Abstract

In this paper, we make use of Bayesian VAR (BVAR) models to conduct an out-of-sample forecasting exercise for CPIF inflation, the inflation target variable at the Riksbank in Sweden. The proposed BVAR models generally outperform simple benchmark models, the BVAR model used by the Riksbank as presented in Iversen et al. (Real-time forecasting for monetary policy analysis: the case of Sveriges Riksbank, Working Paper 16/318, Sveriges riksbank, Stockhol, 2016) and professional forecasts made by the National Institute of Economic Research in Sweden. Moreover, the BVAR models proposed in the present paper have better forecasting precision than both survey forecasts and the method suggested by Faust and Wright (in: Elliott, Timmermann (eds) Handbook of forecasting, 2013). The findings in this paper might be of value to analysts, policymakers and forecasters of the inflation in Sweden (and possibly other small open economies alike).

Similar content being viewed by others

Notes

Survey forecasts is one source of inflation expectations where questions about predicted future inflation are asked to professional economists (from financial institutions or academia), to businesses or to consumers.

CPIF inflation is the consumer price index with fixed interest rates.

Only variables included in the final models are shown. All variables but the foreign and domestic interest rate levels are stationary according to the ADF-test, see Table A1 in Appendix A. The interest rate levels are however apriori stationary (and also found stationary using other unit root tests) and treated as such in this paper following the discussions and suggestions in e.g. Cerrato et al. (2013).

Trade-weighted using weighted averages of the euro area, Norway, Denmark, UK, US and Japan (before 1999 the policy rate in Japan is not included).

In order to replicate Iversen et al. (2016) we use the dlog transformation for some variables and quarter-on-quarter percentage changes for some. Of course, the differences between the two transformations are generally negligible.

Industry, services, construction, retail trade and consumer confidence.

See Nyman (2010).

Dlogs are used instead of percentage changes in the Iversen et al. (2016) model.

See Erlandsson and Markowski (2006) for information about the index.

The nominal KIX index is published by the Riksbank, whereas the NIER transforms it into real terms.

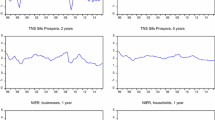

Empirical studies on the information content of the term structure for future inflation have been undertaken by, among others, Fama (1990), Estrella and Mishkin (1997), Ivanova et al. (2000) and Berardi (2009). These studies suggest that the term structure contains information about future inflation at moderate to long horizons (3–5 years). In this paper, the focus is on somewhat shorter horizons (1–12 quarters) but we have chosen to include yield spreads anyway in our analysis.

The priors on the dynamics are slightly different from the traditional Minnesota prior. Instead of setting the prior mean on the first own lag to 1 and zero on all other lags (which is the traditional specification), the prior mean on the first own lag is here set equal to 0.9 and all subsequent lags have a prior mean of zero. The reason for this modification is that the traditional specification is theoretically inconsistent with the mean-adjusted model, as it takes its starting point in a univariate random walk and such a process does not have a well-defined unconditional mean.

In Iversen et al. (2016) the authors state that the nominal exchange rate level is used in the “current version of the model” According to the Riksbank the real exchange rate level was used in 2017. We have therefore estimated the model using the real exchange rate level in both versions of the model we present here. As a sensitivity check we have also evaluated both models with the nominal exchange rate level. The results (available from the authors upon request) are very similar to the ones using the real exchange rate level.

All competing models are first estimated for a training period of 12 years, using data from 1997Q1 to 2008Q4. Forecasts one to twelve quarters ahead, starting 2009Q1, are then generated and the forecast errors are recorded. The sample is then extended one quarter, the models are re-estimated and new forecasts twelve quarters ahead are generated. This procedure is repeated for each new quarter and stops at the end of the sample, see also Sect. 4.1.

Including yield spreads last in the refined models somewhat decreased forecasting precision on average, even at the longest horizons at the longest horizons. Results are available from the authors upon request.

Steps 1–3 in the procedure are based on the order in which the variables enter the BVAR-systems.

Peneva and Rudd (2017) found little evidence that labour costs had a material effect on US inflation in recent years. However, Mossfeldt and Stockhammar (2016) found that labour costs had strong predictive power for Swedish goods and services inflation which motivates the evaluation of these measures in this study.

Oil prices are treated as exogenous in the BVAR model.

We have also evaluated even bigger models, though adding more variables did not increase the forecast accuracy. We have also evaluated different lag lengths and found that m = 4 generates the lowest RMSFEs.

A list of tested, but not used, variables is provided in Table A4 in Appendix 2.

To capture the varying local mean inflation rate, Faust and Wright (2013) measure the trend level of inflation, \(\tau_{t}\), using the most recent five-to-ten-year inflation forecast from Blue Chip.

Until September 2017 the inflation target was formally expressed using CPI inflation. However in practice, as mortgage rates are included in CPI, CPIF inflation has been the main focus for the Riksbank for a long time. From September 2017 the CPIF inflation is also formally the Riksbank’s inflation target variable.

100 × ((0.66–0.30)/0.66) = 55 per cent for the GFAPC model 2 at the four quarter horizons, see Table A5 and A6 in Appendix 3.

According to the Diebold and Mariano (1995) test using HAC standard errors.

Standard VAR models generate considerably, and often significantly, higher RMSFEs than the BVAR counterparts, see Table A5 in Appendix C and Table A9 in Appendix D.

Results from other combinations of models in the Diebold-Mariano test are available from the authors upon request.

Results are available from the authors upon request.

The NIER does, however, publish scenarios for longer horizons than 1-8 quarters. The NIER’s estimation of developments over the next 2 years is a forecast while the description of the development thereafter is defined as a scenario. Forecasting refers to an attempt to predict the most likely development of a number of variables, including cyclical variations. Scenarios are thought of as consistent descriptions of macroeconomic developments expected given a number of central, but simplified, assumptions.

The NIER businesses survey is significantly worse than the Refined version 1 in predicting CPIF inflation on all but the 11 and 12 quarter horizons. All other surveys are significantly worse on all horizons.

See Table A4 in Appendix B. RMSFEs are available from the authors upon request.

The NIER belongs to the forecast institutions with highest forecasting precision 2007–2017 according to Sveriges Riksbank (2018).

See Yellen (2017).

See e.g. Sveriges Riksbank (2018).

References

Ang, A., Bekaert, G., & Wei, M. (2007). Do macro variables, asset markets, or surveys forecast inflation better? Journal of Monetary Economics,54, 1163–1212.

Atkeson, A., & Ohanian, L. E. (2001). Are Phillips curves useful for forecasting inflation? Federal Reserve Bank of Minneapolis Quarterly Review,25, 2–11.

Beechey, M., & Österholm, P. (2010). Forecasting inflation in an inflation targeting regime: A role for informative steady-state priors. International Journal of Forecasting,26, 248–264.

Berardi, A. (2009). Term structure, inflation and real activity. Journal of Financial and Quantitative Analysis,44, 987–1011.

Cerrato, M., Kim, H., & MacDonald, R. (2013). Nominal interest rates and stationarity. Review of Quantitative Finance and Accounting,40, 741–745.

Croushore, D. (2010). An evaluation of inflation forecasts from surveys using real time data. The B.E Journal of Macroeconomics,10, 1–32.

Diebold, F. X., & Mariano, R. S. (1995). Comparing predictive accuracy. Journal of Business and Economic Statistics,13, 253–263.

Doan, T. A. (1992). RATS Users Manual, version 4.

ECB. (2017). Domestic and global drivers of inflation in the euro area. Economic Bulletin,4(2017), 72–96.

Erlandsson, M., & Markowski, A. (2006). The effective exchange rate index KIX—Theory and practice. Working Paper No. 95, National Institute of Economic Research.

Estrella, A., & Mishkin, F. S. (1997). The predictive power of the term structure of interest rates in Europe and the United States: Implications for the European Central Bank. European Economic Review,41, 1375–1401.

Fama, E. F. (1990). Term-structure forecasts of interest rates, inflation and real returns. Journal of Monetary Economics,25, 59–76.

Faust, J., & Wright, J. H. (2013). Inflation forecasting. In G. Elliott & A. Timmermann (Eds.), Handbook of forecasting (pp. 2–56). Amsterdam: Elsevier.

Borio C., & Filardo, A. (2007). Globalisation and inflation: New cross-country evidence on the global determinants of domestic inflation, BIS Working Papers, No. 227.

Ivanova, D., Lahiri, K., & Seitz, F. (2000). Interest rate spreads as predictors of German inflation and business cycles. International Journal of Forecasting,16, 39–58.

Iversen, J., Laséen, S., Lundvall, H. and Söderström, U. (2016). Real-time forecasting for monetary policy analysis: The case of Sveriges Riksbank, Working Paper 16/318, Sveriges riksbank, Stockholm.

Karlsson, S., & Österholm, P. (2018). A note on the stability of the swedish philips curve. Working Paper 6/2018, Örebro University.

Lawrence, M., Edmundson, R., & O’Connor, M. (1985). An examination of the accuracy of judgmental extrapolation of time series. International Journal of Forecasting,1, 25–35.

Mikolajun, I., & Lodge, D. (2016). Advanced economy inflation: the role of global factors. Working Paper Series, No. 1948, ECB.

Mossfeldt, M., & Stockhammar, P. (2016). Forecasting Goods and Services Inflation in Sweden. Working Paper No. 146, National Institute of Economic Research.

Murphy, A. H., & Winkler, R. L. (1992). Diagnostic verification of probability forecasts. International Journal of Forecasting,7, 435–455.

Nyman, C. (2010). An indicator of resource utilization. Economic Commentaries 2010 (4), Sveriges Riksbank.

Peneva, E. V., & Rudd, J. B. (2017). The passthrough of labor costs to price inflation. Journal of Money, Credit and Banking,49, 1777–1802.

Stock, J. H., & Watson, M. W. (2009). Phillips curve inflation forecasts. In J. Fuhrer, Y. Kodrzycki, J. S. Little, & G. Olivei (Eds.), Understanding Inflation and the implications for monetary policy, a phillips curve retrospective (pp. 101–186). Cambridge: MIT Press.

Stockhammar, P., & Österholm, P. (2018). Do Inflation expectations granger cause inflation? Economia Politica,35, 403–431.

Svensson, L. E. O. (2005). Monetary policy with judgment: forecast targeting. International Journal of Central Banking,1, 1–54.

Sveriges Riksbank. (2018). “Evaluation of the Riksbank’s Forecasts”, Riksbank Studies, March 2018.

Villani, M. (2009). Steady-state priors for vector autoregressions. Journal of Applied Econometrics,24, 630–650.

Woodford, M. (2003). Interest and prices: Foundations of a theory of monetary policy. Princeton: Princeton University Press.

Yellen, J. L. (2017). Inflation, Uncertainty, and Monetary Policy. Speech delivered at the “Prospects for Growth: Reassessing the Fundamentals” 59th Annual Meeting of the National Association for Business Economics, Cleveland, Ohio, September 26.

Acknowledgements

We are grateful to Jakob Almerud, Erika Färnstrand Damsgaard, Erik Glans, Petter Hällberg, Pär Österholm and to seminar participants at the National Institute of Economic Research for valuable comments on this paper. We also like to thank two anonymous reviewers whose valuable comments have greatly improved the quality of this manuscript.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Data

See Appendix Figs. 5, 6, 7, 8 and Table 4.

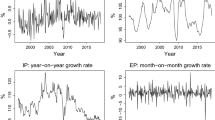

The data. Foreign and Swedish GDP growth and foreign inflation is given as the quarter-on-quarter logarithmic change (dlog). Foreign policy is the average policy rate level in each quarter. The oil price and domestic inflation (CPIF) is measured as the quarter-on-quarter percentage change. The EA unemployment rate and the ES indicator are measured in percent. See Sect. 2 for more information

The Data. Note: Hours worked is given as the quarter-on-quarter logarithmic change (dlog). Hourly earnings (short-term wage) is measured as the year-on-year percentage change and hourly earnings (national accounts) is given as the quarter-on-quarter logarithmic change (dlog). The unemployment rate and the resource utilisation indicator (by the Riksbank) are measured in percent. The exchange rate is measured in level. The Swedish policy rate (the repo rate) is the average policy rate level in each quarter. See Sect. 2 for more information

Appendix 2: Steady-state priors

Appendix 3: RMSFEs

Appendix 4: Diebold-Mariano tests

See Tables 12.

Rights and permissions

About this article

Cite this article

Lindholm, U., Mossfeldt, M. & Stockhammar, P. Forecasting inflation in Sweden. Econ Polit 37, 39–68 (2020). https://doi.org/10.1007/s40888-019-00161-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40888-019-00161-9