Abstract

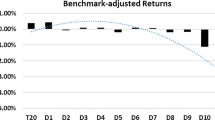

We examine mutual funds that appeared in the Wall Street Journal’s SmartMoney Fund Screen column from September 2004 through July 2009. We find that the majority of funds listed do not have Morningstar’s highest five star rating. Regardless of Morningstar rating, the average prepublication performance of the funds is significantly higher than the benchmarks used to measure performance. Post publication, fund performance declines, and the decline is statistically significant across our performance measures. However, additional tests indicate that the SmartMoney funds which have a three or four star rating from Morningstar are better investment values than corresponding five star Morningstar funds with the same prospectus objective and expense ratio.

Similar content being viewed by others

Notes

More details concerning the Morningstar star rating procedure can be found at www.morningstar.com or in Morey and Gottesman (2006).

The dates of these articles are July 12, 2005 (Underperformers), May 30, 2006 (Index Funds), November 11, 2006 (Index Funds), November 28, 2006 (Lackluster Funds), April 10, 2007 (Funds That Stumble), November 27, 2007 (Poor Performers), June 10, 2008 (Funds That Stumble), and July 1, 2008 (Losers).

In order to be comparable to the SmartMoney sample, the Morningstar universe is determined as follows. We start with all funds available from the December 2004, 2005, 2005, 2007, and 2008 Morningstar Principia Pro Cds. Since SmartMoney funds are designed for retail investors, we eliminate all funds whose share class is institutional. We also excluded funds with the following prospectus objectives as no fund screen in our sample analyzed these types of funds: corporate bond high yield, government bond adjustable rate mortgage, government bond mortgage, multi sector bond, municipal bond national, municipal bond single state, and money market. We calculated the descriptive statistics based on the remaining funds.

An alternative to these factors are the factors used by Hou, Karolyi, and Kho (2011). However, these factors are not available on a daily basis as is required for our analysis in the next section.

One potential weakness of the model is that we do not include a momentum indices for the domestic stock, international stock, or fixed income portions of the model. However, given that neither SmartMoney nor Morningstar explicitly account for momentum in the screens or ratings combined with the lack of available daily momentum indices for international stocks and fixed income securities, we do not include any momentum factors in the model.

Our use of a one year pre and post publication window is motivated by characteristics of the data sample. On average, SmartMoney runs specific screens every 10 to 12 months, thus implicating indicating the screen effective horizon. Our one year pre and post publication window is also identical to that used by Jain and Wu (2000).

We include the actual publication in the post publication period because we want to capture any changes made by the manager in response to the listing in the post publication period. For example, a manager who is aware that the fund appears in the WSJ on January 4 may make trades on the 4th and these trades would be reflected in changes in the net asset value (and thus the return) of the fund on the 4th.

Results are available upon request.

The quarterly Morningstar Cds provide data as of March 31, June 30, September 30, and December 31. Thus, the pool of available funds for a fund published a column dated November 1 would come from the September 30 Cd of that year.

An analysis of the alternative funds indicates that their inclusion would not change the reported results.

We note that this result is consistent with the result found by Blake and Morey (2000) which led to a change in the Moringstar ratings system in 2002. However, our sample begins in 2004 and this result is inconsistent with what would be expected based on Morey and Gottesman (2006). But, Morey and Gottesman only analyze data from 2002 to 2005 while our sample covers 2004 to 2009. Thus our period only has a small overlap with theirs.

There are several potential definitions of the financial crisis period. We choose the entire 2008 calendar year rather than a shorter time period as it provides us with a sufficient number of funds to analyze performance during the crisis period.

References

Barber B, Odean T (2008) All that glitters: the effect of attention and news on the buying behavior of individual and institutional investors. Rev Financ Stud 21:785–818

Blake C, Morey M (2000) Morningstar ratings and mutual fund performance. J Financ Quant Anal 35:451–483

Comer G, Rodriguez Javier (2012) International Mutual Funds: MSCI Benchmarks and Portfolio Evaluation, working paper

Comer G, Larrymore N, Rodriguez J (2009) Controlling for fixed income exposure in portfolio evaluation: evidence from hybrid mutual funds. Rev Financ Stud 22:481–507

Cronqvist H (2006) Advertising and Portfolio Choice, working paper

DelGuercio D, Tkac P (2008) Star power: the effect of morningstar ratings on mutual fund flow. J Financ Quant Anal 43:907–936

Fama E, French K (1993) Common risk factors in the returns on stocks and bonds. J Financ Econ 33:3–56

Gallaher S, Kaniel R, and Starks L (2009) Advertising and Mutual Funds: From Families to Individual Funds, working paper

Jain P, Wu J (2000) Truth in mutual fund advertising: evidence on future performance and fund flows. J Financ 55:937–958

Morey M, Gottesman A (2006) Morningstar mutual fund ratings redux. J Invest Consul 8:25–37

Tetlock P (2007) Giving content to investor sentiment: the role of media in the stock market. J Financ 62:1139–1168

Acknowledgments

We would like to thank Norris Larrymore for his work on an earlier version of this paper. We thank Naielia Allen, Jennifer Lopez, Laura McCann, Herminio Romero, and Arthur Wharton for their excellent research assistance. We also thank Jeff Busse, Debra Glassman, Martin Gruber, Prem Jain, Phyllis Keys, Jennifer Koski, Matt Morey, and James Rimbey for their suggestions and comments on earlier versions of this study. In addition, we appreciate the feedback of workshop participants at Georgetown University, the Rising Stars Conference at Rensselaer Polytechnic Institute, Rutgers University Camden, Saint John’s University, University of Arkansas, University of Montevideo, University of Puerto Rico, and University of Washington. Rodriguez would like to thank the University of Washington for their hospitality during the course of this research. Comer would like to acknowledge the financial support provided by the McDonough School of Business Dean’s Research Fellowship.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Comer, G., Rodriguez, J. An empirical analysis of the Wall Street Journal’s SmartMoney fund screen. J Econ Finan 40, 380–401 (2016). https://doi.org/10.1007/s12197-014-9314-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-014-9314-2