Abstract

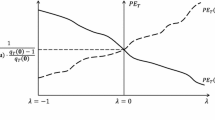

This paper presents evidence that prices of firms followed by sell-side analysts and favored by institutional investors incorporate future earnings earlier than prices of other firms. We conduct two sets of empirical tests: the first examines coefficients from regressions of returns on lead, contemporaneous, and lag earnings changes; the second compares the timing of monthly abnormal returns from earnings-based zero-investment portfolios. In both sets of tests, the results for analysts and institutions are incremental to each other. In addition, neither the analyst price lead nor the institutional price lead is due to price leads increasing with firm size.

Similar content being viewed by others

References

Ali, A., C. Durtschi, B. Lev and M. Trombley. (2002). “Changes in Institutional Ownership and Subsequent Earnings Announcement Abnormal Returns.” Working paper, University of Arizona.

Ayers, B. and R. Freeman. (1997). “Market Assessment of Industry and Firm Earnings Information.” Journal of Accounting & Economics 24, 205¶218.

Ayers, B. and R. Freeman. (2000). “Why Do Large Firms' Prices Anticipate Earnings Earlier Than Small Firms' Prices?” Contemporary Accounting Research 17, 191¶212.

Ball, R. and P. Brown. (1968). “An Empirical Evaluation of Accounting Income Numbers.” Journal of Accounting Research 6, 159¶178.

Bartov, E., S. Radhakrishnan and I. Krinsky. (2000). “Investor Sophistication and Patterns in Stock Returns after Earnings Announcements.” Accounting Review 75, 43¶63.

Beaver, W., R. Lambert and D. Morse. (1980). “The Information Content of Security Prices.” Journal of Accounting & Economics 2, 3¶28.

Bernard, V. and J. Thomas. (1989). “Post-Earnings-Announcement Drift: Delayed Price Response or Risk Premium?” Journal of Accounting Research 27, 1¶36.

Bowen, R., A. Davis and D. Matsumoto. (2002). “Do Conference Calls Affect Analysts' Forecasts?” Accounting Review. Forthcoming.

Brown, L., P. Griffin, R. Hagerman and M. Zmijewski. (1987). “An Evaluation of Alternative Proxies for the Market's Assessment of Unexpected Earnings,” Journal of Accounting & Economics 9, 159¶194.

Brennan, M., N. Jegadeesh and B. Swaminathan. (1993). “Investment Analysis and the Adjustment of Stock Prices to Common Information.” Review of Financial Studies 6, 799¶824.

Collins, D., S. Kothari and J. Rayburn. (1987).“Firm Size and Information Content of Prices with Respect to Earnings.” Journal of Accounting & Economics 9, 111¶138.

Dempsey, S. (1989). “Predisclosure Information Search Incentives, Analyst Following and Earnings Announcement Price Response.” Accounting Review 64, 748¶757.

El-Gazzar, W. (1998). “Predisclosure Information and Institutional Ownership: A Cross-Sectional Examination of Market Revaluations during Earnings Announcement Periods.” Accounting Review 73, 119¶129.

Fama, E. and K. French. (1993). “Common Risk Factors in the Returns on Stocks and Bonds.” Journal of Financial Economics 33, 3¶56.

Fama, E. and J. MacBeth. (1973). “Risk, Return, and Equilibrium; Empirical Tests.” Journal of Political Economy 71, 607¶636.

Frankel, R., M. Johnson and D. Skinner. (1999). “An Empirical Examination of Conference Calls as a Voluntary Disclosure Medium.” Journal of Accounting Research 37, 133¶150.

Freeman, R. (1987). “The Association between Accounting Earnings and Security Returns for Large and Small Firms.” Journal of Accounting & Economics 9, 195¶228.

Freeman, R. and S. Tse. (1992). “A Nonlinear Model of Security Price Responses to Unexpected Earnings.” Journal of Accounting Research 30, 185¶209.

Gelb, K. and P. Zarowin. (2002). “Corporate Disclosure Policy and the Informativeness of Stock Prices.” Review of Accounting Studies 7, 33¶52.

Hassett, K. (2000). “Outlaw Selective Disclosure? No, the More Information the Better.” Wall Street Journal Interactive August 10.

Jiambalvo, J., S. Rajgopal and M. Venkatachalam. (2002). “Institutional Ownership and the Extent to which Stock Prices Reflect Future Earnings.” Contemporary Accounting Research 19, 117¶145.

Kothari, S. and R. Sloan. (1992). “Information in Earnings about Future Earnings: Implications for Earnings Response Coefficients.” Journal of Accounting & Economics 15, 143¶171.

Lundholm, R. and L. Myers. (2002). “Bringing the Future Forward: The Effect of Disclosure on the Retruns-Earnings Relation.” Journal of Accounting Research 40, 809¶839.

O'Brien, P. (1988). “Analysts' Forecasts as Earnings Expectations.” Journal of Accounting & Economics 10, 53¶83.

Shane, P., N. Soderstrom and S. Yoon. (2001). “Earnings and Price Discovery in the Post-Reg FD Information Environment: A Preliminary Analysis” Working paper, University of Colorado at Boulder.

Sunder, S. (2002). “Investor Access to Conference Call Disclosures: Impact of Regulation Fair Disclosure on Information Asymmetry.” Working paper, New York University.

Walther, B. (1997). “Investor Sophistication and Market Earnings Expectations.” Journal of Accounting Research 35, 157¶179.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Ayers, B.C., Freeman, R.N. Evidence that Analyst Following and Institutional Ownership Accelerate the Pricing of Future Earnings. Review of Accounting Studies 8, 47–67 (2003). https://doi.org/10.1023/A:1022647822683

Issue Date:

DOI: https://doi.org/10.1023/A:1022647822683