Abstract

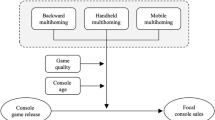

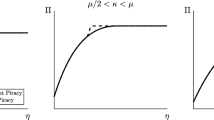

This paper examines the role of software piracy in digital platforms where a platform provider makes a decision of how much software to produce in-house and how much to outsource from a third-party software provider. Using a vertical differentiation model, we theoretically investigate how piracy influences the software outsourcing decision. We find that when piracy is intermediate, the loss in in-house software profits due to piracy outweighs the loss in licensing fee profits. As a result, an increase in piracy leads to more outsourcing. However, when piracy is high, it becomes too expensive for the platform provider to subsidize the software provider, resulting in a decrease in outsourcing. Moreover, when software variety is also endogenously chosen by firms, the platform provider’s incentive to develop software variety in-house depends not only on the return from software profits but also on the return from hardware profits. Under such a situation, an increase in piracy always leads to less outsourcing and less total software variety. To provide additional insights on the outsourcing decision, we conduct empirical analyses using data from the U.S. handheld video game market between 2004 and 2012. This market is a classical two-sided market, dominated by two handheld platforms (Nintendo DS and Sony PlayStation Portable) and is known to have suffered from software piracy significantly. Our regression results show that in this market, piracy increases outsourcing but has no effect on the total software variety.

Similar content being viewed by others

Notes

We thus interpret the piracy parameter in our model as the ease of piracy. See Section 2.

Throughout the paper, we use hardware and platform interchangeably.

Two platforms in our empirical application, Nintendo DS and Sony PlayStation Portable, have this feature. For example, the hardware benefit for Nintendo DS may come from pre-existing software (Rasch and Wenzel 2013) as Nintendo DS is backward-compatible with Game Boy Advance cartridges. Sony PlayStation Portable has a built-in media player that can can play music and video, and an internet web browser.

Since the analytical analysis alone is intractable, we show the result based on a mixture of analytical and numerical analyses.

Once again, we show the result based on a mixture of analytical and numerical analyses.

Note that this is also equivalent to a model where the hardware firm sets the total software variety n and the proportion of in-house software δ (so that ni = nδ and ns = n(1 − δ)).

We focus on non-negative commission rates.

We note that our theoretical model examines a monopoly platform’s decision. Although the empirical application in this section has two platforms, NDS and PSP are highly differentiated from one another. PSP’s target consumer segment was conventional gamers who appreciate high-quality graphics in a portable device, and NDS went after children and casual gamers and offered a new way of playing games with touch screen and pen.

We note that neither Nintendo nor Sony developed software for its rival’s platform.

Our theoretical prediction is based on a static model, but our empirical measures are observed at the monthly level. Although developing a dynamic model is beyond the scope of this paper, we conjecture that our prediction on the outsourcing decision will extend to a dynamic setting. In a dynamic variant of our model, consumers in subsequent periods will have a lower α, which reduces the equilibrium hardware price over time (Nair 2007; Liu 2010). If consumers are forward-looking, they might delay purchase and this will increase α1 in Fig. 1 in period 1. However, as we saw, since the optimal δ is independent of ph at least for an interior solution, we expect that the impact of γ on δ will still remain unchanged.

We note that it is possible that in-house software is developed by an independent software developer and published by a platform provider (see Gil and Warzynski 2015; Ishihara and Rietveld 2017). In this study, we focus on publisher identity because the decision to release a game is made by publishers.

The two-month average number is the average of the values at time t − 1 and t for t > 1. For t = 1 (release month for handheld devices), we simply use that month’s value. Even with this operation, there is one missing value for PSP, and thus the regression uses 171 observations.

In fact, the R4 cartridge for NDS became widely well-known even among primary school children in Japan, and many parents (who do not play video games) did not realize it is illegal and they made inquiries at video game shops as to how to use the R4 cartridge to make downloaded games playable on NDS.

Google Trends (https://trends.google.com/trends/) shows how often a particular keyword is searched relative to the total search volume.

We did not use “nds” because “ds” was a more widely used term for referring to Nintendo DS. For PSP, we did not include a term “Magic Memory Stick,” mainly because it makes the search volume significantly smaller. Also, consumers only need to buy a Pandora battery (Magic Memory Stick can be easily made by downloading software and storing it in a regular Memory Stick).

We also tried adding the cumulative system software updates, but it was not significant and did not affect our main results.

Some video games are released both in the U.S. and Japan, but not necessarily in the same month. Most games have either U.S. or Japan as a primary target market, and based on the performance in the primary market, they may also be released in the other market. Even popular games that are targeted at both markets from the beginning may not be released in the same month. For example, Pokémon Diamond Version, one of the best-selling Nintendo DS games, was released in April 2007 in the U.S., and in September 2006 in Japan.

For observations where the timing of product development decision falls in the pre-release period of a platform (e.g. the decision on games released two months after the platform release), we assume that the cumulative hardware sales and software updates were zero. Also, since piracy was not an issue at all in the early stage of the platforms’ lifecycle, we assume that Google trends’ value was zero for those observations.

We note that Nintendo was aware of the piracy issue in 2007. For example, Nintendo commented in Nov. 2007 that it is “keeping a close eye on the products and studying them” (https://kotaku.com/nintendo-and-54-companies-battle-evil-r4-in-court-5030319).

While software firms tried to embed codes in games that prevented pirates from playing pirated versions, such prevention codes were quickly cracked by hackers and became useless.

For simplicity, we drop some of the constraints that will obviously not bind (e.g., ph, ps ≥ 0).

The upper bound of γ is obtained when the marginal return on δ equals the marginal cost when δ = 1, i.e., \(\frac {\bar {\alpha }^{2}(1-\gamma )}{4}=C_{h}\).

We also have Qh(ph) ≥ Qi(pi), but the latter is always \(\frac {\bar {\alpha }}{2}\) and the former is greater than or equal to \(\frac {\bar {\alpha }}{2}\). Thus the constraint is always satisfied.

References

Chao, Y., & Derdenger, T. (2013). Mixed bunding in Two-Sided markets in the presence of installed base effects. Management Science, 59(8), 1904–1926.

Church, J., & Gandal, N. (1992). Integration, complementary products, and variety. Journal of Economics & Management Strategy, 1(4), 651–675.

Clements, M.T., & Ohashi, H. (2005). Indirect network effects and the product cycle: video games in the U.S., 1994-2002. Journal of Industrial Economics, 53(4), 515–542.

Conner, K.R., & Rumelt, R.P. (1991). Software piracy: an analysis of protection strategies. Management Science, 37(2), 125–139.

Derdenger, T. (2014). Technological tying and the intensity of price competition: an empirical analysis of the video game industry. Quantitative Marketing and Economics, 12(2), 127–165.

Derdenger, T., & Kumar, V. (2013). The dynamic effects of bundling as a product strategy. Marketing Science, 32(6), 827–859.

Dubė, J.-P.H., Hitsch, G.J., Chintagunta, P.K. (2010). Tipping and concentration in markets with indirect network effects. Marketing Science, 29(2), 216–249.

Fukugawa, N. (2011). How Serious is Piracy in the Videogame Industry? Empirical Economics Letters, 10(3), 225–233.

Gil, R., & Warzynski, F. (2015). Vertical integration, exclusivity, and game sales performance in the US video game industry. Journal of Law, Economics, and Organization, 31(1), i143–i168.

Givon, M., Mahajan, V., Muller, E. (1995). Software piracy: estimation of lost sales and the impact on software diffusion. Journal of Marketing, 59(1), 29–37.

Ishihara, M., & Rietveld, J. (2017). The effect of acquisitions on product innovativeness, quality, and sales performance: Evidence from the console video game industry (2002-2010). Working paper.

Jain, S. (2008). Digital piracy: A competitive analysis. Marketing Science, 27 (4), 610–626.

Lahiri, A., & Dey, D. (2013). Effects of piracy on quality of information goods. Management Science, 59(1), 245–264.

Lee, R.S. (2013). Vertical integration and exclusivity in platform and Two-Sided markets. American Economic Review, 103(7), 2960–3000.

Liu, H. (2010). Dynamics of pricing in the video game console market: Skimming or Penetration? Journal of Marketing Research, 47(3), 428–443.

Nair, H. (2007). Intertemporal price discrimination with Forward-Looking consumers: an application to the US market for console Video-Games. Quantitative Marketing and Economics, 5(3), 239–292.

Newey, W.K., & West, K.D. (1987). A simple, positive Semi-Definite, heteroscedasticity and autocorrelation consistent covariance matrix. Econometrica, 55 (3), 703–708.

Peitz, M. (2004). A strategic approach to software protection: comment. Journal of Economics & Management Strategy, 13(2), 371–374.

Rasch, A., & Wenzel, T. (2013). Piracy in a Two-Sided software market. Journal of Economic Behavior & Organization, 88, 78–89.

Rasch, A., & Wenzel, T. (2015). The Impact of Piracy on Prominent and Non-prominent Sofwtare Developers. Telecommunications Policy, 39(8), 735–744.

Rochet, J.-C., & Tirole, J. (2006). Two-Sided Markets: a progress report. RAND Journal of Economics, 37(3), 645–667.

Rysman, M. (2009). The economics of Two-Sided markets. Journal of Economic Perspectives, 23(3), 125–143.

Shy, O., & Thisse, J.-F. (1999). A strategic approach to software protection. Journal of Economics & Management Strategy, 8(2), 163–190.

Sinha, R.K., Machado, F.S., Sellman, C. (2010). Don’t think twice, it’s all right: Music piracy and pricing in a DRM-free environment. Journal of Marketing, 74(2), 40–54.

Staiger, D., & Stock, J.H. (1997). Instrumental variables regression with weak instruments. Econometrica, 65(3), 557–586.

Takeyama, L.N. (1994). The welfare implications of unauthorized reproduction of intellectual property in the presence of demand network externalities. Journal of Industrial Economics, 42(2), 155–166.

Vernik, D.A., Purohit, D., Desai, P.S. (2011). Music downloads and the flip side of digital rights management. Marketing Science, 30(6), 1011–1027.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A

Appendix A

1.1 A.1 Proof of Proposition 1

The hardware firm’s problem is formulated as

subject to (1) Qh(ph) ≥ Qs(ps), and (2) \(Q_{h}(p_{h})\le \bar {\alpha }\).Footnote 25 The Lagrangian is then given by

and the Kuhn-Tucker conditions are

We solve this set of inequalities and equations. Below we examine every possible case.

- 1.

When both constraints (1) and (2) are not binding (λ1 = λ2 = 0): This is the case with an interior solution. We have

$$ \begin{array}{@{}rcl@{}} p_{h} &=& \frac{\bar{\alpha}\gamma+v}{2}, p_{s}=\frac{\bar{\alpha}(1-\gamma)}{2}\\ Q_{h} &=& \frac{\bar{\alpha}\gamma+v}{2\gamma}, Q_{s}=\frac{\bar{\alpha}}{4}. \end{array} $$Constraint (1) is satisfied for any γ because v > 0. Constraint (2) implies that \(\gamma \ge \frac {v}{\bar {\alpha }}\), and Assumption 1 (i.e., \(\bar {\alpha }>\sqrt {2}v\)) implies that the range of γ that supports this scenario is non-empty.

With the optimal ph and ps, the hardware firm’s profit is

$$ \pi_{h} = \frac{(\bar{\alpha}\gamma+v)^{2}}{4\gamma}+\frac{\bar{\alpha}^{2}(1-\gamma)}{4}-\frac{C_{h}}{2}. $$Now we check the condition for \(\pi _{h}\ge \bar {\alpha }v\), i.e., the hardware firm prefers to have software. This condition is equivalent to

$$ (\bar{\alpha}^{2}-2\bar{\alpha}v-2C_{h})\gamma + v^{2} \ge 0. $$When \(C_{h}\le \frac {\bar {\alpha }(\bar {\alpha }-2v)}{2}\), \(\pi _{h}>\bar {\alpha }v\) for any γ because v > 0. When \(C_{h}>\frac {\bar {\alpha }(\bar {\alpha }-2v)}{2}\), \(\pi _{h}\ge \bar {\alpha }v\) for \(\gamma \le \frac {v^{2}}{2C_{h}-\bar {\alpha }(\bar {\alpha }-2v)}\). For the latter case to be non-empty, we need \(\frac {v}{\bar {\alpha }}\le \frac {v^{2}}{2C_{h}-\bar {\alpha }(\bar {\alpha }-2v)}\), or \(C_{h}\le \frac {\bar {\alpha }(\bar {\alpha }-v)}{2}\).

In summary, this scenario is supported under the following conditions: (i) \(C_{h}\le \frac {\bar {\alpha }(\bar {\alpha }-2v)}{2}\) and \(\gamma \in \left [\frac {v}{\bar {\alpha }},1\right )\); (ii) \(C_{h}\in \left (\frac {\bar {\alpha }(\bar {\alpha }-2v)}{2},\frac {\bar {\alpha }(\bar {\alpha }-v)}{2}\right ]\) and \(\gamma \in \left [\frac {v}{\bar {\alpha }},\frac {v^{2}}{2C_{h}-\bar {\alpha }(\bar {\alpha }-2v)}\right ]\).

- 2.

When only constraint (2) is binding (λ1 = 0 and λ2 ≥ 0): This is the case with \(Q_{s}(p_{s})<Q_{h}(p_{h})=\bar {\alpha }\) (everyone buys hardware). We have

$$ \begin{array}{@{}rcl@{}} p_{h} &=& v, p_{s}=\frac{\bar{\alpha}(1-\gamma)}{2}\\ Q_{h} &=& \bar{\alpha}, Q_{s}=\frac{\bar{\alpha}}{4}. \end{array} $$Constraint (1) is satisfied for any γ. Since constraint (2) is binding, we need λ1 ≥ 0, which is equivalent to \(\gamma \le \frac {v}{\bar {\alpha }}\). Assumption 1 implies that the range of γ that supports this scenario is non-empty.

With the optimal ph and ps, the hardware firm’s profit is

$$ \pi_{h} = \bar{\alpha}v+\frac{\bar{\alpha}^{2}(1-\gamma)}{4} - \frac{C_{h}}{2}, $$and it is easy to check that \(\pi _{h}\ge \bar {\alpha }v\) for \(\gamma \le 1-\frac {2C_{h}}{\bar {\alpha }^{2}}\). In order for the range of γ that supports this scenario to be non-empty, we need \(1-\frac {2C_{h}}{\bar {\alpha }^{2}}>0\), or \(C_{h}<\frac {\bar {\alpha }^{2}}{2}\).

In summary, the following conditions support this scenario: (i) \(C_{h}\le \frac {\bar {\alpha }(\bar {\alpha }-v)}{2}\) and \(\gamma \in \left (0,\frac {v}{\bar {\alpha }}\right ]\); (ii) \(C_{h}\in \left (\frac {\bar {\alpha }(\bar {\alpha }-v)}{2},\frac {\bar {\alpha }^{2}}{2}\right )\) and \(\gamma \in \left (0,1-\frac {2C_{h}}{\bar {\alpha }^{2}}\right )\).

- 3.

When only constraint (1) is binding (λ1 ≥ 0 and λ2 = 0): This is the case with \(Q_{h}(p_{h})=Q_{s}(p_{s})<\bar {\alpha }\). This constraint gives the following relationship between ps and ph:

$$ p_{s} = \frac{(1-\gamma)(p_{h}-v)}{\gamma}. $$Substituting this into the first-order conditions, we get \(\lambda _{1}=-\frac {v}{\gamma }<0\) for any γ. Thus this scenario is not supported.

- 4.

When both constraints are binding (λ1 ≥ 0 and λ2 ≥ 0): This is the case with \(Q_{h}(p_{h})=Q_{s}(p_{s})=\bar {\alpha }\). From the discussion above, we can obtain

$$ \begin{array}{@{}rcl@{}} p_{h} &=& v, p_{s}=0\\ Q_{h} &=& Q_{s} = \bar{\alpha}. \end{array} $$Constraint (1) requires λ1 ≥ 0. However, substituting the above optimal prices into the first-order conditions, we can show that \(\lambda _{1}=-\bar {\alpha }(1-\gamma )<0\). Thus, this scenario is not supported.

Combining the results, we have:

- 1.

When \(C_{h}\le \frac {\bar {\alpha }(\bar {\alpha }-2v)}{2}\), the hardware firm will develop software for γ ∈ (0, 1).

For \(\gamma \in \left (0,\frac {v}{\bar {\alpha }}\right ]\), the optimal strategy is characterized by scenario 2.

For \(\gamma \in \left (\frac {v}{\bar {\alpha }},1\right )\), the optimal strategy is characterized by scenario 1.

- 2.

When \(C_{h}\in \left (\frac {\bar {\alpha }(\bar {\alpha }-2v)}{2},\frac {\bar {\alpha }(\bar {\alpha }-v)}{2}\right ]\), the hardware firm will develop software if \(\gamma \in \left (0,\frac {v^{2}}{2C_{h}-\bar {\alpha }(\bar {\alpha }-2v)}\right ]\). Otherwise, it will only sell hardware.

For \(\gamma \in \left (0,\frac {v}{\bar {\alpha }}\right ]\), the optimal strategy is characterized by scenario 2.

For \(\gamma \in \left (\frac {v}{\bar {\alpha }},\frac {v^{2}}{2C_{h}-\bar {\alpha }(\bar {\alpha }-2v)}\right )\), the optimal strategy is characterized by scenario 1.

- 3.

When \(C_{h}\in \left (\frac {\bar {\alpha }(\bar {\alpha }-v)}{2},\frac {\bar {\alpha }^{2}}{2}\right )\), the hardware firm will develop software if \(\gamma \in \left (0,1-\frac {2C_{h}}{\bar {\alpha }^{2}}\right )\). Otherwise, it will only sell hardware.

The optimal strategy is characterized by scenario 2.

- 4.

When \(C_{h}\ge \frac {\bar {\alpha }^{2}}{2}\), the hardware firm will not develop software for γ ∈ (0, 1).

In summary, when Ch is sufficiently low, regardless of γ’s value, software is supplied. When γ is small, all consumers buy hardware. When Ch is intermediate, the hardware firm does not supply software if γ is large. This is because the negative effect of software piracy on in-house software is so large that it would not make sense to pay Ch and sell software. When Ch is large, it is too costly to supply software so the hardware firm just sells hardware.

1.2 A.2 Proof of Proposition 2

The software provider’s problem given the licensing fee f is given by

The first-order condition with respect to ps yields

The hardware provider’s problem is then given by

subject to (1) Qh(ph) ≥ Qs(f), (2) \(Q_{h}(p_{h})\le \bar {\alpha }\), and (3) πs(f) ≥ 0. The Lagrangian is

The Kuhn-Tucker conditions are

We solve this set of inequalities and equations. Below we examine every possible case.

- 1.

When all constraints are not binding (λ1 = λ2 = λ3 = 0): This is the case with interior solutions. We have

$$ \begin{array}{@{}rcl@{}} p_{h} &=& \frac{\bar{\alpha}\gamma+v}{2}, f=\frac{\bar{\alpha}(1-\gamma)}{2}\\ Q_{h} &=& \frac{\bar{\alpha}\gamma+v}{2\gamma}, Q_{s}=\frac{\bar{\alpha}}{4}. \end{array} $$Constraint (1) is satisfied for any γ. Non-binding constraint (2) implies that \(\gamma \ge \frac {v}{\bar {\alpha }}\). Finally, non-binding constraint (3) implies that \(\gamma \le 1-\frac {8C_{s}}{\bar {\alpha }^{2}}\). The range of γ that supports this scenario is non-empty if \(\frac {v}{\bar {\alpha }}\le 1-\frac {8C_{s}}{\bar {\alpha }^{2}}\) or \(C_{s}\le \frac {\bar {\alpha }(\bar {\alpha }-v)}{8}\).

With the optimal ph and f, the hardware firm’s profit is

$$ \pi_{h} = \frac{(\bar{\alpha}\gamma+v)^{2}}{4\gamma}+\frac{\bar{\alpha}^{2}(1-\gamma)}{8}, $$and it is easy to check that \(\pi _{h}>\bar {\alpha }v\) for any γ in the range. Thus, the hardware firm prefers to have software developed. Moreover,

$$ \frac{\partial \pi_{h}}{\partial \gamma} = \frac{\bar{\alpha}^{2}}{8}-\frac{v^{2}}{4\gamma^{2}}. $$Thus, \(\frac {\partial \pi _{h}}{\partial \gamma }>0\) for \(\gamma >\frac {\sqrt {2}v}{\bar {\alpha }}\).

In summary, this scenario is supported under the following conditions: \(C_{h}<\frac {\bar {\alpha }(\bar {\alpha }-v)}{8}\) and \(\gamma \in \left [\frac {v}{\bar {\alpha }},1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right ]\). Moreover, if \(C_{h}<\frac {\bar {\alpha }(\bar {\alpha }-\sqrt {2}v)}{8}\), then \(\frac {\partial \pi _{h}}{\partial \gamma }\le 0\) for \(\gamma \in \left [\frac {v}{\bar {\alpha }},\frac {\sqrt {2}v}{\bar {\alpha }}\right ]\) and \(\frac {\partial \pi _{h}}{\partial \gamma }>0\) for \(\gamma \in \left (\frac {\sqrt {2}v}{\bar {\alpha }},1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right ]\). If \(C_{h}\in \left [\frac {\bar {\alpha }(\bar {\alpha }-\sqrt {2}v)}{8},\frac {\bar {\alpha }(\bar {\alpha }-v)}{8}\right )\), \(\frac {\partial \pi _{h}}{\partial \gamma }\le 0\) for all \(\gamma \in \left [\frac {v}{\bar {\alpha }},1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right ]\).

- 2.

When only constraint (3) is binding (λ1 = λ2 = 0 and λ3 ≥ 0): This is the case where πs(f) = 0. We have

$$ \begin{array}{@{}rcl@{}} p_{h} &=&\frac{\bar{\alpha}\gamma+v}{2}, f = \bar{\alpha}(1-\gamma)-\sqrt{2(1-\gamma)C_{s}}\\ Q_{h} &=& \frac{\bar{\alpha}\gamma+v}{2\gamma}, Q_{s}=\sqrt{\frac{C_{s}}{2(1-\gamma)}}. \end{array} $$Constraint (1) requires \(\frac {\bar {\alpha }\gamma +v}{2\gamma }\ge \sqrt {\frac {C_{s}}{2(1-\gamma )}}\). Let \(g(\gamma ) = \frac {\bar {\alpha }\gamma +v}{2\gamma }- \sqrt {\frac {C_{s}}{2(1-\gamma )}}\). It is easy to check that \(\frac {\partial g(\gamma )}{\partial \gamma }<0\ \forall \gamma \), \(\lim _{\gamma \rightarrow 0}g(\gamma )=+\infty \), and \(\lim _{\gamma \rightarrow 1}g(\gamma )=-\infty \). Thus, there exist a unique threshold, say, γ1 ∈ (0, 1) such that g(γ) ≥ 0 for all γ ≤ γ1. Constraint (2) implies that \(\gamma \ge \frac {v}{\bar {\alpha }}\). Constraint (3) is binding thus we need λ3 ≥ 0, which is equivalent to \(\gamma \ge 1-\frac {8C_{s}}{\bar {\alpha }^{2}}\). The range of γ that supports this scenario is non-empty if g(γ) > 0 at \(\gamma =\max \limits \left \{\frac {v}{\bar {\alpha }},1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right \}\). Suppose that \(\frac {v}{\bar {\alpha }}<1-\frac {8C_{s}}{\bar {\alpha }^{2}}\) (or \(C_{s}<\frac {\bar {\alpha }(\bar {\alpha }-v)}{8}\)). Then, it is easy to check \(g(\gamma =1-\frac {8C_{s}}{\bar {\alpha }^{2}})>0\), so \(\gamma _{1}>1-\frac {8C_{s}}{\bar {\alpha }^{2}}\). If \(\frac {v}{\bar {\alpha }}\ge 1-\frac {8C_{s}}{\bar {\alpha }^{2}}\) (or \(C_{s}\ge \frac {\bar {\alpha }(\bar {\alpha }-v)}{8}\)), then \(g(\gamma =\frac {v}{\bar {\alpha }})\ge 0\) (i.e., \(\frac {v}{\bar {\alpha }}\le \gamma _{1}\)) if \(C_{s}\le 2\bar {\alpha }(\bar {\alpha }-v)\). Together, the range of γ is non-empty if \(C_{s}\le 2\bar {\alpha }(\bar {\alpha }-v)\).

With the optimal ph and f, the hardware firm’s profit is

$$ \pi_{h} = \frac{(\bar{\alpha}\gamma+v)^{2}}{4\gamma}+\left( \bar{\alpha}(1-\gamma)-\sqrt{2(1-\gamma)C_{s}}\right)\sqrt{\frac{C_{s}}{2(1-\gamma)}}. $$When \(\gamma \ge \frac {v}{\bar {\alpha }}\), not everyone buys hardware and \(p_{h}Q_{h} = \frac {(\bar {\alpha }\gamma +v)^{2}}{4\gamma }\ge \bar {\alpha }v\). Thus, the above equation for πh suggests that πh can be lower than \(\bar {\alpha }v\) only when the optimal licensing fee is negative:

$$ \bar{\alpha}(1-\gamma)-\sqrt{2(1-\gamma)C_{s}}<0 \Leftrightarrow \gamma > 1-\frac{2C_{s}}{\bar{\alpha}^{2}}. $$We first check if a negative licensing fee could actually happen within the above range of γ. When \(\frac {v}{\bar {\alpha }}>1-\frac {2C_{s}}{\bar {\alpha }^{2}}\) (or \(C_{s}>\frac {\bar {\alpha }(\bar {\alpha }-v)}{2}\)), then the condition for this scenario to be non-empty (\(C_{s}\le 2\bar {\alpha }(\bar {\alpha }-v)\)) implies that \(1-\frac {2C_{s}}{\bar {\alpha }^{2}}<\gamma _{1}\). If \(\frac {v}{\bar {\alpha }}\le 1-\frac {2C_{s}}{\bar {\alpha }^{2}}\), then it can be shown that \(g(\gamma =1-\frac {2C_{s}}{\bar {\alpha }^{2}})=\frac {\bar {\alpha }^{2}v}{2(\bar {\alpha }^{2}-2C_{s})}>0\). Thus, the negative licensing fee could indeed happen. Below, we focus on \(\gamma \in \left (1-\frac {2C_{s}}{\bar {\alpha }^{2}},\gamma _{1}\right ]\).

First, note that

$$ \frac{\partial \pi_{h}}{\partial \gamma} = \frac{\bar{\alpha}^{2}}{4} - \frac{v^{2}}{4\gamma^{2}} - \frac{\bar{\alpha}}{2}\sqrt{\frac{C_{s}}{2(1-\gamma)}}. $$We can show that for \(\gamma > 1-\frac {2C_{s}}{\bar {\alpha }^{2}}\), \(\sqrt {\frac {C_{s}}{2(1-\gamma )}}>\frac {\bar {\alpha }}{2}\). Thus, we have \(\frac {\partial \pi _{h}}{\partial \gamma }<0\) for \(\gamma \in \left (1-\frac {2C_{s}}{\bar {\alpha }^{2}},\gamma _{1}\right ]\). Given this, if \(1-\frac {2C_{s}}{\bar {\alpha }^{2}}<\frac {v}{\bar {\alpha }}\) (or \(C_{s}>\frac {\bar {\alpha }(\bar {\alpha }-v)}{2}\)), then we have \(\pi _{h}<\bar {\alpha }v\) for \(\gamma \in \left [\frac {v}{\bar {\alpha }},\gamma _{1}\right ]\) because \(\pi _{h}<\bar {\alpha }v\) at \(\gamma =\frac {v}{\bar {\alpha }}\). For \(C_{s}\le \frac {\bar {\alpha }(\bar {\alpha }-v)}{2}\), since \(\pi >\bar {\alpha }v\) at \(\gamma =1-\frac {2C_{s}}{\bar {\alpha }^{2}}\), we can possibly have a unique threshold,say, \(\gamma _{2}\in \left (1-\frac {2C_{s}}{\bar {\alpha }^{2}},\gamma _{2}\right ]\) such that \(\pi _{h}<\bar {\alpha }v\) for γ ∈ (γ2, γ1]. For example, we can numerically check that for \((\bar {\alpha },v,C_{s})=(1.0,0.5,0.2)\), there exists such γ2 < γ1, but for \((\bar {\alpha },v,C_{s})=(1.5,0.5,0.2)\), \(\pi _{h}>\bar {\alpha }v\) at γ = γ1. Since we cannot derive a closed form for the thresholds, let us define \({\Theta }\equiv \{\theta =(\bar {\alpha },v,C_{s}):0<v<\bar {\alpha },0<C_{s}<\frac {\bar {\alpha }(\bar {\alpha }-v)}{2},\pi _{h}(\gamma =\gamma _{1})\ge \bar {\alpha }v\}\).

We can now summarize the range of γ that supports this scenario. When \(C_{h}<\frac {\bar {\alpha }(\bar {\alpha }-v)}{8}\), \(\gamma \in \left [1-\frac {8C_{s}}{\bar {\alpha }^{2}},\gamma _{1}\right ]\) for \((\bar {\alpha },v,C_{s})\in {\Theta }\). For \((\bar {\alpha },v,C_{s})\notin {\Theta }\), there exists a unique \(\gamma _{2}(\theta )\in \left (1-\frac {2C_{s}}{\bar {\alpha }^{2}},\gamma _{1}\right )\) such that \(\pi _{h}<\bar {\alpha }v\) for all γ ∈ (γ2(θ), γ1]. When \(C_{h}\in \left [\frac {\bar {\alpha }(\bar {\alpha }-v)}{8},\frac {\bar {\alpha }(\bar {\alpha }-v)}{2}\right ]\), \(\gamma \in \left [\frac {v}{\bar {\alpha }},\gamma _{1}\right ]\) for \((\bar {\alpha },v,C_{s})\in {\Theta }\). For \((\bar {\alpha },v,C_{s})\notin {\Theta }\), there exists a unique \(\gamma _{2}(\theta )\in \left (1-\frac {2C_{s}}{\bar {\alpha }^{2}},\gamma _{1}\right )\) such that \(\pi _{h}<\bar {\alpha }v\) for all γ ∈ (γ2(θ), γ1]. When \(C_{h}\in \left (\frac {\bar {\alpha }(\bar {\alpha }-v)}{2},2\bar {\alpha }(\bar {\alpha }-v)\right ]\), \(\gamma \in \left [\frac {v}{\bar {\alpha }},\gamma _{1}\right ]\). But as we saw, \(\pi _{h}<\bar {\alpha }v\) for this range of γ and the hardware firm prefers not to have software.

Finally, we examine the effect of γ on πh. We saw that for \(\gamma \in \left (1-\frac {2C_{s}}{\bar {\alpha }^{2}},\gamma _{1}\right ]\), we have \(\frac {\partial \pi _{h}}{\partial \gamma }<0\). We thus consider \(\gamma \in \left [\max \limits \left \{\frac {v}{\bar {\alpha }},1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right \},1-\frac {2C_{s}}{\bar {\alpha }^{2}}\right ]\). Note that

$$ \begin{array}{@{}rcl@{}} \frac{\partial^{2} \pi_{h}}{\partial^{2} \gamma} &=& \frac{v^{2}}{2\gamma^{3}}-\frac{\bar{\alpha}}{4(1-\gamma)}\sqrt{\frac{C_{s}}{2(1-\gamma)}}\\ &=& \frac{v^{2}}{2(1-\gamma)\sqrt{1-\gamma}}\left( \frac{(1-\gamma)\sqrt{1-\gamma}}{\gamma^{3}}-\frac{\bar{\alpha}\sqrt{C_{s}}}{2\sqrt{2}v^{2}}\right). \end{array} $$It is easy to check that \(\lim _{\gamma \rightarrow 0}\frac {\partial ^{2} \pi _{h}}{\partial ^{2} \gamma }=\infty \) and \(\lim _{\gamma \rightarrow 1}\frac {\partial ^{2} \pi _{h}}{\partial ^{2} \gamma }=-\infty \). Let \(h(\gamma )=\frac {(1-\gamma )\sqrt {1-\gamma }}{\gamma ^{3}}-\frac {\bar {\alpha }\sqrt {C_{s}}}{2\sqrt {2}v^{2}}\). We can show that \(\frac {\partial h(\gamma )}{\partial \gamma }<0\) for all γ, and thus, there exists a unique threshold, say, γ3 such that \(\left .\frac {\partial ^{2} \pi _{h}}{\partial ^{2} \gamma }\right |_{\gamma =\gamma _{3}}=0\). We can then consider three possibilities in terms of where γ3 falls into the range of γ above. Suppose \(\gamma _{3}>1-\frac {2C_{s}}{\bar {\alpha }^{2}}\). Then \(\frac {\partial ^{2} \pi _{h}}{\partial ^{2} \gamma }>0\) for \(\gamma \in \left [\max \limits \left \{\frac {v}{\bar {\alpha }},1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right \},1-\frac {2C_{s}}{\bar {\alpha }^{2}}\right ]\). Since \(\frac {\partial \pi _{h}}{\partial \gamma }<0\) at \(\gamma =1-\frac {2C_{s}}{\bar {\alpha }^{2}}\), we have \(\frac {\partial \pi _{h}}{\partial \gamma }<0\) for \(\forall \gamma \in \left [\max \limits \left \{\frac {v}{\bar {\alpha }},1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right \},1-\frac {2C_{s}}{\bar {\alpha }^{2}}\right ]\). For this to happen, we need \(h(\gamma =1-\frac {2C_{s}}{\bar {\alpha }^{2}})>0\). Next, if \(\gamma _{3}<\max \limits \left \{\frac {v}{\bar {\alpha }},1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right \}\), then \(\frac {\partial ^{2} \pi _{h}}{\partial ^{2} \gamma }<0\) for \(\gamma \in \left [\max \limits \left \{\frac {v}{\bar {\alpha }},1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right \},1-\frac {2C_{s}}{\bar {\alpha }^{2}}\right ]\). Thus the sign of \(\frac {\partial \pi _{h}}{\partial \gamma }\) depends on whether \(\frac {\partial \pi _{h}}{\partial \gamma }\) is positive or negative at \(\gamma =\max \limits \left \{\frac {v}{\bar {\alpha }},1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right \}\). First, when \(\frac {v}{\bar {\alpha }}<1-\frac {8C_{s}}{\bar {\alpha }^{2}}\) (or \(C_{s}<\frac {\bar {\alpha }(\bar {\alpha }-v)}{8}\)), we have

$$ \left.\frac{\partial \pi_{h}}{\partial \gamma}\right|_{\gamma=1-\frac{8C_{s}}{\bar{\alpha}^{2}}} = \frac{\bar{\alpha}^{2}}{4}\left[\frac{1}{2}-\left( \frac{\bar{\alpha}v}{\bar{\alpha}^{2}-8C_{s}}\right)^{2}\right], $$which is positive if \(C_{s}<\frac {\bar {\alpha }(\bar {\alpha }-\sqrt {2}v)}{8}\). Thus, when \(C_{s}<\frac {\bar {\alpha }(\bar {\alpha }-\sqrt {2}v)}{8}\), there exists a unique threshold, say, γ4 such that \(\frac {\partial \pi _{h}}{\partial \gamma }>0\) for \(\gamma \in \left (1-\frac {8C_{s}}{\bar {\alpha }^{2}},\gamma _{4}\right )\) and \(\frac {\partial \pi _{h}}{\partial \gamma }\le 0\) otherwise. If \(C_{s}\in \left [\frac {\bar {\alpha }(\bar {\alpha }-\sqrt {2}v)}{8},\frac {\bar {\alpha }(\bar {\alpha }-v)}{8}\right )\), then \(\frac {\partial \pi _{h}}{\partial \gamma }<0\) for all \(\gamma \in \left (1-\frac {8C_{s}}{\bar {\alpha }^{2}},1-\frac {2C_{s}}{\bar {\alpha }^{2}}\right )\). When \(\frac {v}{\bar {\alpha }}<1-\frac {8C_{s}}{\bar {\alpha }^{2}}\), it is easy to check

$$ \left.\frac{\partial \pi_{h}}{\partial \gamma}\right|_{\gamma=\frac{v}{\bar{\alpha}}} = -\frac{\bar{\alpha}}{2}\sqrt{\frac{\bar{\alpha}C_{s}}{2(\bar{\alpha}-v)}}<0\ \ \forall \gamma\in\left( \frac{v}{\bar{\alpha}},1-\frac{2C_{s}}{\bar{\alpha}^{2}}\right). $$Finally, if \(\gamma _{3}\in \left [\max \limits \left \{\frac {v}{\bar {\alpha }},1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right \},1-\frac {2C_{s}}{\bar {\alpha }^{2}}\right ]\), then \(\frac {\partial \pi _{h}}{\partial \gamma }\) is a parabola with a maximum at γ = γ3. Thus, we can check if the maximum attained can be positive. Analytically, it is cumbersome to show. However, our numerical analysis shows that there exists a set of \((\bar {\alpha },v,C_{s})\) such that the maximum is positive (e.g., \((\bar {\alpha },v,C_{s})=(1,0.2,0.1)\)). Under such a condition, there exist \(\gamma _{4},\gamma _{5}\in \left [\max \limits \left \{\frac {v}{\bar {\alpha }},1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right \},1-\frac {2C_{s}}{\bar {\alpha }^{2}}\right ]\) such that \(\frac {\partial \pi _{h}}{\partial \gamma }>0\) for γ ∈ (γ4, γ5) and \(\frac {\partial \pi _{h}}{\partial \gamma }\le 0\) otherwise.

- 3.

When only constraint (2) is binding (λ1 = 0, λ2 ≥ 0, and λ3 = 0): This is the case where \(Q_{h}(p_{h})=\bar {\alpha }\). We have

$$ \begin{array}{@{}rcl@{}} p_{h} &=& v, f = \frac{\bar{\alpha}(1-\gamma)}{2}\\ Q_{h} &=& \bar{\alpha}, Q_{s}=\frac{\bar{\alpha}}{4}. \end{array} $$Constraint (1) is satisfied for any γ. Constraint (2) is binding thus we need λ2 ≥ 0, which results in \(\gamma \le \frac {v}{\bar {\alpha }}\). Constraint (3) implies \(\gamma \le 1-\frac {8C_{s}}{\bar {\alpha }^{2}}\). The range of γ that supports this scenario is non-empty if \(1-\frac {8C_{s}}{\bar {\alpha }^{2}}>0\), or \(C_{s}<\frac {\bar {\alpha }^{2}}{8}\).

The hardware firm’s profit is \(\pi _{h}=\bar {\alpha }v+\frac {\bar {\alpha }^{2}(1-\gamma )}{8}\), which is greater than \(\bar {\alpha }v\) for any \(\gamma \le \min \limits \left \{\frac {v}{\bar {\alpha }},1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right \}\). Moreover, \(\frac {\partial \pi _{h}}{\partial \gamma }<0\).

In summary, this scenario is supported under the following conditions: (i) \(C_{s}\le \frac {\bar {\alpha }(\bar {\alpha }-v)}{8}\) and \(\gamma \in \left (0,\frac {v}{\bar {\alpha }}\right ]\); (ii) \(C_{s}\in \left [\frac {\bar {\alpha }(\bar {\alpha }-v)}{8},\frac {\bar {\alpha }^{2}}{8}\right ]\) and \(\gamma \in \left (0,1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right )\). In both cases, \(\frac {\partial \pi _{h}}{\partial \gamma }<0\).

- 4.

When constraints (2) and (3) are binding (λ1 = 0, λ2 ≥ 0, and λ3 ≥ 0): This is the case where \(Q_{s}(f)\le Q_{h}(p_{h})=\bar {\alpha }\) and πs(f) = 0. We have

$$ \begin{array}{@{}rcl@{}} p_{h} &=&v, f = \bar{\alpha}(1-\gamma)-\sqrt{2(1-\gamma)C_{s}}\\ Q_{h} &=& \bar{\alpha}, Q_{s}=\sqrt{\frac{C_{s}}{2(1-\gamma)}}. \end{array} $$Constraint (1) requires \(\bar {\alpha }\ge \sqrt {\frac {C_{s}}{2(1-\gamma )}}\), which is equivalent to \(\gamma \le 1-\frac {C_{s}}{2\bar {\alpha }^{2}}\). Constraint (2) is binding thus we need λ2 ≥ 0, or \(\gamma \le \frac {v}{\bar {\alpha }}\). Constraint (3) is also binding thus we need λ3 ≥ 0, or \(\gamma \ge 1-\frac {8C_{s}}{\bar {\alpha }^{2}}\). The range of γ that supports this scenario is \(\gamma \in \left [1-\frac {8C_{s}}{\bar {\alpha }^{2}},\min \limits \left \{\frac {v}{\bar {\alpha }},1-\frac {C_{s}}{2\bar {\alpha }^{2}}\right \}\right ]\). In order for this range to be non-empty, we need the following conditions. When \(\frac {v}{\bar {\alpha }}\le 1-\frac {C_{s}}{2\bar {\alpha }^{2}}\) (or \(C_{s}\le 2\bar {\alpha }(\bar {\alpha }-v)\)), we need \(1-\frac {8C_{s}}{\bar {\alpha }^{2}}\le \frac {v}{\bar {\alpha }}\), or \(C_{s}\ge \frac {\bar {\alpha }(\bar {\alpha }-v)}{8}\). When \(\frac {v}{\bar {\alpha }}>1-\frac {C_{s}}{2\bar {\alpha }^{2}}\), we need \(1-\frac {C_{s}}{2\bar {\alpha }^{2}}>0\), or \(C_{s}<2\bar {\alpha }^{2}\). Thus, the range of γ is non-empty if \(C_{s}\in \left [\frac {\bar {\alpha }(\bar {\alpha }-v)}{8},2\bar {\alpha }^{2}\right )\).

With the optimal ph and f, the hardware firm’s profit is

$$ \pi_{h} = \bar{\alpha}v+\left( \bar{\alpha}(1-\gamma)-\sqrt{2(1-\gamma)C_{s}}\right)\sqrt{\frac{C_{s}}{2(1-\gamma)}}. $$This is greater than or equal to \(\bar {\alpha }v\) as long as the licensing fee is non-negative, which implies \(\gamma \le 1- \frac {2C_{s}}{\bar {\alpha }^{2}}\). Since \(1- \frac {2C_{s}}{\bar {\alpha }^{2}}<1- \frac {C_{s}}{2\bar {\alpha }^{2}}\), the range of γ that supports this scenario becomes \(\gamma \in \left [1-\frac {8C_{s}}{\bar {\alpha }^{2}},\min \limits \left \{\frac {v}{\bar {\alpha }},1-\frac {2C_{s}}{\bar {\alpha }^{2}}\right \}\right ]\). When \(\frac {v}{\bar {\alpha }}\le 1-\frac {2C_{s}}{\bar {\alpha }^{2}}\) (or \(C_{s}\le \frac {\bar {\alpha }(\bar {\alpha }-v)}{2}\)), we need \(1-\frac {8C_{s}}{\bar {\alpha }^{2}}\le \frac {v}{\bar {\alpha }}\), or \(C_{s}\ge \frac {\bar {\alpha }(\bar {\alpha }-v)}{8}\). When \(\frac {v}{\bar {\alpha }}>1-\frac {2C_{s}}{\bar {\alpha }^{2}}\), we need \(1-\frac {2C_{s}}{\bar {\alpha }^{2}}>0\), or \(C_{s}<\frac {\bar {\alpha }^{2}}{2}\). Thus, the range of γ is non-empty if \(C_{s}\in \left [\frac {\bar {\alpha }(\bar {\alpha }-v)}{8},\frac {\bar {\alpha }^{2}}{2}\right )\). Moreover, note that

$$ \frac{\partial \pi_{h}}{\partial \gamma} = -\frac{\bar{\alpha}}{2}\sqrt{\frac{C_{s}}{2(1-\gamma)}}. $$Thus \(\frac {\partial \pi _{h}}{\partial \gamma }<0\).

In summary, this scenario is supported under the following conditions: (i) \(C_{s}\in \left [\frac {\bar {\alpha }(\bar {\alpha }-v)}{8}, \frac {\bar {\alpha }(\bar {\alpha }-v)}{2}\right ]\) and \(\gamma \in \left (\max \limits \left \{0,1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right \},\frac {v}{\bar {\alpha }}\right ]\); (ii) \(C_{s}\in \left (\frac {\bar {\alpha }(\bar {\alpha }-v)}{2},\frac {\bar {\alpha }^{2}}{2}\right ]\), \(\gamma \in \left (\max \limits \left \{0,1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right \},1-\frac {2C_{s}}{\bar {\alpha }^{2}}\right ]\). For \(C_{s}\in \left (\frac {\bar {\alpha }^{2}}{2},2\bar {\alpha }^{2}\right ]\), the optimal strategy is supported, but the hardware firm’s profits are lower than \(\bar {\alpha }v\). Moreover, we have \(\frac {\partial \pi _{h}}{\partial \gamma }<0\) under these conditions.

- 5.

When only constraint (1) is binding (λ1 ≥ 0 and λ2 = λ3 = 0): This is the case with Qh(ph) = Qs(f). Intuitively, this scenario will not be supported because when πs(f) > 0, the optimal licensing fee will be high enough to make Qs(f) smaller than Qh(ph). We can compute

$$ \begin{array}{@{}rcl@{}} p_{h} &= \frac{\bar{\alpha}(3-2\gamma)\gamma+(4-3\gamma)v}{2(2-\gamma)}, f=\frac{(\bar{\alpha}(1-\gamma)-v)(1-\gamma)}{2-\gamma}. \end{array} $$The first-order condition with respect to f gives \(\lambda _{1}=\frac {f}{\gamma (1-\gamma )}-\frac {\bar {\alpha }}{2\gamma }\). Substituting the optimal f into this, we can show that λ1 < 0 for any γ. Thus, this scenario is not supported.

- 6.

When constraints (1) and (3) are binding (λ1 ≥ 0, λ2 = 0, and λ3 ≥ 0): This is the case with \(Q_{h}(p_{h})=Q_{s}(f)<\bar {\alpha }\) and πs(f) = 0. This could happen when Cs is large and γ is also large so that the hardware firm needs to lower f sufficiently, which makes the software demand equal to the hardware demand. We can compute

$$ \begin{array}{@{}rcl@{}} p_{h} &=&\bar{\alpha}\gamma+v-\gamma\sqrt{\frac{C_{s}}{2(1-\gamma)}}, f = \bar{\alpha}(1-\gamma)-\sqrt{2(1-\gamma)C_{s}}\\ Q_{h} &=& Q_{s} = \sqrt{\frac{C_{s}}{2(1-\gamma)}}. \end{array} $$Constraint (1) is binding thus we need λ1 ≥ 0. From the first-order condition with respect to ph, we get

$$ \lambda_{1} = -\bar{\alpha}\gamma-v+2\gamma\sqrt{\frac{C_{s}}{2(1-\gamma)}} = 2\gamma\left( \sqrt{\frac{C_{s}}{2(1-\gamma)}}-\frac{\bar{\alpha}\gamma+v}{2\gamma}\right), $$which is greater than or equal to zero when γ ≥ γ1, where \(\tilde {\gamma }\) is defined in scenario 2 above. Constraint (2) requires \(Q_{h}\le \bar {\alpha }\), or \(\gamma \le 1-\frac {C_{s}}{2\bar {\alpha }^{2}}\). Constraint (3) is binding thus we need λ3 ≥ 0, which can be shown to be satisfied when γ ≥ γ1. To see this, note that the first-order condition with respect to f gives

$$ \lambda_{3}\ge 0 \Leftrightarrow \bar{\alpha}(1-\gamma)-2f+\lambda_{1}\ge 0. $$First, note that \(\bar {\alpha }(1-\gamma )-2f\ge 0\) for \(\gamma \ge 1-\frac {8C_{s}}{\bar {\alpha }^{2}}\) and that \(\gamma _{1}>1-\frac {8C_{s}}{\bar {\alpha }^{2}}\) (we have proven this in scenario 2 above, but it is easy to check that because \(\lambda _{1}(\gamma =1-\frac {8C_{s}}{\bar {\alpha }^{2}})<0\) and \(\frac {\partial \lambda _{1}}{\partial \gamma }>0\), it must be \(1-\frac {8C_{s}}{\bar {\alpha }^{2}}<\gamma _{1}\)). Thus, at γ = γ1, λ3 > 0. Overall, the range of γ that supports this scenario is \(\gamma \in \left [\gamma _{1},1-\frac {C_{s}}{2\bar {\alpha }^{2}}\right ]\). For this range of γ to be non-empty, we need \(\lambda _{1}(\gamma =1-\frac {C_{s}}{2\bar {\alpha }^{2}})\le 0\), which is equivalent to \(C_{s}\le 2\bar {\alpha }(\bar {\alpha }-v)\).

With the optimal ph and f, the hardware firm’s profit is

$$ \begin{array}{@{}rcl@{}} \pi_{h} &=& \left( \bar{\alpha}\gamma+v-\gamma\sqrt{\frac{C_{s}}{2(1-\gamma)}}\right)\sqrt{\frac{C_{s}}{2(1-\gamma)}}\\ &&+ \left( \bar{\alpha}(1-\gamma)-\sqrt{2(1-\gamma)C_{s}}\right)\sqrt{\frac{C_{s}}{2(1-\gamma)}}\\ &=&\left( \bar{\alpha}+v-(2-\gamma)\sqrt{\frac{C_{s}}{2(1-\gamma)}}\right)\sqrt{\frac{C_{s}}{2(1-\gamma)}}. \end{array} $$We note that at \(\gamma =1-\frac {C_{s}}{2\bar {\alpha }^{2}}\), we have ph = v, \(f=-\frac {C_{s}}{2\bar {\alpha }}\), \(Q_{h}=Q_{s}=\bar {\alpha }\). Thus,

$$ \pi_{h} = \left( v-\frac{C_{s}}{2\bar{\alpha}}\right)\bar{\alpha} = \bar{\alpha}v - \frac{C_{s}}{2}, $$which is clearly less than \(\bar {\alpha }v\). For \(\gamma \in \left [\gamma _{1},1-\frac {C_{s}}{2\bar {\alpha }}\right )\), note that

$$ \frac{\partial \pi_{h}}{\partial \gamma} = \frac{1}{1-\gamma}\sqrt{\frac{C_{s}}{2(1-\gamma)}}\left( \frac{\bar{\alpha}+v}{2}-\sqrt{\frac{C_{s}}{2(1-\gamma)}}\right). $$We know that \(\frac {\bar {\alpha }+v}{2}<\frac {\bar {\alpha }\gamma +v}{2\gamma }\) for γ < 1. Also, for γ > γ1, \(\frac {\bar {\alpha }\gamma +v}{2\gamma }<\sqrt {\frac {C_{s}}{2(1-\gamma )}}\). Thus, \(\frac {\partial \pi _{h}}{\partial \gamma }<0\) for \(\gamma \in \left [\gamma _{1},1-\frac {C_{s}}{2\bar {\alpha }^{2}}\right )\). As we saw in scenario 2, we can show that \(\pi _{h}-\bar {\alpha }v\) at γ = γ1 can be positive or negative under some values of \((\bar {\alpha },v,C_{s})\). Note that the hardware firm’s profit function in this scenario is identical to that in scenario 2 at γ = γ1. Thus, we can use the same set of Θ we defined in scenario 2, and summarize the results as follows.

When \(C_{h}<\frac {\bar {\alpha }(\bar {\alpha }-v)}{2}\) and \((\bar {\alpha },v,C_{s})\in {\Theta }\), there exists a unique threshold, say, \(\gamma _{6}(\theta )\in \left (\gamma _{1},1-\frac {C_{s}}{2\bar {\alpha }^{2}}\right )\) such that the hardware firm prefers to have software for γ ∈ [γ1, γ6(θ)]. When \(C_{h}<\frac {\bar {\alpha }(\bar {\alpha }-v)}{2}\) and \((\bar {\alpha },v,C_{s})\notin {\Theta }\) or \(C_{h}\in \left [\frac {\bar {\alpha }(\bar {\alpha }-v)}{2},2\bar {\alpha }(\bar {\alpha }-v)\right ]\), the hardware firm prefers not to have software. Moreover, \(\frac {\partial \pi _{h}}{\partial \gamma }<0\).

- 7.

When constraints (1) and (2) are binding (λ1 ≥ 0, λ2 ≥ 0, and λ3 = 0): This is the case with \(Q_{h}(p_{h})=Q_{s}(f)=\bar {\alpha }\). Once again, intuitively, this scenario will not be supported because when πs(f) > 0, the optimal licensing fee will be high enough to make Qs(f) smaller than Qh(ph). We can compute

$$ \begin{array}{@{}rcl@{}} p_{h} &= v f=-\bar{\alpha}(1-\gamma). \end{array} $$The first-order condition with respect to f gives \(\lambda _{1}=\frac {f}{\gamma (1-\gamma )}-\frac {\bar {\alpha }}{2\gamma }\). Substituting the optimal f into this, we can show that λ1 < 0 for any γ.

- 8.

When all constraints are binding (λ1 ≥ 0, λ2 ≥ 0, and λ3 ≥ 0): This is the case with \(Q_{h}(p_{h})=Q_{s}(f)=\bar {\alpha }\) and πs(f) = 0. We can compute

$$ \begin{array}{@{}rcl@{}} p_{h} &=& v f=-\bar{\alpha}(1-\gamma)\\ Q_{h} &=& Q_{s} = \bar{\alpha} \end{array} $$From the three constraints, we can show that this scenario is supported only at \(\gamma =1-\frac {C_{s}}{2\bar {\alpha }^{2}}\). At this γ, the first-order conditions give

$$ \lambda_{3} = \frac{\bar{\alpha}}{C_{s}}\lambda_{1} + 1, \lambda_{2} = \lambda_{1} + v + \frac{C_{s}}{2\bar{\alpha}}-\bar{\alpha}. $$First, for any λ1 ≥, λ3 > 0, but λ2 ≥ 0 if \(v + \frac {C_{s}}{2\bar {\alpha }}-\bar {\alpha }\ge 0\), or \(C_{s}\ge 2\bar {\alpha }(\bar {\alpha }-v)\).

Note that the hardware firm’s profits under the above optimal strategy are then

$$ \pi_{h} = \bar{\alpha}v - \bar{\alpha}(1-\gamma)\bar{\alpha} < \bar{\alpha}v. $$Thus, the hardware firm prefers not to have software.

Combining the results from supported scenarios, we have:

- 1.

When \(C_{s}\le \frac {\bar {\alpha }(\bar {\alpha }-v)}{8}\) and \(\theta =(\bar {\alpha },v,C_{s})\in {\Theta }\), there exists a unique \(\gamma _{6}(\theta )\in \left (\gamma _{1},1-\frac {C_{s}}{2\bar {\alpha }^{2}}\right )\) such that the optimal strategy is characterized as follows.

For \(\gamma \in \left (0,\frac {v}{\bar {\alpha }}\right ]\), the optimal strategy is characterized by scenario 3.

For \(\gamma \in \left (\frac {v}{\bar {\alpha }},1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right )\), the optimal strategy is characterized by scenario 1.

For \(\gamma \in \left (1-\frac {8C_{s}}{\bar {\alpha }^{2}},\gamma _{1}\right )\), the optimal strategy is characterized by scenario 2.

For \(\gamma \in \left (\gamma _{1},\gamma _{6}(\theta )\right ]\), the optimal strategy is characterized by scenario 6.

For \(\gamma \in \left (\gamma _{6}(\theta ),1\right )\), the hardware firm chooses not to have software.

- 2.

When \(C_{s}\le \frac {\bar {\alpha }(\bar {\alpha }-v)}{8}\) and \(\theta =(\bar {\alpha },v,C_{s})\notin {\Theta }\), there exists a unique \(\gamma _{2}(\theta )\in \left (1-\frac {2C_{s}}{\bar {\alpha }^{2}},\gamma _{1}\right )\) such that the optimal strategy is characterized as follows.

For \(\gamma \in \left (0,\frac {v}{\bar {\alpha }}\right ]\), the optimal strategy is characterized by scenario 3.

For \(\gamma \in \left (\frac {v}{\bar {\alpha }},1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right )\), the optimal strategy is characterized by scenario 1.

For \(\gamma \in \left (1-\frac {8C_{s}}{\bar {\alpha }^{2}},\gamma _{2}(\theta )\right ]\), the optimal strategy is characterized by scenario 2.

For \(\gamma \in \left (\gamma _{2}(\theta ),1\right )\), the hardware firm chooses not to have software.

- 3.

When \(C_{s}\in \left (\frac {\bar {\alpha }(\bar {\alpha }-v)}{8},\frac {\bar {\alpha }(\bar {\alpha }-v)}{2}\right ]\) and \(\theta =(\bar {\alpha },v,C_{s})\in {\Theta }\), there exists a unique \(\gamma _{6}(\theta )\in \left (\gamma _{1},1-\frac {C_{s}}{2\bar {\alpha }^{2}}\right )\) such that the optimal strategy is characterized as follows.

For \(C_{s}\le \frac {\bar {\alpha }^{2}}{8}\):

For \(\gamma \in \left (0,1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right ]\), the optimal strategy is characterized by scenario 3.

For \(\gamma \in \left (1-\frac {8C_{s}}{\bar {\alpha }^{2}},\frac {v}{\bar {\alpha }}\right )\), the optimal strategy is characterized by scenario 4.

For \(\gamma \in \left (\frac {v}{\bar {\alpha }},\gamma _{1}\right )\), the optimal strategy is characterized by scenario 2.

For \(\gamma \in \left (\gamma _{1},\gamma _{6}(\theta )\right ]\), the optimal strategy is characterized by scenario 6.

For \(\gamma \in \left (\gamma _{6}(\theta ),1\right )\), the hardware firm chooses not to have software.

For \(C_{s}>\frac {\bar {\alpha }^{2}}{8}\):

For \(\gamma \in \left (0,\frac {v}{\bar {\alpha }}\right )\), the optimal strategy is characterized by scenario 4.

For \(\gamma \in \left (\frac {v}{\bar {\alpha }},\gamma _{1}\right )\), the optimal strategy is characterized by scenario 2.

For \(\gamma \in \left (\gamma _{1},\gamma _{6}(\theta )\right ]\), the optimal strategy is characterized by scenario 6.

For \(\gamma \in \left (\gamma _{6}(\theta ),1\right )\), the hardware firm chooses not to have software.

- 4.

When \(C_{s}\in \left (\frac {\bar {\alpha }(\bar {\alpha }-v)}{8},\frac {\bar {\alpha }(\bar {\alpha }-v)}{2}\right ]\) and \(\theta =(\bar {\alpha },v,C_{s})\notin {\Theta }\), there exists a unique \(\gamma _{2}(\theta )\in \left (1-\frac {2C_{s}}{\bar {\alpha }^{2}},\gamma _{1}\right )\) such that the optimal strategy is characterized as follows.

For \(C_{s}\le \frac {\bar {\alpha }^{2}}{8}\):

For \(\gamma \in \left (0,1-\frac {8C_{s}}{\bar {\alpha }^{2}}\right ]\), the optimal strategy is characterized by scenario 3.

For \(\gamma \in \left (1-\frac {8C_{s}}{\bar {\alpha }^{2}},\frac {v}{\bar {\alpha }}\right )\), the optimal strategy is characterized by scenario 4.

For \(\gamma \in \left (\frac {v}{\bar {\alpha }},\gamma _{2}(\theta )\right ]\), the optimal strategy is characterized by scenario 2.

For \(\gamma \in \left (\gamma _{2}(\theta ),1\right )\), the hardware firm chooses not to have software.

For \(C_{s}>\frac {\bar {\alpha }^{2}}{8}\):

For \(\gamma \in \left (0,\frac {v}{\bar {\alpha }}\right )\), the optimal strategy is characterized by scenario 4.

For \(\gamma \in \left (\frac {v}{\bar {\alpha }},\gamma _{2}(\theta )\right ]\), the optimal strategy is characterized by scenario 2.

For \(\gamma \in \left (\gamma _{2}(\theta ),1\right )\), the hardware firm chooses not to have software.

- 5.

When \(C_{s}\in \left (\frac {\bar {\alpha }(\bar {\alpha }-v)}{2},\frac {\bar {\alpha }^{2}}{2}\right ]\), the optimal strategy is characterized as follows. Note that Assumption 1 implies that \(\frac {\bar {\alpha }(\bar {\alpha }-v)}{2}>\frac {\bar {\alpha }^{2}}{8}\), thus \(C_{s}>\frac {\bar {\alpha }^{2}}{8}\) in this region of Cs.

For \(\gamma \in \left (0,1-\frac {2C_{s}}{\bar {\alpha }^{2}}\right ]\), the optimal strategy is characterized by scenario 4.

For \(\gamma \in \left (1-\frac {2C_{s}}{\bar {\alpha }^{2}},1\right )\), the hardware firm chooses not to have software.

- 6.

When \(C_{s}>\frac {\bar {\alpha }^{2}}{2}\), the hardware firm prefers not to have software for γ ∈ (0, 1).

1.3 A.3 Proof of Proposition 3a

The software provider’s problem given the licensing fee f is given by

The first-order condition with respect to ps yields

The hardware provider’s problem is then given by

subject to (1) Qh(ph) ≥ Qs(f), (2) \(Q_{h}(p_{h})\le \bar {\alpha }\), and (3) πs(f) ≥ 0. The Lagrangian is

The Kuhn-Tucker conditions are

We solve this set of inequalities and equations by restricting our attention to the interior solution case (λ1 = λ2 = λ3 = 0).

The first-order conditions with respect to ph and f give:

Note that \(Q_{h}>\frac {\bar {\alpha }}{2}\) and \(Q_{s}\le \frac {\bar {\alpha }}{2}\). Thus, constraint (1) is satisfied. The first-order condition with respect to δ then gives

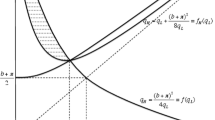

As in Fig. 2, the solution does not exist (i.e., the marginal return on δ is strictly positive for any δ) if the LHS is strictly greater than the RHS for all δ. It is easy to check that this is the case for \(\gamma <1-\frac {128C_{h}}{27\bar {\alpha }^{2}}\). In other words, when γ is very small, we expect a corner solution in which δ = 1.

Now consider \(\gamma \ge 1-\frac {128C_{h}}{27\bar {\alpha }^{2}}\). As γ increases, the RHS shifts down. Also, the RHS is equivalent to the software firm’s per-software profit ((ps(f) − f)Qs(f)). Thus, in order to satisfy constraint (3) (i.e., the software firm’s participation constraint), we need

The LHS is independent of γ, so there is a lower bound of γ that satisfies the first-order conditions and constraint (3). At the lower bound, we have \(\frac {\bar {\alpha }^{2}(1-\gamma )}{4(2-\delta )^{2}} = C_{h}\delta =\frac {C_{s}}{2}(1-\delta )\). Thus, the lower bound of δ is obtained as \(\delta = \frac {C_{s}}{2C_{h}+C_{s}}\). Substituting this into constraint (3), we get

Constraint (2) requires \(\gamma \ge \frac {v}{\bar {\alpha }}\). Because we focus on \(\gamma \ge 1-\frac {128C_{h}}{27\bar {\alpha }^{2}}\), constraint (2) is satisfied on this range as long as \(\frac {v}{\bar {\alpha }}\le 1-\frac {128C_{h}}{27\bar {\alpha }^{2}}\). This implies that \(C_{h}\le \frac {27\bar {\alpha }(\bar {\alpha }-v)}{128}\). Assumption 1 guarantees that the RHS is strictly positive. Thus, constraint (2) is satisfied as long as Ch is sufficiently low.

Next, we discuss the sufficient conditions. Recall that when \(\gamma \in \left (1-\frac {128C_{h}}{27\bar {\alpha }^{2}},1-\frac {4C_{h}}{\bar {\alpha }^{2}}\right ]\), two δ’s satisfy the first-order condition.Footnote 26 However, we can show that one of the δ’s that is greater than \(\frac {2}{3}\) is a saddle point (i.e., the point b in Fig. 2).

To see this, we check the second-order condition of the hardware firm’s problem. First note that \(\frac {\partial ^{2} \pi _{h}}{\partial p_{h} \partial f}=\frac {\partial ^{2} \pi _{h}}{\partial p_{h} \partial \delta }=0\) and \(\frac {\partial ^{2} \pi _{h}}{\partial ^{2} p_{h}}<0\). Thus, we only need to examine the condition for (f, δ). The Hessian is given by

We know that \(-\frac {2-\delta }{2(1-\gamma )}<0\), and

Since the denominator is positive, we only need to check the sign of the numerator. In order for H to be negative semidefinite, we need

Thus, we conclude that when \(\gamma \in \left (1-\frac {128C_{h}}{27\bar {\alpha }^{2}},1-\frac {4C_{h}}{\bar {\alpha }^{2}}\right ]\), one of the solutions for δ that is greater than \(\frac {2}{3}\) is a saddle point.

Finally, since the licensing fee is positive, it is easy to show that the hardware firm’s profits are larger than \(\bar {\alpha }v\).

1.4 A.4 Proof of Proposition 3b

First, it is easy to show that when \(\gamma <1-\frac {128C_{h}}{27\bar {\alpha }^{2}}\), the marginal return on δ becomes strictly positive for any δ. As a result, we have a corner solution with δ = 1. This is equivalent to the Full Integration case, and we have provided details in Appendix 1.

Now consider \(\gamma >1-\frac {4(4C_{h}+C_{s})^{2}C_{h}C_{s}}{(2C_{h}+C_{s})^{3}\bar {\alpha }^{2}}\), and recall the first-order conditions from Appendix 3a:

Since the constraint πs ≥ 0 is now binding, we have λ3 ≥ 0. Also, we know from Appendix 2 that when γ is even higher, the constraint Qh ≥ Qs binds. So for now, consider the case where λ2 = 0. Also, we know that we can satisfy \(Q_{h}\le \bar {\alpha }\) for sufficiently low Ch. The constraint πs = 0 gives:

This condition characterizes the relationship between δ and f and implies that δ increases monotonically as f increases. Moreover,

It is easy to check \(\frac {\partial \lambda _{3}}{\partial f}<0\), and thus λ3 is uniquely determined given f. The first-order condition with respect to δ is

It is easy to check that the LHS is monotonically decreasing in f. Thus, there is a unique f that satisfies the first-order condition. Since δ and λ3 are uniquely determined given f, there is a unique optimal strategy \((p_{h}^{*},f^{*},\delta ^{*})\) (note that \(p_{h}^{*}\) is the same as the interior solution).

Now consider the case where λ2, λ3 ≥ 0. We now have another constraint:

The first-order condition with respect to ph is now

Since λ2 ≥ 0, \(f<-\frac {(1-\gamma )v}{\gamma }\). The first-order condition with respect to f gives

We can check that λ3 monotonically decreases in f. The first-order condition with respect to δ is

We can also check that the LHS monotonically decreases in f. Thus, there is a unique f that satisfies the first-order condition. Since ph, δ, λ2 and δ3 are uniquely determined given f, there is a unique optimal strategy \((p_{h}^{*},f^{*},\delta ^{*})\).

Now we are interested in the sign of \(\frac {\partial \delta ^{*}}{\partial \gamma }\). It is difficult to analytically derive the sign. However, the optimal strategy is unique, so we can numerically solve for \((p_{h}^{*},f^{*},\delta ^{*})\) and examine how δ∗ changes with γ. Specifically, given \((\bar {\alpha },C_{h},C_{s})\), we solve for the optimal strategy \((p_{h}^{*},f^{*},\delta ^{*})\) over γ ∈ (0, 1). We use 10,000 evenly spaced grid points over (0, 1). We have tested extensive sets of \((\bar {\alpha },C_{h},C_{s})\), and consistently found that \(\frac {\partial \delta ^{*}}{\partial \gamma }>0\) for \(\gamma >1-\frac {4(4C_{h}+C_{s})^{2}C_{h}C_{s}}{(2C_{h}+C_{s})^{3}\bar {\alpha }^{2}}\).

1.5 A.5 Proof of Proposition 4a

Let pi and ps be the price of in-house and outsourced software, respectively, and pi is set by the hardware firm and ps is set by the software firm. We consider a case where we take our main analysis in Section 2.4 as the basis (except that we now assume v = 0) and allow pi to be set by the hardware firm.

We first derive the demand for in-house and outsourced software. As before, let ph be the price of hardware, δ be the proportion of in-house software, and α be the benefit from software. Consumers now have the following four options regarding software acquisition:

We show that regardless of whether pi is higher or lower than ps, the marginal consumer who is indifferent between buying and pirating in-house software depends only on pi, not ps, and the marginal consumer who is indifferent between buying and pirating outsourced software depends only on ps. To see this, first notice that the slope on α is the highest for (b,b) (the slope is 1), the lowest for (p,p) (the slope is γ). The slope on (b,p) (i.e., δ + (1 − δ)γ) is larger than the slope on (p,b) (i.e., δγ + (1 − δ)) if \(\delta >\frac {1}{2}\). Notice that the marginal consumer who is indifferent between (b,b) and (b,p) is given by \(\alpha =\frac {p_{s}}{1-\gamma }\). But the marginal consumer who is indifferent between (p,b) and (p,p) is also given by \(\frac {p_{s}}{1-\gamma }\). Consider the utility for each buying/pirating behavior at \(\alpha =\frac {p_{s}}{1-\gamma }\). Then, we know that the utility for (b,b) is equal to that for (b,p), and the utility for (p,b) is equal to that for (p,p). Comparing the utilities for (b,b) and (p,b) at \(\alpha =\frac {p_{s}}{1-\gamma }\), we know that the utility for (b,b) is higher than that for (p,b) when

Suppose ps > pi. Then, we know that \(\alpha \in \left [\frac {p_{s}}{1-\gamma },\bar {\alpha }\right ]\) will choose (b,b). Also, we know that for \(\alpha <\frac {p_{s}}{1-\gamma }\), the utility for (p,p) is higher than that for (p,b). Thus, no one chooses (p,b), and there is a marginal consumer who is indifferent between (b,p) and (p,p), which is given by \(\alpha =\frac {p_{i}}{1-\gamma }\). Thus, the segments will be: (b,b) for \(\alpha \in \left [\frac {p_{s}}{1-\gamma },\bar {\alpha }\right ]\), (b,p) for \(\alpha \in \left [\frac {p_{i}}{1-\gamma },\frac {p_{s}}{1-\gamma }\right ]\), and (p,p) for the rest who buys hardware.

Now suppose ps < pi. Then, we know that \(\alpha <\frac {p_{s}}{1-\gamma }\) will choose (p,p). Also, we know that for \(\alpha >\frac {p_{s}}{1-\gamma }\), the utility for (b,b) is higher than that for (b,p). Thus, no one chooses (b,p), and there is a marginal consumer who is indifferent between (p,b) and (b,b), which is given by \(\alpha =\frac {p_{i}}{1-\gamma }\). Thus, the segments will be: (b,b) for \(\alpha \in \left [\frac {p_{i}}{1-\gamma },\bar {\alpha }\right ]\), (p,b) for \(\alpha \in \left [\frac {p_{s}}{1-\gamma },\frac {p_{i}}{1-\gamma }\right ]\), and (p,p) for the rest who buys hardware.

The same logic applies when \(\delta <\frac {1}{2}\). In this case, the slope on α for (p,b) is larger than that for (b,p). But then the indifferent consumer for (b,b) and (p,b) \(\left (\frac {p_{i}}{1-\gamma }\right )\) is the same as that for (b,p) and (p,p). Thus, we just swap ps and pi and get the same result.

Thus, regardless of whether pi < ps or not and \(\delta >\frac {1}{2}\) or not, the per-unit demand for in-house and outsourced software will be given by

The software firm’s problem given (f, δ) is

The first-order condition with respect to ps gives

The hardware firm’s problem is now

subject to (1) Qh(ph) ≥ Qs(f), (2) \(Q_{h}(p_{h})\le \bar {\alpha }\), and (3) πs(f, δ) ≥ 0.Footnote 27 The Lagrangian is then given by

The Kuhn-Tucker conditions are

We first note that the FOC for pi is not influenced by the constraints. Solving the FOC gives

The per-unit gross profit of in-house software decreases in γ through a lower price. We solve this set of inequalities and equations.

We restrict our attention to the interior solution case (λ1 = λ2 = λ3 = 0). The FOC for ph gives:

The profit from hardware is increasing in γ. Next, the first-order condition with respect to f gives

We thus have

We note that \(\frac {\partial p_{i}Q_{i}}{\partial \gamma }<\frac {\partial fQ_{s}}{\partial \gamma }\). This is one driving force to push software development to the software firm when γ increases. This can be seen in the first-order condition for δ, which gives

Thus, we have \(\frac {\partial \delta }{\partial \gamma }<0\). Given δ ≤ 1, we require \(\gamma \ge 1-\frac {8C_{h}}{\bar {\alpha }^{2}}\).

With the optimal strategy, the software firm’s profit is

Thus πs ≥ 0 if and only if

Finally, hardware firm’s profit is

Also,

Thus, hardware firm benefits from piracy.

1.6 A.6 Proof of Proposition 4b

The proof here is similar to Appendix A.4. First, it is easy to show that when \(\gamma <1-\frac {8C_{h}}{\bar {\alpha }^{2}}\), the marginal return on δ becomes strictly positive for any δ. As a result, we have a corner solution with δ = 1. This is equivalent to the Full Integration case, and we have provided details in Appendix 1.

Now consider \(\gamma >1-\frac {8C_{h}C_{s}}{\bar {\alpha }^{2}(C_{h}+C_{s})}\), and recall the first-order conditions from Appendix A.5:

Since the constraint πs ≥ 0 is now binding, we have λ3 ≥ 0. Also, we know from Appendix 2 that when γ is even higher, the constraint Qh ≥ Qs binds. So for now, consider the case where λ2 = 0. Also, we know that we can satisfy \(Q_{h}\le \bar {\alpha }\) for sufficiently low Ch. The constraint πs = 0 gives:

This condition characterizes the relationship between δ and f and implies that δ increases monotonically as f increases. Moreover,

Since λ3 ≥ 0, \(f\le \frac {\bar {\alpha }(1-\gamma )}{2}\). It is easy to check \(\frac {\partial \lambda _{3}}{\partial f}<0\), and thus λ3 is uniquely determined given f. The first-order condition with respect to δ is

It is easy to check that the LHS is monotonically decreasing in f. Thus, there is a unique f that satisfies the first-order condition. Since δ and λ3 are uniquely determined given f, there is a unique optimal strategy \((p_{h}^{*},f^{*},\delta ^{*})\) (note that \(p_{h}^{*}\) is the same as the interior solution).

Now consider the case where λ2, λ3 ≥ 0. We now have another constraint:

The first-order condition with respect to ph is now

Since λ2 ≥ 0, f < 0. The first-order condition with respect to f gives

We can check that λ3 monotonically decreases in f. The first-order condition with respect to δ is

We can also check that the LHS monotonically decreases in f. Thus, there is a unique f that satisfies the first-order condition. Since δ, ph, λ2 and δ3 are uniquely determined given f, there is a unique optimal strategy \((p_{h}^{*},f^{*},\delta ^{*})\).

We are interested in the sign of \(\frac {\partial \delta ^{*}}{\partial \gamma }\). Similar to Appendix app4A.4, it is difficult to analytically derive the sign. Thus we numerically examine it using a similar approach described there. Again, we consistently found that \(\frac {\partial \delta ^{*}}{\partial \gamma }>0\) for \(\gamma >1-\frac {8C_{h}C_{s}}{\bar {\alpha }^{2}(C_{h}+C_{s})}\).

1.7 A.7 Proof of Proposition 5

The software firm’s profit is

The first-order conditions with respect to ps and ns give:

Given ps and ns(f), the hardware firm’s problem is

where ph is the price of hardware, Qh is the demand for hardware (\(Q_{h}=\bar {\alpha }-\frac {p_{h}}{(n_{i}+n_{s}(f))\gamma })\), pi is the price of in-house software, Qi is the demand for in-house software (\(Q_{i}(p_{i})=\bar {\alpha }-\frac {p_{i}}{1-\gamma }\)).

First, pi influences only the in-house software profit, so can be simply determined by \(\frac {\partial \pi _{h}}{\partial p_{i}}=0\):

Thus the problem now is

The hardware firm maximizes the profit subject to Qh(ph, ni, f) ≥ Qs(f) and πs(f) ≥ 0. However, the latter is always satisfied because the software firm can choose ns optimally. Thus, we consider two scenarios based on the first constraint.

- 1.

Qh ≥ Qs is not binding:

$$ \pi_{h}(p_{h},n_{i},f) = p_{h}Q_{h}(p_{h},n_{i},f)+n_{i}\frac{\bar{\alpha}^{2}(1-\gamma)}{4}+n_{s}(f) f Q_{s}(f) - \frac{C_{h}{n_{i}^{2}}}{2}. $$The first-order conditions are:

$$ \begin{array}{@{}rcl@{}} \frac{\partial \pi_{h}}{\partial p_{h}} &=& \bar{\alpha}-\frac{2p_{h}}{\gamma(n_{i}+n_{s})} = 0 \Longleftrightarrow p_{h}=\frac{\bar{\alpha}\gamma(n_{i}+n_{s})}{2},\ Q_{h}=\frac{\bar{\alpha}}{2}\\ \frac{\partial \pi_{h}}{\partial n_{i}} &=& \frac{\bar{\alpha}^{2}\gamma}{4} + \frac{\bar{\alpha}^{2}(1-\gamma)}{4} - C_{h} n_{i}=0 \Longleftrightarrow n_{i}=\frac{\bar{\alpha}^{2}}{4C_{h}}\\ \frac{\partial \pi_{h}}{\partial f} &=&\frac{\bar{\alpha}^{2}\gamma}{4}n_{s}^{\prime} + n_{s}^{\prime}(fQ_{s})+n_{s}(fQ_{s})'=0 \end{array} $$Note that f influences πh in two channels: via ns and via fQs:

$$ \frac{\partial \pi_{h}}{\partial f} =\left[\frac{\bar{\alpha}^{2}\gamma}{4}+fQ_{s}\right]n_{s}^{\prime} + n_{s}(fQ_{s})' $$The first term captures the return on f via ns and the second term is the direct return on f. Solving the FOC, we get

$$ f = \frac{5\bar{\alpha}(1-\gamma)\pm\bar{\alpha}\sqrt{(1-\gamma)(9+7\gamma)}}{8}. $$Note that \((1-\gamma )(9+7\gamma )=9(1-\gamma )(1+\frac {7}{9}\gamma )>9(1-\gamma )^{2}\). Thus,

$$ \frac{5\bar{\alpha}(1-\gamma)+\bar{\alpha}\sqrt{(1-\gamma)(9+7\gamma)}}{8}> \frac{5\bar{\alpha}(1-\gamma)+3\bar{\alpha}(1-\gamma)}{8}=\bar{\alpha}(1-\gamma). $$Since \(f\le \bar {\alpha }(1-\gamma )\), the optimal f is

$$ f = \frac{5\bar{\alpha}(1-\gamma)-\bar{\alpha}\sqrt{(1-\gamma)(9+7\gamma)}}{8}. $$We thus have

$$ \begin{array}{@{}rcl@{}} p_{s} = \frac{\bar{\alpha}(1-\gamma)\left( 13-\sqrt{\frac{9+7\gamma}{1-\gamma}}\right)}{16}, Q_{s} = \frac{\bar{\alpha}\left( 3+\sqrt{\frac{9+7\gamma}{1-\gamma}}\right)}{16} \end{array} $$Since we require \(Q_{s}\le Q_{h}=\frac {\bar {\alpha }}{2}\),

$$ \begin{array}{@{}rcl@{}} \frac{\bar{\alpha}\left( 3+\sqrt{\frac{9+7\gamma}{1-\gamma}}\right)}{16} \le \frac{\bar{\alpha}}{2} \Longleftrightarrow \gamma \le \frac{1}{2}. \end{array} $$For \(\gamma \le \frac {1}{2}\), \(\frac {\partial f}{\partial \gamma }<0\). Also, note that

$$ \begin{array}{@{}rcl@{}} p_{s}-f =\frac{\bar{\alpha}(1-\gamma)\left( 3+\sqrt{\frac{9+7\gamma}{1-\gamma}}\right)}{16} \end{array} $$Thus,

$$ \begin{array}{@{}rcl@{}} n_{s} = \frac{(p_{s}-f)Q_{s}}{C_{s}}=\frac{K\bar{\alpha}^{2}}{256}\left( 3\sqrt{1-\gamma}+\sqrt{9+7\gamma}\right)^{2} \end{array} $$and

$$ \begin{array}{@{}rcl@{}} \frac{\partial n_{s}}{\partial \gamma} = \frac{\bar{\alpha}^{2}}{128C_{s}}\left( 3\sqrt{1-\gamma}+\sqrt{9+7\gamma}\right)\left( -\frac{3}{2\sqrt{1-\gamma}}+\frac{7}{2\sqrt{9+7\gamma}}\right). \end{array} $$It is straightforward to show that \(\frac {\partial n_{s}}{\partial \gamma }<0\).

Finally, we check πh:

$$ \begin{array}{@{}rcl@{}} \pi_{h} &=& p_{h}Q_{h} + n_{i}p_{i}Q_{i} + n_{s}fQ_{s} - \frac{C_{h}{n_{i}^{2}}}{2}\\ &=&\frac{\bar{\alpha}^{2}\gamma(n_{i}+n_{s})}{4} + n_{i}\frac{\bar{\alpha}^{2}(1-\gamma)}{4} + n_{s} fQ_{s} - \frac{C_{h}{n_{i}^{2}}}{2}\\ &=&\left[\frac{\bar{\alpha}^{2}\gamma}{4}+fQ_{s}\right]n_{s} + \frac{\bar{\alpha}^{2}}{4}n_{i}-\frac{C_{h}}{2}{n_{i}^{2}}\\ &=&\left[\frac{\bar{\alpha}^{2}\gamma}{4}+fQ_{s}\right]n_{s} + \frac{\bar{\alpha}^{4}}{32C_{h}}>0. \end{array} $$Thus hardware firm is in business. Also, we check how γ influences πh. Note that

$$ \begin{array}{@{}rcl@{}} \frac{\partial \pi_{h}}{\partial \gamma} = \left[\frac{\bar{\alpha}^{2}}{4}+\frac{\partial (fQ_{s})}{\partial \gamma}\right]n_{s} + \left[\frac{\bar{\alpha}^{2}\gamma}{4}+fQ_{s}\right]\frac{\partial n_{s}}{\partial \gamma} \end{array} $$where a change in γ influences (1) the marginal return on ns (i.e., first bracket) and (2) ns (i.e., \(\frac {\partial n_{s}}{\partial \gamma }\)). First,

$$ \begin{array}{@{}rcl@{}} fQ_{s} &=& \frac{\bar{\alpha}^{2}(5\sqrt{1-\gamma}-\sqrt{9+7\gamma})(3\sqrt{1-\gamma}+\sqrt{9+7\gamma})}{128}>0\ \forall \gamma\le\frac{1}{2}\\ \frac{\partial (fQ_{s})}{\partial \gamma} &=& \frac{\bar{\alpha}^{2}\left( 7(1-\gamma)-(9+7\gamma)-22\sqrt{(1-\gamma)(9+7\gamma)}\right)}{64\sqrt{(1-\gamma)(9+7\gamma)}} <0\ \forall \gamma \end{array} $$It can be shown that the change in marginal return on ns due to an increase in γ is negative:

$$ \left[\frac{\bar{\alpha}^{2}}{4}+\frac{\partial (fQ_{s})}{\partial \gamma}\right]=\frac{\bar{\alpha}^{2}}{64AB}(7A+B)(A-B)<0 $$where \(A=\sqrt {1-\gamma }\) and \(B=\sqrt {9+7\gamma }\). Then

$$ \begin{array}{@{}rcl@{}} \frac{\partial \pi_{h}}{\partial \gamma} &=& \left[\frac{\bar{\alpha}^{2}}{4}+\frac{\bar{\alpha}^{2}(7A^{2}-B^{2}-22AB)}{64AB}\right]\frac{K\bar{\alpha}^{2}(3A+B)^{2}}{256}\\ &&+\left[\frac{\bar{\alpha}^{2}\gamma}{4} + \frac{\bar{\alpha}^{2}(5A-B)(3A+B)}{128}\right]\frac{K\bar{\alpha}^{2}(3A+B)(7A-3B)}{256AB}\\ &=&\frac{\bar{\alpha}^{2}(16AB+7A^{2}-B^{2}-22AB)}{64AB}\frac{K\bar{\alpha}^{2}(3A+B)^{2}}{256}\\ &&+\frac{\bar{\alpha}^{2}(32\gamma+(5A-B)(3A+B)}{128}\frac{K\bar{\alpha}^{2}(3A+B)(7A-3B)}{256AB}\\ &=&\frac{K\bar{\alpha}^{4}(3A+B)}{128\cdot256AB}\left[2(7A+B)(A-B)(3A+B)\right.\\ &&\left.-[32\gamma+(5A-B)(3A+B)](7A-3B)\right] \end{array} $$Note \(\frac {K\bar {\alpha }^{4}(3A+B)}{128\cdot 256AB}>0\). Thus, we drop it and focus on

$$ S\equiv 2(7A+B)(A-B)(3A+B)-[32\gamma+(5A-B)(3A+B)](7A-3B) $$First, we note that when \(\gamma \le \frac {1}{2}\),

$$ S = 2\underbrace{(7A+B)}_{+}\underbrace{(A-B)}_{-}\underbrace{(3A+B)}_{+} -[32\gamma+\underbrace{(5A-B)}_{+}\underbrace{(3A+B)}_{+}]\underbrace{(7A-3B)}_{-} $$Thus, its sign could depend on γ. This expression can be simplified as

$$ S = -108A-196\gamma A - 36B + 52\gamma B < 0\ \forall \gamma\le\frac{1}{2} $$because \((-36 + 52\gamma )<0\ \forall \gamma \le \frac {1}{2}\). Thus, \(\frac {\partial \pi _{h}}{\partial \gamma }<0\) in this scenario.

- 2.

Qh = Qs:

This happens when γ is high (i.e., \(\gamma >\frac {1}{2}\)) and f < 0. Recall that the constraint implies

$$ \bar{\alpha}-\frac{p_{h}}{(n_{i}+n_{s})\gamma)} = \bar{\alpha} - \frac{p_{s}}{1-\gamma}\ \Longleftrightarrow\ p_{h} = \frac{\gamma(n_{i}+n_{s})}{1-\gamma}p_{s} $$Thus the profit from hardware can be written as

$$ p_{h}Q_{h}=\frac{\gamma(n_{i}+n_{s})}{1-\gamma}p_{s}Q_{s}=\frac{\bar{\alpha}^{2}(1-\gamma)^{2}-f^{2}}{4(1-\gamma)} $$The hardware firm’s profit is now

$$ \begin{array}{@{}rcl@{}} \pi_{h}(n_{i},f) &=& \frac{\gamma(n_{i}+n_{s}(f))}{1-\gamma}\frac{\bar{\alpha}^{2}(1-\gamma)^{2}-f^{2}}{4(1-\gamma)}+n_{i}\frac{\bar{\alpha}^{2}(1-\gamma)}{4}\\ &&+n_{s}(f) f Q_{s}(f) - \frac{C_{h}{n_{i}^{2}}}{2}. \end{array} $$First, the FOC with respect to ni is

$$ \frac{\partial \pi_{h}}{\partial n_{i}} = \frac{\gamma}{1-\gamma}\frac{\bar{\alpha}^{2}(1-\gamma)^{2}-f^{2}}{4(1-\gamma)} + \frac{\bar{\alpha}^{2}(1-\gamma)}{4}-C_{h} n_{i}=0 $$We then get

$$ n_{i} = \frac{\bar{\alpha}^{2}(1-\gamma)^{2}-\gamma f^{2}}{4C_{h}(1-\gamma)^{2}}. $$Note that this is less than \(\frac {\bar {\alpha }^{2}}{4C_{h}}\) (optimal ni when \(\gamma \le \frac {1}{2}\)). Next, the FOC with respect to f is

$$ \begin{array}{@{}rcl@{}} \frac{\partial \pi_{h}}{\partial f} &= \frac{\gamma}{1-\gamma}n_{s}^{\prime}(p_{s}Q_{s})+\frac{\gamma(n_{i}+n_{s})}{1-\gamma}(p_{s}Q_{s})' + n_{s}^{\prime}(fQ_{s})+n_{s}(fQ_{s})'=0, \end{array} $$where

$$ \begin{array}{@{}rcl@{}} \frac{\gamma}{1-\gamma}n_{s}^{\prime}(p_{s}Q_{s})&=&\frac{\gamma}{1-\gamma}\left( -\frac{\bar{\alpha}(1-\gamma)-f}{2(1-\gamma)C_{s}}\right)\left( \frac{\bar{\alpha}^{2}(1-\gamma)^{2}-f^{2}}{4(1-\gamma)}\right)\\ &=& -\frac{\gamma(\bar{\alpha}(1-\gamma)-f)^{2}(\bar{\alpha}(1-\gamma)+f)}{8(1-\gamma)^{3}C_{s}}\\ \frac{\gamma(n_{i}+n_{s})}{1-\gamma}(p_{s}Q_{s})^{\prime}\!&=&\!\frac{\gamma}{1-\gamma}\left[\frac{\bar{\alpha}^{2}(1-\gamma)^{2}-\gamma f^{2}}{4(1-\gamma)^{2}C_{h}}+\frac{(\bar{\alpha}(1-\gamma)-f)^{2}}{4(1-\gamma)C_{s}}\right]\\ &&\!\times \left( -\frac{f}{2(1-\gamma)}\right)\frac{\gamma}{1-\gamma}n_{s}^{\prime}(p_{s}Q_{s}) + \frac{\gamma(n_{i}+n_{s})}{1-\gamma}(p_{s}Q_{s})^{\prime}\\ \!&=&\!-\frac{\gamma(\bar{\alpha}(1-\gamma)-f)^{2}(\bar{\alpha}(1-\gamma)+2f)}{8(1-\gamma)^{3}C_{s}}\\ &&- \frac{\gamma(\bar{\alpha}^{2}(1-\gamma)^{2}-\gamma f^{2})f}{8(1-\gamma)^{4}C_{h}} \end{array} $$and

$$ \begin{array}{@{}rcl@{}} n_{s}^{\prime}(fQ_{s})&=&\left( -\frac{\bar{\alpha}(1-\gamma)-f}{2(1-\gamma)C_{s}}\right)\left( \frac{\bar{\alpha}(1-\gamma)-f)f}{2(1-\gamma)}\right)\\ &=& -\frac{(\bar{\alpha}(1-\gamma)-f)^{2}f}{4(1-\gamma)^{2}C_{s}}\\ n_{s}(fQ_{s})^{\prime}&=&\left( \frac{(\bar{\alpha}(1-\gamma)-f)^{2}}{4(1-\gamma)C_{s}}\right)\left( \frac{\bar{\alpha}(1-\gamma)-2f}{2(1-\gamma)}\right)\\ &=& \frac{(\bar{\alpha}(1-\gamma)-f)^{2}(\bar{\alpha}(1-\gamma)-2f)}{8(1-\gamma)^{2}C_{s}}\\ n_{s}^{\prime}(fQ_{s})+n_{s}(fQ_{s})^{\prime}&=&\frac{(\bar{\alpha}(1-\gamma)-f)^{2}(\bar{\alpha}(1-\gamma)-4f)}{8(1-\gamma)^{2}C_{s}} \end{array} $$Thus,

$$ \begin{array}{@{}rcl@{}} \frac{\partial \pi_{h}}{\partial f} &=&-\frac{\gamma(\bar{\alpha}(1-\gamma)-f)^{2}(\bar{\alpha}(1-\gamma)+2f)}{8(1-\gamma)^{3}C_{s}} - \frac{\gamma(\bar{\alpha}^{2}(1-\gamma)^{2}-\gamma f^{2})f}{8(1-\gamma)^{4}C_{h}}\\ &&+ \frac{(\bar{\alpha}(1-\gamma)-f)^{2}(\bar{\alpha}(1-\gamma)-4f)}{8(1-\gamma)^{2}C_{s}}\\ &=&\frac{(\bar{\alpha}(1-\gamma)-f)^{2}(\bar{\alpha}(1-\gamma)(1-2\gamma)-2(2-\gamma)f)}{8(1-\gamma)^{3}C_{s}}\\ &&- \frac{\gamma(\bar{\alpha}^{2}(1-\gamma)^{2}-\gamma f^{2})f}{8(1-\gamma)^{4}C_{h}} \end{array} $$We note that since \(f\in [-\bar {\alpha }(1-\gamma ),0]\) (otherwise, we have Qs < Qh or \(Q_{s}>\bar {\alpha }\)), we have \(\bar {\alpha }^{2}(1-\gamma )^{2}-\gamma f^{2}>0\). Thus, the second component is positive

$$ -\frac{\gamma(\bar{\alpha}^{2}(1-\gamma)^{2}-\gamma f^{2})f}{8(1-\gamma)^{4}C_{h}} >0 $$and zero only when f = 0. Thus the first component needs to be negative, or zero (when f = 0). First, the first component under f = 0 becomes zero only when \(\gamma =\frac {1}{2}\). Thus, this is one solution, and consistent with the previous case where Qh ≥ Qs. For \(\gamma >\frac {1}{2}\) and f < 0, the first component is negative if

$$ \bar{\alpha}(1-\gamma)(1-2\gamma)-2(2-\gamma)f<0\Leftrightarrow f>\frac{\bar{\alpha}(1-\gamma)(1-2\gamma)}{2(2-\gamma)}. $$So when \(\gamma >\frac {1}{2}\), \(f\in (\frac {\bar {\alpha }(1-\gamma )(1-2\gamma )}{2(2-\gamma )},0)\). Now rewrite the FOC as

$$ \begin{array}{@{}rcl@{}} \frac{\partial \pi_{h}}{\partial f} \!&=&\!\frac{(\bar{\alpha}^{2}(1-\gamma)^{2}-\gamma f^{2})}{8(1-\gamma)^{3}C_{s}}\\ &&\!\times \left( \frac{(\bar{\alpha}(1-\gamma)-f)^{2}(\bar{\alpha}(1-\gamma)(1-2\gamma)-2(2-\gamma)f)}{(\bar{\alpha}^{2}(1-\gamma)^{2}-\gamma f^{2})}-\frac{\gamma C_{s}f}{(1-\gamma)C_{h}}\right) \end{array} $$Let

$$ \begin{array}{@{}rcl@{}} A(f) &\equiv& \frac{(\bar{\alpha}(1-\gamma)-f)^{2}(\bar{\alpha}(1-\gamma)(1-2\gamma)-2(2-\gamma)f)}{(\bar{\alpha}^{2}(1-\gamma)^{2}-\gamma f^{2})}\\ B(f) &\equiv& \frac{\gamma C_{s}f}{(1-\gamma)C_{h}} \end{array} $$and consider their values on \(f\in (\frac {\bar {\alpha }(1-\gamma )(1-2\gamma )}{2(2-\gamma )},0)\). First, B(f) increases monotonically in f and

$$ B(f=\frac{\bar{\alpha}(1-\gamma)(1-2\gamma)}{2(2-\gamma)})<0\text{and} B(f=0)=0 $$Also, we can show

$$ A(f=\frac{\bar{\alpha}(1-\gamma)(1-2\gamma)}{2(2-\gamma)}) = 0\text{and} A(f=0)<0 $$Thus, if A(f) decreases monotonically in f, we have a unique f that satisfies the FOC. Now let

$$ \begin{array}{@{}rcl@{}} C(f)&=&\bar{\alpha}(1-\gamma)-f,\quad D(f)=\bar{\alpha}(1-\gamma)(1-2\gamma)-2(2-\gamma)f, \\ E(f) &=&\bar{\alpha}^{2}(1-\gamma)^{2}-\gamma f^{2} \end{array} $$and note that for \(f\in (\frac {\bar {\alpha }(1-\gamma )(1-2\gamma )}{2(2-\gamma )},0)\), C(f) > 0, D(f) < 0, E(f) > 0, and

$$ C(f)'=-1,\ D(f)'=-2(2-\gamma),\ E(f)'=-2\gamma f $$Then \(A(f)=\frac {C(f)^{2}D(f)}{E(f)}\) and

$$ \begin{array}{@{}rcl@{}} \frac{\partial A(f)}{\partial f} &=& \frac{[2C(f)C(f)'D(f)+C(f)^{2}D(f)']E(f)-C(f)^{2}D(f)E(f)'}{E(f)^{2}}\\ &=&\frac{[-2D(f)-2(2-\gamma)C(f)]C(f)E(f)+2\gamma fC(f)^{2}D(f)}{E(f)^{2}}\\ &=&-\frac{2C(f)}{E(f)^{2}}\left( \left[D(f)+(2-\gamma)C(f)\right]E(f)-\gamma fC(f)D(f)\right) \end{array} $$Since \(\frac {C(f)}{E(f)^{2}}>0\), the sign of \(\frac {\partial A(f)}{\partial f}\) depends on \(\left [D(f)+(2-\gamma )C(f)\right ]E(f)-\gamma fC(f)D(f)\). Let this be F and note that

$$ \begin{array}{@{}rcl@{}} F \!&=&\! \left[(\bar{\alpha}(1-\gamma)(1-2\gamma)-2(2-\gamma)f)+(2-\gamma)(\bar{\alpha}(1-\gamma)-f)\right] \\ &&\times (\bar{\alpha}^{2}(1-\gamma)^{2}-\gamma f^{2})-\gamma f (\bar{\alpha}(1-\gamma)-f)(\bar{\alpha}(1-\gamma)(1-2\gamma)-2(2-\gamma)f)\\ \!&=&\! 3\left[\bar{\alpha}(1-\gamma)^{2}-(2-\gamma)f\right] (\bar{\alpha}^{2}(1-\gamma)^{2}-\gamma f^{2})\\ &&-\gamma f\left[\bar{\alpha}^{2}(1-\gamma)^{2}(1-2\gamma)-2\bar{\alpha}(1-\gamma)(2-\gamma)f\right.\\&&\left.-\bar{\alpha}(1-\gamma)(1-2\gamma)f+2(2-\gamma)f\vphantom{\bar{\alpha}^{2}}\right]\\ \!&=&\! 3\bar{\alpha}^{3}(1-\gamma)^{4}-3\bar{\alpha}(1-\gamma)^{2}\gamma f^{2}-3(2-\gamma)f\bar{\alpha}^{2}(1-\gamma)^{2}+3(2-\gamma)\gamma f^{3}\\ &&-\bar{\alpha}^{2}(1\!-\gamma)^{2}(1\!-2\gamma)\gamma f+\bar{\alpha}(1\!-\gamma)\gamma f^{2} (4\!-2\gamma+1\!-2\gamma)- 2(2\!-\gamma)\gamma f^{3}\\ \!&=&\! 3\bar{\alpha}^{3}(1-\gamma)^{4} - f\bar{\alpha}^{2}(1-\gamma)^{2}[6-3\gamma+\gamma-2\gamma^{2}] + f^{2}\bar{\alpha}(1-\gamma)\\ &&\times \gamma[5-4\gamma-3+3\gamma] - (2-\gamma)\gamma f^{3}\\ \!&=&\!\underbrace{3\bar{\alpha}^{3}(1-\gamma)^{4}}_{+} - \underbrace{2f\bar{\alpha}^{2}(1-\gamma)^{2}[3-\gamma-\gamma^{2}]}_{-} + \underbrace{f^{2}\bar{\alpha}(1-\gamma)(2-\gamma)\gamma}_{+}\\ &&- \underbrace{(2-\gamma)\gamma f^{3}}_{-}\\ &>&0 \end{array} $$Thus \(\frac {\partial A(f)}{\partial f}<0\) and the solution of f is unique and lies on \((\frac {\bar {\alpha }(1-\gamma )(1-2\gamma )}{2(2-\gamma )},0)\). We can also show that for a given δ, an increase in \(\frac {C_{s}}{C_{h}}\) increases the optimal f (i.e., less negative). This is due to the fact that as it costs less to develop in-house software (relative to outsourced software), the hardware firm increases in-house production (relative to outsourced production) so it can lower the “subsidy” to the software firm.

Since the optimal strategy is unique, we use numerical analyses to examine: (1) \(\frac {\partial f}{\partial \gamma }\), (2) \(\frac {\partial n_{i}}{\partial \gamma }\), \(\frac {\partial n_{s}}{\partial \gamma }\), and (3) \(\frac {\partial \pi _{h}}{\partial \gamma }\) and \(\frac {\partial \pi _{s}}{\partial \gamma }\). As before, for extensive sets of \((\bar {\alpha },C_{h},C_{s})\), we observe the following:

There exists \(\gamma _{1}\in \left (\frac {1}{2},1\right )\) such that \(\frac {\partial f}{\partial \gamma }<0\) for \(\gamma \in \left (\frac {1}{2},\gamma _{1}\right )\) and \(\frac {\partial f}{\partial \gamma }>0\) for γ ∈ (γ1, 1).

\(\frac {\partial n_{i}}{\partial \gamma }<0\) and \(\frac {\partial n_{s}}{\partial \gamma }<0\) for all \(\gamma >\frac {1}{2}\). Also, the proportion of outsourced software \(\left (\frac {n_{s}}{n_{i}+n_{s}}\right )\) is decreasing in γ.

\(\frac {\partial \pi _{h}}{\partial \gamma }<0\) and \(\frac {\partial \pi _{s}}{\partial \gamma }<0\) for all \(\gamma >\frac {1}{2}\).

1.8 A.8 Proof of Proposition 6