This Will Require the Oil Price to Rise Significantly. Demand for Oil Is Not Likely to Fall Over This Period Unless There are Much Stronger Pressures for this Than Now

This approximates the recent forecasts (as published up until 2018) from most ‘mainstream’ energy forecasting organisations, including the IEA, EIA, OPEC and some oil majors.

The view that global conventional oil production can remain about on-plateau for the next 20 years or so is—we assume—based in part on the USGS estimates discussed in the context of Fig. 4 and Table 1 (though we have been told IEA’s forecast reflects the expectation that a higher oil price going forward will bring on sufficient additional conventional oil to offset the decline in older fields).

We note that in the past society has been poorly served by oil forecasts from these ‘mainstream’ organisations, and where their recent forecasts mark a significant change from those of only a few years previously. The earlier forecasts were for adequate oil of all categories—including conventional oil—to be available to the end of their forecast horizons, and hence for the oil price to remain low. Thus almost none of the earlier ‘mainstream’ forecasts foresaw the sharp oil price rise that occurred from 2004 onwards, despite the many decades of explicit warnings from scientists. An exception was the IEA 1998 World Energy Outlook (WEO), where Bourdaire—in charge of this forecast—understood that the global peak in conventional oil production would occur soon.Footnote 2

We suspect that the fundamental reason for this major oversight from the mainstream forecasters was that while they correctly factored-in the total oil available (Fig. 4), they did not understand that much of this oil—the conventional oil—would peak at ‘mid-point’. Past ‘mainstream’ forecasts are discussed in Wachtmeister (2018) and Bentley (2016a).

For analysis of the recent differences between the oil production forecast in the IEA’s 2018 WEO and the significantly lower forecast in the 2019 edition, see: https://aspo-deutschland.de/dokumente/2019-11-21AnalysisOfWEO2019-ASPO-de.pdf.

There is No Basis for Concern About Peak Oil Supply as the World is Moving from an Era of Perceived Oil Shortage to One of Aabundance

This view (as opposed to a quantitative forecast) is that of Aguilera and Radetzki, and also of Spencer Dale of BP. Aguilera and Radetzki (2016) suggest that tight oil will add 20 Mb/d by 2035 to global oil supply, while much of the technology that opened up tight oil is also as applicable to conventional oil, and that this will add an additional 20 Mb/d by 2035. Dale likewise writes that increased production of tight oil, plus the additional conventional oil that uses tight oil technology, mean the world has now entered an era of ‘oil abundance’ (Dale 2015; Dale and Fattouh 2018).

However, it seems to us that these authors are again overlooking the principle of ‘peak at mid-point’, and simply add this anticipated extra oil to current total global production without accounting for the decline that will occur in existing fields. We know this in the case of Dale, for example, where in a lecture at Imperial College UK in December 2017 his view of ‘future oil abundance’ was based only on data of proved oil reserves and R/P ratios, without recognising the constraints that arise from ‘peak at mid-point’ (Dale 2017).

Likewise, Aguilera (2019) presents a chart of global oil and liquids recoverable vs. production cost (similar to Fig. 4 above), and says in effect: ‘There is a lot of oil available at not too high a cost, so there is no reason to expect the price to rise significantly’.

Peak Oil from the Supply Side is a Myth

Though this paraphrase may overstate the case, ‘peak oil is a myth’ we think is still the view of authors like Yergin (2011) who wrote “For decades, advocates of 'peak oil' have been predicting a crisis in energy supplies. They've been wrong at every turn”, and Lynch (2019), author of the 2016 book: The Peak Oil Scare and the Coming Oil Flood.Footnote 3

Global Demand for Oil Will Fall Well Before Any Supply-Driven Peak Occurs

Finally, there is an increasing number of organisations which state that global supply-side constraints for oil are not a concern, as they forecast instead a relatively near-term peak in the global demand for oil. The main drivers at play in such forecasts are society’s thirst for oil, changes in society, and the need to meet climate change goals. We discuss these ideas in turn:

Society’s Thirst for Oil

Oil is the world’s largest commercial source of energy, and provides the crucial transport that underpins nearly all of global agriculture, industry and commerce, and thus supports nearly all of current economic activity. In addition, oil is used extensively in some counties for heating and the generation of electricity, and globally in the production of petrochemicals. Each year the world consumes some 36 Gb of all-liquids; if put into a line of 50-gallon drums this would circle the earth over 400 times.

In addition to current demand, nearly all political leaders look to increasing quantities of energy (including oil) to support the growing populations and rising expectations of standards of living of their electorates.

And, as a direct corollary of oil’s key role in society, citizens often get angry if they see the price of fuel rise sharply, whether this be the ‘fuel protests’ across much of Europe in 2000 triggered by a jump in the cost of fuel, the gilets jaunes protests in France triggered by a fuel tax rise for climate change reasons, or the many cases where governments realise how much of their exchequer goes to fuel subsidies (sometimes as pointed out by the IMF), and sharply raise the price of fuel, as in Ecuador and Iran in 2019.

In summary: currently there is a deeply embedded global economic dependence on oil, and a general expectation of significant additional quantities becoming available at not too high a price.

Changes in Society

But society is changing, and perhaps the demand for oil also. Many in cities in the richer countries are no longer demanding their own vehicles, preferring instead to travel by ride-hailing apps, public transport, foot or bicycle. More recently still, there has been significant pressure from both activists and governments to reduce pollution levels in cities, particularly of NOx and particulate matter, and this is affecting the use and choice of vehicle type in towns, leading also to a potential reduction in demand for oil. And perhaps the world may use the opportunity of the pandemic to re-invent its requirement for oil-fuelled transport.

Reduction in Oil Demand to Meet Climate Change Goals

But the biggest reason to reduce oil use comes from climate change where it is now clear that fossil fuel use (including oil) must soon decline if the agreed target of an average global surface temperature rise of 2 ºC above pre-industrial is to be met; and more so if this target is 1.5 ºC above. On the quantity of oil that must then be left in the ground, see for example McGlade and Ekins (2015).

Peak Demand?

So, the question becomes: Does the world reach peak demand for oil before peak supply?

To examine this we need to differentiate two kinds of peak demand. The first we term ‘exogenous’ peak demand, driven by some mix of the social change and climate change pressures listed above. The other is ‘supply-driven’ peak demand, where demand indeed falls, but driven now by high oil prices, in turn reflecting limits to supply. In practice, and given what we have set out above on likely constraints to oil supply, both types of ‘peak demand’ may occur in combination, and it may take considerable analysis from economists and others to disentangle the two.

Quite a number of organisations are now forecasting the global peak in demand for oil in the relatively near term, and hence, implicitly or explicitly, forecasting that this peak will come before a supply-constrained peak. These organisations include Citi Bank, Bank of America Merrill Lynch, World Energy Council, DNV-GL, Carbon Tracker and others.

We have not so far had the opportunity to examine these forecasts in detail, so cannot comment usefully, except to say that we assume these organisations are unlikely to have factored into their forecasts the oil supply constraints detailed in this paper. In this context, we note that the IEA in its 2019 World Energy Outlook Base Case says that while global passenger vehicle demand for oil may peak within 10 years, the total global demand for oil (which includes trucks, shipping, aviation cargo and petrochemicals) will likely not reach plateau until around the 2030s.

Summary

Taken together, the above is an extraordinarily wide range of forecasts and views on global future oil supply, coming as they do from reputable, widely-quoted organisations and individuals. Given the current critical importance of oil supply to the global economy, it seems to us there is an urgent need to move towards a measure of agreement.

Rights and permissions

About this article

Cite this article

Bentley, R.W., Mushalik, M. & Wang, J. The Resource-Limited Plateau in Global Conventional Oil Production: Analysis and Consequences. Biophys Econ Sust 5, 10 (2020). https://doi.org/10.1007/s41247-020-00076-1

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s41247-020-00076-1