Abstract

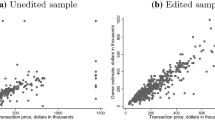

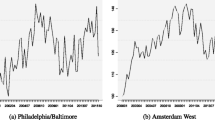

This article examines the characteristics and price behavior of repeatedly transacted properties. Using data from four U.S. counties, we estimate hedonic price models of properties grouped by transaction frequency, and compare estimated standard deviations and estimated appreciation rates by group.

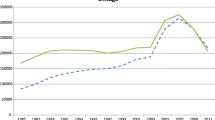

For each of four counties studied, we find that estimated house price appreciation is systematically higher among properties that transact more frequently. One possible explanation for this result is that purchasers make property improvements that are not adequately reflected in the available data.

We also find that estimated standard deviations of the disturbance term show a marked decrease as the frequency of transaction increases. Since frequently transacting properties are not found to be systematically more homogeneous than seldomly transacting properties, we do not attribute this to any increase in homogeneity for frequently transacting properties, but rather to the length of time elapsed between transactions of properties.

The findings of this article suggest that repeat-sales price models may need to be adjusted to account for cross-sectional variation in transaction probabilities---that is, the selectivity of the subsample of properties that transacted (or transacted repeatedly) during any finite study period.

Similar content being viewed by others

References

Bailey, M. J., R. F. Muth, and H. O. Nourse. “A Regression Method for Real Estate Price Index Construction,” Journal of the American Statistical Association 58 (1963), 933–942.

Bryan, T. B., and P. F. Colwell. “Housing Price Indices,” Research in Real Estate 2 (1982, 57–84.

Case, B., and John M. Quigley. “The Dynamics of Real Estate Prices,” Review of Economics and Statistics 73 (1991), 50–58.

Case, B., Henry O. Pollakowski, and Susan M. Wachter. “On Choosing Among House Price Index Methodologies,” Journal of the AREUEA 19 (1991), 286–307.

Case, K. E., and Robert J. Shiller. “The Efficiency of the Market for Single-Family Homes,” American Economic Review 79 (1989), 125–137

Case, K. E., and. “Prices of Single-Family Homes Since 1970: New Indices for Four Cities,” New England Economic Review (September/October 1987), 45–56.

Clapp, J. M., and C. Giaccotto. “Estimating Price Trends for Residential Property: A Comparison of Repeat Sales and Assessed Value Methods,” Journal of the American Statistical Association 87 (1991), 300–306.

Clapp, J. M., and C. Giaccotto. “Repeat Sales Methodology for Price Trend Estimation: An Evaluation for Sample Selectivity,” Journal of Real Estate Finance and Economics 5 (1992), 357–374.

Clapp, J. M., C. Giaccotto, and D. Tirtiroglu. “Housing Price Indices: Based on All Transactions Compared to Repeat Subsamples,” Journal of the AREUEA 19 (1991), 270–285.

Fama, E. F. Foundations of Finance, New York: Basic Books.

Gatzlaff, D. H., and D. R. Haurin. “Sample Selection and Biases in Local House Value Indexes,” Paper presented at the annual conference of the American Real Estate an Urban Economic Association, January 1993.

Goetzmann, W. N. “The Single Family Home in the Investment Portfolio,” Journal of Real Estate Finance and Economics (July 1993), 201–222.

Goetzmann, W. N. and M. Spiegel. “Non-temporal Components of Residential Real Estate Appreciation,” Review of Economics and Statistics 77 (1995), 199–206.

Halvorsen, R., and H. Pollakowski. “Choice of Functional Form for Hedonic Price Equations,” Journal of Urban Economics 10 (1981), 37–49.

Heckman, J. “Sample Selection Bias as a Specification Error,” Econometrica 47 (1979), 153–161.

Meese, R., and N. Wallace. “Non-Parametric Estimation of Dynamic Hedonic Price Models and the Construction of Residential Housing Price Indices,” Journal of the AREUEA 19 (1991), 308–332.

Mills, E. S., and B. W. Hamilton. Urban Economics. Glenview, Illinois: Scott, Foresman and Company, 1984.

Rosen, S. “Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition,” Journal of Political Economy 82 (1974), 34–55.

Shiller, R. J. “Measuring Asset Values for Cash Settlement in Derivative Markets: Hedonic Repeated Measures Indices and Perpetual Futures,” The Journal of Finance 48 (1993), 911–931.

Stambaugh, R. F. “On the Exclusion of Assets from Tests of the Two Parameter Model,” Journal of Financial Economics 10 (1982), 237–268.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Case, B., Pollakowski, H.O. & Wachter, S.M. Frequency of Transaction and House Price Modeling. The Journal of Real Estate Finance and Economics 14, 173–187 (1997). https://doi.org/10.1023/A:1007736521741

Issue Date:

DOI: https://doi.org/10.1023/A:1007736521741