Abstract

For over four decades, the topic of Chief Executive Officer (CEO) compensation has attracted considerable attention from the fields of economics, finance, management, public policy, law, and business ethics. As scholarly interest in CEO pay has increased, so has public concern about the ethics of high CEO pay. Despite growing interest and pressure among the public and government to reduce CEO pay, it has continued to increase. Using a multi-method design incorporating a pilot study, two online experiments, and an event study, we investigate the impact of CEO pay on consumer purchase intent and find that this negative relationship is magnified under conditions of brand crisis. We also find that the negative interaction of high CEO pay and brand crisis on purchase intent is more negative when the brand has strong equity. Finally, when the CEO is awarded high pay while the firm they manage is undergoing a brand crisis, consumers lose trust in the firm’s brand which reduces consumer purchase intent. This research provides insight on how governance decisions can impact consumer perceptions of corporate brands and consumer behavior, with implications for public policy leaders, boards of directors, CEOs, and Chief Marketing Officers regarding how to manage and message CEO pay.

Similar content being viewed by others

CEO pay is a popular topic that has received significant attention from the public, shareholders, and policy makers. As a subject of study, CEO compensation claims multiple academic homes, with economists and finance scholars having begun investigation over four decades ago (e.g., Cosh, 1975; Fama & Jensen, 1983). Since then, as the level of CEO pay has increased, the topic has garnered additional attention from scholars in a variety of domains such as management (e.g., Miller et al., 2002), law (e.g., Bebchuk & Fried, 2005), and business ethics (Conyon & He, 2016; Francoeur et al., 2017; Qu et al., 2020).

As scholarly interest in CEO pay has grown, so has public concern regarding the ethics of the (high) amount of money paid to CEOs (e.g., Harris, 2009; Sandberg & Andersson, 2020). Public outrage over the gap between CEO and average employee pay, increasing from 20:1 in 1965 to 350:1 in 2020, has led to worker protests, demonstrations, and demands for minimum wage hikes (e.g., Cox, 2019; Kiatpongsan & Norton, 2014; Mishel & Kandra, 2021; Morgenson, 2021). The U.S. government has taken steps to address this public concern by first passing the Dodd-Frank Act (intended to improve accountability and transparency in the financial system) and more recently proposing disclosure rules on CEO pay (e.g., Hoffman, 2015). Since 2018, new rules require all public companies to annually disclose the total compensation of the CEO, the median of the total compensation of all employees other than the CEO, and the ratio of these two numbers (Securities & Exchange Commission, 2015).

Efforts by the government, shareholders, media, and the public to reign in pay have had little consequence, as CEO compensation continues to increase (e.g., Morgenson, 2021). According to the market-based view, those responsible for determining CEO pay, boards of directors (BODs),Footnote 1 may view high CEO compensation as necessary to ensure competitive pay with peer-level CEOs (Sandberg & Andersson, 2020). However, this view fails to consider how CEO pay decisions may potentially impact firm performance (Balafas & Florackis, 2014) through consumer perceptions of—and commensurate behavior toward—the firm’s brand.

Despite decades of research regarding CEO pay, examination of how it may impact the key stakeholder that largely determines revenue performance—consumers—is relatively nascent. Yet, with 24/7 news cycles, and growing interest in conscious capitalism, many of today’s more involved, concerned, and connected consumers are aware of and care about CEO pay, particularly when they perceive that it is unfair relative to average employee pay (see Benedetti & Chen, 2018; Mohan et al., 2015, 2018). What has yet to be understood, however, is how CEO pay can impact consumer behavior beyond perceptions of pay fairness. We specifically investigate how CEO pay affects trust in the company’s brand, thereby impacting consumer purchase intent. This line of investigation more directly links a corporate governance decision (i.e., CEO pay) with brand- and firm-impacting consequences. In addition, we contend that the negative impact of high CEO pay on brand trust will be especially salient when a firm is involved in a brand crisis—when company actions violate normative rules that consumers expect of firms (Aaker et al., 2004). Consequently, this research investigates: (1) how CEO pay, as the most visible and widely communicated aspect of corporate governance, influences consumer trust in a firm’s brand, ultimately impacting consumer purchase intent, and (2) how these relationships can be impacted by brand behavior (i.e., crises) and brand strength (i.e., equity).

To address these questions, we employ a multi-method research design. First, we conduct a pilot study to test the assumption that consumers are aware of CEO pay and show interest in it. Then, we conduct an online experiment to examine the negative effect of CEO pay on consumer purchase intent. Drawing on signaling theory (e.g., Connelly et al., 2011; Rao et al., 1999), we demonstrate that the CEO pay–consumer purchase intent relationship is more negative when the firm’s brand is undergoing a crisis (i.e., reinforcing mismanagement of the brand), and further show that this interaction is mediated by erosion of brand trust. A follow-up online experiment shows that the negative link between high CEO pay, brand crisis, and consumer purchase intent is more negative for high-equity brands. Finally, using investors’ reaction as an ex-ante indicator of the reaction of consumers, we conduct an event study of new product introduction announcements across a diverse set of industries as a secondary validation of our central thesis.

Conceptual Development and Hypotheses

CEO Pay and Shareholders

Much of the research on executive pay has focused on the tenuous link between pay and firm performance (e.g., Tosi, 2005; Tosi et al., 2000). Agency theory, which has largely informed this research, suggests that the self-interests of CEOs are at odds with those of shareholders, and as such, CEO pay is a key mechanism by which these disparate interests are brought into alignment (Jensen & Meckling, 1976). To reduce the likelihood of agency issues, the BOD is empowered to determine annual compensation plans designed to align shareholder interests with managerial interests. Since CEO pay is a mechanism used to align CEOs’ and shareholders’ interests, researchers have treated shareholders as the primary stakeholder affected by CEO pay (e.g., Wade et al., 2006).

Historically, research has supported the thesis that shareholder approval of CEO pay occurs when pay is tied to firm outcomes, that is when the CEO’s pay level matches firm performance (e.g., Brickley et al., 1985; Certo et al., 2003). However, investors face information asymmetries with regard to firm management and performance (e.g., Barkema & Gomez-Mejia, 1998; Sanders & Carpenter, 1998). Signaling theory, rooted in economics, suggests that when the information possessed by one party is materially less than that of another party, the party with less knowledge will use signals to infer information and reduce the asymmetry (e.g., Rao et al., 1999; Spence, 1973). Drawing on signaling theory (Rao et al., 1999), CEO pay provides relevant information about the governance and management of a firm and can therefore serve as a signal to shareholders. For example, high CEO pay can signal information about the capability of the CEO or about expectations of future performance; in both cases, it would suggest that high CEO pay would then benefit the shareholders (e.g., Certo et al., 2003). Supporting this view, the market economy principle suggests that compensation is related to the level of expertise and responsibility associated with a particular job; thus, higher CEO pay signals a more complicated job worthy of higher pay (Harris, 2009).

However, some scholars contend that CEO pay is insufficiently tied to firm performance and, subsequently, is unrelated to CEO effort or capability (Conyon, 2014; Walsh, 2008). Further, recent research has found that there are conditions under which investors care more (less) about CEO pay. Krause et al. (2014), for example, found that CEO pay only impacts investor behavior when CEOs receive high pay in the context of weak firm performance, which serves to carry information about the lack of appropriate governance and oversight of the firm. In combination, scholars have demonstrated that CEO pay can serve as an important signal about the management of a company to investors.

CEO Pay as a Consumer Concern

Just as knowledge of CEO pay can impact investors, such information regarding CEOs should also influence consumers. Although most of the research on CEO pay has been in the context of investors, there have been a few recent forays into the impact of CEO pay on consumers. Benedetti and Chen (2018) found that both consumers and employees perceive companies with higher ratios (between CEO and worker pay) more negatively. Consumers are less likely to purchase their products from—and employees show less interest in working for—such companies. Mohan et al. (2015) found that high ratios of CEO pay to average employee pay hurt consumer perception across various products with different price points. Further, Mohan et al. (2018) suggested that consumers are willing to pay more when they are unaware of the company ratio or are aware that a company has a low CEO pay-to-worker ratio. The mediating mechanism that explained these relationships was consumer perceptions of wage fairness. Consumers found high ratios of CEO pay to average employee pay generally unfair, causing a shift in consumer behavior. See Table 1 for a summary of representative CEO pay literature.

Although the limited research to date has demonstrated a negative impact of CEO pay on consumer purchase intent, it has primarily done so by investigating CEO pay in the context of fairness relative to average employee pay. We posit a novel mechanism through which high CEO pay can impact consumer behavior—by directly eroding trust in the firm’s brand. CEO compensation reflects the governance and leadership practices of a firm. As the humanized representative of a firm’s brand (e.g., Fleck et al., 2013), attributes and characteristics associated with CEOs, such as their pay, can therefore carry information about how a firm is being governed. Because of information asymmetry, consumers rely on such signals to understand the important and relevant aspects of the firm to determine whether they can trust a company (e.g., Boulding & Kirmani, 1993). Brand trust is the willingness of a consumer to depend on a brand’s promise, with expectations that the brand will act with appropriate integrity, benevolence, and ability to satisfy consumer needs (e.g., Chaudhuri & Holbrook, 2001; Delgado-Ballester & Munuera-Aleman, 2005).

CEO pay offers an opportunity for consumers to assess whether they can trust that a company is operating in the best interests of consumers as it represents a highly visible choice of how firm leaders choose to use valuable resources. For consumers to trust a brand, they must believe that the firm places consumers’ interests at par with—if not ahead of—executives’ interests (e.g., Erdem & Swait, 2004; Schlosser et al., 2006). Consumers should be more likely to purchase from firms that invest resources in strategies and activities that produce consumer-creating value versus behaving in an opportunistic manner that benefits CEOs (e.g., Sichtmann, 2007). A decision to provide high compensation to a CEO may mean that firm resources are not being used elsewhere in the firm, such as toward reducing the price or improving the quality of products and services. High CEO pay, therefore, can signal a diversion of firm resources away from benevolent, consumer value-creating efforts toward self-serving efforts, ultimately eroding consumer trust in the brand and negatively impacting their desire to maintain a relationship with the firm.

While it is possible that high CEO pay could signal that the firm has employed a more talented CEO and that such investment will indirectly create consumer value through better product and brand decisions, we do not believe this will dominate for three reasons. First, it is plausible that consumers may perceive that a firm that has sufficient money to pay a high CEO wage may also have the funds to devote to increased product quality, therefore connecting high CEO pay with consumer-benefiting value creation. Contrary to this belief, however, Mohan et al. (2015) found that the negative effect of high CEO pay (relative to average employee pay) on consumer intention to buy holds for a wide variety of products—regardless of product quality—and even for products whose quality is outside of that retailer’s purview, such as a gift certificate to a different retailer.

Second, it is likely that consumers will make the simplest and most direct assessment, that high CEO pay is a zero-sum game in which the resources could have been deployed into efforts that directly benefit consumers, such as lower prices, better products, and so forth. Indeed, this is a common way that the media frames the downside of high CEO pay. For example, a recent CNN headline indicated: “Prices are Going Up and CEOs are Making Out Like Bandits”—connecting high consumer prices with high CEO pay (Morrow, 2022).

Finally, if consumers perceived a personal benefit to high CEO pay, we would expect to see some evidence in the existing CEO literature. However, Benedetti and Chen (2018) find that the higher the CEO pay relative to average employee pay, the lower the consumer purchase intent. If consumers predominantly viewed high CEO pay as beneficial to consumers, then the lack of fairness in high CEO pay (relative to employee pay) should have created cognitive conflict as consumers grappled with the employee unfairness but saw personal benefits through enhanced products and services. This did not occur and so for the three reasons mentioned, we believe that consumers will be more likely to believe that high CEO pay will signal that the firm cannot be trusted to operate in the best interests of consumers and the result will be a negative impact on consumer purchase intent.

H1

CEO pay has a negative effect on consumer purchase intent.

Brand Crisis as a Catalyst

Thus far, we have argued that high CEO pay signals to consumers that those governing the firm support a decision to divert resources toward executive compensation and away from value creating endeavors that would more directly benefit consumers, negatively impacting purchase intent. Extending this line of thinking, we further suggest that the negative relationship between CEO pay and consumers’ purchase intent will be amplified when a CEO leads a firm during a brand crisis, i.e., an event that violates the performance- and evaluation-based rules that consumers expect of firms (e.g., Aaker et al., 2004; Dutta & Pullig, 2011). Brand crises weaken consumer perception of a brand’s ability to deliver on expectations, therefore jeopardizing the brand’s reputation (e.g., Dawar & Lei, 2009; Pullig et al., 2006). Further, brand crises reduce consumers’ belief that brands can either deliver functional benefits (i.e., performance-related crises) or behave in concert with expected social or ethical norms (i.e., values-related crises) (Dutta & Pullig, 2011).

High CEO pay becomes even more salient for consumers when it is connected to information that signals that the company is being mismanaged in a context meaningful to consumers, such as when there is a performance- or values-based brand crisis. In such cases, there is incongruence between the CEO’s leadership of the firm (which is poor) and the amount of reward he/she receives (which is high). This phenomenon is consistent with the desert-based view of compensation which suggests that people should be paid in proportion to what is owed and deserved. Inspired by Kantian or deontological ethics (Olsaretti, 2004), this principle of compensation is backward-looking as it is meant to reward past/actual effort rather than future/expected effort (Sandberg & Andersson, 2020).

A CEO receiving high pay at the same time his/her firm experiences a brand crisis (i.e., poor performance) amplifies the message that the firm is behaving in a CEO-serving, rather than consumer-serving, manner, reducing consumer trust and decreasing consumers’ propensity to buy from the firm. As an example, consider the following headline: “While BP Stalled on Gulf Oil Spill Payments, CEO’s Pay Tripled Last Year” (Leber, 2014). The headline highlights the incongruence of a CEO receiving high pay during a brand crisis, which can signal poor leadership and in combination infers a governance problem with the firm behaving in a self-serving manner.

H2

The negative CEO pay–consumer purchase intent relationship is more negative under conditions of brand crisis.

Piecing it Together: Violation of Brand Trust

Managerial research suggests that today’s consumers care about the behavior of firms and their leaders (Komiya, 2020). For example, Edelman’s Trust Barometer (2021) indicates that firm and CEO actions can influence consumer trust in companies and that “CEOs should hold themselves accountable to the public and not just the board of directors” (Edelman, 2021, p. 34). Consumers believe that the CEO’s most important job is “to build trust,” ranking this attribute higher than any of the following three attributes: “producing high quality products and services,” “[producing] business decisions [that] reflect company values,” or “increasing profits and stock price” (Edelman, 2018). Most (63%) consumers believe trust is paramount in a consumer-brand relationship (Edelman, 2018, p. 2): “…unless I come to trust the company behind the product, I will soon stop buying it…”.

Surprisingly, “there has been little empirical research into it (brand trust)” (Delgado-Ballester & Munuera-Aleman, 2005, p. 187) and “what builds trust remains largely unanswered” (Kang & Hustvedt, 2014, p. 253). What has been investigated suggests that firm behaviors such as compliance with regulations (Nienaber et al., 2014), delivering on new product launch commitments (Herm, 2013), and efforts to be transparent and socially responsible (Kang & Hustvedt, 2014) directly impact consumer perceptions of brand trust.

However, consumers face information asymmetry, just as investors do, and so assessing whether a firm is trustworthy is a challenge. Consequently, consumers rely on certain cues to determine whether a corporate brand is trustworthy (Conyon, 2014). Krause et al. (2016) suggest that consumers use information regarding CEOs to assess the legitimacy of a firm. We extend this view and suggest that CEO pay can serve as a signal that carries information about a firm’s brand. For consumers to trust a brand, they must have confidence that the firm is benevolent and not purely egocentrically profit motivated (e.g., Erdem & Swait, 2004; Mayer et al., 1995; Schlosser et al., 2006).

An incongruence between the CEO’s management of the firm (e.g., a brand crisis) and his/her pay (e.g., high CEO pay) can create a perception that a firm is violating expected standards of behavior by signaling the prioritization of executives’ interests over consumers. This perception, in turn, is likely to decrease consumers’ trust in the firm and reduce their purchase intention (Ellen et al., 2006). In line with this expectation, the International Corporate Governance Network (ICGN), a large investor-led governance organization, published a note in April 2020 about CEO compensation in a COVID-19 world. The note suggested that maintaining or increasing executive pay during the COVID-19 global pandemic—a time when companies are forced to lay off employees to cut costs—could threaten consumers’ trust in the company as well as the company’s social license to operate (Konigsburg & Finzi, 2020).Footnote 2

The two dimensions of trust, reliability (i.e., the competence of a brand to satisfy consumer needs now and in the future) and intention (i.e., the perception that a brand has positive intentions toward consumer welfare), provide insight on how CEO pay and brand crisis can interact to negatively impact trust (e.g., Chaudhuri & Holbrook, 2001; Delgado-Ballester & Munuera-Aleman, 2005). High CEO pay impacts the intention dimension as, mentioned earlier, it can lead to consumer perception that a company is using resources in a self-serving, rather than benevolent and consumer-welfare enhancing, manner. Brand crisis impacts the reliability dimension as it signals an inability of a firm to competently meet consumer needs. In combination, high CEO pay and brand crisis interact to weaken consumers’ ability to have confidence (i.e., trust) that a firm wants to and can behave in a consumer-centric manner, which then negatively impacts their likelihood to engage in commerce with the firm.

We therefore argue that the interaction of high CEO pay and brand crisis will negatively impact consumer trust in the brand. Drawing upon research demonstrating the positive (negative) impact of trust (distrust) on consumers’ intent to purchase (Chaudhuri & Holbrook, 2001), we further posit that lower brand trust, in turn, will negatively impact consumers’ purchase intent.

H3

The negative interaction of CEO pay and brand crisis on purchase intent is mediated through brand trust.

Brand Equity: A Double-edged Sword?

While we argue that CEO pay interacts with brand crises to have a negative impact on consumer purchase intent, we don’t believe that the effect will be the same across all brands. Some brands develop stronger equities—or consumer-based associations that enable brands to achieve superior results relative to the same product without the brand name—over time than do other brands (e.g., Aaker, 1991; Keller, 1993). When a CEO receives high pay under conditions of brand crisis, it is unclear whether a stronger brand equity will mitigate or exacerbate the negative impact of brand on the CEO pay–consumer purchase behavior relationship. Below we provide arguments for both possibilities.

Research has shown that consumers interpret firm actions based on prior expectations of firm behavior (e.g., Dawar & Pillutla, 2000). As such, consumers should have higher expectations about firm behavior from firm brands that have achieved higher levels of brand equity (henceforth referred to as strong brands) versus lower levels of brand equity (henceforth referred to as weak brands). When brands have accrued stronger equity, it means that through experience, consumers have developed positive associations and higher levels of brand trust that set up high(er) expectations of future behavior (e.g., Dawar & Pillutla, 2000; Delgado-Ballester & Munuera-Aleman, 2005; Keller, 1993). This high(er) expectation of future behavior that results from strong equity can turn into a liability. Rhee and Haunschild (2006) found that highly reputed firms suffer a greater market penalty after a product recall. When brands with stronger equity violate consumers’ higher expectation of behavior, such as when high pay is awarded to a CEO during a brand crisis, consumers are more likely to be disappointed as it represents a stronger trust violation due to the higher expectations. This is because consumers’ prior belief about the brand sets up an expectation that influences their subsequent evaluation (e.g., Pullig et al., 2006) and the higher level of disappointment will cause the impact of brand crisis on the CEO pay–consumer behavior relationship to be perceived as a greater violation of trust (i.e., more negative for brands with strong equity).

In contrast, research also suggests that strong brand equity provides significant benefits to the focal brand, such as helping to insulate it, in some cases, from: (1) competitive actions and threats (e.g., Ailawadi & Keller, 2004), (2) competitive market entry (e.g., Lim & Tan, 2009), (3) market-level declines (Rego et al., 2009), (4) negative publicity (e.g., Pullig et al., 2006), and (5) negative word-of-mouth communication (Laczniak et al., 2001). Godfrey (2005) proposed that a good reputation provides an “insurance-like effect” in protecting brands experiencing a crisis, and Hsu and Lawrence (2016) found that higher levels of brand equity may help protect a company from negative social media following a product recall. Further, consumers are more likely to blame weak brands (versus strong brands) for product recalls (Cleeran et al., 2013). In such cases, a strong brand (i.e., high brand equity) helps counter the effect of high CEO pay under conditions of brand crisis on consumer behavior by providing additional, favorable associations that buffer the negative impact.

Despite this alternative argument, we believe that it is more likely that a “liability of brand equity strength” will cause the impact of the interaction of brand crisis and CEO pay on purchase intention to be more negative for strong brands. Our belief stems from the high(er) expectations consumers are likely to have of strong brands, resulting in a more negative consumer reaction to the breach of trust that occurs under conditions of brand crisis and high CEO pay. See Fig. 1 for the proposed relationships among the constructs.

H4

The impact of brand crisis on the CEO pay-consumer purchase intent relationship is more negative for strong than weak brands.

Overview of Method

In the following sections, we present results employing a multi-method approach that entails a pilot study, two online experiments, and an event study. The benefit of conducting experiments is that they provide higher internal validity than cross-sectional or even longitudinal studies and enable researchers to draw conclusions about the causal direction among related variables. The drawback is that external validity may be limited as generalizing from the experimental conditions to real-world settings is more difficult. We believe that we have struck an acceptable balance between internal and external validity with the use of mixed methods.

The pilot study is designed to test the assumption that consumers are aware of CEO pay and show some interest in it. Study 1 employs an experiment to examine the direct impact of CEO pay on consumer purchase intent (H1), to explore the moderating role of brand crisis (H2), and to examine the mechanism for this moderated relationship, which is brand trust (H3). Study 2 shows that the impact of CEO pay on purchase intent during brand crisis is more negative for brands with high equity (H4). Finally, the event study uses a diverse set of industries to provide more general validation from Studies 1 and 2. Specifically, it examines the link between CEO pay and shareholder value during firms’ product-related crises (H2), as investors incorporate the predicted impact of crises on consumers’ purchase intentions. To explore the moderating role of brand equity (i.e., H4), the sample of events was also divided into two sub-samples representing brands with high and low equities, respectively.

Pilot Study

The purpose of the pilot study was to understand consumer awareness of CEO pay. To identify possible differences between those who work within the business community versus the general population about CEO pay, two different samples were employed: an online convenience sample recruited from Amazon Mechanical Turk (n = 80; Male = 42; 18–25: 26.3%, 26–34: 32.5%, 35–54: 33.8%, and 55–64: 7.5%) and business professionals with a minimum three years of experience (n = 68; Male = 37; 18–25: 20.0%, 26–34: 61.5%, 35–54: 9.2%, 55–64: 1.5%, and 65 or over: 7.7%).

The awareness of CEO pay at firms from which respondents purchase, measured on a 5-point scale (1 = Never, 5 = All of the time), was moderate; there was no significant difference between the general population and business professionals samples (M mturk = 2.31 vs. M business = 2.22; t (1, 146) = 0.65, p = 0.46). The mechanism for becoming aware of CEO pay was also the same across both segments; the majority of respondents primarily learned about CEO pay after reading articles (65%), watching news (37%), or speaking to a friend (14%). Additionally, most individuals were able to accurately identify the pay range within which the average Fortune 500 CEO was compensated (MTurk: 70.36%; business professionals: 88.14%). Overall, findings from this pilot study show that consumers across both samples are generally aware of CEO pay and that they seem to “consume” information about CEO pay and effectively digest it.

Study 1

The purpose of this experiment is threefold: (1) to examine the negative impact of CEO pay on consumer purchase intention (H1), (2) to explore whether the relationship between CEO pay and consumer purchase intention becomes more negative under conditions of brand crisis (H2), and (3) to test whether brand trust mediates the interactive effect of CEO pay and brand crisis on consumer purchase intention (H3).

Method

Participants and Design. Two-hundred and fifty-four MTurk participants (51% female, average age = 33.2) participated in a 2 (CEO pay: low vs. high) × 2 (financial crisis: present vs. absent) between-subjects design study for modest compensation. Eleven respondents were dropped from the sample as they didn’t pass the screening question (4), failed to finish the survey (4), or failed the attention questions.Footnote 3 Participants indicated that they would actively search for information on CEO compensation if publicly available (M = 4.88), measured on a 7-point scale (1 = Extremely unlikely, 7 = Extremely likely). This value didn’t significantly vary across conditions (Fs < 1.6, ps > 0.05).

In each experimental condition, participants read three news articles about a well-known manufacturer of electronics. They were informed that the company is referred to as “Company X” in the articles due to legal concerns related to pending investigations. All three news articles were shown randomly, and each article had to be viewed for at least 30 s. However, only one article was about the CEO in company X being paid higher [lower] than the average CEO in the same industry. The other two articles served as fillers and covered stories on company X’s partnership with the American Heart Association and company X’s vision for the future. The filler articles were selected so that the news about CEO pay would not stand out to reduce demand effect and would not be artificially “forced” on respondents.

Borrowing the manipulation from Mohan et al. (2018), the CEO pay article mentioned that “Company X reported that the CEO received total pay for fiscal year 2020–2021 valued at $24.74 [$4.74] million, significantly higher [lower] than the average CEO pay package within the consumer electronics industry. The total compensation includes salary, incentives, and perquisites according to a filing with the Securities and Exchange Commission (SEC).” The presence of financial crisis was manipulated by informing half the participants that “Company X is on the brink of financial disaster. Its sales have declined consistently over the past few years, and it is on the verge of bankruptcy. Company X announced today that net revenue declined 8% for fiscal year 2021 relative to 2020.” This information was not presented to the rest of sample when the financial crisis was absent. See Appendix A for the sample news articles.

Measures. After reading the news articles, participants indicated that they would actively search for information on CEO compensation if publicly available (M = 4.88), measured on a 7-point scale (1 = Extremely unlikely, 7 = Extremely likely). This value didn’t vary significantly across conditions (Fs < 1.6, ps > 0.05). We asked participants to indicate how much they agreed/disagreed with four statements that measure brand trust, using 7-point Likert scales (1 = Strongly disagree, 7 = Strongly agree): “I trust this brand”, “I rely on this brand”, “This is an honest brand”, and “This brand is safe” (items adapted from Chaudhuri & Holbrook, 2001). Participants also indicated their perception of CEO pay fairness on a 7-point scale (1 = Not at all fair, 7 = Very fair): “How fair do you think the CEO compensation is?”, adapted from Mohan et al. (2018) and Benedetti and Chen (2018). Then, to ensure participants were not guessing the true identity of Company X, they were asked to indicate how familiar they were with Company X, measured on a 5-point scale (1 = Not at all familiar, 5 = Extremely familiar), and how likely they were to purchase a product from Company X, measured on a 7-point scale (1 = Extremely unlikely, 7 = Extremely likely). Finally, participants responded to questions related to manipulation checks and attention tasks and we measured the level of education, the current field of occupation, age, and gender.

Results

Manipulation checks. When asked “How does the compensation of Company X’s CEO compare to the compensation of other CEOs in the industry?” and “Based on the information provided in the news article, how would you rate the level of pay for Company X’s CEO?”, using two-item 7-point scale (1 = Very low, 7 = Very high), participants in the high CEO pay condition rated it significantly higher than those in the low CEO pay condition (M high CEO pay = 6.28 M low CEO pay = 3.58; F (1, 253) = 15.11, p = 0.01). In addition, using a 7-point scale (1 = None at all, 7 = A great deal), when the financial crisis was present, participants significantly rated Company X to be facing a financial crisis more than when the financial crisis scenario was absent (M financial crisis present = 4.81 M financial crisis absent = 2.93; F (1, 253) = 10.62, p = 0.03). Therefore, the manipulations of both factors were successful.

Support for H1 and H2. We ran hierarchical regression and constructed three different models (Gelman & Hill, 2006). The descriptive statistics and correlation coefficients of the variables used in the models are shown in Table 2. The control variables (i.e., age, gender, education, and occupation) were entered as a set in the first hierarchical step (i.e., model 1). Then, we added CEO pay and financial crisis variables in the second hierarchical step (i.e., model 2). Finally, the two-way interaction term between CEO pay and financial crisis was entered as the third hierarchical step (i.e., model 3). No mean-centering was required for the independent variables in the moderated regression analysis as they were both dichotomous (Cohen et al., 2003). The results show that CEO pay and financial crisis together explained about 10% of variance in purchase intention, beyond 3% variance explained by the control variables. The difference in R square between model 1 & 2 was 7% and significant (F (2, 247) = 9.95, p < 0.001). The beta weight for the CEO pay in model 2 confirms support for H1 (β = − 0.29; t = -4.35, p < 0.001). Further, model 3 (i.e., the third hierarchical step) explained a statistically significant incremental 4% of the variance in purchase intention over model 2 (F (1, 246) = 10.82, p = 0.001). The beta weight for the two-way interaction between CEO pay and financial crisis was statistically significant, supporting H2 (β = − 0.42; t = − 3.29, p = 0.001). The results of this analysis along with the standardized regression weights are presented in Table 3.

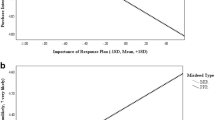

We graphically present the result of the significant interaction between CEO pay and financial crisis on purchase intention in Fig. 2. We plotted this interaction using the regression equation and inserting the dummy coded values for CEO pay and the financial crisis. The simple slope when the financial crisis is present (− 2.60) is significantly different from zero (t = − 2.81, p = 0.02), whereas the slope when the financial crisis is absent (0.25) does not significantly differ from zero (t = 0.27, p = 0.53). Therefore, the negative differential impact of CEO pay on consumer purchase intention is evident under conditions of brand crisis.

Process evidence and support for H3. We employed a maximum likelihood exploratory factor analysis (EFA) with varimax rotation to test the dimensionality of the brand trust construct. Field (2013) indicates that an item should be deleted from a pool of items if it has an item-to-total correlation of less than 0.5. He recommends that only factor loadings greater than 0.4 which explain around 16% of the variance in a variable should be interpreted. All items of the brand trust construct met these two criteria and the first extracted factor explained 79.61% of the total variance. We created an index of brand trust by averaging the four items (Cronbach’s alpha = 0.92).

According to the conceptual model presented in Fig. 1, H3 predicts that trust mediates the moderating effect of CEO pay and financial crisis on purchase intent. To formally test this proposed relationship (i.e., moderated mediation), we applied the procedures outlined in Preacher et al. (2007) and Preacher and Hayes (2008). Unlike Baron and Kenny (1986), Preacher and his colleagues recommend testing the indirect effects (i.e., mediation) using a product of coefficient approach rather than the causal steps approach. Following the bootstrapping method that Preacher and Hayes (2008) outlined and using the Model 8 template for SPSS macro (i.e., it allows testing the significance of conditional indirect effects at different values of the moderator), we estimate the indirect effects when both moderation and mediation are present.

The moderated mediation test used by Preacher and Hayes (2008) involves multiple steps which we will describe below. First, it builds a mediator regression model(s), wherein the mediator(s) serves as the dependent variable(s) while CEO pay, financial crisis, and their corresponding two-way interaction serve as independent variables. Given that the previous literature has identified pay fairness as a potential mediator between CEO pay and consumer behavior (Benedetti & Chen, 2018; Mohan et al., 2018), we decided to test our focal mediator (i.e., trust) along with the alternative mediator (i.e., pay fairness) in the mediator regression models. This method has many advantages over other methods of testing mediation as it examines the relative size of the indirect effects via different mediators in multiple mediation models (Preacher & Hayes, 2004). Importantly, it allows us to explore whether trust influences purchase intention above and beyond perceptions of pay fairness.Footnote 4 Table 4 shows the results of the mediator regression models for trust and pay fairness.

The main effect of CEO pay (b = − 0.44; t = − 2.14, p = 0.04) and the two-way interaction of CEO pay with financial crisis (b = − 0.89; t = − 2.48, p = 0.02) on trust in the first mediation regression model were significant. Similarly, we found the impact of the two-way interaction of CEO pay with financial crisis on pay fairness was significant in the second regression mediation model (b = − 1.02; t = − 2.80, p = 0.01) (see Table 4). This fulfills the precondition for mediation that the independent variables should significantly predict the mediator(s) (Preacher & Hayes, 2008). Next, following the approach recommended by Preacher and Hayes (2008) and Tausch et al. (2010), we entered both mediators simultaneously into the dependent model along with CEO pay, financial crisis, and their corresponding interaction as the final step. In this model, purchase intention served as the dependent variable. In the presence of both mediators in the dependent model equation, the two-way interaction of CEO pay with financial crisis on purchase intention was reduced but still significant (b = − 0.88; t = − 2.15, p = 0.03). This is consistent with a partial mediation explanation. More specifically, the direct effect of CEO pay on purchase intention in the presence of financial crisis was significant (b = − 0.99; t = − 3.30, p < 0.001; 95% confidence interval [CI] = − 1.59, − 0.40). However, this direct effect disappeared when the financial crisis was absent (b = − 0.12; t = − 0.42, p = 0.67; 95% confidence interval [CI] = − 0.66, 0.43). The full results from the last step of this analysis are presented in Table 5.

Finally, in Table 6, we examined the indirect effects through trust and pay fairness paths as the final step in the approach by Preacher and Hayes (2008). Results from the bootstrapping procedure using 5000 resamples corroborated the moderating effect of CEO pay and financial crisis on purchase intention. The SPSS macro for multiple mediators used by Preacher and Hayes (2008) tests the indirect effects at each value of the moderator. Our findings show that brand trust significantly mediated the relationship between CEO pay and purchase intention when financial crisis was present (b = −0.40, 95% confidence interval [CI] = − 0.68, − 0.17), but not when financial crisis was absent (b = − 0.08, 95% confidence interval [CI] = − 0.29, 0.11). Index of moderated mediation (i.e., the difference between conditional indirect effects at each level of moderator) was also significant (b = − 0.31, 95% confidence interval [CI] = − 0.65, − 0.04). However, pay fairness perception failed to mediate the moderating impact of CEO pay and financial crisis on purchase intention when it was entered along with brand trust in the dependent model. Irrespective of financial crisis being present (b = − 0.15, 95% confidence interval [CI] = − 0.37, 0.05) or absent (b = -0.04, 95% confidence interval [CI] = − 0.29, 0.19), pay fairness did not significantly mediate the relationship between CEO pay and purchase intention. The index of moderated mediation was also insignificant (b = − 0.10, 95% confidence interval [CI] = − 0.39, 0.17). The full results for the mediation tests are presented in Table 6. Overall, our findings rule out the possibility of pay fairness as an alternative mechanism explaining the proposed effects.Footnote 5 Instead, our results indicate that when a company is under financial crisis, the high (vs. low) CEO pay negatively impacts brand trust, which ultimately reduces purchase intention. This fully supports H3.

Discussion

The results from Study 1 provide support for our hypothesized relationships, illustrating the negative impact of CEO pay on consumer purchase intention (H1). Further, we found that the interaction of high CEO pay and financial crisis negatively impacts consumers’ purchase intention (H2). Finally, when CEO pay (high) was incongruent with performance (i.e., brand crisis), consumers lost trust in the brand and ultimately reduced their purchase intention (H3). Meanwhile, this contrast is also subject to a different interpretation, suggesting that when there is a financial crisis present, low CEO pay increases purchase intent. This presents a novel opportunity for Chief Marketing Officers (CMOs) during a crisis to elevate purchase intention by highlighting lower CEO pay when applicable. Thus, when there is a crisis and CEO pay is low, there is a chance to build trust and subsequently increase purchase intention.

Study 2

The purpose of this experiment is both to replicate the findings from Study 1 in another context and explore the joint effect of CEO pay and brand equity when a company faces brand crisis (H4).

Method

Participants and Design. Three hundred MTurk individuals participated in a 2 (CEO pay: low vs. high) × 2 (financial crisis: absent vs. present) × 2 (brand equity: low vs. high) between-subjects for fair compensation. Forty-six respondents were dropped from the sample as they either didn’t pass the screening question (26) or failed in the attention questions, like those used in Study 1. Although the inclusion of participants who failed the attention checks did not change the results of the current experiment, the attention questions were incorporated into the survey to detect participants who were actively engaged (Oppenheimer et al., 2009). Thus, we kept two-hundred fifty-four responses for the final analyses (Females = 121; Mage = 36.54; 74.4% had some sort of college degree).

Unlike Study 1, we selected a familiar shopping good for this experiment to induce a moderate level of decision risk for the purchase intention. We told participants that they were about to see three news articles (like those used in Study 1) on a “real” brand which makes digital SLR cameras, among other electronics. We manipulated high versus low brand equity based on a pretest which examined brand value perceptions of different brands of digital SLR cameras (n = 27). Pretest participants ranked the brand value of eight brands of digital SLR cameras (i.e., Canon, Sony, Nikon, Samsung, LG, Kodak, Olympus, and Sigma). Sony and Sigma brands represented high brand equity and low brand equity, respectively, as Sony earned the highest rank and Sigma was ranked the lowest in this group. Therefore, depending on the experimental condition, half of the subjects read news articles about Sony, whereas the rest of sample were exposed to news articles about Sigma. All three news articles were shown randomly, but only one was about CEO pay.

CEO pay was manipulated by informing participants via a news article format that “Sony/Sigma’s CEO, Richard Hawthorn, received total pay for fiscal year 2020–2021 valued at $4.74 [$24.74] million, significantly lower [higher] than the average CEO pay package within the consumer electronics industry. The total compensation includes salary, incentives, and perquisites according to a filing with the Securities and Exchange Commission (SEC).” The other two articles served as fillers and covered stories on Sony/Sigma’s partnership with the American Heart Association and Sony/Sigma’s vision for the future.

Finally, brand crisis was manipulated by informing half of the participants that “Sony/Sigma, one of the leading manufacturers of digital SLR cameras, is on the brink of financial disaster. Sony/Sigma’s sales have declined consistently over the past few years. However, similar to other brands in this industry, the financial crisis in 2009 accelerated Sony/Sigma’s decline. Sony/Sigma announced today that net revenue declined 8% for fiscal year 2021 relative to 2020.” When the financial crisis was absent, no information was provided about the financial standing of Sony/Sigma. See Appendix B for the sample news articles.

Measures. After reading the news articles, participants responded to the brand trust questions (Chaudhuri & Holbrook, 2001), indicated their level of familiarity with the brand, and indicated their likelihood of buying a digital SLR camera from the brand (1 = Extremely unlikely, 7 = Extremely likely). Finally, participants responded to questions related to manipulation checks and indicated the level of education, the current field of occupation, age, and gender. Overall, the scenarios were found to be highly believable (M = 2.67), measured on a 7-point scale (1 = Very easy to believe, 7 = Very difficult to believe). We also found that more than half of our sample (57.1%) were to some extent aware of the CEOs’ compensation at firms they patronize (M = 4.27), measured on a 5-point scale (1 = Always, 5 = Never). On a 7-point scale (1 = Extremely likely, 7 = Extremely unlikely), about 40% of participants also reported that they will actively search for information on CEO compensation if publicly available (M = 4.84).

Results

Manipulation checks. We asked participants to rate the value of the brand they saw in the news articles on 7-point Likert scales, using a nine-item brand equity construct (Yoo & Donthu, 2001). As expected, the results showed that participants perceived the brand equity of Sony to be significantly higher than that of Sigma (M Sony = 5.26 vs. M Sigma = 3.96; F (1, 252) = 72.49, p < 0.001). On a 7-point scale (1 = Very low, 7 = Very high), respondents who were assigned to the high pay condition rated the salary of the CEO compared to the compensation of other CEOs in the industry significantly higher than those did in the low pay condition (M high = 4.84 vs. M low = 2.74; F (1, 252) = 140.15, p < 0.001). Similarly, when asked about the level of pay (1 = Very low, 7 = Very high), subjects in the high pay condition rated the salary of the CEO significantly higher than those in the low pay condition (M high = 4.61 vs. M low = 3.69; F (1, 252) = 20.08, p = 0.02). Finally, using a 7-point scale (1 = Not at all, 7 = A great deal), participants who were exposed to the financial crisis condition believed that the brand was in greater financial trouble more than did those who saw no information on the brand’s financial crisis (M financial crisis present = 4.45 vs. M financial crisis absent = 3.01; F (1, 252) = 97.29, p < 0.001). Therefore, the manipulation of all three factors was successful.

Support for H1, H2, and H4. To explore the interactive effect of CEO pay, financial crisis, and brand equity on purchase intention, we ran hierarchical regression (Gelman & Hill, 2006) and created three models akin to Study 1. The descriptive statistics and correlation coefficients of the variables used in the models are shown in Table 7. The control variables (i.e., age, gender, education, and occupation) were entered as a set in the first hierarchical step (i.e., model 1). Then, we added CEO pay, financial crisis, and brand equity variables in the second hierarchical step (i.e., model 2). Finally, all possible two-way interactions and the three-way interaction among CEO pay, financial crisis, and brand equity were entered as the third hierarchical step (i.e., model 3). Due to the nature of the independent variables being categorical, no mean-centering was carried out (Cohen et al., 2003). The results from model 1 show that control variables were all non-significant (ts < 1.6, ps > 0.05) and they only explained 3% of variance in purchase intention. In model 2, CEO pay, financial crisis, and brand equity together explained about 40% of variance in purchase intention, almost 37% beyond variance explained by control variables pF (3, 246) = 51.27, p < 0.001]. In support of H1, the beta weight for the CEO pay in model 2 was significant (β = − 0.37; t = − 5.12, p < 0.001). Finally, model 3 (i.e., the third hierarchical step) explained a statistically significant incremental 6% of the variance in purchase intention over model 2 [F (4, 242) = 6.44, p < 0.001]. More importantly, the beta weight for the three-way interaction among CEO pay, financial crisis, and brand equity was statistically significant (β = − 0.58; t = − 3.09, p = 0.002). The results of this analysis along with the standardized regression weights are presented in Table 8.

Notably, as Table 8 shows, the two-way interaction between CEO pay and financial crisis was not significant (β = 0.01; t = 0.18, p = 0.73). Given that the data was pulled across the brand equity variable representing low vs. high levels, we explored this relationship further at each level of brand equity. More specifically, when the brand equity was high, the negative impact of CEO pay on purchase intention was significantly intensified by the financial crisis [b = − 2.05; F (1, 245) = 5.79, p < 0.001]. The simple slope when the financial crisis is present (− 2.01) is significantly different from zero (t = − 2.43, p = 0.03), whereas the slope when the financial crisis is absent (0.16) does not significantly differ from zero (t = 0.24, p = 0.58). However, when the brand equity was low, the impact of CEO pay on purchase intention was not significantly moderated by the financial crisis [b = − 0.16; F (1, 245) = 0.08, p = 0.78]. Overall, these results demonstrate that H2 is only supported when brand equity is high but not when it is low.

To formally test H4, we examined the two-way interaction between CEO pay and brand equity at each level of financial crisis (i.e., absent vs. present). Additional analyses showed that in the absence of financial crisis, the two-way interaction effect of brand equity and CEO pay on purchase intention was significant (β = 0.26; t = 2.41, p = 0.02). See the top portion of Table 9. Then, we plotted this interaction using the regression equation and inserting the dummy coded values for the CEO pay and brand equity. The simple slope when the brand equity is high (0.05) does not significantly differ from zero (t = 0.07, p = 0.68), whereas the slope when the brand equity is low (-1.22) significantly differs from zero (t = − 3.73, p < 0.001). This suggests that strong brands are safeguarded against high CEO pay when they are not facing financial crisis. In other words, in the absence of financial crisis, variance in CEO pay has no meaningful impact on purchase intention when the brand equity is high. See Fig. 3a below.

When the financial crisis was present, the two-way interaction between brand equity and CEO pay was also significant (β = − 0.31; t = − 2.02, p = 0.05). We plotted this interaction using the regression equation and inserting the dummy coded values for the CEO pay and brand equity. The simple slope when the brand equity is high (− 2.32) is significantly different from zero (t = − 8.36, p < 0.001). Similarly, the slope when the brand equity is low (− 1.25) significantly differs from zero (t = − 2.81, p = 0.01). See the lower part of Table 9 and Fig. 3b below. The difference in difference for purchase intention between high- and low-equity brands (− 1.07) was also significant (t = 2.16, p = 0.04). This finding indicates that when brands are going through financial crisis, consumers are more likely to purchase their products when CEO pay is substantially lower than the average in the industry, especially in the case of high-equity brands, supporting H4. Consequently, this supports prior research indicating a liability of good reputation in the context of a brand crisis and is inconsistent with Godfrey’s (2005) suggestion that reputation can produce an insurance-like benefit.

Process evidence and support for H3. To explore whether trust would mediate the moderating effects of CEO pay and financial crisis on purchase intention, given the context of brand equity, we initially built a mediator regression model. In this model, trust was the dependent variable while CEO pay, financial crisis, brand equity, and all possible two-way and three-way interactions were independent variables. The main effects of CEO pay (β = − 0.35; t = − 3.39, p < 0.001), financial crisis (β = − 0.29; t = − 2.36, p = 0.03), and brand equity (β = 0.44; t = 4.56, p < 0.001) were significant. Also, we found the two-way interaction of CEO pay and brand equity (β = 0.37; t = 2.47, p = 0.03) as well as the three-way interaction of CEO pay, financial crisis, and brand equity on trust were significant (β = − 0.80; t = − 3.95, p < 0.001). Table 10 shows the results of the mediator regression models for trust as the dependent variable.

Since the independent variables and their corresponding higher order interactions significantly predicted the mediator, we built a dependent model following the procedure offered by Preacher and Hayes (2008). To test the moderated mediation with two moderators, we adopted the Model 12 template where CEO pay, financial crisis, brand equity, and their corresponding two-way and three-way interactions were entered simultaneously into the dependent model (i.e., the dependent variable was purchase intention) along with the mediator (i.e., brand trust). In the presence of trust in the dependent model equation, the three-way interaction of CEO pay, financial crisis, and brand equity on purchase intention was reduced, but still significant (b = − 1.90; t = − 2.41, p = 0.02). This provides evidence of partial mediation. More specifically, in the absence of financial crisis, the impact of CEO pay on purchase intention was only significant when the brand equity was low (b = − 1.03; t = − 3.00, p = 0.003; 95% confidence interval [CI] = − 1.71, -0.36), but not when it was high (b = 0.04; t = 0.11, p = 0.91; 95% confidence interval [CI] = − 0.76, 0.85). However, in the presence of financial crisis, the impact of CEO pay on purchase intention was significant both when the brand equity was low (b = − 1.19; t = − 2.64, p = 0.009; 95% confidence interval [CI] = − 2.08, − 0.30) and high (b = − 2.01; t = − 5.76, p < 0.001; 95% confidence interval [CI] = − 2.69, − 1.32). The full results from the last step of this analysis as well as the conditional direct effects of CEO pay on purchase intention are presented in Table 11.

Finally, we examined the indirect effects through trust as the final step in the approach by Preacher and Hayes (2008). Results from the bootstrapping procedure using 5000 resamples corroborated the moderating effect of CEO pay, financial crisis, and brand equity on purchase intention. The SPSS macro using template model 12 in Preacher and Hayes (2008) examines the indirect effect of trust at each value of the moderators. Our findings show that when brand equity was low, brand trust significantly mediated the relationship between CEO pay and purchase intention when the financial crisis was absent (b = − 0.18, 95% confidence interval [CI] = − 0.38, − 0.02), but not when the brand equity was high (b = 0.01, 95% confidence interval [CI] = − 0.12, 0.15). These results indicate that for brands with low equity experiencing the absence of a financial crisis, higher CEO pay results in loss of trust among consumers, which ultimately translates into lower purchase intention. However, brands with high equity establish strong brand trust among consumers and are immune from decline in purchase intention in the absence of financial crisis. On the other hand, when a financial crisis was present, brand trust significantly mediated the relationship between CEO pay and purchase intention when the brand equity was high (b = − 0.31, 95% confidence interval [CI] = − 0.63, − 0.03), but not when it was low (b = − 0.05, 95% confidence interval [CI] = − 0.23, 0.10). These findings suggest that brands with high equity amid financial crisis are susceptible to diminishing trust in the minds of consumers and subsequently suffer from lower purchase intention. Overall, our results indicate that when a company with high brand equity is experiencing a financial crisis, the high (vs. low) CEO pay negatively impacts brand trust, which subsequently reduces purchase intention. Therefore, H3 is supported for brands with high equity and not those with low equity. The full results for the mediation tests are presented in Table 12.

Discussion

The results from Study 2 provide support for H4, indicating that the impact of brand crisis on the CEO pay–consumer purchase intent relationship is more negative for strong than weak brands. This suggests that strong (versus weak) brand equity establishes high expectations of behavior. When there is incongruence between CEO pay (high) and CEO performance (leader of the firm during a time of brand crisis), brands that have established strong equities are likely to drive greater consumer distrust, causing lower levels of purchase intent. While strong brand equity provides significant benefits for firms, this suggests a potential negative consequence of such strong equity. What is particularly striking about these results is that brand equity helps insulate a company against the negative effects of high CEO pay; however, it has a negative impact when a company experiences both high CEO pay and brand crisis. This shift in impact suggests that for strong equity brands, high CEO pay and brand crisis create a significant failure to live up to both prior performance that enabled the brand to achieve strong equity and current expectations of performance. To further validate our findings from experiments in Study 1 and Study 2, we employ an event study by considering investors’ reaction as an ex-ante indicator of the reaction of consumers.

Event Study

To corroborate our theory and experimental results associated with CEO pay and the brand-related interactions—i.e., H2 dealing with the interaction of brand crisis and H4 dealing with the role of brand equity in the interaction of brand crisis—we conducted an event study.

Prior research suggests that when an unexpected firm event takes place, investors incorporate the predicted impact of the event on consumers’ purchase intentions and, in turn, the health of a firm’s future cash flows in their valuation of the event (e.g., Kashmiri & Mahajan, 2015; Wiles & Danielova, 2009). This stream of work shows that abnormal stock returns at the time of a firm’s new product introduction announcement reflect investors’ assessment of the new product introduction’s impact on the firm’s future cash flows with investors making this assessment by incorporating the likely response of consumers to the new product. Existing research has also shown that investors incorporate the likely response of consumers in many contexts such as consumer exposure to deceptive marketing practices (Tipton et al., 2009), data breaches (Kashmiri et al., 2017), financial restatement announcements (Palmrose et al., 2004), and scandals associated with brand ambassadors (Knittel & Stango, 2014). Similarly, investors have been found to reward firms in the stock market when these firms have announced actions perceived to be value-generating for consumers: brand acquisitions and disposals (Wiles et al., 2012), product placements in movies (Karniouchina et al., 2011; Wiles & Danielova, 2009), sponsorship announcements (Mazodier & Rezaee, 2013), and new product preannouncements (Sorescu et al., 2007).

In essence, investors consider the impact of an event on consumer behavior in their investment choices, and this consideration in turn impacts the firm’s stock market performance. Consequently, investor behavior can serve as a proxy for expected consumer behavior. Hence, we considered investors’ reaction as an ex-ante indicator of the reaction of consumers and conducted an event study of a key strategic event pertinent to firms’ customers: new product introductions. In line with our hypotheses and the event study literature, we assume that if investors predict that CEO pay and brand crises decrease consumers’ purchase intention of the firm’s newly introduced products, investors would penalize the firm in the stock market at the time of the firm’s new product introduction announcements.

Sample

We used an event study on 870 new product announcements in the year 2012 of 188 public U.S. firms listed on the NYSE, AMEX, or NASDAQ stock exchanges. Our sample firms belonged to a diverse set of industries, representing 7 different 1-digit SIC codes. We collected reports of product announcements using the S&P Capital IQ database. We also conducted a search of product introduction news on LexisNexis for the year 2012. Following the recommendations of prior researchers (e.g., Sorescu et al., 2017), we dropped announcements for which there was at least one confounding event (such as dividend increases and decreases, executive turnover, earning forecasts by management, strategic alliance announcement, earnings announcement, stock-repurchase, convertible debt issuance, etc.) within a window of 10 days before and after the announcement in reaching our sample of 870 new product announcements.

Data Sources and Measures

We collected data using S&P’s COMPUSTAT and company annual reports as our main sources. Below, we provide the measures and sources of data for the various control variables used in our models. We collected data on total CEO compensation from Execucomp and DEF 14-A proxy statements for the year 2011. As the data for CEO compensation was skewed, we employed the natural logarithm of CEO compensation in our regression model. We used “product-related concerns” as the measure of brand crises, relying on KLD Research & Analytics Inc.’s ratings. KLD evaluates firms’ social weaknesses in a number of categories, of which we used the category of products. For product-related concerns, a firm that was not involved in any controversy in a particular year receives a 0; otherwise, KLD gives the firm a count rating based on the number of product-related controversies in which the firm was involved. For each new product announcement, we considered the corresponding firm’s total product-related concerns in the preceding year (i.e., the year 2011) as our measure of the firm’s brand crises.Footnote 6 We controlled for firm size (recorded as the natural logarithm of the firm’s total assets), firm age (recorded as the number of years since the firm was founded), and leverage (recorded as the firm’s long-term debt to asset ratio).Footnote 7 The values of all these control variables represented their values for the year preceding the new product introduction year (i.e., the year 2011). We also controlled for the firm’s industry by including six industry dummy variables. These dummy variables were based on the firms’ 1-digit SIC classification.

Analysis of Shareholder Value Impact of New Product Introduction Announcements

We used a common event study methodology, employed by several researchers (e.g., Gielens et al., 2008; Kashmiri & Mahajan, 2015; Wiles et al., 2012). The market model was used to estimate abnormal stock returns (e.g., Brown & Warner, 1985; Swaminathan & Moorman, 2009).

Market Model:

Here, Ri,t reflects the rate of return on the stock price of firm i on day t; Rm,t is the average rate of return on a benchmark portfolio of market assets over an estimation period preceding the event, αi is the intercept, and εi,t is the residual of the estimation which is assumed to be distributed i.i.d. normal. We report results based on an estimation sample covering 245 to 6 trading days before a new product introduction announcement.

We estimated abnormal returns (ARs) associated with a new product announcement by taking the difference between the observed rate of return Ri,t and the expected rate of return E(Ri,t), i.e.,

To estimate the relationship between CEO pay and the shareholder impact of new product introductions, we regressed ARs on CEO pay while controlling for a number of firm and industry-specific variables discussed earlier. For ease of interpretation of regression coefficients, we multiplied raw abnormal returns by 100 and used the transformed abnormal returns in our regression model. For example, if a firm experienced an abnormal return of 0.10%, its abnormal return in the regression model was recorded as 0.10. Overall, we used the following regression equation:

We used robust standard errors to account for the correlation between multiple events of the same firm.

As shown in Table 13, the mean abnormal stock return on the day of the event (0.09%) was positive and significant according to both the CDA test as well as the Generalized Z test. Furthermore, these results were consistent with the use of the Market Adjusted Model (Brown & Warner, 1985), which assumes that the expected return is the average rate of return of all stocks trading in the stock market at time t. Moreover, 4 of the 5 mean daily abnormal stocks were non-significant in the window -5 to -1 according to at least one of the two test scores (CDA and Generalized Z), and similarly all the 5 mean daily abnormal returns were non-significant in the window + 1 to + 5 according to at least one of these two tests. The most significant abnormal returns were found on day 0, the date of the new product announcement. We conclude from these results that firms that announced new product introductions experienced, on average, an increase in their value. We also conclude that there was no evidence of information leakage or delayed stock market response, and that abnormal returns on day 0 were the most appropriate choice of dependent variable while analyzing the valuation impact of new product introductions.

In light of these findings, we next conducted multivariate analyses using each firm’s abnormal return on day 0 as the dependent variable, and the focal and control variables highlighted earlier as the independent variables. The descriptive statistics for all measures are presented in Table 14. Table 14 also shows the correlations between our measures, pooled over the period of observation. All pair-wise correlations were less than or equal to 0.50. Furthermore, the variance inflation factors were less than the benchmark of 5. Thus, based on these tests, we did not find evidence of multicollinearity issues in our regression model (Kennedy, 2003).

The results of our multivariate analyses are shown in Table 15. In Model 1, we included CEO pay and product-related concerns separately as independent variables but did not include their interaction terms. We found no significant relationship between CEO pay and abnormal returns.Footnote 8 Thus, CEO pay, in general, does not seem to impact the value of new product introductions. However, as expected, more brand crises (i.e., product-related controversies) were associated with lower abnormal returns of new product introductions (β product-related concern = − 0.12, p = 0.04), suggesting that firms that have a history of brand crises (i.e., product-related controversies) on average experience lower abnormal returns associated with new product introductions. In regard to control variables, we found that larger firms enjoyed superior abnormal returns of new product introductions (β firm size = 0.87, p = 0.02). In unreported analysis, we also found that firms whose 1-digit SIC was 2 (i.e., firms in the light manufacturing industry) had superior abnormal returns compared to other firms.

In Model 2, we included the interaction term of CEO pay and product-related concerns. As Table 15 reveals, we found (in support of H2) that though the coefficient of CEO pay remained non-significant, the interaction term was negative and significant (β product-related concern * CEO pay = − 0.12, p = 0.04). Thus, CEO pay seems to negatively affect the shareholder value of new product introductions when the firm has a history of many product-related concerns. Our conclusions remained robust to the use of standardized abnormal returns rather than raw abnormal returns as our dependent variable. Our conclusions also remained robust to the use of the Market Adjusted Model rather than the market model in calculating abnormal returns. We plot the interaction effect of CEO pay and product-related concerns on the valuation of new product introductions in Appendix C (Fig. 4).

To test whether the interactive effect of product-related concerns and CEO-pay on the valuation of new product introductions is further moderated by brand equity (i.e., to test H4), we divided our sample of events into two sub-samples: events where the new product introduction featured a brand with high equity and events where the new product introduction featured a brand with low equity. We used Businessweek/Interbrand’s list of top 100 global brands in 2011 (Gunelius, 2011), a valid measure of brand equity (Madden et al., 2006), to make this classification. Events which featured a brand that was part of Businessweek/Interbrand’s top 100 global brands list in 2011 were classified as high brand equity events while the remaining events were classified as low brand equity events. We then re-ran Model 2, i.e., the model involving CEO pay, product-related concerns, the interaction of CEO pay and product-related concerns, along with other control variables on both these sub-samples. As shown in Table 16, we found that though the coefficient of CEO pay remained non-significant for both sub-samples, the interaction term was negative and significant for only the sub-sample of events featuring high-equity brands (β product-related concern * CEO pay = − 0.39, p = 0.01 < 0.05). The interaction term was not significant for the sub-sample of events featuring low-equity brands (β product-related concern * CEO pay = − 0.01, p = 0.95 > 0.05). This result provided further support for H4—the negative effect of product-related concerns on the link between CEO pay and the valuation of new product introductions was stronger for brands with high equity.

Indeed, as found earlier, it seems that when there is incongruence between CEO pay (high) and CEO performance (as evidenced by the firm having a history of product-related controversies), brands that have established strong equities are likely to drive greater consumer disappointment and distrust at the time of new product introductions, causing a less positive reaction in the stock market to new product introduction press.

Discussion of Event Study

The objective of the event study was to provide additional evidence of both the theory and experimental results associated with CEO pay and the brand-related interactions. Specifically, the event study analyzed shareholder reaction (which is an ex-ante indicator of consumer reaction) to CEO pay and product-related controversies (i.e., brand crises) in the context of new product introduction announcements. The results of the event study are broadly in line with H2 where we predicted that CEO pay has a negative effect on consumer purchase intention under conditions of brand crisis. Furthermore, our results are consistent with H4, where we predicted that the negative effect of CEO pay on consumer purchase intention under conditions of brand crisis is stronger for brands with high equity.

This event study measured the response of investors, which the literature has demonstrated is a novel way to predict future consumer reactions as investor behavior is reflective of near-future consumer reactions (e.gKarniouchina et al., 2011; Mazodier & Rezaee, 2013; Sorescu et al., 2007). A key assumption in this work is that investors incorporate the predicted impact of an event on consumers’ purchase intentions and, in turn, the health of a firm’s future cash flows in their valuation of the event (Kashmiri & Mahajan, 2015; Wiles & Danielova, 2009).Footnote 9

Furthermore, the event study methodology assumes that a firm’s stock price is an accurate reflection of all value-relevant information that is available to investors (Sorescu et al., 2017). As investors get new information related to the firm, they update their expectations about the firm’s future cash flows, leading to a change in the firm’s stock price. Thus, abnormal stock returns at the time of a firm’s new product introduction announcement reflect investors’ assessment of the new product introduction’s impact on the firm’s future cash flows with investors making this assessment by incorporating the likely response of consumers to the new product. Put simply, if investors believe that high CEO pay of a firm with a large number of product-related controversies is likely to decrease the purchase intention of the firm’s newly introduced product, we would expect them to penalize the firm in the stock market, leading to a reduction in the positive abnormal returns associated with such firms’ new product announcements. In sum, the event study suggests that, in the eyes of investors, high CEO pay is likely to have a negative effect on consumers’ purchase intentions toward the firm’s newly introduced products when the firm has suffered a brand crisis (i.e., product-related controversy), consistent with H2. Furthermore, in line with H4, investors appear to expect a negative impact of high CEO pay on consumers’ purchase intentions toward new product introductions of brand crisis firms (i.e., firms with a history of many product-related controversies) only when the introductions feature brands with high equity.

General Discussion

For decades, government officials, the media, and the public have attempted to put pressure on boards to change CEO pay practices to no avail (e.g., Brownstein & Panner, 1992; Lazonick, 2014). The current body of literature has also failed to show conclusive results regarding the relationship between high CEO pay and firm performance. Some studies report a positive association between high CEO and firm performance (e.g., Fong et al., 2015) with others reporting a negative relationship between high CEO and firm performance (Balafas & Florackis, 2014; Brick et al., 2006). We contribute to this public policy and business ethics issue by providing insight on consumer beliefs and behavior that may be useful for boards of directors determining CEO pay, government bodies contemplating legislative action, and the media as they write about the subject of high CEO pay. The present research empirically demonstrates that firms’ performance is likely to suffer when the BOD provide high CEO remuneration during crises as high CEO pay causes consumers to lose trust in the brand.

While interest in executive compensation has been high over the past few decades, the topic has taken on greater significance with the 2008–2009 financial collapse and ethical concerns over the continued increase in the CEO–average worker pay gap. Because of the growing interest, governmental involvement in CEO pay has increased with passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which requires that public companies: (1) provide shareholders with a “say-on-pay” (i.e., shareholders can vote on CEO compensation), and (2) annually report the ratio between CEO pay and that of its median employee (Francis & Fuhrmans, 2018). Further, greater transparency in CEO pay is being driven by enhanced regulatory requirements (e.g., reporting of pay in proxy statements), increased 24/7 access to business-related news (e.g. CNBC), increased consumer access to information via the internet, and the increasing number of CEOs who obtain celebrity-like status. In combination, consumers not only have increased access to information but also greater exposure to myriad messages regarding CEO pay, making this research relevant and timely.

Our findings suggest that high CEO pay has a negative impact on consumer purchase intent. This negative relationship is exacerbated under conditions of brand crises. Further, the negative interaction of CEO pay and brand crisis on purchase intent is mediated through brand trust. When CEO pay is high and the firm is experiencing a brand crisis, consumers lose trust in the brand as these governance practices signal that the firm is operating in a self-serving, rather than consumer value-creating, manner, which subsequently reduces purchase intent. Interestingly, the negative interaction effect of high CEO pay and brand crisis on purchase intent is more negative when the brand has strong equity, suggesting that rather than insulating high-equity brands, consumers are more disappointed (relative to weak-equity brands) by signals of mismanagement.

Theoretical and Practical Implications