Abstract

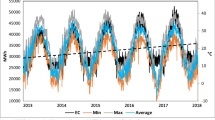

Forecasting is a very important and difficult task for various economic activities. Despite the great evolution of time series modeling, forecasters are still in the hunt for better strategies to improve mathematical models and come up with more accurate predictions. In this respect, several new models, mixing autoregressive processes to artificial neural networks (ANNs), have recently emerged. This is particularly the case for energy economics, where old forecasting tools are replaced by new hybrid strategies. Along the same lines, this paper aims to define a wavelet-based hybridization, involving nonlinear smooth functions, autoregressive fractionally integrated moving average (ARFIMA) model and feedforward ANNs, for electricity spot prices forecasting. The use of the wavelet decomposition in this model allows to characterize certain patterns of power time series, such as the nonlinear trend and multiple seasonal effects, and to exactly extrapolate them over the time scale. In fact, such patterns have already been pointed out as potential causes of the ANN’s inaccuracy. An ARFIMA–ANN model is then used to forecast the resulting irregular component. In the last stage, the smooth and irregular components are recombined to constitute the forecasted price. We will demonstrate the cost-effectiveness of the proposed method using hourly power prices from the Nord Pool Exchange. The testing time series consists of 52,614 observations and corresponds to the period ranging from 2012 to 2017. The results show that the new method is able to provide better interval forecasting than four benchmark models.

Similar content being viewed by others

Notes

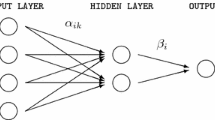

An activation function is deterministic and symmetrically nonlinear. The range of the output values of a feedforward model is controlled by N(.). If the output value is not restricted to particular intervals, such as binary or discrete results, then it can simply be set to an identity function.

Denmark, Norway, Sweden and Finland.

References

Aladag CH, Egrioglu E, Kadilar C (2012) Improvement in forecasting accuracy using the hybrid model of ARFIMA and feed forward neural network. Am J Intell Syst 2(2):12–17

Ben Amor S, Boubaker H, Belkacem L (2018) Forecasting electricity spot price for Nord Pool market with a hybrid \(k\)-factor GARMA–LLWNN model. J Forecast 37(8):832–851

Ben Mabrouk A, Ben Abdallah N, Dhifaoui Z (2008) Wavelet decomposition and autoregressive model for time series prediction. Appl Math Comput 199(1):334–340

Chaâbane N (2014) A hybrid ARFIMA and neural network model for electricity price prediction. Int J Electr Power Energy Syst 55:187–194

Chaâbane N, Saâdaoui F, Benammou S (2012) Modelling power spot prices in deregulated European energy markets: a dual long memory approach. Glob Bus Econ Rev 14(4):338–361

Chen K, Wang C (2007) A hybrid SARIMA and support vector machines in forecasting the production values of the machinery industry in Taiwan. Expert Syst Appl 32(1):254–264

Diongue AK, Guégan D, Vignal B (2009) Forecasting electricity spot market prices with a k-factor GIGARCH process. Appl Energy 86(4):505–510

Dragomiretskiy K, Zosso D (2014) Variational mode decomposition. IEEE Trans Signal Process 62(3):531–544

Fard AK, Akbari-Zadeh MR (2014) A hybrid method based on wavelet, ANN and ARIMA model for short-term load forecasting. J Exp Theor Artif Intell 26(2):167–182

Flandrin P (2004) Empirical mode decompositions as data-driven wavelet-like expansions. Int J Wavelets Multiresolut Inf Process 02(04):477–496

Funahashi K (1989) On the approximate realization of continuous mappings by neural networks. Neural Netw 2(3):183–192

Grané A, Veiga H (2010) Wavelet-based detection of outliers in financial time series. Comput Stat Data Anal 54(11):2580–2593

Granger CWJ, Joyeux R (1980) An introduction to long memory time series models and fractional differencing. J Time Ser Anal 1(1):15–39

Hamrita MS, Ben Abdallah N, Ben Mabrouk A (2011) A wavelet method coupled with quasi-self-similar stochastic processes for time series approximation. Int J Wavelets Multiresolut Inf Process 9(5):685–711

Hornik K (1991) Approximation capabilities of multilayer feedforward networks. Neural Netw 4(2):251–257

Huang NE, Shen Z, Long SR, Wu MC, Shin Q, Zheng HH, Yen NC, Tung CC, Liu HH (1998) The empirical mode decomposition and the Hilbert spectrum for nonlinear and non-stationary time series analysis. Proc Math Phys Eng Sci 454(1971):903–995

Ismail MT, Audu B, Tumala MM (2016) Comparison of forecasting performance between MODWT-GARCH(1, 1) and MODWT-EGARCH(1, 1) models: evidence from African stock markets. J Finance Data Sci 2(4):254–264

Karthikeyan L, Nagesh Kumar D (2013) Predictability of nonstationary time series using wavelet and EMD based ARMA models. J Hydrol 502:103–119

Lütkepohl H, Krätzig M (2004) Applied time series econometrics. Cambridge University Press, Cambridge

Mallat S (1999) A wavelet tour of signal processing. Academic Press, New York

Nelson M, Hill T, Remus T, O’Connor M (1999) Time series forecasting using NNs: Should the data be deseasonalized first? J Forecast 18(5):359–367

Nowotarski J, Weron R (2018) Recent advances in electricity price forecasting: a review of probabilistic forecasting. Renew Sustain Energy Rev 81(1):1548–1568

Pai FP, Lin CS (2005) A hybrid ARIMA and support vector machines model in stock price forecasting. Omega 33(6):497–505

Papaioannou GP, Dikaiakos C, Evangelidis GI, Papaioannou P, Georgiadis D (2015) Co-movement analysis of Italian and Greek electricity market wholesale prices by using a wavelet approach. Energies 8(10):11770–11799

Percival DB, Walden AT (2000) Wavelet methods for time series analysis. Cambridge University Press, Cambridge

Raviv E, Bouwman KE, van Dijk D (2015) Forecasting day-ahead electricity prices: utilizing hourly prices. Energy Econ 50:227–239

Saâdaoui F (2010) Acceleration of the EM algorithm via extrapolation methods: review, comparison and new methods. Comput Stat Data Anal 54(3):750–766

Saâdaoui F (2013) The price and trading volume dynamics relationship in the EEX power market: a wavelet modeling. Comput Econ 42(1):47–69

Saâdaoui F (2017) A seasonal feedforward neural network to forecast the Nord Pool electricity prices. Neural Comput Appl 28(4):835–847

Saâdaoui F, Mrad M (2017) Stochastic modelling of the price–volume relationship in electricity markets: evidence from the Nordic energy exchange. Int Trans Electr Energy Syst 27(9):e2362

Saâdaoui F, Rabbouch H (2014) A wavelet-based multiscale vector-ANN model to predict comovement of econophysical systems. Expert Syst Appl 41(13):6017–6028

Saâdaoui F, Naifar N, Aldohaiman MS (2017) Predictability and co-movement relationships between conventional and Islamic stock market indexes: a multiscale exploration using wavelets. Phys A Stat Mech Appl 482:552–568

Sato JR, Morettin PA, Arantes PR, Amaro E Jr (2007) Wavelet based time-varying vector autoregressive modelling. Comput Stat Data Anal 51(12):5847–5866

Soares LJ, Medeiros MC (2008) Modeling and forecasting short-term electricity load: a comparison of methods with an application to Brazilian data. Int J Forecast 24:630–44

Wardana ANI (2016) A comparative study of EMD, EWT and VMD for detecting the oscillation in control loop. In: International seminar on application for technology of information and communication (ISemantic), pp 58–63

Weron R (2006) Modeling and forecasting electricity loads and prices: a statistical approach. Wiley, Chichester

Weron R (2014) Electricity price forecasting: a review of the state-of-the-art with a look into the future. Int J Forecast 30(4):1030–1081

Yang L, Tschernig R (2002) Non- and semiparametric identification of seasonal nonlinear autoregression models. Econ Theory 18(6):1408–1448

Zhang GP (2003) Time series forecasting using a hybrid ARIMA and neural network model. Neurocomputing 50:159–175

Zhang GP, Qi M (2005) Neural network forecasting for seasonal and trend time series. Eur J Oper Res 160(2):501–514

Zhu L, Wang Y, Fan Q (2014) MODWT-ARMA model for time series prediction. Appl Math Modell 38(5–6):1859–1865

Acknowledgements

We would like to thank the anonymous reviewers, for their insightful and constructive comments that have greatly contributed to improving the paper, and to the editorial staff for their generous support and assistance during the review process.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

We declare that we are not and shall not be in any situation which could give rise to a conflict of interest in what concerns the publication of this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Saâdaoui, F., Rabbouch, H. A wavelet-based hybrid neural network for short-term electricity prices forecasting. Artif Intell Rev 52, 649–669 (2019). https://doi.org/10.1007/s10462-019-09702-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10462-019-09702-x