Abstract

The current article investigates if machine learning techniques, more specifically the nearest neighbor algorithm, can be used for nowcasting Swedish GDP growth utilizing business tendency survey data. The results show that the machine learning algorithm can work at least as well as the linear indicator models that have become standard workhorses in Swedish GDP growth nowcasting. This is an indication that nowcasting model suits could benefit from including also machine learning methods going forward.

Similar content being viewed by others

Notes

The index for the construction sector is excluded from the current investigations due to the inadequate length of the time series.

For GDP, the 2019Q2 vintage of data is used, while the 2019Q3 vintage of data is used for the ETS. The quarterly surveys are those published by the NIER in January, April, July and October, and accordingly the quarterly observations are obtained from these surveys.

As a sidenote, these results are similar to those of Richardson et al. (2018), who find that the forecast accuracy of the KNN algorithm, using \(K=4\), can match that of a baseline AR model when nowcasting the GDP of New Zealand.

See e.g. Beechey and Österholm (2010) for a discussion of significance testing in forecast comparisons.

The Diebold–Mariano test is performed with the Bartlett kernel and a lag window of four.

In the few cases where missing data is encountered, interpolation and extrapolation methods, based on neighboring vintages and observations, are used.

References

Beechey, M., & Österholm, P. (2010). Forecasting inflation in an inflation-targeting regime: A role for informative steady-state priors. International Journal of Forecasting, 26, 248–264.

Billstam, M., Frändén, K., Samuelsson, J., & Österholm, P. (2017). Quasi-real-time data of the economic tendency survey. Journal of Business Cycle Research, 13, 105–138.

den Reijer, A., & Johansson, A. (2019). Nowcasting Swedish GDP with a large and unbalanced data set. Empirical Economics, 57(4), 1351–1373.

Diebold, F. X., & Mariano, R. S. (1995). Comparing Predictive Accuracy. Journal of Business and Economic Statistics, 13(3), 253–263.

Hansson, J., Jansson, P., & Löf, M. (2005). Business survey data: do they help in forecasting GDP growth? International Journal of Forecasting, 21, 377–389.

Kaufmann, D., & Scheufele, R. (2017). Business tendency surveys and macroeconomic fluctuations. International Journal of Forecasting, 33, 878–893.

Mullainathan, S., & Spiess, J. (2017). Machine learning: An applied econometric approach. Journal of Economic Perspectives, 31(2), 87–106.

Österholm, P. (2014). Survey data and short-term forecasts of Swedish GDP growth. Applied Economics Letters, 21, 135–139.

Richardson, A., van Florenstein Mulder, T., & Vehbi, T. (2018). Nowcasting New Zealand GDP using machine learning algorithms. CAMA working paper 47/2018, Centre for Applied Macroeconomic Analysis, Australian National University.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that they have no conflict of interest statement.

Human Participants and/or Animals

No.

Informed Consent

No.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The work relating to the current article was mainly performed while the author was at the National Institute of Economic Research and the author grateful for help from, and fruitful discussions with, Marcus Jansson and Torbjörn Lindquist. The opinions expressed in the current article are the sole responsibility of the author and should not be interpreted as reflecting the views of Sveriges Riksbank. The author is grateful to two referees for providing useful input to the current article.

Appendix

Appendix

1.1 Real-Time Nowcast Evaluation

In order to investigate whether the results from Sect. 5 hold also when data revisions are taken into account, a real-time nowcast evaluation is performed. The methodology is the same as above, but the data used is different. Instead of using one single vintage of GDP and sentiment index figures, new vintages are used for estimation and nowcasts as they become available.

For GDP, the NIER real-time database covering vintages for 2002Q4–2019Q2 is used. For the ETS, the quasi-real-time dataset of Billstam et al. (2017) is used for the period 2002Q4–2015Q4, while the NIER real-time dataset is used for 2016Q1–2019Q2.Footnote 6 Based on these datasets, nowcast evaluations covering the periods 2002Q4–2019Q2 and 2008Q1–2019Q2 are performed. The results are presented in Table 2.

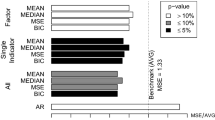

As seen from Table 2, there are some important similarities to the quasi-real-time results in Table 1. First, there are considerable forecast information to be found in sentiment indicators. Also, the forecasting results from the KNN models with \(K\ge 3\) are comparable to most of the results for the linear indicator models.

There are also some differences that can be observed compared to the quasi-real-time evaluation in Sect. 5. Specifically, the best-performing ETS-based models now become somewhat better than the best-performing KNN model. But overall, the KNN methodology performs competitively to the linear indicator models.

As seen in Table 2, the overarching conclusions from previous sections prevail. There is information content in the ETS that can improve nowcasts and the KNN methodology performs competitively compared to the linear indictor models. Hence, machine learning techniques should be considered as a natural ingredient in nowcasting suits for Swedish GDP.

Rights and permissions

About this article

Cite this article

Jönsson, K. Machine Learning and Nowcasts of Swedish GDP. J Bus Cycle Res 16, 123–134 (2020). https://doi.org/10.1007/s41549-020-00049-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41549-020-00049-9