Abstract

This paper presents a new data set of capital controls by inflows and outflows for 10 asset categories in 100 countries during 1995–2013. Building on the data inSchindler (2009) and other data sets based on the analysis of the IMF’s Annual Report on Exchange Arrangements and Exchange Restrictions (AREAER), this data set covers additional asset categories, more countries, and a longer time period. The paper discusses in detail the construction of the data and characterizes them with respect to the prevalence and correlation of controls across asset categories and between inflow and outflow controls, the aggregation of the separate categories into broader indicators, the experience of some particular countries, and the comparison of these data with others indices of capital controls.

Similar content being viewed by others

Notes

We maintain the common usage of the term “capital controls” in this paper but note that the transactions between residents and nonresidents in the financial assets and liabilities of interest here are in fact recorded in the Financial Account of the Balance of Payments. The so-called Capital Account captures nonproduced nonfinancial assets and capital transfers between residents and nonresidents which are typically of small empirical relevance. See IMF (2009).

Quoted in Skidelsky (1992, p. 477).

Examples of IMF studies include Ostry and others (2010) and Ostry and others (2011). The article in The Economist appeared in the April 7, 2011 issue.

For just a few examples, see Korinek (2010), Bianchi (2011), Farhi and Werning (2012), Jeanne (2012), Schmitt-Grohé and Uribe (2012), and Benigno and others (2014).

See, for example, studies of the experiences of Chile by De Gregorio, Edwards, and Valdés (2000) and Forbes (2007), and of Brazil by Forbes and others (2012).

See Quinn, Schindler, and Toyoda (2011) for a comprehensive review of existing de jure measures. In independent work, El-Shagi (2010, 2011, 2012) constructed a data set using a similar approach as in Schindler (2009) (see also footnote 20).

The latest version of the data set is publicly available www.columbia.edu/~mu2166//fkrsu and reflects continuous corrections and updates. Jahan and Wang (2015) present a data set that extends the country sample including all low-income countries for which there are AREAER reports, but they use only the second column (on whether or not there are restrictions in place) of the AREAER reports rather than the narrative in the third column as we do.

That is, the measures capture legal restrictions, but not the extent to which they are enforced. Although it may in many cases be desirable to construct a de facto indicator—that is, how much are capital flows affected quantitatively by the presence of restrictions?—this is a challenging task. One difficulty in trying to construct empirically based de facto indicators of capital account restrictions is that there is no clear benchmark of the gross capital flows consistent with free capital mobility. An alternative approach based on the equalization of rates of return is hampered by the need to assume efficient markets and to make assumptions about investors’ expectations and preferences as well as the correlations of asset returns with other measures of risk.

Early works using the AREAER to create panel data sets of capital controls include Grilli and Milesi-Ferretti (1995), Quinn (1997) and Chinn and Ito (2006).

There is very limited coverage for the years 1995 and 1996 for the category of bonds with maturity of greater than one year, and so the data series for this asset begins in 1997.

The nine added countries were those with the largest populations in 2012 (according to the World Development Indicators) that were not in the original Schindler data set, but were included in the AREAER. These countries are Algeria, Colombia, Ethiopia, Iran, Myanmar, Nigeria, Poland, Ukraine, and Vietnam.

Specifically, whenever a discrepancy arose in a particular asset/country category between Schindler’s original data set and ours in 2005 (the last year of Schindler’s data set), the data were revised for that category in that year and backwards until no discrepancy was detected. If there was no discrepancy in 2005 then there was no revision backwards for that country/asset subcategory. In total, 145 observations (less than 1 percent of the original data set) were revised. These observations are listed in the master data file.

By definition, capital controls are rules or regulations that treat residents and nonresidents differently. Capital controls do not make a distinction based on citizenship rather than residency.

The AREAER narrative is limited to either “n.r.” or “n.a.” in about 2.8 percent of the cases in our data. According to the IMF’s Annual Report on Exchange Arrangements and Exchange Restrictions (Washington, 2011, p. 59), the entry “n.a.” is used “when it is unclear whether a particular category or measure exists because pertinent information is not available at the time of publication.” The entry “n.r.” is used when members have provided the IMF staff with information that a category or an item is not regulated, but this information is not sufficient to establish whether the transaction is restricted or not. In addition, our data set has the category “d.n.e.,” which we created, to represent “does not exist” and documents the cases where there is no information at all, but this appears only 15 times in the entire data set (0.03 percent of the data set). The data set available online retains the n.r., n.a., and d.n.e. entries, but in the statistics presented in this paper we set to “missing” any entry with any of these three classifications.

A more detailed description of our rules and guiding principles is contained in the Technical Appendix.

In principle, the variation in types of controls contains additional information. For example, El-Shagi (2012) codes controls that require approval as ones that leave a degree of discretion to the authorities (as opposed to outright prohibitions), which could be used as an indicator of the severity/rigidity of controls. Quinn (1997) is an earlier attempt of using the narrative information to construct an intensity scale; see also footnote 19.

When there is a missing value in one of the two inflow or outflow subcategories (see footnote15), we score the aggregate inflow or outflow entry with the value taken by the remaining subcategory.

Quinn (1997) makes an attempt at coding intensity based on a number of assumptions. He assumes prohibition is more severe (“intense”) than a (nonautomatic) approval requirement, and that the latter in turn is more restrictive than taxation) which may or may not be valid in any individual case. In fact, it would seem a challenging task to come up with a generically sensible ordering even within more narrowly defined categories: for example, it will be difficult to rank two countries’ tax rates without also knowing other characteristics of the tax system (such as exemptions, caps, nonlinearities, and so on).

The correlations are across all observations, that is, across all pairs (x(t), y(t)), where x and y represent asset/direction categories and t represents the time period. Correlations will be missing if the variance of an indicator is zero, but, in practice, there are relatively few instances of this, even among the Open and Walls categories. Zero variances would be more prevalent if we first calculated correlations for each country, that is the correlation of x(i,t) and y(i,t) where i represents a country, and then take the average of these correlations across countries to calculate the overall correlation.

As an alternative to our use of unweighted averages, one could weigh each category of assets by its importance in total capital flows. This would raise endogeneity issues, however, since flows might move toward less restricted assets, thus underestimating the true severity of controls. Of course, an unweighted average could overestimate the severity of controls by ignoring that investors’ partially mitigate the effect of controls by adjusting their behavior.

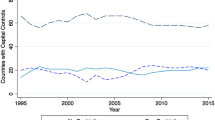

These marked swings are driven by the countries classified as “Gate” in Table 2. Although these countries are currently classified as “high income,” some of them started to meet this World Bank definition only in recent years.

For example, Klein and Shambaugh (2015) use an indicator that includes only Money Market Instruments and Bonds in their analysis of interest parity as well as another indicator that includes those asset categories plus Equities, Collective Investment, and Financial Credits. Prati, Schindler, and Valenzuela (2012) are an example of a study using the distinction between inflow and outflow controls as an identification strategy.

Figure 5 also illustrates the point that changes in the intensity of controls might not be captured by our data. For example, the tightening of controls on outflows in Malaysia during the crisis in 1998 is not picked up by the outflow index. This is because controls on outflows were already in place in Malaysia on most asset categories in our index at the time, and the policy tightening did not introduce controls on new categories. See Johnson and others (2006, Table 1) and the Malaysian data on individual asset categories for more details.

There are as many as 98 countries in both the Chinn-Ito set and our data set; the two countries in our data set that do not appear in the Chinn-Ito data set are Yemen and Brunei Darussalam. There are as many as 90 countries in both the Quinn data set and our data set; the 10 countries in our data set that do not appear in the Quinn data set are Kuwait, Yemen, United Arab Emirates, Brunei Darussalam, Angola, Swaziland, Togo, and Moldova.

As in Figure 7, the average values of KC10 i used in the regressions are calculated using annual data only for those countries that have data for the Quinn and the Chinn-Ito indices in the respective years.

References

Benigno, G. et al 2014, “Optimal Capital Controls and Exchange Rate Policy? A Pecuniary Externality Perspective,” CEPR Discussion Paper 9936 (London, UK: Centre for Economic Policy Research).

Bhagwati, J., 1998, “The Capital Myth: The Difference Between Trade in Widgets and Trade in Dollars,” Foreign Affairs, Vol. 77, No. 3, pp. 7–12.

Bianchi, J., 2011, “Overborrowing and Systemic Externalities in the Business Cycle,” American Economic Review, Vol. 101, No. 7, No. 3, pp. 3400–26.

Binici, M., M. Schindler and M. Hutchison, 2010, “Controlling Capital? Legal Restrictions and the Asset Composition of International Financial Flows,” Journal of International Money and Finance, Vol. 29, No. 4, pp. 666–84.

Chinn, M.D. and Hiro Ito, 2006, “What Matters for Financial Development? Capital Controls, Institutions, and Interactions,” Journal of Development Economics, Vol. 81, No. 1, pp. 163–92.

Chinn, M.D. and H. Ito, 2008, “A New Measure of Financial Openness,” Journal of Comparative Policy Analysis, Vol. 10, No. 3, pp. 309–22.

De Gregorio, J., S. Edwards and R. Valdés, 2000, “Controls on Capital Inflows: Do They Work?,” Journal of Development Economics, Vol. 63, No. 1, pp. 59–83.

Dornbusch, R., 1998, “Capital Controls: An Idea Whose Time is Gone,” Mimeographed document (Cambridge: Massachusetts Institute of Technology).

El-Shagi, M., 2010, “Capital Controls and International Interest Rate Differentials,” Applied Economics, Vol. 42, No. 6, pp. 681–88.

El-Shagi, M., 2011, “The Distorting Impact of Capital Controls,” German Economic Review, Vol. 13, No. 1, pp. 41–55.

El-Shagi, M., 2012, “Initial Evidence from a New Database on Capital Market Restrictions,” Panoeconomicus, Vol. 59, No. 3, pp. 283–92.

Farhi, E. and I. Werning, 2012, “Dealing with the Trilemma: Optimal Capital Controls with Fixed Exchange Rates,” NBER Working Paper No. 18199 (Cambridge, MA: National Bureau of Economic Research).

Fernández, A., A. Rebucci and M. Uribe, 2015, “Are Capital Controls Countercylical?,” Journal of Monetary Economics, Vol. 76, pp. 1–14.

Forbes, K., 2007, “One Cost of Chilean Capital Controls: Increased Financial Constraints for Smaller Traded Firms,” Journal of International Economics, Vol. 71, No. 2, pp. 294–323.

Forbes, K., M. Fratzscher, T. Kostka and R. Straub, 2012, “Bubble Thy Neighbor: Direct and Spillover Effects of Capital Controls,” NBER Working Paper No. 18052 (Cambridge, MA: National Bureau of Economic Research).

Forbes, K.J. and M.W. Klein, 2015, “Pick Your Poison: The Choices and Consequences of Policy Responses to Crises,” IMF Economic Review, Vol. 63, No. 1, pp. 197–237.

Grilli, V. and G.-M. Milesi-Ferretti, 1995, “Economic Effects and Structural Determinants of Capital Controls,” IMF Staff Papers, Vol. 42, No. 3, pp. 517–51.

IMF Strategy, Policy, and Review Department, 2011, Recent Experiences in Managing Capital Inflows: Cross-Cutting Themes and Possible Policy Framework(Washington, DC: International Monetary Fund), Available via the Internet: www.imf.org/external/np/pp/eng/2011/021411a.pdf.

International Monetary Fund (IMF), 2009, Balance of Payments and International Investment Position Manual (BPM6), 6th ed.((Washington, DC: International Monetary Fund), Available via the Internet: www.imf.org/external/pubs/ft/bop/2007/pdf/bpm6.pdf.

Jahan, S. and D. Wang, 2015, “Capital Account Liberalization in Low-Income Countries: Evidence from a New Index,” manuscript (Washington, DC: International Monetary Fund).

Jeanne, O., 2012, “Capital Flow Management,” American Economic Review Papers and Proceedings, Vol. 102, No. 3, pp. 203–06.

Jeanne, O., A. Subramanian and J. Williamson, 2012, Who Needs to Open the Capital Account? (Washington, DC: Peterson Institute for International Economics).

Johnson, S., K. Kochhhar, T. Mitton and N. Tamirisa, 2006, “Malaysia Capital Controls: Macroeconomics and Institutions,” IMF Working Paper 06/51 (Washington, DC: International Monetary Fund).

Keynes, J.M., 1920, The Economic Consequences of the Peace (New York: Harcourt, Brace and Howe).

Klein, M.W., 2012, “Capital Controls: Gates Versus Walls,” Brookings Papers on Economic Activity, Vol. 2012 (fall, pp. 317–55).

Klein, M.W. and J.C. Shambaugh, 2015, “Rounding the Corners of the Policy Trilemma: Sources of Monetary Policy Autonomy,” American Economic Journal: Macroeconomics, Vol. 7, No. 4, pp. 33–66.

Korinek, A., 2010, “Regulating Capital Flows to Emerging Markets: An Externality View,” mimeographed document (College Park, MD: University of Maryland).

Lane, P. and G.-M. Milesi-Ferretti, 2007, “The External Wealth of Nations Mark II,” Journal of International Economics, Vol. 73, No. 2, pp. 223–50.

Miniane, J., 2004, “A New Set of Measures on Capital Account Restrictions,” IMF Staff Papers, Vol. 51, No. 2, pp. 276–308.

Ostry, J.D., and others 2010, “Capital Inflows: The Role of Controls.” in IMF Staff Position Note 10/04 (Washington, DC: International Monetary Fund).

Ostry, J.D., and others 2011, “Capital Controls: When and Why,” IMF Economic Review, Vol. 59, No. 3, pp. 562–80.

Prati, A., M. Schindler and P. Valenzuela, 2012, “Who Benefits from Capital Account Liberalization? Evidence from Firm-Level Credit Ratings Data,” Journal of International Money and Finance, Vol. 31, No. 6, pp. 1649–73.

Quinn, D., 1997, “The Correlates of Change in International Financial Regulation,” American Political Science Review, Vol. 91, No. 3, pp. 531–51.

Quinn, D., M. Schindler and A.M. Toyoda, 2011, “Assessing Measures of Financial Openness and Integration,” IMF Economic Review, Vol. 59, No. 3, pp. 488–522.

Rey, H., 2013, “Dilemma not Trilemma: The Global Financial Cycle and Monetary Independence,” in Global Dimensions of Unconventional Monetary Policy: A Symposium Sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming, August 22–24, 2013 (Kansas City, MO: Federal Reserve Bank).

Rodrik, D., 1998, “Who Needs Capital-Account Convertibility?,” in Should the IMF Pursue Capital Account Convertibility?, Essays in International Finance No. 207, ed. by S. Fischer, Richard N. Cooper, R. Dornbusch, Peter M. Garber, C. Massad, Jacques J. Polak, D. Rodrik and Savak S. Tarapore (Princeton, N.J.: Princeton University, Department of Economics, International Finance Section).

Rogoff, K.S., 2002, “Rethinking Capital Controls: When Should We Keep an Open Mind?,” Finance and Development, Vol. 39, No. 4, pp. 55–56.

Schindler, M., 2009, “Measuring Financial Integration: A New Data Set,” IMF Staff Papers, Vol. 56, No. 1, pp. 222–38.

Schmitt-Grohé, S. and M. Uribe, 2012, “Prudential Policy for Peggers,” NBER Working Paper 18031 (Cambridge, MA: National Bureau of Economic Research).

Skidelsky, R., 1992, John Maynard Keynes: The Economist as Saviour, 1920–1937 (London: Macmillan).

Tamirisa, N., 1999, “Exchange and Capital Controls as Barriers to Trade,” IMF Staff Papers, Vol. 46, No. 1, pp. 69–88.

Author information

Authors and Affiliations

Additional information

*Fernández: InterAmerican Development Bank; Klein: Fletcher School, Tufts University and NBER; Rebucci: Carey Business School, Johns Hopkins University; Schindler: International Monetary Fund and Joint Vienna Institute (JVI); Uribe: Columbia University and NBER. We thank Javier Caicedo and Asel Isakova for excellent research assistance, and participants for helpful comments received during presentations at the 2016 ASSA meetings, the OECD, the Joint Vienna Institute, the NBER Summer Institute, the IMF Workshop on capital controls on low-income countries, and Tufts University. The information and opinions presented in this work are entirely those of the authors, and express or imply no endorsement by the Inter-American Development Bank, the International Monetary Fund, the Board of Executive Directors of either institution or the countries they represent.