Abstract

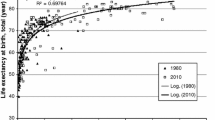

Much uncertainty surrounds the length of human life. The standard deviation in adult life span is about 15 years in the USA, and theory and evidence suggest that it is costly. I calibrate a utility-theoretic model that shows that 1 year in standard deviation is worth about half a life year. Differences in variance exacerbate health inequalities between and among rich and poor countries. Accounting for the cost of life-span variance appears to amplify recently discovered patterns of convergence in world average human well-being because the component of variance due to infant mortality has exhibited even more convergence than life expectancy.

Similar content being viewed by others

Notes

The data are simple averages of sex-specific period life tables supplied by Bell and Miller (2005). Statistics prior to 1933, when the NCHS Death Registration Area expanded to include all states at 90% completeness, are of lower quality and include interpolated values.

Remaining life expectancy, e x , which is the entry commonly seen in a life table, is equal to average length of life conditional on survival to age x, M x , minus x: e x = M x − x. It is useful to calculate M x because of its role in the standard deviation and other central moments.

Edwards and Tuljapurkar (2005) argue that the standard deviation in life span after age 10, S 10, is a good measure of this dispersion in adult life span. Age 10 is a convenient cutoff because it facilitates the examination of longer historical series or wider cross sections in which premature mortality is more prevalent. Opinions vary regarding the ideal type of variability measure for length of life. Wilmoth and Horiuchi (1999) and Fuchs and Ersner-Hershfield (2008) prefer the interquartile range, while Shkolnikov et al. (2003) favor the Gini, and Smits and Monden (2009) prefer the Theil index measured above age 15. Preferable qualities of S 10 are that it is invariant to trends in infant mortality, which is etiologically distinct from adult mortality, and that like the mean, it is analytical tractable.

My approach is similar to those of Jones and Klenow (2010), who price consumption inequality using a Rawlsian perspective, or before any correlates with income are known, and to Lucas (1987), who prices aggregate consumption uncertainty without regard to heterogeneity in the variance of consumption across consumers. In a closely related paper (Edwards 2009), I consider a problem that is analogous to Lucas’s: the cost of cyclical fluctuations in mortality.

Previous studies of the total economic value of mortality decline in the USA since 1900 such as Nordhaus (2003) and Murphy and Topel (2006) typically account for all changes in the survivorship schedule, whether involving the mean, variance, or higher moments, and thus provide unbiased results. But studies of international well-being such as Becker et al. (2005) and Jones and Klenow (2010) often use only e 0 due to data limitations and thus cannot account for the shape of the life-span distribution.

The shape of preferences tends to vary by subgroup characteristics and based on whether the gamble is short or long-term in nature. Pliskin et al. (1980) reveal apparent risk neutrality and even risk preference among 10 Harvard researchers. Verhoef et al. (1994) find that their subjects are risk-seeking over small gambles in life span but risk averse over large gambles, consistent with prospect theory. Miyamoto and Eraker (1985) settle on risk neutrality over life years as an average over the wide-ranging preferences they observe.

A consumption trajectory fitting Bommier’s definition of the constant flow of satisfaction consumption profile, where e − δt u(c(t)) is time invariant given a constant time discount rate δ, must be increasing through age because marginal utility is positive. This does not appear to be typical (Banks et al. 1998).

Yaari (1965) initially posits a more general form of the subjective discount function, but time discounting must be exponential at a constant rate in order to insure preferences are time consistent (Strotz 1956). Bommier (2006) discusses preferences over length of life in other frameworks, such as with hyperbolic discounting and other types of time inconsistent preferences.

Kalemli-Ozcan et al. (2000) and Li and Tuljapurkar (2004) develop models that include retirement, endogenous capital accumulation, and education alongside mortality. Each element probably increases the cost of life-span variance. If individuals must trade their leisure time for market earnings, higher S 10 erodes expected lifetime wealth provided that the retirement age is within the support of probabilistic life span. If capital and the interest rate were endogenous, higher S 10 would likely deplete the capital stock by lowering the marginal utility of wealth, raising the interest rate and lowering the wage rate. Effects on welfare are countervailing, but it seems likely that the net effect would be negative. Human capital investment is riskier when S 10 is higher, which should result in lower educational attainment and a decrease in welfare. But it is also true that S 10 is lower for groups with more education (Edwards and Tuljapurkar 2005). We might interpret this as very tangible evidence that S 10 is costly.

In this model with costlessly enforced contracts, the price of the annuity is the right to leave bequests. All wealth that is unused by those who die is redistributed to the living.

In a discrete-time life table, q(t) is the probability of dying between t and t + 1, equal to \(q(t) = \log \left[ \ell(t) \right] - \log \left[\ell(t+1) \right]\) or implicitly as ℓ(t + 1) = ℓ(t) [1 − q(t)], in order to attrit the entire cohort at a finite age. In continuous time, q(t) is the hazard or mortality rate.

To be sure, the use of power (isoelastic) utility raises some issues in any setting when periods of life are variable. Here, the level of utility matters, which is usually not the case. It must be positive or else life is not good. We can model this with certain combinations of the utility shifter K and the coefficient of relative risk aversion, γ, as do Ehrlich (2000), Becker et al. (2005), and Hall and Jones (2007), but questions may remain as to the appropriateness of this technique. No study has attempted to test the restrictions imposed on the characteristics of u(·) in this case, namely the implied degree of risk aversion and intertemporal substitution in consumption and analogous preferences over years of life. We already know that power utility does not jointly satisfy the first two particularly well (Epstein and Zin 1989, 1991) but that has not precluded its widespread use. To what extent modeling preferences over length of life complicate this picture is a question awaiting future research. I believe my core results hinge on the assumptions of time separability and exponential time discounting, and not on the curvature of the period utility function, or on the restriction that the coefficient of relative risk aversion in consumption equals the intertemporal elasticity of substitution in consumption.

Mean life span, M, affects c(0) in obvious ways, and Rosen (1988) shows how extending life incurs a marginal cost associated with reducing consumption in all periods, holding other things, namely lifetime wealth, equal. A more subtle point is that the variance in life span, S 2, also affects c(0) for the same reason that variance affects lifetime expected utility. But the direction of the effect is counterintuitive. Through Jensen’s inequality, (expected) lifetime discounted consumption is lower when variance in life span is higher. At any given initial wealth, c(0) can then be higher than under less variance while still satisfying the budget constraint. Numerical simulations reveal that the effects on c(0) of changing M or S 2 are small.

Without annuities, the presence of q(t) in the consumption function precludes analytical solutions because mortality increases exponentially with age.

As I discussed earlier, Bommier (2006) instead argues that the framework of Yaari (1965) implies risk neutrality over length of life. But the risk neutrality result derives from Bommier’s assumption of a “constant flow of satisfaction consumption profile,” in which e − δt u(c(t)) is time invariant. That condition requires flow utility and thus consumption to be growing over time. As shown by the consumption trajectory in Eq. 6, consumption growth requires that r be higher than δ. In particular, if γ = 0.8, as I assume later, then c(t) must be growing five times as fast as δ to produce growth in u(·) equal to δ. This would require r = 5 δ, a very large difference. If γ is bigger, flow utility is more sharply concave, requiring an even larger increase in consumption to raise utility by a particular amount. By Eq. 6, the difference between r and δ would then have to be even larger to achieve a particular level of consumption growth.

As shown by Fig. 1, adult life spans are technically not normal, with both leftward skewness and leptokurtosis, or peakedness with fat tails, an indicator of different subgroup variances. Below, I show that numerical simulations show that normality reduces the cost of S as long as the discount rate is positive, so this assumption produces an underestimate of the true cost.

It is a standard observation that period utility, which is the marginal utility of being alive in that period, should be nonnegative when modeling dynamics of life span (Rosen 1988; Hall and Jones 2004; Becker et al. 2005). If it were negative or zero, a utility maximizing individual would choose to die. Becker et al. (2005) calibrate the additive utility shifter K < 0. This reduces the cost of S through the second piece of Eq. 11, but numerical simulations confirm this effect to be small and uninteresting.

The constant utility shifter does not appreciably augment the insights to be gained. Were K to describe period utility alone, it would imply the same dynamics as when r = δ, with only δ mattering for cost. When K is combined with flow utility from consumption, both numerator and denominator in Eq. 12 are weighted averages of the two pieces in Eq. 11. When the piece including K has more weight, the coefficient on S in p S shifts closer to δ than \(\hat{\delta}\).

We see the same type of behavior in financial markets, where returns on financial assets are also approximately lognormal, and risk premia tend to rise strongly with the riskiness of returns. According to data presented by Ibbotson Associates (2002), the standard deviation of the excess return on equities was 14% between 1948 and 1999, which demanded a risk premium of about 9%. Excess returns on corporate bonds had a standard deviation a little over half as large, 8.5%, but the risk premium on corporate bonds was much lower, only 1.3%, or about one seventh of the equity risk premium.

I truncate these synthetic distributions at ages 0 and 150 and rescale so that their cdf’s sum to unity. Age 150 is an unrealistic but convenient choice when life spans are normally distributed. The Human Mortality Database (2009) topcodes age at 110, and there are few documented individuals who have survived to that age. When life spans are normally distributed with means around age 80, densities past age 110 are not miniscule. Truncating at age 110 actually creates significant skewness in the distribution and probably changes the mean and variance. Such skewed distributions actually produce a p S locus that better resembles that under realistic survivorship because real life spans are skew-left.

In 1994, M 10 = 76.85 and S 10 = 15.66, while in 1999, M 10 = 77.67 and S 10 = 15.05. It is convenient to use data from these 2 years because there is a relatively large difference in S 10 but a small difference in M 10, which reduces the complexity of later simulations with fully realistic mortality.

As I discussed in note 12, the tradition in the literature on valuing life extension is not to separate the coefficient of relative risk aversion (CRRA) from the elasticity of intertemporal substitution (EIS), although researchers in asset pricing often model preferences that way (Epstein and Zin 1989, 1991). When longevity is endogenous and must be purchased, as in the growth model of Hall and Jones (2007), this could be problematic because the marginal rate of substitution between consumption and length of life ought to depend on the EIS, not the CRRA. In the present context, the conflation of the EIS and CRRA is not particularly important. The influence of γ is best interpreted here as deriving from its role as the inverse of the EIS. When 0 < γ < 1, the consumer likes to substitute consumption between periods because marginal utility in any period remains high, and any difference between r and δ will be amplified and will generally affect p S . But when γ > 1, there are weaker gains from intertemporal redistribution, and high or low interest rates do not greatly affect \(\hat{\delta} \approx \delta\). Functionally, the MRS between average length of life and the variance depends mostly on the time discount rate. Intuitively, it is utility curvature over length of life, not consumption, that matters most in the cost of life-span variance. The relevant issue here is whether additively time-separable preferences are overly confining, an issue discussed by Bommier (2006, 2008) and Bommier and Villeneuve (2011).

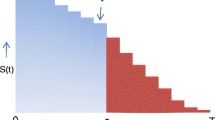

It is tricky to model realistic life spans with particular means and variances because we do not have a convenient functional form of the actual probability distribution of life spans. I proceed by generating additive translations of the 1999 life-span distribution above age 10 in the USA, which originally had a mean of 77.67 and a standard deviation of 15.05, so that I have an array of realistic distributions with varying means but fixed variances. Then I search for the distribution that produces the same lifetime expected utility as the 1994 distribution above age 10 with M 10 = 76.85 and S 10 = 15.66. I apply a cubic spline to the distribution of life spans by single years of age over age 10 in the USA in 1999, and I sequentially evaluate the spline at hundredths of a year in age, spaced 1 year apart. I then redefine age back to whole years, which produces a sideways translation of the distribution, changing the mean but preserving the variance. At ages under 10, I simply duplicate the density at 10 and renormalize the entire distribution. Later I include realistic infant mortality as explained in the text.

I overlay the life span distribution under age 10 in 1999 on top of the distribution in 1994 and on top of each translated distribution from 1999 that has a different mean. Then I renormalize so that each distribution cumulates to unity.

To assess how very high rates of infant mortality might change the marginal utility of mean life span and this p S , I ran the same experiment using Swedish data from 1900, when deaths at age 0 were 10%. Results were very similar, with the analytical result still a conservative estimate so long as δ > 0.02 when r = 0.03. If δ < 0.01, p S became positive with such high infant mortality.

When schedule q *(t) differs from q(t) only by q *(0) = q(0) + i, survivorship is given by

$$ \begin{array}{rll} \ell^*(t) &=& \exp \left( - \int_0^\infty q^*(t) \ {\rm d}t \right) = \exp \left( -[ q(0) + i] - \int_1^\infty q(t) \ {\rm d}t \right) \\ &=& e^{-i} \exp \left( - \int_0^\infty q(t) \ {\rm d}t \right) = e^{-i} \ell(t) . \end{array} $$Life expectancy at birth is the integral of survivorship, \(e_0 = \int_0^\infty \ell(t) \ {\rm d}t\), while lifetime expected utility is given by Eq. 1. With complete annuities and r = δ, lifetime utility rises proportionally with i along with e 0 and ℓ(t).

For example, if life expectancy T = M with complete certainty, r = δ, and consumption is fully annuitized, \({\rm EU} = u(\bar{c}) (1 - e^{-\delta M}) / \delta\). When δ = 0.03, an increase in M of 1% will raise EU by half a percent when M is around 40, by one third of a percent when M is near 60, and by one quarter of a percent when M is 80. Numerical simulation reveals that this relationship also holds when there is realistic but static variance in length of life.

The less fortunate would also bear a heavier burden if they have disproportionately less access to annuities, which I found offset perhaps one third of the cost of life-span uncertainty. This characteristic may be observationally linked to high δ, since one reason why low-SES individuals might appear to have high δ, myopia, or insufficient saving is if they face liquidity constraints or incomplete markets. We would expect that access to annuities markets are also poor for liquidity constrained individuals.

Technically, true cohort S 10 should also reflect uncertainty about future mortality rates, or in other words, uncertainty about the shape of the probability distribution itself. We can treat forecast uncertainty as independent from what we might call life-table uncertainty, by which we mean the uncertainty in life span in a known probability distribution, because the time-series evidence seems to support that conclusion (Lee and Carter 1992). Using the Lee–Carter method of forecasting mortality, I found that forecast uncertainty appears to be small, perhaps 1 year in standard deviation for the cohort born in 2000, relative to life-table uncertainty around 15.3 years. Since these are independent risks, this cohort’s total S 10 = 15.33, or only 0.03 year higher than that implied by the median forecast life table.

For large changes in the moments, S and thus p S will change. The isoquants of lifetime expected utility for two normally distributed life spans \(L_1 \sim N(M_1,S_1^2)\) and \(L_2 \sim N(M_2,S_2^2)\) are given by \(M_1 - M_2 = \hat{\delta} ( S_1^2 - S_2^2)/2\).

In their original work, Becker et al. (2003) examined a narrower cross section of 49 countries in the WHO mortality database. With data on age-specific mortality rates, they constructed life tables and full survivorship schedules. Becker et al. (2005) measured convergence among a broader sample of 96 countries for whom only life expectancy at birth is provided by the World Bank’s World Development Indicators database.

In general, however, convergence results are not robust to the breadth and quality of the sample, nor to the use of population weights, and they appear not to have been robust in the original data examined by Becker et al. (2005) either. Unweighted estimates, which place much more emphasis on the experiences of small countries, reveal greater inequality in full income than in GDP per capita in 2000. This is true in the broad sample of 180, in the smaller sample of 96 used by Becker et al., and it is also true in a subset of 35 countries with high-quality mortality data drawn from the Human Mortality Database (2009). In the last subsample, which is dominated by high-income countries, even population-weighted estimates show slightly increased inequality in full income compared to GDP per capita in 2000. Two factors probably account for these patterns. First, countries that have been hit hardest by HIV/AIDS tend to be small. Unweighted estimates are therefore likely to overestimate the impact of the disease on convergence in average human well-being, although they correctly measure the convergence across countries. Second, because high-quality mortality data are a luxury affordable only to high-income countries and income also correlates strongly with the demographic transition, it is not surprising that mortality trends based only on high-quality data are different than those based on a much broader sample. Still, it is troubling that the basic result, namely increased convergence in full income compared to GDP per capita, seems to hinge on the use of mortality data of questionable quality. Recent developments in a related literature on income inequality and population health testify to the inherent dangers (Judge et al. 1998). Less troubling but still worthy of note is the finding that average well-being in small countries seems not to be converging toward that in large countries, which bears broad implications, such as for the continued spread of the demographic transition.

A recent paper posits that contemporary declines in adult mortality are due to earlier declines in childhood disease and mortality (Finch and Crimmins 2004), owing to a reduced accumulation of inflammatory exposure from infectious disease. One might infer that sustained mortality decline could happen in no other way. But in many modern developing countries, infant mortality remains high even though imported medical technologies can reduce adult mortality. Life expectancy in many such countries has increased (Becker et al. 2005), although perhaps not as robustly as in the developed world.

To be sure, the story must also involve marginal costs, since the socially optimal allocation of resources occurs where the ratio of marginal utilities is equal to the ratio of marginal costs. Reducing variance through improved sanitation or other public health initiatives is likely to be much less costly than increasing the adult mean, which involves treating degenerative diseases.

The intuition derives from an analogy to the relationships between time trends in aggregate consumption, risk premia in consumption, and preferences over consumption, which are described by Campbell and Viceira (2002). Log consumption is trending linearly upward over time, while financial risk premia and the standard deviations of asset returns and log consumption have remained roughly constant. Preferences over consumption that exhibit constant relative risk aversion are consistent with these facts, and this is one reason why the familiar power utility function is useful for modeling. By comparison, average length of life is trending upward at an approximately linear rate, and the standard deviation has remained roughly constant since 1960. These facts imply that constant absolute risk aversion over length of life would be consistent with these facts and with stable risk premia placed on length of life. Although we technically do not observe the latter in any market, it seems reasonable to expect that they probably are constant.

References

Aldy JE, Viscusi WK (2003) Age variations in workers’ value of statistical life. NBER Work Pap 10199

Aldy JE, Viscusi WK (2008) Adjusting the value of a statistical life for age and cohort effects. Rev Econ Stat 90(3):573–581

Atkinson AB (1970) On the measurement of inequality. J Econ Theory 2(3):244–263

Banks J, Blundell R, Tanner S (1998) Is there a retirement savings puzzle? Am Econ Rev 88:769–788

Barsky RB, Juster FT, Kimball MS, Shapiro MD (1997) Preference parameters and behavioral heterogeneity: an experimental approach in the health and retirement study. Q J Econ 112:537–579

Becker GS, Mulligan CB (1997) The endogenous determination of time preference. Q J Econ 112(3):729–758

Becker GS, Philipson TJ, Soares RR (2003) The quantity and quality of life and the evolution of world inequality. NBER Work Pap 9765

Becker GS, Philipson TJ, Soares RR (2005) The quantity and quality of life and the evolution of world inequality. Am Econ Rev 95(1):277–291

Bell FC, Miller ML (2005) Life tables for the United States Social Security Area, 1900–2100, actuarial study no. 120, Office of the Chief Actuary, Social Security Administration

Bernheim BD, Shleifer A, Summers LH (1985) The strategic bequest motive. J Polit Econ 93(6):1045–1076

Bishai DM (2004) Does time preference change with age? J Popul Econ 17(4):583–602

Bleichrodt H, Johannesson M (1997) The validity of QALYs: an experimental test of constant proportional tradeoff and utility independence. Med Decis Mak 17(1):21–32

Bleichrodt H, Quiggin J (1999) Life-cycle preferences over consumption and health: when is cost-effectiveness analysis equivalent to cost–benefit analysis? J Health Econ 18(6):681–708

Bommier A (2006) Uncertain lifetime and intertemporal choice: risk aversion as a rationale for time discounting. Int Econ Rev 47(4):1223–1246

Bommier A (2008) Rational impatience? Working paper, http://hal.archives-ouvertes.fr/hal-00441880/en/

Bommier A, Villeneuve B (2011) Risk aversion and the value of risk to life. J Risk Insur. http://onlinelibrary.wiley.com/doi/10.1111/j.1539-6975.2010.01390.x/abstract

Campbell JY, Viceira LM (2002) Strategic asset allocation: portfolio choice for long-term investors. Oxford University Press, Oxford

Chang FR (1991) Uncertain lifetimes, retirement and economic welfare. Economica 58(230):215–232

Costa DL (1998) The evolution of retirement: an American economic history. University of Chicago Press, Chicago, pp 1880–1990

Costa DL, Kahn ME (2004) Changes in the value of life, 1940–1980. J Risk Uncertain 29(2):159–180

Cutler D, Deaton A, Lleras-Muney A (2006) The determinants of mortality. J Econ Perspect 20(3):97–120

Cutler DM, Richardson E (1997) Measuring the health of the U.S. population. Brookings papers on economic activity. Microeconomics 97:217–271

Deaton A (2004) Health in an age of globalization. In: Collins SM (ed) Brookings trade forum 2004: globalization, poverty, and inequality. University of Chicago Press, Chicago, pp 83–110

Dynan KE, Skinner J, Zeldes SP (2004) Do the rich save more?. J Polit Econ 112(2):397–444

Edwards RD (2009) The cost of cyclical mortality. BE J Macroecon 9(1):Contributions, Article 7

Edwards RD (2011) Changes in world inequality in length of life: 1970–2000. Popul Dev Rev 37(3):499–528

Edwards RD, Tuljapurkar S (2005) Inequality in life spans and a new perspective on mortality convergence across industrialized countries. Popul Dev Rev 31(4):645–675

Ehrlich I (2000) Uncertain lifetime, life protection, and the value of life saving. J Health Econ 19:341–367

Epstein LG, Zin SE (1989) Substitution, risk aversion, and the temporal behavior of consumption growth and asset returns I: a theoretical framework. Econometrica 57(4):937–969

Epstein LG, Zin SE (1991) Substitution, risk aversion, and the temporal behavior of consumption and asset returns: an empirical analysis. J Polit Econ 99(2):263–286

Finch CE, Crimmins EM (2004) Inflammatory exposure and historical changes in human life-spans. Science 305(5691):1736–1739

Fuchs VR (1982) Time preference and health: An exploratory study. In: Fuchs VR (ed) Economic aspects of health. University of Chicago Press, Chicago, chapter 3

Fuchs VR, Ersner-Hershfield H (2008) Inequality in length of life. SIEPR Policy Brief October 1

Hall RE, Jones CI (2004) The value of life and the rise in health spending. NBER Work Pap 10737

Hall RE, Jones CI (2007) The value of life and the rise in health spending. Q J Econ 122(1):39–72

Hubbard RG, Judd KL (1987) Social security and individual welfare: precautionary saving, borrowing constraints, and the payroll tax. Am Econ Rev 77(4):630–646

Hubbard RG, Skinner J, Zeldes SP (1994) The importance of precautionary motives in explaining individual and aggregate saving. Carnegie-Rochester Conf Ser Public Policy 40:59–125

Human Mortality Database (2009) University of California, Berkeley (USA) and Max Planck Institute for Demographic Research (Germany). Available at www.mortality.org.

Hurd MD (1987) Savings of the elderly and desired bequests. Am Econ Rev 77(3):298–312

Hurd MD (1989) Mortality risks and bequests. Econometrica 57(4):779–813

Hurd MD, Smith JP, Zissimopoulos J (2004) The effects of subjective survival on retirement and social security claiming. J Appl Econ 19(6):761–775

Ibbotson Associates (2002) Stocks, bonds, bills, and inflation yearbook. Ibbotson Associates, Chicago

Johansson PO (2002) On the definition and age-dependency of the value of a statistical life. J Risk Uncertain 25(3):251–263

Jones CI, Klenow PJ (2010) Beyond GDP? Welfare across countries and time. NBER Work Pap 16352

Judge K, Mulligan J, Benzeval M (1998) Income inequality and population health. Soc Sci Med 46(4–5):567–579

Kalemli-Ozcan S, Weil DN (2010) Mortality change, the uncertainty effect, and retirement. J Econ Growth 15(1):65–91

Kalemli-Ozcan S, Ryder HE, Weil DN (2000) Mortality decline, human capital investment, and economic growth. J Dev Econ 62(1):1–23

Kelley AS (2011) Treatment intensity at end of life—time to act on the evidence. Lancet 378(9800):1364–1365

Kitagawa EM, Hauser PM (1973) Differential mortality in the united states: a study in socioeconomic epidemiology. Harvard University Press, Cambridge

Kopczuk W, Lupton JP (2007) To leave or not to leave: the distribution of bequest motives. Rev Econ Stud 74(1):207–235

Kreps DM, Porteus EL (1978) Temporal resolution of uncertainty and dynamic choice theory. Econometrica 46(1):185–200

Kwok AC, Semel ME, Lipsitz SR, Bader AM, Barnato AE, Gawande AA, Jha AK (2011) The intensity and variation of surgical care at the end of life: a retrospective cohort study. Lancet 378(9800):1408–1413

Lee RD (2003) The demographic transition: three centuries of fundamental change. J Econ Perspect 17(4):167–190

Lee RD, Carter LR (1992) Modeling and forecasting U.S. mortality. J Am Stat Assoc 87(419):659–671

Li Q, Tuljapurkar S (2004) Life, death, and the economy: mortality change in overlapping-generations models. Michigan Retirement Research Center Working Paper WP 2004-072

Lichtenberg FR (2007) The impact of new drugs on us longevity and medical expenditure, 1990–2003: evidence from longitudinal, disease-level data. Am Econ Rev 97(2):438–443

Lopez AD, Ahmad OB, Guillot M, Inoue M, Ferguson BD, Salomon JA, Murray CJ, Hill KH (2002) World mortality in 2000: life tables for 191 countries. World Health Organization, Geneva

Lucas RE (1987) Models of business cycles. Blackwell, New York

Maas A, Wakker PP (1994) Additive conjoint measurement for multiattribute utility. J Math Psychol 38(1):86–101

Maddison A (2003) The world economy: historical statistics. OECD Development Cenre, Paris

McNeil BJ, Weichselbaum R, Pauker SG (1978) Fallacy of the five-year survival in lung cancer. N Engl J Med 299(25):1397–1401

Meara ER, Richards S, Cutler DM (2008) The gap gets bigger: changes in mortality and life expectancy, by education, 1981–2000. Health Aff 27(2):350–360

Miyamoto JM, Eraker SA (1985) Parameter estimates for a QALY utility model. Med Decis Mak 5(2):191–213

Moser K, Shkolnikov V, Leon DA (2005) World mortality 1950–2000: divergence replaces convergence from the late 1980s. Bull W H O 83(3):202–209

Murphy KM, Topel RH (2006) The value of health and longevity. J Polit Econ 114(5):871–904

Nordhaus WD (2003) The health of nations: the contribution of improved health to living standards. In: Murphy KM, Topel RH (eds) Measuring the gains from medical research: an economic approach. University of Chicago Press, Chicago

Oeppen J, Vaupel JW (2002) Broken limits to life expectancy. Science 296:1029–1031

Picone G, Sloan F, Taylor Jr D (2004) Effects of risk and time preference and expected longevity on demand for medical tests. J Risk Uncertain 28(1):39–53

Pliskin JS, Shepard DS, Weinstein MC (1980) Utility functions for life years and health status. Oper Res 28(1):206–224

Ried W (1998) QALYs versus HYEs—what’s right and what’s wrong. a review of the controversy. J Health Econ 17(5):607–625

Rogers AR (1994) Evolution of time preference by natural selection. Am Econ Rev 84(3):460–481

Rosen S (1988) The value of changes in life expectancy. J Risk Uncertain 1(3):285–304

Satchell S, Thorp S (2011) Uncertain survival and time discounting: intertemporal consumption plans for family trusts. J Popul Econ 24(1):239–266

Shkolnikov VM, Andreev EE, Begun AZ (2003) Gini coefficient as a life table function: computation from discrete data, decomposition of differences and empirical examples. Demogr Res 8(11):305–358

Slemrod J (2003) Thanatology and economics: the behavioral economics of death. Am Econ Rev 93(2):371–375

Smits J, Monden C (2009) Length of life inequality around the globe. Soc Sci Med 68(6):1114–1123. doi:10.1016/j.socscimed.2008.12.034

Stiggelbout AM, Kiebert GM, Kievit J, Leer JWH, Stoter G, de Haes JCJM (1994) Utility assessment in cancer patients: adjustment of time tradeoff scores for the utility of life years and comparison with standard gamble scores. Med Decis Mak 14(1):82–87

Strotz RH (1956) Myopia and inconsistency in dynamic utility maximization. Rev Econ Stud 23(3):165–180

Tolley GS, Kenkel DS, Fabian RG (eds) (1994) Valuing health for policy: an economic approach. University of Chicago Press, Chicago

Verhoef LCG, Haan AFJD, van Daal WAJ (1994) Risk attitude in gambles with years of life: empirical support for prospect theory. Med Decis Mak 14(2):194–200

Viscusi WK (1993) The value of risks to life and health. J Econ Lit 31(4):1912–1946

Viscusi WK, Aldy JE (2003) The value of a statistical life: a critical review of market estimates throughout the world. J Risk Uncertain 27(1):5–76

White KM (2002) Longevity advances in high-income countries. Popul Dev Rev 28(1):59–76

Wilmoth JR (2003) Human longevity in historical perspective. In: Timiras PS (ed) Physiological basis of aging and geriatrics. CRC, New York, pp 11–24

Wilmoth JR, Horiuchi S (1999) Rectangularization revisited: variability of age at death within human populations. Demography 36(4):475–495

Wilson C (2001) On the scale of global demographic convergence 1950–2000. Popul Dev Rev 27(1):155–171

Yaari ME (1965) Uncertain lifetime, life insurance, and the theory of the consumer. Rev Econ Stud 32(2):137–150

Acknowledgements

I thank Deborah Balk, Neil Bennett, David Canning, Victor Fuchs, Ronald Lee, Shripad Tuljapurkar, David Weil, seminar participants at Queens College, CUNY, and at the Harvard Initiative for Global Health, and several anonymous referees for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Junsen Zhang

This research was partially supported by NICHD grant T32 HD 07329.

Rights and permissions

About this article

Cite this article

Edwards, R.D. The cost of uncertain life span. J Popul Econ 26, 1485–1522 (2013). https://doi.org/10.1007/s00148-012-0405-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-012-0405-0