Abstract

Among studies on performance outcomes of entry mode choices disagreement fueled by ambiguous research findings is apparent as regards whether the best performers are those firms that enter foreign countries with high or low entry mode degree of control. To solve this dilemma and test new hypotheses, the relationship between entry mode degree of control and firm performance is examined by meta-analyzing 133 studies (740,114 observations) covering entry mode choices from 1980 to 2010. We find that (a) overall high-control entry modes lead to higher performance, and (b) adopting high-control entry modes is particularly important for firms entering developing countries.

Similar content being viewed by others

Notes

As we will explain later when describing the variables used in our model, the meta-regression analysis was initially performed using the terms ‘developing’ and ‘emerging’ as synonyms. Subsequently, as a robustness check, we created a sub-sample including only studies considering entries in ‘emerging countries’, defined as those developing countries that have some characteristics of developed countries but do not meet standards to be developed.

Interestingly, 39 out of 133 of our sampled studies considered only China as the host country of entry initiatives. This is a relevant number, and suggests a particular interest in modes that better perform to enter this country.

The variable emerging countries takes value 1 if the host country is an emerging country or set of emerging countries but not one or more developing or developed countries, and 0 otherwise.

It is worth noting that in various studies entry mode and/or firm performance were used as control variables, and thus no hypothesis was posited on their relationship.

The dummy survival was dropped in all meta-regression models because of multicollinearity.

In those papers where firm age was measured with the natural logarithm of the number of years, we transformed it into years.

These controls were added one-by-one in order to not reduce too much the number of observations in the meta-regression models.

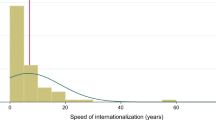

Each step of the cumulative meta-analysis considers one more study, and the pooled effect size is recomputed in the same way as in the traditional meta-analysis; the only difference is that the effect size is not calculated for the whole group of studies at once but is instead recalculated each time a new study is added to the analysis. This allows for estimating the contribution of individual studies and the evolution of the magnitude and direction of research findings. In our cumulative meta-analysis, articles with the same ‘median year of the study observation period’ were entered into the analysis in random order (Gurevitch et al. 2001; Rosenberg et al. 2000).

References

Agarwal, S., & Ramaswami, S. N. (1992). Choice of foreign market entry mode: Impact of ownership, location and internalization factors. Journal of International Business Studies, 23(1), 1–27.

Alchian, A. A., & Demsetz, H. (1972). Production, information costs, and economic organization. The American Economic Review, 62(5), 777–795.

Anand, J., & Delios, A. (1997). Location specificity and the transferability of downstream assets to foreign subsidiaries. Journal of International Business Studies, 28(3), 579–603.

Anderson, E., & Gatignon, H. (1986). Modes of foreign entry: A transaction cost analysis and propositions. Journal of International Business Studies, 17(3), 1–16.

Barkema, H. G., & Vermeulen, F. (1997). What differences in the cultural backgrounds of partners are detrimental for international joint ventures? Journal of International Business Studies, 28(4), 845–864.

Barkema, H. G., & Vermeulen, F. (1998). International expansion through start-up or acquisition: A learning perspective. Academy of Management Journal, 41(1), 7–26.

Beamish, P. W. (1985). The characteristics of joint ventures in developed and developing countries. Columbia Journal of World Business, 20(3), 13–19.

Beamish, P. W., & Kachra, A. (2004). Number of partners and JV performance. Journal of World Business, 39, 107–120.

Becker, B. J., & Wu, M. J. (2007). The synthesis of regression slopes in meta-analysis. Statistical Science, 22(3), 414–429.

Bhanji, Z., & Oxley, J. E. (2013). Overcoming the dual liability of foreignness and privateness in international corporate citizenship partnerships. Journal of International Business Studies, 44(4), 290–311.

Borenstein, M., Hedges, L. V., Higgins, J. P. T., & Rothstein, H. R. (2009). Introduction to meta-analysis. Chichester: Wiley.

Borenstein, M., Hedges, L. V., & Rothstein, H. R. (2007). Meta-analysis. Fixed effects vs random effects. Englewood: Biostat.

Brouthers, K. D. (2002). Institutional, cultural and transaction cost influences on entry mode choice and performance. Journal of International Business Studies, 33(2), 203–221.

Brouthers, K. D. (2013). A retrospective on: Institutional, cultural and transaction cost influences on entry mode choice and performance. Journal of International Business Studies, 44(1), 14–22.

Brouthers, L. E., Brouthers, K. D., & Werner, S. (1999). Is Dunning’s eclectic theory descriptive or normative? Journal of International Business Studies, 30(4), 831–844.

Brouthers, K. D., Brouthers, L. E., & Werner, S. (2008). Resource-based advantages in an international context. Journal of Management, 34(2), 18–217.

Brouthers, K. D., & Hennart, J. F. (2007). Boundaries of the firm: Insights from international entry mode research. Journal of Management, 33(3), 395–425.

Brouthers, K. D., & Nakos, G. (2004). SME international entry mode choice and performance: A transaction cost perspective. Entrepreneurship Theory & Practice, 28(3), 229–247.

Buckley, P. J., Clegg, L. J., Cross, A. R., Liu, X., Voss, H., & Zheng, P. (2007). The determinants of Chinese outward foreign direct investment. Journal of International Business Studies, 38(4), 499–518.

Buganza, T., Dell’Era, C., & Verganti, R. (2009). Exploring the relationships between product development and environmental turbulence: The case of mobile TLC services. Journal of Product Innovation Management, 26(3), 308–321.

Chang, S. J., Chung, J., & Moon, J. J. (2013). When do wholly owned subsidiaries perform better than joint ventures? Strategic Management Journal, 34(3), 317–337.

Chang, S. J., & Xu, D. (2008). Spillovers and competition among foreign and local firms in China. Strategic Management Journal, 29(5), 495–518.

Chatterjee, S. (1990). Excess resources, utilization costs, and mode entry. Academy of Management Journal, 33(4), 780–800.

Chiao, Y.-C., Yu, C.-M. J., & Peng, J.-T. A. (2009). Partner nationality, market-focus and IJV performance: A contingent approach. Journal of World Business, 44(3), 238–249.

Chung, C. C., & Beamish, P. W. (2012). Multi-party international joint ventures: Multiple post-formation change processes. Journal of World Business, 47(4), 648–663.

Claver, E., & Quer, D. (2005). Choice of market entry mode in China: The influence of form-specific factors. Journal of General Management, 30(3), 51–70.

Cohen, J. (1988). Statistical power analysis in the behavioral sciences (2nd ed.). Hillsdale: Erlbaum.

Combs, J. G., Ketchen, J. G. J., Crook, T. R., & Roth, P. L. (2010). Assessing cumulative evidence within ‘macro’ research: Why meta-analysis should be preferred over vote counting. Journal of Management Studies, 48(1), 178–197.

Cui, L., & Jiang, F. (2009). FDI entry mode choice of Chinese firms: A strategic behavior perspective. Journal of World Business, 44(4), 434–444.

D’Aveni, R. A., Dagnino, G. B., & Smith, K. G. (2010). The age of temporary advantage. Strategic Management Journal, 31(13), 1371–1385.

Dalton, D. R., & Dalton, C. M. (2005). Strategic management studies are a special case for meta-analysis. In D. J. Ketchen & D. D. Bergh (Eds.), Research methodology in strategy and management (Vol. 2, pp. 31–63). Bingley: Emerald Group Publishing Limited.

De Battisti, F., & Salini, S. (2013). Robust analysis of bibliometric data. Statistical Methods and Applications, 22(2), 269–283.

Delios, A., & Beamish, P. W. (1999). Ownership strategy of Japanese firms: Transactional, institutional, and experience influences. Strategic Management Journal, 20(10), 915–933.

Delios, A., & Beamish, P. W. (2004). Joint venture performance revisited: Japanese foreign subsidiaries worldwide. Management International Review, 44(1), 69–91.

Demirbag, M., McGuinness, M., & Altay, H. (2010). Perceptions of institutional environment and entry mode. FDI from an emerging country. Management International Review, 50(2), 207–240.

Doucouliagos, H. (2011). How large is large? Preliminary and relative guidelines for interpreting partial correlations in economics. Deakin University, Department of Economics, Series WP no. 2011/5.

Dunning, J. H. (1977). Trade, location of economic activity and the MNE: A search for an eclectic approach. In B. Ohlin, et al. (Eds.), The international allocation of economic activity. London: Macmillan.

Dunning, J. H. (1998). Location and the multinational enterprise: A neglected factor? Journal of International Business Studies, 29(1), 45–66.

Eden, D. (2002). From the editors: Replication, meta-analysis, scientific progress, and AMJ’s publication policy. Academy of Management Journal, 45(5), 841–846.

Elango, B., Dhandapani, K., & Giachetti, C. (2018). Impact of institutional reforms and industry structural factors on market returns of emerging market rivals during acquisitions by foreign firms. International Business Review. https://doi.org/10.1016/j.ibusrev.2018.03.008.

European Commission (2015). SME Definition—user guide 2015. European Commission. https://ec.europa.eu/docsroom/documents/15582/attachments/1/translations/en/renditions/native.

Field, A. P. (2001). Meta-analysis of correlation coefficients: A Monte-Carlo comparison of fixed- and random-effects methods. Psychological Methods, 6(2), 161–180.

Gao, G. Y., Pan, Y., Lu, J., & Tao, Z. (2008). Performance of multinational firms’ subsidiaries: Influences of cumulative experience. Management International Review, 48(6), 749–768.

Gatignon, H., & Anderson, E. (1988). The multinational corporation’s degree of control over foreign subsidiaries: An empirical test of a transaction cost explanation. Journal of Law Economics and Organization, 4(2), 89–120.

Gaur, A. S., & Lu, J. W. (2007). Ownership strategies and survival of foreign subsidiaries: Impacts of institutional distance and experience. Journal of Management, 33(1), 84–110.

Geringer, J. M., & Hebert, L. (1991). Measuring performance of international joint ventures. Journal of International Business Studies, 22(2), 249–263.

Geyskens, I., Krishnan, R., Steenkamp, J. B., & Cunha, P. V. (2009). A Review and evaluation of meta-analysis practices in management research. Journal of Management, 35(2), 393–419.

Giachetti, C. (2016). Competing in emerging markets: Performance implications of competitive aggressiveness. Management International Review, 56(3), 325–352.

Giachetti, C., Lampel, J., & Li Pira, S. (2017). Red queen competitive imitation in the UK mobile phone industry. Academy of Management Journal, 60(5), 1882–1914.

Glass, G. V., McGaw, B., & Smith, M. (1981). Meta-analysis in social research. Beverly Hills: Sage Publications.

Guillen, M. F. (2000). Business groups in emerging economies: a resource-based view. Academy of Management Journal, 43(3), 362–380.

Gurevitch, J., Curtis, P. S., & Jones, M. H. (2001). Meta-analysis in ecology. Advances in Ecological Research, 32, 199–247.

Hedges, L. V., & Olkin, I. (1985). Statistical methods for meta-analysis. Orlando: Academic Press Inc.

Hennart, J. F. (1988). A transaction costs theory of equity joint ventures. Strategic Management Journal, 9(4), 361–374.

Higgins, J. P. T., Thompson, S. G., Deeks, J. J., & Altman, D. G. (2003). Measuring inconsistency in meta-analyses. British Medical Journal, 327, 557–560.

Hitt, M. A., Ahlstrom, D., Dacin, M. T., Levitas, E., & Svobodina, L. (2004). The institutional effects on strategic alliance partner selection in transition economies: China versus Russia. Organization Science, 15(2), 173–185.

Hoskisson, R. E., Eden, L., Lau, C. M., & Wright, M. (2000). Strategy in emerging economies. Academy of Management Journal, 43(3), 249–267.

Hunter, J. E., & Schmidt, F. L. (2014). Methods of meta-analysis: Correcting error and bias in research findings (3rd ed.). Thousand Oaks: Sage Publications.

Hunter, J., Schmidt, F., & Jackson, G. (1982). Meta-analysis: Cumulating research findings across studies. Beverly Hills: Sage Publications.

Ioannidis, J. P. A., Contopoulos-Ioannidis, D. G., & Lau, J. (1999). Recursive cumulative meta-analysis: A diagnostic for the evolution of total randomized evidence from group and individual patient data. Journal of Clinical Epidemiology, 52(4), 281–291.

Ioannidis, J. P. A., & Lau, J. (2001). Evolution of treatment effects over time: Empirical insight from recursive cumulative metaanalyses. Proceedings of the National Academy of Science of the United States of America, 98(3), 831–836.

Isobe, T., Makino, S., & Montogmery, D. B. (2000). Resource commitment, entry timing, and market performance of foreign direct investments in emerging economies: The case of Japanese international joint ventures in China. Academy of Management Journal, 43(3), 468–484.

Jiang, R. J., Beamish, P. W., & Makino, S. (2014). Time compression diseconomies in foreign expansion. Journal of World Business, 49(1), 114–121.

Johnson, J., & Tellis, G. J. (2008). Drivers of success for market entry into China and India. Journal of Marketing, 72(May), 1–13.

Khanna, T., & Palepu, K. (1997). Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75(4), 41–51.

Khanna, T., & Palepu, K. (2010). Winning in emerging markets: A road map for strategy and execution. Boston: Harvard Business Press.

Khanna, T., Palepu, K., & Sinha, J. (2005). Strategies that fit emerging markets. Harvard Business Review, 83(6), 6–15.

Killing, J. P. (1982). How to make a global joint venture work. Harvard Business Review, 61(3), 120–127.

Klein, S., Frazier, G. L., & Roth, V. J. (1990). A transaction cost analysis model of channel integration in international markets. Journal of Marketing Research, 27(2), 196–208.

Li, J. J. (1995). Foreign entry and survival: Effects of strategic choices on performance in international markets. Strategic Management Journal, 16(5), 333–351.

Li, J. J. (2005). The formation of managerial networks of foreign firms in China: The effects of strategic orientations. Asia Pacific Journal of Management, 22(4), 423–443.

Li, J. J., Poppo, L., & Zhou, K. Z. (2008). Do managerial ties in China always produce value? Competition, uncertainty, and domestic vs. foreign firms. Strategic Management Journal, 29(4), 383–400.

Lu, J. W., & Xu, D. (2006). Growth and survival of international joint ventures: An external-internal legitimacy perspective. Journal of Management, 32(3), 426–448.

Luo, Y. (1997). Guanxi and performance of foreign-invested enterprises in China: An empirical inquiry. Management International Review, 37(1), 51–70.

Luo, Y. (2001). Determinants of entry in an emerging economy: A multilevel approach. Journal of Management Studies, 38(3), 443–472.

Luo, Y., & Peng, M. W. (1999). Learning to compete in a transition economy: Experience, environment, and performance. Journal of International Business Studies, 30(2), 269–296.

Ma, X., & Delios, A. (2007). A new tale of two cities: Japanese FDIs in Shanghai and Beijing, 1979–2003. International Business Review, 16(2), 207–228.

Magnusson, P., Westjohn, S. A., & Boggs, D. J. (2009). Order-of-entry effects for service firms in developing markets: An examination of multinational advertising agencies. Journal of International Marketing, 17(2), 23–41.

Markides, C. C., & Ittner, C. D. (1994). Shareholder benefits from corporate international diversification: Evidence from US international acquisitions. Journal of International Business Studies, 25(2), 343–366.

Meyer, K. E., Estrin, S., Bhaumik, S., & Peng, M. W. (2009). Institutions, resources, and entry strategies in emerging economies. Strategic Management Journal, 30(1), 61–80.

Oxley, J., & Yeung, B. (2001). E-commerce readiness: Institutional environment and international competitiveness. Journal of International Business Studies, 32(4), 705–723.

Pan, Y. (2002). Equity ownership in international joint ventures: The impact of source country factors. Journal of International Business Studies, 33(2), 375–384.

Pan, Y., & Chi, P. S. K. (1999). Financial performance and survival of multinational corporations in China. Strategic Management Journal, 20(4), 359–374.

Park, S. H., Li, S., & Tse, D. (2006). Market liberalization and firm performance during China’s economic transition. Journal of International Business Studies, 37(1), 127–147.

Pettus, M. L., Kor, Y. Y., & Mahoney, J. T. (2009). A theory of change in turbulent environments: The sequencing of dynamic capabilities following industry deregulation. International Journal of Strategic Change Management, 1(3), 186–211.

Powell, K. S., & Lim, E. (2017). Investment motive as a moderator of cultural-distance and relative knowledge relationships with foreign subsidiary ownership structure. Journal of Business Research, 70, 255–262.

Rasheed, H. S. (2005). Foreign entry mode and performance: The moderating effects of environment. Journal of Small Business Management, 43(1), 41–54.

Ren, H., Gray, B., & Kim, K. (2009). Performance of international joint ventures: What factors really make a difference and how? Journal of Management, 35(3), 805–832.

Robson, M. J., Leonidou, L. C., & Katsikeas, C. S. (2002). Factors influencing international joint venture performance: Theoretical perspectives, assessment, and future direction. Management International Review, 42(4), 385–418.

Rosenberg, M. S., Adams, D. C., & Gurevitch, J. (2000). META-WIN: Statistical software for meta-analysis, v. 2.0. Sunderland: Sinauer.

Shaver, J. M. (1998). Accounting for endogeneity when assessing strategy performance: Does entry mode choice affect FDI survival? Management Science, 44(4), 571–585.

Slangen, A. H. (2013). Greenfield or acquisition entry? The roles of policy uncertainty and MNE legitimacy in host countries. Global Strategy Journal, 3(3), 262–280.

Stanley, T. D., & Jarrell, S. B. (1989). Meta-regression analysis: A quantitative method of literature surveys. Journal of Economic Surveys, 19(3), 299–308.

Stevens, C. E., & Makarius, E. E. (2015). Overcoming information asymmetry in foreign entry strategy: The impact of reputation. Global Strategy Journal, 5(3), 256–272.

Sutcliffe, K. M., & Zaheer, A. (1998). Uncertainty in the transaction environment: An empirical test. Strategic Management Journal, 19(1), 1–23.

Tang, M., & Yu, CJ. (1990). Foreign market entry: production-related strategies. Management Science 36(4), 476–489.

Thomas, L. G., & D’Aveni, R. (2009). The changing nature of competition in the U.S. manufacturing sector, 1950 to 2002. Strategic Organization, 7(4), 387–431.

Tihanyi, L., Griffith, D. A., & Russell, C. J. (2005). The effect of cultural distance on entry mode choice, international diversification, and MNE performance: A meta-analysis. Journal of International Business Studies, 36(3), 270–280.

Tseng, C.-H., & Lee, R. P. (2010). Host environmental uncertainty and equity-based entry mode dilemma: The role of market linking capability. International Business Review, 19(4), 407–418.

Van Hessen, M., Van Oosterhout, J. H., & Carneyet, M. (2012). Corporate boards and the performance of Asian firms: A meta-analysis. Asia Pacific Journal of Management, 29(4), 873–905.

Williamson, O. E. (1985). The economic institutions of capitalism. New York: Free Press.

Williamson, O. E. (1991). Comparative economic organization: The analysis of discrete structural alternatives. Administrative Sciences Quarterly, 36(2), 269–296.

Woodcock, C. P., Beamish, P. W., & Makino, S. (1994). Ownership-based entry mode strategies and international performance. Journal of International Business Studies, 25(2), 253–273.

Wright, M., Filatotchev, I., Hoskisson, R. E., & Peng, M. W. (2005). Strategy research in emerging economies: Challenging the conventional wisdom. Journal of Management Studies, 42(1), 1–33.

Zeng, Y., Shenkar, O., Song, S., & Lee, S. H. (2013). FDI experience location and subsidiary mortality. Differences in national culture and the expansion of Korean MNEs. Management International Review, 53, 477–509.

Zhao, H., Ma, Y., & Yang, J. (2017). 30 years of research on entry mode and performance relationship: A meta-analytical review. Management International Review, 57(5), 653–682.

Acknowledgements

We gratefully acknowledge the excellent guidance provided by the Editor Joachim Wolf and the two anonymous reviewers, who helped strengthen this paper. We thank Ettore Spadafora, Ashish Arora and Wesley Cohen for their thoughtful feedback on earlier drafts of this paper.

Author information

Authors and Affiliations

Corresponding author

Appendix: Studies included in the Meta-Analysis

Appendix: Studies included in the Meta-Analysis

Author(s) | Year | Journal |

|---|---|---|

Anand and Delios | 1997 | Journal of International Business Studies |

Anh et al. | 2006 | International Business Review |

Barden et al. | 2005 | Journal of International Business Studies |

Barkema and Vermeulen | 1997 | Journal of International Business Studies |

Beamish and Kachra | 2004 | Journal of World Business |

Belderbos and Zou | 2009 | Journal of International Business Studies |

Belderbos et al. | 2014 | Strategic Management Journal |

Bradshaw et al. | 2004 | Journal of Accounting Research |

Brouthers and Xu | 2002 | Journal of International Business Studies |

Brouthers et al. | 2000 | British Journal of Management |

Brouthers et al. | 2003 | Strategic Management Journal |

Brouthers et al. | 2008 | Journal of Management |

Brouthers et al. | 2008 | Journal of Management Studies |

Chang and Xu | 2008 | Strategic Management Journal |

Chang et al. | 2013 | Strategic Management Journal |

Chen | 1999 | Journal of World Business |

Chiao et al. | 2009 | Journal of World Business |

Child | 2002 | Organization Studies |

Child et al. | 2003 | Journal of International Business Studies |

Choi et al. | 2011 | Research Policy |

Chung and Beamish | 2010 | Organization Science |

Chung and Beamish | 2012 | Journal of World Business |

Chung et al. | 2013 | Management International Review |

Colpan and Yoshikawa | 2012 | Corporate Governance: An International Review |

Cullen et al. | 1995 | Journal of International Business Studies |

Dai et al. | 2013 | Journal of International Business Studies |

Delios and Beamish | 2001 | Academy of Management Journal |

Delios and Beamish | 2004 | Management International Review |

Delios and Makino | 2003 | Journal of International Marketing |

Demirbag et al. | 2007 | International Business Review |

Demirbag et al. | 2011 | Journal of World Business |

Dikova | 2009 | International Business Review |

Fey and Beamish | 2001 | Organization Science |

Fisch and Zschoche | 2012 | International Business Review |

Gao et al. | 2008 | Management International Review |

Gaur and Lu | 2007 | Journal of Management |

Ghahroudi and Hoshino | 2007 | Journal of Developmental Entrepreneurship |

Glaister and Buckley | 1999 | Management International Review |

Gomez and Werner | 2004 | Journal of Business Research |

Gong | 2003 | Academy of Management Journal |

Gong et al. | 2007 | Strategic Management Journal |

Hebert et al. | 2005 | Organization Science |

Herrmann and Datta | 2002 | Journal of International Business Studies |

Hsieh et al. | 2010 | Journal of International Management |

Hutzschenreuter and Voll | 2008 | Journal of International Business Studies |

Isobe et al. | 2000 | Academy of Management Journal |

Jiang et al. | 2014 | Journal of World Business |

Jung et al. | 2008 | Management International Review |

Kallunki et al. | 2001 | Management International Review |

Kim and Gray | 2008 | Management International Review |

Kim and Park | 2002 | Management International Review |

Kim et al. | 2012 | Journal of International Business Studies |

Konopaske et al. | 2002 | Journal of Business Research |

Kumarasinghe and Hoshino | 2009 | Asian Journal of Finance & Accounting |

Lee and Beamish | 1995 | Journal of International Business Studies |

Lee and MacMillan | 2008 | International Business Review |

Lee and Song | 2012 | Strategic Management Journal |

Lee et al. | 2013 | Journal of International Management |

Lee et al. | 2014 | The International Journal of Human Resource Management |

Li et al. | 2009 | Strategic Management Journal |

Lu | 2002 | Journal of International Business Studies |

Lu and Beamish | 2006 | Journal of Business Venturing |

Lu and Hebert | 2005 | Journal of Business Research |

Lu and Xu | 2006 | Journal of Management |

Luo | 1997 | Organization Science |

Luo | 1997 | Management International Review |

Luo | 1999 | Journal of Business Research |

Luo | 1999 | Journal of Management Studies |

Luo | 1999 | Asia Pacific Journal of Management |

Luo | 2001 | Administrative Science Quarterly |

Luo | 2001 | Journal of International Business Studies |

Luo | 2002 | Journal of Management |

Luo | 2002 | Organization Science |

Luo | 2002 | Strategic Management Journal |

Luo | 2002 | Strategic Management Journal |

Luo | 2003 | Journal of International Business Studies |

Luo | 2006 | Human Relations |

Luo and Park | 2004 | Journal of International Business Studies |

Luo and Park | 2001 | Strategic Management Journal |

Luo and Peng | 1999 | Journal of International Business Studies |

Luo and Shenkar | 2002 | Journal of International Management |

Luo and Zhao | 2013 | Business Society |

Luo and Zhao | 2004 | Journal of International Management |

Luo and Han | 2009 | Journal of World Business |

Ma and Delios | 2007 | International Business Review |

Magnusson et al. | 2009 | Journal of International Marketing |

Makino et al. | 2007 | Strategic Management Journal |

Markides and Ittner | 1994 | Journal of International Business Studies |

Merchant | 2002 | Management International Review |

Merchant | 2005 | Canadian Journal of Administrative Sciences |

Merchant and Schendel | 2000 | Strategic Management Journal |

Meschi and Riccio | 2008 | International Business Review |

Murray et al. | 2012 | Journal of International Marketing |

O’Brien et al. | 2013 | Strategic Management Journal |

Ogasavara and Hoshino | 2009 | Review of Quantitative Finance and Accounting |

Pak et al. | 2009 | International Business Review |

Pan et al. | 1999 | Journal of International Business Studies |

Pangarkar and Klein | 2004 | Journal of International Marketing |

Pangarkar and Lim | 2003 | International Business Review |

Park and Kim | 1997 | Journal of Business Venturing |

Peng and Beamish | 2013 | Asia Pacific Journal of Management |

Peng | 2012 | Journal of International Management |

Pothukuchi et al. | 2002 | Journal of International Business Studies |

Ramaswamy et al. | 1998 | International Business Review |

Rasheed | 2005 | Journal of Small Business Management |

Reddy and Naik | 2011 | VIKALPA: The Journal for Decision Makers |

Reuer and Miller | 1997 | Strategic Management Journal |

Reuer | 2001 | Strategic Management Journal |

Rhee | 2008 | Asian Business & Management |

Riaz et al. | 2014 | Journal of World Business |

Sakakibara and Yamawaki | 2008 | Managerial and Decision Economics |

Schotter and Beamish | 2011 | International Studies of Management and Organization |

Shaver | 1998 | Management Science |

Slangen and Hennart | 2008 | Journal of Management Studies |

Song | 2013 | Asia Pacific Journal of Management |

Steensma and Lyles | 2000 | Strategic Management Journal |

Steensma et al. | 2005 | Academy of Management Journal |

Sytse et al. | 2006 | Strategic Management Journal |

Tang and Rowe | 2012 | Journal of World Business |

Tong and Reuer | 2007 | Journal of International Business Studies |

Xu and Lu | 2007 | Journal of Business Research |

Yoshikawa and Gedajlovic | 2002 | Asia Pacific Journal of Management |

Yoshikawa et al. | 2010 | Journal of Business Research |

Yu et al. | 2009 | Academy of Management Journal |

Zahra et al. | 2000 | Academy of Management Journal |

Zeng et al. | 2013 | Management International Review |

Zeng et al. | 2013 | Journal of International Business Studies |

Zhan and Luo | 2008 | Management International Review |

Zhan et al. | 2009 | Asia Pacific Journal of Management |

Zhang et al. | 2006 | Journal of Management |

Zhang et al. | 2007 | Journal of International Business Studies |

Zhao and Luo | 2002 | Management International Review |

Rights and permissions

About this article

Cite this article

Giachetti, C., Manzi, G. & Colapinto, C. Entry Mode Degree of Control, Firm Performance and Host Country Institutional Development: A Meta-Analysis. Manag Int Rev 59, 3–39 (2019). https://doi.org/10.1007/s11575-018-0365-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11575-018-0365-z