Abstract

Investments in power generation constitute a typical budget allocation problem in the context of multiple objectives, while all factors influencing investor’s decisions for power plants are subject to considerable uncertainties. The paper introduces a multi-objective stochastic model designed to optimize budget allocation decisions for power generation in the context of risk aversion taking into account several sources of uncertainty, especially with regard to volatility of fossil fuel and electricity prices, technological costs, and climate policy variability. Probability distributions for uncertain factors influencing investment decisions are directly derived from the stochastic global energy model PROMETHEUS and thus they take into account complex interactions between variables in the systemic context. In order to fully incorporate stochastic characteristics of the problem, the model is specified as an optimization problem in which the probability that an objective exceeds a given threshold is maximized (risk aversion) subject to a set of deterministic and probabilistic constraints. The model is formulated as a mixed integer program providing complete flexibility on the joint distributions of rates of return of technologies competing for investments, as it can handle non-symmetric distributions and take automatically into account complex covariance patterns as emerging from comprehensive PROMETHEUS stochastic results. The analysis shows that risk is a crucial factor for power generation investments with investors not opting for technologies subject to uncertainty related to climate policies and fossil fuel prices. On the other hand, combination of options with negative covariance tends to benefit in the context of risk-hedging behavior.

Similar content being viewed by others

Notes

The assumption of normality of rates of return is used here for illustration purposes in order to demonstrate a concrete specification of the methodology. However, the normality assumption is an inaccurate simplification that violates the distribution form of rates of return for power generation technologies as they emerge from PROMETHEUS stochastic analysis. The methodology used in case of non-normal and asymmetric distributions is described in detail in Section 2.4.

A standard PROMETHEUS run includes 2048 Monte Carlo experiments, although this number can be varied.

The analysis can also be performed for present investments; in this case, the investor has complete knowledge of capital costs of technologies (i.e., they are deterministic) and variability in production costs of technologies arises from uncertain development of fossil fuel prices and O&M costs as well as the construction time of power plants.

PROMETHEUS, as most large-scale energy-economy models, estimates implicitly the cost of the transmission of electricity, but does not include a detailed representation of the power transmission grid. In the model, transmission grid cost is assumed to depend on the evolution of power demand by sector and on cost mark-ups that increase with share of variable RES (wind and solar PV), similar to [38]. For a detailed assessment of transmission grid problem in a probabilistic context to minimize the likelihood of black-outs, refer to [39].

These methods are outside the scope of the current analysis.

Failure refers to rates of return lower than 6%.

References

Vithayasrichareon, P., & MacGill, I. F. (2012). A Monte Carlo based decision-support tool for assessing generation portfolios in future carbon constrained electricity industries. Energy Policy, 41, 374–392.

IEA. (2007). Climate policy uncertainty and investment risk. Paris: International Energy Agency.

IEA (2012) World energy outlook.

Fragkos, P., Tasios, N., Paroussos, L., Capros, P., & Tsani, S. (2016). Energy system impacts and policy implications of the European intended nationally determined contribution and low-carbon pathway to 2050. Energy Policy, 100, 216–226.

Stoll, H. G. (1989). Least-cost electric utility planning. New York: Wiley.

Lohmann, T., Rebennack, S. (2016) Tailored benders decomposition for a long-term power expansion model with short-term demand response. Management science, June 2016[39] EU ETS directive: Directive 2003/87/EC as amended by Directive 2004/101/EC (international credits), Directive 2008/101/EC (aviation), Directive 2009/29/EC (revision for 2020 climate and energy package), Regulation (EU) No 176/2014 (back-loading).

Fell, H., & Linn, J. (2013). Renewable electricity policies, heterogeneity, and cost-effectiveness. Journal of Environmental Economics and Management, 66(3), 688–707.

Jin, S., Ryan, S. M., Watson, J.-P., & Woodruff, D. L. (2011). Modelling and solving a large-scale generation expansion planning problem under uncertainty. Energy Systems, 2(3–4), 209–242.

Myers, S. C. (1984). Finance theory and financial strategy. Strategic Management, 14(1), 126–137.

Blyth, W., & Yang, M. (2006). Impact of climate change policy uncertainty in power investment. Paris: International Energy Agency.

Rothwell, G. (2006). A real options approach to evaluating new nuclear power plants. The Energy Journal, 27, 37–53.

Loulou, R., & Kanudia, A. (1999). Minimax regret strategies for greenhouse gas abatement: methodology and application. Operations Research Letters, 25, 219–230.

Kanudia, A., & Loulou, R. (1998). Robust responses to climate change via stochastic MARKAL: the case of Quebec. European Journal of Operations Research, 106, 15–30.

Kann, A., & Weyant, J. (2000). Approaches for performing uncertainty analysis in large-scale energy/economic policy models. Environmental Modeling and Assessment, 5, 29–46.

Birge, J. R., & Rosa, C. H. (1996). Incorporating investment uncertainty into greenhouse policy models. The Energy Journal, 17(1), 79–90.

Cano, E. L., Moguerza, J. M., & Alonso-Ayuso, A. (2016). A multi-stage stochastic optimization model for energy systems planning and risk management. Energy and Buildings, 110(2016), 59–56.

Pereira, M. V. F., & Pinto, L. M. (1991). Multi-stage stochastic optimization applied to energy planning. Mathematical Programming, 52, 359–375.

Ahmed, S., King, A., & Parija, G. (2003). A multi-stage stochastic integer programming approach for capacity expansion under uncertainty. Journal of Global Optimisation, 26, 3–24.

Ahmed, S., King, A., Parija, G (2003): A multi-stage stochastic integer programming approach for capacity expansion under uncertainty. Journal of Global Optimisation, 26(2003), 3–24.

Conejo, A. J., Carrión, M., Morales, J. (2010). Decision making under uncertainty in electricity markets, international series in operations research and management science series, Springer.

Duenas, P., Reneses, J., & Barquin, J. (2011). Dealing with multi-factor uncertainty in electricity markets by combining Monte Carlo simulation with spatial interpolation techniques. Generation, Transmission & Distribution, IET, 5, 323–331.

Roques, F.A., Nuttall, W.J., Newbery, D. (2006). Using probabilistic analysis to value power generation investments under uncertainty. EPRG working paper.

Bosetti V., Golub A., Markandya A., Massetti E., Tavoni M. (2008). Abatement cost uncertainty and policy instrument selection under a stringent climate policy. A dynamic analysis, Fondazione Eni Enrico Mattei Working Paper Series, Climate change modelling and policy, 15 2008.

Green, R. (2008). Carbon tax or carbon permits: the impact on generators’ risks. The Energy Journal, 29, 67–89.

Kirschen, D. S., Strbac, G., Cumperayot, P., & de Paiva Mendes, D. (2000). Factoring the elasticity of demand in electricity prices. IEEE Transactions on Power Systems, 15, 612–617.

Fragkos, P., Kouvaritakis, N., & Capros, P. (2015). Incorporating uncertainty into world energy modelling: the PROMETHEUS Model. Environmental Modelling & Assessment, Springer, 20(5), 549–569.

Capros, P., De Vita, A., Fragkos, P., Kouvaritakis, N., Paroussos, L., Fragkiadakis, K., Tasios, N., & Siskos, P. (2015). The impact of hydrocarbon resources and GDP growth assumptions for the evolution of the EU energy system for the medium and long term. Energy Strategy Reviews, 6, 64–79.

E3MLab (2015). The PROMETHEUS model, Available at: http://www.e3mlab.eu/e3mlab/PROMETHEUS%20Manual/prometheus_documentation.pdf.

Capros, P., De Vita, et al. (2016). EU reference scenario 2016 - energy, transport and GHG emissions trends to 2050. EUROPEAN COMMISSION directorate - general for energy, directorate - general for climate action and directorate - general for mobility and transport.

Awerbuch, S. (2006). Portfolio-based electricity generation planning: policy implications for renewables and energy security. Mitigation and Adaptation Strategies for Global Change, 11, 693–710.

European Commission, energy roadmap 2050, impact, in: assessment and scenario analyses, 2011. Documentation available at: http://ec.europa.eu/energy/energy2020/roadmap/doc/roadmap2050_ia_20120430_en. pdf.

Ackoij, W. et al. (2011). Chance constrained programming and its applications to energy management. Stochastic optimization—seeing the optimal for the uncertain. In-Tech.

Linderoth, J. (2003). Chance constrained programming. Retrieved 18 May 2017, Available at: http://homepages.cae.wisc.edu/~linderot/classes/ie495/lecture22.pdf.

Spiegelhalter, D. J., & Riesch, H. (2011). Don’t know, can’t know: embracing deeper uncertainties when analysing risks. Philosophical Transactions. Series A, Mathematical, Physical, and Engineering Sciences, 369(1956), 4730–4750.

Arora V. (2013). An evaluation of macro-economic models for use at EIA, EIA Working Paper Series, Dec 2013.

Little, J. D. C., Murty, K. G., Sweeney, D. W., & Karel, C. (1963). An algorithm for the traveling salesman problem. Operations Research, 11(6), 972–989. https://doi.org/10.1287/opre.11.6.972.

Rebennack, S. (2016). Combining sampling-based and scenario-based nested benders decomposition methods: application to stochastic dual dynamic programming. Mathematical Programming, 156(1), 343–389.

Pietzcker, R. C., Ueckerdt, F., Carrara, S., de Boer, S. H., Després, J., Fujimori, S., et al. (2017). System integration of wind and solar power in integrated assessment models: a cross-model evaluation of new approaches. Energy Economics, 64, 583–599.

Shortle, J., Rebennack, S., & Glover, F. W. (2014). Transmission-capacity expansion for minimizing blackout probabilities. IEEE Transactions on Power Systems, 29(1), 43–52.

Rebennack, S. (2014). Generation expansion planning under uncertainty with emissions quotas. Electric Power Systems Research, 114, 78–85.

Decision (EU) 2015/1814 of the European Parliament and of the council, concerning the establishment and operation of a market stability reserve for the union greenhouse gas emission trading scheme and amending directive 2003/87/EC, 6 Oct 2015.

DeJonghe, C., Hobbs, B. F., & Belmans, R. (2012). Optimal generation mix with short-term demand response and wind penetration. IEEE Transactions on Power Systems, 27(2), 830–839.

European Commission (2014). Impact assessment accompanying the document a policy framework for climate and energy in the period from 2020 up to 2030 European Council (2011) European Council Conclusions, 4th February 2011, EUCO 2/1/11 REV 1, 8 March 2011, Brussels.

Pohekar, S. D., & Ramachandran, M. (2004). Application of multi-criteria decision making to sustainable energy planning—a review. Renewable and Sustainable Energy Reviews, 8, 365–381.

Ehrgott, M., Stewart, T. J., & Wallenius, J. (2010). Multiple criteria decision making for sustainable energy and transportation systems. New York: Springer.

Author information

Authors and Affiliations

Corresponding author

Appendices

Annex A

The figure below presents various types of distributions of rates of return obtained from PROMETHEUS stochastic results (distributions are hypothetical and are used for illustrative purposes). The distribution at the bottom right-hand side can be adequately represented by normal distribution with the same mean and standard deviation. The distributions at the top of figure are typical of the more speculative/uncertain power generation technologies that are asymmetric and display high skewness, i.e., the top left figure illustrates a case with high probabilities for low profitability and relatively small probabilities for high rates of return. The multi-modal distribution defies all attempts to fit a normal approximation and it is essentially characterized by virtually discrete clusters for low or high return on investment.

Examples of the probability distributions of rates of return of technologies as emerging from PROMETHEUS analysis:

Annex B

Equations below are used to calculate revenues and upfront capital investment expenditures respectively (in each Monte Carlo experiment). Revenues are calculated on annual basis and then are aggregated over the lifetime of investment to determine annual rate of return of each technological option.

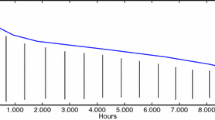

Parameter hours represents the required operation hours of power plants (considered as 7000 per year in our base load example), capfact j is the availability factor of technology j (uncertain and derived from PROMETHEUS results), while elcprice represents electricity price for industrial consumers, which is also uncertain, derived from PROMETHEUS stochastic projections and is based on the evolution of long-term average power generation and distribution cost. Parameters vom j and eff j symbolize variable costs of Operation and maintenance (O&M) and technical efficiency of technologies, respectively, which are derived from the technology progress mechanisms of PROMETHEUS, fprice j represents the price for fossil fuels used in electricity production (from PROMETHEUS analysis), parameter CV is the uncertain carbon price (used as a measure for climate policy intensity), emfac j is the deterministic emissions factor per fossil fuel, cdist is the transport and distribution costs of electricity to industrial consumers, and the variable fc j represent fixed O&M costs.

Stochastic capital outlays are calculated from Eq. (17) where ovcc2030 j represents overnight cost for investment in 2030 (which is stochastic and derived from PROMETHEUS results), decshare j refers to decommissioning costs of power production technologies, ctime j is the uncertain construction period of time of technology j, lft j is the lifetime of technology j, while parameter ir represents stochastic long term interest rate that is derived from PROMETHEUSS macro-economic module.

Rights and permissions

About this article

Cite this article

Fragkos, P., Kouvaritakis, N. Investments in Power Generation Under Uncertainty—a MIP Specification and Large-Scale Application for EU. Environ Model Assess 23, 511–527 (2018). https://doi.org/10.1007/s10666-017-9583-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10666-017-9583-1