Abstract

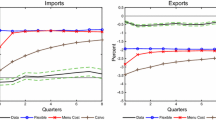

This article proposes an extension of Dixit (Q J Econ 104(2):205–228, 1989a, J Polit Econ 97(3):620–638, 1989b) assuming that potential exporting firms benefit from the experience of nearby firms already settled in the foreign market, which allows the sunk entry costs to diminish. The numerical results show that hysteresis (an effect that persists after the cause that brought it about has been removed) is lower than in Dixit’s case. More interestingly, hysteresis is not monotonically increasing with the number of firms. Moreover, decreasing sunk entry costs have a stronger impact on entering than exiting a foreign market. Regarding the market share, exchange rate depreciations hide the positive effect of decreasing sunk entry costs. In contrast, this positive effect dampens the negative effect of exchange rate appreciations.

Similar content being viewed by others

Notes

Alternatively, I could use the model of Belke and Göcke (1999, 2001, 2005) for one-time versus permanent uncertainty with only two states: good and bad. These authors base their contribution on a comparative-static and linearized model which permits a much more straightforward economic interpretation of the results and makes deriving policy conclusions much easier. However, Dixit’s model has the advantage that it allows for a more dynamic approach to considering sequential entry-exit decisions of firms.

A good explanation of hysteresis in exports can be found in Belke et al. (2013).

I have also considered the case of decreasing lineal sunk entry costs, \( K^{\prime \prime }\left ( n\right ) =0\) and concave sunk entry costs, \( K^{\prime \prime }\left ( n\right ) <0\) . In general, similar results were found and are available upon request.

In the cases of decreasing lineal sunk entry costs, \(K^{\prime \prime }\left ( n\right ) =0\) and concave sunk entry costs, \(K^{\prime \prime }\left ( n\right ) <0\), hysteresis is monotonically decreasing across firms. Results are available upon request.

References

Aitken B, Hanson GH, Harrison AE (1997) Spillovers, foreign investment, and export behavior. J Int Econ 43(1-2):103–132

Becchetti L, Rossi S (2000) The positive effect of industrial district on the export performance of Italian firms. Rev Ind Organ 16(1):53–68

Belke A, Göcke M (1999) A simple model of hysteresis in employment under exchange rate uncertainty. Scottish J Polit Econ 46(3):260–286

Belke A, Göcke M (2001) Exchange rate uncertainty and employment: an algorithm describing ‘play’. Appl Stoch Model Bus Ind 17(2):181–204

Belke A, Göcke M (2005) Real option effects on employment: does exchange rate uncertainty matter for aggregation. Ger Econ Rev 6(2):185–203

Belke A, Göcke M, Günter M (2013) Exchange rate bands of inaction and play-hysteresis in german exports - sectoral evidence for some OECD destinations. Metroeconomica 64(1):152–179

Belke A, Göcke M, Hebler M (2005) Institutional uncertainty and European social union: impacts on job creation and destruction in the CEECs. J Policy Model 27(3):345–354

Benkler Y (2006) The wealth of networks: how social production transforms markets. Yale University Press, New Haven

Bernard A, Jensen JB (2004) Why some firms export. Rev Econ Stat 86(2):561–569

Castillo J, Requena F (2007) Information spillovers and the choice of export destination: a multinomial logit analysis of Spanish young SMEs. Small Bus Econ 28(1):69–86

Clerides SK, Lach S, Tybout JR (1998) Is learning by exporting important? Micro-dynamic evidence from Colombia, Mexico and Morocco. Q J Econ 113(3):903–947

Desmet K, Fafchamps M (2005) Changes in the spatial concentration of employment across US counties: a sectoral analysis 1972-2000. J Econ Geogr 5(3):261–84

Dixit A (1989a) Hysteresis, import penetration, and exchange rate pass-through. Q J Econ 104(2):205–228

Dixit A (1989b) Entry and exit decisions under uncertainty. J Polit Econ 97(3):620–638

Esteves PS, Rua A (2013) Is there a role for domestic demand pressure on export performance? Banco de portugal working papers 03/2013

Head K, Ries J, Swenson D (1995) Agglomeration benefits and location choice: evidence from Japanese manufacturing investments in the United States. J Int Econ 38(3-4):223–247

Koenig P (2009) Agglomeration and the export decisions of French firms. J Urban Econ 66(3):186–195

Koenig P, Mayneris F, Poncet S (2010) Local export spillovers in France. Eur Econ Rev 54(4):622–641

Author information

Authors and Affiliations

Corresponding author

Additional information

Acknowledgments

The author gratefully acknowledges financial support from the Spanish Ministry of Education and Science through Project MICINN-ECO2011-25737 and anonymous referees for comments..

Rights and permissions

About this article

Cite this article

Aray, H. Hysteresis and import penetration with decreasing sunk entry costs. Int Econ Econ Policy 12, 175–188 (2015). https://doi.org/10.1007/s10368-014-0269-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10368-014-0269-8